SIX MONTH SALES – $160.2

MILLION SECOND QUARTER SALES – $80.1

MILLION

Q.E.P. CO., INC. (OTC:QEPC.PK) (the “Company”)

today reported its consolidated results of operations for the first

six months and second quarter of its fiscal year ending February

28, 2017.

The Company reported net sales of $160.2 million

for the six months ended August 31, 2016, an increase of $0.2

million or 0.1% from the $160.0 million reported in the same period

of fiscal 2016. As a percentage of net sales, gross margin

was 28.2% in the first six months of fiscal 2017 compared to 27.1%

in the first six months of fiscal 2016.

Net sales for the second quarter of fiscal 2017

were $80.1 million and reflected a gross margin of 28.1% compared

to net sales of $81.7 million and a gross margin of 27.1% for the

second quarter of fiscal 2016.

Lewis Gould, Chairman of the Company’s Board of

Directors, commented, "In spite of the numerous headwinds and

pressure on our worldwide companies, I am pleased to report

additional profit and a decrease in our debt balance this year to

date."

Net sales for both the six and three month

periods ended August 31, 2016 as compared to the same period in the

prior fiscal year reflects mixed growth across product categories,

net of the impact of changes in inventory purchasing patterns of

certain retail customers and the negative effects of foreign

currency rate changes, particularly in the UK during the second

quarter.

The Company’s gross margin as a percentage of

net sales for both year-to-date and the second quarter increased

compared to the prior fiscal year periods. The Company benefited

from changes in the product mix and management of costs, which were

offset by the negative impact of changes in foreign currency

rates.

Operating expenses for the first six months and

second quarter of fiscal 2017 were $37.5 million and $18.7 million,

respectively, or 23.4% and 23.3% of net sales in those periods,

compared to $37.4 million and $18.4 million, respectively, or 23.4%

and 22.5% of net sales in the comparable fiscal 2016 periods. The

relatively unchanged Operating expense trend was driven by targeted

increases in US marketing programs, offset by decreased shipping

costs related to customer and product mix and the favorable

translation impact of foreign currency movements.

Non-operating income for the first six months

and the second quarter of fiscal 2017 represents a gain on the sale

of certain non-core assets of the Company.

The decrease in interest expense during fiscal

2017 as compared to fiscal 2016 is principally the result of the

repayment of $5.6 million outstanding under a term loan facility in

the first quarter of fiscal 2016.

The provision for income taxes as a percentage

of income before taxes for the first six months and second quarter

of fiscal 2017 was 37.5% in each period, compared to 35.0% in each

period for the comparable periods of fiscal 2016. The effective tax

rate in both fiscal years reflects the relative contribution of the

Company’s earnings sourced from its international operations.

Net income for the first six months and second

quarter of fiscal 2017 was $4.5 million and $2.3 million,

respectively, or $1.41 and $0.73, respectively, per diluted share.

For the comparable periods of fiscal 2016, net income was $3.5

million and $2.2 million, respectively, or $1.08 and $0.69,

respectively, per diluted share.

Earnings before interest, taxes, depreciation

and amortization (EBITDA) and non-operating income for the first

six months and second quarter of fiscal 2017 was $9.6 million and

$4.8 million, respectively, as compared to $8.2 million and $4.8

million, respectively, for the comparable periods of fiscal

2016.

| |

|

|

|

|

|

|

|

|

|

|

|

|

|

| |

|

|

For the Three Months |

|

For the Six Months |

|

|

|

|

| |

|

|

Ended August 31, |

|

Ended August 31, |

|

|

|

|

| |

|

|

|

2016 |

|

|

|

2015 |

|

|

|

2016 |

|

|

|

2015 |

|

|

|

|

|

| |

Net

income |

$ |

2,343 |

|

|

$ |

2,220 |

|

|

$ |

4,528 |

|

|

$ |

3,488 |

|

|

|

|

|

| |

Add: |

Interest expense,

net |

|

291 |

|

|

|

287 |

|

|

|

572 |

|

|

|

607 |

|

|

|

|

|

| |

|

Provision for income

taxes |

|

1,407 |

|

|

|

1,195 |

|

|

|

2,718 |

|

|

|

1,878 |

|

|

|

|

|

| |

|

Depreciation and

amortization |

|

977 |

|

|

|

1,115 |

|

|

|

1,993 |

|

|

|

2,185 |

|

|

|

|

|

| |

|

Gain on sale of

business |

|

(184 |

) |

|

|

- |

|

|

|

(184 |

) |

|

|

- |

|

|

|

|

. |

| |

EBITDA

before non-operating income |

$ |

4,834 |

|

|

$ |

4,817 |

|

|

$ |

9,627 |

|

|

$ |

8,158 |

|

|

|

|

|

| |

|

|

|

|

|

|

|

|

|

|

|

|

|

Cash provided by operations during the first six months of

fiscal 2017 was $3.0 million as compared to $3.5 million in the

first six months of fiscal 2016, reflecting both the increase in

operating income and additional net investments in working capital.

In both the current and prior year six month fiscal periods, the

Company’s capital expenditures, investments and treasury stock

purchases were funded through cash from operations as additional

funds from operations were used, along with cash balances, to

reduce debt.

Working capital at the end of the Company’s

fiscal 2017 second quarter was $43.5 million compared to $38.7

million at the end of the 2016 fiscal year. Aggregate debt,

net of available cash balances, at the end of the Company’s fiscal

2017 second quarter was $18.0 million or 24.7% of equity, a

decrease of $2.1 million compared to $20.1 million or 29.4% of

equity at the end of the 2016 fiscal year.

The Company will be hosting

a conference call to discuss these results and to answer

your questions at 10:00 a.m. Eastern Time on Tuesday, October 11,

2016. If you would like to join the conference call, dial

1-888-455-2311 toll free from the US or 1-719-325-2364

internationally approximately 10 minutes prior to the start time

and ask for the Q.E.P. Co., Inc. Second-Quarter Conference Call /

Conference ID 9856218. A replay of the conference call will be

available until midnight October 18, 2016 by calling 1-844-512-2921

toll free from the US and entering pin number 9856218;

internationally, please call 1-412-317-6671 using the same pin

number.

Q.E.P. Co., Inc., founded in 1979, is a world

class, worldwide provider of innovative, quality and value-driven

flooring and industrial solutions. As a leading manufacturer,

marketer and distributor, QEP delivers a comprehensive line of

hardwood and laminate flooring, flooring installation tools,

adhesives and flooring related products targeted for the

professional installer as well as the do-it-yourselfer. In

addition, the Company provides industrial tools with cutting edge

technology to the industrial trades. Under brand names including

QEP®, ROBERTS®, Capitol®, Harris®Wood, Fausfloor®, Vitrex®,

Homelux®, TileRite®, PRCI®, Nupla®, HISCO®, Plasplugs®, Ludell®,

Porta-Nails®, Tomecanic®, Bénètiere® and Elastiment®, the Company

sells its products to home improvement retail centers, specialty

distribution outlets, municipalities and industrial solution

providers in 50 states and throughout the world.

This press release contains forward-looking

statements, including statements regarding economic conditions,

sales growth, profit improvements, product development and

marketing, operating expenses, cost savings, cash flow, debt and

currency exchange rates. These statements are not guarantees of

future performance and actual results could differ materially from

our current expectations.

-Financial Information

Follows-

| |

|

|

|

|

|

|

|

|

|

| |

Q.E.P. CO., INC. AND

SUBSIDIARIES |

|

| |

CONSOLIDATED STATEMENTS OF

EARNINGS |

|

| |

(In thousands except per share data) |

|

| |

(Unaudited) |

|

| |

|

|

|

|

|

|

|

|

|

| |

|

For the Three

Months Ended August

31, |

|

For the Six

Months Ended August

31, |

|

|

|

|

|

2016 |

|

|

|

2015 |

|

|

|

2016 |

|

|

|

2015 |

|

|

| |

|

|

|

|

|

|

|

|

|

| |

Net sales |

$ |

80,080 |

|

|

$ |

81,706 |

|

|

$ |

160,258 |

|

|

$ |

159,973 |

|

|

| |

Cost of

goods sold |

|

57,548 |

|

|

|

59,594 |

|

|

|

115,117 |

|

|

|

116,619 |

|

|

| |

Gross profit |

|

22,532 |

|

|

|

22,112 |

|

|

|

45,141 |

|

|

|

43,354 |

|

|

| |

|

|

|

|

|

|

|

|

|

| |

Operating expenses: |

|

|

|

|

|

|

|

|

| |

Shipping |

|

7,025 |

|

|

|

7,106 |

|

|

|

13,682 |

|

|

|

14,416 |

|

|

| |

General and administrative |

|

6,504 |

|

|

|

6,329 |

|

|

|

12,904 |

|

|

|

12,585 |

|

|

| |

Selling and marketing |

|

5,291 |

|

|

|

5,087 |

|

|

|

11,212 |

|

|

|

10,578 |

|

|

| |

Other income, net |

|

(145 |

) |

|

|

(112 |

) |

|

|

(291 |

) |

|

|

(198 |

) |

|

| |

Total operating expenses |

|

18,675 |

|

|

|

18,410 |

|

|

|

37,507 |

|

|

|

37,381 |

|

|

| |

|

|

|

|

|

|

|

|

|

| |

Operating income |

|

3,857 |

|

|

|

3,702 |

|

|

|

7,634 |

|

|

|

5,973 |

|

|

| |

|

|

|

|

|

|

|

|

|

| |

Non-operating expense |

|

184 |

|

|

|

- |

|

|

|

184 |

|

|

|

- |

|

|

| |

Interest

expense, net |

|

(291 |

) |

|

|

(287 |

) |

|

|

(572 |

) |

|

|

(607 |

) |

|

| |

|

|

|

|

|

|

|

|

|

| |

Income before provision for income taxes |

|

3,750 |

|

|

|

3,415 |

|

|

|

7,246 |

|

|

|

5,366 |

|

|

| |

|

|

|

|

|

|

|

|

|

| |

Provision for income taxes |

|

1,407 |

|

|

|

1,195 |

|

|

|

2,718 |

|

|

|

1,878 |

|

|

| |

|

|

|

|

|

|

|

|

|

| |

Net income |

$ |

2,343 |

|

|

$ |

2,220 |

|

|

$ |

4,528 |

|

|

$ |

3,488 |

|

|

| |

|

|

|

|

|

|

|

|

|

| |

Net income per share: |

|

|

|

|

|

|

|

|

| |

Basic |

$ |

0.73 |

|

|

$ |

0.69 |

|

|

$ |

1.41 |

|

|

$ |

1.09 |

|

|

| |

Diluted |

$ |

0.73 |

|

|

$ |

0.69 |

|

|

$ |

1.41 |

|

|

$ |

1.08 |

|

|

| |

|

|

|

|

|

|

|

|

|

| |

Weighted average

number of common |

|

|

|

|

|

|

|

|

| |

shares outstanding: |

|

|

|

|

|

|

|

|

| |

Basic |

|

3,202 |

|

|

|

3,206 |

|

|

|

3,199 |

|

|

|

3,209 |

|

|

| |

Diluted |

|

3,215 |

|

|

|

3,228 |

|

|

|

3,217 |

|

|

|

3,231 |

|

|

| |

|

|

|

|

|

|

|

|

|

| |

|

|

|

|

|

|

|

|

|

| |

Q.E.P. CO., INC. AND

SUBSIDIARIES |

|

| |

CONSOLIDATED STATEMENTS OF COMPREHENSIVE

INCOME |

|

| |

(In thousands) |

|

| |

(Unaudited) |

|

| |

|

|

|

|

|

|

|

|

|

| |

|

For the Three

Months Ended August

31, |

|

For the Six

Months Ended August

31, |

|

| |

|

|

2016 |

|

|

|

2015 |

|

|

|

2016 |

|

|

|

2015 |

|

|

| |

|

|

|

|

|

|

|

|

|

| |

Net

income |

$ |

2,343 |

|

|

$ |

2,220 |

|

|

$ |

4,528 |

|

|

$ |

3,488 |

|

|

| |

|

|

|

|

|

|

|

|

|

| |

Unrealized currency

translation adjustments |

|

(361 |

) |

|

|

(363 |

) |

|

|

143 |

|

|

|

(481 |

) |

|

| |

|

|

|

|

|

|

|

|

|

| |

Comprehensive

income |

$ |

1,982 |

|

|

$ |

1,857 |

|

|

$ |

4,671 |

|

|

$ |

3,007 |

|

|

| |

|

|

|

|

|

|

|

|

|

| |

|

|

|

|

|

|

|

|

|

|

|

|

|

Q.E.P. CO., INC. AND SUBSIDIARIES |

|

|

|

|

|

|

|

|

|

CONSOLIDATED BALANCE SHEETS |

|

|

|

|

|

|

|

|

|

(In thousands except per share values) |

|

|

|

|

|

|

|

| |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

August 31, 2016

(Unaudited) |

|

February 29,

2016 |

|

|

|

|

|

|

|

| |

|

|

|

|

|

|

|

|

|

|

|

| |

ASSETS |

|

|

|

|

|

|

|

|

|

|

| |

Cash |

$ |

13,647 |

|

|

$ |

15,923 |

|

|

|

|

|

|

|

|

| |

Accounts

receivable, less allowance for doubtful accounts of $406 |

|

|

|

|

|

|

|

|

|

|

| |

and

$377 as of August 31, 2016 and February 29, 2016, respectively |

|

40,990 |

|

|

|

39,491 |

|

|

|

|

|

|

|

|

| |

Inventories |

|

43,125 |

|

|

|

42,797 |

|

|

|

|

|

|

|

|

| |

Prepaid

expenses and other current assets |

|

3,013 |

|

|

|

2,234 |

|

|

|

|

|

|

|

|

|

|

Current assets |

|

100,775 |

|

|

|

100,445 |

|

|

|

|

|

|

|

|

| |

|

|

|

|

|

|

|

|

|

|

|

| |

Property

and equipment, net |

|

18,669 |

|

|

|

19,538 |

|

|

|

|

|

|

|

|

| |

Deferred

income taxes, net |

|

5,276 |

|

|

|

5,288 |

|

|

|

|

|

|

|

|

| |

Intangibles, net |

|

15,491 |

|

|

|

15,717 |

|

|

|

|

|

|

|

|

| |

Other

assets |

|

371 |

|

|

|

550 |

|

|

|

|

|

|

|

|

| |

|

|

|

|

|

|

|

|

|

|

|

|

|

Total Assets |

$ |

140,582 |

|

|

$ |

141,538 |

|

|

|

|

|

|

|

|

| |

|

|

|

|

|

|

|

|

|

|

|

| |

LIABILITIES AND SHAREHOLDERS' EQUITY |

|

|

|

|

|

|

|

|

|

|

| |

|

|

|

|

|

|

|

|

|

|

|

| |

Trade

accounts payable |

$ |

18,616 |

|

|

$ |

18,432 |

|

|

|

|

|

|

|

|

| |

Accrued

liabilities |

|

16,611 |

|

|

|

17,854 |

|

|

|

|

|

|

|

|

| |

Income

taxes payable |

|

271 |

|

|

|

383 |

|

|

|

|

|

|

|

|

| |

Lines of

credit |

|

19,737 |

|

|

|

23,093 |

|

|

|

|

|

|

|

|

| |

Current

maturities of notes payable |

|

1,992 |

|

|

|

2,032 |

|

|

|

|

|

|

|

|

|

|

Current liabilities |

|

57,227 |

|

|

|

61,794 |

|

|

|

|

|

|

|

|

| |

|

|

|

|

|

|

|

|

|

|

|

| |

Notes

payable |

|

9,945 |

|

|

|

10,899 |

|

|

|

|

|

|

|

|

| |

Other

long term liabilities |

|

589 |

|

|

|

589 |

|

|

|

|

|

|

|

|

|

|

Total Liabilities |

|

67,761 |

|

|

|

73,282 |

|

|

|

|

|

|

|

|

| |

|

|

|

|

|

|

|

|

|

|

|

| |

Preferred stock, 2,500 shares authorized, $1.00 par value; 337

shares |

|

|

|

|

|

|

|

|

|

|

| |

issued and outstanding at August 31, 2016 and February 29,

2016 |

|

337 |

|

|

|

337 |

|

|

|

|

|

|

|

|

| |

Common

stock, 20,000 shares authorized, $.001 par value; 3,821 and |

|

|

|

|

|

|

|

|

|

|

| |

3,802 shares issued, and 3,208 and 3,198 shares outstanding at |

|

|

|

|

|

|

|

|

|

|

| |

August 31, 2016 and February 29, 2016, respectively |

|

4 |

|

|

|

4 |

|

|

|

|

|

|

|

|

| |

Additional paid-in capital |

|

10,766 |

|

|

|

10,737 |

|

|

|

|

|

|

|

- |

| |

Retained

earnings |

|

72,477 |

|

|

|

67,952 |

|

|

|

|

|

|

|

|

| |

Treasury

stock, 612 and 604 shares held at cost at August 31, 2016 |

|

|

|

|

|

|

|

|

|

|

| |

and February 29, 2016, respectively |

|

(7,016 |

) |

|

|

(6,884 |

) |

|

|

|

|

|

|

|

| |

Accumulated other comprehensive income |

|

(3,747 |

) |

|

|

(3,890 |

) |

|

|

|

|

|

|

|

|

|

Shareholders' Equity |

|

72,821 |

|

|

|

68,256 |

|

|

|

|

|

|

|

|

| |

|

|

|

|

|

|

|

|

|

|

|

|

|

Total Liabilities and Shareholders' Equity |

$ |

140,582 |

|

|

$ |

141,538 |

|

|

|

|

|

|

|

|

| |

|

|

|

|

|

|

|

|

|

|

|

| |

|

|

|

|

|

| |

Q.E.P. CO., INC. AND SUBSIDIARIES |

|

| |

CONSOLIDATED STATEMENTS OF CASH

FLOWS |

|

| |

(In thousands) |

|

| |

(Unaudited) |

|

| |

|

|

|

|

|

| |

|

For the Six Months Ended August

31, |

|

| |

|

|

2016 |

|

|

|

2015 |

|

|

| |

|

|

|

|

|

| |

Operating

activities: |

|

|

|

|

| |

Net income |

$ |

4,528 |

|

|

$ |

3,488 |

|

|

| |

Adjustments to reconcile

net income to net cash |

|

|

|

|

| |

provided by

operating activities: |

|

|

|

|

| |

Depreciation and

amortization |

|

1,993 |

|

|

|

2,185 |

|

|

| |

(Gain)/Loss on sale

of business |

|

(184 |

) |

|

|

- |

|

|

| |

Other non-cash

adjustments |

|

4 |

|

|

|

117 |

|

|

| |

Changes in assets and

liabilities, net of acquisition: |

|

|

|

|

| |

Accounts

receivable |

|

(1,182 |

) |

|

|

(5,093 |

) |

|

| |

Inventories |

|

(94 |

) |

|

|

(1,763 |

) |

|

| |

Prepaid expenses

and other assets |

|

(514 |

) |

|

|

591 |

|

|

| |

Trade accounts

payable and accrued liabilities |

|

(1,506 |

) |

|

|

3,934 |

|

|

| |

Net cash provided by

operating activities |

|

3,045 |

|

|

|

3,459 |

|

|

| |

|

|

|

|

|

| |

Investing

activities: |

|

|

|

|

| |

Proceeds from sale

of property |

|

48 |

|

|

|

344 |

|

|

| |

Capital

expenditures |

|

(802 |

) |

|

|

(592 |

) |

|

| |

Acquisitions, net

of cash acquired |

|

(1,702 |

) |

|

|

- |

|

|

| |

Proceeds from sale

of business |

|

850 |

|

|

|

- |

|

|

| |

Net cash used in

investing activities |

|

(1,606 |

) |

|

|

(248 |

) |

|

| |

|

|

|

|

|

| |

Financing

activities: |

|

|

|

|

| |

Net (repayments)

under lines of credit |

|

(2,515 |

) |

|

|

(667 |

) |

|

| |

Net (repayments) of

notes payable |

|

(994 |

) |

|

|

(6,568 |

) |

|

| |

Purchase of

treasury stock |

|

(60 |

) |

|

|

(60 |

) |

|

| |

Dividends |

|

(4 |

) |

|

|

(4 |

) |

|

| |

Net cash (used in)

financing activities |

|

(3,573 |

) |

|

|

(7,299 |

) |

|

| |

|

|

|

|

|

| |

Effect of exchange

rate changes on cash |

|

(142 |

) |

|

|

(4 |

) |

|

| |

|

|

|

|

|

| |

Net (decrease)

increase in cash |

|

(2,276 |

) |

|

|

(4,092 |

) |

|

| |

Cash at beginning

of period |

|

15,923 |

|

|

|

10,576 |

|

|

| |

Cash at end of

period |

$ |

13,647 |

|

|

$ |

6,484 |

|

|

| |

|

|

|

|

|

Q.E.P. Co., Inc.

Mark S. Walter

Senior Vice President Finance and

Chief Financial Officer

561-994-5550

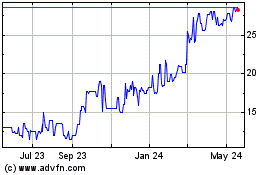

Q E P (QX) (USOTC:QEPC)

Historical Stock Chart

From Nov 2024 to Dec 2024

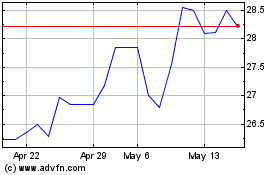

Q E P (QX) (USOTC:QEPC)

Historical Stock Chart

From Dec 2023 to Dec 2024