false

0001103795

0001103795

2025-02-19

2025-02-19

iso4217:USD

xbrli:shares

iso4217:USD

xbrli:shares

UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

FORM 8-K

CURRENT REPORT

Pursuant to Section 13 or 15(d) of the

Securities Exchange Act of 1934

Date of Report (Date of earliest event

reported): February 19, 2025

QS Energy, Inc.

(Exact Name of Registrant as Specified

in Charter)

| Nevada |

|

0-29185 |

|

52-2088326 |

|

(State or other jurisdiction

of incorporation) |

|

(Commission File

Number) |

|

(IRS Employer

Identification No.) |

| 23902

FM 2978 |

|

|

| Tomball, Texas |

|

77375 |

| (Address of principal executive offices) |

|

(Zip Code) |

Registrant’s telephone number, including

area code: (775) 300-7647

____________________________________________________________

(Former name or former address, if changed since last report)

Check the appropriate box below if the Form

8-K filing is intended to simultaneously satisfy the filing obligation of the registrant under any of the following provisions:

| ☐ |

Written communications pursuant to Rule 425 under the Securities Act (17 CFR 230.425) |

| |

|

| ☐ |

Soliciting material pursuant to Rule 14a-12 under the Exchange Act (17 CFR 240.14a-12) |

| |

|

| ☐ |

Pre-commencement communications pursuant to Rule 14d-2(b) under the Exchange Act (17 CFR 240.14d- 2(b)) |

| |

|

| ☐ |

Pre-commencement communications pursuant to Rule 13e-4(c) under the Exchange Act (17 CFR 240.13e- 4(c)) |

Securities registered pursuant to Section 12(b)

of the Exchange Act: None.

| Title of each Class |

Trading Symbol |

Name of each exchange on which registered |

| N/A |

N/A |

N/A |

Indicate by check mark whether the

registrant is an emerging growth company as defined in Rule 405 of the Securities Act of 1933 (§230.405 of this chapter) or Rule

12b-2 of the Securities Exchange Act of 1934 (§240. 12b-2 of this chapter).

Emerging growth company ☐

If an emerging growth company, indicate

by check mark if the registrant has elected not to use the extended transition period for complying with any new or revised financial

accounting standards provided pursuant to Section 13(a) of the Exchange Act. ☐

| Item 1.01 | Entry into a Material Definitive Agreement |

On February 19, 2025, QS Energy, Inc. (the “Company”)

entered into an Employment Agreement (“Agreement”) with Cecil Bond Kyte, the Company’s Chief Executive Officer (“CEO”)

and Chief Financial Officer (“CFO”). The term (“Term”) of the Agreement is one (1) year and will automatically

renew for successive one (1) year periods unless either Mr. Kyte or the Company provides notice, no later than December 1 of the then-current

year of the Term, that the Agreement shall not be renewed.

The effective date of the Agreement is January

1, 2025 (“Effective Date”), and provides for Mr. Kyte to continue to serve as the Company’s CEO and CFO for a base salary

of $35,000 per month. The Agreement also provides Mr. Kyte with a retention bonus of $1,557,500, payable in three (3) equal installments

of $519,617. The Agreement provides that payment of each of the installments is subject to the Company’s financial condition, including

the Company maintaining sufficient funds to pay, as due, its operating expenses and establishing a reasonable reserve therefor. Subject

to the foregoing condition, the first installment of $519,167 was due on execution of the Agreement; the second installment of $519,617

will be due on the execution, delivery, and effective date of a customer contract for the purchase or lease and installation of the Company’s

AOT product; and the third installment of $519,617 will be due on the execution, closing, and effective date of debt or equity financing

in favor of the Company in an amount of no less than $5,000,000.

The Agreement also provides a further inducement

to Mr. Kyte to continue his employment as CEO and CFO of the Company in the form of stock options. Upon execution of the Agreement, the

Company issued to Mr. Kyte an option (“Option”) to purchase 20,817,500 shares of restricted common stock of the Company, at

an exercise price of $0.03 per share. The Option immediately vested on the issuance thereof and expires 10 years from the Effective Date.

Upon execution of the Agreement, the Company also

issued to Mr. Kyte an additional option (“Additional Option”) to purchase 3,500,000 shares of restricted common stock of the

Company, at an exercise price equal to the price quoted in the OTC pink sheets for the Company’s publicly traded shares as of the

Effective Date. The Additional Option immediately vested on the issuance thereof, and expires 10 years from the Effective Date.

In addition to the Option and Additional Option

described above, the Agreement provides that Mr. Kyte will receive an option to purchase an additional 3,500,000 shares of restricted

common stock of the Company on each annual renewal of the Agreement (“Renewal Option”), at a price equal to the price quoted

in the OTC pink sheets for the Company’s publicly traded shares on the date of renewal of the Agreement. The Renewal Option will

vest at the rate of one-twelfth (1/12th) per month on the last calendar day of each month, provided the Agreement is not terminated and

Mr. Kyte continues to serve as the Company’s CEO and CFO on the date of vesting. The Renewal Option will expire 10 years from its

issuance date.

The Agreement also contains other terms and conditions

usual and customary in employment agreements.

The above description of material terms and conditions

of the Agreement is qualified in its entirety by reference to the Agreement, a copy of which is attached hereto as Exhibit 10.1, and incorporated

herein by reference.

| Item 9.01 | Financial Statements and Exhibits |

The following Exhibit is filed herewith.

SIGNATURES

Pursuant to the requirements of the Securities Exchange

Act of 1934, the Registrant has duly caused this report to be signed on its behalf by the undersigned hereunto duly authorized.

| Date: February 21, 2025 |

QS ENERGY, INC. |

| |

|

| |

By: /s/ Cecil Bond Kyte |

| |

Name: Cecil Bond Kyte |

| |

Title: CEO and CFO |

Exhibit 10.1

EMPLOYMENT AGREEMENT

This Employment

Agreement (“Agreement”) is entered into as of January 1, 2025 (the “Effective Date”), by and between QS Energy,

Inc. a Nevada corporation (“Company”) and Cecil Bond Kyte (“Executive”) (collectively, the “Parties”).

WHEREAS, Executive

was appointed to serve as the Company’s Chief Executive Officer (“CEO”) and Chief Financial Officer (“CFO”),

effective April 15, 2021, upon mutually acceptable terms and conditions to be determined at a later date based on and subject to the Company’s

financial condition and viability.

WHEREAS, Executive

served as Company’s CEO and CFO without compensation from April 15, 2021, through July 7, 2024.

WHEREAS, commencing

July 7, 2024, Company paid compensation to Executive in the amount of $210,000, representing payment to him for his services as CEO and

CFO commencing on April 15, 2021, through the Effective Date hereof.

WHEREAS,

effective as of the Effective Date, it continues to be the Company’s desire that Executive continue to serve as the

Company’s CEO and CFO, and it is Executive’s desire to continue to serve in such capacities for the Company, pursuant to

the terms and conditions set forth herein.

NOW, THEREFORE,

in consideration of the mutual covenants and agreements contained herein, the receipt and sufficiency are hereby acknowledged, the Parties

agree, as follows:

AGREEMENT

1.

Employment.

1.1

Acceptance of Employment. Effective as of the Effective Date, Company agrees to the continued employment of Executive,

and Executive agrees to continued employment with Company, on the terms and conditions set forth in this Agreement.

1.2

Duties and Powers. Executive shall continue to serve as the Company’s CEO and CFO. Executive’s duties

shall be consistent with such positions, including raising capital (debt or equity or a combination thereof) for the Company, and continuing

to take all necessary and reasonable steps to commercialize the Company’s technology and products. In carrying out his duties,

Executive shall use Executive’s best efforts, skills, judgment, and abilities, and shall at all times promote the Company’s

interest and perform and discharge well and faithfully, those duties. In addition, Executive shall abide by all of the requirements of

the Securities and Exchange Commission (“SEC”), and adhere to the policies and requests of the Company with respect thereto,

as the same may exist from time to time, applicable to executive officers of public companies. Executive shall perform or do all such

duties, services, acts or things necessary or advisable at the direction of Company and subject at all times to the policies set by the

Board of Directors of the Employer (the “Services”).

1.3

Supervision. Employee shall report to the Board of Directors of the Company in connection with the performance of

his duties hereunder.

1.4

Location. Executive shall perform his duties at the Company’s offices and locations as shall be approved and

directed by the Company.

1.5 Hours

of Employment. Executive shall devote his full energies, abilities and productive time to the performance of his duties

under this Agreement, except Executive may engage in other activities provided any such other activities do not materially interfere

with or adversely affect Executive’s performance of his duties hereunder and provided any such activities are not competitive

with or adverse to the business of the Company.

2.

Confidential Information. Executive hereby acknowledges that, during and solely as a result of his employment by

Company, he will have access to the Company’s confidential information and business and professional contacts. Executive hereby

agrees as follows:

2.1 Definition.

“Confidential Information” shall mean any information, tangible or intangible, relating to the business of Company and

its affiliated companies, and their products, finances, budgets, methods, policies, procedures, business, plans, computer or other

data, techniques, designs, research or development projects or results, customers or clients, employees, trade secrets, intellectual

property, licenses, or other knowledge or processes of or developed by Company and its affiliated companies, and any other

confidential information relating to or dealing with the businesses of Company and its affiliated companies, made known to Executive

or learned or acquired by Executive while in the employ of Company.

2.2

Use. During the Term (defined below), Executive shall use and disclose Confidential Information only for the benefit

of Company and only as necessary to carry out Executive’s responsibilities under this Agreement. After the Term (defined below),

Executive shall not, directly or indirectly, disclose to any person or entity, or use for the direct or indirect benefit of himself or

any person or entity, any Confidential Information, without the express written permission of Company. At no time shall Executive, directly

or indirectly, remove or cause to be removed from the premises or computers or other electronic devices of Company any Confidential Information

(including copies, extracts and summaries thereof) except in furtherance of the performance of Executive’s duties hereunder.

2.3

Proprietary Interests. Executive acknowledges and agrees that all Confidential Information, whether developed by

him or others, is and will remain the sole and exclusive property of Company. Executive further recognizes and agrees that all work performed

or work product developed by him in the course of his employment with Company is and shall remain the sole and exclusive property of Company.

Executive hereby assigns to Company any rights Executive may have or acquire in such Confidential Information and agrees to sign any additional

document(s) that Company may determine is/are necessary to effectuate such assignment. This Agreement does not apply to an invention by

Executive that qualifies as a nonassignable invention under any applicable state law.

2.4 Return

of Confidential Information. Upon the termination of Executive’s employment with Company for any reason, or at the

request of Company before, at or after termination, Executive will promptly deliver to Company all records, files, memoranda,

documents, lists and other information containing any Confidential Information, including all copies or summaries thereof, in

Executive’s possession or control, whether prepared by Executive or others. Should Executive discover such items in his

possession after his separation and departure from employment with Company, he agrees to return them promptly to Company without

retaining copies.

3.

Term of Employment. Subject to earlier termination as provided herein, Executive hereby agrees to continue to be

employed by Company for a term of one (1) year beginning on the Effective Date of this Agreement, and Company hereby agrees to employ

Executive during such Term. Thereafter, this Agreement shall automatically be renewed for successive one (1) year periods unless either

party hereto shall give written notice to the other, not later than December 1 of the then-current year of the Term that this Agreement

shall not be renewed (“Expiration Date”). This Agreement shall in all respects terminate on the Expiration Date, except for

those obligations of either party hereto that are expressly stated to continue after such time or by the nature of terms hereof will continue

after such time. The period beginning on the Effective Date and ending on the earlier of the Expiration Date or Executive’s employment

hereunder actually terminates is referred to herein as the term (“Term”).

4.

Compensation. In consideration for the continued performance of Executive’s duties and the rendition by Executive

of the Services to be provided under this Agreement, and in consideration of Executive’s agreement to continue his employment with

Company, Company shall compensate Executive, as follows:

4.1 Base

Salary. Throughout the Term, Company shall pay Executive an annual base salary (“Base Salary”) of Four Hundred

Twenty Thousand Dollars ($420,000). Base Salary shall be payable ratably in bi-weekly installments, or more or less often in

accordance with Company’s standard payroll practices in effect from time to time, net of all amounts required to be withheld

by Company for taxes imposed on Executive pursuant to all applicable laws.

4.2

Option. As an inducement to Executive to agree to continue his employment with Company pursuant to the terms and

conditions hereunder, Company upon the execution hereof agrees to issue to Executive an option (“Option”) to purchase twenty

million eight hundred seventeen thousand five hundred (20,817,500) shares of restricted common stock of the Company, at an exercise price

of $0.03 per share. The Option shall immediately vest in its entirety upon the issuance thereof. The Option shall expire ten (10) years

from the Effective Date, and shall be of no force or effect thereafter.

4.3

Additional Option. As additional consideration payable to Executive for his Services, upon the execution hereof,

Company shall issue an additional option (“Additional Option”) to Executive to purchase three million five hundred thousand

(3,500,000) shares of restricted common stock of the Company, at a price per share equal to the price quoted on the OTC pink sheets for

the Company’s publicly traded shares of common stock on the Effective Date. The Additional Option shall immediately vest in its

entirety upon the issuance thereof, and shall expire ten (10) years from the Effective Date, and shall be of no force or effect thereafter.

4.4

Renewal Option. In addition to the Additional Option described in section 4.3, above, for each year this Agreement

is renewed the Company shall issue on the date of such renewal a renewal option (“Renewal Option”) to Executive to purchase

3,500,000 shares of restricted common stock of the Company, at a price per share equal to the price quoted on the OTC pink sheets for

the Company’s publicly traded shares of common stock on the day of the renewal hereof. The Renewal Option shall vest at the rate

of one-twelfth per month (291,667 shares per month for the first eleven months and 291,663 shares for the twelfth month) on the last

calendar of each month. The Renewal Option shall expire ten (10) years from the issuance thereof. If this Agreement is terminated for

any reason, all unvested Renewal Options shall terminate and be of no force or effect.

Executive understands and agrees that the Options

to be issued by Company in accordance with sections 4.2, 4.3, and 4.4 above and the shares to be issued in connection therewith will

not be registered under federal or state securities laws by reason of specific exemptions thereunder. Executive also understands and

agrees that the aforementioned Options to be issued and shares to be issued in connection therewith are “restricted securities”

under applicable federal securities laws and that Executive may dispose of the shares only pursuant to an effective registration statement

under federal securities laws or exemption therefrom.

4.5 Retention

and Discretionary Bonuses. As a further inducement to Executive to agree to continue his employment with Company pursuant to

the terms and conditions hereunder, Company shall pay Executive a retention bonus of one million five hundred fifty seven thousand

five hundred dollars ($1,557,500), payable in the following instalments, subject to the Company’s financial condition,

including maintaining sufficient funds to pay, as due, operating expenses and a reasonable reserve therefor: (i) $519,167 shall be

paid to Executive on the execution of this Agreement; (ii) $519,167 shall be paid to Executive on the execution, delivery, and

effective date of a customer contract for the purchase or lease and installation of the Company’s AOT product; (iii) $519,166

shall be paid to Executive on the execution, closing, and effective date of debt or equity financing in favor of the Company in the

amount of no less than $5,000,000. Additionally, Executive shall be eligible to receive a discretionary bonus compensation during

the Term as the Board of Directors of Company shall determine within the Board’s sole and absolute discretion.

4.6 Reimbursement

of Expenses. Company agrees to pay, or promptly to reimburse, Executive for all reasonable out-of-pocket business expenses

incurred by Executive in connection with the performance of his duties hereunder, including business-related entertainment expenses,

travel expenses, food and lodging while away from home, all subject to such reasonable policies as Company may from time to time

determine. Executive agrees that prior to incurring any expense or debt on behalf of Company, Executive shall comply with such

approval policies and procedures as Company may establish from time to time.

4.7

Health Benefits. Executive shall be eligible to receive monthly health benefits. Executive may elect to participate

in any group health insurance plan which may be offered by Company to employees. If Executive elects not to participate in such group

health insurance plan, Executive shall be paid on the last day of each month during the Term the sum of $1,500 per month.

5.

Other Benefits.

5.1

General. In addition to any specific benefits herein granted to Executive, Executive shall be entitled to participate

in all benefit programs, if any, such as pension or retirement plans, profit-sharing plans, life insurance, and any other plans or benefits

that Company provides from time to time to its employees, subject to the terms and conditions of Company’s policies and benefit

plans. Executive shall also be entitled to a non-accountable home office allowance in the amount of $1,000 per month, and a non-accountable

automobile allowance of $500 per month.

5.2 Vacation.

For work performed, Executive shall earn paid vacation at the rate of six (6) weeks for each calendar year, or prorated portion

thereof, as applicable, of his employment. Any vacation time not taken in the year during which it accrues shall cumulate until

taken, up to a maximum of six (6) weeks. Once the maximum accrual amount is reached, no further vacation time shall be earned until

some vacation is used, and the amount of accrued vacation falls below the permitted maximum. Vacations shall be taken at a time and

for a period reasonably convenient to Company. Except as provided herein, vacation shall be governed by Company’s standard

policy on vacation for all full time employees.

5.3 Illness.

Employee shall be entitled to four (4) weeks per year as sick leave with full pay. Sick leave may not be cumulated.

6.

Termination of Employment by Company. Company may terminate Executive’s employment only for the following reasons:

6.1

Death. Upon the death of the Executive.

6.2 Disability.

After any disability that prevents Executive from fulfilling the essential duties of his position for more than three (3)

consecutive months, unless otherwise required by law. It is understood and agreed that Executive will, during the three (3) month

period, be provided all vacation time, sick leave and benefits, and any reasonable accommodations that are legally required, and

will also be provided during the three (3) month period, subject to Section 7, below, all Base Salary. As used herein, the term

“disability” means an illness, injury or similar incapacity of Executive, including, without limitation, physical or

mental incompetence, by reason of which Executive is rendered substantially unable to perform his duties hereunder during any

consecutive three (3) month period. Executive agrees first to submit to a medical examination by a physician or health care provider

selected and paid for by Company, and any follow up examinations that may be reasonably necessary, solely for the purpose of

determining the issue of disability. Thereafter, any dispute as to Executive’s disability shall be determined by arbitration

pursuant to Section 8.5 hereof.

6.3 For

Cause. As used herein, “Cause” for termination shall mean Executive’s employment is terminated because

Executive has: (a) committed any act or omission constituting a material breach of this Agreement; (b) engaged in gross negligence

or willful misconduct in connection with the Company’s business; (c) been convicted of, or plead guilty or nolo contender in

connection with, fraud or any crime that constitutes a felony or that involves moral turpitude or theft; (d) has committed any

intentional act of embezzlement, theft, misappropriation of the Company’s funds, dishonesty, fraud or unauthorized use of the

Company’s funds or property; or (e) undertaken any act injurious to the Company’s business, including insubordination or

failure to follow a directive of the Company’s Board of Directors.

6.4 Without

Cause. As used herein, “Without Cause” shall mean any termination by Company, except for termination for Cause,

death or disability.

7.

Effect of Termination.

7.1 Termination

Due to Death or Disability. If Executive’s employment is terminated pursuant to any of Sections 6.1 or 6.2 hereof,

Executive (or his estate) shall be entitled to receive his Base Salary prorated through the date of termination under Sections 6.1

or 6.2 hereof, any due and payable retention bonus, and all compensation attributable to accrued but unused vacation and sick leave,

prorated up through the date of such termination. Subject to Section 8.6, as applicable, all other rights and obligations of Company

to Executive and Executive to Company under this Agreement shall be completely extinguished, and, for avoidance of doubt, all

unvested options shall be extinguished and of no further force or effect.

7.2 Termination

For Cause. If Executive’s employment is terminated pursuant to Section 6.3 (for Cause), Executive shall be entitled

only to his Base Salary prorated through the date of termination for Cause and all compensation attributable to accrued but unused

vacation and sick leave, prorated through the date of termination for Cause. Subject to Section 8.6, as applicable, all other rights

and obligations of Company to Executive and Executive to Company under this Agreement shall be completely extinguished, and, for

avoidance of doubt, all unvested options shall be extinguished and of no further force or effect.

7.3 Executive’s

Resignation. In the event Executive resigns from employment prior to the end of the Term of this Agreement for any reason,

Executive shall be entitled only to his Base Salary prorated through the last day of employment, any due and payable retention

bonus, and all compensation attributable to accrued but unused vacation and sick leave, prorated through the last day of employment.

Subject to Section 8.6, as applicable, all other rights and obligations of Company to Executive and Executive to Company under this

Agreement shall be completely extinguished, and, for the avoidance of doubt, all unvested options shall be extinguished and of no

further or effect.

7.4

Without Cause. If Executive’s employment is terminated Without Cause, Company shall be obligated to pay Executive

his Base Salary through the date of expiration of the Term, any due and payable retention bonus, and all compensation attributable to

accrued but unused vacation and sick leave, prorated up through the date of termination. Subject to Section 8.6, as applicable, all other

rights and obligations of the Company to Executive and Executive to Company under this Agreement shall be completely extinguished, and,

for avoidance of doubt, all unvested options shall be extinguished and of no further force or effect.

7.5 Change

of Control. Upon a Change of Control event, this Agreement shall be deemed terminated, and Company shall pay Executive the

amount set forth in this Section 7.5, within ten (10) days from the Change of Control event. For purposes of this Section 7.5,

Change of Control means the occurrence of one or more of the following events:

| (i) | The consummation of a merger or consolidation of Company with or into another entity

or any other corporate reorganization, if more than fifty percent (50%) of the combined voting power of the continuing or surviving entity’s

securities outstanding immediately after such merger, consolidation, or other reorganization is owned by persons who are not stockholders

of Company immediately prior to such merger, consolidation, or other reorganization; or |

| | | |

| (ii) | Any person, including all affiliates of such person, who is or becomes the beneficial

owner (as defined in Rule 13d-3 under the Securities Exchange Act of 1934, as amended), directly or indirectly, of securities of Company

representing fifty percent (50%) or more of the combined voting power of Company’s then outstanding securities. |

| | | |

| (iii) | The sale, transfer, or other disposition of all or substantially all of Company’s

assets. |

In the event of

a Change of Control event occurring during the Term, or in the event that any contract is entered into by Company relating to a Change

of Control event during the Term which contract provides for a closing thereof after the expiration of the Term, Company shall pay Executive

the sum $420,000, and all unvested Options shall immediately vest.

8.

Miscellaneous.

8.1 Captions.

The captions of the sections hereof are included for convenience only and shall not affect the construction or interpretation of any

provisions hereof.

8.2 Notices.

All notices, requests, demands, consents, approvals and other communications required or permitted under this Agreement shall be in

writing and shall be deemed given upon receipt if delivered personally or by courier, by fax (if a fax number is indicated and

confirmation of the transmission is received by the sender), or by email, or three days after being mailed, certified or registered,

postage prepaid, return receipt requested, to the party to whom the same is so delivered or mailed, as follows:

| 8.2.1 |

If to Company: |

| |

QS Energy, Inc. |

| |

_____________________ |

| |

_____________________ |

|

|

_____________________ |

| |

|

| |

Attn: |

|

|

Katrina Foreman, Corporate Secretary |

|

8.2.2

|

If to Executive: |

| |

Cecil Bond Kyte |

| |

_____________________ |

| |

_____________________ |

or to such other

address or fax number or email address as any of the above shall have specified by notice duly given hereunder.

8.3 Severability.

Should any provisions or portion of this Agreement be held unenforceable or invalid for any reason by an arbitrator or court of

competent jurisdiction, that provision shall be deemed modified to the extent necessary to allow enforceability of the provision as

so limited, it being the intention of the parties that they should receive the benefits contemplated by this Agreement to the

fullest extent permitted by law. If a deemed modification is not satisfactory in the judgment of the arbitrator or court, the

provision shall be deemed deleted and the validity and enforceability of the remaining provisions and portions of this Agreement

shall be unaffected by such holding.

8.4 Waivers.

Neither party hereto shall be deemed as a consequence of any act, delay, failure, omission, forbearance or other indulgences granted

from time to time by the other party hereto: (a) to have waived, or to be estopped from exercising, any of its rights or remedies

under this Agreement; or (b) to have modified, changed, amended, terminated, rescinded, or superseded any of the terms of this

Agreement, unless such waiver modification, etc. is expressed, in writing and signed by the party that is to be bound thereby. No

single or partial exercise by either party hereto of any right or remedy will preclude any other or further exercise thereof or

preclude the exercise of any other right or remedy, and a waiver expressly made in writing on one occasion will be effective only in

that specific instance and only for the precise purpose for which given, and will not be construed as a consent to or a waiver of

any right or remedy on any future occasion or a waiver of any right or remedy against the other party.

8.5

Arbitration.

8.5.1 Arbitrable

Claims. To the fullest extent permitted by law, all disputes between Executive (and his heirs and assigns) and Company

relating in any manner whatsoever to the employment or termination of employment, including, without limitation, all disputes

arising under this Agreement (“Arbitrable Claims”), shall be resolved by arbitration. Arbitrable Claims shall include,

but are not limited to, contract (express or implied) and tort claims of all kinds, as well as all claims based on any federal,

state or local law, statute or regulation, to the fullest extent permitted by law and excepting claims under applicable

workers’ compensation law and unemployment insurance claims.

8.5.2 Procedure.

Arbitration of Arbitrable Claims shall be in accordance with the then current National Rules for the Resolution of Employment

Disputes of the American Arbitration Association, as amended (“AAA Employment Rules”), as augmented in this Agreement.

Arbitration shall be initiated as provided by the AAA Employment Rules, although the written notice to the other party initiating

arbitration shall also include a statement of the claim(s) asserted and the facts upon which the claim(s) are based. The Arbitration

shall be final and binding upon the parties and shall be the exclusive remedy for all Arbitrable Claims. Either party may bring an

action in court to compel arbitration under this Agreement and to enforce an arbitration award. Otherwise, neither party shall

initiate or prosecute any lawsuit or administrative action in any way related to any Arbitrable Claim. Notwithstanding the

foregoing, either party may, at its option, seek injunctive relief pursuant to applicable state law. All arbitration hearings under

this Agreement shall be conducted in Reno, Nevada. THE PARTIES HEREBY WAIVE ANY RIGHTS THEY MAY HAVE TO TRIAL BY JURY IN REGARD TO

ARBITRABLE CLAIMS, INCLUDING, WITHOUT LIMITATION, ANY RIGHT TO TRIAL BY JURY AS TO THE MAKING, EXISTENCE, VALIDITY OR ENFORCEABILITY

OF THE AGREEMENT TO ARBITRATE.

8.5.3

Arbitrator Selection and Authority. All disputes involving Arbitrable Claims shall be decided by a single arbitrator.

The arbitrator shall be selected by mutual agreement of the parties within thirty (30) days of the effective date of the notice initiating

the arbitration. If the parties cannot agree on an arbitrator, then the complaining party shall notify the AAA and request selection of

an arbitrator in accordance with AAA Employment Rules. The arbitrator shall have authority to award equitable relief, damages, costs and

fees to the same extent that, but not greater than, a state or federal district court in Nevada would have. The fees of the arbitrator

shall be split between both parties equally, unless this would render this Section of Arbitration unenforceable, in which case the arbitrator

shall apportion said fees and any statutory remedies so as to preserve enforceability. The arbitrator shall have exclusive authority to

resolve all Arbitrable Claims, including, but not limited to, whether any particular claim is arbitrable and whether all or any part of

this Agreement is void or unenforceable. Upon completion of the arbitration proceedings, the arbitrator shall issue a written report to

both parties which reveals the essential findings and conclusions upon which any award was based.

8.6 Continuing

Obligations. The rights and obligations of Executive and Company set forth in Section 2 and subparts thereof (Confidential

Information), Section 4 and subparts thereof (Compensation), Section 7 and subparts thereof (Effect of Termination) and Section 8

and subparts thereof (including Arbitration and other Miscellaneous provisions) and any other provision which by its terms is

intended to continue shall survive the termination of Executive’s employment and the expiration of this Agreement to the

extent reasonably necessary to enforce the terms of this Agreement.

8.7 Attorney’s

Fees. In the event that either of the parties hereto (or any successor thereto) resorts to legal action, including

arbitration, in order to enforce, defend or interpret any of the terms or the provisions of this Agreement, the prevailing party

shall be entitled to an award of reasonable attorneys’ fees if otherwise provided by law and the arbitrator determines such an

award is warranted. In addition, when attorneys’ fees are awarded by the arbitrator, the prevailing party shall be entitled to

recover from the non-prevailing party post-judgment attorneys’ fees incurred by the prevailing party in enforcing a judgment

against the non-prevailing party. Notwithstanding anything in this Agreement to the contrary, the provisions of the preceding

sentence are intended to be severable from the balance of this Agreement, shall survive any judgment rendered in connection with the

aforesaid legal action, and shall not be merged into any such judgment.

8.8 Entire

Agreement; Amendment. This Agreement embodies the entire agreement and understanding of the Parties hereto with respect to

the subject matter herein and supersedes all prior or contemporaneous oral or written understandings and agreements of the Parties.

This Agreement cannot be amended or terminated orally, but only by a writing duly executed by the Parties hereto.

8.9 Applicable

Law. This Agreement shall be governed by, and construed and enforced in accordance with, the internal laws of the state of

Nevada.

IN WITNESS

WHEREOF, the Parties have executed this Agreement as of the Effective Date.

| |

|

“Company”

QS ENERGY, INC.

|

| |

|

|

| By: |

|

/s/ Katrina Foreman |

| |

|

Katrina Foreman, Corporate Secretary |

| Dated: |

|

2/19/2025 |

| |

|

|

| |

|

|

| |

|

“Executive” |

| |

|

|

| |

|

/s/ Cecil Bond Kyte |

| |

|

Cecil Bond Kyte |

| Dated: |

|

2/19/2025 |

| |

|

|

| |

|

|

| Approved: |

|

/s/ Eric Bunting |

| |

|

Eric Bunting, Director |

| Dated: |

|

2/19/2025 |

| |

|

|

| |

|

|

| |

|

|

v3.25.0.1

| X |

- DefinitionBoolean flag that is true when the XBRL content amends previously-filed or accepted submission.

| Name: |

dei_AmendmentFlag |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionFor the EDGAR submission types of Form 8-K: the date of the report, the date of the earliest event reported; for the EDGAR submission types of Form N-1A: the filing date; for all other submission types: the end of the reporting or transition period. The format of the date is YYYY-MM-DD.

| Name: |

dei_DocumentPeriodEndDate |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:dateItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionThe type of document being provided (such as 10-K, 10-Q, 485BPOS, etc). The document type is limited to the same value as the supporting SEC submission type, or the word 'Other'.

| Name: |

dei_DocumentType |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:submissionTypeItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionAddress Line 1 such as Attn, Building Name, Street Name

| Name: |

dei_EntityAddressAddressLine1 |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- Definition

+ References

+ Details

| Name: |

dei_EntityAddressCityOrTown |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionCode for the postal or zip code

| Name: |

dei_EntityAddressPostalZipCode |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionName of the state or province.

| Name: |

dei_EntityAddressStateOrProvince |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:stateOrProvinceItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionA unique 10-digit SEC-issued value to identify entities that have filed disclosures with the SEC. It is commonly abbreviated as CIK. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b-2

| Name: |

dei_EntityCentralIndexKey |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:centralIndexKeyItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionIndicate if registrant meets the emerging growth company criteria. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b-2

| Name: |

dei_EntityEmergingGrowthCompany |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionCommission file number. The field allows up to 17 characters. The prefix may contain 1-3 digits, the sequence number may contain 1-8 digits, the optional suffix may contain 1-4 characters, and the fields are separated with a hyphen.

| Name: |

dei_EntityFileNumber |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:fileNumberItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionTwo-character EDGAR code representing the state or country of incorporation.

| Name: |

dei_EntityIncorporationStateCountryCode |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:edgarStateCountryItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionThe exact name of the entity filing the report as specified in its charter, which is required by forms filed with the SEC. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b-2

| Name: |

dei_EntityRegistrantName |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionThe Tax Identification Number (TIN), also known as an Employer Identification Number (EIN), is a unique 9-digit value assigned by the IRS. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b-2

| Name: |

dei_EntityTaxIdentificationNumber |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:employerIdItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionLocal phone number for entity.

| Name: |

dei_LocalPhoneNumber |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionBoolean flag that is true when the Form 8-K filing is intended to satisfy the filing obligation of the registrant as pre-commencement communications pursuant to Rule 13e-4(c) under the Exchange Act. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 13e

-Subsection 4c

| Name: |

dei_PreCommencementIssuerTenderOffer |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionBoolean flag that is true when the Form 8-K filing is intended to satisfy the filing obligation of the registrant as pre-commencement communications pursuant to Rule 14d-2(b) under the Exchange Act. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 14d

-Subsection 2b

| Name: |

dei_PreCommencementTenderOffer |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionBoolean flag that is true when the Form 8-K filing is intended to satisfy the filing obligation of the registrant as soliciting material pursuant to Rule 14a-12 under the Exchange Act. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 14a

-Subsection 12

| Name: |

dei_SolicitingMaterial |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionBoolean flag that is true when the Form 8-K filing is intended to satisfy the filing obligation of the registrant as written communications pursuant to Rule 425 under the Securities Act. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Securities Act

-Number 230

-Section 425

| Name: |

dei_WrittenCommunications |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

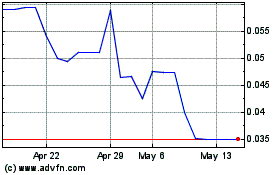

QS Energy (PK) (USOTC:QSEP)

Historical Stock Chart

From Feb 2025 to Mar 2025

QS Energy (PK) (USOTC:QSEP)

Historical Stock Chart

From Mar 2024 to Mar 2025