INTERVIEW: Emerging Markets Remain Growth Engines - Compass CEO

04 August 2011 - 2:12AM

Dow Jones News

Emerging markets will remain the growth engine for the catering

industry, attracting investment and providing acquisition

opportunities to offset the impact of ailing economies across

Northern and Continental Europe, Compass Group PLC (CPG.LN) Chief

Executive Richard Cousins told Dow Jones Newswires Wednesday.

Cousins said in an interview that since taking the helm of the

Surrey, U.K.-based FTSE 100 business five years ago, he has brought

focus to an "out of control" company by shrinking its geographical

footprint, selling off underperforming assets and paring costs.

He said the company, which is the world's largest caterer by

revenue ahead of French rival Sodexo (SW.FR), will "put more and

more of our capital and focus into the emerging economies," which

last month posted a 7.9% rise in third-quarter sales.

He expects double-digit organic revenue growth from growth

markets such as Asia, Africa and Latin America, as well as further

acquisition opportunities.

The group, which supplies around 4 billion meals a year to

offices, schools, hospitals, armed forces and leisure centers in 50

countries, made five bolt-on acquisitions in India in the last 18

months, and has previously bought out joint venture agreements in

both Brazil and Turkey. "We are beginning to see these [markets] as

really significant growth engines," said Cousins.

"We have just bought a little business in Hong Kong. We are

growing very strongly in the Middle East, China is very exciting

and Russia is going well," he added.

Cousins is also upbeat on the U.S., which accounts for more than

40% of group operations. "The economy is not great, but it is

better than the U.K. and Europe. The outsourcing trends are

positive. We are pretty bullish."

However, corporate catering and hospitality have suffered as

companies and government services cut costs amid austerity measures

and a slow economic recovery, leading to falling sales in the U.K.

and Ireland and only a modest rise in Europe in the third

quarter.

"Our working assumption is that, in the U.K. and Europe, it's

going to be tough [in the second half]. You can imagine that with

some of the big banks, BT Group PLC (BT.A.LN), the Post Office --

they are taking people out all the time and we do notice that,"

Cousins said.

He also noted the challenge posed by input inflation which hits

the company's margins despite an attempt to partially offset the

higher raw materials costs through menu planning and pricing.

"What we are seeing globally today is food inflation between 2%

and 4%, so 3% on average. If beef goes up by 10% and pork goes up

by 4% it's fairly obvious what you do with planning your menus,"

said Cousins.

"We have to mitigate it as much as we possibly can. That

probably takes the 3% headline down to 2% and then we have to pass

the rest on through pricing."

The CEO also said paring logistic and distribution costs is a

necessity. "We spend well over a billion (US) dollars a year

globally on pure transportation from manufacturers to

distributors."

Compass last month posted a rise in third-quarter sales and said

its full-year expectations remained unchanged, despite a GBP20

million hit to second-half profit due to supply chain disruption in

Japan following the March tsunami.

"We don't think Japan will be back to normal for some months,"

Cousins warned.

By Simon Zekaria, Dow Jones Newswires; +44 207 842-9410;

simon.zekaria@dowjones.com

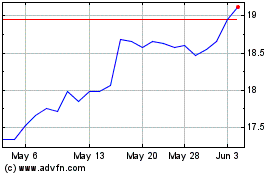

Sodexo (PK) (USOTC:SDXAY)

Historical Stock Chart

From Oct 2024 to Nov 2024

Sodexo (PK) (USOTC:SDXAY)

Historical Stock Chart

From Nov 2023 to Nov 2024