UNITED

STATES

SECURITIES

AND EXCHANGE COMMISSION

Washington,

D.C. 20549

SCHEDULE

14C

(Rule

14c-101)

INFORMATION

REQUIRED IN INFORMATION STATEMENT

SCHEDULE

14C INFORMATION

Information

Statement Pursuant to Section 14(c) of the Securities

Exchange

Act of 1934

☐

Preliminary Information Statement

☐

Confidential, for use of the Commission only (as permitted by Rule 14c-5(d)(2))

☒

Definitive Information Statement

Strategic

Environmental & Energy Resources, Inc.

Payment

of Filing Fee (Check the appropriate box):

☒ No

fee required

☐

Fee computed on table below per Exchange Act Rules 14c-5(g) and 0-11

(1)

Titled of each class of securities to which transaction applies: Common

(2)

Aggregate number of securities to which transaction applies: 250,000,000 newly authorized common share

(3)

Per unit price or other underlying value of transaction computed pursuant to Exchange Act Rule 0-11 (set forth the amount on which the

filing fee is calculated and state how it was determined):

(4)

Proposed maximum aggregate value of transaction:

(5)

Total fee paid:

☐

Fee paid previously with preliminary materials.

☐

Check box if any part of the fee is offset as provided by Exchange Act Rule 0-11(a)(2) and identify the

filing for which the offsetting fee was paid previously. Identify the previous filing by registration number, or the Form or Schedule

and the date of its filing.

(1)

Amount Previously Paid:

(2)

Form, Schedule or Registration No:

(3)

Filing Party: Strategic Environmental & Energy Resources, Inc.

(4)

Date Filed: February 14, 2025

STRATEGIC

ENVIRONMENTAL & ENERGY RESOURCES, INC.

370

Interlocken Blvd

Suite

680

Broomfield,

CO 80021

(303)

277-1625

NOTICE

OF ACTION TO BE TAKEN WITHOUT A MEETING

To

Our Stockholders:

On

December 20, 2024, our Board of Directors acted by written consent in lieu of a meeting, to adopt and approve an amendment to our Articles

of Incorporation to increase the number of shares of common stock we are authorized to issue from 70,000,000 common shares with a par

value of $0.001 to 320,000,000 common shares with a par value of $0.001(a net increase of 250,000,000 common shares).

Our

Board of Directors fixed December 31, 2024 as the record date for determining the holders of common stock entitled to notice and receipt

of this Information Statement.

The

accompanying Information Statement, which describes the above corporate action in more detail, is being furnished to our stockholders

for informational purposes only pursuant to Section 14(c) of the Securities Exchange Act of 1934, as amended (the “Exchange Act”),

and the rules and regulations prescribed thereunder

We

will timely file, with the Nevada Secretary of State, the Articles of Amendment to our corporate Articles of Incorporation to effectuate

the increase of our authorized capital stock.

THIS

IS NOT A NOTICE OF A MEETING OF STOCKHOLDERS

AND

NO STOCKHOLDERS’ MEETING WILL BE HELD TO CONSIDER ANY MATTER DESCRIBED HEREIN. WE ARE NOT ASKING YOU FOR A PROXY A

AND

YOU ARE REQUESTED NOT TO SEND US A PROXY.

The

earliest date on which the amendment to our Articles of Incorporation may be affected is February 1, 2024.

| By Order of the Board of Directors: |

|

| |

|

| /s/ John Combs |

|

| President, Director |

|

The

date of this notice and the accompanying Information Statement is January 21, 2024.

STRATEGIC

ENVIRONMENTAL & ENERGY RESOURCES, INC.

370

Interlocken Blvd

Suite

680

Broomfield,

CO 80021

(303)

277-1625

INFORMATION

STATEMENT REGARDING ACTION TAKEN BY WRITTEN CONSENT

OF

STOCKHOLDERS IN LIEU OF A MEETING

BACKGROUND

STRATEGIC

ENVIRONMENTAL & ENERGY RESOURCES, INC. (“we,” “us” and the “Company”) is a Nevada corporation

with our principal executive offices located at 370 Interlocken Blvd, Suite 680, Broomfield, CO 80021. Our telephone number is (303)

277-1625. This Information Statement is being sent at the direction of our Board of Directors (our “Board”) to inform you

of action the holders of amajority of our outstanding shares of common stock have taken by written consent, in lieu of a special meeting.

On

December 20, 2024, our Board unanimously adopted resolutions approving an amendment to our Articles of Incorporation to increase the

number of shares of common stock the Company is authorized to issue from 70,000,000 to 320,000,000 (the “Amendment”).

On

December 31, 2024, a majority of the holders of our common stock as of the Record Date acted by written consent, in lieu of a meeting,

to approve the Amendment. The action by written consent will be effective when the Company files a Certificate of Amendment to our Articles

of Incorporation with the Nevada Secretary of State.

As

of the Record Date, our authorized capital stock consisted of 70,000,000 shares of common stock, par value $0.001 per share and 5,000,000

shares of preferred stock, par value $0.001. As of the Record Date, there were approximately 62,303,575 shares of common stock and 4,000,000

shares of preferred stock issued with a 15:1 voting preference.

The

above-referenced written consent was taken by the following stockholders (collectively, the “Majority Stockholders”), who

held, as of the Record Date, approximately 27,332,463 common and preferred shares with concomitant votes totaling 83,332,463, or approximately

68% of our voting stock and votes entitled to be cast:

Continued

on the next page.

| SEER Shareholder Vote Analysis | |

| | |

| | |

| |

| | |

| | |

| | |

| | |

| |

| Shares Issued and Outstanding

as of Dec 2024 | |

Shares | | |

Votes | | |

% of Common | | |

% of Vote | |

| Common | |

| 62,303,575 | | |

| 62,303,575 | | |

| | | |

| | |

| Preferred | |

| 4,000,000 | | |

| 60,000,000 | | |

| | | |

| | |

| Total Entitled Votes | |

| | | |

| 122,303,575 | | |

| | | |

| | |

| Majority of Votes Threshold | |

| | | |

| 62,374,823 | | |

| | | |

| | |

| | |

| | | |

| | | |

| | | |

| | |

| Voting

Results -Approvals | |

| | | |

| | | |

| | | |

| | |

| | |

| | | |

| Votes | | |

| | | |

| | |

| Carl Berg | |

| | | |

| 3,500,000 | | |

| 0.06 | | |

| 0.03 | |

| Clyde Berg | |

| | | |

| 6,010,000 | | |

| 0.10 | | |

| 0.05 | |

| J. John Combs | |

| | | |

| 3,606,315 | | |

| 0.06 | | |

| | |

| First Block - Preferred (Vote 15:1) | |

| | | |

| 60,000,000 | | |

| | | |

| 0.49 | |

| LPD | |

| | | |

| 6,290,832 | | |

| 0.10 | | |

| 0.05 | |

| Tracy Miles | |

| | | |

| 3,925,316 | | |

| 0.06 | | |

| 0.03 | |

| | |

| | | |

| 83,332,463 | | |

| | | |

| | |

| | |

| | | |

| | | |

| | | |

| | |

| Final Voting Approval Percentage | |

| | | |

| 0.68 | | |

| | | |

| | |

We

will file an amendment to our Articles of Incorporation with the Nevada Secretary of State, substantially in the form attached to this

Information Statement as Appendix A

Our

Board elected to seek approval of the Articles of Amendment through the written consent of the Majority Stockholders for the following

reasons:

| 1. | In

order to avoid the time, expense and management attention involved in convening a special

meeting of stockholders and soliciting proxies. |

| | | |

| 2. | In

order to assure that it has sufficient available common stock available for general corporate

purposes including, without limitation, equity financings, acquisitions, conversion of debt,

establishing strategic relationships with corporate partners, providing equity incentives

to employees, stock splits or other recapitalizations. |

All

required corporate approvals for the Amendment have been obtained. This Information Statement is furnished solely for the purpose of

informing our stockholders of this corporate action in the manner required by Rule 14c-2(b) under the Securities Exchange Act of 1934,

as amended.

WE

ARE NOT ASKING YOU FOR A PROXY

AND

YOU ARE REQUESTED NOT TO SEND US A PROXY.

THIS

IS NOT A NOTICE OF A MEETING OF STOCKHOLDERS AND NO STOCKHOLDERS’

MEETING

WILL BE HELD TO CONSIDER ANY MATTER DESCRIBED HEREIN.

The

Company is paying the costs of the preparation and distribution of this Information Statement.

INCREASE

IN AUTHORIZED CAPITAL STOCK

General.

On

January 10, 2025, our Board unanimously approved the adoption of an amendment to our Articles of Incorporation to increase the number

of shares of common stock we are authorized to issue from 70,000,000 to 320,000,000 (the “Amendment”). On December 31, 2024,

the Majority Stockholders voted in favor of the Amendment and vote of the Majority Stockholders was obtained by written consent, in lieu

of a special meeting. The terms of the additional shares of common stock will be identical to those of our currently authorized shares

of common stock. The relative rights and limitations of the shares of common stock will not be changed by the Amendment.

Consent

Required.

Approval

of the Amendment required the consent of the holders of a majority of the issued and outstanding shares of our shares entitled to vote,

both common and preferred stock, as of the Record Date, or at least 62,374,823 votes. As of the Record Date, the Majority Stockholders

owned shares with votes in an aggregate of approximately 83,332,463, representing approximately 68% of the entitled votes concomitant

with our issued and outstanding shares of both common and preferred stock. The Majority Stockholders have given their written consent

to the Amendment and accordingly, the requisite stockholder approval of the Amendment was obtained.

Amendment.

Our

Board and the Majority Stockholders have voted to amend Article Five: Amendment of Articles of Incorporation of our Articles of Incorporation

to increase the number of our shares of common stock the Company is authorized to issue from 70,000,000 to 320,000,000. The text of the

amendment to our Articles of Incorporation, substantially in the form attached to this Information Statement, is included as Appendix

A.

Reasons

for Increase in our Authorized Shares of Common Stock.

The

principal purpose of increasing our authorized Common Stock is to ensure that the Company has sufficient shares of Common Stock available

for general corporate purposes, including, without limitation, equity financings, acquisitions, debt conversions, establishing strategic

relationships with corporate partners, providing equity incentives to employees, or other recapitalizations. Without an increase in the

shares of Common Stock authorized for issuance, the Company might not be able to conclude any such transaction in a timely fashion.

To

the extent that additional authorized shares are issued in the future, such issuance may decrease our existing stockholders’ percentage

equity ownership and, depending on the price at which they are issued, could be dilutive to our existing stockholders. The holders of

our Common Stock have no preemptive rights to subscribe for additional securities that may be issued by the Company, which means that

current stockholders do not have a prior right to purchase any new issue of capital stock of the Company in order to maintain their proportionate

ownership of Common Stock. In addition, if the Board elects to cause the Company to issue additional shares of Common Stock or securities

convertible into or exercisable for Common Stock, such issuance could have a dilutive effect on the voting power and earnings per share

of existing stockholders. The increase in our authorized capital will not have any immediate effect on the rights of our existing stockholders.

The

increase in the number of authorized shares and the subsequent issuance of such shares could have an anti-takeover effect, although this

is not the intent of the Board in initiating the Amendment. For example, if the Board issues additional shares in the future, such issuance

could dilute the voting power of a person seeking control of the Company, thereby deterring or rendering more difficult a merger, tender

offer, proxy contest or an extraordinary transaction opposed by the Board. Any such issuance of additional stock could have the effect

of diluting our earnings per share and book value per share of outstanding shares of our Common Stock or the stock ownership and voting

rights of a person seeking to obtain control of the Company. The relative rights and limitations of the shares of Common Stock will remain

unchanged under the Amendment.

The

Company does not have any other provisions in its Articles of Incorporation, Bylaws, employment agreements, or any other documents that

have material anti-takeover consequences. Additionally, the Company has no plans or proposals to adopt other provisions or enter into

other arrangements that may have material anti-takeover consequences and this Amendment is not being enacted with the intent that it

be utilized as a type of anti-takeover device.

SECURITY

OWNERSHIP OF

CERTAIN

BENEFICIAL OWNERS AND MANAGEMENT

The

following table sets forth, as of December 31, 2024, the number of shares of our common stock owned by (i) each person who is known by

us to own of record or beneficially five percent (5%) or more of our outstanding shares, (ii) each of our directors, (iii) each of our

executive officers and (iv) all of our directors and executive officers as a group. Unless otherwise indicated, each of the persons listed

below has sole voting and investment power with respect to the shares of our common stock beneficially owned.

IDENTITY

OF PERSON OR GROUP | |

ACTUAL

AMOUNT OF SHARES OWNED | | |

ACTUAL

PERCENT OF SHARES OWNED | | |

CLASS | |

| Joseph John Combs III | |

| 3,606,315 | | |

| 5.78 | | |

| common | |

| Clyde Berg | |

| 6,010,000 | | |

| 9.64 | | |

| common | |

| Carl Berg | |

| 3,500,000 | | |

| 5.6 | | |

| common | |

| First Block, Inc. | |

| 4,000,000 | | |

| 80%

of authorized preferred shares | | |

| preferred | |

| LPD Investments, Ltd. | |

| 6,290,832 | | |

| 10.1 | | |

| common | |

| Tracy Miles | |

| 3,925,316 | | |

| 6.3 | | |

| common | |

| | |

| | | |

| | | |

| | |

Officers

and Directors as a Group (two persons) | |

| | | |

| | | |

| Common | |

Beneficial

Ownership of Securities: Pursuant to Rule 13d-3 under the Securities Exchange Act of 1934, involving the determination of beneficial

owners of securities, includes as beneficial owners of securities, any person who directly or indirectly, through any contract, arrangement,

understanding, relationship or otherwise has, or shares, voting power and/or investment power with respect to the securities, and any

person who has the right to acquire beneficial ownership of the security within sixty days through any means including the exercise of

any option, warrant or conversion of a security.

DISSENTERS’

RIGHTS

Pursuant

to Article 13, Paragraph 17-16-1302 of the Nevada Business Corporation Act, there are no dissenters’ rights with regard to this

type of transaction.

WHERE

YOU CAN FIND ADDITIONAL INFORMATION

We

file annual, quarterly and current reports and other information with the U.S. Securities and Exchange Commission (“SEC”).

You may obtain such SEC filings from the SEC’s website at www.sec.gov. You can also read and copy these materials at the

SEC’s public reference room at 100 F Street, N.E., Washington, D.C. 20549. You can obtain information about the operation of the

SEC’s public reference room by calling the SEC at 1-800-SEC-0330.

FORWARD-LOOKING

STATEMENTS

This

Information Statement may contain certain “forward-looking” statements representing our expectations or beliefs regarding

our company. These forward-looking statements relate to our expectation that we will file and effect the Amendment to increase our authorized

capital stock from 70,000,000 to 320,000,000. These forward-looking statements involve risks and uncertainties that the anticipated filing

and effectiveness of the Amendment may not occur.

COMPANY

CONTACT INFORMATION

All

inquiries regarding the Company and the matters described in this Information Statement should be addressed to our principal executive

offices:

370

Interlocken Blvd

Suite

680

Broomfield,

CO 80021

(303)

277-1625

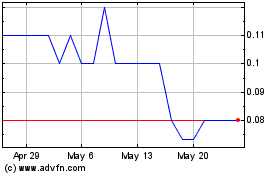

Strategic Environmental ... (QB) (USOTC:SENR)

Historical Stock Chart

From Jan 2025 to Feb 2025

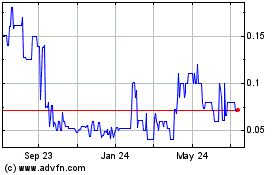

Strategic Environmental ... (QB) (USOTC:SENR)

Historical Stock Chart

From Feb 2024 to Feb 2025