0001817760

false

--12-31

0001817760

2023-09-19

2023-09-19

iso4217:USD

xbrli:shares

iso4217:USD

xbrli:shares

UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

FORM 8-K

CURRENT REPORT

Pursuant to Section 13 or 15(d) of

The Securities Exchange Act of 1934

Date of Report (Date of earliest event reported): September 19, 2023

SmartKem, Inc.

(Exact name of registrant as specified in its charter)

| Delaware |

000-56181 |

85-1083654 |

|

(State or Other Jurisdiction

of Incorporation) |

(Commission

File Number) |

(I.R.S. Employer

Identification No.) |

Manchester Technology Center, Hexagon Tower

Delaunays Road, Blackley

Manchester, M9 8GQ U.K.

(Address of principal executive offices, including

zip code)

011-44-161-721-1514

(Registrant’s telephone number, including

area code)

N/A

(Former name or former address, if changed since

last report)

Check the appropriate box below if the Form 8-K filing is intended

to simultaneously satisfy the filing obligation of the registrant under any of the following provisions:

| ¨ |

Written communications pursuant to Rule 425 under the Securities Act (17 CFR 230.425) |

| ¨ |

Soliciting material pursuant to Rule 14a-12 under the Exchange Act (17 CFR 240.14a-12) |

| ¨ |

Pre-commencement communications pursuant to Rule 14d-2(b) under the Exchange Act (17 CFR 240.14d-2(b)) |

| ¨ |

Pre-commencement communications pursuant to Rule 13e-4(c) under the Exchange Act (17 CFR 240.13e-4(c)) |

Securities registered pursuant to

Section 12(b) of the Act: None

Indicate by check mark whether the registrant is an emerging growth company as defined in Rule 405 of the Securities Act of 1933 (17 CFR

§230.405) or Rule 12b-2 of the Securities Exchange Act of 1934 (17 CFR §240.12b-2).

Emerging growth

company x

If an emerging

growth company, indicate by check mark if the registrant has elected not to use the extended transition period for complying with any

new or revised financial accounting standards provided pursuant to Section 13(a) of the Exchange Act.

| Item 3.03 | Material Modification to Rights of Security Holders. |

To the extent required by

Item 3.03 of Form 8-K, the information regarding the Reverse Stock Split (as defined below) contained in Item 5.03 of this Current Report

on Form 8-K is incorporated by reference herein.

| Item 5.03 | Amendments to Articles of Incorporation or Bylaws; Change in Fiscal Year. |

On August 25, 2023, SmartKem,

Inc. (the “Company”) held its 2023 annual meeting of stockholders (the “Annual Meeting”). At the Annual Meeting,

the Company’s stockholders granted the Company’s Board of Directors (the “Board”) the discretion to effect a reverse

stock split of the Company’s issued and outstanding common stock, par value $0.0001 per share (“Common Stock”), through

an amendment (the “Reverse Stock Split Amendment”) to its Amended and Restated Certificate of Incorporation, as amended to

date (the “Charter”), at a ratio of not less than 1-for-30 and not more than 1-for-60, with such ratio to be determined by

the Board without further approval or authorization of the Company’s stockholders.

On September 19, 2023, the

Board approved a reverse stock split of the Company’s issued and outstanding Common Stock at a ratio of 1-for-35 (the “Reverse

Stock Split”). Following the Board approval, the Company filed the Reverse Stock Split Amendment with the Secretary of State of

the State of Delaware to effect the Reverse Stock Split. In accordance with the terms of the Reverse Stock Split Amendment (as corrected),

the Reverse Stock Split will become effective at 12:01 AM Eastern Time on September 21, 2023 (the “Effective Time”). The

Company’s Common Stock will continue to be reported on the OTC under the symbol “SMTK” and will begin trading on a

split-adjusted basis when the market opens on September 21, 2023, under a new CUSIP number, 83193D203.

At the Effective Time, every

thirty-five shares of the Company’s issued and outstanding Common Stock will be converted automatically into one issued and outstanding

share of Common Stock, with no corresponding reduction in the number of authorized shares of Common Stock, and without any change in the

par value per share. Stockholders holding shares through a brokerage account will have their shares automatically adjusted to reflect

the 1-for-35 Reverse Stock Split. It is not necessary for stockholders holding shares of the Common Stock in certificated form to exchange

their existing stock certificates for new stock certificates of the Company in connection with the Reverse Stock Split, although stockholders

may do so if they wish.

The Reverse Stock Split

will affect all stockholders uniformly and will not alter any stockholder’s percentage interest in the Company’s equity,

except to the extent that the Reverse Stock Split would result in a stockholder owning a fractional share. No fractional shares will

be issued in connection with the Reverse Stock Split. Stockholders who would otherwise be entitled to receive a fractional share

will automatically be entitled to receive an additional fraction of a share of Common Stock to round up to the next whole share. The

Reverse Stock Split will reduce the number of shares of Common Stock outstanding from 30,507,773 shares to approximately 871,706

shares. Proportional adjustments will be made to the number of shares of Common Stock issuable upon exercise or conversion of the

Company’s outstanding equity awards, convertible preferred stock and warrants, as well as the applicable conversion and

exercise prices thereof. The Reverse Stock Split will proportionally reduce the number of shares of Common Stock issuable under the

Company’s 2021 Equity Incentive Plan from 26,008,708 shares to 743,106 shares. Stockholders with shares in brokerage accounts

should direct any questions concerning the Reverse Stock Split to their broker; all other stockholders may direct questions to the

Company’s transfer agent, Vstock Transfer LLC, at 855-9VSTOCK. Each certificate representing shares before the Reverse Stock

Split will continue to be valid and will represent the adjusted number of whole shares based on the ratio. No new post-Reverse Stock

Split stock certificates will be issued to a stockholder until such stockholder has surrendered such stockholder’s outstanding

certificate(s).

On September 19, 2023, the

Company issued a press release announcing the Reverse Stock Split. A copy of the press release is being filed as Exhibit 99.1 hereto.

On September 20, 2023, the

Company issued a press release indicating that the Reverse Stock Split would be effective on September 21, 2023, not September 20, 2023

as previously announced. A copy of the press release is being filed as Exhibit 99.2 hereto.

| Item 9.01. |

Financial Statements and Exhibits. |

Signature

Pursuant to the requirements

of the Securities Exchange Act of 1934, the registrant has duly caused this report to be signed on its behalf by the undersigned hereunto

duly authorized.

| |

SMARTKEM, INC. |

| |

|

|

| Dated: September 20, 2023 |

By: |

/s/ Barbra C. Keck |

| |

|

Barbra C. Keck |

| |

|

Chief Financial Officer |

Exhibit 3.1

CERTIFICATE OF AMENDMENT TO THE

AMENDED AND RESTATED

CERTIFICATE OF INCORPORATION

OF

SMARTKEM, INC.

SmartKem, Inc. (the “Corporation”), a corporation

organized and existing under and by virtue of the General Corporation Law of the State of Delaware, does hereby certify as follows:

FIRST: That a resolution was duly adopted on July 13, 2023,

by the Board of Directors of the Corporation pursuant to Section 242 of the General Corporation Law of the State of Delaware setting

forth an amendment to the Certificate of Incorporation of the Corporation and declaring said amendment to be advisable. The stockholders

of the Corporation duly approved said proposed amendment at the annual meeting of stockholders held on August 25, 2023, in accordance

with Section 242 of the General Corporation Law of the State of Delaware. The proposed amendment set forth as follows:

Article IV of the Amended and Restated Certificate

of Incorporation of the Corporation be and hereby is amended by adding the following after the first paragraph of Section A of Article IV:

“Upon effectiveness (“Effective Time”) of

this amendment to the Certificate of Incorporation, a one-for-thirty-five reverse stock split (the “Reverse Split”)

of the Corporation’s Common Stock shall become effective, pursuant to which each thirty-five (35) shares of Common Stock outstanding

and held of record by each stockholder of the Corporation and each share of Common Stock held in treasury by the Corporation immediately

prior to the Effective Time (“Old Common Stock”) shall automatically, and without any action by the holder thereof,

be reclassified and combined into one (1) validly issued, fully paid and non-assessable share of Common Stock (“New Common

Stock”), subject to the treatment of fractional interests as described below and with no corresponding reduction in the number

of authorized shares of our Common Stock. The Reverse Split shall also apply to any outstanding securities or rights convertible into,

or exchangeable or exercisable for, Old Common Stock and all references to such Old Common Stock in agreements, arrangements, documents

and plans relating thereto or any option or right to purchase or acquire shares of Old Common Stock shall be deemed to be references to

the New Common Stock or options or rights to purchase or acquire shares of New Common stock, as the case may be, after giving effect to

the Reverse Split.

No fractional shares of Common Stock will be issued in connection with

the Reverse Split. If, upon aggregating all of the Common Stock held by a holder of Common Stock immediately following the Reverse Split

a holder of Common Stock would otherwise be entitled to a fractional share of Common Stock, the Corporation shall issue to such holder

such fractions of a share of Common Stock as are necessary to round the number of shares of Common Stock held by such holder up to the

nearest whole share.

Each holder of record of a certificate or certificates for one

or more shares of the Old Common Stock shall be entitled to receive as soon as practicable, upon surrender of such certificate, a certificate

or certificates representing the largest whole number of shares of New Common Stock to which such holder shall be entitled pursuant to

the provisions of the immediately preceding paragraphs. Each stock certificate that, immediately prior to the Effective Time, represented

shares of Old Common Stock that were issued and outstanding immediately prior to the Effective Time shall, from and after the Effective

Time, automatically and without the necessity of presenting the same for exchange, represent that number of whole shares of New Common

Stock after the Effective Time into which the shares formerly represented by such certificate have been reclassified, subject to adjustment

for fractional shares as described above.”

SECOND: That said amendment will have an Effective Time

of 12:01 AM, Eastern Time, on September 20, 2023.

IN WITNESS WHEREOF, the Corporation has caused this Certificate of

Amendment to be signed by its Chief Executive Officer this 19th day of September 2023.

| /s/ Ian Jenks |

|

| Ian Jenks |

|

| Chief Executive Officer |

|

Exhibit 3.2

CERTIFICATE OF CORRECTION

TO

CERTIFICATE

OF AMENDMENT TO THE

AMENDED

AND RESTATED

CERTIFICATE

OF INCORPORATION

OF

SMARTKEM,

INC.

(Under Section 103(f) of the General Corporation

Law of the State of Delaware)

The undersigned, being the Chief

Financial Officer of SmartKem, Inc., a corporation organized and existing under the laws of the State of Delaware (the “Corporation”),

does hereby certify as follows:

| 1. | The name of the Corporation is SmartKem, Inc. |

| 2. | The Certificate of Amendment to the Amended and Restated Certificate of Incorporation, filed with the

Secretary of State of the State of Delaware on September 19, 2023 (the “Certificate of Amendment”) requires correction as

permitted by Section 103(f) of the General Corporation Law of the State of Delaware (the “DGCL”). |

| 3. | The inaccuracies or defects contained in the Certificate of Amendment are as follows: |

| a. | As a result of a scrivener’s error, Section SECOND of the Certificate of Amendment erroneously states

that the Certificate of Amendment will have an Effective Time of 12:01 AM, Eastern Time, on September 20, 2023. However, the Effective

Time of the Certificate of Amendment is intended to be September 21, 2023. |

| 4. | Section SECOND of the Certificate of Amendment is hereby corrected to read in its entirety as follows: |

“SECOND: That said amendment will

have an Effective Time of 12:01 AM, Eastern Time, on September 21, 2023.”

5. Other

than as provided in this Certificate of Correction, all terms and provisions of the Certificate of Amendment remain in full force and

effect.

[Signature Page Follows]

IN WITNESS WHEREOF, the

undersigned, being a duly authorized officer of the Corporation, has executed this Certificate of Correction to the Certificate of Amendment

on behalf of the Corporation this 19th day of September, 2023.

| |

By: |

/s/ Barbra Keck |

|

| |

|

Name: Barbra Keck |

|

| |

|

Title: Chief Financial Officer |

|

Exhibit 99.1

| PRESS

RELEASE

|

SMARTKEM, INC. ANNOUNCES 1-for-35 REVERSE

STOCK SPLIT

Manchester, England – September 19, 2023 – SmartKem, Inc.

(“SmartKem” or the “Company”) (OTCQB: SMTK), a company seeking to reshape the world of electronics with

its disruptive organic thin-film transistors (OTFTs) that will drive the next generation of displays, has announced that it

will proceed with a 1-for-35 reverse stock split of its outstanding shares of common stock. The reverse stock split will become effective

at 12:01 a.m. Eastern Time, on September 20, 2023.

The Company's

common stock will begin trading on a post-split basis at the market open at 9:30 a.m., under the Company's existing trading symbol

"SMTK". The CUSIP number for the common stock following the reverse stock split will be 83193D203.

SmartKem’s OTCQB information can be found on the OTC Markets

website: www.otcmarkets.com/stock/SMTK/overview

About SmartKem

SmartKem is seeking to reshape the world of electronics with its disruptive

organic thin-film transistors (OTFTs) that can drive the next generation of displays. SmartKem’s unique and patented TRUFLEX®

semiconductor and dielectric inks, or liquid electronic polymers, are used to make a new type of transistor that has the potential to

revolutionize the display industry. SmartKem’s inks enable low temperature printing processes that are compatible with existing

manufacturing infrastructure to deliver low-cost displays that outperform existing models. The company’s electronic polymer platform

can be used in a number of display technologies including microLED, miniLED and AMOLED displays for next generation televisions, laptops,

augmented reality (AR) and virtual reality (VR) headsets, smartwatches and smartphones.

SmartKem develops its materials at its research and development facility

in Manchester, UK, its semiconductor manufacturing processes at the Centre for Process Innovation (CPI) at Sedgefield, UK and retains

a field application office in Taiwan. The company has an extensive IP portfolio including 125 granted patents across 19 patent families

and 40 codified trade secrets. For more information, visit: www.smartkem.com and follow us on LinkedIn and Twitter @SmartKemTRUFLEX.

Smartkem Ltd

Manchester

Technology Center, Hexagon Tower,

Delaunays Road,

Blackley, Manchester, M9 8GQ UK

+44 (0) 161 721 1514

enquiries@smartkem.com

| PRESS

RELEASE

|

Forward-Looking Statements

All statements in this press release that are not historical are forward-looking

statements, including, among other things, statements relating to the SmartKem’s expectations regarding its market position and

market opportunity, expectations and plans as to its product development, manufacturing and sales, and relations with its partners and

investors. These statements are not historical facts but rather are based on SmartKem Inc.’s current expectations, estimates, and

projections regarding its business, operations and other similar or related factors. Words such as “may,” will,” “could,”

“would,” “should,” “anticipate,” “predict,” “potential,” “continue,”

“expect,” “intend,” “plan,” “project,” “believe,” “estimate,”

and other similar or elated expressions are used to identify these forward-looking statements, although not all forward-looking statements

contain these words. You should not place undue reliance on forward-looking statements because they involve known and unknown risks, uncertainties,

and assumptions that are difficult or impossible to predict and, in some cases, beyond the Company’s control. Actual results may

differ materially from those in the forward-looking statements as a result of a number of factors, including those described in the Company’s

filings with the Securities and Exchange Commission. The Company undertakes no obligation to revise or update information in this release

to reflect events or circumstances in the future, even if new information becomes available.

Contact Details:

Barbra Keck, Chief Financial Officer, SmartKem

b.keck@smartkem.com

Selena Kirkwood, Head of Communications, SmartKem

s.kirkwood@smartkem.com

##END##

Smartkem Ltd

Manchester

Technology Center, Hexagon Tower,

Delaunays Road,

Blackley, Manchester, M9 8GQ UK

+44 (0) 161 721 1514

enquiries@smartkem.com

Exhibit 99.2

|

PRESS

RELEASE |

SMARTKEM, INC. ANNOUNCES 1-for-35 REVERSE STOCK SPLIT -- CORRECTION

MANCHESTER, England, Sept.

19, 2023 -- SmartKem, Inc. ("SmartKem" or the "Company") (OTCQB: SMTK), a company

seeking to reshape the world of electronics with its disruptive organic thin-film transistors (OTFTs) that will drive the next generation

of displays, has announced that after further discussion with FINRA, the previously announced one-for-thirty-five (1:35) reverse

stock split of the Company’s issued and outstanding Common Stock is expected to be effected on September 21, 2023 rather than September

20, 2023, as earlier announced.

The Company's

common stock is expected to begin trading on a post-split basis at the market open at 9:30 a.m. on September 21, 2023, under the

Company's existing trading symbol "SMTK". The CUSIP number for the common stock following the reverse stock split will be 83193D203.

SmartKem’s OTCQB information can be found on the OTC Markets

website: www.otcmarkets.com/stock/SMTK/overview

About SmartKem

SmartKem is seeking to reshape the world of electronics with its disruptive

organic thin-film transistors (OTFTs) that can drive the next generation of displays. SmartKem’s unique and patented TRUFLEX®

semiconductor and dielectric inks, or liquid electronic polymers, are used to make a new type of transistor that has the potential to

revolutionize the display industry. SmartKem’s inks enable low temperature printing processes that are compatible with existing

manufacturing infrastructure to deliver low-cost displays that outperform existing models. The company’s electronic polymer platform

can be used in a number of display technologies including microLED, miniLED and AMOLED displays for next generation televisions, laptops,

augmented reality (AR) and virtual reality (VR) headsets, smartwatches and smartphones.

SmartKem develops its materials at its research and development facility

in Manchester, UK, its semiconductor manufacturing processes at the Centre for Process Innovation (CPI) at Sedgefield, UK and retains

a field application office in Taiwan. The company has an extensive IP portfolio including 125 granted patents across 19 patent families

and 40 codified trade secrets. For more information, visit: www.smartkem.com and follow us on LinkedIn and Twitter @SmartKemTRUFLEX.

Forward-Looking Statements

All statements in this press release that are not historical are forward-looking

statements, including, among other things, statements relating to the SmartKem’s expectations regarding its market position and

market opportunity, expectations and plans as to its product development, manufacturing and sales, and relations with its partners and

investors. These statements are not historical facts but rather are based on SmartKem Inc.’s current expectations, estimates, and

projections regarding its business, operations and other similar or related factors. Words such as “may,” will,” “could,”

“would,” “should,” “anticipate,” “predict,” “potential,” “continue,”

“expect,” “intend,” “plan,” “project,” “believe,” “estimate,”

and other similar or elated expressions are used to identify these forward-looking statements, although not all forward-looking statements

contain these words. You should not place undue reliance on forward-looking statements because they involve known and unknown risks, uncertainties,

and assumptions that are difficult or impossible to predict and, in some cases, beyond the Company’s control. Actual results may

differ materially from those in the forward-looking statements as a result of a number of factors, including those described in the Company’s

filings with the Securities and Exchange Commission. The Company undertakes no obligation to revise or update information in this release

to reflect events or circumstances in the future, even if new information becomes available.

Smartkem Ltd

Manchester Technology Center, Hexagon Tower,

Delaunays Road, Blackley, Manchester, M9 8GQ UK

+44 (0) 161 721 1514

enquiries@smartkem.com

| PRESS RELEASE |

Contact Details:

Barbra Keck, Chief Financial Officer, SmartKem

b.keck@smartkem.com

Selena Kirkwood, Head of Communications, SmartKem

s.kirkwood@smartkem.com

##END##

Smartkem Ltd

Manchester Technology Center, Hexagon Tower,

Delaunays Road, Blackley, Manchester, M9 8GQ UK

+44 (0) 161 721 1514

enquiries@smartkem.com

v3.23.3

Cover

|

Sep. 19, 2023 |

| Cover [Abstract] |

|

| Document Type |

8-K

|

| Amendment Flag |

false

|

| Document Period End Date |

Sep. 19, 2023

|

| Current Fiscal Year End Date |

--12-31

|

| Entity File Number |

000-56181

|

| Entity Registrant Name |

SmartKem, Inc.

|

| Entity Central Index Key |

0001817760

|

| Entity Tax Identification Number |

85-1083654

|

| Entity Incorporation, State or Country Code |

DE

|

| Entity Address, Address Line One |

Manchester Technology Center, Hexagon Tower

|

| Entity Address, Address Line Two |

Delaunays Road

|

| Entity Address, Address Line Three |

Blackley

|

| Entity Address, City or Town |

Manchester

|

| Entity Address, Country |

GB

|

| Entity Address, Postal Zip Code |

M9 8GQ

|

| City Area Code |

011-44-161

|

| Local Phone Number |

721-1514

|

| Written Communications |

false

|

| Soliciting Material |

false

|

| Pre-commencement Tender Offer |

false

|

| Pre-commencement Issuer Tender Offer |

false

|

| Entity Emerging Growth Company |

true

|

| Elected Not To Use the Extended Transition Period |

false

|

| X |

- DefinitionBoolean flag that is true when the XBRL content amends previously-filed or accepted submission.

| Name: |

dei_AmendmentFlag |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionEnd date of current fiscal year in the format --MM-DD.

| Name: |

dei_CurrentFiscalYearEndDate |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:gMonthDayItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionFor the EDGAR submission types of Form 8-K: the date of the report, the date of the earliest event reported; for the EDGAR submission types of Form N-1A: the filing date; for all other submission types: the end of the reporting or transition period. The format of the date is YYYY-MM-DD.

| Name: |

dei_DocumentPeriodEndDate |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:dateItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionThe type of document being provided (such as 10-K, 10-Q, 485BPOS, etc). The document type is limited to the same value as the supporting SEC submission type, or the word 'Other'.

| Name: |

dei_DocumentType |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:submissionTypeItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionAddress Line 1 such as Attn, Building Name, Street Name

| Name: |

dei_EntityAddressAddressLine1 |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionAddress Line 2 such as Street or Suite number

| Name: |

dei_EntityAddressAddressLine2 |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionAddress Line 3 such as an Office Park

| Name: |

dei_EntityAddressAddressLine3 |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- Definition

+ References

+ Details

| Name: |

dei_EntityAddressCityOrTown |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionISO 3166-1 alpha-2 country code.

| Name: |

dei_EntityAddressCountry |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:countryCodeItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionCode for the postal or zip code

| Name: |

dei_EntityAddressPostalZipCode |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionA unique 10-digit SEC-issued value to identify entities that have filed disclosures with the SEC. It is commonly abbreviated as CIK. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b-2

| Name: |

dei_EntityCentralIndexKey |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:centralIndexKeyItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionIndicate if registrant meets the emerging growth company criteria. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b-2

| Name: |

dei_EntityEmergingGrowthCompany |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionCommission file number. The field allows up to 17 characters. The prefix may contain 1-3 digits, the sequence number may contain 1-8 digits, the optional suffix may contain 1-4 characters, and the fields are separated with a hyphen.

| Name: |

dei_EntityFileNumber |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:fileNumberItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionTwo-character EDGAR code representing the state or country of incorporation.

| Name: |

dei_EntityIncorporationStateCountryCode |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:edgarStateCountryItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionThe exact name of the entity filing the report as specified in its charter, which is required by forms filed with the SEC. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b-2

| Name: |

dei_EntityRegistrantName |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionThe Tax Identification Number (TIN), also known as an Employer Identification Number (EIN), is a unique 9-digit value assigned by the IRS. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b-2

| Name: |

dei_EntityTaxIdentificationNumber |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:employerIdItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionLocal phone number for entity.

| Name: |

dei_LocalPhoneNumber |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionBoolean flag that is true when the Form 8-K filing is intended to satisfy the filing obligation of the registrant as pre-commencement communications pursuant to Rule 13e-4(c) under the Exchange Act. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 13e

-Subsection 4c

| Name: |

dei_PreCommencementIssuerTenderOffer |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionBoolean flag that is true when the Form 8-K filing is intended to satisfy the filing obligation of the registrant as pre-commencement communications pursuant to Rule 14d-2(b) under the Exchange Act. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 14d

-Subsection 2b

| Name: |

dei_PreCommencementTenderOffer |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionBoolean flag that is true when the Form 8-K filing is intended to satisfy the filing obligation of the registrant as soliciting material pursuant to Rule 14a-12 under the Exchange Act. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Section 14a

-Number 240

-Subsection 12

| Name: |

dei_SolicitingMaterial |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionBoolean flag that is true when the Form 8-K filing is intended to satisfy the filing obligation of the registrant as written communications pursuant to Rule 425 under the Securities Act. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Securities Act

-Number 230

-Section 425

| Name: |

dei_WrittenCommunications |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

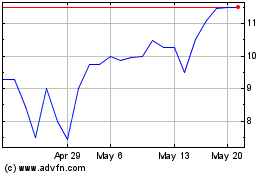

SmartKem (QB) (USOTC:SMTK)

Historical Stock Chart

From Apr 2024 to May 2024

SmartKem (QB) (USOTC:SMTK)

Historical Stock Chart

From May 2023 to May 2024