Statement of Beneficial Ownership (sc 13d)

25 February 2023 - 8:20AM

Edgar (US Regulatory)

UNITED

STATES

SECURITIES

AND EXCHANGE COMMISSION

Washington,

D.C. 20549

SCHEDULE

13D

Under

the Securities Exchange Act of 1934

(Amendment

No. ___)*

SUSTAINABLE

PROJECTS GROUP INC.

(Name

of Issuer)

Common

Stock, $0.0001 par value per share

(Title

of Class of Securities)

86933P

105

(CUSIP

Number)

Aldo

Petersen

Amaliegade

6, DK-1256 København K

(Name,

Address and Telephone Number of Person Authorized to Receive Notices and Communications)

February

14, 2023

(Date

of Event which Requires Filing of this Statement)

If

the filing person has previously filed a statement on Schedule 13G to report the acquisition which is the subject of this Schedule 13D,

and is filing this schedule because of Rule 13d-1(e), 13d-1(f) or 13d-1(g), check the following box ☐.

Note:

Schedules filed in paper format shall include a signed original and five copies of the schedule, including all exhibits. See Rule

13d-7 for other parties to whom copies are to be sent.

*The

remainder of this cover page shall be filled out for a reporting person’s initial filing on this form with respect to the subject

class of securities, and for any subsequent amendment containing information which would alter disclosures provided in a prior cover

page.

The

information required on the remainder of this cover page shall not be deemed to be “filed” for the purpose of Section 18

of the Securities Exchange Act of 1934 (“Act”) or otherwise subject to the liabilities of that section of the Act but shall

be subject to all other provisions of the Act (however, see the Notes).

SCHEDULE

13D

| 1 |

NAME

OF REPORTING PERSON

I.R.S.

IDENTIFICATION NO. OF ABOVE PERSON (Entities Only)

AØNP14

ApS (1) |

|

| 2 |

CHECK

THE APPROPRIATE BOX IF A MEMBER OF A GROUP

(See

Instructions)

|

(a)

☐

(b)

☐ |

| 3 |

SEC

USE ONLY

|

|

| 4 |

SOURCE

OF FUNDS (See Instructions)

OO |

|

| 5 |

CHECK BOX IF DISCLOSURE OF LEGAL PROCEEDINGS IS REQUIRED PURSUANT TO ITEMS 2(d) or 2(e)

|

☐

|

| 6 |

CITIZENSHIP

OR PLACE OF ORGANIZATION

Denmark |

|

NUMBER

OF |

7 |

SOLE

VOTING POWER

21,700,059 |

SHARES

BENEFICIALLY

OWNED

BY |

8 |

SHARED

VOTING POWER

0 |

EACH

REPORTING

PERSON |

9 |

SOLE

DISPOSITIVE POWER

21,700,059 |

WITH |

10 |

SHARED

DISPOSITIVE POWER

0 |

| 11 |

AGGREGATE

AMOUNT BENEFICIALLY OWNED BY EACH REPORTING PERSON

21,700,059 |

|

| 12 |

CHECK

BOX IF THE AGGREGATE AMOUNT IN ROW (11) EXCLUDES CERTAIN SHARES

(See

Instructions)

|

☐ |

| 13 |

PERCENT

OF CLASS REPRESENTED BY AMOUNT IN ROW (11)

7.6%

(2) |

|

| 14 |

TYPE

OF REPORTING PERSON (See Instructions)

OO |

|

(1)

Aldo Petersen is the managing director of AØNP14 ApS.

(2)

Based on 287,190,813 shares of the Issuer’s common stock outstanding as of February 14, 2023, as reported in the Issuer’s

Form 8-K filed on February 14, 2023.

| 1 |

NAME

OF REPORTING PERSON

I.R.S.

IDENTIFICATION NO. OF ABOVE PERSON (Entities Only)

Aldo

Petersen |

|

| 2 |

CHECK

THE APPROPRIATE BOX IF A MEMBER OF A GROUP

(See

Instructions)

|

(a)

☐

(b)

☐ |

| 3 |

SEC

USE ONLY

|

|

| 4 |

SOURCE

OF FUNDS (See Instructions)

OO |

|

| 5 |

CHECK

BOX IF DISCLOSURE OF LEGAL PROCEEDINGS IS REQUIRED PURSUANT TO ITEMS 2(d) or 2(e)

|

☐ |

| 6 |

CITIZENSHIP

OR PLACE OF ORGANIZATION

Denmark |

|

NUMBER

OF |

7 |

SOLE

VOTING POWER

21,700,059

(1)

|

SHARES

BENEFICIALLY

OWNED

BY |

8 |

SHARED

VOTING POWER

0 |

EACH

REPORTING

PERSON |

9 |

SOLE

DISPOSITIVE POWER

21,700,059

(1) |

WITH |

10 |

SHARED

DISPOSITIVE POWER

0

|

| 11 |

AGGREGATE

AMOUNT BENEFICIALLY OWNED BY EACH REPORTING PERSON

21,700,059

(1)

|

|

| 12 |

CHECK

BOX IF THE AGGREGATE AMOUNT IN ROW (11) EXCLUDES CERTAIN SHARES

(See

Instructions)

|

☐ |

| 13 |

PERCENT

OF CLASS REPRESENTED BY AMOUNT IN ROW (11)

7.6%

(1)(2) |

|

| 14 |

TYPE

OF REPORTING PERSON (See Instructions)

IN |

|

(1)

Represents shares held by AØNP14 ApS, of which Aldo Petersen is the managing director.

(2)

Based on 287,190,813 shares of the Issuer’s common stock outstanding as of February 14, 2023, as reported in the Issuer’s

Form 8-K filed on February 14, 2023.

Item

1 – Security and Issuer

(a)

This statement on Schedule 13D relates to the common stock of Sustainable Projects Group Inc., a Nevada corporation (the “Issuer”).

(b)

The principal executive offices of the Issuer are located at 2316 Pine Ridge Road #383, Naples, Florida 34102.

Item

2 - Identity and Background

This

Schedule 13D is being filed on behalf of AØNP14 ApS, a Danish private limited liability company (the “Company”), and

its managing director, Aldo Petersen, a citizen of Denmark (the “Reporting Person”). The address of the Company and the Reporting

Person is Amaliegade 6, DK-1256 København K. The principal business of the Company

is to hold certain assets of the Reporting Person.

During

the last five years, neither the Company nor the Reporting Person has (i) been convicted in a criminal proceeding (excluding traffic

violations or similar misdemeanors) or (ii) been a party to a civil proceeding of a judicial or administrative body of competent jurisdiction

and as a result of such proceeding was or is subject to a judgment, decree or final order enjoining future violations of, or prohibiting

or mandating activities subject to, federal or state securities laws or finding any violation with respect to such laws.

Item

3 - Source and Amount of Funds or Other Consideration

Pursuant

to the terms of a Securities Exchange Agreement among the Issuer, Lithium Harvest ApS, a Danish private limited liability company (“Lithium

Harvest”), and, for certain limited purposes, its shareholders (the “Shareholders”), the Issuer acquired all of the

outstanding shares of capital stock of Lithium Harvest in exchange for issuing to the Shareholders 206,667,233 shares of the Issuer’s

common stock (the “Exchange Transaction”). As a result of the Exchange Transaction, the Company acquired 21,700,059

shares of the Issuer’s common stock on February 14, 2023.

Item

4 - Purpose of Transaction

As

disclosed in Item 3 above, the Shareholders, including the Company, acquired the shares in connection with the Exchange Transaction.

In addition, Sune Mathiesen was appointed Chairman, President and Chief Executive Officer of the Issuer, Stefan Muehlbauer was appointed

Chief Financial Officer and director of the Issuer, and Paw Juul was appointed Chief Technology Officer and, effective

10 days following the mailing of an information statement that satisfies the requirements of Rule 14F-1 under the Securities Exchange

Act of 1934, as amended, to the Issuer’s stockholders, a director of the Issuer. The Issuer is now a

pure-play lithium company focused on supplying high performance lithium compounds to the electric vehicle and broader battery markets.

The Issuer’s principal stockholders are Sune Mathiesen Holding ApS and FENO Holding ApS,

which each own approximately 32.2% of the Issuer, Kestrel Flight Fund LLC, which owns approximately 25.0% of the Issuer, and the Company,

which owns approximately 7.6% of the Issuer.

Item 5. Interest in Securities of the Issuer

| |

(a) |

The

aggregate number of securities to which this Schedule 13D relates is 21,700,059 shares of the Issuer’s common stock, representing

7.6% of the 287,190,813 shares of common stock outstanding as reported in the Issuer’s

Form 8-K filed on February 14, 2023. |

| |

|

|

| |

(b) |

Each

of the Company and the Reporting Person has sole power to vote or to direct the vote, and sole power to dispose or to direct the

disposition, of 21,700,059 shares of the Issuer’s common stock. |

| |

|

|

| |

(c) |

The

Company and the Reporting Person have not engaged in any transaction in shares of the Issuer’s common stock during the past

60 days other than as described in Items 3 and 4. The responses in Items 3 and 4 are incorporated by reference. |

| |

|

|

| |

(d) |

None. |

| |

|

|

| |

(e) |

Not

applicable. |

Item 6. Contracts, Arrangements, Understandings or Relationships with Respect to Securities of the Issuer.

The

responses in Items 3 and 4 are incorporated by reference.

Item 7. Material to Be Filed as Exhibits

| Exhibit

No. |

|

Description |

| 99.1 |

|

Securities Exchange Agreement, among Sustainable Projects Group Inc., Lithium Harvest ApS and, for certain limited purposes, its shareholders, dated as of February 14, 2023 (incorporated by reference to Exhibit 2.1 to the Issuer’s Current Report on Form 8-K filed on February 14, 2023). |

| 99.2 |

|

Joint Filing Agreement, dated February 24, 2024, by and between AØNP14 ApS and Aldo Petersen |

The

filer must sign the filing and certify that the information is true, complete and correct. If the filer is an entity, the filing must

be signed by an authorized officer.

Signature

After

reasonable inquiry and to the best of my knowledge and belief, I certify that the information set forth in this statement is true, complete

and correct.

| |

Aldo

Petersen |

| |

|

| |

February

24, 2023 |

| |

Date |

| |

|

| |

/s/

Aldo Petersen |

| |

Signature |

| |

|

| |

Aldo

Petersen |

| |

Name/Title |

| |

AØNP14

ApS |

| |

|

| |

February

24, 2023 |

| |

Date |

| |

|

| |

/s/

Aldo Petersen |

| |

Signature |

| |

|

| |

Aldo

Petersen, Managing Director |

| |

Name/Title |

Attention:

Intentional misstatements or omissions of fact

constitute Federal Criminal violations (See 18 U.S.C. 1001)

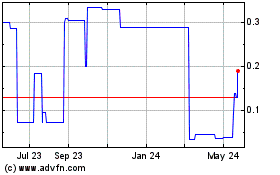

Sustainable Projects (PK) (USOTC:SPGX)

Historical Stock Chart

From Jan 2025 to Feb 2025

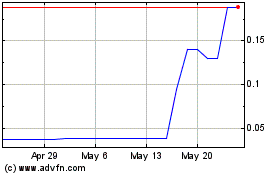

Sustainable Projects (PK) (USOTC:SPGX)

Historical Stock Chart

From Feb 2024 to Feb 2025