UNITED

STATES

SECURITIES

AND EXCHANGE COMMISSION

Washington,

D.C. 20549

SCHEDULE

14C

(Rule

14c-101)

SCHEDULE

14C INFORMATION

Information

Statement Pursuant to Section 14(c) of the

Securities

Exchange Act of 1934

Check

the appropriate box:

| ☒ |

Preliminary

Information Statement |

| |

|

| ☐ |

Confidential,

for Use of the Commission Only (as permitted by Rule 14c-5(d)(2)) |

| |

|

| ☐ |

Definitive

Information Statement |

SUSTAINABLE

PROJECTS GROUP INC.

(Name

of Registrant as Specified in Its Charter)

Payment

of Filing Fee (Check the appropriate box):

| ☒ |

No

fee required |

| |

|

| ☐ |

Fee

paid previously with preliminary materials |

| |

|

| ☐ |

Fee

computed on table in exhibit required by Item 25(b) of Schedule 14A (17 CFR 240.14a-101) per Item 1 of this Schedule and Exchange

Act Rules 14c-5(g) and 0-11 |

PRELIMINARY

COPY DATED AUGUST 23, 2024, SUBJECT TO COMPLETION

SUSTAINABLE

PROJECTS GROUP INC.

Tankedraget

7

Aalborg,

Denmark DK-900

NOTICE

OF STOCKHOLDER ACTION BY WRITTEN CONSENT

DATE

FIRST MAILED TO STOCKHOLDERS: September 3, 2024

To

Our Stockholders:

This

Notice and the accompanying Information Statement are being furnished to the stockholders of Sustainable Projects Group Inc., a Nevada

corporation (the “Company”), to notify stockholders of the actions taken by the Company’s Board of Directors (the “Board”)

by written consent dated August 21, 2024 and by the holders of a majority of the issued and outstanding shares of the Company’s

common stock by written consent delivered to the Company on August 21, 2024, approving an amendment

to our Articles of Incorporation, as amended, to effect a reverse stock split of our outstanding common stock, par value $0.0001 per

share (the “Common Stock”), at a reverse stock split ratio ranging from any whole number between 1-for-10 and 1-for-100,

subject to and as determined by the Board.

As

the matters set forth in this Information Statement have been duly authorized and approved by the written consent of the holders of more

than a majority of the Company’s voting securities, your vote or consent is not requested or required to approve these matters.

The Information Statement is provided solely for your information, and also serves the purpose of informing stockholders of the matters

described herein pursuant to Section 14(c) of the Securities Exchange Act of 1934, as amended, and the rules and regulations prescribed

thereunder, including Regulation 14C. You do not need to do anything in response to this Notice and the Information Statement.

WE

ARE NOT ASKING YOU FOR A PROXY AND

YOU

ARE REQUESTED NOT TO SEND US A PROXY.

| Sincerely, |

|

| |

|

| /s/

Sune Mathiesen |

|

| Sune

Mathiesen |

|

| Chairman,

President & Chief Executive Officer |

|

TABLE

OF CONTENTS

Sustainable

Projects Group Inc.

Tankedraget

7

Aalborg,

Denmark DK-900

INFORMATION

STATEMENT

WE

ARE NOT ASKING YOU FOR A PROXY AND

YOU

ARE REQUESTED NOT TO SEND US A PROXY

ABOUT

THIS INFORMATION STATEMENT

General

Sustainable

Projects Group Inc., a Nevada corporation, and its subsidiaries is sending you this Information Statement solely for purposes of informing

the Company’s stockholders of record as of August 21, 2024 (the “Record Date”) of actions taken by the Company’s

stockholders by less than unanimous written consent in lieu of a special meeting of stockholders. No action is requested or required

on your part. When used in this Information Statement, the terms the “Company,” “we,” “us,” or “our”

refer to Sustainable Projects Group Inc., and/or its subsidiaries, depending on the context.

This

Information Statement is first being mailed on or about September 3, 2024. The Company’s principal executive offices are located

at Tankedraget 7, Aalborg, Denmark DK-900, and the Company’s telephone number is (305) 814-2915.

The

holders of a majority of our issued and outstanding shares of common stock (the “Majority Stockholders”) have approved, by

written consent delivered to the Company on August 21, 2024, an amendment to our Articles of Incorporation,

as amended (the “Articles”), to effect a reverse stock split of our outstanding common stock, par value $0.0001 per share

(the “Common Stock”), at a reverse stock split ratio ranging from any whole number between 1-for-10 and 1-for-100,

subject to and as determined by the Board (the “Reverse Stock Split”).

Important

Notice Regarding the Internet Availability of this Information Statement: a copy of this Notice and the Information Statement is

available to you free of charge at https://www.lithiumharvest.com/investors/.

The

Notice and Information Statement is first being mailed on or about September 3, 2024 to the Company’s stockholders of record as

of the Record Date.

Summary

of the Corporate Action

Approval

of Reverse Stock Split

The

Majority Stockholders have approved, by written consent delivered to the Company on August 21, 2024, an

amendment to our Articles to effect the Reverse Stock Split.

We

may effect the Reverse Stock Split on or after September 23,

2024, the 20th calendar day after we mail the Notice and this Information Statement to stockholders

of record as of the Record Date, and prior to March 31, 2025.

Voting

and Vote Required

The

Company is not seeking consent, authorizations or proxies from you. Under Chapter 78 of the Nevada Revised Statutes (the “NRS”),

the Articles, and the Company’s by-laws (the “By-Laws”), the Reverse Split may be approved, without a meeting of stockholders,

by a resolution of our Board of Directors (the “Board”) and the written consent of the Majority Stockholders. As of the Record

Date, the Company had 296,037,813 shares of Common Stock outstanding and entitled to vote. Each share of our Common Stock is entitled

to one vote. The written consent was executed by the Majority Stockholders, holding 184,967,174 shares of common stock, representing

a majority of the voting power of our Common Stock as of the Record Date. Accordingly, the written consent was executed by stockholders

holding sufficient voting power to approve the actions contemplated by the written consent and no further stockholder action is required.

The Majority Stockholders are Sune Mathiesen Holding ApS and FENO Holding ApS. Sune Mathiesen, our Chief Executive Officer, President

and Chairman of the Board, is the Managing Director of Sune Mathiesen Holding ApS, and Paw Juul, our Chief Technology Officer, is the

Managing Director of FENO Holding ApS.

Dissenters’

Rights of Appraisal

The

NRS does not provide dissenters’ rights of appraisal to the Company’s stockholders in connection with the matters approved

by the written consent.

FORWARD-LOOKING

STATEMENTS

This

Information Statement contains “forward-looking statements” within the meaning of the Private Securities Litigation Reform

Act of 1995 that involve risks and uncertainties, many of which are beyond our control. Our actual results could differ materially and

adversely from those anticipated in such forward-looking statements as a result of certain factors, including those set forth in this

Information Statement.

All

statements, other than statements of historical facts, included in this Information Statement regarding our Reverse Stock Split, strategy,

future operations and plans and objectives of management are forward-looking statements. When used in this Information Statement, the

words “will,” “may,” “believe,” “anticipate,” “intend,” “estimate,”

“expect,” “project,” “plan,” and similar expressions are intended to identify forward-looking statements,

although not all forward-looking statements contain such identifying words. All forward-looking statements speak only as of the date

of this Information Statement. We undertake no obligation to update any forward-looking statements or other information contained herein.

Stockholders and potential investors should not place undue reliance on these forward-looking statements. Although we believe that our

plans, intentions, and expectations reflected in or suggested by the forward-looking statements in this Information Statement are reasonable,

we cannot assure stockholders and potential investors that these plans, intentions, or expectations will be achieved. We disclose important

factors that could cause our actual results to differ materially from our expectations under Part I, Item 1A. “Risk Factors”

in our Annual Report on Form 10-K for the year ended December 31, 2023, filed with the U.S. Securities and Exchange Commission (the “SEC”)

on April 4, 2024, and in Part II, Item 1A. “Risk Factors” in any Quarterly Reports on Form 10-Q filed subsequently

thereto. These cautionary statements qualify all forward-looking statements attributable to us or persons acting on our behalf.

APPROVAL

TO EFFECT A REVERSE STOCK SPLIT

Our

Board and the Majority Stockholders have adopted resolutions to authorize the Board, in its sole discretion, to amend our Articles to

effect the Reverse Stock Split at any time prior to March 31, 2025 (the “Split Authorization”). The amendment to our Articles

would be accomplished by adding to the end of the third paragraph thereof referring to the number of shares with par value the following

text:

“Upon

the filing and effectiveness (the “Reverse Stock Split Effective Time”) pursuant to the General Corporation Law of Nevada

of the Certificate of Amendment to these Articles of Incorporation of the Corporation, each [●] shares of Common Stock issued and

outstanding immediately prior to the Reverse Stock Split Effective Time shall, automatically and without any further action on the part

of the Corporation or any of the respective holders thereof, be reclassified, combined and converted into one (1) fully paid and nonassessable

share of Common Stock (the “Reverse Stock Split”), subject to the treatment of fractional share interests as described below.

The reclassification of the Common Stock will be deemed to occur at the Reverse Stock Split Effective Time. From and after the Reverse

Stock Split Effective Time, certificates representing Common Stock prior to such reclassification shall represent the number of shares

of Common Stock into which such Common Stock prior to such reclassification shall have been reclassified pursuant to the Certificate

of Amendment. No fractional shares shall be issued in connection with the Reverse Stock Split and, in lieu thereof, any stockholder who

would otherwise be entitled to receive a fractional share of Common Stock shall instead be entitled to receive a cash payment equal to

the product obtained by multiplying (a) the closing price per share of the Common Stock on the OTC Pink on the date of the Reverse Stock

Split Effective Time, after giving effect to the Reverse Stock Split, by (b) the fraction of the share owned by the stockholder, without

interest.”

The

Split Authorization permits, but does not require, our Board to effect a reverse stock split of our issued and outstanding Common

Stock at any time prior to March 31, 2025 at a reverse stock split ratio ranging from any whole

number between 1-for-10 and 1-for-100, subject to and as determined by the Board. Our Board reserves the right to elect to abandon

the Reverse Stock Split, if it determines, in its sole discretion, that the Reverse Stock Split is no longer in the best interests of

the Company and its stockholders.

We

do not intend to issue fractional shares in connection with the Reverse Stock Split. Instead, any stockholders who would have been entitled

to receive fractional shares as a result of the Reverse Stock Split will instead receive cash payments in lieu of such fractional shares.

Each holder of our Common Stock will hold the same percentage of our outstanding Common Stock immediately following the Reverse Stock

Split as that stockholder did immediately prior to the Reverse Stock Split, except to the extent that the Reverse Stock Split results

in stockholders receiving cash in lieu of fractional shares. The par value of our Common Stock will continue to be $0.0001 per share.

Background

and Reasons for the Reverse Stock Split; Potential Consequences of the Reverse Stock Split

Our

Board and Majority Stockholders approved the Split Authorization with the primary intent of (1) increasing the market price of our Common

Stock, enabling a future uplisting of our Common Stock onto The Nasdaq Capital Market, and (2) making our Common Stock more attractive

to a broader range of institutional and other investors.

We

are seeking to increase the market price of our Common Stock to satisfy one of the initial listing requirements for uplisting onto The

Nasdaq Capital Market, although we are under no obligation to uplist and there can be no assurance that the trading price of our Common

Stock would be maintained at such level or that we will be able to maintain any such listing of our Common Stock on The Nasdaq Capital

Market if we are able to uplist in the future. The Nasdaq Capital Market requires, among other items, an initial bid price of at least

$4.00 per share, and following initial listing, maintenance of a continued bid price of at least $1.00 per share.

We

also believe that the Reverse Stock Split, if implemented, will make our Common Stock more attractive to a broader range of institutional

and other investors, as we believe that the current market price of our Common Stock may affect its acceptability to certain institutional

investors, professional investors and other members of the investing public. Many brokerage houses and institutional investors have internal

policies and practices that either prohibit them from investing in low-priced stocks or tend to discourage individual brokers from recommending

low-priced stocks to their customers. In addition, some of those policies and practices may function to make the processing of trades

in low-priced stocks economically unattractive to brokers. Moreover, because brokers’ commissions on low-priced stocks generally

represent a higher percentage of the stock price than commissions on higher-priced stocks, the current average price per share of Common

Stock can result in individual stockholders paying transaction costs representing a higher percentage of their total share value than

would be the case if the share price were substantially higher. We believe that, if implemented by our Board, the Reverse Stock Split

will make our Common Stock a more attractive and cost-effective investment for many investors.

Reducing

the number of outstanding shares of our Common Stock through the Reverse Stock Split is intended, absent other factors, to increase the

per share market price of our Common Stock. However, other factors, such as our financial results, market conditions and the market perception

of our business, may adversely affect the market price of our Common Stock. As a result, there can be no assurance that the Reverse

Stock Split, if completed, will result in the intended benefits described above, that the market price of our Common Stock will increase

following the Reverse Stock Split or that the market price of our Common Stock will not decrease in the future. Additionally, we cannot

assure you that the market price per share of our Common Stock after a Reverse Stock Split will increase in proportion to the reduction

in the number of shares of our Common Stock outstanding before the Reverse Stock Split. Accordingly, the total market capitalization

of our Common Stock after the Reverse Stock Split may be lower than the total market capitalization before the Reverse Stock Split.

Criteria

the Board of Directors May Use to Determine Whether to Implement the Reverse Stock Split

When

determining whether to implement the Reverse Stock Split, and which Reverse Stock Split ratio to implement, if any, the Board may consider

various factors, including:

| | ● | the

historical trading price and trading volume of our Common Stock; |

| | | |

| | ● | the

then-prevailing trading price and trading volume of our Common Stock and the expected impact

of the Reverse Stock Split on the trading market for our Common Stock in the short- and long-term; |

| | | |

| | ● | the

number of shares of our Common Stock outstanding; |

| | | |

| | ● | the

anticipated impact of a particular ratio on the Company’s ability to reduce administrative

and transactional costs; and |

| | | |

| | ● | prevailing

general market, legal and economic conditions. |

Procedure

for Implementing the Reverse Stock Split

The

Reverse Stock Split, if approved by our stockholders, would become effective on the date and time set forth in the Certificate of Amendment

to our Articles that is filed with the Nevada Secretary of State, which we expect would be shortly after such filing is made with the

Nevada Secretary of State (the “Effective Time”). The exact timing of the filing of the Certificate of Amendment that will

effect the Reverse Stock Split will be determined by our Board based on its evaluation as to when such action will be the most advantageous

to the Company and our stockholders. In addition, our Board reserves the right, without further action by the stockholders, to elect

not to proceed with the Reverse Stock Split if, at any time prior to filing the amendment to our Articles, our Board, in its sole discretion,

determines that it is no longer in our best interest and the best interests of our stockholders to proceed with the Reverse Stock Split.

If a Certificate of Amendment effecting the Reverse Stock Split has not been filed with the Nevada Secretary of State by the close of

business on March 31, 2025, our Board will abandon the Reverse Stock Split.

Fractional

Shares

Stockholders

will not receive fractional shares of Common Stock in connection with the Reverse Stock Split. Instead, any holder of Common Stock who

would otherwise be entitled to a fractional share of Common Stock as a result of the Reverse Stock Split will instead be entitled to

receive a cash payment equal to the product obtained by multiplying (a) the closing price per share of the Common Stock on the OTC Pink

on the date of the Effective Time, after giving effect to the Reverse Stock Split, by (b) the fraction of the share owned by the stockholder,

without interest.

Stockholders

will not be entitled to receive interest for the period of time between the Effective Time and the date payment is made for their fractional

share interest. You should also be aware that, under the escheat laws of certain jurisdictions, sums due for fractional interests that

are not timely claimed after the funds are made available may be required to be paid to the designated agent for each such jurisdiction.

Thereafter, stockholders otherwise entitled to receive such funds may have to obtain the funds directly from the state to which they

were paid.

If

you believe that you may not hold sufficient shares of our Common Stock at the Effective Time to receive at least one share in the Reverse

Stock Split and you want to continue to hold our Common Stock after the Reverse Stock Split, you may do so by either:

| | ● | purchasing

a sufficient number of shares of our Common Stock; or |

| | | |

| | ● | if

you have shares of our Common Stock in more than one account, consolidating your accounts; |

in

each case, so that you hold a number of shares of our Common Stock in your account before the Reverse Stock Split that will entitle you

to receive at least one share of Common Stock in the Reverse Stock Split. Shares of our Common Stock held in registered form and shares

of our Common Stock held in “street name” (that is, through a broker, bank or other holder of record) for the same stockholder

will be considered held in separate accounts and will not be aggregated when effecting the Reverse Stock Split.

Effect

of the Reverse Stock Split on Holders of Outstanding Common Stock

General

After

the Effective Time of the Reverse Stock Split, should the Board elect to implement it, each stockholder will own a reduced number of

shares of Common Stock. However, the Reverse Stock Split would affect all of our stockholders uniformly and would not affect any stockholder’s

percentage ownership interests in the Company, except to the extent that the Reverse Stock Split results in any of our stockholders owning

a fractional share as described above. Voting rights and other rights and preferences of the holders of our Common Stock would not be

affected by the Reverse Stock Split (other than as a result of the payment of cash in lieu of fractional shares). For example, a holder

of 2% of the voting power of the outstanding shares of our Common Stock immediately prior to the Reverse Stock Split would continue to

hold 2% (assuming there is no impact as a result of the payment of cash in lieu of fractional shares) of the voting power of the outstanding

shares of our Common Stock immediately after the Reverse Stock Split. The number of stockholders of record also would not be affected

by the Reverse Stock Split (assuming there is no impact as a result of the payment of cash in lieu of fractional shares).

The

principal effects of the Reverse Stock Split would be that:

| | ● | each

10 to 100 shares of our Common Stock owned by a stockholder (depending on the Reverse Stock

Split ratio selected by the Board), would be combined into one new share of our Common Stock; |

| | | |

| | ● | no

fractional shares of Common Stock would be issued in connection with the Reverse Stock Split;

instead, any stockholders who would have been entitled to receive fractional shares as a

result of the Reverse Stock Split will instead receive cash payments in lieu of such fractional

shares; |

| | | |

| | ● | by

reducing the number of shares of Common Stock outstanding without reducing the number of

shares of available but unissued Common Stock, the Reverse Stock Split will effectively increase

the relative number of authorized but unissued shares, which the Board may use in connection

with future financings or other issuances; |

| | ● | based

upon the Reverse Stock Split ratio selected by the Board of Directors, proportionate adjustments

would be made to the per share exercise price and the number of shares issuable upon the

exercise or vesting of all then outstanding equity awards with respect to the number of shares

of Common Stock subject to such award and the exercise price thereof, to the extent applicable,

subject to the terms of such awards; |

| | | |

| | ● | the

number of shares of Common Stock authorized under the Company’s 2023 Equity Incentive

Plan (the “Plan”), will be proportionately adjusted for the Reverse Stock Split

ratio selected by the Board; and |

| | | |

| | ● | the

number of stockholders owning “odd lots” of less than 100 shares of our Common

Stock may potentially increase; odd lot shares may be more difficult to sell and brokerage

commissions and other costs of transactions in odd lots generally are proportionately higher

than the costs of transactions in “round lots” of even multiples of 100 shares. |

However,

we believe that any potential negative effects are outweighed by the benefits of the Reverse Stock Split.

Effect

on Shares of Common Stock

For

the purposes of providing examples of the effect of the Reverse Stock Split on our Common Stock, the following table contains approximate

information, based on share information as of the Record Date, of the effect of a Reverse Stock Split at certain ratios within the range

of the proposed Reverse Stock Split ratios on the number of shares of our Common Stock authorized, outstanding, reserved for future issuance

and not outstanding or reserved:

| Status | |

Number of Shares of Common

Stock Authorized | | |

Number of

Shares of Common

Stock Issued and Outstanding | | |

Number of

Shares of Common Stock Underlying Outstanding

Equity Awards | | |

Number of

Shares of Common Stock

Authorized but Not

Outstanding or Reserved | |

| Pre-Reverse Stock Split | |

| 500,000,000 | | |

| 296,037,813 | | |

| — | | |

| 203,962,187 | |

| Post-Reverse Stock Split 1:10 | |

| 500,000,000 | | |

| 29,603,781 | | |

| — | | |

| 470,396,219 | |

| Post-Reverse Stock Split 1:20 | |

| 500,000,000 | | |

| 14,801,890 | | |

| — | | |

| 485,198,110 | |

| Post-Reverse Stock Split 1:30 | |

| 500,000,000 | | |

| 9,867,927 | | |

| — | | |

| 490,132,073 | |

| Post-Reverse Stock Split 1:40 | |

| 500,000,000 | | |

| 7,400,945 | | |

| — | | |

| 492,599,055 | |

| Post-Reverse Stock Split 1:50 | |

| 500,000,000 | | |

| 5,920,756 | | |

| — | | |

| 494,079,244 | |

| Post-Reverse Stock Split 1:60 | |

| 500,000,000 | | |

| 4,933,963 | | |

| — | | |

| 495,066,037 | |

| Post-Reverse Stock Split 1:70 | |

| 500,000,000 | | |

| 4,229,111 | | |

| — | | |

| 495,770,889 | |

| Post-Reverse Stock Split 1:80 | |

| 500,000,000 | | |

| 3,700,472 | | |

| — | | |

| 496,299,528 | |

| Post-Reverse Stock Split 1:90 | |

| 500,000,000 | | |

| 3,289,309 | | |

| — | | |

| 496,710,691 | |

| Post-Reverse Stock Split 1:100 | |

| 500,000,000 | | |

| 2,960,378 | | |

| — | | |

| 497,039,622 | |

After

the Effective Time of the Reverse Stock Split that our Board elects to implement, our Common Stock would have a new CUSIP number.

Effect

on our Authorized Preferred Stock

The

Reverse Stock Split, if implemented, would not affect the total authorized number of shares of our preferred stock or the par value of

our preferred stock.

Effect

on Outstanding Equity Awards and Equity Plans

If

our Board decides to implement the Reverse Stock Split, as of the Effective Time, based on the Reverse Stock Split ratio selected by

the Board, proportionate adjustments will be made to all then-outstanding equity awards with respect to the number of shares of Common

Stock subject to such award and the exercise price thereof, to the extent applicable. In addition, the number of shares of Common Stock

available for issuance under the Plan will be proportionately adjusted for the Reverse Stock Split ratio selected by the Board, such

that fewer shares will be subject to the Plan.

Reduction

in Stated Capital

Pursuant

to the Reverse Stock Split, the par value of our Common Stock would remain $0.0001 per share. As a result of the Reverse Stock Split,

at the Effective Time, the stated capital on our balance sheet attributable to our Common Stock would be reduced in proportion to the

size of the Reverse Stock Split, subject to a minor adjustment in respect of the treatment of fractional shares, and the additional paid-in

capital account would be credited with the amount by which the stated capital is reduced. Our stockholders’ equity, in the aggregate,

would remain unchanged.

Beneficial

Holders of Common Stock (i.e., stockholders who hold in street name)

Upon

the implementation of the Reverse Stock Split, we intend to treat shares held by stockholders through a bank, broker, custodian or other

nominee in the same manner as registered stockholders whose shares are registered in their names. Banks, brokers, custodians or other

nominees will be instructed to effect the Reverse Stock Split for their beneficial holders holding our Common Stock in street name. However,

these banks, brokers, custodians or other nominees may have different procedures than registered stockholders for processing the Reverse

Stock Split. Stockholders who hold shares of our Common Stock with a bank, broker, custodian or other nominee and who have any questions

in this regard are encouraged to contact their banks, brokers, custodians or other nominees.

Registered

“Book-Entry” Holders of Common Stock (i.e., stockholders that are registered on the transfer agent’s books and

records but do not hold stock certificates)

Certain

of our registered holders of Common Stock may hold some or all of their shares electronically in book-entry form with the transfer agent.

These stockholders do not have stock certificates evidencing their ownership of the Common Stock. They are, however, provided with a

statement reflecting the number of shares registered in their accounts.

Stockholders

who hold shares electronically in book-entry form with the transfer agent will not need to take action (the exchange will be automatic)

to receive whole shares of post-Reverse Stock Split Common Stock, subject to adjustment for the treatment of fractional shares.

Holders

of Certificated Shares of Common Stock

If

you hold any of your shares of our Common Stock in certificated form, you will receive a transmittal letter from our transfer agent after

the Effective Time. The transmittal letter will be accompanied by instructions specifying how you can exchange your certificate representing

the pre-Reverse Stock Split shares of our Common Stock for either: (1) a certificate representing the post-Reverse Stock Split shares

of our Common Stock, or (2) post-Reverse Stock Split shares of our Common Stock in a book-entry form, evidenced by a transaction statement

that will be sent to your address of record indicating the number of shares of our Common Stock you hold, together with any payment of

cash in lieu of fractional shares to which you are entitled. Beginning at the Effective Time of the Reverse Stock Split, each certificate

representing pre-Reverse Stock Split shares of our Common Stock will be deemed for all corporate purposes to evidence ownership of post-Reverse

Stock Split shares. If you are entitled to a payment of cash in lieu of fractional shares, payment will be made as described above under

“Fractional Shares.”

WE

MAY ISSUE THE ADDITIONAL SHARES OF AUTHORIZED COMMON STOCK THAT WILL BECOME AVAILABLE AS A RESULT OF THE REVERSE STOCK SPLIT WITHOUT

THE ADDITIONAL APPROVAL OF OUR STOCKHOLDERS.

Not

a Going Private Transaction

Notwithstanding

the decrease in the number of outstanding shares following the implementation of the Reverse Stock Split, the Board does not intend for

this transaction to be the first step in a “going private transaction” within the meaning of Rule 13e-3 of the Securities

Exchange Act of 1934, as amended (the “Exchange Act”), and the implementation of the proposed Reverse Stock Split will not

cause the Company to go private.

No

Appraisal Rights

Under

the NRS, our stockholders are not entitled to appraisal rights with respect to the Reverse Stock Split, and we will not independently

provide our stockholders with any such rights.

Material

U.S. Federal Income Tax Consequences of the Reverse Stock Split

The

following discussion is a summary of material U.S. federal income tax consequences of an implemented Reverse Stock Split to U.S. Holders

(as defined below) that hold shares of our Common Stock as “capital assets” (generally, property held for investment) within

the meaning of Section 1221 of the U.S. Internal Revenue Code of 1986, as amended (the “Code”). This summary is based upon

the Code, Treasury regulations promulgated thereunder, published rulings and administrative pronouncements of the Internal Revenue Service

(the “IRS”), and judicial decisions, in each case in existence on the date hereof, all of which are subject to change and

to differing interpretations. Any such change could apply retroactively and could adversely affect the tax consequences described below.

No assurance can be given that the IRS will agree with the consequences described in this summary, or that a court will not sustain any

challenge by the IRS in the event of litigation. No advance tax ruling has been or will be sought or obtained from the IRS regarding

the tax consequences of the transactions described herein.

For

purposes of this summary, a “U.S. Holder” is a beneficial owner of shares of our Common Stock that is (a) an individual who

is a citizen or resident of the United States for U.S. federal income tax purposes, (b) an entity that is classified for U.S. federal

income tax purposes as a corporation and that is organized under the laws of the United States, any state thereof, or the District of

Columbia, or is otherwise treated for U.S. federal income tax purposes as a domestic corporation, (c) an estate the income of which is

subject to U.S. federal income taxation regardless of its source, or (d) a trust (i) whose administration is subject to the primary supervision

of a court within the United States and all substantial decisions of which are subject to the control of one or more United States persons

as described in Section 7701(a)(30) of the Code (“United States persons”), or (ii) that has a valid election in effect under

applicable Treasury regulations to be treated as a United States person.

This

summary does not discuss all U.S. federal income tax considerations that may be relevant to U.S. Holders in light of their particular

circumstances or that may be relevant to certain beneficial owners that may be subject to special treatment under U.S. federal income

tax law (for example, tax-exempt or governmental organizations, S corporations, partnership and other pass through entities (and investors

therein)), mutual funds, insurance companies, banks, thrifts and other financial institutions, dealers in securities, brokers or traders

in securities, commodities or currencies that elect to use a mark-to-market method of accounting, real estate investment trusts, regulated

investment companies, individual retirement accounts, qualified pension plans or other tax deferred accounts, persons who hold shares

of our Common Stock as part of a straddle, hedging, constructive sale, wash sale, synthetic security, conversion, or other integrated

transaction, persons required for U.S. federal income tax purposes to confirm the timing of income accruals to their financial statements

under Section 451 of the Code, U.S. Holders that have a functional currency other than the U.S. dollar, persons that own 5% or more (by

vote or value) of our Common Stock, and persons who acquired shares of our Common Stock as a result of the exercise of employee stock

options or otherwise as compensation or through a tax-qualified retirement plan). Furthermore, this summary does not discuss any alternative

minimum tax consequences or the Medicare contribution tax on net investment income and does not address any aspects of U.S. federal estate

or gift tax laws or of U.S. state or local or non-U.S. taxation.

If

an entity or arrangement classified for U.S. federal income tax purposes as a partnership owns shares of our Common Stock, the tax treatment

of a member of the entity or party to such arrangement will depend on the status of the member and the activities of the entity and such

member. The tax treatment of such an entity or arrangement, and the tax treatment of any member of such an entity or party to such an

arrangement, are not addressed in this summary. Any entity or arrangement that is classified for U.S. federal income tax purposes as

a partnership and that owns shares of our Common Stock, and any members of such an entity and parties to such an arrangement, are encouraged

to consult their tax advisors.

THIS

DISCUSSION IS FOR INFORMATIONAL PURPOSES ONLY AND IS NOT TAX ADVICE. BENEFICIAL OWNERS OF SHARES OF OUR COMMON STOCK ARE ENCOURAGED TO

SEEK ADVICE FROM THEIR OWN TAX ADVISORS REGARDING THE INCOME TAX CONSEQUENCES OF THE REVERSE STOCK SPLIT, TAKING INTO ACCOUNT THEIR PARTICULAR

SITUATIONS AS WELL AS ANY TAX CONSEQUENCES OF THE REVERSE STOCK SPLIT ARISING UNDER THE U.S. FEDERAL INCOME, ESTATE OR GIFT TAX LAWS

OR UNDER THE LAWS OF ANY STATE, LOCAL OR NON-U.S. TAXING JURISDICTION OR UNDER ANY APPLICABLE INCOME TAX TREATY.

We

intend to take the position that the Reverse Stock Split constitutes a recapitalization for U.S. federal income tax purposes pursuant

to Section 368(a)(1)(E) of the Code. Assuming the Reverse Stock Split qualifies as a recapitalization:

| | ● | a

U.S. Holder will not recognize gain or loss on the Reverse Stock Split, except with respect

to any cash received in lieu of a fractional share of our Common Stock; |

| | | |

| | ● | the

aggregate tax basis of the shares of our Common Stock received by a U.S. Holder in the Reverse

Stock Split will be equal to the aggregate tax basis of the shares exchanged therefor, excluding

any portion of such basis allocable to a fractional share of our Common Stock; |

| | | |

| | ● | the

holding period of the shares of our Common Stock received by a U.S. Holder in the Reverse

Stock Split will include the holding period of the shares exchanged therefor; and |

| | | |

| | ● | such

capital gain or loss will be short term if the shares owned immediately prior to the Reverse

Stock Split were held for one year or less at the Effective Time of the Reverse Stock Split

and long term if held for more than one year. |

In

general, a U.S. Holder who receives a cash payment in lieu of a fractional share of our Common Stock should be treated as if the fractional

share were issued and then redeemed. Whether such redemption qualifies for sale or exchange treatment depends on whether the reduction

in such U.S. Holder’s stock ownership is considered to be “not essentially equivalent to a dividend” for purposes of

Section 302(b)(l) of the Code or otherwise eligible for sale or exchange treatment. Whether such redemption is “not essentially

equivalent to a dividend” with respect to a U.S. Holder will depend upon such U.S. Holder’s particular circumstances. At

a minimum, however, for the redemption to be “not essentially equivalent to a dividend,” it must result in a “meaningful

reduction” in the U.S. Holder’s percentage stock ownership of the Company. The redemption of fractional shares from a minority

shareholder of a publicly traded corporation in a recapitalization is generally considered to be a meaningful reduction in interest or

otherwise eligible for sale or exchange treatment. Therefore, minority U.S. Holders that do not exercise control over the Company’s

corporate affairs are generally expected to recognize capital gain or loss equal to the difference between the amount of cash received

in lieu of the fractional share of our Common Stock and the portion of the U.S. Holder’s tax basis of the shares of our Common

Stock owned by such U.S. Holder immediately prior to the Reverse Stock Split that is allocable to the fractional share. Such gain or

loss generally will be long-term capital gain or loss if the U.S. Holder’s holding period in the shares of our Common Stock that

it owns immediately prior to the Reverse Stock Split is more than one year as of the date on which the Reverse Stock Split occurs. The

deductibility of capital losses is subject to limitations.

U.S.

Treasury regulations provide detailed rules for allocating the tax basis and holding period among shares of Common Stock which were acquired

by a stockholder on different dates and at different prices. U.S. Holders that acquired shares of our Common Stock on different dates

or at different prices should consult their tax advisors regarding the allocation of the tax basis and holding period among such shares.

Payments

of cash made in lieu of a fractional share of our Common Stock may, under certain circumstances, be subject to information reporting

and backup withholding. To avoid backup withholding, each U.S. Holder of our Common Stock that does not otherwise establish an exemption

from backup withholding should furnish on applicable IRS forms its taxpayer identification number and comply with the applicable certification

procedures.

Backup

withholding is not an additional tax and amounts withheld will be allowed as a credit against the U.S. Holder’s U.S. federal income

tax liability and may entitle such U.S. Holder to a refund, provided the required information is timely furnished to the IRS. U.S. Holders

of our Common Stock should consult their own tax advisors regarding the application of the information reporting and backup withholding

rules to them.

SECURITY

OWNERSHIP OF CERTAIN BENEFICIAL OWNERS AND MANAGEMENT

The

following table sets forth information regarding the beneficial ownership of our Common Stock on the Record Date by (a) each person who

is known by us to beneficially own 5% or more of our Common Stock, (b) each of our directors and executive officers, and (c) all of our

directors and executive officers as a group. Beneficial ownership is determined according to the rules of the SEC, which generally provide

that a person has beneficial ownership of a security if he, she or it possesses sole or shared voting or investment power over that security,

which includes the power to dispose of or to direct the disposition of the security or the right to acquire such powers within 60 days.

In computing the number of shares of our Common Stock beneficially owned by a person or entity and the percentage ownership, the Company

deemed outstanding shares of its Common Stock subject to options held by that person or entity that are currently exercisable or exercisable

within 60 days of the Record Date. We did not deem these shares outstanding, however, for the purpose of computing the percentage ownership

of any other person or entity. Unless otherwise noted, the address of each beneficial owner is c/o Tankedraget 7, Aalborg, Denmark DK-9000.

The

beneficial ownership of our Common Stock is based on 296,037,813 shares of our Common Stock issued and outstanding as of the Record Date.

| Name | |

Number of Shares Beneficially Owned | | |

Percentage of Shares Beneficially Owned(2) | |

| | |

| | |

| |

| Greater than 5% Stockholders | |

| | | |

| | |

| | |

| | | |

| | |

| Kestrel Flight Fund LLC(1) | |

| 71,797,703 | | |

| 24.3 | % |

| | |

| | | |

| | |

| AØNP14 ApS(2) | |

| 21,700,059 | | |

| 7.3 | % |

| | |

| | | |

| | |

| Directors and Executive Officers | |

| | | |

| | |

| | |

| | | |

| | |

| Sune Mathiesen | |

| 92,483,587 | (3) | |

| 31.2 | % |

| | |

| | | |

| | |

| Stefan Muehlbauer | |

| 1,000,000 | | |

| 0.3 | % |

| | |

| | | |

| | |

| Paw Juul | |

| 92,483,587 | (4) | |

| 31.2 | % |

| | |

| | | |

| | |

| All directors and executive officers as a group (3 persons) | |

| 185,967,174 | | |

| 62.2 | % |

| |

(1) |

Albert

Hanser is the Managing Partner of Kestrel Flight Fund LLC. The address of Kestrel Flight Fund LLC is 149 Meadowbrook Road, Weston,

Massachusetts 02493. |

| |

|

|

| |

(2) |

Aldo

Petersen is the managing director of AØNP14 ApS. The address of AØNP14 ApS is Amaliegade 6, DK-1256 København

K. |

| |

|

|

| |

(3) |

Consists

of 92,483,587 shares owned directly by Sune Mathiesen Holding ApS. Mr. Mathiesen is the managing director of Sune Mathiesen Holding

ApS. |

| |

|

|

| |

(4) |

Consists

of 92,483,587 shares owned by FENO Holding ApS. Mr. Juul is the managing director of FENO Holding ApS. |

WHERE

YOU CAN FIND ADDITIONAL INFORMATION

We

are subject to the reporting and information requirements of the Exchange Act, and as a result file reports, information statements and

other information with the SEC. The SEC maintains a website at www.sec.gov that contains reports, proxy and information statements

and other information regarding registrants, such as the Company, that file electronically with the SEC. We also maintain a website at

https://www.lithiumharvest.com/investors/, at which you may access these materials free of charge as soon as reasonably practicable after

they are electronically filed with, or furnished to, the SEC. The information contained in, or that can be accessed through, our website

is not part of this Information Statement.

OTHER

MATTERS

Other

Business

The

Board knows of no other matters other than those described in this Information Statement that have been approved or considered by the

Majority Stockholders.

Stockholders

Sharing an Address

The

Company will deliver only one copy of this Information Statement to multiple stockholders sharing an address unless the Company has received

contrary instructions from one or more of the stockholders. Furthermore, the Company undertakes to deliver promptly, upon written or

oral request, a separate copy of this Information Statement to a stockholder at a shared address to which a single copy of this Information

Statement is delivered. A stockholder can notify the Company that the stockholder wishes to receive a separate copy of this Information

Statement by contacting the Company at: Sustainable Projects Group Inc., 2800 Post Oak Blvd., Suite 1910, Houston, Texas 77056,

or by calling (346) 998-1533. Conversely, if multiple stockholders sharing an address receive multiple Information Statements and wish

to receive only one, such stockholders can notify the Company at the address or phone number set forth above.

*

* * * * * * * * * * * * * *

Pursuant

to the requirements of the Exchange Act, the registrant has duly caused this Information Statement to be signed on its behalf by the

undersigned hereunto authorized.

| By

Order of the Board of Directors |

|

| |

|

| /s/

Sune Mathiesen |

|

| Sune

Mathiesen |

|

| Chairman,

President & Chief Executive Officer |

|

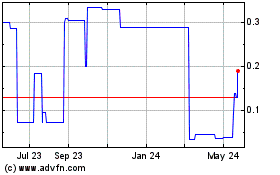

Sustainable Projects (PK) (USOTC:SPGX)

Historical Stock Chart

From Jan 2025 to Feb 2025

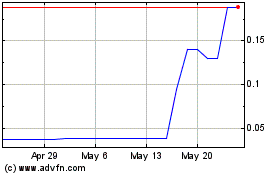

Sustainable Projects (PK) (USOTC:SPGX)

Historical Stock Chart

From Feb 2024 to Feb 2025