Swiss Re 'Assessing' SoftBank Deal, 2017 Net Profit Hit by Natural Catastrophes -- Update

23 February 2018 - 7:06PM

Dow Jones News

(Adds updates throughout.)

By Pietro Lombardi

Swiss Re AG (SREN.EB) is "carefully assessing" the implications

of a deal with SoftBank Group Corp. (9984.TO), the reinsurance

giant said on Friday, as it reported that net profit fell sharply

to $331 million in 2017, hit by a number of natural

catastrophes.

"Swiss Re's board of directors is carefully assessing the

strategic and financial implications of such a partnership, having

in mind the best interests of the company and its

shareholders," it said.

"Swiss Re's capital position remains very strong; the issuance

of new capital is not under consideration," it said.

Earlier in February, The Wall Street Journal reported that

SoftBank Group was in advanced talks to buy a stake of up to a

third in the Swiss reinsurer.

The Zurich-based reinsurer's 2017 net profit of $331 million

compares with a profit of $3.56 billion in 2016.

The results include a benefit of $93 million from U.S. tax

reform.

Claims of about $4.7 billion stemming from natural disasters

including hurricanes Harvey, Irma and Maria, as well as an

earthquake in Mexico and wildfires in California, hurt the

insurance company's full-year profit, it said.

"2017 was clearly a challenging year for the industry - and

Swiss Re. However, we believe the outlook for our industry is now

more positive than it has been during the last four years,"

Chief Executive Christian Mumenthaler said.

Gross premiums declined 2.4% to $34.78 billion.

Natural catastrophes weighed on the company's property and

casualty business, as well as its corporate-solutions unit, both

sliding to a loss in 2017.

Swiss Re's property and casualty business--its largest

unit--posted a net loss of $413 million for the quarter compared

with a net profit of $2.10 billion a year earlier. Gross premiums

at the unit fell to $16.54 billion from $18.15 billion. Corporate

solutions posted a loss of $741 million compared with a profit of

$135 million a year earlier.

The board will propose to raise the dividend to 5 Swiss francs

($5.34) from the CHF4.85 it paid the previous year and to launch a

new buyback program of up to CHF1 billion.

The company said its January 2018 renewals premium volume

increased 8%, while prices were up 2%.

Write to Pietro Lombardi at pietro.lombardi@dowjones.com

(END) Dow Jones Newswires

February 23, 2018 02:51 ET (07:51 GMT)

Copyright (c) 2018 Dow Jones & Company, Inc.

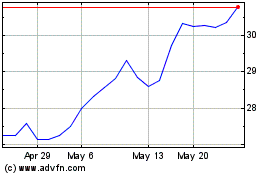

Swiss Re (PK) (USOTC:SSREY)

Historical Stock Chart

From Apr 2024 to May 2024

Swiss Re (PK) (USOTC:SSREY)

Historical Stock Chart

From May 2023 to May 2024