UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

FORM 6-K

Report of Foreign Private Issuer

Pursuant to Rule 13a-16 or 15d-16

of the Securities Exchange Act of 1934

For the month of December, 2023

Commission File Number: 001-09531

Telefónica, S.A.

(Translation of registrant's name into English)

Distrito Telefónica, Ronda de la Comunicación s/n,

28050 Madrid, Spain

3491-482 87 00

(Address of principal executive offices)

Indicate by check mark whether the registrant files or will file annual reports under cover of Form 20-F or Form 40-F:

Indicate by check mark if the registrant is submitting the Form 6-K in paper as permitted by Regulation S-T Rule 101(b)(1):

Indicate by check mark if the registrant is submitting the Form 6-K in paper as permitted by Regulation S-T Rule 101(b)(7):

Telefónica, S.A.

TABLE OF CONTENTS

| | | | | | | | |

| Item | | Sequential Page Number |

| | |

| 1. | Telefónica announces the early results and pricing of the debt tender offer to purchase announced | 2 |

TELEFÓNICA, S.A., in compliance with the Securities Market legislation, hereby communicates the following

OTHER RELEVANT INFORMATION

Further to the communication made on November 20, 2023, Telefónica, S.A. ("Telefónica") announces the early results and pricing of the previously announced debt tender offer (the "Offer") by Telefónica Emisiones, S.A.U. ("Telefónica Emisiones") and Telefónica Europe B.V. ("Telefónica Europe" and, together with Telefónica Emisiones, the "Offerors") to purchase for cash the debt securities issued by the Offerors and guaranteed by Telefónica listed in the table below (collectively, the “Securities”).

The Offer is being made upon and is subject to the terms and conditions set forth in the Offer to Purchase, dated November 20, 2023, as amended by the press release issued by Telefónica earlier today and as it may be further amended or supplemented (the “Offer to Purchase”). Capitalized terms used and not otherwise defined in this announcement have the meaning given in the Offer to Purchase.

In the Offer, the Offerors have decided to accept an aggregate principal amount for both Offerors and all series of Securities of $500,008,000 (such amount, as may be amended pursuant to the Offer to Purchase, the “Maximum Tender Amount”).

The aggregate principal amount of validly tendered (and not validly withdrawn) Securities of each series as of 5:00 p.m., New York City time, on December 4, 2023 (the “Early Tender Deadline”), and the respective aggregate principal amount of the Securities of such series accepted by the relevant Offeror for purchase, is set forth in the table below, together with certain pricing information for the Offer (including the Total Consideration determined based on the yields of the applicable Reference Securities at 10:00 a.m., New York City time, today):

| | | | | | | | | | | | | | | | | | | | | | | | | | | | | |

Issuer of Security / Applicable Offeror | Title of Security | Principal Amount Outstanding | Principal Amount Tendered | Principal Amount Accepted | CUSIP/

ISIN | Acceptance Priority Level | Reference Yield | Fixed Spread (basis points) | Total Consideration(1)(2) |

| Telefónica Emisiones | 4.665% Notes due 2038 | $750,000,000 | $249,597,000 | $ 249,597,000 | 87938WAV5 / US87938WAV54 | 1 | 4.215% | 175 | $ 876.31 |

| Telefónica Emisiones | 4.103% Notes due 2027 | $1,500,000,000 | $434,521,000 | $ 250,411,000 | 87938WAT0 / US87938WAT09 | 2 | 4.206% | 100 | $ 967.32 |

| Telefónica Europe | 8.250% Notes due 2030 | $1,250,000,000 | $174,107,000 | — | 879385AD4 / US879385AD49 | 3 | — | — | — |

(1) Per $1,000 principal amount of Securities validly tendered at or prior to the Early Tender Deadline and accepted for purchase.

(2) For the avoidance of doubt, the Early Tender Premium was already included within the Total Consideration (which, in the case of all Securities was calculated using the Fixed Spread over the relevant Reference Yield, as described in the Offer to Purchase) and was not in addition to the Total Consideration. Holders of Securities whose validly tendered Securities were accepted for purchase on the Early Settlement Date will receive the applicable Total Consideration. In addition, Holders whose Securities were accepted for purchase will also receive accrued and unpaid interest on the principal amount of Securities from, and including, the most recent interest payment date prior to the Early Settlement Date up to, but not including, the Early Settlement Date, rounded to the nearest cent (“Accrued Interest”) on such Securities.

The Offer will expire at 5:00 p.m., New York City time, on December 19, 2023 (such date and time, as it may be extended, the “Expiration Date”), unless earlier terminated. However, because the aggregate principal amount of validly tendered Securities at or prior to the Early Tender Deadline exceeds the Maximum Tender Amount, the Offerors will not accept for purchase any Securities tendered after the Early Tender Deadline and at or prior to the Expiration Date.

The amount of each series of Securities that has been accepted for purchase in the Offer on the Early Settlement Date (as defined below) has been determined in accordance with the Acceptance Priority Levels specified in the table above, with 1 being the highest Acceptance Priority Level and 3 being the lowest Acceptance Priority Level, subject to the Maximum Tender Amount. In particular, as the aggregate principal amount of 2038 Notes validly tendered and not validly withdrawn does not exceed the 2038 Notes Sub-Cap, and as the aggregate principal amount of 2038 Notes and 2027 Notes validly tendered and not validly withdrawn exceed the Maximum Tender Amount, the 2038 Notes will be accepted in full (without pro ration) and the 2027 Notes will be accepted on a pro rata basis within such series of Securities and will be subject to a Scaling Factor of approximately 53.625%. No 2030 Notes will be accepted for purchase.

Holders of Securities who validly tendered their Securities at or prior to the Early Tender Deadline (and did not validly withdraw such Securities by the Withdrawal Deadline) and whose Securities were accepted for purchase will receive the applicable Total Consideration, which already includes the applicable Early Tender Premium. Accrued Interest will be paid in cash on all validly tendered Securities accepted for purchase. Payment of these amounts will be made as soon as reasonably practicable following the Early Tender Deadline (such date, the "Early Settlement Date"). The Offerors expect that the Early Settlement Date will be December 7, 2023.

Each Offeror’s obligation to accept for payment and pay for the Securities validly tendered in the Offer is subject to the satisfaction or waiver of the conditions described in the Offer to Purchase.

The Offer may be amended, extended, terminated or withdrawn in whole or with respect to any series of Securities without amending, extending, terminating or withdrawing the Offer with respect to any other series of Securities.

Madrid, December 5, 2023

This announcement is for informational purposes only. None of the Offer, the Offer to Purchase or this announcement constitutes an offer of securities or the solicitation of an offer of securities in Spain which require the approval and the publication of a prospectus under Regulation (EU) 2017/1129, Spanish Law 6/2023, of March 17, on the Securities Markets and the Investment Services (Ley 6/2023, de 17 de marzo, de los Mercados de Valores y de los Servicios de Inversión), and its ancillary and related regulations. Accordingly, the Offer to Purchase has not been and will not be submitted for approval nor approved by the Spanish Securities Market Commission. The Offer is being made only pursuant to the Offer to Purchase and only in such jurisdictions as is permitted under applicable law. Please see the Offer to Purchase for certain important information on offer restrictions applicable to the Offer.

NOT FOR DISTRIBUTION TO ANY PERSON LOCATED OR RESIDENT IN ANY JURISDICTION IN WHICH SUCH DISTRIBUTION IS UNLAWFUL

SIGNATURES

Pursuant to the requirements of the Securities Exchange Act of 1934, the registrant has duly caused this report to be signed on its behalf by the undersigned, thereunto duly authorized.

| | | | | | | | | | | | | | | | | |

| | Telefónica, S.A. |

| Date: | December 5, 2023 | | By: | /s/ Pablo de Carvajal González |

| | | | Name: | Pablo de Carvajal González |

| | | | Title: | Secretary to the Board of Directors |

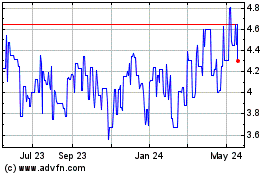

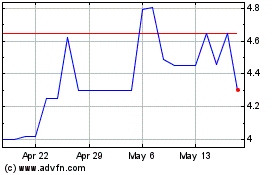

Telefonica (PK) (USOTC:TEFOF)

Historical Stock Chart

From Jan 2025 to Feb 2025

Telefonica (PK) (USOTC:TEFOF)

Historical Stock Chart

From Feb 2024 to Feb 2025