Amended Statement of Beneficial Ownership (sc 13d/a)

31 January 2019 - 10:06PM

Edgar (US Regulatory)

|

SECURITIES AND EXCHANGE COMMISSION

|

|

|

Washington, D.C. 20549

|

|

|

|

|

|

SCHEDULE 13D/A

|

|

(Amendment No. 1)*

|

|

|

|

Under the Securities Exchange Act of 1934

|

|

|

|

Telecom Italia

S.p.A.

|

|

(Name of Issuer)

|

|

|

|

Ordinary

Shares, no nominal value

|

|

(Title of Class of Securities)

|

|

|

|

IT0003497168**

|

|

(CUSIP Number)

|

|

|

|

Elliott Associates, L.P.

c/o Elliott Management Corporation

40 West 57th Street

New York, NY 10019

with a copy to:

Eleazer Klein, Esq.

Marc Weingarten, Esq.

Schulte Roth & Zabel LLP

919 Third Avenue

New York, New York 10022

(212) 756-2000

|

|

(Name, Address and Telephone Number of Person

|

|

Authorized to Receive Notices and Communications)

|

|

|

|

January 30,

2019

|

|

(Date of Event Which Requires Filing of This Statement)

|

If the filing person has previously filed a statement on Schedule

13G to report the acquisition that is the subject of this Schedule 13D, and is filing this schedule because of Rule 13d-1(e), Rule

13d-1(f) or Rule 13d-1(g), check the following box. [ ]

(Page 1 of 7 Pages)

______________________________

* The remainder of this cover page shall be filled out for a reporting

person’s initial filing on this form with respect to the subject class of securities, and for any subsequent amendment containing

information which would alter disclosures provided in a prior cover page.

** The Ordinary Shares do not have a CUSIP number. The ISIN number

for the Ordinary Shares is IT0003497168

The information required on the remainder

of this cover page shall not be deemed to be “filed” for the purpose of Section 18 of the Securities Exchange Act of

1934 (“

Act

”) or otherwise subject to the liabilities of that section of the Act but shall be subject to all

other provisions of the Act (however, see the Notes).

|

ISIN No.

IT0003497168

|

Schedule 13D/A

|

Page

2

of 7 Pages

|

|

|

|

|

|

1

|

NAME OF REPORTING PERSON

Elliott Associates, L.P.

|

|

2

|

CHECK THE APPROPRIATE BOX IF A MEMBER OF A GROUP

|

(a)

x

(b)

¨

|

|

3

|

SEC USE ONLY

|

|

4

|

SOURCE OF FUNDS

WC

|

|

5

|

CHECK BOX IF DISCLOSURE OF LEGAL PROCEEDING IS REQUIRED PURSUANT TO ITEMS 2(d) or 2(e)

|

¨

|

|

6

|

CITIZENSHIP OR PLACE OF ORGANIZATION

Delaware

|

NUMBER OF

SHARES

BENEFICIALLY

OWNED BY

EACH

REPORTING

PERSON WITH:

|

7

|

SOLE VOTING POWER

455,701,021

|

|

8

|

SHARED VOTING POWER

-0-

|

|

9

|

SOLE DISPOSITIVE POWER

455,701,021

|

|

10

|

SHARED DISPOSITIVE POWER

-0-

|

|

11

|

AGGREGATE AMOUNT BENEFICIALLY OWNED BY EACH PERSON

455,701,021

|

|

12

|

CHECK IF THE AGGREGATE AMOUNT IN ROW (11) EXCLUDES CERTAIN SHARES

|

¨

|

|

13

|

PERCENT OF CLASS REPRESENTED BY AMOUNT IN ROW (11)

3.0%

|

|

14

|

TYPE OF REPORTING PERSON

PN

|

|

|

|

|

|

|

|

ISIN No.

IT0003497168

|

Schedule 13D/A

|

Page

3

of 7 Pages

|

|

|

|

|

|

1

|

NAME OF REPORTING PERSON

Elliott International, L.P.

|

|

2

|

CHECK THE APPROPRIATE BOX IF A MEMBER OF A GROUP

|

(a)

x

(b)

¨

|

|

3

|

SEC USE ONLY

|

|

4

|

SOURCE OF FUNDS

WC

|

|

5

|

CHECK BOX IF DISCLOSURE OF LEGAL PROCEEDING IS REQUIRED PURSUANT TO ITEMS 2(d) or 2(e)

|

¨

|

|

6

|

CITIZENSHIP OR PLACE OF ORGANIZATION

Cayman Islands, British West Indies

|

NUMBER OF

SHARES

BENEFICIALLY

OWNED BY

EACH

REPORTING

PERSON WITH:

|

7

|

SOLE VOTING POWER

-0-

|

|

8

|

SHARED VOTING POWER

968,364,667

|

|

9

|

SOLE DISPOSITIVE POWER

-0-

|

|

10

|

SHARED DISPOSITIVE POWER

968,364,667

|

|

11

|

AGGREGATE AMOUNT BENEFICIALLY OWNED BY EACH PERSON

968,364,667

|

|

12

|

CHECK IF THE AGGREGATE AMOUNT IN ROW (11) EXCLUDES CERTAIN SHARES

|

¨

|

|

13

|

PERCENT OF CLASS REPRESENTED BY AMOUNT IN ROW (11)

6.4%

|

|

14

|

TYPE OF REPORTING PERSON

PN

|

|

|

|

|

|

|

|

ISIN No.

IT0003497168

|

Schedule 13D/A

|

Page

4

of 7 Pages

|

|

|

|

|

|

1

|

NAME OF REPORTING PERSON

Elliott International Capital Advisors Inc.

|

|

2

|

CHECK THE APPROPRIATE BOX IF A MEMBER OF A GROUP

|

(a)

x

(b)

¨

|

|

3

|

SEC USE ONLY

|

|

4

|

SOURCE OF FUNDS

OO

|

|

5

|

CHECK BOX IF DISCLOSURE OF LEGAL PROCEEDING IS REQUIRED PURSUANT TO ITEMS 2(d) or 2(e)

|

¨

|

|

6

|

CITIZENSHIP OR PLACE OF ORGANIZATION

Delaware

|

NUMBER OF

SHARES

BENEFICIALLY

OWNED BY

EACH

REPORTING

PERSON WITH:

|

7

|

SOLE VOTING POWER

-0-

|

|

8

|

SHARED VOTING POWER

968,364,667

|

|

9

|

SOLE DISPOSITIVE POWER

-0-

|

|

10

|

SHARED DISPOSITIVE POWER

968,364,667

|

|

11

|

AGGREGATE AMOUNT BENEFICIALLY OWNED BY EACH PERSON

968,364,667

|

|

12

|

CHECK IF THE AGGREGATE AMOUNT IN ROW (11) EXCLUDES CERTAIN SHARES

|

¨

|

|

13

|

PERCENT OF CLASS REPRESENTED BY AMOUNT IN ROW (11)

6.4%

|

|

14

|

TYPE OF REPORTING PERSON

CO

|

|

|

|

|

|

|

|

ISIN No.

IT0003497168

|

Schedule 13D/A

|

Page

5

of 7 Pages

|

|

|

|

|

|

The following constitutes Amendment No.1 to the Schedule 13D filed by the undersigned ("

Amendment No. 1

"). This Amendment No. 1 amends the Schedule 13D as specifically set forth herein.

|

|

Item 3.

|

SOURCE AND AMOUNT OF FUNDS OR OTHER CONSIDERATION

|

|

Item 3 of the Schedule 13D is hereby amended and restated as follows:

|

|

Elliott Working Capital

|

The aggregate purchase price of the Ordinary Shares directly owned by Elliott is approximately $118,643,435.

|

|

Elliott International Working Capital

|

The aggregate purchase price of the

Ordinary Shares

directly owned by Elliott International is approximately $723,403,961.

|

|

The Reporting Persons may effect purchases of the Ordinary Shares through margin accounts maintained for them with prime brokers, which extend margin credit as and when required to open or carry positions in their margin accounts, subject to applicable federal margin regulations, stock exchange rules and such firms’ credit policies. Positions in the Ordinary Shares may be held in margin accounts and may be pledged as collateral security for the repayment of debit balances in such accounts. Since other securities may be held in such margin accounts, it may not be possible to determine the amounts, if any, of margin used to purchase the Ordinary Shares.

|

|

Item 4.

|

PURPOSE OF TRANSACTION

|

|

Item 4 of the Schedule 13D is hereby amended and restated as follows:

|

|

The Reporting Persons

believe the securities of the Issuer are undervalued and represent an attractive investment opportunity. Accordingly, the Reporting

Persons have increased their beneficial ownership of the Issuer from their last reported 13D filing on April 9, 2018 from 8.8%

to 9.4%.

The Reporting Persons believe

that there are several pathways for the Issuer to enhance shareholder value, including but not limited to, the separation of its

fixed line access network (NetCo) and the evaluation of market consolidation options, as well as the conversion of the saving shares.

The Reporting Persons believe any change in composition of the Board at this juncture would be detrimental to the execution and

delivery of the Issuer’s anticipated value creation plans.

|

|

Item 5.

|

INTEREST IN SECURITIES OF THE ISSUER

|

|

Item 5(a) and (c) of the Schedule 13D are hereby amended and restated as follows:

|

|

(a)

As of the date hereof, Elliott, Elliott International and EICA collectively have beneficial ownership of 1,424,065,688 Ordinary Shares constituting approximately 9.4% of the Ordinary Shares outstanding.

|

|

The aggregate percentage of the Ordinary Shares reported owned by each person named herein is based upon 15,203,122,583 Ordinary Shares outstanding, which is the total number of Ordinary Shares outstanding as of September 30, 2018 as reported in the Issuer’s Report of Foreign Private Issuer filed on Form 6-K with the Securities and Exchange Commission on November 28, 2018.

|

|

ISIN No.

IT0003497168

|

Schedule 13D/A

|

Page

6

of 7 Pages

|

|

|

|

|

|

As of the date hereof, Elliott beneficially owned 455,701,021 Ordinary Shares, including 170,242,036 Ordinary Shares through The Liverpool Limited Partnership, a Bermuda limited partnership that is a wholly-owned subsidiary of Elliott (“

Liverpool

”), constituting 3.0% of the Ordinary Shares outstanding.

|

|

As

of the date hereof, Elliott International beneficially owned 968,364,667 Ordinary Shares, constituting 6.4% of the Ordinary

Shares outstanding. EICA, as the investment manager of Elliott International may be deemed to beneficially own the

968,364,667 Ordinary Shares beneficially owned by Elliott International, constituting 6.4% of the Ordinary Shares

outstanding.

|

|

(c)

The transactions effected by the Reporting Persons during the past 60 days are set forth on

Schedule 1

attached hereto.

|

|

Item 6.

|

CONTRACTS, ARRANGEMENTS, UNDERSTANDINGS OR RELATIONSHIPS WITH RESPECT TO SECURITIES OF THE ISSUER

|

|

Item 6 of the Schedule 13D is hereby amended and restated as follows:

|

|

Elliott and Elliott International have entered into (i) cash settled European style short call options (the “

Call Options

”) relating to 240,000,000 and 510,000,000 Ordinary Shares of the Issuer, respectively and (ii) cash settled European style put options (the “

Put Options

”) relating to 240,000,000 and 510,000,000 Ordinary Shares of the Issuer, respectively. The Call Options have a strike price of EUR 0.4809 and the Put Options have a strike price of EUR 0.4351. The Call Options and Put Options have expiration dates ranging from May 29, 2020 to September 29, 2020. The counterparty to the Call Options and the Put Options is JPMorgan Chase Bank, N.A., London Branch.

|

|

On April 9, 2018, Elliott, Elliott International and EICA entered into a Joint Filing Agreement (the “

Joint Filing Agreement

”) in which the parties agreed to the joint filing on behalf of each of them of statements on Schedule 13D with respect to the securities of the Issuer to the extent required by applicable law. The Joint Filing Agreement is attached as

Exhibit 99.1

hereto and is incorporated herein by reference.

|

|

Except as described above in this Item 6, none of the Reporting Persons has any contracts, arrangements, understandings or relationships with respect to the securities of the Issuer.

|

|

ISIN No.

IT0003497168

|

Schedule 13D/A

|

Page

7

of 7 Pages

|

|

|

|

|

SIGNATURES

After reasonable

inquiry and to the best of his or its knowledge and belief, each of the undersigned certifies that the information set forth in

this statement is true, complete and correct.

DATE: January 30, 2019

|

ELLIOT ASSOCIATES, L.P.

|

|

|

|

By: Elliott Capital Advisors, L.P., as General Partner

|

|

|

|

By: Braxton Associates, Inc., as General Partner

|

|

|

|

|

|

|

|

|

|

|

|

/s/ Elliot Greenberg

|

|

|

|

Name: Elliot Greenberg

|

|

|

|

Title: Vice President

|

|

|

|

|

|

|

|

ELLIOTT INTERNATIONAL, L.P.

|

|

|

|

By: Elliott International Capital Advisors Inc., as Attorney-in-Fact

|

|

|

|

|

|

|

|

|

|

|

|

/s/ Elliot Greenberg

|

|

|

|

Name: Elliot Greenberg

|

|

|

|

Title: Vice President

|

|

|

|

|

|

|

|

ELLIOTT INTERNATIONAL CAPITAL ADVISORS INC.

|

|

|

|

|

|

|

|

|

|

|

|

/s/ Elliot Greenberg

|

|

|

|

Name: Elliot Greenberg

|

|

|

|

Title: Vice President

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

SCHEDULE 1

Transactions of the Reporting Persons Effected

During the Past 60 Days

The following transactions were effected directly by Elliott Associates,

L.P. in the Ordinary Shares during the past 60 days:

|

Date

|

Security

|

Amount of Shs.

Bought / (Sold)

|

Approx. price (€)

per Share

|

|

|

|

|

|

|

01/04/2019

|

Ordinary Shares

|

2,459,339

|

0.505

|

|

01/03/2019

|

Ordinary Shares

|

2,400,000

|

0.501

|

|

01/02/2019

|

Ordinary Shares

|

2,880,000

|

0.483

|

|

12/28/2018

|

Ordinary Shares

|

3,200,000

|

0.486

|

|

12/27/2018

|

Ordinary Shares

|

3,200,000

|

0.480

|

The following transactions were effected by The Liverpool Limited

Partnership in the Ordinary Shares during the past 60 days:

|

Date

|

Security

|

Amount of Shs.

Bought / (Sold)

|

Approx. price (€)

per Share

|

|

|

|

|

|

|

01/30/2019

|

Ordinary Shares

|

4,160,000

|

0.460

|

|

01/29/2019

|

Ordinary Shares

|

4,106,036

|

0.460

|

|

01/17/2019

|

Ordinary Shares

|

2,855,782

|

0.525

|

The following transactions were effected by Elliott International,

L.P. in the Ordinary Shares during the past 60 days:

|

Date

|

Security

|

Amount of Shs.

Bought / (Sold)

|

Approx. price (€)

per Share

|

|

|

|

|

|

|

01/30/2019

|

Ordinary Shares

|

8,840,000

|

0.460

|

|

01/29/2019

|

Ordinary Shares

|

8,725,327

|

0.460

|

|

01/17/2019

|

Ordinary Shares

|

6,068,536

|

0.525

|

|

01/04/2019

|

Ordinary Shares

|

5,226,095

|

0.505

|

|

01/03/2019

|

Ordinary Shares

|

5,100,000

|

0.501

|

|

01/02/2019

|

Ordinary Shares

|

6,120,000

|

0.483

|

|

12/28/2018

|

Ordinary Shares

|

6,800,000

|

0.486

|

|

12/27/2018

|

Ordinary Shares

|

6,800,000

|

0.480

|

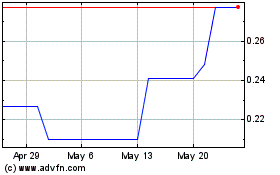

Telcom Italia (PK) (USOTC:TIAOF)

Historical Stock Chart

From Nov 2024 to Dec 2024

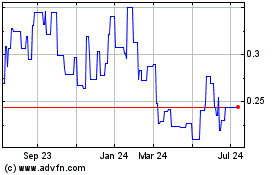

Telcom Italia (PK) (USOTC:TIAOF)

Historical Stock Chart

From Dec 2023 to Dec 2024

Real-Time news about Telcom Italia SPA New (PK) (OTCMarkets): 0 recent articles

More Tim S.p.a. News Articles