Form 8-K - Current report

15 February 2024 - 7:00AM

Edgar (US Regulatory)

UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

FORM 8-K

CURRENT REPORT

Pursuant to Section 13 or 15(d) of

The Securities Exchange Act of 1934

Date of Report (Date of earliest event reported): February 13, 2024

TEL-INSTRUMENT ELECTRONICS CORP.

(Exact name of registrant as specified in its charter)

| New Jersey | 001-31990 | 22-1441806 |

| (State or other Jurisdiction of Incorporation) | (Commission File Number) | (IRS Employer Identification No.) |

One Branca Road

East Rutherford, New Jersey 07073

(Address of principal executive offices)

(201) 933-1600

(Telephone number, including area code)

Securities registered pursuant to Section 12(b) of the Act:

| Title of each class | | Trading Symbol(s) | | Name of each exchange on which registered |

| N/A | | N/A | | N/A |

Check the appropriate box below if the Form 8-K filing is intended to simultaneously satisfy the filing obligation of the registrant under any of the following provisions:

| ☐ | Written communications pursuant to Rule 425 under the Securities Act (17 CFR 230.425) |

| ☐ | Soliciting material pursuant to Rule 14a-12 under the Exchange Act (17 CFR 240.14a-12) |

| ☐ | Pre-commencement communications pursuant to Rule 14d-2(b) under the Exchange Act (17 CFR 240.14d-2(b)) |

| ☐ | Pre-commencement communications pursuant to Rule 13e-4(c) under the Exchange Act (17 CFR 240.13e-4(c)) |

Indicate by check mark whether the registrant is an emerging growth company as defined in Rule 405 of the Securities Act of 1934 (§240.12b-2 of this chapter).

Emerging growth company ☐

If an emerging growth company, indicate by check mark if the registrant has elected not to use the extended transition period for complying with any new or revised financial accounting standards provided pursuant to Section 13(a) of the Exchange Act. ☐

Item 2.02. Results of Operations and Financial Condition.

On February 13, 2024, Tel-Instrument Electronics Corp. (the “Company”) issued a press release announcing its financial results for the quarter ended December 31, 2023. A copy of the Press Release is attached as Exhibit 99.1 to this Current Report on Form 8-K and is incorporated by reference herein.

The information furnished under this Item 2.02 and in the accompanying Exhibit 99.1 shall not be deemed “filed” for purposes of Section 18 of the Securities Exchange Act of 1934, as amended (the “Exchange Act”), or incorporated by reference in any filing under the Securities Act of 1933, as amended, or the Exchange Act regardless of any general incorporation language in such filing, unless expressly incorporated by specific reference in such filing.

Item 9.01. Financial Statements and Exhibits.

(d) Exhibits

*Filed herewith

SIGNATURES

Pursuant to the requirements of the Securities Exchange Act of 1934, the Registrant has duly caused this report to be signed on its behalf by the undersigned thereunto duly authorized.

| |

TEL-INSTRUMENT ELECTRONICS CORP.

|

| |

|

| |

|

|

|

|

Date: February 14, 2024

|

|

Jeffrey O’Hara

|

|

| |

|

Name: Jeffrey O’Hara

|

|

| |

|

Title: Chief Executive Officer

|

|

NONE

false

0000096885

0000096885

2024-02-13

2024-02-13

Exhibit 99.1

Tel-Instrument Electronics Corp. Reports Financial Results

For Third Quarter FY 2024

East Rutherford, NJ – February 13, 2024 – Tel-Instrument Electronics Corp. (“Tel-Instrument,” “TIC,” or the “Company”) (OTCQB: TIKK), a leading designer and manufacturer of avionics test and measurement solutions, today reported a net income of $134K ($0.01 per basic share) on revenues of $2.4 million for the third quarter of 2024 fiscal year, ended December 31, 2023.

Notes On Third Quarter:

| |

●

|

Revenues for the third quarter were $2.4 million, a 3% increase from $2.3 million in the year-ago quarter.

|

| |

●

|

The gross margin percentage increased to 40% versus 38% in the year-ago quarter.

|

| |

●

|

Operating expenses decreased by $239K, a 25% decline versus the year-ago level as a result of funded engineering projects.

|

| |

●

|

The order backlog remained strong at $6.0 million.

|

| |

●

|

Net income was $134K or $0.01 per share and $0.02 per diluted share.

|

| |

●

|

The Aeroflex lawsuit was paid in full. This was partially funded through the issuance of $721k of preferred shares.

|

| |

●

|

$690k credit line from Bank of America has been extended until June 30, 2024.

|

Mr. Jeffrey O’Hara, Tel-Instrument’s President and CEO commented: “We were disappointed by the Aeroflex lawsuit result but are glad to finally put it behind us. The third quarter represented a modest improvement, but we are still being impacted by supply chain issues that are delaying customer shipments. We have hired a new Supply Chain Manager to be more proactive in managing the difficult environment. We are expecting a much stronger FY 2025 due to the commencement of CRAFT ECP production; increased SDR-OMNI sales; and a $1.5 million MADL order for the F-35 program. The SDR-OMNI test sets continue to gain market traction and we expect to secure a market leading position in the commercial avionics segment. We recently introduced an SDR-OMNI/MIL version and have received orders from two international customers. The engineering for the U.S. Army software upgrade for the TS-4530A product is now complete and we are waiting for government certification to close out this program. The CRAFT ECP engineering is proceeding on schedule and the Test Readiness Review (“TRR”) will take place this May. This will generate a $1.2 million invoice which should shore up our cash position. The CRAFT ECP production contract should commence later this year and is expected to generate annual revenues of up to $5 million per year.”

About Tel-Instrument Electronics Corp.

Tel-Instrument is a leading designer and manufacturer of avionics test and measurement solutions for the global commercial air transport, general aviation, and government/military aerospace and defense markets. Tel-Instrument provides instruments to test, measure, calibrate, and repair a wide range of airborne navigation and communication equipment. For further information, please visit our website at www.telinstrument.com.

This press release includes statements that are not historical in nature and may be characterized as “forward-looking statements,” including those related to future financial and operating results, benefits, and synergies of the combined companies, statements concerning the Company’s outlook, pricing trends, and forces within the industry, the completion dates of capital projects, expected sales growth, cost reduction strategies, and their results, long-term goals of the Company and other statements of expectations, beliefs, future plans and strategies, anticipated events or trends, and similar expressions concerning matters that are not historical facts. All predictions as to future results contain a measure of uncertainty and, accordingly, actual results could differ materially. Among the factors which could cause a difference are: changes in the general economy; changes in demand for the Company’s products or in the cost and availability of its raw materials; the actions of its competitors; the success of our customers; technological change; changes in employee relations; government regulations; litigation, including its inherent uncertainty; difficulties in plant operations and materials; transportation, environmental matters; and other unforeseen circumstances. A number of these factors are discussed in the Company’s previous filings with the U.S. Securities and Exchange Commission. The Company disclaims any intention or obligation to update any forward-looking statements as a result of developments occurring after the date of this press release. The safe harbor for forward-looking statements contained in the Securities Litigation Reform Act of 1995 (the “Act”) protects companies from liability for their forward-looking statements if they comply with the requirements of the Act.

|

Contact:

|

Pauline Romeo

|

| |

Tel-Instrument Electronics Corp.

|

| |

(201) 933-1600 (Ext 309)

|

TEL-INSTRUMENT ELECTRONICS CORP.

CONDENSED CONSOLIDATED BALANCE SHEETS

| |

|

December 31,

2023

|

|

|

March 31,

2023

|

|

| |

|

(unaudited)

|

|

|

|

|

|

|

ASSETS

|

|

|

|

|

|

|

|

|

| |

|

|

|

|

|

|

|

|

|

Current assets:

|

|

|

|

|

|

|

|

|

|

Cash

|

|

$ |

220,791 |

|

|

$ |

3,839,398 |

|

|

Accounts receivable, net

|

|

|

1,176,203 |

|

|

|

900,881 |

|

|

Inventories, net

|

|

|

4,319,840 |

|

|

|

3,586,065 |

|

|

Restricted cash to support appeal bond

|

|

|

- |

|

|

|

2,011,083 |

|

|

Prepaid expenses and other current assets

|

|

|

243,907 |

|

|

|

817,625 |

|

|

Total current assets

|

|

|

5,960,741 |

|

|

|

11,155,052 |

|

| |

|

|

|

|

|

|

|

|

|

Equipment and leasehold improvements, net

|

|

|

83,495 |

|

|

|

85,167 |

|

|

Operating lease right-of-use assets

|

|

|

1,375,726 |

|

|

|

1,526,551 |

|

|

Deferred tax asset, net

|

|

|

2,630,274 |

|

|

|

2,627,935 |

|

|

Other long-term assets

|

|

|

35,109 |

|

|

|

35,109 |

|

|

Total assets

|

|

$ |

10,085,345 |

|

|

$ |

15,429,814 |

|

| |

|

|

|

|

|

|

|

|

|

LIABILITIES & STOCKHOLDERS’ EQUITY

|

|

|

|

|

|

|

|

|

| |

|

|

|

|

|

|

|

|

|

Current liabilities:

|

|

|

|

|

|

|

|

|

|

Line of credit

|

|

$ |

690,000 |

|

|

$ |

690,000 |

|

|

Operating lease liabilities – current portion

|

|

|

208,076 |

|

|

|

202,087 |

|

|

Accounts payable

|

|

|

804,363 |

|

|

|

322,582 |

|

|

Deferred revenues - current portion

|

|

|

82,797 |

|

|

|

123,117 |

|

|

Accrued expenses ‐vacation pay, payroll and payroll withholdings

|

|

|

230,992 |

|

|

|

240,034 |

|

|

Accrued legal damages

|

|

|

- |

|

|

|

6,360,698 |

|

|

Accrued expenses - other

|

|

|

220,808 |

|

|

|

157,896 |

|

|

Total current liabilities

|

|

|

2,237,036 |

|

|

|

8,096,414 |

|

| |

|

|

|

|

|

|

|

|

|

Operating lease liabilities – long-term

|

|

|

1,167,650 |

|

|

|

1,324,464 |

|

|

Other long term liabilities

|

|

|

48,140 |

|

|

|

53,416 |

|

|

Deferred revenues – long-term

|

|

|

128,778 |

|

|

|

173,883 |

|

| |

|

|

|

|

|

|

|

|

|

Total liabilities

|

|

|

3,581,604 |

|

|

|

9,648,177 |

|

| |

|

|

|

|

|

|

|

|

|

Commitments and contingencies

|

|

|

|

|

|

|

|

|

| |

|

|

|

|

|

|

|

|

|

Stockholders’ equity:

|

|

|

|

|

|

|

|

|

|

Preferred stock, 1,000,000 shares authorized, par value $0.10 per share

|

|

|

|

|

|

|

|

|

|

Preferred stock, 500,000 shares 8% Cumulative Series A Convertible Preferred

authorized, issued, and outstanding, respectively par value $0.10 per share

|

|

|

4,055,998 |

|

|

|

3,875,998 |

|

|

Preferred stock, 320,000 shares 8% Cumulative Series B Convertible Preferred

authorized; 233,334 and 166,667 issued, and outstanding, par value $0.1 per share

|

|

|

1,676,701 |

|

|

|

1,207,367 |

|

|

Preferred stock, 166,667 shares 8% Cumulative Series C Convertible Preferred

authorized; 53,500 and 0 issued, and outstanding, par value $0.10 per share

|

|

|

328,795 |

|

|

|

- |

|

|

Common stock, 7,000,000 shares authorized, par value $0.10 per share,

3,255,887 and 3,255,887 shares issued and outstanding, respectively

|

|

|

325,586 |

|

|

|

325,586 |

|

|

Additional paid-in capital

|

|

|

6,471,562 |

|

|

|

6,721,535 |

|

|

Accumulated deficit

|

|

|

(6,354,901 |

) |

|

|

(6,348,849 |

) |

|

Total stockholders’ equity

|

|

|

6,503,741 |

|

|

|

5,781,637 |

|

|

Total liabilities and stockholders’ equity

|

|

$ |

10,085,345 |

|

|

$ |

15,429,814 |

|

TEL-INSTRUMENT ELECTRONICS CORP.

CONDENSED CONSOLIDATED STATEMENTS OF OPERATIONS

(Unaudited)

| |

|

Three Months Ended

|

|

|

Nine Months Ended

|

|

| |

|

December 31,

2023

|

|

|

December 31,

2022

|

|

|

December 31,

2023

|

|

|

December 31,

2022

|

|

| |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Net sales

|

|

$ |

2,403,099 |

|

|

$ |

2,328,254 |

|

|

$ |

6,835,123 |

|

|

$ |

6,594,768 |

|

|

Cost of sales

|

|

|

1,434,981 |

|

|

|

1,434,547 |

|

|

|

4,212,971 |

|

|

|

4,312,405 |

|

| |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Gross margin

|

|

|

968,118 |

|

|

|

893,707 |

|

|

|

2,622,152 |

|

|

|

2,282,363 |

|

| |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Operating expenses:

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Selling, general and administrative

|

|

|

414,458 |

|

|

|

588,937 |

|

|

|

1,520,386 |

|

|

|

1,625,123 |

|

|

Engineering, research, and development

|

|

|

306,546 |

|

|

|

370,795 |

|

|

|

913,701 |

|

|

|

1,502,534 |

|

|

Total operating expenses

|

|

|

721,004 |

|

|

|

959,732 |

|

|

|

2,434,087 |

|

|

|

3,127,657 |

|

| |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Income (loss) from operations

|

|

|

247,114 |

|

|

|

(66,025 |

) |

|

|

188,065 |

|

|

|

(845,294 |

) |

| |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Other income (expense):

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Interest income

|

|

|

35 |

|

|

|

5,665 |

|

|

|

50,642 |

|

|

|

8,782 |

|

|

Income other

|

|

|

- |

|

|

|

628,400 |

|

|

|

1,000 |

|

|

|

628,406 |

|

|

Interest expense – judgement

|

|

|

- |

|

|

|

(71,017 |

) |

|

|

(198,535 |

) |

|

|

(193,953 |

) |

|

Interest expense

|

|

|

(22,976 |

) |

|

|

- |

|

|

|

(49,561 |

) |

|

|

- |

|

|

Total other net (expense) income

|

|

|

(22,941 |

) |

|

|

563,048 |

|

|

|

(196,454 |

) |

|

|

443,235 |

|

| |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Income (loss) before income taxes

|

|

|

224,173 |

|

|

|

497,023 |

|

|

|

(8,389 |

) |

|

|

(402,059 |

) |

| |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Income tax expense (benefit)

|

|

|

90,364 |

|

|

|

104,396 |

|

|

|

(2,337 |

) |

|

|

(84,449 |

) |

| |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Net income (loss) income

|

|

|

133,809 |

|

|

|

392,627 |

|

|

|

(6,052 |

) |

|

|

(317,610 |

) |

| |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Preferred dividends

|

|

|

(94,420 |

) |

|

|

(80,000 |

) |

|

|

(257,128 |

) |

|

|

(240,000 |

) |

| |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Net income (loss) attributable to common shareholders

|

|

$ |

39,389 |

|

|

$ |

312,627 |

|

|

$ |

(263,180 |

) |

|

$ |

(557,610 |

) |

| |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Basic net income (loss) per common share

|

|

$ |

0.01 |

|

|

$ |

0.10 |

|

|

$ |

(0.08 |

) |

|

$ |

(0.17 |

) |

|

Diluted net income (loss) per common share

|

|

$ |

0.02 |

|

|

$ |

0.08 |

|

|

$ |

(0.08 |

) |

|

$ |

(0.17 |

) |

| |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Weighted average shares outstanding:

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Basic

|

|

|

3,255,887 |

|

|

|

3,255,887 |

|

|

|

3,255,887 |

|

|

|

3,255,887 |

|

|

Diluted

|

|

|

5,610,634 |

|

|

|

5,155,665 |

|

|

|

3,255,887 |

|

|

|

3,255,887 |

|

v3.24.0.1

| X |

- DefinitionBoolean flag that is true when the XBRL content amends previously-filed or accepted submission.

| Name: |

dei_AmendmentFlag |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionFor the EDGAR submission types of Form 8-K: the date of the report, the date of the earliest event reported; for the EDGAR submission types of Form N-1A: the filing date; for all other submission types: the end of the reporting or transition period. The format of the date is YYYY-MM-DD.

| Name: |

dei_DocumentPeriodEndDate |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:dateItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionThe type of document being provided (such as 10-K, 10-Q, 485BPOS, etc). The document type is limited to the same value as the supporting SEC submission type, or the word 'Other'.

| Name: |

dei_DocumentType |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:submissionTypeItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionAddress Line 1 such as Attn, Building Name, Street Name

| Name: |

dei_EntityAddressAddressLine1 |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- Definition

+ References

+ Details

| Name: |

dei_EntityAddressCityOrTown |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionCode for the postal or zip code

| Name: |

dei_EntityAddressPostalZipCode |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionName of the state or province.

| Name: |

dei_EntityAddressStateOrProvince |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:stateOrProvinceItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionA unique 10-digit SEC-issued value to identify entities that have filed disclosures with the SEC. It is commonly abbreviated as CIK. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b-2

| Name: |

dei_EntityCentralIndexKey |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:centralIndexKeyItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionIndicate if registrant meets the emerging growth company criteria. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b-2

| Name: |

dei_EntityEmergingGrowthCompany |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionCommission file number. The field allows up to 17 characters. The prefix may contain 1-3 digits, the sequence number may contain 1-8 digits, the optional suffix may contain 1-4 characters, and the fields are separated with a hyphen.

| Name: |

dei_EntityFileNumber |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:fileNumberItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionTwo-character EDGAR code representing the state or country of incorporation.

| Name: |

dei_EntityIncorporationStateCountryCode |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:edgarStateCountryItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionThe exact name of the entity filing the report as specified in its charter, which is required by forms filed with the SEC. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b-2

| Name: |

dei_EntityRegistrantName |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionThe Tax Identification Number (TIN), also known as an Employer Identification Number (EIN), is a unique 9-digit value assigned by the IRS. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b-2

| Name: |

dei_EntityTaxIdentificationNumber |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:employerIdItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionLocal phone number for entity.

| Name: |

dei_LocalPhoneNumber |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionBoolean flag that is true when the Form 8-K filing is intended to satisfy the filing obligation of the registrant as pre-commencement communications pursuant to Rule 13e-4(c) under the Exchange Act. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 13e

-Subsection 4c

| Name: |

dei_PreCommencementIssuerTenderOffer |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionBoolean flag that is true when the Form 8-K filing is intended to satisfy the filing obligation of the registrant as pre-commencement communications pursuant to Rule 14d-2(b) under the Exchange Act. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 14d

-Subsection 2b

| Name: |

dei_PreCommencementTenderOffer |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionTitle of a 12(b) registered security. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b

| Name: |

dei_Security12bTitle |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:securityTitleItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionName of the Exchange on which a security is registered. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection d1-1

| Name: |

dei_SecurityExchangeName |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:edgarExchangeCodeItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionBoolean flag that is true when the Form 8-K filing is intended to satisfy the filing obligation of the registrant as soliciting material pursuant to Rule 14a-12 under the Exchange Act. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Section 14a

-Number 240

-Subsection 12

| Name: |

dei_SolicitingMaterial |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionTrading symbol of an instrument as listed on an exchange.

| Name: |

dei_TradingSymbol |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:tradingSymbolItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionBoolean flag that is true when the Form 8-K filing is intended to satisfy the filing obligation of the registrant as written communications pursuant to Rule 425 under the Securities Act. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Securities Act

-Number 230

-Section 425

| Name: |

dei_WrittenCommunications |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

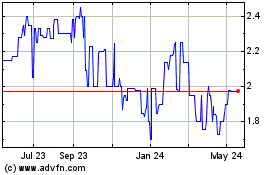

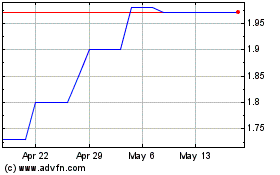

Tel Instrument Electronics (QB) (USOTC:TIKK)

Historical Stock Chart

From Mar 2025 to Apr 2025

Tel Instrument Electronics (QB) (USOTC:TIKK)

Historical Stock Chart

From Apr 2024 to Apr 2025