UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington D.C. 20549

FORM 8-K

CURRENT REPORT

Pursuant to Section 13 OR 15(d) of The Securities Exchange Act of 1934

Date of Report (Date of earliest event reported)

April 20, 2009

TRIMAX CORPORATION

(Exact name of registrant as specified in its charter)

Nevada

(State or other jurisdiction of incorporation)

0-32749

(Commission File Number)

76-0616468

(IRS Employer Identification No.)

8300 Via de Ventura, Unit 1024

Scottsdale, AZ 85253

(Address of principal executive offices)(Zip Code)

Registrant’s telephone number, including area code

(310) 739-1275

1500 East Tropicana Avenue, Suite 100, Las Vegas Nevada 89119

(Former name or former address, if changed since last report.)

Check the appropriate box below if the Form 8-K filing is intended to simultaneously satisfy the filing obligation of the registrant under any of the following provisions (see General Instruction A.2. below):

[ ] Written communications pursuant to Rule 425 under the Securities Act (17 CFR 230.425)

[ ] Soliciting material pursuant to Rule 14a-12 under the Exchange Act (17 CFR 240.14a-12)

[ ] Pre-commencement communications pursuant to Rule 14d-2(b) under the Exchange Act (17 CFR 240.14d-2(b))

[ ] Pre-commencement communications pursuant to Rule 13e-4(c) under the Exchange Act (17 CFR 240.13e-4(c))

Section 2 – Financial Information

Item 2.01 Completion of Acquisition or Disposition of Assets.

On March

20, 2009, Trimax Corporation entered into a binding letter agreement with Exploraciones San Bernardo S.A. de C.V, a Mexican company, to purchase two strategic mining claims the Mexican Company holds near the Municipality of Alamos, Sonora, Mexico. On April 20, 2009, the Company completed the purchase.

Pursuant to the letter agreement, Trimax has issued 10,000,000 shares of the Corporation’s common stock to the San Bernardo Subscribers, on closing, and will issue a further 20,000,000 shares over two years to acquire 100% of the Claims.

As part of the transaction, the Company has formulated a new plan of operations and is divesting itself of its broadband over power line business plans, trade secrets and proprietary information, and any remaining digital signage equipment.

Business

The Company is now engaged in business as an exploration stage gold and silver mining company. The Company’s new plan of operations is to develop and exploit its mining claims in Sonora, Mexico.

Forward Looking Statements

This current report and the exhibits attached hereto contain "forward-looking statements" within the meaning of the Private Securities Litigation Reform Act of 1995. Such forward-looking statements concern the Company's anticipated results and developments in the Company's operations in future periods, planned exploration and development of its properties, plans related to its business and other matters that may occur in the future. These statements relate to analyses and other information that are based on forecasts of future results, estimates of amounts not yet determinable and assumptions of management.

Any statements that express or involve discussions with respect to predictions, expectations, beliefs, plans, projections, objectives, assumptions or future events or performance (often, but not always, using words or phrases such as “believes” or “does not believe”, "expects" or "does not expect", "is expected", "anticipates" or "does not anticipate", "plans", "estimates" or "intends", or stating that certain actions, events or results "may", "could", "would", "might" or "will" be taken, occur or be achieved) are not statements of historical fact and may be forward-looking statements. Forward-looking statements are subject to a variety of known and unknown risks, uncertainties and other factors which could cause actual events or results to differ from those expressed or implied by the forward-looking statements, including, without limitation:

•

risks related to our properties being in the exploration stage;

•

risks related to our mineral operations being subject to government regulation;

•

risks related to our ability to obtain additional capital to develop our resources, if any;

•

risks related to mineral exploration activities;

•

risks related to the fluctuation of prices for precious and base metals, such as gold, silver and copper;

•

risks related to the competitive industry of mineral exploration;

•

risks related to our title and rights in our mineral properties;

•

risks related to the possible dilution of our common stock from additional financing activities; and

•

risks related to fluctuations of the price of our shares of common stock.

The Mining Industry

Any mineral deposit first begins with an initial discovery of a resource. Early exploration companies are involved with new discoveries and the subsequent drilling and geological testing is required to further define both the size and the grade of the deposit.

A measured resource has a higher degree of confidence than an indicated resource. Drilling and analysis is required before upgrading an indicated resource to the status of a measured resource. Measure and indicated resources are useful when considering the future potential of a mining project.

The Securities and Exchange Commission has established industry guides for mining company disclosures. It separates mining companies into three stages:

-the exploration stage: companies engaged in the search for mineral deposits (reserves) which are not in either the development or production stage

-the development stage: companies engaged in the preparation of an established commercially minable deposit (reserves) for its extraction which are not in the production stage.

-the production stage: companies engaged in the exploitation of a mineral deposit (reserves)

The Company is in the exploration stage. The Company’s predecessor has undertaken primary exploration on our mining claims, consisting of geological studies on the Company’s properties which outline the likely mineralization of the properties. The next steps will involve further exploration and the preparation of a preliminary feasibility study to determine economic viability of the properties and outline the inferred, indicated and measured resources of the mineral deposits and the economically mineable probably and proven reserves.

Properties

The Company owns mining claims covering

10,240.575

hectares in Alamos, 90 km north east of

Navojoa in Sonora, Mexico. The property consists of five mineral concessions; the Raquel 2, approximately 9,451.575 hectares in size, La Dura 8, No. 226.576, approximately 90 hectares in size, La Dura 8, No. 226.831, approximately 109 hectares in size, La Dura 5, No. 226.830, approximately 90 hectares in size, and La Dura 5, No. 226.829, approximately 500 hectares in size.

Geological studies commissioned by the former owners of the claims have been performed in the past several years, consisting of collection and analysis of rock samples.

History

The area within and surrounding the Sonoran property has been mined intermittently for approximately 400 years. Deposits in the area include Porphyry copper deposits, high grade silver and gold quartz vein deposits, and polymetallic carbonate-hosted deposits that have been exploited, including silver, zinc, lead and copper.

The Las Minitas project is located approximately 35 kilometers to the southwest of the Sonoran property, wherein mineral resources of 13.5 metric tons of mineral resources have been identified, with approximately 102,590,737 ounces of silver and 120,456 ounces of gold.

Mineralization on the Sonoran property is confined predominantly to fault and fissure-fill and gold and silver bearing, epithermal veins and manto and skarn type carbonate hosted silver-rich base metal occurrences. Prospects and deposits exploited in the past are the result of Late Cretaceous to Early Ecocene

Raquel 2

The Raquel 2 property consists of one mineral concession, approximately 9,451.575 hectares in size. The rocks in Raquel 2 comprised mainly of intruded granodiorite rocks and minor volcanic rocks The Granodiorite (and in some casa the volcanic rocks) are the main sources of epithermal gold, silver, zinc and copper mineralization.

La Dura Concessions

The La Dura 8 concessions consist of two concessions of 90 hectares and 100 hectares in size., respectively. The La Dura 5 concessions consists of two concessions of 90 and 500 hectares in size, respectively. Geological studies, consisting of rock sampling and assays conducted on the property in 2005 have indicated gold, silver and copper mineralized veins on the properties may be encountered with further exploration activity.

Competition

There is aggressive competition within the minerals industry to discover and acquire mineral properties considered to have commercial potential. We compete for the opportunity to participate in promising exploration projects with other entities, many of which have greater resources than us. In addition, we compete with others in efforts to obtain financing to acquire and explore mineral properties. Specific to our Sonoran project, we compete in mining claims staking with local miners and entrepreneurs.

Employees

We employ two management employees. We intend to hire more management and clerical employees as we gear up our new plan of operations, and, as we explore and develop the Sonoran properties, we will add additional employees or contract resources to advance our exploration plans.

Regulation

Our activities will be subject to various federal, state, and local laws and regulations governing prospecting, exploration, production, labor standards, occupational health and mine safety, control of toxic substances, and other matters involving environmental protection and taxation. It is possible that future changes in these laws or regulations could have a significant impact on our business, causing those activities to be economically re-evaluated at that time.

Environmental Risks

Minerals exploration and mining are subject to potential risks and liabilities associated with pollution of the environment and the disposal of waste products occurring as a result of mineral exploration and production. Insurance against environmental risks, including potential liability for pollution or other hazards as a result of the disposal of waste products occurring from exploration and production, is not generally available to us (or to other companies in the minerals industry) at a reasonable price. To the extent that we may become subject to environmental liabilities, the remediation of any such liabilities would reduce funds otherwise available to us and could have a material adverse effect on our financial condition. Laws and regulations intended to ensure the protection of the environment are constantly changing, and are generally becoming more restrictive.

Plan of Operations

Our exploration program will take place in phases, which are ultimately designed to determine if the Sonoran properties are viable for production.

The milestones for the phase 1 exploration program include the review of available data to create a structural mineralization framework, detailed soil and rock sampling, a geochemical survey of the property, and a geographical mapping program, in order to better understand the existing known mineralization. The cost of phase 1 is approximately $115,000.

The objectives for phase 2 of the exploration plan is to undertake a ground magnetic resistivity survey of the property to better delineate the mineralization of the property. The cost of phase 2 is approximately $150,000.

The accomplishment of these milestones will require the company to secure financing for the exploration activities and obtain licenses and permits from the Mexican government.

RISK FACTORS

We are subject to various risks which may materially harm our business, financial condition and results of operations. You should carefully consider the risks and uncertainties described below and the other information in this filing before deciding to purchase our common stock. If any of these risks or uncertainties actually occur, our business, financial condition or operating results

could be materially harmed. In that case, the trading price of our common stock could decline and you could lose all or part of your investment.

Because Of The Speculative Nature Of Exploration Of Mineral Concessions And The Unique Difficulties And Uncertainties Inherent In The Mineral Exploration Business, There Is Substantial Risk That No Commercially Exploitable Minerals Will Be Found And That This Business Will Fail.

Exploration for minerals is a speculative venture involving substantial risk. New mineral exploration companies encounter difficulties, and there is a high rate of failure of such enterprises. The expenditures we may make in the exploration of the mineral concessions may not result in the discovery of commercial quantities of ore. The likelihood of success must be considered in light of the problems, expenses, difficulties, complications and delays encountered in connection with the exploration of the mineral properties that we plan to undertake. These potential problems include, but are not limited to, unanticipated problems relating to exploration, additional costs and expenses that may exceed current estimates, unusual or unexpected mineral formations, and other geological conditions. If we find mineral reserves which we decide to extract, of which there is no guarantee, we may face additional problems, expenses, difficulties and complications including, but not limited to, environmental concerns regarding the use of cyanide, potential third party liability due to the actions of contractors, the purchase of used equipment without warranties, and inconsistent grade of ore or not enough ore to make mining profitable. If we encounter any or all of these unanticipated problems, we may be unable to complete our business plan. In addition, the search for valuable minerals involves numerous hazards. As a result, we may become subject to liability for such hazards, including pollution, cave-ins, the use of explosives, waste disposal, worker safety and other hazards against which we cannot insure or against which we may elect not to insure. The payment of such liabilities may have a material adverse effect on our financial position.

As We Undertake Exploration Of Our Mineral Claims, We Will Be Subject To Compliance With Government Regulations That May Increase The Anticipated Cost Of Our Exploration Program.

There are several governmental regulations that materially restrict mineral exploration or exploitation. We will be subject to federal, state, and local mining laws in Mexico as we carry out our exploration program. We may be required to obtain work permits, post bonds and perform remediation work for any physical disturbance to the land in order to comply with these regulations. While our planned exploration program includes a budget for regulatory compliance, there is a risk that new regulations could increase our costs of doing business and prevent us from carrying out our exploration program.

If We Are Unable To Secure The Proper Permits From The Mexican Government, We Would Not Be Able To Mine and Mill Any Minerals That We May Find. If We Cannot Mine and Mill Mineral Deposits, We Will Not Be Able To Pursue Our Business Plan.

We are required to obtain permits for any concessions on which we want to mine and mill minerals, if we find such minerals. The Mexican Government has the discretion to refuse to issue us such a permit on any or all of our concessions. If the Mexican Government does not issue us this permit, we will not be able to mine and mill any mineral reserves or conduct any mining activities on the property. If we cannot mine and mill minerals, we will not be able to pursue our business plan and may have to cease operations.

Because Our Assets and Operations Will Be Located Outside the U.S., U.S. Investors May Experience Difficulties In Attempting To Enforce Judgments Based Upon U.S. Federal Securities Laws. U.S. Laws and/or Judgments Might Not Be Enforced Against Us In Foreign Jurisdictions.

All of our operations and all of our assets will be located outside of the United States. As a result, it may be difficult or impossible for U.S. investors to enforce judgments of U.S. courts for civil liabilities against us or against any of our individual directors or officers. In addition, U. S. investors should not assume that courts in the countries in which our operations or assets are located (i) would enforce judgments of U.S. courts obtained in actions against us or our subsidiary based upon the civil liability provisions of applicable U.S. federal and state securities laws or (ii) would enforce, in original actions, liabilities against us or our subsidiary based upon these laws.

Mining activities involve a high degree of risk.

Our operations on our properties will be subject to all the hazards and risks normally encountered in the mining deposits of gold. These hazards and risks include, without limitation, unusual and unexpected geologic formations, seismic activity, rock bursts, pit-wall failures, cave-ins, flooding and other conditions involved in the drilling and removal of material, any of which could result in damage to, or destruction of, mines and other producing facilities, damage to life or property, environmental damage and legal liability. Milling operations, if any, are subject to various hazards, including, without limitation, equipment failure and failure of retaining dams around tailings disposal areas, which may result in environmental pollution and legal liability.

The parameters that would be used at our properties in estimating possible mining and processing efficiencies would be based on the testing and experience our management has acquired in operations elsewhere. Various unforeseen conditions can occur that may materially affect estimates based on those parameters. In particular, past mining operations indicate that care must be taken to ensure that proper mineral grade control is employed and that proper steps are taken to ensure that the underground mining operations are executed as planned to avoid mine grade dilution, resulting in uneconomic material being fed to the mill. Other unforeseen and uncontrollable difficulties may occur in planned operations at our properties which could lead to failure of the operation.

If we make a decision to exploit either of our properties based on gold mineralization that may be discovered and proven, we plan to process the resource using technology that has been demonstrated to be commercially effective at other geologically similar gold deposits elsewhere in the world. These techniques may not be as efficient or economical as we project, and we may never achieve profitability.

We may be adversely affected by fluctuations in gold prices.

The value and price of our securities, our financial results, and our exploration activities may be significantly adversely affected by declines in the price of gold and other precious metals. Gold prices fluctuate widely and are affected by numerous factors beyond our control such as interest rates, exchange rates, inflation or deflation, fluctuation in the relative value of the United States dollar against foreign currencies on the world market, global and regional supply and demand for gold, and the political and economic conditions of gold producing countries throughout the world. The price for gold fluctuates in response to many factors beyond anyone’s ability to predict. The

prices that would be used in making any resource estimates at our properties would be disclosed and would probably differ from daily prices quoted in the news media. Percentage changes in the price of gold cannot be directly related to any estimated resource quantities at any of our properties, as they are affected by a number of additional factors. For example, a ten percent change in the price of gold may have little impact on any estimated resource quantities and would affect only the resultant cash flow. Because any future mining would occur over a number of years, it may be prudent to continue mining for some periods during which cash flows are temporarily negative for a variety of reasons, including a belief that a low price of gold is temporary and/or that a greater expense would be incurred in temporarily or permanently closing a mine there.

Mineralized material calculations and life-of-mine plans, if any, using significantly lower gold and precious metal prices could result in material write-downs of our investments in mining properties and increased reclamation and closure charges.

In addition to adversely affecting any of our mineralized material estimates and its financial aspects, declining metal prices may impact our operations by requiring a reassessment of the commercial feasibility of a particular project. Such a reassessment may be the result of a management decision related to a particular event, such as a cave-in of a mine tunnel or open pit wall. Even if any of our projects may ultimately be determined to be economically viable, the need to conduct such a reassessment may cause substantial delays in establishing operations or may interrupt on-going operations, if any, until the reassessment can be completed.

Estimates of mineralized material are subject to evaluation uncertainties that could result in project failure.

Our exploration and future mining operations, if any, are and would be faced with risks associated with being able to accurately predict the quantity and quality of mineralized material within the earth using statistical sampling techniques. Estimates of any mineralized material on any of our properties would be made using samples obtained from appropriately placed trenches, test pits and underground workings and intelligently designed drilling. There is an inherent variability of assays between check and duplicate samples taken adjacent to each other and between sampling points that cannot be reasonably eliminated. Additionally, there also may be unknown geologic details that have not been identified or correctly appreciated at the current level of accumulated knowledge about our properties. This could result in uncertainties that cannot be reasonably eliminated from the process of estimating mineralized material. If these estimates were to prove to be unreliable, we could implement an exploitation plan that may not lead to commercially viable operations in the future.

We depend on a single property – the Sonoran property.

Our flagship mineral property at this time is the Sonoran property. We are dependent on making a number of gold, silver, copper, lead, calcite and zinc discoveries at the Sonoroan property for the furtherance of the Company at this time. Should we be able to make economic finds, we would be dependent on multiple mining and metallurgical operations for our revenues and profits, if any.

Future legislation and administrative changes to the Mexcian mining laws could prevent us from exploring our properties.

Mexican laws and regulations, amendments to existing laws and regulations, administrative interpretation of existing laws and regulations, or more stringent enforcement of existing laws and

regulations, could have a material adverse impact on our ability to conduct exploration and mining activities. Any change in the regulatory structure making it more expensive to engage in mining activities could cause us to cease operations.

We are a relatively young company with limited operating history

Since we are a young company, it is difficult to evaluate our business and prospects. At this stage of our business operations, even with our good faith efforts, potential investors have a high probability of losing their investment. Our future operating results will depend on many factors, including the ability to generate sustained and increased demand and acceptance of our products, the level of our competition, and our ability to attract and maintain key management and employees. While management believes their estimates of projected occurrences and events are within the timetable of their business plan, there can be no guarantees or assurances that the results anticipated will occur.

We expect to incur net losses in future quarters.

If we do not achieve profitability, our business may not grow or operate. We may not achieve sufficient revenues or profitability in any future period. We will need to generate revenues from the sales of our products or take steps to reduce operating costs to achieve and maintain profitability. Even if we are able to generate revenues, we may experience price competition that will lower our gross margins and our profitability. If we do achieve profitability, we cannot be certain that we can sustain or increase profitability on a quarterly or annual basis.

We may require additional funds to operate in accordance with our business plan.

We may not be able to obtain additional funds that we may require. We do not presently have adequate cash from operations or financing activities to meet our long-term needs. If unanticipated expenses, problems, and unforeseen business difficulties occur, which result in material delays, we will not be able to operate within our budget. If we do not achieve our internally projected sales revenues and earnings, we will not be able to operate within our budget. If we do not operate within our budget, we will require additional funds to continue our business. If we are unsuccessful in obtaining those funds, we cannot assure you of our ability to generate positive returns to the Company. Further, we may not be able to obtain the additional funds that we require on terms acceptable to us, if at all. We do not currently have any established third-party bank credit arrangements. If the additional funds that we may require are not available to us, we may be required to curtail significantly or to eliminate some or all of our development, manufacturing, or sales and marketing programs.

If we need additional funds, we may seek to obtain them primarily through equity or debt financings. Such additional financing, if available on terms and schedules acceptable to us, if available at all, could result in dilution to our current stockholders and to you. We may also attempt to obtain funds through arrangement with corporate partners or others. Those types of arrangements may require us to relinquish certain rights to our intellectual property or resulting products.

If capital is not available to us to expand our business operations, we will not be able to pursue our business plan.

We will require substantial additional capital to acquire additional properties and to

participate in the development of those properties. Cash flows from operations, to the extent available, will be used to fund these expenditures. We intend to seek additional capital from loans from current shareholders and from public and private equity offerings. Our ability to access capital will depend on our success in participating in properties that are successful in exploring for minerals. It will also be dependent upon the status of the capital markets at the time such capital is sought. Should sufficient capital not be available, the development of our business plan could be delayed and, accordingly, the implementation of the Company’s business strategy would be adversely affected. In such event it would not be likely that investors would obtain a profitable return on their investments or a return of their investments.

We compete with larger, better capitalized competitors in the mining industry.

The mining industry is acutely competitive in all of its phases. We face strong competition from other mining companies in connection with the acquisition of exploration-stage properties, or properties capable of producing precious metals. Many of these companies have greater financial resources, operational experience and technical capabilities than us. As a result of this competition, we may be unable to maintain or acquire attractive mining properties on terms it considers acceptable or at all. Consequently, our revenues, operations and financial condition and possible future revenues could be materially adversely affected by actions by our competitors.

Risks Relating to Our Common Stock

Our directors and executive officers beneficially own a substantial amount of our common stock.

Accordingly, these persons will be able to exert significant influence over the direction of our affairs and business, including any determination with respect to our acquisition or disposition of assets, future issuances of common stock or other securities, and the election or removal of directors. Such a concentration of ownership may also have the effect of delaying, deferring, or preventing a change in control of the Company or cause the market price of our stock to decline. Notwithstanding the exercise of their fiduciary duties by the directors and executive officers and any duties that such other stockholder may have to us or our other stockholders in general, these persons may have interests different than yours.

We do not expect to pay dividends for the foreseeable future.

For the foreseeable future, it is anticipated that earnings, if any, that may be generated from our operations will be used to finance our operations and that cash dividends will not be paid to holders of our common stock.

We are subject to SEC regulations and changing laws, regulations and standards relating to corporate governance and public disclosure, including the Sarbanes-Oxley Act of 2002, new SEC regulations and other trading market rules, are creating uncertainty for public companies.

We are committed to maintaining high standards of corporate governance and public disclosure. As a result, we intend to invest appropriate resources to comply with evolving standards, and this investment may result in increased general and administrative expenses and a diversion of management time and attention from revenue-generating activities to compliance activities.

PROPERTIES

We own the mining concessions Raquel 2, approximately 9,451.575 hectares in size, La Dura 8, No. 226.576, approximately 90 hectares in size, La Dura 8, No. 226.831, approximately 109 hectares in size, La Dura 5, No. 226.830, approximately 90 hectares in size, and La Dura 5, No. 226.829, approximately 500 hectares in size.

SECURITY OWNERSHIP OF CERTAIN BENEFICIAL OWNERS AND M ANAGEMENT

The following table sets forth information furnished to us with respect to the beneficial ownership of our common stock by (i) each executive officer, director and nominee, and by all directors and executive officers as a group, and (ii) each beneficial owner of more than five percent of our outstanding common stock, in each case as of April 10, 2009. Unless otherwise indicated, each of the persons listed has sole voting and dispositive power with respect to the shares shown as beneficially owned.

|

|

|

|

|

|

Title of Class

|

Name and Address of Beneficial Owner

|

Amount of Beneficial Ownership

|

Percent of Class

|

|

Common Stock

|

Robert Stewart

|

2,000,000

|

5.7%

|

|

Common Stock

|

Exploraciones San Bernardo S.A. de C.V.

Boulevard Miguel Hidalgo 64, Colonia Centenario,

Sonora,Mexico.

|

10,000,000

|

28.6%

|

|

Common Stock

|

Shares of directors and executive officers as a group (6 persons)

|

2,000,000

|

5.7%

|

DIRECTORS AND EXECUTIVE OFFICERS

Name

Age

Position

Robert S. Stewart

61

Chairman,

Chief Executive Officer,

Director

Robert S. Stewart.

Mr. Stewart has acted as Chairman, Chief Executive Officer and Director of the Company since April 2, 2009. Since 1976, Mr. Stewart has acted as Chairman and Chief Executive Officer of Interop A.G., a company which has engaged in the exploration and development of petroleum and pipeline projects, mines, mills and smelters. He holds a Political Economist degree from the University of Manitoba in 1968.

Corporate Governance

The Board of Directors is committed to maintaining strong corporate governance principles and practices. The Board periodically reviews evolving legal, regulatory, and best practice developments to determine those that will best serve the interests of our shareholders.

Meetings and Attendance

Our Board of Directors is required by our bylaws to hold regularly scheduled annual meetings. In addition to the annual meetings, it has the authority to call regularly scheduled meetings and special meetings by resolution. Our Board met 1 time during the past fiscal year.

All incumbent directors attended 100% or more of the Board meetings during the last fiscal year.

Nominations of Directors

There are no material changes to the procedures by which security holders may recommend nominees to the registrant’s board of directors.

Audit Committee

The Company currently does not have a designated Audit Committee, and accordingly, the Company's Board of Directors' policy is to pre-approve all audit and permissible non-audit services provided by the independent auditors. These services may include audit services, audit-related services, tax services and other services. Pre-approval is generally provided for up to one year and any pre-approval is detailed as to the particular service or category of services and is generally subject to a specific budget. The independent auditors and management are required to periodically report to the Company's Board of Directors regarding the extent of services provided by the independent auditors in accordance with this pre-approval, and the fees for the services performed to date. The Board of Directors may also pre-approve particular services on a case-by-case basis.

EXECUTIVE COMPENSATION

At this time there is no set executive compensation package for any of the directors or officers of the Company. The Company currently has an employee incentive stock option plan. The Company believes that it will adopt an executive compensation plan sometime within the next calendar year.

CERTAIN RELATIONSHIPS AND RELATED TRANSACTIONS

All shares issued reflect all forward and reverse splits authorized by the Company.

The Company issued 91,039 private placement restricted common shares in settlement of certain debts from shareholders of the Company for $0.05 per share.

During the year ended September 30, 2008 accrued management salaries have been recorded for services of the Chief Executive Officer, Chief Financial Officer and Chief Operating Officer totaling $nil (2007 - $100,000) and are included in accrued liabilities.

During the year ended September 30, 2007 the Company issued 472,000 shares of common stock valued at $1,285,102 to directors of the Company in payment for services rendered to the Company (2008 – nil).

RECENT SALES OF UNREGISTERED SECURITIES

The following securities have been issued by the company in the past two years, which were not registered under the Securities Act of 1933:

On January 24, 2007 the Company issued 1,177,622 restricted common shares to the officers of the company for services provided to the Company. The fair value was measured at the value of the Company's common stock on the date that the commitment for performance had been reached.

This valuation date was January 24, 2007 at which time the value was $4,437,961. The fair value of the equity instrument has been charged directly to compensation expense and additional paid-in capital.

On January 22, 2007 the Company filed a Form S-8 Registration Statement ‘Securities to be offered to Employees in Employee Benefit Plans’. Under the terms of this filing the company registered 1,369,286 unissued shares of common stock with a par value of $.001 per share for settlement of amounts payable by the company to the employees. The fair value was measured at the value of the Company's common stock on the date on the registration. This valuation date was January 22, 2007 at which time the stock was valued at $0.16. The fair value of the equity instrument has been charged directly to the related amounts due to the respective parties and additional paid-in capital.

On April 17, 2007 the Company cancelled the 120,000 common shares related to the legal circumstances surrounding the acquisition of MSI. Trimax terminated the agreement to acquire MSI.

On May 9, 2007 the Company adopted the 2007 Equity Incentive Plan the purpose of which is to provide incentives to attract retain and motivate eligible persons whose present and potential contributions are important to the success of the Company. The total number of shares reserved and available for grant and issuance pursuant to the Plan is 5,000,000 shares.

On May 14, 2007 the Company issued 128,000 shares of common stock for deposits on contracts, pursuant to Section 4(2) of the Securities Act of 1933.

On December 31, 2007, the Company issued 120,000 shares of common stock to directors of the Company as fees for services valued at $30,000, 120,000 shares of common stock for management services valued at $30,000, and 300,000 shares in settlement of loans payable in the

amount of $75,000.

On January 25, 2008, the Company cancelled 132,000 shares of common stock previously valued at $512,100 in deposits on acquisitions.

On April 14, 2008, the Company issued 2,827,049 shares of common stock to various parties in settlement of $252,029 in outstanding loans, and issued 80,000 for services valued at $7,200

In February 2009 the Company issued 5,472,500 shares of common stock for conversion of

outstanding debt, at the rate of $0.012 per share, pursuant to Section 4(2) of the Securities

Act of 1933.

In March 2009 the Company issued 11,799,998 shares of common stock for conversion of

outstanding debt, at the rate of $0.012 per share, pursuant to Section 4(2) of the Securities

Act of 1933.

Effective April 20, 2009, 10,000,000 shares of common stock were issued to Exploraciones

San Bernardo S.A. de C.V., and its related parties, pursuant to Section 4(2) of the Securities Act of 1933.

Effective April 20, 2009, 2,000,000 shares of common stock were issued to Robert Stewart, from conversion of outstanding debt which was assigned to Mr. Stewart, at the rate of $0.012 per share, pursuant to Section 4(2) of the Securities Act of 1933.

Section 9 – Financial Statements and Exhibits

Item 9.01 Financial Statements and Exhibits

(c) Exhibits

Exhibit No

.

Description

2

Closing Memorandum

99

News Release

SIGNATURES

Pursuant to the requirements of the Securities Exchange Act of 1934, the registrant has duly caused this report to be signed on its behalf by the undersigned hereunto duly authorized.

TRIMAX CORPORATION

Date: April 23, 2009 __

/s/ Robert S. Stewart

_________

Robert S. Stewart, Chief Executive Officer

EXHIBIT INDEX

|

|

|

|

Exhibit No.

|

Description

|

|

2

|

Closing Agreement By and Between Trimax Corporation entered into a binding letter agreement with Exploraciones San Bernardo S.A. de C.V

|

|

99

|

News Release –Trimax Corporation closing of agreement with Exploraciones San Bernardo S.A. de C.V

|

Exhibit No.2

Closing Memorandum on

Agreement for Purchase of

La Raquel 2, La Dura 8, La Dura 8, La Dura 5, La Dura 5, Prospect

Alamos, Sonora, Mexico

The undersigned hereby certify that all contingencies of the Agreement for sale and purchase (“Agreement”), between Exploraciones San Bernardo S.A. de C.V.: (“San Bernardo”), a Mexican Corporation, and Trimax Corporation, Inc. (“Trimax”), a Nevada corporation, have been satisfied, and all due diligence completed. Therefore, the parties are proceeding to the close of the Agreement, effective this date.

April 20, 2009

Respectfully,

Exploraciones San Bernardo S.A. de C.V.:

By:

/s/Athanasios Raptis

___________________

Athanasios Raptis

Trimax Corporation, Inc.

By:

/s/ Robert S. Stewart

___________________

Robert S. Stewart, Chief Executive Officer

Exhibit No.99

TRIMAX CORPORATION closes the purchase of San Bernardo Mining Properties in Sonora, Mexico

Scottsdale, Arizona – April 20, 2009 - Trimax Corporation

(OTCBB:

TMXN

) Chairman and CEO Robert S. Stewart announced the closing today of the purchase of five mining properties in Mexico from

Exploraciones San Bernardo S.A. de C.V. The purchase consists of properties comprising over 10,000 acres known as La Raquel 2, two claims on La Dura 8, and two claims on La Dura 5.

Trimax plans to develop several strategic gold, silver, copper and calcite mining claims on these properties in the municipality of Alamos, Sonora, Mexico. The history of the properties and preliminary geological studies indicate the presence of mineral resources.

Trimax will thoroughly research these mining claims, carrying out extensive geological and geophysical analysis and building an exploration program. A drilling program will commence immediately after concluding the surface investigations.

This press release contains statements, which may constitute "forward-looking statements" within the meaning of the Securities Act of 1933 and the Securities Exchange Act of 1934, as amended by the Private Securities Litigation Reform Act of 1995. Those statements include statements regarding the intent, belief or current expectations of Trimax Corporation and members of its management as well as the assumptions on which such statements are based. Prospective investors are cautioned that any such forward-looking statements are not guarantees of future performance and involve risks and uncertainties, and that actual results may differ materially from those contemplated by such forward-looking statements. Important factors currently known to management that could cause actual results to differ materially from those in forward-statements include fluctuation of operating results, the ability to compete successfully and the ability to complete before-mentioned transactions. The company undertakes no obligation to update or revise forward-looking statements to reflect changed assumptions, the occurrence of unanticipated events or changes to future operating results.

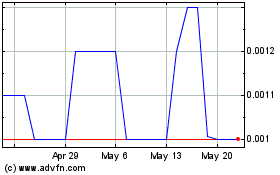

Trimax (PK) (USOTC:TMXN)

Historical Stock Chart

From Jun 2024 to Jul 2024

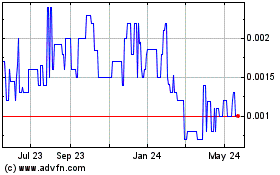

Trimax (PK) (USOTC:TMXN)

Historical Stock Chart

From Jul 2023 to Jul 2024