UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

FORM 10-Q

(Mark One)

|

|

|

|

|

|

|

x

|

Quarterly report under Section 13 or 15(d) of the Securities Exchange Act of 1934

|

For the quarterly period ended March 31, 2009

|

|

|

|

|

|

|

o

|

Transition report under Section 13 or 15(d) of the Exchange Act

|

Commission file number:

0-32749

TRIMAX CORPORATION

(Exact name of small business issuer as specified in its charter)

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Nevada

|

|

76-0616468

|

|

|

|

(State of incorporation)

|

|

(I.R.S. Employer Identification No.)

|

|

8300 E. Via Ventura, Unit 1024

Scottsdale, AZ 85253 USA

(Address of principal executive offices)

|

|

|

|

|

|

|

|

|

|

1 480 778 8345

|

|

|

|

(Issuer’s telephone number)

|

(Issuer’s website)

|

Check whether the issuer (1) filed all reports required to be filed by Section 13 or 15(d) of the Exchange Act during the past 12 months (or for such shorter period that the registrant was required to file such reports), and (2) has been subject to such filing requirements for the past 90 days.

Yes

x

No

o

Indicate by check mark whether the registrant is a shell company (as defined in Rule 12b-2 of the Exchange Act). Yes

o

No

x

State the number of shares outstanding of each of the issuer’s classes of common equity, as of the latest practicable date:

7,250,725 shares of common stock as of May 19, 2009.

Transitional Small Business Disclosure Format (check one): Yes

o

No

x

TABLE OF CONTENTS

|

|

|

|

|

|

|

|

|

PART I — FINANCIAL INFORMATION

|

2

|

|

Item 1.

|

Financial Statements

|

3

|

|

Item 2.

|

Management’s Discussion and Analysis

|

10

|

|

Item 3.

|

Controls and Procedures

|

12

|

|

PART II — OTHER INFORMATION

|

13

|

|

Item 1.

|

Legal Proceedings

|

13

|

|

Item 2.

|

Unregistered Sales of Equity Securities and Use of Proceeds

|

13

|

|

Item 3.

|

Defaults Upon Senior Securities

|

13

|

|

Item 4.

|

Submission of Matters to a Vote of Security Holders

|

13

|

|

Item 5.

|

Other Information

|

13

|

|

Item 6.

|

Exhibits

|

13

|

PART I — FINANCIAL INFORMATION

Item 1. Financial Statements

The unaudited financial statements for the quarter ended March 31, 2009 are incorporated herein by reference.

The unaudited financial statements have been prepared by management in accordance with accounting principles generally accepted in the US for interim financial information and within the instructions to Form 10-Q. Accordingly, they do not include all of the information and footnotes required by generally accepted accounting principles for complete financial statements. In the opinion of management, all adjustments (consisting of normal recurring accruals) considered necessary for a fair presentation have been included. Operating results for the three and six months ended March 31, 2009 and for the period August 25, 2000 (inception) to March 31, 2009 are not necessarily indicative of the results that may be expected for the year ended September 30, 2009. For further information, refer to the consolidated financial statements and footnotes thereto included in the Company’s annual report on Form 10-K for the year ended September 30, 2008.

2

|

|

|

|

|

|

|

|

|

|

|

|

TRIMAX CORPORATION

|

|

(A Development Stage Company)

|

|

BALANCE SHEETS

|

|

(Expressed in United States Dollars)

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

March 31,

|

|

September 30,

|

|

|

|

|

|

|

2009

|

|

2008

|

|

|

|

|

|

|

|

(Unaudited)

|

|

|

|

|

ASSETS

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

CURRENT ASSET

|

|

|

|

|

|

|

|

Cash

|

|

|

$

|

|

|

$

|

-

|

|

|

|

|

|

|

|

|

|

|

|

|

TOTAL CURRENT ASSETS

|

|

|

|

-

|

|

|

-

|

|

|

|

|

|

|

|

|

|

|

|

|

TOTAL ASSETS

|

|

|

$

|

-

|

|

$

|

-

|

|

|

|

|

|

|

|

|

|

|

|

|

LIABILITIES AND STOCKHOLDERS' (DEFICIT)

|

|

|

|

|

|

|

|

|

|

|

|

|

CURRENT LIABILITIES

|

|

|

|

|

|

|

|

|

|

Bank indebtedness

|

|

|

$

|

-

|

|

$

|

121

|

|

|

Accounts payable and accrued liabilities

|

|

|

|

208,755

|

|

|

351,077

|

|

|

Notes payable to related parties

|

|

|

|

198,438

|

|

|

172,792

|

|

|

Other loans and advances payable

|

|

|

|

310,186

|

|

|

114,267

|

|

|

|

|

|

|

|

|

|

|

|

|

TOTAL CURRENT LIABILITIES

|

|

|

|

717,379

|

|

|

638,257

|

|

|

|

|

|

|

|

|

|

|

|

|

TOTAL LIABILITIES

|

|

|

|

717,379

|

|

|

638,257

|

|

|

|

|

|

|

|

|

|

|

|

|

STOCKHOLDERS' EQUITY (DEFICIT)

|

|

|

|

|

|

|

|

|

|

Preferred stock, 20,000,000 authorized

|

|

|

|

|

|

|

|

|

|

with a par value of $0.001 per share, no shares

|

|

|

|

|

|

|

|

|

outstanding

|

|

|

|

-

|

|

|

-

|

|

|

Common stock; $0.001 par value;

|

|

|

|

|

|

|

|

|

|

100,000,000 shares authorized, 7,250,725

|

|

|

|

|

|

|

|

|

|

and 5,853,898 issued and outstanding,

|

|

|

|

|

|

|

|

|

|

respectively

|

|

|

|

7,251

|

|

|

5,854

|

|

|

Additional paid-in capital

|

|

|

|

15,910,960

|

|

|

15,893,195

|

|

|

Accumulated other comprehensive income

|

|

|

|

-

|

|

|

20,620

|

|

|

Deficit accumulated during the development stage

|

|

(16,635,590)

|

|

|

(16,557,926)

|

|

|

|

|

|

|

|

|

|

|

|

|

TOTAL STOCKHOLDERS' EQUITY (DEFICIT)

|

|

|

|

(717,379)

|

|

|

(638,257)

|

|

TOTAL LIABILITIES AND

|

|

|

|

|

|

|

|

|

STOCKHOLDERS' EQUITY (DEFICIT)

|

|

|

$

|

-

|

|

$

|

-

|

|

|

|

|

|

|

|

|

|

|

|

|

The accompanying notes are an integral part of these financial statements.

|

|

|

3

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

TRIMAX CORPORATION

|

|

(A Development Stage Company)

|

|

STATEMENTS OF OPERATIONS

|

|

(Expressed in United States Dollars)

|

|

(Unaudited)

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

From Inception

|

|

|

|

|

|

|

|

|

|

|

On August 25,

|

|

|

For the Three

Months Ended

|

For the Six

Months Ended

|

2000 Through

|

|

|

March 31,

|

|

|

March 31,

|

|

March 31,

|

|

|

2009

|

|

2008

|

|

2009

|

|

2008

|

|

2009

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

REVENUES

|

$

|

-

|

|

$

|

-

|

|

$

|

-

|

|

$

|

-

|

|

$

|

-

|

|

COST OF SALES

|

|

-

|

|

|

-

|

|

|

-

|

|

|

-

|

|

|

-

|

|

GROSS PROFIT

|

|

-

|

|

|

-

|

|

|

-

|

|

|

-

|

|

|

-

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

OPERATING EXPENSES

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

General and administrative

|

|

-

|

|

|

-

|

|

|

-

|

|

|

-

|

|

|

-

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

TOTAL OPERATING EXPENSES

|

|

-

|

|

|

-

|

|

|

-

|

|

|

-

|

|

|

-

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

NET LOSS FROM CONTINUING OPERATIONS

|

|

-

|

|

|

-

|

|

|

-

|

|

|

-

|

|

|

-

|

|

DISCONTINUED OPERATIONS

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Gain of disposal of discontinued operations

|

|

-

|

|

|

-

|

|

|

-

|

|

|

-

|

|

|

283,191

|

|

Loss from discontinued operations

|

|

(68,796)

|

|

|

(184,322)

|

|

|

(77,664)

|

|

|

(353,081)

|

|

|

(16,918,781)

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

LOSS BEFORE INCOME TAX

|

|

(68,796)

|

|

|

(184,322)

|

|

|

(77,664)

|

|

|

(353,081)

|

|

|

(16,635,590)

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

INCOME TAX

|

|

-

|

|

|

-

|

|

|

-

|

|

|

-

|

|

|

-

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

NET LOSS

|

$

|

(68,796)

|

|

$

|

(184,322)

|

|

$

|

(77,664)

|

|

$

|

(353,081)

|

|

$

|

(16,635,590)

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

FOREIGN CURRENCY TRANSLATION

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

ADJUSTMENT

|

|

(20,620)

|

|

|

7,126

|

|

|

(20,620)

|

|

|

8,825

|

|

|

-

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

COMPREHENSIVE INCOME (LOSS)

|

$

|

(89,416)

|

|

$

|

(177,196)

|

|

$

|

(98,284)

|

|

$

|

(344,256)

|

|

$

|

(16,635,590)

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

NET LOSS PER COMMON SHARE

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

(Basic and diluted)

|

$

|

(0.01)

|

|

$

|

(0.07)

|

|

$

|

(0.01)

|

|

$

|

(0.15)

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

WEIGHTED AVERAGE COMMON SHARES

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

OUTSTANDING

|

|

6,249,235

|

|

|

2,742,790

|

|

|

6,051,922

|

|

|

2,336,843

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

The accompanying notes are an intregal part of these financial statements

|

|

|

4

|

|

|

|

|

|

|

|

|

|

|

TRIMAX CORPORATION

|

|

(A Development Stage Company)

|

|

STATEMENTS OF CASH FLOWS

|

|

(Expressed in United States Dollars)

|

|

(Unaudited)

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

From Inception

|

|

|

|

|

|

|

|

|

August 25,

|

|

|

For the Six Months Ended

|

|

2000 through

|

|

|

March 31,

|

|

March 31,

|

|

|

2009

|

|

2008

|

|

2009

|

|

|

|

|

|

|

|

CASH FLOWS FROM OPERATING ACTIVITIES

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Net loss

|

$

|

(77,664)

|

|

$

|

(353,081)

|

|

$

|

(16,635,590)

|

|

Adjustments to reconcile net loss to

|

|

|

|

|

|

|

|

|

|

net cash used in operating activities:

|

|

|

|

|

|

|

|

|

|

Depreciation of tangible and intangible assets

|

|

-

|

|

|

2,858

|

|

|

219,946

|

|

Gain on disposal of subsidiary

|

|

-

|

|

|

-

|

|

|

(283,191)

|

|

Losses on write off and impairment of investments

|

|

-

|

|

|

-

|

|

|

198,768

|

|

Cancellation of common stock

|

|

-

|

|

|

-

|

|

|

(16,000)

|

|

Stock compensation expense - warrants

|

|

-

|

|

|

-

|

|

|

87,940

|

|

Common stock issued in settlement of legal claim

|

|

-

|

|

|

-

|

|

|

59,408

|

|

Accretion of beneficial conversion feature

|

|

-

|

|

|

-

|

|

|

436,239

|

|

Common stock issued for services

|

|

-

|

|

|

60,000

|

|

|

11,961,237

|

|

Write off of directors compensation

|

|

-

|

|

|

-

|

|

|

(311,355)

|

|

Changes in operating assets and liabilities:

|

|

|

|

|

|

|

|

|

|

Accounts payable and accrued liabilities

|

|

(142,443)

|

|

|

143,800

|

|

|

1,706,025

|

|

NET CASH (USED IN) PROVIDED BY

|

|

|

|

|

|

|

|

|

|

OPERATING ACTIVITIES

|

|

(220,107)

|

|

|

(146,423)

|

|

|

(2,576,573)

|

|

|

|

|

|

|

|

|

|

|

|

CASH FLOWS FROM INVESTING ACTIVITIES

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Advances to Multi-Source Inc.

|

|

-

|

|

|

-

|

|

|

(226,680)

|

|

Deposits on acquisitions

|

|

-

|

|

|

(12,310)

|

|

|

(299,380)

|

|

Acquisition of equipment

|

|

-

|

|

|

-

|

|

|

(58,190)

|

|

CASH FLOWS (USED IN)

|

|

|

|

|

|

|

|

|

|

INVESTING ACTIVITIES

|

|

-

|

|

|

(12,310)

|

|

|

(584,250)

|

|

|

|

|

|

|

|

|

|

|

|

CASH FLOWS FROM FINANCING ACTIVITIES

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Proceeds from long term debt

|

|

-

|

|

|

-

|

|

|

165,356

|

|

Advances from related parties

|

|

240,727

|

|

|

189,104

|

|

|

978,066

|

|

(Repayment) to related parties

|

|

-

|

|

|

(51,394)

|

|

|

(126,100)

|

|

Other loans and advances

|

|

-

|

|

|

-

|

|

|

1,010,452

|

|

Proceeds from the issuance of common stock

|

|

-

|

|

|

-

|

|

|

1,133,049

|

|

|

|

|

|

|

|

|

|

|

|

CASH FLOWS USED IN FINANCING ACTIVITIES

|

|

240,727

|

|

|

137,710

|

|

|

3,160,823

|

|

|

|

|

|

|

|

|

|

|

|

EFFECT OF FOREIGN CURRENCY TRANSLATION

|

|

(20,620)

|

|

|

9,012

|

|

|

-

|

|

NET (DECREASE) INCREASE IN CASH

|

|

20,620

|

|

|

(21,023)

|

|

|

-

|

|

CASH, BEGINNING OF PERIOD

|

|

-

|

|

|

12,011

|

|

|

-

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

CASH, END OF PERIOD

|

$

|

-

|

|

$

|

-

|

|

$

|

-

|

|

|

|

|

|

|

|

|

|

|

|

SUPPLEMENTAL CASH FLOW DISCLOSURES:

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

CASH PAID FOR:

|

|

|

|

|

|

|

|

|

|

Interest

|

$

|

-

|

|

$

|

-

|

|

$

|

-

|

|

Income taxes

|

$

|

-

|

|

$

|

-

|

|

$

|

-

|

|

|

|

|

|

|

|

|

|

|

|

NON CASH FINANCING ACTIVITIES:

|

|

|

|

|

|

|

|

|

|

Common stock issued for debt

|

$

|

19,162

|

|

$

|

75,000

|

|

$

|

94,162

|

|

|

|

|

|

|

|

|

|

|

|

The accompanying notes are an intregal part of these financial statements

|

|

|

5

TRIMAX CORPORATION

Notes to the Condensed Financial Statements

NOTE 1 - CONDENSED FINANCIAL STATEMENTS

The accompanying financial statements have been prepared by the Company without audit. In the opinion of management, all adjustments (which include only normal recurring adjustments) necessary to present fairly the financial position, results of operations and cash flows at March 31, 2009 and for all periods presented have been made.

Certain information and footnote disclosures normally included in financial statements prepared in accordance with accounting principles generally accepted in the United States of America have been condensed or omitted. It is suggested that these condensed financial statements be read in conjunction with the financial statements and notes thereto included in the Company's September 30, 2008 audited financial statements. The results of operations for the three months and six months ended March 31, 2009 and March 31, 2008 are not necessarily indicative of the operating results for the full year.

NOTE 2 - GOING CONCERN

The Company’s financial statements are prepared using generally accepted accounting principles applicable to a going concern which contemplates the realization of assets and liquidation of liabilities in the normal course of business. The Company has had no revenues and has generated losses from operations.

In order to continue as a going concern and achieve a profitable level of operations, the Company will need, among other things, additional capital resources

and to develop a consistent source of revenues. Management’s plans include investing in and developing businesses in the mining industry.

The ability of the Company to continue as a going concern is dependent upon its ability to successfully accomplish the plan described in the preceding paragraph and eventually attain profitable operations. The accompanying financial statements do not include any adjustments that might be necessary if the Company is unable to continue as a going concern.

NOTE 3 - SIGNIFICANT ACCOUNTING POLICIES

Use of Estimates

The preparation of financial statements in conformity with generally accepted accounting principles requires management to make estimates and assumptions that affect the reported amounts of assets and liabilities and disclosure of contingent assets and liabilities at the date of the financial statements and the reported amounts of revenues and expenses during the reporting period. Actual results could differ from those estimates.

Principles of Consolidation

The Company had no subsidiaries at March 31, 2009. The Company’s financial statements at March 31, 2008 include the accounts of its wholly owned subsidiary as discontinued operations.

Recent Accounting Pronouncements

In June 2008, the FASB issued FASB Staff Position EITF 03-6-1,

Determining Whether Instruments Granted in Share-Based Payment Transactions Are Participating Securities,

(“FSP EITF 03-6-1”). FSP EITF 03-6-1 addresses whether instruments granted in share-based payment transactions are participating securities prior to vesting, and therefore need to be included in the computation of earnings per share under the two-class method as described in FASB Statement of Financial Accounting Standards No. 128, “Earnings per Share.” FSP EITF 03-6-1 is effective for financial statements issued for fiscal years beginning on or after December 15, 2008 and earlier adoption is prohibited. We are not required to adopt FSP EITF 03-6-1; neither do we believe that FSP EITF 03-6-1 would have material effect on our consolidated financial position

and results of operations if adopted.

6

In May 2008, the Financial Accounting Standards Board (“FASB”) issued SFAS No. 163, “

Accounting for Financial Guarantee Insurance Contracts-and interpretation of FASB Statement No. 60

”.

SFAS No. 163 clarifies how Statement 60 applies to financial guarantee insurance contracts, including the recognition and measurement of premium revenue and claims liabilities. This statement also requires expanded disclosures about financial guarantee insurance contracts. SFAS No. 163 is effective for fiscal years beginning on or after December 15, 2008, and interim periods within those years. SFAS No. 163 has no effect on the Company’s financial position, statements of operations, or cash flows at this time.

In May 2008, the Financial Accounting Standards Board (“FASB”) issued SFAS No. 162, “

The Hierarchy of Generally Accepted Accounting Principles

”.

SFAS No. 162 sets forth the level of authority to a given accounting pronouncement or document by category. Where there might be conflicting guidance between two categories, the more authoritative category will prevail. SFAS No. 162 will become effective 60 days after the SEC approves the PCAOB’s amendments to AU Section 411 of the AICPA Professional Standards. SFAS No. 162 has no effect on the Company’s financial position, statements of operations, or cash flows at this time.

NOTE 4 – COMMON STOCK

During the quarter ended March 31, 2009 the Company cancelled 200,000 shares and issued 1,596,833 common shares to satisfy $19,162 in outstanding loans.

NOTE 5 – SUBSEQUENT EVENTS

On March 23, 2009, the Company entered into a binding letter agreement with Exploraciones San Bernardo S.A. de C.V, a Mexican company, to purchase five strategic mining claims the Mexican company holds near the Municipality of Alamos, Sonora, Mexico. On April 20, 2009, the Company completed the purchase.

Effective April 20, 2009, the Company agreed to issue 10,000,000 shares of the Company’s common stock to the San Bernardo Subscribers, on closing, and to issue a further 20,000,000 shares over two years to acquire 100% of the Claims.

As part of the transaction, the Company has formulated a new plan of operations and is divesting itself of its broadband over power line business plans, trade secrets and proprietary information, and any remaining digital signage equipment. The Company is now engaged in business as an exploration stage gold and silver mining company. The Company’s new plan of operations is to develop and exploit its mining claims in Sonora, Mexico. Accordingly, the Company’s financial statements have been restated to reflect its prior operations as discontinued operations.

Effective April 20, 2009, the Company has agreed to issue 2,000,000 shares of common stock to Robert Stewart, for his services to be performed as officer of the Company.

7

Overview

Trimax attempted to become a broadband over power line (“BPL”) integrator and service provider. Using existing powerline infrastructures, it tried to deliver innovative data, voice and video communications to commercial, residential and other markets. BPL technology has evolved from 85 mbps to where new generation chip sets now deliver applications at 225 mbps transfer rates. New applications such as video streaming, online gaming and IPTV need sufficient bandwidth to operate. BPL’s fiber-like speeds are now considerably faster than cable or DSL without the corresponding costs. Utility companies have been slow to adopt the technology as further test pilots are required for any eventual broad scale deployment.

A hydro utilities main asset, its electrical distribution infrastructure, is in most cases used only to deliver power. New Millennium Research recently reported that approximately 20 percent of U.S. utilities are considering investments in BPL technology. Utilities are implementing Automatic Meter Reading (“AMR”) and other real-time performance monitoring services to create a ‘smart electrical grid’.

In pursuit of companies and technologies that can deliver a revenue base which will eventually allow it to be self sufficient, Trimax entered into on going negotiations for BPL digital signage and content management technology with Cybersonics Broadcast Services Inc.

The Company has since been involved in several projects with an assortment of potential clients for BPL enhanced digital signage screens and content management. These projects have not yet become revenue generating and remain at the demonstrational stage. Trimax had been showcasing a complete digital signage solution, including content management software and remote management tools for administrators to manage larger scale deployments which can be further enhanced and be made more cost effective with the use of BPL technology.

As a result of its efforts, Trimax contributed to the purchase of 126 digital signage screens for an anticipated initial order totalling $226,000. Trimax has caused to be advanced a further $90,000 to Cybersonics Sound Technologies Inc. in the effort to further the Company’s business . This Media venture did not come to fruition and the Company has written its investment off.

Recent changes by the FCC in the United States have instilled certain obstacles which has allowed Trimax to believe that it is less likely that Broadband Over Powerlines will have any significant impact within North America and Hydro companies within. Due to these changes most BPL companies such as Trimax have suffered. Subsequently, Trimax decided to divest itself from its wholly owned subsidiary PLC Network Solutions Inc. and sold the company to a third party for a nominal fee. The Company has consequently been searching and evaluating other business opportunities, but continues to attempt to collect on funds owed to Trimax such as Cybersonics and Electrolinks.

On July 01, 2008 Trimax sold all of its interest in its subsidiary, PLC Network Solutions Inc., to a third party for a nominal fee of $1.00. PLC’s assets included the deposit on the transaction Trimax entered into with 3One Networks Inc. on 17 May 2006.

Deposits toward Acquisition

3One Networks Inc.

On May 17, 2006, Trimax entered into a purchase and sale agreement with 3One Networks Inc. (“3One”). 3One is a technology and service company that has commercialized BPL technologies that transmit digital signals through the electrical power line infrastructure.

3One markets products for (Industrial) Power Grid Management and (Commercial) In-building Broadband Access. 3One’s energy saving BPL Power Grid Management Solutions combine advanced hardware and software to enable the remote and real- time monitoring and control of electrical power grids. 3One’s BPL

In-Building Access products provide low cost methods to deliver broadband Internet to end-users within commercial and multi-tenant buildings.

8

Trimax had made a deposit towards the purchase of a High Speed Internet Access (“HSIA”) service business, including a portfolio of 50 Hotels consisting of approximately 4,600 rooms and all existing service contracts and related assets for providing HSIA services to these hotels, motels and resorts. The acquisition would allow for the potential to upgrade the services, technology, IP applications and broadband provisioning to these hotel sites. The purchase price was $220,230 CDN. Trimax has paid initial deposits and payments totalling $94,600 USD. The company has halted further payments while in negotiations with 3One for possible mutually beneficial changes in its relationship on a going forward basis. Therefore, remaining, payments pertaining to the purchase and sale agreement have yet to be fulfilled and the rights to these assets do not transfer to the company until fully paid, the deposits and payments paid were reflected in the balance sheet under prepaid expenses and deposits. No additional deposits and payments have been paid subsequent to year end. The agreement also provides for 3One to deliver certain BPL equipment based on normal distribution pricing.

On July 01, 2008 Trimax sold all of its interest in its subsidiary, PLC Network Solutions Inc., to a third party for a nominal fee of $1.00. PLC’s assets included the deposit on the transaction Trimax entered into with 3One Networks Inc. on 17 May 2006.

Multi-Media Management Distribution Technology

On August 14, 2007, pursuant to an asset purchase agreement by and between Cybersonics Broadcast Services Inc., a company incorporated in the Province Of Ontario under the Business Corporations Act, and Trimax, 80,000 shares of Trimax common stock were issued as a deposit towards the acquisition of assets known as Multi-Media Management Distribution Technology and issued 48,000 shares of common stock pursuant to a supply chain agreement to purchase certain digital signage screens. This Media venture did not come to fruition and the Company has written its investment off.

Recent changes by the FCC in the United States have instilled certain obstacles which has allowed Trimax to believe that it is less likely that Broadband Over Powerlines will have any significant impact within North America and Hydro companies within. Due to these changes most BPL companies such as Trimax have suffered. Subsequently, Trimax decided to divest itself from its wholly owned subsidiary PLC Network Solutions Inc. and sold the company to a third party for a nominal fee. The Company has consequently been searching and evaluating other business opportunities, but continues to attempt to collect on funds owed to Trimax such as Cybersonics and Electrolinks.

On July 01, 2008 Trimax sold all of its interest in its subsidiary, PLC Network Solutions Inc., to a third party for a nominal fee of $1.00. PLC’s assets included the deposit on the transaction Trimax entered into with 3One Networks Inc. on 17 May 2006.

Going Concern

The Company's financial statements are presented on a going concern basis, which contemplates the realization of assets and satisfaction of liabilities in the normal course of business. The Company has experienced losses from operations since inception that raise substantial doubt as to its ability to continue as a going concern.

The Company's ability to continue as a going concern is contingent upon its ability to obtain the financing and strategic alliances necessary to attain profitable operations.

The financial statements do not include any adjustments to reflect the possible future effects on the recoverability and classification of assets or the amounts and classification of liabilities that may result from the possible inability of the Company to continue as a going concern.

Principles of Accounting

The accompanying financial statements as of March 31, 2009 include the accounts of the Company and have been prepared in accordance with accounting principles generally accepted in the United States of America ("GAAP"). The Company has no subsidiaries as of March 31, 2009.

9

The Company has not earned any revenues from limited principal operations and accordingly, the Company's activities have been accounted for as those of a "Development Stage Enterprise" as set forth in SFAS No. 7, Accounting and Reporting by Development Stage Enterprises.

Among the disclosures required by SFAS No. 7 are that the Company's financial statements be identified as those of a development stage company, and that the statements of operation, stockholders' deficiency and cash flows disclose activity since the date of the Company's inception.

Convertible Debenture

On May 15, 2006 Trimax secured financing from a private accredited group of investors. The commitment of $1,500,000 is available to be drawn down in $300,000 tranches at Trimax's option. If drawn down, the loans would mature on May 14, 2009 and bear an annual interest rate of 12%. At the investor's option, the loan is convertible to common shares at the prior 20 day average price. Each common share has one purchase warrant attached. On 10 October 2006 the Company drew down $150,000 of the available loan under the terms of the supplementary and amending agreement to the convertible debenture. This draw down was simultaneously used as proceeds for the issuance of 750,000 restricted common shares and warrants for an additional 750,000 common shares exercisable at $0.20 to May 14, 2009. There are currently no obligations owing towards the transaction.

Capital Stock

The stockholders' equity section of the Company contains the following classes of capital stock as of September 30, 2008:

Common stock, $0.001 par value; 100,000,000 shares authorized: 5,853,840 shares issued and outstanding.

Preferred stock, $0.001 par value; 20,000,000 shares authorized, no shares issued and outstanding.

During the period ended March 31, 2009, the Company cancelled 200,000 shares issued for services and issued 1,596,833 shares of common stock to repay cash advances of $19,162.

The Company’s board of directors has offered to settle up to $457,670 in liabilities and loans payable for the issuance of shares of common stock valued at their market price at time of settlement. As of the date of the 10Q, the liabilities have not been settled and remain outstanding. The Company is in the process of negotiating the liabilities.

Item 2. Management’s Discussion and Analysis

The following discussion should be read in conjunction with the information contained in our consolidated financial statements and the notes thereto appearing elsewhere in this quarterly report, and in conjunction with the Management's Discussion and Analysis set forth in (1) our annual report on Form 10-KSB for the year ended September 30, 2008.

Preliminary Note Regarding Forward-Looking Statements

This quarterly report and the documents incorporated herein by reference contain forward-looking statements within the meaning of the federal securities laws, which generally include the plans and objectives of management for future operations, including plans and objectives relating to our future economic performance and our current beliefs regarding revenues we might earn if we are successful in implementing our business strategies.

The forward-looking statements and associated risks may include, relate to or be qualified by other important factors. You can identify forward-looking statements generally by the use of forward-looking terminology such as “believes,” “expects,” “may,” “will,” “intends,” “plans,” “should,” “could,” “seeks,” “pro forma,” “anticipates,” “estimates,” “continues,” or other variations of those terms, including their use in the negative, or by discussions of strategies, opportunities, plans or intentions. You may find these forward-looking statements in this Item 2, Management’s Discussion and Analysis of Financial Condition and Results of Operations, as well as throughout this quarterly report. A number of unforeseen factors could cause results to differ materially from those anticipated by forward-looking statements.

10

These forward-looking statements necessarily depend upon assumptions and estimates that may prove to be incorrect. Although we believe that the assumptions and estimates reflected in the forward-looking statements are reasonable, we cannot guarantee that we will achieve our plans, intentions or expectations. The forward-looking statements involve known and unknown risks, uncertainties and other factors that may cause actual results to differ in significant ways from any future results expressed or implied by the forward-looking statements.

Any of the factors described in this quarterly report, and other factors unknown to the Company at this time, could cause our financial results, including our net (loss) or growth in net income (loss) to differ materially from prior results, which in turn could, among other things, cause the price of our common stock to fluctuate substantially. We base our forward-looking statements on information currently available to us, and we assume no obligation to update them.

In addition, readers are also advised to refer to the information contained in our filings with the SEC, especially on Forms 10-K, 10-Q and 8-K, in which we discuss in more detail various important

factors that could cause actual results to differ from expected or historic results. It is not possible to foresee or identify all such factors. As such, investors should not consider any list of such factors to be an exhaustive statement of all risks and uncertainties or potentially inaccurate assumptions.

Plan of Operations

Trimax through its previously wholly owned subsidiary PLC Network Solutions Inc. were providers of BPL communication technologies. The Company was attempting to specialize in the development, distribution, implementation, and servicing technologies that use the power grid to deliver 128-bit encrypted high-speed symmetrical broadband for data, voice and video transmission.

In 2006, the Company completed pilot projects, deployed test equipment, begun negotiations of contracts worldwide including North and South America, Africa, India, Pakistan, and Saudi Arabia. Anticipated interest for deployment of its devices and bundled services in the 2007 calendar year did not materialize for the Company. The Company anticipated securing some noteworthy contracts in fiscal 2007 for its devices and bundled services in emerging markets but did not. Consequently the company is reviewing other potential business acquisitions.

The Company had been involved in several projects with an assortment of potential clients for BPL enhanced digital signage screens and content management. These projects have not yet become revenue generating and remain at the demonstrational stage. Trimax had been showcasing a complete digital signage solution, including content management software and remote management tools for administrators to manage larger scale deployments which can be further enhanced and be made more cost effective with the use of BPL technology.

As a result of its efforts, Trimax had purchased 126 digital signage screens for an anticipated initial order totalling $226,000. Trimax has further invested thus far $90,000 to Cybersonics Sound Technologies Inc. in the effort to further the Company’s business

which has included the anticipation of securing contracts and orders stemming from various test pilot projects that have been ongoing. Cybersonics has yet to be awarded any contracts which has been contrary to its claims and expectations. Subsequently, Trimax has made requests from Cybersonics for further updates on these anticipated contracts and its business in general, but has failed to receive a response. Due to the lack of response, Trimax anticipates sending a formal letter to Cybersonics demanding payment in full on its loan plus interest costs.

In September of 2007, the company initiated a BPL deployment on a project located in Hamilton, Ontario. The project was a University student residence by the name of West Village. It called for a deployment of BPL for the purpose of distributing internet connectivity throughout the building via broadband over powerlines. No revenues have resulted from this project due to a dispute over technical issues.

11

Recent changes by the FCC in the United States have instilled certain obstacles which has allowed Trimax to believe that it is less likely that Broadband Over Powerlines will have any significant impact within North America and Hydro companies within. Due to these changes most BPL companies such as Trimax have suffered. Subsequently, Trimax decided to divest itself from its wholly owned subsidiary PLC Network Solutions Inc. and sold the company to a third party for a nominal fee. The Company has consequently been searching and evaluating other business opportunities, but continues to attempt to collect on funds owed to Trimax such as Cybersonics and Electrolinks.

On July 01, 2008 Trimax sold all of its interest in its subsidiary, PLC Network Solutions Inc., to a third party for a nominal fee of $1.00. PLC’s assets included the deposit on the transaction Trimax entered into with 3One Networks Inc. on 17 May 2006. Due to the sale of PLC the company is reviewing other potential business acquisitions, and expects to have a decision made on its new business direction very shortly.

The Company had no revenues or expenses from continuing operations during the three months or six months ended March 31, 2009 and 2008. The Company has losses of $68,796 and $184,322, for the three months ended March 31, 2009 and 2008, respectively. The Company also has losses of $77,664 and $353,081 for the six months ended March 31, 2009 and 2008, respectively.

On March 18, 2009, Trimax Corporation entered into a binding letter agreement with Exploraciones San Bernardo S.A. de C.V,a Mexican company, to purchase five strategic mining claims the Mexican Company holds near the Municipality of Alamos, Sonora, Mexico. On April 20, 2009, the company completed the purchase.

Pursuant to the letter agreement, Trimax approved the issuance of 10,000,000 shares of the Corporation’s common stock to the San Bernardo Subscribers, on closing, and will issue a further 20,000,000 shares over two years to acquire 100% of the Claims.

As part of the transaction, the Company formulated a new plan of operations and divested itself of its broadband over power line business plans, trade secrets and proprietary information, and any remaining digital signage equipment. The Company is now engaged in business as an exploration stage gold and silver mining company. The Company’s new plan of operations is to develop and exploit its mining claims in Sonora, Mexico.

Liquidity and Capital Resources

The forecasted expenses of implementing the Company's business plan will exceed the Company's current resources. The Company therefore will need to secure additional funding through an offering of its securities or through capital contributions from its stockholders.

No commitments to provide additional funds have been made by management. There can be no assurances that any additional funds will be available on terms acceptable to the Company, or at all.

Item 3. Controls and Procedures

We maintain disclosure controls and procedures that are designed to be effective in providing reasonable assurance that information required to be disclosed in our reports under the Securities Exchange Act of 1934 is recorded, processed, summarized and reported within the time periods specified in the rules and forms of the SEC, and that such information is accumulated and communicated to our management to allow timely decisions regarding required disclosure.

In designing and evaluating disclosure controls and procedures, management recognizes that any controls and procedures, no matter how well designed and operated, can provide only reasonable, not absolute assurance of achieving the desired objectives. Also, the design of a control system must reflect the fact that there are resource constraints and the benefits of controls must be considered relative to their costs. Because of the inherent limitations in all control systems, no evaluation of controls can provide absolute assurance that all control issues and instances of fraud, if any, have been detected. These inherent limitations include the realities that judgments in decision-making can be faulty and that breakdowns can occur because of simple error or mistake. The design of any system of controls is based, in part, upon certain assumptions about the likelihood of future events and there can be no assurance that any design will succeed in achieving its stated goals under all potential future conditions.

12

As of the end of the period covered by this report, we carried out an evaluation, under the supervision and with the participation of management, including our chief executive officer and principal financial officer, of the effectiveness of the design and operation of our disclosure controls and procedures as defined in Rules 13a-15(e) and 15d-15(e) of the Exchange Act. Based upon that evaluation, management concluded that our disclosure controls and procedures are effective to cause the information required to be disclosed by us in reports that we file or submit under the Exchange Act is recorded, processed, summarized and reported within the time periods prescribed by SEC, and that such information is accumulated and communicated to management, including our chief executive officer and principal financial officer, as appropriate, to allow timely decisions regarding required disclosure.

Four weaknesses in our internal controls were identified during the completion of our year end September 30, 2008 and detailed in our form 10K disclosure for the year ended September 30, 2008. The four weaknesses were resolved by the implementations and changes disclosed in the 10K.

There was no change in our internal controls over financial reporting identified in connection with the requisite evaluation that occurred during our last fiscal quarter that has materially affected, or is reasonably likely to materially affect, our internal control over financial reporting.

PART II — OTHER INFORMATION

Item 1. Legal Proceedings

On March 22, 2006 Trimax filed an action in The Superior Court of Ontario against Electrolinks Corporation alleging damages of $1,250,000. Subsequently, Trimax received a court ordered judgment, and is awaiting payment of $107,000 plus applicable legal fees and interest.

On May 22, 2006, Trimax was notified of an action out of the district court of Clark County Nevada whereby 16 plaintiffs registered an action for $120,000 against the Company. All of the plaintiffs are former shareholders of PLC Network Solutions Inc., a Canadian company, which is no longer owned by Trimax. Both parties previously agreed to a settlement, although no actions have been taken in this regard for the past three years. The initial proposed settlement had consisted of a payment of $25,000 from the Company to PLC, with Electrolinks Corporation paying Trimax $25,000 in exchange for a full release by Trimax. Trimax has received no further correspondence from the plaintiffs and no other actions have taken place. The Company has not had any indications that this action will progress further.

Item 2. Unregistered Sales of Equity Securities and Use of Proceeds

The Company issued 1,596,833 shares of common stock pursuant to Section 4(2) of the Securities Act of 1933, during the period ended March 31, 2009 to settle cash advancers of $19,162.

Item 3. Defaults Upon Senior Securities

Not applicable.

Item 4. Submission of Matters to a Vote of Security Holders

Not applicable.

Item 5. Other Information

Not applicable.

Item 6. Exhibits

The following exhibits are being filed as part of this quarterly report:

13

|

|

|

|

|

Exhibit No.

|

|

Description

|

|

|

|

|

|

31.1

|

|

Certification of Chief Executive Officer pursuant to Section 302 of the Sarbanes-Oxley Act of 2002 and Rule 13a-14(a)/15d-14(a) of the Securities Exchange Act of 1934.

|

|

|

|

|

|

31.2

|

|

Certification of Chief Financial Officer pursuant to Section 302 of the Sarbanes-Oxley Act of 2002 and Rule 13a-14(a)/15d-14(a) of the Securities Exchange Act of 1934.

|

|

|

|

|

|

32.1

|

|

Certification of Chief Executive Officer and Chief Financial Officer pursuant to 18 U.S.C. Section 1350, as adopted pursuant to Section 906 of the Sarbanes-Oxley Act of 2002.

|

SIGNATURES

In accordance with the requirements of the Exchange Act, the registrant caused this report to be signed on its behalf by the undersigned, thereunto duly authorized.

|

|

|

|

|

|

|

|

|

|

TRIMAX CORPORATION

|

|

|

|

|

|

|

By:

|

/s/ Robert S. Stewart

|

|

|

|

Name: Robert S. Stewart

|

|

|

|

Title: President, Director and Chief Executive Officer

|

|

|

Date: May 20, 2009

|

|

|

|

|

14

CERTIFICATIONS OF CEO PURSUANT TO SECTION 302 OF THE SARBANES-OXLEY ACT OF 2002

Exhibit 31.1

I, Robert S. Stewart, certify that

1. I have reviewed this quarterly report on Form 10-Q of Trimax Corporation;

2. Based on my knowledge, this report does not contain any untrue statement of a material fact or omit to state a material fact necessary to make the statements made, in light of the circumstances under which such statements were made, not misleading with respect to the period covered by this report;

3. Based on my knowledge, the financial statements, and other financial information included in this report, fairly present in all material respects the financial condition, results of operations and cash flows of the registrant as of, and for, the periods presented in this report;

4. I am responsible for establishing and maintaining disclosure controls and procedures (as defined in Exchange Act Rules 13a-15(e) and 15d-15(e)) for the registrant and have:

a) Designed such disclosure controls and procedures, or caused such disclosure controls and procedures to be designed under our supervision, to ensure that material information relating to the registrant, including its consolidated subsidiaries, is made known to us by others within those entities, particularly during the period in which this report is being prepared;

b) Evaluated the effectiveness of the registrant’s disclosure controls and procedures and presented in this report our conclusions about the effectiveness of the disclosure controls and procedures, as of the end of the period covered by this report based on such evaluation; and

c) Disclosed in this report any change in the registrant’s internal control over financial reporting that occurred during the registrant’s most recent fiscal quarter that has materially affected, or is reasonably likely to materially affect, the registrant’s internal control over financial reporting; and

5. I have disclosed, based on my most recent evaluation of internal control over financial reporting, to the registrant’s auditors and the audit committee of registrant’s board of directors (or persons performing the equivalent functions):

a) All significant deficiencies and material weaknesses in the design or operation of internal control over financial reporting which are reasonably likely to adversely affect the registrant’s ability to record, process, summarize and report financial information; and

b) Any fraud, whether or not material, that involves management or other employees who have a significant role in the registrant’s internal control over financial reporting.

May 20, 2008

/s/ Robert S.Stewart

Robert S. Stewart, Chief Executive Officer

15

CERTIFICATIONS OF CFO PURSUANT TO SECTION 302 OF THE SARBANES-OXLEY ACT OF 2002

Exhibit 31.2

I, Robert S. Stewart, certify that:

1. I have reviewed this quarterly report on Form 10-Q of Trimax Corporation;

2. Based on my knowledge, this report does not contain any untrue statement of a material fact or omit to state a material fact necessary to make the statements made, in light of the circumstances under which such statements were made, not misleading with respect to the period covered by this report;

3. Based on my knowledge, the financial statements, and other financial information included in this report, fairly present in all material respects the financial condition, results of operations and cash flows of the

registrant as of, and for, the periods presented in this report;

4. I am responsible for establishing and maintaining disclosure controls and procedures (as defined in Exchange Act Rules 13a-15(e) and 15d-15(e)) for the registrant and have:

a) Designed such disclosure controls and procedures, or caused such disclosure controls and procedures to be designed under our supervision, to ensure that material information relating to the registrant, including its consolidated subsidiaries, is made known to us by others within those entities, particularly during the period in which this report is being prepared;

b) Evaluated the effectiveness of the registrant’s disclosure controls and procedures and presented in this report our conclusions about the effectiveness of the disclosure controls and procedures, as of the end of the period covered by this report based on such evaluation; and

c) Disclosed in this report any change in the registrant’s internal control over financial reporting that occurred during the registrant’s most recent fiscal quarter that has materially affected, or is reasonably likely to materially affect, the registrant’s internal control over financial reporting; and

5. I have disclosed, based on my most recent evaluation of internal control over financial reporting, to the registrant’s auditors and the audit committee of registrant’s board of directors (or persons performing the equivalent functions):

a) All significant deficiencies and material weaknesses in the design or operation of internal control over financial reporting which are reasonably likely to adversely affect the registrant’s ability to record, process, summarize and report financial information; and

b) Any fraud, whether or not material, that involves management or other employees who have a significant role in the registrant’s internal control over financial reporting.

May 20, 2008

/s/ Robert Stewart

Robert S. Stewart, Acting Chief Financial Officer

16

CERTIFICATIONS PURSUANT TO SECTION 906 OF THE SARBANES-OXLEY ACT OF 2002

(18 U.S.C. SECTION 1350)

Exhibit 32.1

In connection with the quarterly report of Trimax Corporation, a Nevada corporation (the “Company”), on Form 10-Q for the quarter ended March 31, 2009, as filed with the Securities and Exchange Commission (the “Report”), Robert S. Stewart, Chief Executive Officer and Acting Chief Financial Officer of the Company do hereby certify, pursuant to § 906 of the Sarbanes-Oxley Act of 2002 (18 U.S.C. § 1350), that to his knowledge:

(1) The Report fully complies with the requirements of section 13(a) or 15(d) of the Securities Exchange Act of 1934; and

(2) The information contained in the Report fairly presents, in all material respects, the financial condition and result of operations of the Company.

By:

/s/ Robert S. Stewart

Name: Robert S. Stewart

Title: Chief Executive Officer and Acting Chief Financial Officer

Date: May 20, 2008

|

|

|

|

|

[A signed original of this written statement required by Section 906 has been provided to Trimax Corporation and will be retained by Trimax Corporation and furnished to the Securities and Exchange Commission or its staff upon request.]

|

17

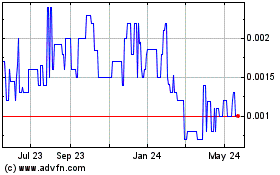

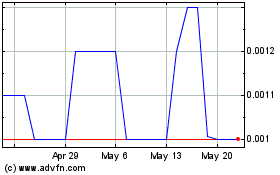

Trimax (PK) (USOTC:TMXN)

Historical Stock Chart

From Jun 2024 to Jul 2024

Trimax (PK) (USOTC:TMXN)

Historical Stock Chart

From Jul 2023 to Jul 2024