Form 1-U - Current Report Pursuant to Regulation A

30 January 2025 - 3:38AM

Edgar (US Regulatory)

UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

FORM 1-U

CURRENT REPORT PURSUANT TO REGULATION A

Date of Report (Date of earliest event reported)

January 29, 2025 (January 24, 2025)

UC Asset LP

(Exact name of issuer as specified in its charter)

| Delaware |

|

30-0912782 |

State or other jurisdiction of

incorporation or organization |

|

(I.R.S. Employer

Identification No.) |

537 Peachtree Street, NE, Atlanta, GA 30308

(Full mailing address of principal executive offices)

470-475-1035

(Issuer’s telephone number, including area

code)

Title of each class of securities issued pursuant to Regulation

A: Common Units

INFORMATION TO BE INCLUDED IN THE REPORT

CAUTIONARY NOTE REGARDING FORWARD-LOOKING STATEMENTS

We make statements in this Form 1-U that are

forward-looking statements within the meaning of the federal securities laws. The words “believe,” “estimate,”

“expect,” “anticipate,” “intend,” “plan,” “seek,” “may,” and similar

expressions or statements regarding future periods are intended to identify forward-looking statements. These forward-looking statements

involve known and unknown risks, uncertainties and other important factors that could cause our actual results, performance or achievements,

or industry results, to differ materially from any predictions of future results, performance or achievements that we express or imply

in this Form 1-U or in the information incorporated by reference into this Form 1-U.

The forward-looking statements included in this

Form 1-U are based upon our current expectations, plans, estimates, assumptions and beliefs that involve numerous risks and uncertainties.

Actual results and performance could differ materially from those set forth in the forward-looking statements. You are cautioned not to

place undue reliance on any forward-looking statements included in this Form 1-U. Except as otherwise required by the federal securities

laws, we undertake no obligation to publicly update or revise any forward-looking statements after the date of this Form 1-U, whether

as a result of new information, future events, changed circumstances or any other reason. The inclusion of such forward-looking statements

in this Form 1-U should not be regarded as a representation by us or any other person that the objectives and plans set forth in this

Form 1-U will be achieved.

Item 4. Changes in Issuer’s Certifying Accountant

4.1 Acceptance of Resignation of Previously Engaged Principal Accountant

On January 24, 2025, the management of UC Asset LP (the “Partnership”)

accepted the resignation by Integritat, Audit, Accounting & Advisory, LLC (“Integritat CPA”), to terminate the engagement

of Integritat CPA, which was the Partnership’s principal accountant to audit our financial statements since April 09, 2024.

In conformity with 17 CFR 229.304, the Partnership hereby discloses:

| i) | That Integritat resigned and the Partnership accepted its resignation; |

| ii) | That Integritat’s report on the Partnership’s financial statements did NOT contain an adverse opinion or a disclaimer

of opinion, and was NOT qualified or modified as to uncertainty, audit scope, or accounting principles; |

| iii) | That the decision to change principal accountant was decided by the general partner of the Partnership, with whom the power of changing

accountant was duly vested; |

| iv) | That the Partnership had eventually accepted all updates proposed by Integritat on the financial statements preceding its resignation,

and therefore, there were NO disagreements on any matter of accounting principles or practices, financial statement disclosure, or auditing

scope or procedure, that were not resolved to the satisfaction of Integritat; and |

| v) | That Integritat had suggested the following Internal Control Deficiencies and the Partnership had taken the following actions to address

Integritat’s suggestions: |

| a) | Integritat suggested that the Partnership should “Maintain comprehensive and up-to-date fixed asset roll forward schedule for

all fixed assets, including details on depreciation methods, useful lives, and date placed in service. Regularly review and update this

documentation to reflect any changes in asset usage, value and apply accounting policies appropriately.” “Consider using automated

systems for calculating depreciation to reduce the risk of manual errors.” |

The Partnership responded by expressing that it would adopt

this advice and improve its fixed asset registration going forward, to the extent reasonable in consideration of the limited resources

available for the Partnership.

| b) | That the Partnership have “been incurring expenses based on payments rather than amount on the bill or the invoice. Such practice

could result in a material understatement of expenses and liabilities and materially misstated financial statements.” And therefore,

the Partnership should “establish period-end accrual procedures” and “regular review and audit”. |

The Partnership acknowledged that Integritat’s suggestion

underscored the importance of applying accrual accounting rules at a stricter level. The Partnership responded that it would give serious

consideration to Integritat’s suggestion, and would discuss this matter with our new principal accountant in a timely manner.

The Partnership has furnished Integritat CPA with a copy of this disclosure

and has requested that Integritat CPA furnish us with a letter addressed to the SEC stating whether it agrees with the foregoing statements.

In addition, the Partnership has authorized Integritat to respond fully to the inquiries of its successor concerning the subject matter

as set forth above.

4.2 Engagement of a New Principal Accountant

On January 24, 2025, the management of UC Asset LP (the “Partnership”)

decided to engage Robert Adams, CPA (“Adams”) as the Partnership’s principal accountant to audit our financial statements.

We did not consult with Adams during our two most recent fiscal years

or through the date of this report regarding (i) the application of accounting principles as to a specified transaction either completed

or proposed or on the type of audit opinion that may be rendered on our financial statement and neither a written nor oral advice was

provided by Adams that was an important factor considered by us in reaching a decision as to any accounting auditing or financial report

issue; (ii) any matter that was the subject of a disagreement as a reportable event as defined in Item 304(a)(l)(iv) and (v) of Regulation

S-K.

SIGNATURES

Pursuant to the requirements

of Regulation A, the issuer has duly caused this report to be signed on its behalf by the undersigned, thereunto duly authorized.

| |

UC Asset LP |

| |

(Exact name of issuer as specified in its charter) |

| |

|

|

| |

By: |

/s/ Larry Xianghong Wu |

| |

Name: |

Larry Xianghong Wu |

| |

Title: |

Majority Member of General Partner |

Date 01/29/2025

4

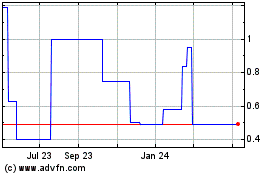

UC Asset Limited Partner... (QB) (USOTC:UCASU)

Historical Stock Chart

From Jan 2025 to Feb 2025

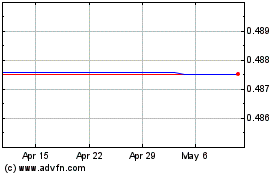

UC Asset Limited Partner... (QB) (USOTC:UCASU)

Historical Stock Chart

From Feb 2024 to Feb 2025