Petra Diamonds Buys Finsch Mine From De Beers

21 January 2011 - 7:24PM

Dow Jones News

Diamond miner Petra Diamonds Ltd. (PDL.LN) said Friday it agreed

to buy South Africa's second-largest diamond mine from Anglo

American PLC's (AAL.LN) De Beers unit for 1.43 billion South

African rand ($210 million), in a deal that will more than double

its current production.

Petra said Finsch is expected to produce 1.5 million carats in

its first full year of production under Petra's ownership, pushing

overall group production to roughly four million carats a year by

2014.

Finsch adds a resource of 48.1 million carats, including 26.6

million carats of reserves. The deal will increase Petra's resource

base to 309 million carats, which, at current prices, represents

$38 billion of diamonds.

"Finsch is a major diamond producer and this acquisition will

serve to immediately more than double our current production,

significantly enhance earnings and cashflow and will increase our

resource base to over 300 million carats," said Petra Chief

Executive Johan Dippenaar.

Petra said it agreed to raise GBP205 million in a share sale to

help fund the deal. It placed roughly 137 million shares with

investors at 150 pence a share, a 7% discount to Thursday's closing

price.

-By Jason Douglas, Dow Jones Newswires; 44-20-7842-9272;

jason.douglas@dowjones.com

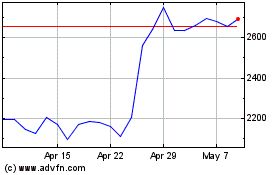

Anglo American (LSE:AAL)

Historical Stock Chart

From Dec 2024 to Jan 2025

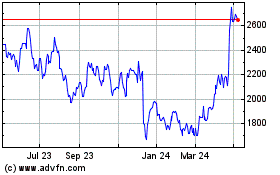

Anglo American (LSE:AAL)

Historical Stock Chart

From Jan 2024 to Jan 2025