AssociatedBrit.Foods - Final Results

03 November 1997 - 10:00PM

UK Regulatory

RNS No 9284r

ASSOCIATED BRITISH FOODS PLC

3rd November 1997

ASSOCIATED BRITISH FOODS plc

PRELIMINARY ANNOUNCEMENT

FOR THE YEAR ENDED 13 SEPTEMBER 1997

KEY POINTS

- Profit before tax from continuing businesses up by 10% at #401 million

- Profit on disposal of businesses #424 million

- Worldwide sales from continuing operations level at #4,437 million

- Special interim ordinary dividend of 5p per share

- Sterling appreciation reduced sales by #305 million and profits before

tax by #39 million

- In the past twelve months:

- Expenditure on new assets #254 million

- Shareholders' funds up 19% to #2,917 million

The profit before tax for the year of #850 million includes #424 million

arising from the sales of our Irish food retailing interests to Tesco in May

of this year and the adhesives operations in Australia.

The profit on ordinary activities before tax on the continuing businesses at

#401 million was up by #35 million compared with the previous year.

Further, the operating profits earned by the Irish food retailing companies

to the date of the sale plus the investment income on the sale proceeds for

the balance of the year, were #8 million less than their operating profits

reported last year.

The increase in the strength of the pound sterling had a major adverse

effect on our results reducing profits by #39 million and sales values by

some #305 million. The realignment of the green pound particularly affected

British Sugar, whilst our major exporting companies, Twinings tea and

Burtons biscuits, suffered from their inability to increase selling prices

in local currencies against strong local competition overseas.

Group turnover at #5,203 million is #504 million lower than the year ago

figure. However, after allowing for the operations sold during the year and

for the currency effect, sales show an underlying increase of some 5 per

cent.

The United Kingdom based food manufacturing companies reported sales and

profits of #3,051 million and #270 million respectively compared with #3,059

million and #276 million a year ago.

British Sugar contributed profits of #179 million, only #4 million down on a

year ago, despite the green pound effect referred to above. This excellent

result was achieved following a record harvest, and the benefits arising

from the restructuring of the company within a capital investment programme

in excess of #230 million undertaken since acquisition by the group in 1991.

Allied Bakeries experienced difficult trading following some loss of volume

in own label products early in the year and although the expansion of our

range of products throughout the year compensated to some extent, there was

a net loss of revenue over the period.

Allied Mills had a satisfactory year producing profits 7 per cent ahead of

budgets. A decision to close the loss making European commodity trading

operation within the Allied Grain division was taken towards the end of the

financial year.

Our other United Kingdom manufacturing companies contributed excellent

results and, despite the effect of the strength of sterling on their

overseas trading, Burtons produced record profits and Twinings narrowly

failed to match their last years excellent result.

Primark, our retail textile operation contributed record profits up 46 per

cent at #19 million on sales increased by 6 per cent to #256 million.

The operating profits of George Weston Foods in Australia and New Zealand

were reduced to #33 million from #38 million a year ago, although half of

this reduction is attributable to currency translation. Sales of #620

million show a growth rate of 4 per cent on the continuing businesses.

AC Humko and Abitec in the United States continue their development into

added value products and this has been complemented by two further

acquisitions during the year. Profits increased by #6 million to #9 million

which is after charging further rationalisation and integration costs of #1

million.

The group continues to seek further investment opportunities in the Far East

and by the end of the current financial year in September 1998 it is

budgeted that our investment in that area will amount to #38 million.

Investment income for the year was #72 million. Overall, the return

obtained was disappointing but there was an on budget performance in the

second half of the year following the poor result reported in our interim

statement. The increase of #18 million on a year ago is largely

attributable to the income on additional funds arising on the sale of the

Irish retail food companies.

This sale also contributed #639 million to the increase in net investment

funds which at the year end amounted to #1,460 million.

The group remains strongly cash generative funding expenditure this year on

new assets and subsidiaries exceeding #300 million, 25 per cent greater than

last year.

The average tax rate as disclosed by the profit and loss account is 19 per

cent. The corporation tax payable on the profit arising on the disposal of

the Irish food retailing companies under the capital gains tax provisions is

calculated after the rebasing of values at March 1982, together with

indexation relief thereon, and the offset of capital losses. Allowing for

these factors, the average tax rate is 31 per cent compared with 33 per cent

a year ago. This reduction follows the lowering of the UK corporation tax

rate to 31 per cent and the lower proportion of profits arising overseas.

At a Board Meeting today, the directors declared a second interim ordinary

dividend of 5.75p per share (1996 - 5.25p), payable on 23 February 1998.

The first and second interim dividends paid in respect of this financial

year will be the equivalent of a 5.3 per cent increase on the dividends paid

in respect of 1996.

At the same Board Meeting the directors declared a special interim ordinary

dividend of 5.0p per share which will be paid on 23 February 1998 with the

second interim dividend of 5.75p per share to be paid on that day. The

additional payment is in recognition of the value created for shareholders

arising from the sale of our Irish food retail operations and will not be

payable on an annual basis.

Both dividends will be paid to shareholders on the register on 30 January

1998.

The Annual Report and Accounts will be available on 12 November 1997 and the

annual general meeting will be held at the New Connaught Rooms on Friday 5

December 1997.

Press enquiries to: Garry H Weston - Chairman

Telephone: 0171-589 6363

CONSOLIDATED PROFIT AND LOSS ACCOUNT

For the year ended For the year ended

13 September 1997 14 September 1996

Con- Discon- Con- Discon-

tinuing tinued tinuing tinued

oper- oper- oper- oper-

ations ations Total ations ations Total

Note #m #m #m #m #m #m

Turnover 1 4,437 766 5,203 4,443 1,264 5,707

Operating costs (4,095) (738) (4,833) (4,104) (1,208) (5,312)

Operating profit 1 342 28 370 339 56 395

Profit less losses on sale of

properties 4 2 6 (1) 7 6

Profit on sale of businesses 4 420 424 - - -

Investment income 72 - 72 53 1 54

Profit on ordinary activities

before interest 422 450 872 391 64 455

Interest payable (21) (1) (22) (25) - (25)

Profit on ordinary activities

before taxation 401 449 850 366 64 430

Tax on profit on

ordinary activities 2 (119) (42) (161) (120) (24) (144)

Profit on ordinary activities

after taxation 282 407 689 246 40 286

Minority interests - equity (8) - (8) (8) - (8)

Profit for the financial year 274 407 681 238 40 278

Dividend - interim 3 (90) - (90) (85) - (85)

- special interim 3 (45) - (45) - - -

Retained profit for the

financial year 139 407 546 153 40 193

Earnings per ordinary share 30.3p 45.3p 75.6p 26.7p 4.3p 31.0p

The group has made no material acquisitions within the meaning of the

Financial Reporting Standards during either 1997 or 1996.

CONSOLIDATED BALANCE SHEET

As at As at

13 Sept 14 Sept

1997 1996

#m #m

Fixed assets

Tangible fixed assets 1,396 1,650

Investments 12 8

1,408 1,658

Current assets

Stocks 416 482

Debtors 495 514

Investments 1,618 900

Cash at bank and in hand 50 93

2,579 1,989

Creditors - amounts falling due within one year

Short term borrowings (51) (33)

Other creditors (722) (875)

(773) (908)

Net current assets 1,806 1,081

Total assets less current liabilities 3,214 2,739

Creditors - amounts falling due after one year

Loans (157) (163)

Other creditors (15) (12)

(172) (175)

Provisions for liabilities and charges (54) (38)

2,988 2,526

Capital and reserves

Called up share capital 47 47

Revaluation reserve 4 5

Other reserves 173 173

Profit and loss account 2,693 2,228

Equity shareholders' funds 2,917 2,453

Minority interests in subsidiary

undertakings - equity 71 73

2,988 2,526

CONSOLIDATED CASH FLOW STATEMENT

For the For the

year ended year ended

13 Sept 14 Sept

1997 1996

Note #m #m

Cash flow from operating

activities 4 489 577

Returns on investments and servicing

of finance

Dividends and other investment income 76 62

Interest paid (22) (24)

Dividends paid to minorities (12) (3)

42 35

Taxation (148) (107)

Capital expenditure and

financial investment

Purchase of tangible fixed assets (254) (225)

Sale of tangible fixed assets 23 24

Sale of equity investments 1 3

(230) (198)

Acquisitions and disposals

Purchase of new subsidiary undertakings (48) (17)

Purchase of associated undertakings (5) (2)

Sale of subsidiary undertakings 647 -

594 (19)

Equity dividends paid (85) (79)

Net cash inflow before use

of liquid resources and financing 662 209

Management of liquid funds 5 658 114

Financing 5 (12) 34

Increase in cash 5 16 61

662 209

CONSOLIDATED STATEMENT OF TOTAL

RECOGNISED GAINS AND LOSSES

For the For the

year ended year ended

13 Sept 14 Sept

1997 1996

#m #m

Profit for the financial year 681 278

Currency translation differences on foreign

currency net assets (53) 10

Total recognised gains and losses 628 288

CONSOLIDATED STATEMENT OF HISTORICAL COST PROFITS

There is no material difference between the group results as reported and on

an unmodified historical cost basis. Accordingly no note of historical cost

profits and losses has been prepared.

RECONCILIATION OF MOVEMENTS IN

CONSOLIDATED SHAREHOLDERS' FUNDS

For the For the

year ended year ended

13 Sept 14 Sept

1997 1996

#m #m

Profit for the financial year 681 278

Dividend- interim (90) (85)

- special interim (45) -

Retained profit for the financial year 546 193

Other recognised gains and losses relating

to the year (53) 10

Goodwill acquired and written off during the

year (31) (8)

Goodwill written back during the year 2 -

Net increase in shareholders' funds 464 195

Opening shareholders' funds 2,453 2,258

Closing shareholders' funds 2,917 2,453

NOTES TO THE PRELIMINARY ANNOUNCEMENT

For the For the

year ended year ended

13 Sept 14 Sept

1997 1996

#m #m

1.Analysis of turnover

Geographical analysis (by origin and

destination):

European Union, mainly United Kingdom

and Ireland 3,307 3,301

Australia and New Zealand 620 637

North America 453 451

Other 57 54

Continuing operations 4,437 4,443

Discontinued operations - United Kingdom

& Ireland 766 1,264

5,203 5,707

Business sector:

Manufacturing 4,181 4,201

Retail 256 242

Continuing operations 4,437 4,443

Discontinued operations - retail 766 1,264

5,203 5,707

Analysis of profits

Geographical analysis (by origin and

destination):

European Union, mainly United Kingdom

and Ireland 289 289

Australia and New Zealand 33 38

North America 13 6

Other 7 6

Continuing operations 342 339

Discontinued operations - United Kingdom

& Ireland 28 56

Operating profit 370 395

Business sector:

Manufacturing 323 326

Retail 19 13

Continuing operations 342 339

Discontinued operations - retail 28 56

Operating profit 370 395

Other net income 480 35

Profit on ordinary activities before

taxation 850 430

2.Tax on profit on ordinary activities

United Kingdom 122 97

Overseas 39 47

161 144

The tax charge for the year has been reduced by the use of capital losses

and the rebasing of the tax values of assets sold, together with

indexation relief thereon.

3.Ordinary dividends

First interim dividend of 4.25p per share

(1996 - 4.25p) 38 38

Second interim dividend of 5.75p per share

(1996 - 5.25p) 52 47

90 85

Special interim dividend of 5.00p per share 45 -

4.Cash flow from operating activities

Operating profit 370 395

Depreciation 156 172

(Increase)/decrease in working capital:

Stocks (6) 5

Debtors (17) (26)

Creditors (30) 30

Provisions 16 1

489 577

5.Analysis of changes in net funds

Opening balance 797 601

Increase in cash 16 61

Financing (12) 34

Management of liquid funds 658 114

Sale of equity investments (1) (2)

Changes in market value - (8)

Acquisition of subsidiary undertakings (6) (5)

Shares issued to minority shareholders 8 -

Effect of currency changes - 2

Closing balance 1,460 797

As at As at

13 Sept 14 Sept

1997 1996

#m #m

6.Analysis of net funds

Current asset investments 1,618 900

Cash at bank and in hand 50 93

Short term borrowings (51) (33)

Loans falling due after one year (157) (163)

1,460 797

7.Basis of preparation

The financial information set out above does not constitute the group's

statutory financial statements for the years ended 13 September 1997 and

14 September 1996, but is derived from them. The 1996 financial

statements have been filed with the Registrar of Companies whereas those

for 1997 will be delivered following the company's annual general meeting.

The auditor's opinions on these financial statements were unqualified and

did not include a statement under section 237 (2) or (3) of the Companies

Act 1985.

END

FR FSAFSDUWUFFF

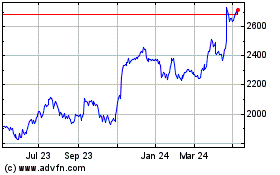

Associated British Foods (LSE:ABF)

Historical Stock Chart

From Jan 2025 to Feb 2025

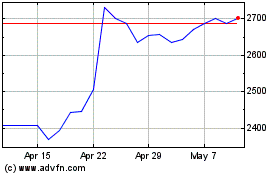

Associated British Foods (LSE:ABF)

Historical Stock Chart

From Feb 2024 to Feb 2025