RNS No 8483j

ASSOCIATED BRITISH FOODS PLC

19 April 1999

INTERIM REPORT

FOR THE 24 WEEKS ENDED 27 FEBRUARY 1999

KEY POINTS

- Worldwide sales #1,985 million

- Profit before exceptional charges and tax #183 million

- FRS 11 asset write down of #74 million

- Investment income #48 million

- Earnings per share before exceptional charges 14.0 pence

- Return of capital of #448 million, equivalent to 12% of ABF's market

capitalisation, by way of a Special Dividend of 50 pence per share

- Consolidation of share capital. 88 new shares for every

100 existing shares

- In addition to the Special Dividend the first interim dividend of

4.25 pence will be paid in September and the company will in

future maintain its normal dividend policy

Garry H Weston, Executive Chairman, reports:-

Group turnover for the period has increased to #1,985 million, up #22 million

on the previous period. After allowing for currency translation effects which

reduced turnover by some #30 million and the closure of a high volume, low

margin European commodity trading operation last year, sales show an increase

on last year of some 5%.

Operating profit of #146 million for the period before exceptional charges

and the amortisation of goodwill shows a small decrease of #4 million on the

previous year. That we have been able to produce these results during a

period of very low retail growth and competitive pricing, particularly in the

food sector, is very encouraging.

Recent accounting standard changes have had a significant effect on the

presentation of this interim statement. The Accounting Standards Board has

published Financial Reporting Standard 11 detailing comprehensive guidelines

on the carrying value of fixed assets. Following the adoption of this

standard and applying the guidelines, in view of the economic returns

currently being obtained by some of our operating divisions, it is considered

necessary to reduce the book value of the fixed assets employed within these

by #74 million. For some years the company has been writing off against

profits the costs of restructuring its cereal processing and baking

activities. In reviewing these activities under the FRS 11 guidelines it has

been decided to further reduce the book value of the fixed assets employed in

these divisions which accounts for substantially all of the write down. Under

the requirements of FRS 11 it will be necessary to review the carrying value

of these assets each year.

Changes to the accounting standard concerning the treatment of goodwill no

longer allow its immediate write off to reserves, but require the goodwill

acquired to be capitalised in the balance sheet and amortised through the

profit and loss account. The effect of adopting this revised standard has

been to reduce operating profits for the period by #2 million and to increase

shareholders' funds by #99 million.

British Sugar's sales volumes have exceeded budget for the period and this

year's sugar beet harvest has produced a crop in excess of 1.4 million

tonnes. Operating profits have risen slightly to #74 million compared with

the same period last year. The Green pound was succeeded by the Euro with

effect from 1 January 1999, with UK sugar prices being aligned to the Euro

from this date. The effect of Green pound and Euro movements have had little

effect on this period's results. Trading conditions for British Sugar's

operations in Poland and China have shown some deterioration since last year,

with falling selling prices resulting in trading losses for the period.

Allied Bakeries have had a mixed trading period. In January, the major

retailers reduced the price of economy bread to 7 pence per loaf. This

prompted a 50% increase in demand for economy bread. The increase was

inevitably at the expense of the premium loaf, nevertheless, the Kingsmill

brand increased its sales over last year and is now the single largest

selling bread brand in the United Kingdom. Restructuring costs of some #2

million (last year #1 million) have been incurred in the period to improve

production efficiency.

Our other UK manufacturing operations are continuing to find that trading

conditions at home and in our export markets remain difficult. Animal feeds,

although still suffering from industry overcapacity and weak demand, have

shown significant recovery from the low levels of profitability which were

seen in the second half of 1998. Twinings are continuing to develop and

expand their business and sales and operating profits for this group have

increased by 8% and 7% respectively. The Twinings distribution network has

been further strengthened by the acquisition of Carl Lange in Denmark.

In Australia and New Zealand, George Weston Foods' sales in local currency

have increased by 4% in the period which translates to a small decrease on a

year ago when converted to sterling. Operating profits within most of the

divisions have shown a modest increase on last year, but with the continued

pressure on margins within the baking sector, it has proved difficult to

achieve last year's performance. The implementation of a major computer

system is progressing ahead of plan and one-off costs of some #5 million have

been charged during the period in respect of this project. Currency

movements have further reduced operating profits by #1 million. Management is

budgeting for improved results in the second half.

Our operations in the United States continue to expand in the ingredients

sector with the US$ 215 million acquisition of SPI Polyols in October last

year. The company operates mainly in the United States with a further

production facility in France and is a leading supplier of polyols in

North and South America. Polyols are used as sweetening agents in food

products and as ingredients in personal care products such as toothpaste.

AC Humko, our oils and food ingredients division in the United States, has

experienced operational difficulties and competitive trading conditions. The

modification of refining operations to cope with increased throughput had

some effect in reducing production efficiencies, although that issue has now

been resolved. The results for the period were also adversely affected by the

start up costs of the rice mill in Greenville, Mississippi acquired last

year.

Primark, our clothing retail division, enjoyed particularly encouraging

results and another record Christmas period with sales and operating profits

increasing by 21% and 75% respectively. Furthermore, these exceptional

results are being maintained. Primark has secured a major new site in

Reading, England, which is due to open early in the autumn and further

expansion is planned in the coming year.

Investment income for the period of #48 million is slightly down on last

year, largely due to funds being used for the acquisition of SPI Polyols

referred to above. Returns achieved by our professional fund managers during

the period are comparable to those obtained a year ago, but future returns

will be affected by the lower level of interest rates now available.

The group's Year 2000 remedial programme is nearing completion. Most of our

divisions will have finished their replacement and testing phase by the end

of April this year. Attention now focuses on contingency planning to ensure

that minimal disruption will occur to our divisions in the event of a failure

of our suppliers or equipment.

Whilst trading conditions remain extremely competitive we are continuing to

invest in our business and are confident that we are well placed to benefit

from any upturn in the economy and in the markets that we serve.

Dividends

Following a review of the company's strategic options, the company

has decided to return #448 million of capital to shareholders, equivalent to

12% of the market capitalisation of the company, by way of a Special

Dividend. At a board meeting today the directors declared a Special Dividend

of 50p per share payable on 14 May 1999 to shareholders on the register on 7

May 1999.

It is proposed that the shares of the company be consolidated to reflect the

return of capital in ABF's financial ratios. The consolidation is subject to

shareholder approval. Wittington Investments Limited, the company's

controlling shareholder, has informed the board that it intends to vote in

favour of the consolidation.

The effect of the Special Dividend and consolidation for a holder of 100

ordinary shares would be a receipt of #50 in cash and a reduced holding of 88

new ordinary shares in the company. Your board considers that this will not

only return a significant sum to shareholders but will leave the company with

adequate resources to pursue attractive investment opportunities.

A circular explaining these proposals is enclosed with this report.

As in previous years, at the board meeting today, the directors declared a

first interim dividend of 4.25p per share (1998 - 4.25p) which will be paid

on the consolidated share capital on 1 September 1999 to shareholders

registered at the close of business on 6 August 1999.

Board changes

As already announced, Mr John Bason will be joining the board

of our company as Finance Director and will commence his new duties from 4

May 1999.

I also wish to advise that Mr David Garman will be leaving the company,

having resigned as a director on 16 April 1999, after five years as a main

board director, and head of the group's bakery operations. David is leaving

us to become Chief Executive of a PLC and we wish him every success with his

new responsibilities, and I thank him for his strong contribution to ABF

whilst with us.

Mr Garman's position on our board, and the management of our bread

operations, will become the responsibility of Mr George G Weston, at present

working with Mr Garman as head of the Kingsmill division of Allied Bakeries.

George Weston first joined our company in 1988 as manager of the group's

flour milling operations in Melbourne, Australia.

Press enquiries to:Garry H Weston - Chairman

Harry Bailey - Deputy Chairman

Telephone: 0171-589 6363

CONSOLIDATED PROFIT AND LOSS ACCOUNT

24 Weeks to 27 Feb 1999 Year to 12 Sept 1998

Con- Con-

tinuing tinuing

oper- oper-

ations 24 Weeks ations

before Excep- to before Excep-

excep- tional 28 Feb excep- tional

tionals items Total 1998 tionals items Total

Note # m # m # m # m # m # m # m

Turnover of the group

including its share of

joint ventures 1,988 - 1,988 1,966 4,202 - 4,202

Less share of turnover

of joint ventures (3) - (3) (3) (7) - (7)

Group turnover 1 1,985 - 1,985 1,963 4,195 - 4,195

Operating costs (1,843) (74) (1,917) (1,815) (3,878) (19) (3,897)

Group operating profit 142 (74) 68 148 317 (19) 298

Share of operating

results of

-joint ventures 1 - 1 1 (3) - (3)

associates 1 - 1 1 2 - 2

Total operating

profit 1 144 (74) 70 150 316 (19) 297

Operating profit before

exceptional items and

amortisation of

goodwill 146 - 146 150 316 - 316

Exceptional items 1 - (74) (74) - - (19) (19)

Amortisation of goodwill (2) - (2) - - - -

Profits less losses on

sale of properties 2 - 2 - (3) - (3)

Investment income 48 - 48 53 119 - 119

Profit on ordinary

activities before

interest 194 (74) 120 203 432 (19) 413

Interest payable (11) - (11) (10) (22) - (22)

Profit on ordinary

activities before

taxation 183 (74) 109 193 410 (19) 391

Tax on profit on

ordinary activities 2 (56) - (56) (61) (124) - (124)

Profit on ordinary

activities after

taxation 127 (74) 53 132 286 (19) 267

Minority interests -

equity (1) - (1) (2) (2) - (2)

Profit for the financial

period 126 (74) 52 130 284 (19) 265

Dividends -

first interim (34) - (34) (38) (38) - (38)

second interim - - - - (56) - (56)

special interim (448) - (448) - - - -

Retained profit for the

financial period (356) (74) (430) 92 190 (19) 171

Earnings per ordinary

share 14.0p (8.2)p 5.8p 14.5p 31.7p (2.1)p 29.6p

The group has made no material acquisitions nor discontinued any operations

within the meaning of the Financial Reporting Standards during either 1999 or

1998.

CONSOLIDATED BALANCE SHEET

As at As at As at

27 Feb 28 Feb 12 Sept

1999 1998 1998

# m # m # m

Fixed assets

Intangible fixed assets

- goodwill 99 - -

Tangible fixed assets 1,459 1,409 1,439

1,558 1,409 1,439

Interest in net assets of

- joint ventures 2 7 3

- associates 9 6 6

Other investments 18 8 17

Total investments 29 21 26

1,587 1,430 1,465

Current assets

Stocks 745 773 428

Debtors 533 490 481

Investments 1,298 1,359 1,570

Cash at bank and in hand 88 72 70

2,664 2,694 2,549

Creditors amounts falling due

within one year

Short term borrowings (56) (57) (44)

Other creditors (846) (771) (682)

Special interim dividend (448) - -

(1,350) (828) (726)

Net current assets 1,314 1,866 1,823

Total assets less

current liabilities 2,901 3,296 3,288

Creditors amounts falling due

after one year

Loans (164) (156) (157)

Other creditors (6) (50) (13)

(170) (206) (170)

Provision for liabilities and

charges (54) (51) (55)

2,677 3,039 3,063

Capital and reserves

Called up share capital 47 47 47

Revaluation reserve 3 4 3

Other reserves 173 173 173

Profit and loss account 2,375 2,737 2,774

Equity shareholders' funds 2,598 2,961 2,997

Minority interests in subsidiary

undertakings - equity 79 78 66

2,677 3,039 3,063

CONSOLIDATED CASH FLOW STATEMENT

24 weeks 24 weeks Year

to to to

27 Feb 28 Feb 12 Sept

1999 1998 1998

Note #m #m #m

Cash flow from operating

activities 3 (44) (22) 448

Dividends from joint ventures - - 1

Dividends from associates - - 1

Return on investments and

servicing of finance

Dividends and other

investment income 49 52 113

Interest paid (11) (11) (22)

Dividends paid to minorities (1) (1) (2)

37 40 89

Taxation (22) (23) (127)

Capital expenditure and

financial investment

Purchase of tangible fixed

assets (114) (102) (226)

Sale of tangible fixed assets 5 2 10

Purchase of equity investments - - (3)

Sale of equity investments 1 - 3

Purchase of own shares - (1) (8)

(108) (101) (224)

Acquisitions and disposals

Purchase of new subsidiary

undertakings (140) (37) (57)

Advances to joint ventures (1) - (1)

(141) (37) (58)

Equity dividends paid - (97) (135)

Net cash (outflow)/inflow before use

of liquid funds and financing (278) (240) (5)

Management of liquid

funds 5 (52) (138) (107)

Financing 4 (21) (9) (11)

Increase/(decrease) in

cash 5 (205) (93) 113

(278) (240) (5)

CONSOLIDATED STATEMENT OF TOTAL

RECOGNISED GAINS AND LOSSES

24 weeks 24 weeks Year

to to to

27 Feb 28 Feb 12 Sept

1999 1998 1998

#m #m #m

Profit for the financial period 52 130 265

Currency translation differences

on foreign currency net assets 31 (24) (59)

Total recognised gains and

losses 83 106 206

RECONCILIATION OF MOVEMENTS IN

CONSOLIDATED SHAREHOLDERS' FUNDS

24 weeks 24 weeks Year

to to to

27 Feb 28 Feb 12 Sept

1999 1998 1998

#m #m #m

Profit for the financial period 52 130 265

Dividend- first interim (34) (38) (38)

second interim - - (56)

special interim (448) - -

Retained profit for the

financial period (430) 92 171

Other recognised gains and

losses relating to the period 31 (24) (59)

Goodwill acquired and written

off during the period - (24) (32)

Net increase in shareholders'

funds (399) 44 80

Opening shareholders' funds 2,997 2,917 2,917

Closing shareholders' funds 2,598 2,961 2,997

NOTES TO THE INTERIM STATEMENTS

24 weeks 24 weeks Year

to to to

27 Feb 28 Feb 12 Sept

1999 1998 1998

#m #m #m

1.Geographical analysis of turnover

(by origin and destination)

European Union, mainly United Kingdom

and Ireland 1,377 1,433 3,023

Australia and New Zealand 244 257 534

North America 312 240 557

Elsewhere, mainly Asia 52 33 81

Group Turnover 1,985 1,963 4,195

Business sector

Manufacturing 1,812 1,820 3,900

Retail 173 143 295

Group Turnover 1,985 1,963 4,195

Geographical analysis of operating profit

(by origin)

European Union, mainly United Kingdom

and Ireland 127 124 268

Australia and New Zealand 9 15 25

North America 10 11 22

Elsewhere, mainly Asia (2) - 1

Total operating profit

before exceptional items 144 150 316

Exceptional items

-impairment of fixed assets (74) - -

European Commission fine - - (13)

write down of joint ventures - - (6)

Total operating profit 70 150 297

Business sector

Manufacturing 123 138 293

Retail 21 12 23

Total operating profit

before exceptional items 144 150 316

Exceptional items

-impairment of fixed assets (74) - -

European Commission fine - - (13)

write down of joint ventures - - (6)

Total operating profit 70 150 297

2.Tax on profit on ordinary activities

United Kingdom 41 44 93

Overseas 14 16 29

Associates and joint ventures 1 1 2

56 61 124

3.Cash flow from operating activities

Operating profit 68 148 298

Depreciation 83 77 151

Impairment of fixed assets 74 - -

(Increase)/decrease in

working capital

-stocks (297) (356) (16)

debtors (35) 5 7

creditors 64 106 6

Provisions (1) (2) 2

(44) (22) 448

4.Analysis of changes in financing

Issue of short term loans (18) (4) (32)

Repayment of short term loans 5 - 24

Issue of loans over one year (7) - -

Repayment of loans over one

year 2 - 2

Shares issued to minority

shareholders (3) (5) (5)

(21) (9) (11)

5.Changes in net funds

Increase/(decrease) in net

cash (205) (93) 113

Financing (note 4) (21) (9) (11)

Management of liquid funds (52) (138) (107)

Shares issued to minority

shareholders 3 5 5

Purchase of equity investments - - 1

Sale of equity investments - - (1)

Changes in market value - - 3

Arising on the acquisition of

subsidiary undertakings - (2) (8)

Effect of currency changes 2 (5) (16)

Movement in net funds for the

period (273) (242) (21)

Opening net funds 1,439 1,460 1,460

Closing net funds 1,166 1,218 1,439

Analysis of net funds

Current asset investments 1,298 1,359 1,570

Cash at bank and in hand 88 72 70

Short term borrowings (56) (57) (44)

Loans falling due after one

year (164) (156) (157)

1,166 1,218 1,439

6.Other information

The figures shown for the financial year ended 12 September 1998, which

have been abridged from the group's 1998 financial statements, are not the

group's statutory accounts. Those accounts have been reported on by the

auditors and delivered to the Registrar of Companies. The report of the

auditors was unqualified and did not contain a statement under section 237

(2) or (4) of the Companies Act 1985.

The figures for the 24 weeks ended 27 February 1999 and 28 February 1998

are unaudited.

ACCOUNTING POLICIES

Basis of preparation

These financial statements have been prepared under the historical cost

convention as modified by the revaluation of certain assets, and in

accordance with applicable accounting standards and the Companies Act 1985.

The comparative figures for the 24 weeks to 28 February 1998 have been

restated to reflect the adoption of FRS9.

Basis of consolidation

The group accounts comprise a consolidation of the accounts of the Company

and all its subsidiaries together with the group's share of the results and

net assets of its associates and joint ventures. The financial statements of

the company and its subsidiary undertakings are made up for the 24 weeks

ended 27 February 1999, except for those of the Australian and New Zealand

group and China and Poland which are made up to 16 January 1999, and the

North American subsidiary undertakings which are made up to 13 February 1999

to avoid delay in the preparation of the consolidated financial statements.

Acquisitions

The consolidated profit and loss account includes the results of new

subsidiary undertakings, associates and joint ventures attributable to the

period since acquisition. Goodwill on acquisition, being the excess of the

purchase price of new subsidiary undertakings, associates and joint ventures

over the fair value of net assets acquired, is capitalised in accordance with

FRS 10 and amortised over its useful economic life. Goodwill previously

eliminated against reserves has not been reinstated.

Disposals

The results of subsidiary undertakings, associates and joint ventures sold

are included up to the dates of change of control. The profit or loss on the

disposal of an acquired business takes into account the attributable value of

purchased goodwill not previously amortised relating to that business.

Foreign currencies

Assets and liabilities overseas are converted into sterling at the rates of

exchange ruling at the balance sheet date. The results of overseas operations

have been translated at the average rate prevailing during the period.

Exchange differences arising on consolidation are taken directly to reserves.

Other exchange differences are dealt with as part of operating profits.

Pensions

The group has established separately funded pension schemes for the benefit

of permanent staff, which vary with employment conditions in the countries

concerned. Net pension costs are charged to income over the expected average

remaining service lives of employees. Any differences between the charge for

pensions and total contributions are included within pension provisions or

debtors as appropriate.

Research and development

Expenditure in respect of research and development is written off against

profits in the period in which it is incurred.

Fixed asset investments

Associated undertakings and joint ventures are accounted for in the financial

statements of the group under the equity method of accounting. Other fixed

asset investments are stated at cost less amounts written off in respect of

any permanent diminution in value.

Depreciation

Depreciation, calculated on cost or on valuation, is provided on a straight

line basis to residual value over the anticipated life of the asset. No

depreciation is provided on freehold land. Leaseholds are written off over

the period of the lease. The anticipated life of other assets is generally

deemed to be not longer than:

Freehold buildings 66 years

Plant, machinery, fixtures and fittings

-sugar factories 20 years

other operations 12 years

Vehicles 8 years

Leases

All material leases entered into by the group are operating leases, whereby

substantially all of the risks and rewards of ownership of an asset remain

with the lessor. Rental payments are charged against profits on a straight

line basis over the life of the lease.

Stocks

Stocks are valued at the lower of cost or net realisable value, after making

due provision against obsolete and slow-moving items. In the case of

manufactured goods the term "cost" includes ingredients, production wages and

production overheads.

Current asset investments

Current asset investments are stated at the lower of cost or market value.

Deferred tax

Deferred tax represents corporation tax in respect of accelerated taxation

allowances on capital expenditure and other timing differences, to the extent

that a liability is anticipated in the foreseeable future.

With the exception of FRS 10 and FRS 11 which were adopted in the period,

these accounting policies are consistent with those used in the preparation

of the financial statements for the year ended 12 September 1998.

DIRECTORS Garry H Weston Chairman +

Harold W Bailey Deputy Chairman

Trevor HM Shaw

Peter J Jackson

David NC Garman (resigned 16 April 1999)

George G Weston (appointed 19 April 1999)

WG Galen Weston *

Rt Hon John RR MacGregor OBE * +

Professor Sir Roland Smith * +

SECRETARY Trevor HM Shaw

REGISTERED OFFICE Weston Centre

Bowater House

68 Knightsbridge

London SW1X 7LQ

Company registered in England, number 293262

REGISTRAR'S AND Lloyds Bank Plc

TRANSFER OFFICE Registrar's Department

Goring by Sea

Worthing BN99 6DA

INTERNET SITE http://www.ABF.co.uk

* Non-executive director

+ Member of Audit and Remuneration Committees

END

IR BKFFFKZKLBKQ

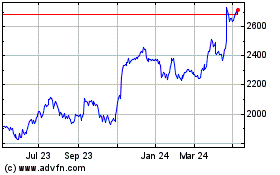

Associated British Foods (LSE:ABF)

Historical Stock Chart

From Jan 2025 to Feb 2025

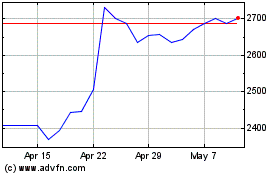

Associated British Foods (LSE:ABF)

Historical Stock Chart

From Feb 2024 to Feb 2025