Armadale Capital PLC Management Team Enhanced With Key Appointment (7397V)

15 December 2021 - 8:29PM

UK Regulatory

TIDMACP

RNS Number : 7397V

Armadale Capital PLC

15 December 2021

Armadale Capital Plc / Index: AIM / Epic: ACP / Sector:

Investment Company

15 December 2021

Armadale Capital Plc

('Armadale' the 'Company' or the 'Group')

Management team enhanced with key appointment

Armadale, the AIM quoted investment company focused on natural

resource projects in Africa, is delighted to announce that Mr Greg

Entwistle has agreed to join as Project Director (non-board) to

spear-head developing the Mahenge Liandu Project in Tanzania. Mr

Entwistle brings a wealth of experience to the group which should

materially aid Armadale's efforts to accelerate commissioning

mining operations at the Mahenge Liandu Project.

Mr Greg Entwistle: Project Director

Mr Entwistle has an excellent pedigree and has worked across all

aspects of the resources value chain - from feasibility through to

production - in emerging and developed mining jurisdictions. During

his career Mr Entwistle has worked for blue-chip Newcrest Mining as

Engineering and Production Manager for the Telfer Operation in

Western Australia and Halmahera Operation in Indonesia. Senior

roles include Director of Operations for Agincourt Resources in

Indonesia as well as Chief Operating Officer for the Kapulo &

Dikulushi Copper Projects in the Democratic Republic of Congo.

Over the past five years, Mr Entwistle has focused on

specialising in the emerging graphite sector in East Africa,

consulting to several groups that are advancing projects towards

production.

From Armadale's perspective, Mr Entwistle's appointment is

timely as it coincides with a plethora of positive developments

including: 1) the Mahenge Liandu Project being granted a mining

licence in September 2021; and, 2) improving fundamentals with

strong demand for downstream battery products boosting graphite

prices materially.

Nick Johansen, Director of Armadale, said: "Appointing Greg

Entwistle to lead developing the Mahenge Liandu Project is a

significant breakthrough, as he brings considerable skills and

experience to expedite progress towards commissioning production.

Consequently, our vision to become a significant low-cost graphite

producer has been considerably reinforced. The Board looks forward

to updating the market as fresh developments materialise."

MAHENGE LIANDU PROJECT UPDATE

Armadale is now advancing its FEED study which includes

geotechnical studies on the plant and tailings dam locations, with

final design of the tailings dam and detailed design to be

completed. In addition, a ground water study has been initiated to

facilitate the development of production bores.

Armadale has continued to engage with international and local

contractors to develop strategies in regard to the construction and

implementation of the project. Final alignment of the site access

route is being developed which will allow final design work to be

completed.

-- Mahenge Liandu Graphite Project established as a large, long

life graphite deposit capable of producing high quality graphite

concentrate for the rapidly emerging EV market through optimised

Definitive Feasibility Study ('DFS')

o High-grade JORC compliant indicated and inferred mineral

resource estimate of 59.48Mt @ 9.8% TGC with outstanding purity of

up to of 99.99% TGC achievable using conventional treatment

o US$985m pre-tax cashflow to be generated from initial 15 year

mine life utilising just 25% of the resource, which remains open in

multiple directions offering significant further upside

o Estimated pre-tax NPV of US$430m and IRR of 91%

o Average annual production of large flake high-purity graphite

of 109ktpa

-- Low cost, fast-tracked production to be delivered through staged ramp-up

o 60,000tpa graphite concentrate to be produced for the first

three years (Stage 1) before increasing to life of mine average of

109,000tpa (Stage 2)

o Low capital cost estimate - Stage 1 is US$39.7m, including

contingency of U$S4.1m or 15% of total direct capital cost with 1.6

year (after tax) payback period from first production based on an

average sales price of US$1,112/t

o Stage 2 expansion to be funded from cashflow

The information contained within this announcement is deemed to

constitute inside information as stipulated under the Market Abuse

Regulations (EU No. 596/2014) which is part of UK law by virtue of

the European Union (Withdrawal) Act 2018. Upon the publication of

this announcement, this inside information is now considered to be

in the public domain.

This information is provided by RNS, the news service of the

London Stock Exchange. RNS is approved by the Financial Conduct

Authority to act as a Primary Information Provider in the United

Kingdom. Terms and conditions relating to the use and distribution

of this information may apply. For further information, please

contact rns@lseg.com or visit www.rns.com.

RNS may use your IP address to confirm compliance with the terms

and conditions, to analyse how you engage with the information

contained in this communication, and to share such analysis on an

anonymised basis with others as part of our commercial services.

For further information about how RNS and the London Stock Exchange

use the personal data you provide us, please see our Privacy

Policy.

END

MSCMZMMZLKDGMZG

(END) Dow Jones Newswires

December 15, 2021 04:29 ET (09:29 GMT)

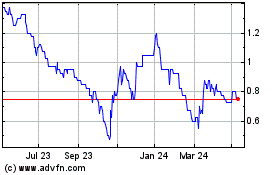

Armadale Capital (LSE:ACP)

Historical Stock Chart

From Dec 2024 to Jan 2025

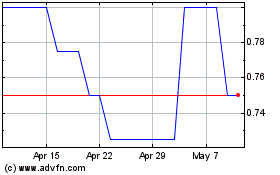

Armadale Capital (LSE:ACP)

Historical Stock Chart

From Jan 2024 to Jan 2025