Response to share price movement

10 August 2009 - 10:58PM

UK Regulatory

TIDMSEY

RNS Number : 1726X

Sterling Energy PLC

10 August 2009

NOT FOR RELEASE, PUBLICATION OR DISTRIBUTION IN WHOLE OR IN PART IN, INTO OR

FROM ANY JURISDICTION WHERE TO DO SO WOULD CONSTITUTE A VIOLATION OF THE

RELEVANT LAWS OR REGULATIONS OF THAT JURISDICTION

10 August 2009

STERLING ENERGY PLC

("Sterling" or the "Company")

Response to share price movement

Sterling Energy (symbol: SEY), an AIM listed independent oil & gas exploration

and production company, with interests in the Gulf of Mexico, Africa and the

Middle East, notes the recent movement in its share price and updates the market

that, within the context of determining a long-term solution to Sterling's

financing position, it is continuing to consider its strategic options.

The Company confirms that it is currently exploring a number of options

including a sizeable placing of new equity at a significant discount to the

current market price.

In addition, the Company continues to hold discussions with interested third

parties regarding the sale of assets or the sale of the Company. Sterling

emphasises that there is no certainty an offer for the Company will be

forthcoming.

Enquiries

Sterling Energy Plc (+44 20 7405 4133)

Graeme Thomson, CEO

Jon Cooper, FD

Rothschild (+44 20 7280 5000)

(Financial Adviser)

Neeve Billis

David Hemmings

Evolution Securities (+44 20 7071 4300)

Nominated Adviser and Broker

Rob Collins

Chris Sim

Citigate Dewe Rogerson (+44 20 7638 9571)

Martin Jackson

Emma Woollaston

Web site: www.sterlingenergyplc.com

Notes to editors

The Directors of Sterling accept responsibility for the information contained in

this announcement. To the best of knowledge and belief of the Directors, who

have taken all reasonable care to ensure such is the case, the information

contained in this announcement is in accordance with the facts and does not omit

anything likely to affect the import of such information.

Rothschild, who is authorised and regulated by the Financial Services

Authority in the United Kingdom, is acting as financial adviser to Sterling and

no one else in connection with the contents of this announcement and will not be

responsible to anyone other than Sterling for providing the protections afforded

to clients of Rothschild or for providing advice in relation to the contents of

this announcement.

Evolution Securities, who is authorised and regulated by the Financial

Services Authority in the United Kingdom, is acting as NOMAD and broker to

Sterling and no one else in connection with the contents of this announcement

and will not be responsible to anyone other than Sterling for providing the

protections afforded to clients of Evolution Securities or for providing advice

in relation to the contents of this announcement.

Dealing Disclosure Requirements

Under the provisions of Rule 8.3 of the Takeover Code (the "Code"), if any

person is, or becomes, "interested" (directly or indirectly) in 1% or more of

any class of "relevant securities" of STERLING, all "dealings" in any "relevant

securities" of that company (including by means of an option in respect of, or a

derivative referenced to, any such "relevant securities") must be publicly

disclosed by no later than 3.30 pm (London time) on the London business day

following the date of the relevant transaction. This requirement will continue

until the date on which any offer (if made) becomes, or is declared,

unconditional as to acceptances, lapses or is otherwise withdrawn or on which

the "offer period" otherwise ends. If two or more persons act together pursuant

to an agreement or understanding, whether formal or informal, to acquire an

"interest" in "relevant securities" of STERLING, they will be deemed to be a

single person for the purpose of Rule 8.3.

Under the provisions of Rule 8.1 of the Code, all "dealings" in "relevant

securities" of STERLING by STERLING, or by any of its "associates", must be

disclosed by no later than 12.00 noon (London time) on the London business day

following the date of the relevant transaction.

A disclosure table, giving details of the companies in whose "relevant

securities" "dealings" should be disclosed, and the number of such securities in

issue, can be found on the Takeover Panel's website at .

"Interests in securities" arise, in summary, when a person has long

economic exposure, whether conditional or absolute, to changes in the price of

securities. In particular, a person will be treated as having an "interest" by

virtue of the ownership or control of securities, or by virtue of any option in

respect of, or derivative referenced to, securities.

Terms in quotation marks are defined in the Code, which can also be found

on the Panel's website. If you are in any doubt as to whether or not you are

required to disclose a "dealing" under Rule 8, you should consult the Panel.

This information is provided by RNS

The company news service from the London Stock Exchange

END

SPMURVURKBRWAAR

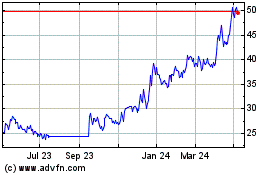

Afentra (LSE:AET)

Historical Stock Chart

From Jan 2025 to Feb 2025

Afentra (LSE:AET)

Historical Stock Chart

From Feb 2024 to Feb 2025