TIDMALTN

AltynGold plc

("AltynGold" or the "Company")

Publication of Annual Report and Financial Results for the year

ended 31 December 2022; update on temporary share suspension

AltynGold is pleased to announce that the Company's Annual

Report and audited financial results for the year ended 31 December

2022 have been published on the Company's website at

www.altyngold.uk and uploaded to the Financial Conduct Authority's

("FCA") National Storage Mechanism at

https://data.fca.org.uk/#/nsm/nationalstoragemechanism.

Further to its announcement on 28 April 2023, the Company has

applied to the FCA for the restoration of its ordinary shares to

the standard listing segment of the Official List of the FCA and to

trading on the Main Market of the London Stock Exchange. A further

announcement in this respect will be made in due course.

Highlights

Financial highlights

-- Turnover increased in the year to US$62m (2021: US$50m) an

increase of 23.4%.

-- 34,499oz of gold sold (2021: 27,747oz), an increase of

24.3%.

-- Average gold price achieved (including silver), US$1,762oz,

(2021: US$1,803oz).

-- The Company made a profit before tax of US$13.4m (2021:

US$18.3m).

-- Adjusted EBITDA (Earnings before interest, tax, depreciation

and amortisation) of US$21.9m (2021: US$26.4m).

-- The Group repaid borrowings of US$15m (2021: US$7.9m).

-- The Group obtained a further advance of US$40m from Bank

Center Credit for capital development.

Operational highlights

-- Ore processed 527,000t (2021: 571,000t).

-- Gold poured 34,023oz, (2021: 28,450oz) a 19.6 % increase

year-on-year.

-- Mined gold grade 2.17g/t, (2021: 1.97g/t).

-- Operating cash cost US$805oz, (2021: US$649oz).

-- Gold recovery rate 83.43% (2021: 83.05%).

Underground development & exploration

-- Transport declines were developed and are both now at 50masl

from 117masl decline 1 and 134masl decline 2.

-- Development of the shaft and tunnelling amounted to 6,699

linear metres (2021: 6,209 linear metres).

-- Exploration drilling at Sekisovskoye amounted to 129,928

linear metres (2021: 119,438 linear metres).

-- An extension to the mining licence for two years at Teren-Sai

has been applied for and is expected to be finalised in the second

half of 2023.

The Annual General Meeting of the Company will be held at

Langham Court Hotel, 31-35 Langham Street, London W1W 6BU, United

Kingdom on Thursday 22 June 2023 at 11.00am.

Further Information:

For further information please contact:

AltynGold Plc

Rajinder Basra

+44 (0) 203 432 3198

The information contained within this announcement is deemed by

the Company to constitute inside information as stipulated under

the Market Abuse Regulations (EU) No. 596/2014, as it forms part of

domestic law by virtue of the European Union (Withdrawal) Act

2018.

Information on the Company

AltynGold Plc (LSE:ALTN) is an exploration and development

company, which is listed on the main market segment of the London

Stock Exchange.

To read more about AltynGold Plc please visit our website

www.altyngold.uk.

CHAIRMAN'S STATEMENT

The Company had another successful year increasing its sales

output to 34,499oz, generating a turnover of US$62m and a profit

before tax of US$13.4m.

The Company is advancing on its development plan having

successfully secured US$ 40m funding at attractive terms. The

ensuing objective is to increase ore production to 760ktpa in 2023

as a springboard to achieving 1mtpa thereafter in line with the

processing plant expansion planned for 2023-2024.

In conjunction with its development strategy, the Company is

closely monitoring and controlling its carbon emissions. AltynGold

currently ranks among the lowest emitters according to Kazakhstan's

environmental legislation. The Board is continuing to develop plans

and reviewing technologies that will reduce future carbon

emissions.

The development of Teren-Sai has been progressing slower than

anticipated but the management is committed to continuing the

exploration program and accelerating ore extraction; initially open

pit and then underground. The mining license for an additional two

year term is in process and expected to be granted in the second

half of 2023. The application for renewal is with the appropriate

government department for consideration, and the delay has been due

to checks to be performed by the relevant government body on the

land to be returned that is not required for commercial

development. The checks have been delayed until weather conditions

improve on site, but the Company sees no issues in progressing the

application once this has been done.

Looking forward, the Company is anticipating solid growth. While

higher interest rates and the strong dollar may hinder the demand

and price of gold, the latter should be supported by geopolitical

turmoil. Indeed, professional consensus forecasts see the gold

price trading in US$1,800oz -US$1,900oz range. Although Kazakhstan

is not immune to the global inflationary dynamic, this pressure

should be mitigated by the stronger dollar in which our revenues

are denominated.

With continuing positive operational developments, it is hoped

that the share price will be more reflective of the Company

progress and its future prospects.

Finally I would like to conclude by thanking our Board members

and employees for their unwavering support and I look forward to

another successful year.

Kanat Assaubayev

Chairman

CHIEF EXECUTIVE OFFICER'S REVIEW

Overview

The Company's gold production increased 19.6% with gold poured

reaching 34,023oz the highest level since operations at

Sekisovskoye mine commenced. This was achieved despite the setback

of extreme weather which resulted in abnormally low production of

527,000tpa of processed ore which was mitigated by higher grades of

2.17g/t and drawing on stock pile with 585,000tpa ore milled.

The budgets have been set to reach an output of 760-800,000tpa

for 2023 assuming the additional capex equipment comes on stream as

planned.

Following extensive drilling works at Teren-Sai, the exploration

area has been remapped versus the original license with areas that

are no longer of commercial interest returned to the government.

This process has slowed the license renewal which is now expected

to be finalised in the second half of 2023. In the interim, the

Company has put plans in place for further drilling and site

preparation pending the agreement on the new the license

details.

The Company entered into credit arrangements with Bank Center

Credit to finance the processing plant expansion and the

acquisition of new mining equipment. While this financing was

completed in November, the funds will be fully drawn in in 2023.

Concurrently, the processing plant expansion work has already

commenced and substantial equipment purchases were placed post year

end, which should result in higher level of ore production.

Mine development

The Company has continued its development at Sekisovskoye in

line with its mining plan. The pace of development should further

accelerate in 2023 as the US$40m funding is deployed for the

acquisition of new equipment and infrastructure development. The

majority of the new equipment is expected to be in place during the

first half of 2023

The principal development milestones achieved during the period

were:

-- Tunnelling and shaft sinking of 6,699 linear metres, (2021:

6,209). This included 1,040 linear metres at 150masl to open up

further reserves for explotation in 2023.

-- Blast hole drilling of 129,928 linear metres (2021:

119,438).

-- Exploration drilling was carried out and amounted to 13,928

linear metres (2021: 18,943). The exploration drilling was carried

out at horizons 174masl and 150masl along ore bodies 11 and 5.

-- Backfilling of voids was carried out as the declines are

moving down and the blocks are mined.

The principal mining operations in the period were at ore bodies

6-8, ore body 5 and 11 at horizons 117masl, 134masl, and

150masl.

Both transport declines have been developed to 50masl with

expected continuation of this development in 2023 as shown on the

underground map of the mine.

In order to continue safe mining operations and enable efficient

engagement with the local environment, the following capital and

maintenance works were carried out at the mine site and surrounding

areas:

-- Connections were made to the local water supply and

maintenance carried on the water pumps.

-- The local stream was cleared and the bridge giving access to

the mine and the local village repaired. The main roads were also

repaired and cleared during the winter season.

-- The Company undertook the repair of the local stadium and

park zones of the local village from where the majority of the work

force are hired.

The key production figures are shown below:

Mining results ore extraction

2022 2021

Ore mined T 527,231 571,035

Gold grade g/t 2.17 1.94

Silver grade g/t 1.78 1.81

Contained gold oz 36,835 35,580

Contained silver oz 30,233 33,296

Mining results processing

2022 2021

Crushing T 574,614 534,426

Milling T 585,480 541,576

G old grade g/t 2.17 1.97

Silver grade g/t 1.64 1.63

Gold recovery % 83.43 83.05

Silver recovery % 72.87 73.54

Contained gold oz 40,782 34,258

Contained silver oz 30,927 28,408

Gold Poured oz 34,023 28,450

Silver poured oz 22,538 20,891

Exploration -- Teren-Sai

As mentioned above the Company is awaiting the extension of the

license for a three-year period therefore only a limited

exploration activity was carried out. In the period, 2,000 linear

metres of exploration drilling were carried out.

The areas of interest are No. 2,4 and 5 with area 2 being the

first target of development. A competent persons report was

conducted on this area in 2019. As noted previously, the results

from the test production obtained from open pit workings for Area

No. 2 indicated an average grade of 1.8g/t.

The exploration work carried out in the period under the

original 2016 license is as follows:

- exploratory pneumatic percussion drilling of 1,352 wells, with

a total volume of 67,581 running meters ;

- core drilling - 74 wells, with a total volume of 18,360

running meters ;

- sludge sampling - 33,791 samples;

- core sampling - 18,350 samples.

Based on the results of prospecting work conducted during the

reporting period, three prospective areas for the discovery of gold

mineralisation were identified in the ore field areas Nos. 2, 4 and

5.

In area No. 2, 25 major ore intersections were identified in 7

wells. In area No. 4, 15 major ore intersections were identified in

6 wells. In area No. 5, 14 major ore intersections were identified

in 14 wells.

The main tasks relating to the updated license consists of the

following geological and geophysical works:

- topographic and geodetic works;

- drilling of core wells;

- logging works;

- testing;

- laboratory and analytical work;

- Topographic tie-in of the 133 wells to be drilled;

- Geophysical research in 1,995 linear meters wells;

- Drilling operations (core inclined drilling) with a volume of

39,900 linear meters;

- Laboratory work on 50,474 samples;

- Other geological operations (development of design documents,

work, etc.)

The exploration activities are aimed at obtaining sufficient

geological data to make a preliminary estimate of mineral

resources, which will be followed by production.

Capital requirements

The Company raised a US$40m facility in order to fund its

capital requirements for 2023 as detailed in the table below:

-The principal focus will be on capacity expansion which entails

upgrading the processing plant and infrastructure. An extra

grinding mill and new underground mining equipment will also be

added. The mill is expected to be installed with minimal disruption

to existing operations in 2023 with the capex program extending

into 2024.

Regarding Teren-Sai, the current capex budget foresees

continuation of exploration at the site pending the approval of the

updated development plan. Further advancement of the project will

subsequently depend on raising additional funding.

Projected capital expenditure Total 2023 2024

US$m US$m US$m

Prospect drilling 4 2 2

Underground development 19 8 11

Infrastructure 2 2 -

Ore handling facilities 17 11 6

Process plant incremental expansion 2 1 1

Total 44 24 20

Longer term plan

The Company has had a successful year, with the capex investment

increasing ore extraction from the Sekisovskoye site which

increased to 570ktpa. The aim remains to move this up to 1mtpa, and

budgets have been drawn up and funds allocated to expand the

existing capacity of the processing plant to 1mtpa within two

years. The longer term aim is to increase the ore extraction

towards the 2mtpa within a time frame of 6 years.

The capex required as outlined above amounts to US$38m, and will

be largely met from funds raised from operations. In addition to

this an amount of US$75m will be required to bring the Teren-Sai

project on stream, as it will require new processing facilities and

infrastructure to be developed at the Teren-Sai site. In the

initial period the site will be stripped and made ready for open

pit production in order to move to production efficiently once the

necessary funding is in place. The brokers who are providing

sponsored research and opening up opportunities for investor

funding will play a key role in moving the projects forward.

The Board are constantly looking to diversify and invest in new

and complementary operations in Kazakhstan and internationally,

however the primary driver at present is to bring the Kazakhstan

gold sites, as outlined above, to their full potential.

FINANCIAL PERFORMANCE

Key performance indicators 2022 2021 2020

Annual gold sales Oz 34,499 27,747 16,535

Annual gold poured Oz 34,023 28,450 17,028

Revenue US$m 62 50.0 30.0

Operating cash cost of production US$oz 805 649 800

EBITDA US$m 21.9 26.4 13.5

Net Assets US$m 62.2 55.2 35.3

The production results at Sekisovskoye are encouraging with the

investment in the capital and more efficient working practices

increasing the key figures of mineral processing towards target

levels. Further investment is planned, with the funds received from

Bank Center Credit to increase the capacity of the process plant.

As this will be an add on to the existing structures there is no

disruption anticipated while the works are being carried out to

implement the upgrades.

Ore mined totalled 527,000t which was lower than the previous

year due to extreme weather. Part of the shortfall was covered by

stockpiles from prior years.

Gold poured increased 19.6 % to 34,023oz (2021: 28,450oz).

Recovery rate also improved to 83.43% (2021:83.05%).

During 2022, the Company sold 34,499oz of gold (2021: 27,747oz)

at an average price US$1,762per oz (2021:US$1,803). As such revenue

expansion was solely driven by volume increase in production. The

Company budgets a medium term price range of US$1,700 - US$1,800.

Total Company output was taken by the Kazakh national refinery In

line with the long standing off-take agreement. As in previous

years, sales were translated using the spot US$ exchange rate at

the point of sales.

The total cash cost of production which includes administrative

costs but excludes depreciation and provisions amounted to

US$1,160oz, (2021: US$834oz). The operating cash cost excluding

administrative costs amounted to US$805oz (2021: US$649oz).

>The administrative costs have increased by US$6.6m mainly as

a result of one off items. The Company sponsored projects worth

US$3.6m for the benefit of the community in line with central

government recommendations. A further US$3m was spent on mine

upgrade, ecological research, carbon offset programs and climate

change reporting. The expenditure on these projects is expected to

decline in the forthcoming 2023 period.

The Company realised a gross profit of US$29.3m (2021: US$27.8m)

and net profit before tax of US$13.4m (2021: US$18.3m).

Adjusted EBITDA decreased to US$21.9m (2021: US$26.4m) as a

result of the non-recurring increase in administrative costs

identified above. Details of the calculation are shown in note 13

of the financial statements.

Cash at year end was US$116,000 (2021: US$3.6m). Funds

utilization included US$9.7m change in working capital following

significant prepayments for equipment, US$6.4m bond and other loans

and interest repayment net of new loans and US$9.2m capital

additions. The Company raised funds post year end from the issue of

a bond on the Astana International Exchange (AIX), raising

US$9.4m.

CONSOLIDATED INCOME STATEMENT

for the year ended 31 December 2022

2022 2021

Note $000 $000

Revenue 3 62,037 50,290

Cost of sales (32,697) (22,496)

Gross profit 29,340 27,794

Administrative expenses (8,590) (4,648)

Administrative expenses -- sponsorship

programs (3,654) (490)

Impairments (82) (734)

Operating profit 17,014 21,922

Foreign exchange (504) (366)

Finance expense (3,096) (3,289)

Total finance cost (3,600) (3,655)

Profit before tax 13,414 18,267

Taxation receipt/(expense) (181) 56

Profit for the year attributable to the equity

holders of the parent 13,233 18,323

Profit per ordinary share

Basic 48.42c 11.27c

Diluted 48.42c 10.97c

CONSOLIDATED STATEMENT OF COMPREHENSIVE INCOME

for the year ended 31 December 2022

2022 2021

Note $000 $000

Profit for the year 13,233 18,323

Items that may be reclassified subsequently

to the income statement

Currency translation differences arising on

translations of foreign operations (4,822) (1,491)

Currency translation differences on translation of

foreign operations relating to tax (1,408) 3,038

(6,230) 1,547

Total comprehensive profit for the year 7,003 19,870

Total comprehensive profit attributable to:

Equity holders of the parent 7,003 19,870

CONSOLIDATED STATEMENT OF FINANCIAL POSITION

as at 31 December 2022

2022 2021

(Registration number: 05048549) Note $000 $000

Assets

Non-current assets

Intangible assets 5 12,698 13,346

Property, plant and equipment 6 36,975 35,350

Deferred tax assets 6,052 8,189

Trade and other receivables 14,600 3,925

Restricted cash 50 70

70,375 60,880

Current assets

Inventories 11,260 9,121

Trade and other receivables 16,622 21,530

Cash and cash equivalents 116 3,593

27,998 34,244

Total assets 98,373 95,124

Equity and liabilities

Current liabilities

Trade and other payables (6,253) (5,684)

Provisions (263) (232)

Loans and borrowings (13,611) (15,087)

(20,127) (21,003)

Non-current liabilities

Vat payable (332) (242)

Other payables (688) (1000)

Provisions (5,517) (5,453)

Loans and borrowings (9,501) (12,221)

(16,038) (18,916)

Total liabilities (36,165) (39,919)

Equity

Share capital (4,267) (4,267)

Share premium (152,839) (152,839)

Merger reserve 282 282

Other reserves - -

Foreign currency translation reserve 57,642 51,412

Accumulated losses 36,974 50,207

Equity attributable to owners of the company (62,208) (55,205)

Total equity and liabilities (98,373) (95,124)

CONSOLIDATED STATEMENT OF CHANGES IN EQUITY

for the year ended 31 December 2022

Currency

Share Share Merger translation Other Accumulated Total

capital premium reserve reserve reserves losses equity

$000 $000 $000 $000 $000 $000 $000

At 1 January

2021 4,267 152,839 (282) (52,959) 333 (68,863) 35,335

Profit for the

year -- -- -- -- -- 18,323 18,323

Other

comprehensive

loss -- -- -- 1,547 -- -- 1,547

Total

comprehensive

loss -- -- -- 1,547 -- 18,323 19,870

Share options

exercised -- -- -- -- (333) 333 --

At 31 December

2021 4,267 152,839 (282) (51,412) -- (50,207) 55,205

At 1 January

2022 4,267 152,839 (282) (51,412) -- (50,207) 55,205

Profit for the

year -- -- -- -- -- 13,233 13,233

Other

comprehensive

income -- -- -- (6,230) -- -- (6,229)

Total

comprehensive

income -- -- -- (6,230) -- 13,233 7,004

Transfer to

reserves -- -- -- -- -- -- --

At 31 December

2022 4,267 152,839 (282) (57,642) -- (36,974) 62,208

CONSOLIDATED STATEMENT OF CASH FLOWS

for the year ended 31 December 2022

2022 2021

$000 $000

Cash flows from operating activities

Net cash flow from operating activities 12,234 6,797

Cash flows from investing activities

Acquisitions of property plant and equipment (8,948) (5,495)

Acquisition of intangible assets (240) (837)

Net cash flows from investing activities (9,188) (6,332)

Cash flows from financing activities

Interest paid (2,388) (2,411)

Loans received 11,025 6,356

Loans repaid (15,028) (7,985)

Net cash flows from financing activities (6,391) (4,040)

Net (decrease)/increase in cash and cash equivalents (3,345) (3,575)

Cash and cash equivalents at 1 January 3,593 7,154

Effect of exchange rate fluctuations on cash held (132) 14

Cash and cash equivalents at 31 December 116 3,593

NOTES TO THE FINANCIAL STATEMENTS

for the year ended 31 December 2022

1 General information

AltynGold Plc (the "Company") is a Company incorporated in

England and Wales under the Companies Act 2006. The financial

information set out above for the years ended 31 December 2022 and

31 December 2021 does not constitute statutory accounts as defined

in Section 434 of the Companies Act 2006, but is derived from those

accounts. Whilst the financial information included in this

announcement has been compiled in accordance with international

financial reporting standards adopted pursuant to Regulation (EC)

in conformity with the requirements of the Companies Act 2006, this

announcement itself does not contain sufficient financial

information to comply with IFRS. A copy of the statutory accounts

for 2021 has been delivered to the Registrar of Companies and those

for 2022 will be layed before the shareholders at the Annual

General Meeting. The full audited financial statements for the

years end 31 December 2022 and 31 December 2021 do comply with

IFRS.

2 Going concern

The Group increased turnover in the year to US$62m, generating

an EBITDA of US$21.9m (2021 US$26.4m) . The EBITDA was lower than

the prior year due to additional costs incurred in the period.

Additional amounts were paid in relation to government initiated

sponsorship of community projects, these amounted to US$3.6m,

together with fees paid in relation to project appraisals and

consultancy amounting to US$3m. These fees are not expected to be

at the same level in future years.

In summary the EBITDA was utilised in repayment of debt, falling

from US$27.4m to US$23.1m, the investment in capital equipment of

US$9m , and advances to suppliers to commence works at Sekisovskoye

resulted in an increase of working capital of US$8m. As the US$10m

Bond was repaid in December 2022, this resulted in a low cash

balance at the year end of US$116,000 (2021: US$3.6m).

The Board have reviewed the Group's forecast cash flows for the

period to June 2024, which include the capital and interest

repayments to be made in relation to the Group's borrowings. The

bank loans to fund the increase in production have been agreed with

capital repayment holidays to allow production to increase before

principal loan repayments are required. In addition the Company has

raised further funds amounting to US$10m by placing a bond on AIX

in April 2023 to provide additional working capital to fund

operations in its growth stage.

Capital and operating costs are based on approved budgets and

latest forecasts and development plans. Based on the Group's cash

flow forecasts, the Directors believe that the, net cash flows from

operations, and increased production based on projections of future

growth, are sufficient for the Company to achieve its current plans

and cash requirements including the repayment of loans which are

due for repayment in the period.

The Board have considered possible stress case scenarios that

they consider may be likely to impact on the Group's operations,

financial position and forecasts. Factors considered are factors

that may lower the production at the mine and possible impact on

the price of gold if this was to fall. From the analysis undertaken

the Board have concluded that Group will be able to continue to

trade by the careful management of its existing resources. The

stress tests included the following scenarios amongst others, a

fall in the gold price by 10% from current levels, a drop in

budgeted production by 10% or a combination of both factors

together. In each case the Group would not experience a cash

shortfall in either scenario. If required the Group would manage

its resources, reducing investment and managing its payables in

order to maintain liquidity.

The Board therefore considers it is appropriate to adopt the

going concern basis of accounting in preparing these financial

statements.

3 Revenue

The analysis of the Group's revenue for the year from continuing

operations is as follows:

2022 2021

$000 $000

Sale of gold and silver 61,053 50,031

Other sales 984 259

62,037 50,290

Included in revenues from sale of gold and silver are revenues

of US$61,053,000 (2021: US$50,031,000) which arose from sales of

precious metals to one customer based Kazakhstan. Other sales

amounted to US$984,000 (2021: US$259,000) and related to lease and

rental income.

4 Profit per ordinary share

The calculation of basic and diluted earnings per share from

continuing operations is based upon the retained profit from

continuing operations for the financial year of US$13.2m (2021:

US$18.3m).

The weighted average number of ordinary shares for calculating

the basic earnings per share in 2022 and 2021 is shown below.

2022 2021

No. No.

Basic 27,332,933 27,332,933

Diluted 27,332,933 27,332,933

5 Intangible assets

Teren-Sai Exploration and

geological data evaluation costs Total

Group US$000 US$000 US$000

Cost or valuation

At 1 January 2021 9,026 8,650 17,676

Additions -- 830 830

Amortisation capitalised -- 585 585

Currency translation (225) (240) (465)

At 31 December 2021 8,801 9,825 18,626

At 1 January 2022 8,801 9,825 18,626

Additions -- 240 240

Amortisation capitalised -- 541 541

Currency translation (589) (654) (1,243)

At 31 December 2022 8,212 9,952 18,164

Amortisation

At 1 January 2021 4,662 165 4,827

Amortisation charge 585 -- 585

Currency translation (125) (7) (132)

At 31 December 2021 5,122 158 5,280

At 1 January 2022 5,122 158 5,280

Amortisation charge 541 -- 541

Currency translation (343) (12) (355)

At 31 December 2022 5,320 146 5,466

Carrying amount

At 31 December 2022 2,892 9,806 12,698

At 31 December 2021 3,679 9,667 13,346

At 1 January 2021 4,364 8,485 12,849

The value of the geological data purchased is in the opinion of

the Directors the value that would have been incurred if the

drilling had been undertaken by a third party (or internally). The

Company has continued to develop the site with a CPR completed in

2019 on one of the fifteen target zones area 2, which includes 3

potential targets, and further exploration works in the other

areas. Full details are given in the mineral resources statement

included as part of the Annual Report. A two years extension to

continue to explore the area has been applied for, the approval is

expected to be received in H2 2023.

The directors consider that no impairment is required taking

into account the CPR results, exploration and planned production in

the future. The write off of the geological data over the period of

the licence to the end of the extended licence period.is

appropriate. After that period the costs amortised are capitalised

in line with the Company's accounting policy within the subsidiary

TOO GMK Altyn MM LLP, there are no impairment indicators.

The bank loan from Bank Center Credit is secured in the assets

of the Group.

.

6 Property, plant and equipment

Equipment, Plant,

Freehold fixtures machinery

Mining Land and and and Assets under

properties buildings fittings buildings construction Total

Group US$000 US$000 US$000 US$000 US$000 US$000

Cost or

valuation

At 1 January

2021 13,264 24,050 11,780 9,322 1,973 60,389

Additions 3,356 197 2,147 653 2,187 8,540

Disposals -- -- (655) (4) -- (659)

Transfers -- 1,441 -- -- (1,441) --

Transfer from

inventories -- -- -- -- 170 170

Currency

translation (611) (654) (203) (261) (67) (1,796)

At 31

December

2021 16,009 25,034 13,069 9,710 2,822 66,644

At 1 January

2022 16,009 25,034 13,069 9,710 2,822 66,644

Additions 3,936 42 837 6 4,295 9,116

Disposals -- -- (476) (33) -- (509)

Transfers -- 4,387 187 65 (4,639) --

Transfer from

inventories -- -- -- -- (16) (16)

Currency

translation (1,584) (1,673) (929) (674) (183) (5,043)

At 31

December

2022 18,361 27,790 12,688 9,074 2,279 70,192

Depreciation

At 1 January

2021 2,869 11,371 9,182 4,875 -- 28,297

Charge for

year 699 2,188 817 782 -- 4,486

Eliminated on

disposal -- (2) (655) (4) -- (661)

Currency

translation (218) (238) (239) (133) -- (828)

At 31

December

2021 3,350 13,319 9,105 5,520 -- 31,294

At 1 January

2022 3,350 13,319 9,105 5,520 -- 31,294

Charge for

the year 800 2,128 893 770 -- 4,591

Eliminated on

disposal -- -- (464) (33) -- (497)

Currency

translation (227) (986) (590) (368) -- (2,171)

At 31

December

2022 3,923 14,461 8,944 5,889 -- 33,217

Carrying

amount

At 31

December

2022 14,438 13,329 3,744 3,185 2,279 36,975

At 31

December

2021 12,659 11,715 3,964 4,190 2,822 35,350

At 1 January

2021 10,395 12,679 2,598 4,447 1,973 32,092

Capitalised cost of mining property are amortised over the life

of the licence from commencement of production on a unit of

production basis. This basis uses the ratio of production in the

period compared to the mineral reserves at the end of the period.

Mineral reserves estimates are based on a number of underlying

assumptions, which are inherently uncertain. Mineral reserves

estimates take into consideration estimates by independent

geological consultants. However, the amount of mineral that will

ultimately be recovered cannot be known until the end of the life

of the mine.

Any changes in reserve estimates are, for amortisation purposes,

treated on a prospective basis. The recovery of the capitalised

cost of the Company's property, plant and equipment is dependent on

the development of the underground mine.

The Directors are required to consider whether the non-current

assets comprising, mineral properties, plant and equipment have

suffered any impairment. The recoverable amount is determined based

on value in use calculations. The use of this method requires the

estimation of future cash flows and the choice of a discount rate

in order to calculate the present value of the cash flows. The

directors considered entity specific factors such as available

finance, cost of production, grades achievable, and sales price.

The directors have concluded that no adjustment is required for

impairment.

The bank loan from Bank Center Credit is secured on the assets

of the Group.

View source version on businesswire.com:

https://www.businesswire.com/news/home/20230505005209/en/

CONTACT:

AltynGold Plc

SOURCE: AltynGold Plc

Copyright Business Wire 2023

(END) Dow Jones Newswires

May 05, 2023 08:19 ET (12:19 GMT)

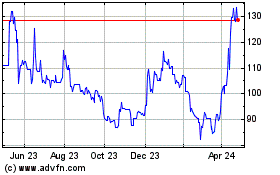

Altyngold (LSE:ALTN)

Historical Stock Chart

From Feb 2025 to Mar 2025

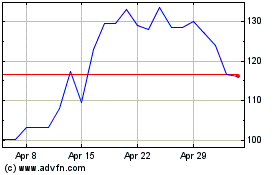

Altyngold (LSE:ALTN)

Historical Stock Chart

From Mar 2024 to Mar 2025