Arbuthnot Banking 2022 Pretax Profit Rose on BoE's Rate Increases

30 March 2023 - 5:56PM

Dow Jones News

By Christian Moess Laursen

Arbuthnot Banking Group PLC said Thursday that its pretax profit

and net interest income rose significantly in 2022 thanks to the

Bank of England's rate increases, which are expected to further

boost revenue in 2023.

The private and commercial bank said its pretax profit rose to

20.0 million pounds ($24.6 million) in 2022 from GBP4.6 million in

2021, helped mainly by the increases of the Bank of England's base

rate during the year.

Net interest income increased to GBP99.1 million from GBP64.1

million.

The bank's assets under management decreased slightly to GBP1.33

billion from GBP1.36 billion, despite strong gross inflows of

GBP209 million, representing 16% of assets under management at the

start of the year, and an increase of 21% on year.

However, market turbulence from the war in Ukraine, along with

domestic inflationary pressure resulted in adverse market

performance, offsetting the net inflows during the year, the bank

said.

The bank's CET1 ratio as of Dec. 31 was 11.6% compared with

12.3% a year prior.

Looking ahead, the bank said revenue will benefit from further

rate increases in 2023, but that the cost-of-living crisis will

have an impact on the bank's cost base and the ability of borrowers

to maintain payments of loan facilities.

Arbuthnot said its board is recommending a final dividend of 25

pence a share, which is an increase from 22 pence a share in

2021.

Write to Christian Moess Laursen at christian.moess@wsj.com

(END) Dow Jones Newswires

March 30, 2023 02:41 ET (06:41 GMT)

Copyright (c) 2023 Dow Jones & Company, Inc.

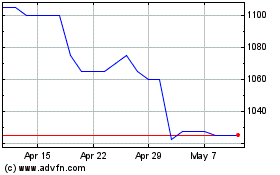

Arbuthnot Banking (LSE:ARBB)

Historical Stock Chart

From May 2024 to Jun 2024

Arbuthnot Banking (LSE:ARBB)

Historical Stock Chart

From Jun 2023 to Jun 2024