TIDMARC

RNS Number : 1957R

Arcontech Group PLC

27 February 2019

ARCONTECH GROUP PLC

("Arcontech" or the "Group")

INTERIM RESULTS FOR THE SIX MONTHSED 31 DECEMBER 2018

Arcontech (AIM: ARC), the provider of products and services for

real-time financial market data processing and trading, is pleased

to report its unaudited results for the six months ended 31

December 2018.

Highlights:

-- Turnover increased by 13% to GBP1,371,107 (six months ended 31 December 2017: GBP1,213,776)

-- Profit before tax increased by 91% to GBP452,756 (six months

ended 31 December 2017: GBP237,581)

-- Adjusted profit before tax (before release of accruals for

administrative costs in respect of prior years) increased by 41% to

GBP335,470 (six months ended 31 December 2017: GBP237,581)

-- Annual run-rate of recurring revenues at 31 December 2018

increased by 14% to GBP2.78 million (at 31 December 2017: GBP2.43

million).

-- Cash of GBP3,231,830 as at 31 December 2018 (31 December 2017: GBP2,663,935)

-- Trading in line and on track to meet management's full year expectations

Richard Last, Chairman of Arcontech Group, said:

"The Board is pleased with Arcontech's growth in revenue and

adjusted profit before tax. Cash at the half year was GBP567,895

higher than the previous half year, further strengthening the

Balance Sheet. We have continued to invest in product development

to maintain and enhance our propositions to the market. Our sales

cycle is often long and unpredictable however we remain positive

about the Group's long term prospects and the Board expects results

for the full year to be in line with expectations."

Enquiries:

Arcontech Group plc 020 7256 2300

Richard Last, Chairman and Non-Executive

Director

Matthew Jeffs, Chief Executive

finnCap Ltd (Nomad & Broker) 020 7220 0500

Carl Holmes/Simon Hicks

To access more information on the Group please visit:

www.arcontech.com

The information communicated in this announcement contains

inside information for the purposes of Article 7 of the Market

Abuse Regulation (EU) No. 596/2014.

The interim report will only be available to view online

enabling the Group to communicate in a more environmentally

friendly and cost-effective manner.

Chairman's Statement

I am pleased to report that Arcontech has continued to grow

profits in the six-month period ended 31 December 2018, reporting

an adjusted profit before tax of GBP335,470 (six months ended 31

December 2017: GBP237,581) an increase of 41%. Turnover increased

by 13% to GBP1,371,107 compared to the corresponding six-month

period in 2017 where turnover amounted to GBP1,213,776. This

reflects the growth in recurring annual licence fees, primarily

from existing customers, which on an annualised basis amounted to

GBP2.78 million at 31 December 2018, compared to GBP2.43 million as

at 31 December 2017. Fully diluted earnings per share were 3.72

pence per share compared to 2.36 pence per share for the

corresponding period last year.

During the half year to 31 December 2018 Arcontech's increase in

revenues reflects the full year effect of sales made during the

year to 30 June 2018 and the impact of selling more products into

the existing customer base. We are continuing to trial our Desktop

software solution and have made a number of enhancements following

positive comments from customers and prospective users. Usage has

increased with existing customers by approximately 75% to 70. We

also continue to see demand for our Excelerator product with

additional users to an approximate value of GBP225,000-pa being

deployed by two existing clients.

For the server-side of the business our MVCS (Multi-Vendor

Contribution System) and Real-time Cache continue to make a

significant contribution to group revenue. We have continued to

invest in the development and enhancement of these products to

further optimise their efficiency whilst enhancing the customer

experience. This work helps integrate the products further within

the client environment, however, new sales in this area are

significant projects in themselves and although we have a number of

qualified prospects, none have contracted in the half year. A

further benefit of that work is that both the MVCS and our

Real-time Cache are increasingly seen as preferable alternatives to

competitive offerings which also help our pipeline.

Financing

The Group has a strong financial position with cash balances at

the 31 December 2018 of GBP3,231,830 (31 December 2017

GBP2,663,935), an increase of GBP567,895, providing a sound basis

for continued investment in the business. The small increase in

cash between 30 June 2018 and 31 December 2018 principally reflects

timing differences in relation to advance payments.

Dividend

No interim dividend is proposed to be paid in respect of the

half year, although the Board does expect to continue its policy of

paying a dividend following the announcement of its full year

results.

Employees

I should like to thank our employees and directors for their

continued hard work and dedication, which I know is appreciated by

our customers and shareholders alike.

Outlook

Arcontech has a sound business base supported by a high level of

recurring revenues and a strong balance sheet. Our business is

international with customers operating in the UK, Europe, the USA,

Hong Kong and Singapore. As such it is the Board's view that we are

unlikely to be adversely affected by Brexit. We propose to maintain

ongoing investment in product development and enhancement, and as a

result of working with existing customers we are delivering world

class solutions which provide cost savings and competitive

advantage. As we repeatedly note in our statements to shareholders

we remain mindful of the long and unpredictable sales cycles we

often face and the challenges this brings in predicting the timing

of contract wins. Nevertheless, the Board views the long term

future for the business with optimism and in the short term expects

results for the full year to be in line with expectations.

Richard Last

Chairman and Non-Executive Director

GROUP INCOME STATEMENT AND STATEMENT OF COMPREHENSIVE INCOME

Note Six months Six months Year ended

ended 31 ended 31 30 June

December December

2018 2017 2018

(unaudited) (unaudited) (audited)

GBP GBP GBP

Revenue 1,371,107 1,213,776 2,519,699

Administrative costs (931,902) (982,528) (1,958,176)

Operating profit 4 439,205 231,248 561,523

Finance income 13,551 6,333 14,109

Profit before taxation 452,756 237,581 575,632

Taxation 6 45,318 69,452 339,452

Profit for the period

after tax 498,074 307,033 915,084

Total comprehensive income 498,074 307,033 915,084

Profit per share (basic) 3.77p 2.42p 7.14p

Adjusted* Profit per share

(basic) 2.88p 2.42p 6.94p

Profit per share (diluted) 3.72p 2.36p 7.09p

Adjusted* Profit per share

(diluted) 2.84p 2.36p 6.90p

*Adjusted for release of accruals for administrative expenses in

respect of prior years

All of the results relate to continuing operations.

GROUP BALANCE SHEET

31 December 31 December 30 June

2018 2017

(unaudited) (unaudited) 2018

(audited)

GBP GBP GBP

Non-current assets

Goodwill 1,715,153 1,715,153 1,715,153

Property, plant and equipment 11,398 24,834 17,941

Deferred tax asset 270,000 - 270,000

Trade and other receivables 141,750 141,750 141,750

Total non-current assets 2,138,301 1,881,737 2,144,844

Current assets

Trade and other receivables 320,608 624,781 310,123

Cash and cash equivalents 3,231,830 2,663,935 3,210,058

Total current assets 3,552,438 3,288,716 3,520,181

Current liabilities

Trade and other payables (769,105) (865,561) (863,156)

Deferred income (801,409) (1,233,990) (1,026,119)

Total current liabilities (1,570,514) (2,099,251) (1,889,275)

Net current assets 1,981,924 1,189,465 1,630,906

Net assets 4,120,225 3,071,202 3,775,750

Equity

Share capital 1,651,314 1,600,375 1,651,314

Share premium account 56,381 24,881 56,381

Share option reserve 74,101 225,591 56,366

Retained earnings 2,338,429 1,220,355 2,011,689

4,120,225 3,071,202 3,775,750

GROUP CASH FLOW STATEMENT

Note Six months Six months Year ended

ended 31 ended 31 30 June

December December

2018 2017 2018

(unaudited) (unaudited) (audited)

GBP GBP GBP

Net cash generated from operating

activities 9 181,880 94,113 552,111

Investing activities

Interest received 13,551 6,333 14,109

Purchases of plant and equipment (2,325) - (2,090)

Net cash generated from investing

activities 11,226 6,333 12,019

------------ ------------ ---------------

Financing activities

Issue of shares - 52,778 135,217

Dividends paid (171,334) (125,760) (125,760)

Net cash (used in)/generated

from financing activities (171,334) (72,982) 9,457

------------ ------------ ---------------

Net increase in cash and cash

equivalents 21,772 27,464 573,587

Cash and cash equivalents

at beginning of period 3,210,058 2,636,471 2,636,471

Cash and cash equivalents

at end of period 3,231,830 2,663,935 3,210,058

============ ============ ===============

GROUP STATEMENT OF CHANGES IN EQUITY

Share Share Share-based Retained Total

capital premium paymentsreserve earnings

GBP GBP GBP GBP GBP

At 1 July 2017 1,562,676 9,802 188,425 1,039,082 2,799,985

Total

comprehensive

income for the

period - - - 307,033 307,033

Issue of shares 37,699 15,079 - - 52,778

Dividends paid - - - (125,760) (125,760)

Share-based

payments - - 37,166 - 37,166

At 31 December

2017 1,600,375 24,881 225,591 1,220,355 3,071,202

----------------- ----------------- -------------------- ------------------ ------------------- -----------------

Total

comprehensive

income for the

period - - - 608,051 608,051

Issue of shares 50,939 31,500 - - 82,439

Share-based

payments - - 14,058 - 14,058

Realisation of

share option

reserve - - (183,283) 183,283 -

At 30 June 2018 1,651,314 56,381 56,366 2,011,689 3,775,750

----------------- ----------------- -------------------- ------------------ ------------------- -----------------

Total

comprehensive

income for the

period - - - 498,074 498,074

Dividends paid - - - (171,334) (171,334)

Share-based

payments - - 17,735 - 17,735

At 31 December

2018 1,651,314 56,381 74,101 2,338,429 4,120,225

----------------- ----------------- -------------------- ------------------ ------------------- -----------------

NOTES TO THE FINANCIAL INFORMATION

1. The figures for the six months ended 31 December 2018 and 31

December 2017 are unaudited and do not constitute statutory

accounts. The interim results have been prepared using accounting

policies which are consistent with International Financial

Reporting Standards as adopted by the European Union and are

expected to be adopted in the next annual accounts.

2. The financial information for the year ended 30 June 2018 set

out in this interim report does not comprise the Group's statutory

accounts as defined in section 434 of the Companies Act 2006. The

statutory accounts for the year ended 30 June 2018, which were

prepared under International Financial Reporting Standards (IFRS)

as adopted for use in the EU, applied in accordance with the

provisions of the Companies Act 2006, have been delivered to the

Registrar of Companies. The auditors reported on those accounts;

their report was unqualified and did not contain a statement under

either Section 498(2) or Section 498(3) of the Companies Act 2006

and did not include references to any matters to which the auditor

drew attention by way of emphasis.

3. Copies of this statement are available from the Company

Secretary at the Company's registered office at 1(st) Floor 11-21

Paul Street, London, EC2A 4JU or from the Company's website at

www.arcontech.com.

4. Operating profit is stated after release of accruals for

administrative expenses in respect of prior years of GBP117,286 (31

December 2017: Nil; 30 June 2018: GBP25,500).

5. Earnings per share have been calculated based on the profit

after tax and the weighted average number of shares in issue during

the half year ended 31 December 2018 of 13,210,510 (31 December

2017: 12,675,498; 30 June 2018: 12,396,220).

The number of dilutive shares under option at 31 December 2018

was 189,343 (31 December 2017: 330,023; 30 June 2018: 77,699). The

calculation of diluted earnings per share assumes conversion of all

potentially dilutive ordinary shares, all of which arise from share

options. A calculation is done to determine the number of shares

that could have been acquired at the average market price during

the period, based upon the issue price of the outstanding share

options including future charges to be recognised under the

share-based payment arrangements.

6. Taxation is based on the unaudited results and provision has

been estimated at the rate applicable to the Company at the time of

this statement and expected to be applied to the total annual

earnings. No corporation tax has been charged in the period as any

liability has been offset against tax losses brought forward from

prior years. The tax credit represents the cash recovery of

Research & Development tax credits during the period.

7. A final dividend in respect of the year ended 30 June 2018 of

1.30 pence per share (2017 1.0 pence per share) was paid on 4

October 2018.

8. The Directors have elected not to apply IAS34 Interim financial reporting.

9. Net cash generated from operations

Six months Six months Year ended

ended 31 ended 31 30 June

December December

2018 2017 2018

(unaudited) (unaudited) (audited)

GBP GBP GBP

Operating profit 439,205 231,248 561,523

Depreciation charge 8,868 8,991 17,974

Non cash share option charges 17,735 37,166 51,224

Increase in trade and other

receivables (10,485) (379,833) (134,626)

(Decrease)/increase in trade

and other payables (318,761) 196,541 (13,436)

Tax recovered 45,318 - 69,452

Cash generated from operations 181,880 94,113 552,111

This information is provided by RNS, the news service of the

London Stock Exchange. RNS is approved by the Financial Conduct

Authority to act as a Primary Information Provider in the United

Kingdom. Terms and conditions relating to the use and distribution

of this information may apply. For further information, please

contact rns@lseg.com or visit www.rns.com.

END

IR LLFLDFIIRFIA

(END) Dow Jones Newswires

February 27, 2019 02:00 ET (07:00 GMT)

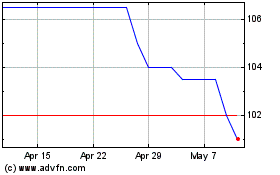

Arcontech (LSE:ARC)

Historical Stock Chart

From Jan 2025 to Feb 2025

Arcontech (LSE:ARC)

Historical Stock Chart

From Feb 2024 to Feb 2025