Ashmore Group PLC Trading Statement (0923L)

17 April 2018 - 4:00PM

UK Regulatory

TIDMASHM

RNS Number : 0923L

Ashmore Group PLC

17 April 2018

Ashmore Group plc

+0700 17 April 2018

THIRD QUARTER ASSETS UNDER MANAGEMENT STATEMENT

Ashmore Group plc ("Ashmore", "the Group"), the specialist

Emerging Markets asset manager, announces the following update to

its assets under management ("AuM") in respect of the quarter ended

31 March 2018.

Assets under management

Actual Estimated

31 December 31 March

2017 2018 Movement pre-reclassification(1)

Theme (US$ billion) (US$ billion) (%)

---------------- --------------- --------------- ---------------------------------

External debt 15.0 15.3 +1%

---------------- --------------- --------------- ---------------------------------

Local currency 14.9 17.7 +19%

---------------- --------------- --------------- ---------------------------------

Corporate

debt 7.8 9.4 +21%

---------------- --------------- --------------- ---------------------------------

Blended debt 18.8 20.7 +11%

---------------- --------------- --------------- ---------------------------------

Equities 3.9 4.3 +10%

---------------- --------------- --------------- ---------------------------------

Alternatives 1.6 1.5 -6%

---------------- --------------- --------------- ---------------------------------

Multi-asset 1.2 1.2 -

---------------- --------------- --------------- ---------------------------------

Overlay /

liquidity 6.3 6.4 +2%

---------------- --------------- --------------- ---------------------------------

Total 69.5 76.5 +10%

---------------- --------------- --------------- ---------------------------------

Assets under management increased by US$7.0 billion during the

period, with net inflows of US$6.4 billion and positive investment

performance of US$0.6 billion.

Continued investor demand for Emerging Markets assets delivered

net inflows in each of the fixed income and equities investment

themes during the quarter, resulting in the strongest quarter for

gross and net flows since June 2013. The flows continued to be

broad-based by investor type, including significant top-ups from a

range of clients. Net flows were strongest in the local currency,

blended debt and corporate debt themes, and also positive in

equities, external debt and overlay/liquidity.

Ashmore's active investment processes delivered positive

investment performance despite more volatile market conditions,

particularly in February. Local currency and blended debt

portfolios delivered strong levels of absolute and relative

performance while the US dollar-denominated external debt and

corporate debt themes performed in line with slightly lower market

levels. Performance in the equities theme was marginally negative

overall but with continued outperformance in the specialist

products such as frontier markets.

Mark Coombs, Chief Executive Officer, Ashmore Group plc,

commented:

"This quarter has seen particularly strong net inflows across

the range of the Group's products. Over the medium to longer term,

positive investor sentiment towards Emerging Markets will continue

to be supported by attractive valuations, the need for

institutional investors to address underweight allocations, better

earnings and credit fundamentals, and relative currency strength

arising from further US dollar weakness.

"Significantly, the increased market volatility experienced over

the past three months has had little effect on the fundamental

drivers of returns in Emerging Markets and, as expected, both

Emerging Markets fixed income and equity markets have outperformed.

Volatility that originates in the developed world typically leads

to Emerging Markets assets being mispriced, presenting attractive

investment opportunities for Ashmore with its specialist, active

management approach and a focus on value."

Notes

1. During the quarter, assets totalling US$0.2 billion were

reclassified from blended debt to external debt as a result of

changes to benchmarks and investment guidelines. Including the

reclassification, external debt AuM increased by 2% and blended

debt AuM increased by 10% over the three months.

Ashmore's Legal Entity Identifier (LEI) is

549300U3L59WB4YI2X12.

For further information please contact:

Ashmore Group plc

Paul Measday

Investor Relations +44 (0)20 3077 6278

FTI Consulting

Andrew Walton +44 (0)20 3727 1514

Laura Ewart +44 (0)20 3727 1160

This information is provided by RNS

The company news service from the London Stock Exchange

END

TSTLLFLDSSIRLIT

(END) Dow Jones Newswires

April 17, 2018 02:00 ET (06:00 GMT)

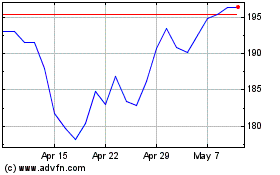

Ashmore (LSE:ASHM)

Historical Stock Chart

From Mar 2025 to Apr 2025

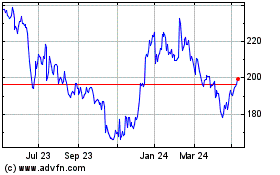

Ashmore (LSE:ASHM)

Historical Stock Chart

From Apr 2024 to Apr 2025