TIDMATM

RNS Number : 2015Q

AfriTin Mining Ltd

26 October 2021

26 October 2021

AfriTin Mining Limited

("AfriTin" or the "Company")

Exploration and Development Programme

AfriTin Mining Limited (AIM: ATM), an African tech-metals mining

company with its flagship asset, the Uis Tin Mine ("Uis") in

Namibia, is pleased to announce that it has commenced exploration

programmes designed to expand the size of the current

JORC-compliant resource at Uis Mine beyond the current V1 and V2

pegmatites and to evaluate several highly prospective exploration

targets.

Highlights:

-- Commencement of a drilling programme to potentially increase

the current lithium and tantalum inferred resource and confidence

level for potentially significant by-product elements;

-- Expansion of the initial confirmatory drilling programme to

potentially expand the historical resource and reserve estimates at

Uis;

-- Confirmatory sampling and drilling programmes at the historic

Brandberg West tin and tungsten mine;

-- High resolution mapping and geochemical characterisation of

lithium bearing pegmatites at historic Nai-Nais mine and licence

area; and

-- Geological modelling of historical information for the B1 and

C1 pegmatites on ML129, close to Uis

Link to Figures: https://bit.ly/3jzFWEk

Anthony Viljoen CEO commented:

"AfriTin has displayed its ability to bring mineral deposits

into production by declaring an ore reserve and bringing the Phase

1 pilot plant into production at the Uis mine site. This ore

reserve, however, represents a small portion of the historically

drilled area in the mining licence property and we believe that the

extended Uis project area can expand the size of the operation as

well as the Company's footprint within the region. The exploration

programme has been designed to validate the historical reserves and

upgrade them to meet modern JORC requirements whilst at the same

time it will look to increase the confidence levels of the exciting

lithium and tantalum by-product potential. The Company's other

licence areas across the region encompass other historical mining

areas and the potential for these to deliver sustained long-term

value by reopening a global significant tech metals province for

AfriTin, remains a high priority."

AfriTin is commencing a detailed exploration and development

programme for its existing and new licence areas, which currently

span 62,949 Ha (Figure 1). The exploration programme has been split

into various phases that will be initiated in the coming weeks and

run over a period of approximately three years, with a focus on the

high priority targets. AfriTin has identified cassiterite

mineralisation contained in over 180 pegmatites within 5km of the

processing plant at Uis. The programme has been designed to

optimise the near-term value of the current mining operations, as

well as assess the additional licence areas for the resumption of

commercial operations at the various licence areas. The programme

has been split into five areas that are prioritized as

follows:-

Priority 1

This programme has already commenced, with the objective being

to expand the confidence level of the existing lithium and tantalum

resources within the V1/V2 orebody (Figure 2). The programme is

expected to run for a period of 12 months from the completion of

mobilisation and is expected to comprise approximately 8,000 metres

of drilling. The intention is to improve the classification of the

inferred lithium and tantalum resources to indicated and measured

JORC-compliant categories, in order to increase confidence in

mineral concentration and production estimation modelling, that

will eventually lead to their incorporation into an overall mineral

reserve estimate.

Priority 2

This programme aims to expand the historical resource over the

Uis licence through a confirmatory drilling programme over other

pegmatite outcrops with existing drill holes. The Company

previously validated 141 historical holes by drilling 26

confirmatory drill holes spaced throughout the orebody. More than

600 additional drill holes remain over the Uis mining area. The

validation of these remaining historical holes will require

approximately 19,000 meters of drilling, to be undertaken over a

period of 24 months.

Priority 3

The historic Brandberg West Mine provides a compelling

opportunity to expand the Company's tin and tungsten exploration

and production footprint within the Erongo metallogenic province.

The objectives of this programme are to verify and confirm the

historical information declared when the previous owners, Gold

Fields, mined the deposit, achieving peak production in 1978 when

they produced 1,249 tonnes of tin and tungsten concentrate. To

achieve these objectives, the Company will initially undertake a

mapping and sampling programme to identify mineralisation

extensions within and along strike of the historical Brandberg West

mine. The results will be combined with existing datasets to

delineate a drill programme to evaluate the continuity of

mineralisation along strike and at depth. The programme will

initially comprise approximately 3,000 metres of drilling and is

expected to be finalised within 10 months of commencement. Multiple

additional prospective tin and tungsten targets within the license

area (EPL 5445) have been identified for investigation while the

drill programme is underway.

Priority 4

This programme focuses on the further evaluation of the Nai-Nais

mining license (ML133) which incorporates the historical Tin Tan

Mine that produced tin until the late 1980's. Sampling by AfriTin

in 2017 yielded the highest lithium grades (up to 3.9% Li(2) O) yet

assayed in the district (see the Company's Admission Document).

This programme aims to identify the areas of greatest mineral

potential for tin, tantalum and lithium by undertaking high

resolution geological mapping and geochemical characterisation

programmes within the license. This programme will require eight

months for the field work to be executed and geochemical analysis

finalised, with a view to implementation of a drilling programme

and ultimately the production of a maiden resource.

Priority 5

This programme involves the investigation of historical

information on license ML129 which contains the B1 and C1

pegmatites, these have previously been reported to contain

significant tantalum grades as well as secondary tin mineralisation

(see the Company's Admission Document). An orebody modelling

initiative will be undertaken to incorporate historical drill

datasets over the B1 and C1 pegmatites - the resulting model will

be evaluated for economic potential and inform future work

programmes in the license area. Data acquisition, orebody modelling

and evaluation is expected to yield results within four months of

commencement.

The exploration priorities detailed above will provide a deeper

understanding of the mineral potential within the licence areas

held by AfriTin in Namibia. The advancement of these programmes

will contribute to expanding the Company's metal inventory,

diversifying production and consolidating its tech metal

exposure.

AfriTin Mining Limited +27 (11) 268 6555

Anthony Viljoen, CEO

Nominated Adviser +44 (0) 207 220 1666

WH Ireland Limited

Katy Mitchell

Corporate Advisor and Joint Broker

H&P Advisory Limited

Andrew Chubb

Jay Ashfield

Nilesh Patel +44 (0) 20 7907 8500

Turner Pope Investments

Andy Thacker

James Pope +44 (0) 20 3657 0050

Tavistock Financial PR (United

Kingdom) +44 (0) 207 920 3150

Jos Simson

Nick Elwes

About AfriTin Mining Limited

Notes to Editors

AfriTin Mining Limited is the first pure tin company listed in

London and its vision is to create a portfolio of globally

significant, conflict-free, tin-producing assets. The Company's

flagship asset is the Uis Tin Mine in Namibia, formerly the world's

largest hard-rock open cast tin mine.

AfriTin is managed by an experienced board of directors and

management team with a current strategy to ramp-up production at

the Uis Tin Mine in Namibia to 10,000 tonnes of concentrate in a

Phase 2 expansion, having reached Phase 1 commercial production in

2020. The Company strives to capitalise on the solid supply/demand

fundamentals of tin by developing a critical mass of tin resource

inventory, achieving production in the near term and further

scaling production by consolidating tin assets in Africa.

This information is provided by RNS, the news service of the

London Stock Exchange. RNS is approved by the Financial Conduct

Authority to act as a Primary Information Provider in the United

Kingdom. Terms and conditions relating to the use and distribution

of this information may apply. For further information, please

contact rns@lseg.com or visit www.rns.com.

RNS may use your IP address to confirm compliance with the terms

and conditions, to analyse how you engage with the information

contained in this communication, and to share such analysis on an

anonymised basis with others as part of our commercial services.

For further information about how RNS and the London Stock Exchange

use the personal data you provide us, please see our Privacy

Policy.

END

MSCKELFLFBLEFBV

(END) Dow Jones Newswires

October 26, 2021 02:00 ET (06:00 GMT)

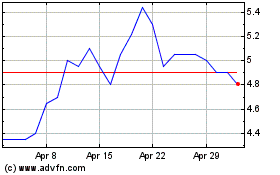

Andrada Mining (LSE:ATM)

Historical Stock Chart

From Jan 2025 to Feb 2025

Andrada Mining (LSE:ATM)

Historical Stock Chart

From Feb 2024 to Feb 2025