Immediate Acquisition PLC Sale of Sprift Loan and Notice of Final Results (8908N)

07 June 2022 - 1:42AM

UK Regulatory

TIDMIME

RNS Number : 8908N

Immediate Acquisition PLC

06 June 2022

THIS ANNOUNCEMENT CONTAINS INSIDE INFORMATION AS STIPULATED

UNDER THE UK VERSION OF THE MARKET ABUSE REGULATION NO 596/2014

WHICH IS PART OF ENGLISH LAW BY VIRTUE OF THE EUROPEAN (WITHDRAWAL)

ACT 2018, AS AMENDED. ON PUBLICATION OF THIS ANNOUNCEMENT VIA A

REGULATORY INFORMATION SERVICE, THIS INFORMATION IS CONSIDERED TO

BE IN THE PUBLIC DOMAIN.

6 June 2022

Immediate Acquisition Plc

("IME" or "the Company")

Sale of Sprift Loan and Notice of Final Results

The Company is pleased to announce the sale of its loan to

Sprift Technologies Limited (the "Sprift Loan"), at face value, for

a total cash consideration of GBP1.05 million to Mark Horrocks,

Non-Executive Director of IME. The sale of the Sprift Loan

therefore constitutes a related party transaction pursuant to AIM

Rule 13, the independent directors (being Tim Hipperson and Simon

Leathers), having consulted with the Company's nominated adviser,

believe that the terms of the sale of the Sprift Loan are fair and

reasonable insofar as shareholders are concerned.

Notice of Final Results

The Company also announces that it anticipates its Final Results

for the year ended 31 December 2021 will be published later this

week.

For further information please contact:

Immediate Acquisition Plc Tel: +44 (0) 203 515 0233

Tim Hipperson, Non-executive Chairman

Simon Leathers, Non-executive Director

SPARK Advisory Partners Limited (Nomad) Tel: +44 (0) 203 368 3550

Mark Brady

Neil Baldwin

SP Angel Corporate Finance LLP (Broker) Tel: +44 (0) 207 470 0470

Abigail Wayne

Buchanan Communications Tel: +44 (0) 207 466 5000

Chris Lane

Immediate Acquisition Plc

Following the disposal of Immedia Broadcast Limited, announced

21 April 2022, the Company became an AIM Rule 15 cash shell and, as

such, is required to make an acquisition or acquisitions which

constitute(s) a reverse takeover under AIM Rule 14 (including

seeking re-admission as an investing company (as defined under the

AIM Rules)) on or before the date falling six months from

completion of the disposal or be re-admitted to trading on AIM as

an investing company under the AIM Rules (which requires the

raising of at least GBP6 million), failing which the Company's

Ordinary Shares would then be suspended from trading on AIM

pursuant to AIM Rule 40. Admission to trading on AIM would be

cancelled six months from the date of suspension should the reason

for the suspension not be rectified during that period.

Any failure in completing an acquisition or acquisitions which

constitute(s) a reverse takeover under AIM Rule 14, including

seeking re-admission as an investing company (as defined under the

AIM Rules), will result in the cancellation of the Company's

Ordinary Shares from trading on AIM.

This information is provided by RNS, the news service of the

London Stock Exchange. RNS is approved by the Financial Conduct

Authority to act as a Primary Information Provider in the United

Kingdom. Terms and conditions relating to the use and distribution

of this information may apply. For further information, please

contact rns@lseg.com or visit www.rns.com.

RNS may use your IP address to confirm compliance with the terms

and conditions, to analyse how you engage with the information

contained in this communication, and to share such analysis on an

anonymised basis with others as part of our commercial services.

For further information about how RNS and the London Stock Exchange

use the personal data you provide us, please see our Privacy

Policy.

END

MSCFLFSERLIRIIF

(END) Dow Jones Newswires

June 06, 2022 11:42 ET (15:42 GMT)

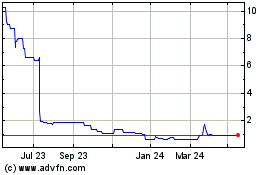

Fiinu (LSE:BANK)

Historical Stock Chart

From Oct 2024 to Nov 2024

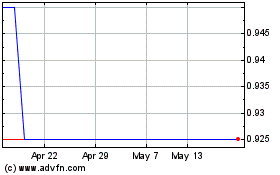

Fiinu (LSE:BANK)

Historical Stock Chart

From Nov 2023 to Nov 2024