TIDMCASP

RNS Number : 6208A

Caspian Sunrise plc

26 September 2022

The following amendment has been made to the Interim results for

six months ended 30 June 2022 announcement released on 26 September

2022 at 07:00 under RNS No 5365A.

Under the subtitle "Acquisition Process" the current version

refers to "the consideration is expected to be payable solely from

production from BNG".

It has been replaced with "solely from production from Block

8".

All other details remain unchanged.

The full amended text is shown below:

Caspian Sunrise PLC ("Caspian Sunrise" or the "Company")

Interim results for the six months ended 30 June 2022, planned

acquisition & dividend update

Highlights

Non-financial

-- Operational - (new wells drilled at the end of the period) 2022: 2 (2021: 2)

-- Aggregate production in the period (bbls) up 81% - 2022: 414,048 (2021: 228,387)

-- Post period end production up 101% at 2,264 bopd (2021: 1,124 bopd)**

Financial

-- Revenue up 155% at $25.6 million (2021: $10.1 million) and more than 2021 as a whole

-- Gross Profit up 145% at $18.9 million (2021: $7.7 million)

-- Operating profit up 168% at $10.3 million (2021: $3.9 million)

-- Profit before tax up 193% at $10.0 million (2021: $3.4 million)

-- Profit after tax up 211% at $7.3 million (2021: $2.4 million)

-- Net current liabilities down 41% at $13.1 million (2021: $22.6 million)

-- Cash up $4.7 million at $5.0 million (2021: $0.3 million)

-- Total assets down 11% at $112.5 million (2021: $126.1 million)

** based on production at end August 2022 & and August 2021

The Directors are pleased to present the unaudited results for

the six months ended 30 June 2022, together with details of a

significant asset acquisition and an update on the timing of first

dividends.

Introduction

Despite losing between $30 and $35 per barrel on export sales

since March 2022 as a result of the war in the Ukraine these

results for the six months ended 30 June 2022 are comfortably the

best in the Group's history.

Results

Revenue

Revenue for the period at $25.6 million was approximately 155%

ahead of the corresponding period in 2021 (2021: $10.1) and greater

than for 2021 as a whole. The increase comprises an 81% increase in

the volume of oil produced and a 39% increase in the gross price at

which that oil was sold.

Production volumes

In the period under review 414,048 barrels of oil were produced

(2021: 228,387) at an average of 2,288 bopd (2021: 1,262). This

increased production included contributions from Wells 154 and 153,

which were not operational in the corresponding period in 2020.

Prices achieved

All the oil produced came from the shallow structures at BNG for

which we have long term full production licences allowing oil to be

sold by reference to international prices. However, under Kazakh

regulations a proportion of the oil produced under export licences

must be sold on the domestic market.

In the period under review approximately 42% of oil sold was at

domestic prices averaging approximately $25 per barrel.

Approximately 55% of the oil sold in the period was at

international prices, which for most of the period under review

were after significant discounts for "Urals Oil" of between $30 and

$35 per barrel. The average price achieved for these export sales

was approximately $86 per barrel compared to average Brent prices

in the period of $120 and beyond.

A development towards the end of the period under review was the

emergence of local mini refineries. The advantage of sales to mini

refineries are significantly lower taxes and treatment &

transportation costs as sales to mini refineries are taxed on a

domestic basis with buyers collecting the oil untreated direct from

the wellhead. However, in the period under review only

approximately 3% of oil sold was to these mini refineries.

The overall average gross price achieved for all the oil sold in

the first 6 months of 2022 was approximately $61 per barrel (2021:

$44 per barrel).

Cost of sales

In the period under review cost of sales increased by 186% to

$6.7 million (2021: $2.3 million).

Gross profit

Gross profit for the period was $18.9 million (2021: $7.7

million).

Selling expenses

In the period under review, selling expenses increased by

approximately 224% from $2.1 million to $6.9 million as the result

of increased crude oil volume sold and prices.

Other administrative expenses

These were stable at approximately $1.7 million as throughout

the period under review the board maintained the temporary cost

reduction first introduced in H1 2020.

Operating income

Operating income increased by approximately 168% to $10.3

million from $3.8 million.

Finance costs

Finance costs reduced by 37% from approximately $0.5 million to

approximately $0.3 million, principally following the conversion of

the $6.2 million Oraziman family debt.

Profit before tax

Profit before tax increased by 193% to $10.0 million ($3.4

million).

Tax charge

Tax in the period under review has been estimated at

approximately $2.7 million compared to $1.1 million in the

corresponding period.

Profit after tax

Profit after taxation was approximately 211% higher at $7.3

million (2021: $2.4 million).

Non-current assets

Non-current assets at approximately $101 million were

approximately 7% lower than in the corresponding period in 2021,

principally as the result of amortisation charges.

Net current liabilities

Net current liabilities at approximately $13.1 million were

approximately 42% lower (2021: $22.6 million).

Cash

Included in net current liabilities at 30 June 2022 was cash of

approximately $5.0 million (2021: $0.30 million.

Cashflows

Of the approximately $24.3 million received from customers

approximately $14.2 million was paid to suppliers and staff; $5.5

million spent on additions to unproven oil and gas assets; and

approximately $4.6 million added to retained cash balances.

Other developments in the period under review

Drilling - deep wells

Having extended the well from approximately 4,500 meters to

approximately 5,400 meters in 2021 in the period under review we

attempted to produce from three of the potential oil-bearing

intervals identified. However, after some initial success, we

concluded that A8 would not produce at commercial quantities and

moved the rig to other targets.

In June 2022 we spudded Deep Well 802 on the Yelemes Deep

structure. This is the sixth and final deep well required under the

BNG work programme.

Drilling - shallow wells

Workover and horizontal drilling at Well 142 on the MJF

structure was interrupted at a key stage by the civil unrest at the

start of January. A consequence of which was the loss of a drilling

camera and a delay in bring the well back into production.

Similarly at Well 141 we have been delayed for several weeks

with a pipe stuck in the well with the well not producing in the

period under review.

3A Best

During the period under review there has been no material

progress at 3A Best.

Caspian Explorer

We have submitted the final tender documents for a commercial

drilling charter in 2023 and expect to know whether we have been

successful before the end of the year. There was no Caspian

Explorer income in the period under review.

Loan conversion

On 9 March 2022 independent Caspian Sunrise shareholders voted

to convert approximately $6.2 million of debt due to the Oraziman

family into 139,729,446 new Ordinary shares at a price of 3.2p per

shares, increasing the Oraziman family's aggregate shareholding

from 45.0% to 48.4%.

Cancelation of share premium

On 22 April 2022 shareholders voted to cancel the share premium

account and the deferred shares in Caspian Sunrise Plc paving the

way for the future declaration of dividends. On 22 June 2022 the UK

High Court confirmed the cancellations, which took effect in the

period under review.

Covid

The impact of Covid in the period under review was minimal

despite several office closures.

Current trading

Oil prices

Given our production volumes we are obliged to use local

international oil traders for our international sales. This is set

to change from 1 January 2023 when we will be able to sell direct

to end users eliminating trader commissions.

Despite the European Union confirming oil produced in Kazakhstan

and transported through the Russian pipeline system is not subject

to EU sanctions and the action taken by the Kazakh authorities in

redesignating oil produced in Kazakhstan as Kazakhstan Export Blend

Crude Oil (KEBCO) the discount for oil emerging from Russian

pipeline has if anything widened from the $30 - 35 per barrel

previously reported to nearer $40 per barrel. At the same time

international prices have retreated below the $100 per barrel

level.

This, together with international sales being taxed at the pre

discount prices has reduced both the net amount receivable for

international sales.

At the same time the domestic price has increased to

approximately $32 per barrel and the price from mini refineries has

increased to approximately $38 per barrel with very few other

deductions.

We have therefore focused since the period under review on sales

to mini refineries for the majority of oil produced, still with a

significant minority of sold on the conventional domestic market.

We will look to resume export sales as and when export market

prices improve.

Production

Recent production levels are 2,264 bopd. This is lower than

previously achieved, in part as Wells 142 and 145 have been taken

out of production to deal with a rising water cuts, and in part as

Well 141 has not yet resumed production, where the delays relate to

a stuck pipe. Our focus has now moved back to Well 142, which we

believe this can be brought back into production sooner than Well

141.

Drilling

At Deep Well 802, has reached a depth of 3,800 meters with

casing set for the 3,000 meters. We have drilled through the salt

layer and already encountered significant oil shows and the usual

high pressures. We look forward to completing and testing the well,

which based on current progress we to be in Q4 2022.

Block 8

We are pleased to announce the intention to acquire Block 8, a

producing Contract Area located approximately 160 km from BNG, for

a maximum consideration of $60 million, payable in cash from the

future production from Block 8 at the rate of $5 per barrel of oil

produced.

Background

The Block 8 Contract Area is 2,823 sq km with three identified

structures and production from two existing wells. The Block 8

Contract Area is owned by a member of the Oraziman family, which

holds approximately 48.4% of the shares in Caspian Sunrise, and as

such it would constitute a related party transaction.

Caspian Sunrise has acquired an option to acquire the UAE

registered holding company of EPC Munai LLP, which is the Kazakh

registered holder of the licence for the Block 8 Contract Area,

conditional upon inter alia satisfactory due diligence, including a

review by an independent expert; the renewal of the existing

licence; Independent Director and Nominated Adviser approval; and

the consents of the regulatory authorities in Kazakhstan the UAE

and the UK.

The Company and the Oraziman family have entered into a loan

agreement under which the Company has agreed to advance cash and

equipment up to $5 million to EPC LLP to complete the existing work

programme commitments under the existing licence. The loan will

bear interest at the rate of 7% and in the event the acquisition of

Block 8 does not complete would be repayable by the Oraziman family

from future dividend payments.

The Block 8 licence was previously owned by LG International the

Korean conglomerate, who in 2006 started to acquire 3D seismic data

over approximately 456 sq km. In recent years two deep wells have

been drilled to depths of 4,203 meters and 3,449 maters

respectively, from which oil has flowed at rates of up to 800

bopd.

Current production from Block 8 is approximately 110 bopd, with

oil transported to the same treatment and pumping station used by

BNG.

The acquisition of Block 8 would bring a second flagship asset

into the Caspian Sunrise Group together with BNG with both having

the ability to transform the value of the Group in the event of

successful deep drilling.

Acquisition process

As the acquisition terms do not involve the issue of additional

shares and the consideration is expected to be payable solely from

production from Block 8, the option if exercised is not expected to

result in any material dilution for existing shareholders.

It is anticipated that the Independent Directors would be in a

position to exercise the option by the end of Q1 2023, and that, if

exercised, the acquisition would take a further 9-12 months to

complete, with much of that time spent on securing the required

regulatory approvals.

Other than the initial $5 million loan ("Loan Agreement") it is

not expected that the acquisition of Block 8 would require

additional funding from Caspian Sunrise and the therefore the

Group's existing other development plans should be unaffected.

Related Party transaction

The Loan Agreement is considered a Related Party Transaction

pursuant to the AIM Rules for Companies.

The Independent Directors consider, having consulted with WH

Ireland, that the terms of the proposed Loan Agreement are fair and

reasonable insofar as shareholders of Caspian Sunrise and the

Company are concerned. Should the option to acquire Block 8 be

exercised by the Independent Directors a further formal assessment

by the Independent Directors and WH Ireland would be required at

that time.

First dividends

Economic and financial uncertainties over the past few weeks led

us to review the start date for the commencement of dividends.

However, based on the current position it remains our intention as

set out in the 2021 audited accounts published in June, to commence

dividends payments in H2 2022.

Comment

Clive Carver, Chairman said

"These results demonstrate the strength of the Group's business.

Even after suffering discounts of between $30 and $35 per barrel on

export sales since March 2022 and continuing to be taxed as if we

were selling at full international prices, we have recorded the

largest trading profit in the Group's history.

The Group's balance sheet has been strengthened with a reduction

in net current liabilities of approximately $8.5 million. Cash at

approximately $5.0 million was the highest for several years.

All this is without any meaningful contribution from the Caspian

Explorer.

The proposed acquisition of Block 8 has been structured to

provide a second flagship asset with huge potential but in a way

that should not materially dilute existing shareholders.

We remain on track to pay the first dividend before the end of

the year.

When the Ukraine war and the associated sanctions end there

should be a very material improvement in profitability. Until then

the Group looks to broaden its asset base and continue to trade

profitably adding to shareholder value."

UNAUDITED CONDENSED CONSOLIDATED INCOME STATEMENT

Six months Six months

Ended 30 June ended 30

2022 Unaudited June 2021

US$000s US$000s

Revenue 25,591 10,055

Cost of sales (6,705) (2,341)

---------------------- --------------- ----------

Gross Profit 18,886 7,714

Selling expense (6,906) (2,129)

Other administrative

expenses (1,662) (1,733)

Operating Income 10,318 3,852

Finance cost 4 (330) (447)

Finance income 10 11

Income before taxation 9,998 3,416

Taxation (2,690) (1,065)

------------------------------ ------ ------- -------

Income after taxation 7,308 2,351

------------------------------ ------ ------- -------

Income attributable to

owners of the parent 7,218 2,389

Income (Loss) attributable

to non-controlling interest 90 (38)

------------------------------ ------ ------- -------

Income for the year 7,308 2,351

------------------------------ ------ ------- -------

Earnings per share 3

------------------------------ ------ ------- -------

Basic income per ordinary share (US cents) 0.33 0.11

UNAUDITED CONDENSED CONSOLIDATED STATEMENT OF COMPREHENSIVE

INCOME

Six months Six months

Ended 30 June ended 30 June

2022 Unaudited 2021

US$000s US$000s

Income after taxation 7,218 2,351

------------------------------------- --------------- --------------

Other comprehensive loss:

------------------------------------- -------------------------------

Items to be reclassified

to profit or loss in subsequent

periods

Exchange differences on

translating

foreign operations (9,264) (2,103)

------------------------------------- --------------- --------------

Total comprehensive loss

for the period (1,956) 248

------------------------------------- --------------- --------------

Total comprehensive loss

attributable to: Owners

of the parent (2,046) 286

Non-controlling interest 90 (38)

------------------------------------- --------------- --------------

UNAUDITED CONDENSED CONSOLIDATED STATEMENT OF CHANGES IN

EQUITY

For the six months ended 30 June 2022

Unaudited Share Share Deferred Cumulative Capital Merger Retained Total Non-controlling Total

capital premium shares translation contribution Reserve deficit interests equity

reserve reserve

----------------

US$'000 US$'000 US$'000 US$'000 US$'000 US$'000 US$'000 US$'000 US$'000 US$'000

---------------- -------------------- ----------- ---------- ------------- -------------- ------------------ --------------- --------- --------------- ---------

At 1 January

2022 31,118 164,817 64,702 (62,103) (2,362) 11,511 (156,239) 51,444 (5,801) 45,643

---------------- -------------------- ----------- ---------- ------------- -------------- ------------------ --------------- --------- --------------- ---------

Income after

taxation - - - - - - 7,218 7,218 90 7,308

Exchange

differences

on translating

foreign

operations - - - (9,264) - - - (9,264) - (9,264)

---------------- -------------------- ----------- ---------- ------------- -------------- ------------------ --------------- --------- --------------- ---------

Total

comprehensive

income for

the period - - - (9,264) - - 7,218 (2,046) 90 (1,956)

Shares issue

(debt to

equity)* 1,942 4,273 - - - - - 6,215 - 6,215

Share premium

and Deferred

Shares

reserves

cancellation** (169,090) (64,702) 233,792 - - -

---------------- -------------------- ----------- ---------- ------------- -------------- ------------------ --------------- --------- --------------- ---------

At 30 June

2022 33,060 - - (71,367) (2,362) 11,511 84,771 55,613 (5,711) 49,902

---------------- -------------------- ----------- ---------- ------------- -------------- ------------------ --------------- --------- --------------- ---------

For the six months ended 30 June 2021

Unaudited Share Share Deferred Cumulative Capital Retained Total Non-controlling Total

capital premium shares translation contribution deficit interests equity

reserve reserve

---------------

US$'000 US$'000 US$'000 US$'000 US$'000 US$'000 US$'000 US$'000 US$'000

--------------- --------------- ----------- -------- ----------- ------------ ---------- ------- --------------- -------

At 1 January

2021 30,804 248,950 64,702 (55,240) (2,362) (223,868) 62,986 (5,809) 57,177

--------------- --------------- ----------- -------- ----------- ------------ ---------- ------- --------------- -------

Income after

taxation - - - - - 2,389 2,389 (38) 2,351

Exchange

differences

on

translating

foreign

operations - - - (2,103) - - (2,103) - (2,103)

--------------- --------------- ----------- -------- ----------- ------------ ---------- ------- --------------- -------

Total

comprehensive

income for

the period - - - (2,103) - 2,389 286 (38) 248

Shares issue 43 57 - - - - 100 - 100

--------------- --------------- ----------- -------- ----------- ------------ ---------- ------- --------------- -------

At 30 June

2021 30,847 249,007 64,702 (57,343) (2,362) (221,479) 63,372 (5,847) 57,525

--------------- --------------- ----------- -------- ----------- ------------ ---------- ------- --------------- -------

Reserve Description and purpose

Share capital The nominal value of shares issued

Deferred shares The nominal value of deferred shares issued

Cumulative translation

reserve

Losses arising on retranslating the net assets of

overseas operations into US Dollars

Merger reserves Gains accrued as the result of acquisitions made

in previous periods

Capital contribution Capital contribution arise when a shareholder has

Reserve made an irrevocable gift to the Company

Retained deficit Cumulative losses recognised in the profit or loss

Non-controlling interest The interest of non-controlling parties in the net

assets of the subsidiaries

UNAUDITED CONDENSED CONSOLIDATED STATEMENT OF FINANCIAL

POSITION

As at As at As at

30 June 31 December 30 June

---------------------------

2022 2021 2021

Note US$000s US$000s US$000s

--------------------------- -------------------- --------- --------------------- -------------------

Assets Unaudited Audited Unaudited

Non-current assets

Unproven oil and 5 29,090 46,137 61,634

gas assets

Property, plant

and equipment 6 65,471 57,134 51,549

Other receivables 7 5,813 4,263 6,848

Restricted use cash 607 634 241

--------------------------- -------------------- --------- --------------------- ----------------

Total non-current

assets 100,981 108,168 120,272

--------------------------- -------------------- --------- --------------------- ----------------

Current assets

Inventories 677 664 1,219

Other receivables 5,832 4,950 4,376

Cash and cash equivalents 5,044 429 262

Total current assets 11,553 6,043 5,857

--------------------------- -------------------- --------- --------------------- ----------------

Total assets 112,534 114,211 126,129

--------------------------- -------------------- --------- --------------------- ----------------

Equity and liabilities

Equity

Share capital 8 33,060 31,118 30,847

Share premium - 164,817 249,007

Deferred shares 8 - 64,702 64,702

Other reserves (2,362) (2,362) (2,362)

Merger reserve 11,511 11,511 -

Retained earnings 84,771 (156,239) (221,479)

Cumulative translation

reserve (71,367) (62,103) (57,343)

--------------------------- -------------------- --------- --------------------- ----------------

Shareholders' equity 55,613 51,444 63,372

Non-controlling

interests (5,711) (5,801) (5,847)

--------------------------- -------------------- --------- --------------------- ----------------

Total equity 49,902 45,643 57,525

Current liabilities

Trade and other

payables 15,206 13,240 13,194

Short-term borrowings 9 988 6,425 5,871

Provision for BNG

license payment 3,178 3,178 3,178

Other current provisions 5,261 5,482 6,173

--------------------------- -------------------- --------- --------------------- -------------------

Total current liabilities 24,633 28,325 28,416

--------------------------- -------------------- --------- --------------------- -------------------

Non-current liabilities

Deferred tax liabilities 6,629 6,463 6,529

Provision for BNG

license payment 17,923 19,290 20,578

Other non-current

provisions 452 487 406

Other payables 12,995 14,003 12,675

--------------------------- -------------------- --------- --------------------- -------------------

Total non-current

liabilities 37,999 40,243 40,188

--------------------------- -------------------- --------- --------------------- -------------------

Total liabilities 62,632 68,568 68,604

Total equity and

liabilities 112,534 114,211 126,129

--------------------------- -------------------- --------- --------------------- -------------------

This financial information was approved and authorised for issue

by the Board of Directors on 23 September 2022 and was signed on

its behalf by:

Clive Carver

Chairman

UNAUDITED CONDENSED CONSOLIDATED STATEMENT OF CASH FLOWS

Six months ended Six months

30 June 2022 ended

30 June 2021

------------------ --------------------------------- --------------------------------------------------------------------------------------

Unaudited Unaudited

US$000s US$000s

Cash flow

provided

by operating

activities

Cash received

from

customers 24,328 8,480

Payments made to

suppliers

and employees (14,222) (8,252)

------------------ --------------------------------- --------------------------------------------------------------------------------------

Net cash used by

operating

activities 10,106 228

Cash flow used

in

investing

activities

Additions to

unproven

oil and gas

assets (5,362) (566)

Purchase of PP&E (129) -

Cash flow used in

investing

activities (5,491) (566)

--------------------------------- --------------------------------- -----------------------------------------------------------------------

Cash flow used by financing

activities

Loans provided - 271

Net cash used by financing

activities - 271

--------------------------------- --------------------------------- -----------------------------------------------------------------------

Net increase /decrease

in cash and

cash equivalents 4,615 (67)

--------------------------------- --------------------------------- -----------------------------------------------------------------------

Cash and cash equivalents

at

the start of the period 429 329

--------------------------------- --------------------------------- -----------------------------------------------------------------------

Cash and cash equivalents

at the end of the period 5,044 262

--------------------------------- --------------------------------- -----------------------------------------------------------------------

NOTES TO THE UNAUDITED CONDENSED CONSOLIDATED FINANCIAL

INFORMATION

1. STATUTORY ACCOUNTS

The interim nancial results for the period ended 30 June 2022

are unaudited. The nancial information contained within this report

does not constitute statutory accounts as defined by Section 434(3)

of the Companies Act 2006.

2. BASIS OF PREPARATION

Caspian Sunrise plc is registered and domiciled in England and

Wales.

This interim nancial information of the Company and its

subsidiaries ("the Group") for the six months ended 30 June 2022

has been prepared on a basis consistent with the accounting

policies set out in the Group's consolidated annual nancial

statements for the year ended 31 December 2021. It has not been

audited or reviewed, does not include all of the information

required for full annual nancial statements, and should be read in

conjunction with the Group's consolidated annual nancial statements

for the year ended 31 December 2021. The 2021 annual report and

accounts, which received an unquali ed opinion from the auditors,

included a material uncertainty in respect of going concern but did

not contain a statement under section 498 (2) or 498 (3) of the

Companies Act 2006, have been led with the Registrar of Companies.

As permitted, the Group has chosen not to adopt IAS 34 'Interim

Financial Reporting'.

The financial information is presented in US Dollars and has

been prepared under the historical cost convention.

The accounting policies adopted in the preparation of the

interim condensed consolidated nancial statements are consistent

with those followed in the preparation of the Group's annual

nancial statements for the year ended 31 December 2021 except for

the e ect of new standards e ective from 1 January 2022 as

explained below. These are expected to be consistent with the

nancial statements of the Group as at 31 December 2021 that

are/will be prepared in accordance with IFRS and their

interpretations issued by the International Accounting Standards

Board ("IASB") as adopted by the European Union ("EU").

Several other amendments and interpretations apply for the rst

time in 2022, but do not have an impact on the interim consolidated

nancial statements of the Group as well.

Going Concern

The Group's Financial Statements for the year ended 31 December

2021, which were published on 27 June 2022, contained reference to

the existence of a material financial uncertainty, which only some

three months on continues to exist. This may cast significant doubt

about the Group's ability to continue as a going concern and

therefore it may be unable to realise its assets and discharge its

liabilities in the normal course of business.

The financial information in these interim results has been

prepared on a going concern basis using current income levels but a

reduced work programme. On this basis the Directors believe that

the Group will have sufficient resources for its operational needs

over the relevant period, being until September 2023. Accordingly,

the Directors continue to adopt the going concern basis.

However, the Group's liquidity is dependent on a number of key

factors:

-- The Group continues to forward sell it domestic production

and receive advances from oil traders with $US2.5 million advanced

at 30 June 2022, and the continued availability of such

arrangements is important to working capital. Whilst the Board

anticipates such facilities remaining available given its trader

relationships, should they be withdrawn or reduced more quickly

than expected then additional funding would be required.

-- Similarly, the Group sells to local mini refineries. Should

these arrangements be terminated or reduced then additional funding

would be required.

-- For the time being the Group is not selling to the

international markets as a consequence of the impact of sanctions

on Russia, including access to pipelines and the price at which oil

emerging from Russian pipelines is sold.

-- As ever forecasts remain sensitive to oil prices, which have

shown significant volatility in recent times. In the event of a

significant decline in world and domestic oil prices additional

funding would be required.

3. INCOME PER SHARE

Basic loss per share is calculated by dividing the loss

attributable to ordinary shareholders by the weighted average

number of ordinary shares outstanding during the year including

shares to be issued.

There is no di erence between the basic and diluted loss per

share as the Group made a loss for the current and prior year.

Dilutive potential ordinary shares include share options granted to

employees and directors where the exercise price (adjusted

according to IAS33) is less than the average market price of the

Company's ordinary shares during the period.

The calculation of loss

per share is based on:

------------------------------ ---------------------------------------------

Six months Six months

ended 30 ended 30

June 2022 June 2021

Unaudited Unaudited

------------------------------ ---------------------- ---------------------

The basic weighted average

number of ordinary

shares in issue during the

period 2,157,729,446 2,088,973,983

------------------------------ ---------------------- ---------------------

The income (loss) for the

year attributable to owners

of the parent (US$'000) 7,284 2 , 3 89

------------------------------ ---------------------- ---------------------

4. FINANCIAL EXPENSE

The Group incurred US$330,000 financial expenses during the 6

months to 30 June 2022, of which US$49,000 was the interest expense

on loans provided by Kuat Oraziman and the companies controlled by

him (2021: US$130,000).

5. UNPROVEN OIL AND GAS ASSETS

During the six months period ended June 30 2022 the Company's

oil and gas assets decreas ed on US$ 17 million (2021: increase on

US$ 221,000) mainly due to transfer of shallow South Yelemes into

production (note 6) and the depreciation expense.

6. PROPERTY, PLANT & EQUIPMENT

Proved oil Motor Other Total

and gas Vehicles

Group assets

US$'000 US$'000 US$'000 US$'000

Cost at 1 January 202

1 43,722 56 11,177 54,955

Additions 1,757 2,198 4,938 8,894

Disposals - - (11) (11)

Acquisitions - - 53 53

Foreign exchange difference (550) (128) (212) (890)

------------------------------ ----------- ---------- -------- --------

Cost at 3 1 December

2021 44,929 2,126 15,946 63,001

------------------------------ ----------- ---------- -------- --------

Additions* 14,564 129 - 14,693

Foreign exchange difference (3,543) (112) (955) (4,610)

------------------------------ ----------- ---------- -------- --------

Cost at 30 June 2022 55,400 2,015 14,779 72,194

------------------------------ ----------- ---------- -------- --------

Depreciation at 1 January

2021 1,390 47 673 2,110

1,7 3

Charge for the year 1,339 482 6 3,558

Disposals - - (7) (7)

Foreign exchange difference 42 40 124 206

------------------------------ ----------- ---------- -------- --------

Depreciation at 31

December 2021 2,771 570 2,526 5,867

------------------------------ ----------- ---------- -------- --------

Charge for the year 399 179 459 1,037

Foreign exchange difference (152) (9) (20) (181)

------------------------------ ----------- ---------- -------- --------

Depreciation at 30

June 2022 3,018 740 2,965 6,723

------------------------------ ----------- ---------- -------- --------

Net book value at:

----------------------------- ----------- ---------- -------- --------

01 January 2021 42,332 9 10,504 52,845

31 December 2021 42,158 1,556 13,419 57,134

30 June 2022 52,382 1,276 11,813 65,471

------------------------------ ----------- ---------- -------- --------

* During six months of 2022 BNG has moved its unproven oil and

gas asset on total US $14,392 into proved assets.

7. OTHER NON-CURRENT RECEIVABLES

During the six months period ended June 30, 2022, the Company

has provided advances related to its drilling operations in the

amount of US$1.52 million (2021: US$1.48 million). Total

prepayments made for drilling services as at 30.06.2022 was US$

1,524,000 (2021: US$ 1,482,000). VAT recoverable at the Group level

as at 30.06.2022: US$4,289,000 (2020: US$4,031,000).

8. CALLED UP SHARE CAPITAL

Number of $'000 Number $'000

ordinary of deferred

shares shares

--------------- ---------------- --------- ------------- --------

Balance at

31 December

2021 2,110,772,114 31,118 373,317,105 64,702

--------------- ---------------- --------- ------------- --------

Balance at

30 June 2022 2,250,501,560 33,060 -* -*

--------------- ---------------- --------- ------------- --------

*In June 2022 the Company received approval from the UK High

Court for the cancellation of its Deferred shares and Share premium

accounts

9. BORROWINGS

------------------------------------------------------------------------------------------------------------------

Six Year ended

months 31

ended December 2021

30 June US$'000

2022

US$'000

Unaudited Audited

--------------------------- -------------------------------- ----------------------------------------

Amounts payable within

one year

Akku Investments 99 4,433

Mr Oraziman 355 1,424

Other borrowings 534 568

--------------------------- -------------------------------- ----------------------------------------

988 6,425

--------------------------- -------------------------------- ----------------------------------------

In March 2022 Caspian Sunrise plc converted its debts to Mr. Oraziman

and the related companies by means of issuing in exchange of total

139,729,446 common shares of the Company on total US$ 6.2 million,

of which US$5.6 million were the converted loans. During the period

to 30 June 2022 Vertom International NV provided US$ 350,000 of

new loans to the companies of the group.

This information is provided by RNS, the news service of the

London Stock Exchange. RNS is approved by the Financial Conduct

Authority to act as a Primary Information Provider in the United

Kingdom. Terms and conditions relating to the use and distribution

of this information may apply. For further information, please

contact rns@lseg.com or visit www.rns.com.

RNS may use your IP address to confirm compliance with the terms

and conditions, to analyse how you engage with the information

contained in this communication, and to share such analysis on an

anonymised basis with others as part of our commercial services.

For further information about how RNS and the London Stock Exchange

use the personal data you provide us, please see our Privacy

Policy.

END

IR SEESUMEESEFU

(END) Dow Jones Newswires

September 26, 2022 05:14 ET (09:14 GMT)

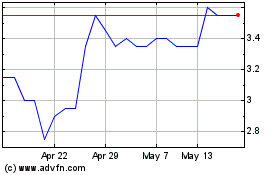

Caspian Sunrise (LSE:CASP)

Historical Stock Chart

From Dec 2024 to Jan 2025

Caspian Sunrise (LSE:CASP)

Historical Stock Chart

From Jan 2024 to Jan 2025