TIDMCBA

RNS Number : 7858J

Ceiba Investments Limited

29 April 2022

29 April 2022

CEIBA INVESTMENTS LIMITED

(the "Company")

(TICKER CBA, ISIN: GG00BFMDJH11)

Legal Entity Identifier: 213800XGY151JV5B1E88

RESULTS FOR THE YEARED 31 DECEMBER 2021

COMPANY OVERVIEW

GENERAL

CEIBA Investments Limited ("CEIBA" or the "Company") is a

Guernsey-incorporated, closed-ended investment company, with

registered number 30083. The Ordinary Shares of the Company are

listed on the Specialist Fund Segment ("SFS") of the London Stock

Exchange's Main Market under the symbol CBA (ISIN: GG00BFMDJH11).

The Company's Bonds are listed on the International Stock Exchange,

Guernsey under the symbol CEIB1026 (ISIN: GG00BMV37C27). The

governance framework of the Company reflects that as an investment

company there are no employees, and the Directors, the majority of

whom are independent, are all non-executive. Like many other

investment companies, the investment management and administration

functions are outsourced to third party providers. Through its

consolidated subsidiaries (together with the Company, the "Group"),

the Company invests in Cuban real estate and other assets by

acquiring shares in Cuban joint venture companies or other entities

that have direct interests in the underlying properties. The

Company also arranges and invests in financial instruments granted

in favour of Cuban borrowers.

FINANCIAL HIGHLIGHTS AS AT 31 DECEMBER 2021 IN GBP AND US$

(FOREX: GBP/US$ = 1.3477)

The Company's Net Asset Value ("NAV") and share price are quoted

in Sterling (GBP) but the functional currency of the Company is the

U.S. Dollar (US$). As such, the financial highlights of the Company

set out below are being provided in both currencies, applying the

applicable exchange rate as at 31 December 2021 of GBP1:US$ 1.3477

(2020: GBP1=US$1.3608).

USD 31-Dec-21 31-Dec-20 % change

( 17.

Total Net Assets (m) $160.3 $194.4 5)%

( 17.5

NAV per Share (1) $1.16 $1.41 )%

Net Loss to shareholders ($ 19.80 ( 45.5

(m) ($ 28.8 ) ) )%

($ 0.21 ( 50.0

Loss per share ) ($ 0.14 ) )%

GBP 31-Dec-21 31-Dec-20 % change

( 16.7

Total Net Assets (m) GBP118.96 GBP142.90 )%

( 16.7

NAV per Share (1) GBP0.864 GBP1.038 )%

( 24.7

Market Capitalisation (m) GBP88.1 GBP116.30 )%

( 24.7

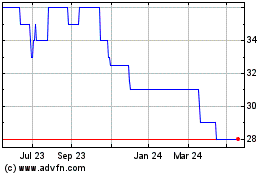

Share price GBP0.64 GBP0.85 )%

Discount (1) ( 25.9 )% ( 18.6 )%

Shares in issue 137,671,576 137,671,576

------------- ------------

Ongoing charges (1) 2.80% 2.91%

1 These are considered Alternative Performance Measures. See

glossary for more information.

MANAGEMENT

The Company has appointed Aberdeen Standard Fund Managers

Limited ("ASFML" or the "AIFM") as the Company's alternative

investment fund manager to provide portfolio and risk management

services to the Company. The AIFM has delegated portfolio

management to Aberdeen Asset Investments Limited ("AAIL" or the

"Investment Manager"). Both ASFML and AAIL are wholly-owned

subsidiaries of abrdn plc ("abrdn"), a publicly-quoted company on

the London Stock Exchange. References throughout this document to

abrdn refer to both the AIFM and the Investment Manager.

CHAIRMAN'S STATEMENT

At the time of publication of the 2020 Annual Report of CEIBA

Investments Limited ("CEIBA" or the " Company ") in April 2021,

both the Company and Cuba were in the midst of the battle against

the Covid-19 pandemic and at that time the long-term impact of the

virus and the timing of the expected return to normality were

difficult to predict with any degree of certainty. Overall, Cuba

has handled the virus well and to date, around 10.6 million people

or 94% of the population have received at least one vaccine dose

and 87% are fully vaccinated. Consequently, like many other

countries, Cuba has now rolled back many of the various

restrictions, especially concerning travel, which had been imposed

to combat the virus. However, as global travel begins a slow

recovery there is no question that CEIBA has been severely impacted

throughout 2020 and 2021 and will continue to suffer somewhat until

a full return to normal is achieved. Compounding the pandemic

issues are the challenges presented by the ongoing U.S. embargo

against Cuba, the conflict between Russia and Ukraine and the

transitionary effects of recent monetary reforms adopted by the

Cuban government. Overall, CEIBA finds itself at present trading in

a very challenging environment.

CUBA MONETARY REFORMS

In the second half of 2020, the Cuban government undertook to

adopt significant monetary reforms, which your Board considers to

be positive overall. These reforms, which are generally referred to

as the Tarea Ordenamiento (TO), took effect on 1 January 2021 and

included:

- the elimination of the Cuban Convertible Peso (CUC), which

previously traded at par with the U.S. Dollar (US$), thereby

unifying the dual currency system under a single currency: the

Cuban Peso or CUP;

- a fixed official exchange rate between the CUP and the US$ of 24 to 1, and;

- the adoption of a system for allocating hard currency

throughout the economy intended to largely decentralise business

decisions and provide foreign investment vehicles and Cuban

entities with real financial autonomy. This is accomplished through

the creation of "liquidity" rights (denominated in US$) that can be

used to exchange Cuban Pesos to hard currency for international

transfers on a decentralised basis.

While the Board considers these reforms to be a positive move

the timing, in hindsight, has been unfortunate. The lack of any

easing of the U.S. Cuban embargo under the Biden administration and

the very slow resumption of international travel in the face of the

pandemic have severely impaired the foreign exchange reserves and

general liquidity position of the Cuban economy, through reduced

overseas remittances and greatly reduced tourism income.

What we are presently witnessing in Cuba as a result of the poor

liquidity position is a shortage of vital imported products,

increased inflation and a serious devaluation of the street value

of the CUP. The Investment Manager's report describes the reforms

and their effects in further detail, but at present the main

uncertainty caused by them for CEIBA is in relation to the income

generated by Inmobiliaria Monte Barreto S.A. (" Monte Barreto ")

and the Company's ability to realise such income in the form of

hard currency dividend payments.

RELATIONS WITH THE UNITED STATES

U.S.-Cuba relations had been expected to improve following the

inauguration of President Biden in January 2021, but

disappointingly to date nothing has changed from the Trump

presidency and all U.S. sanctions have remained stubbornly in place

during 2021. In respect of U.S. personnel and entities, the U.S.

Cuban embargo legislation prohibits investments in Cuba, greatly

constrains family and other hard currency remittances, commercial

transactions and trade, and severely restricts travel. It is

possible that following the mid-term election in November 2022 we

may see some relaxation of the rules in accordance with the

promises given prior to his election. Any initiatives to improve

the relationship between the two countries should have a very

positive impact on the Cuban economy and also on the Company's

assets.

2021 REVIEW

Similar to its performance throughout the whole of 2020 and

despite the backdrop of the Covid-19 pandemic, Monte Barreto, the

Cuban joint venture company that owns and operates the Miramar

Trade Center, which is Cuba's leading mixed-use office and retail

real estate complex, continued to trade strongly throughout 2021

and occupancy levels remained well over 95% throughout the year.

Although revenues were down slightly as compared with the prior

year, net income in 2021 reached US$15.6 million for the year,

representing an 8.5% increase over the prior year and making 2021

the most profitable year since incorporation of the joint venture.

This increase in profitability has largely been a result of the

lower operating costs as a result of the unification of the

currency. The 2022 outlook for Monte Barreto continues to be

positive, with occupancy percentage levels expected to remain in

the high nineties throughout the year.

While Monte Barreto continues to trade well, there presently

remains considerable uncertainty over the impact of Cuba's monetary

reforms on the ability of the joint venture company to generate

"liquid" hard currency income from its operations (and consequently

its ability to pay dividends to its shareholders without depending

on allocations of hard currency from the Cuban authorities). This

matter remains unresolved at present and discussions are continuing

between the joint venture partner and the relevant Cuban government

authorities to confirm the position. While this uncertainty

remains, the discount rates applied to future cash flows for the

purpose of arriving at a valuation for Monte Barreto have

increased, resulting in a lower valuation for CEIBA's present

interest. In addition, due to the uncertainty on the timing of

payment of the dividends owed to the Company by Monte Barreto, the

Company has made a provision in its financial statements in the

amount of US$12,281,408 representing the outstanding dividends

receivable from Monte Barreto.

Throughout 2021, the global travel and hotel industries

continued to be severely impacted by the Covid-19 pandemic. During

November 2021 Cuba re-opened its borders to international tourism,

but then the Omicron variant of the virus spread globally and

further delayed any material recovery in the travel trade. As a

result, in 2021 Cuba received fewer than 360,000 tourists - 67%

less than during 2020, and less than 10% of the 4 million tourists

that Cuba hosted during 2019, the last year before the

pandemic.

CEIBA's main hotel interests are held through its 32.5% holding

in the Cuban joint venture company Miramar S.A. (" Miramar ").

Miramar owns three hotels in Varadero and one hotel in Havana. In

Varadero, the Meliã Las Américas and the Meliã Varadero re-opened

in November 2021, having been closed since arrival of the pandemic

in March 2020. The Sol Palmeras remained open for most of the year

but traded on a heavily scaled-back basis and mainly to Cuban

nationals. The Meliã Habana Hotel in Havana remained open

throughout 2021 and was one of the main quarantine hotels on the

island, managing to maintain positive operations throughout the

year. Miramar had a negative EBITDA of US$4.5 million, including a

one-time foreign exchange expense of US$5.4 million relating to the

conversion of monetary assets under the monetary reforms. While the

recovery in the tourist trade remains slow, a gradual build up

throughout 2022 is expected.

CEIBA's other hotel interest is its 40% holding in the Cuban

joint venture company TosCuba S.A. (" TosCuba "), which is

constructing the 400-room Meliã Trinidad Península Hotel. This

hotel is situated on the south coast of Cuba close to the historic

city of Trinidad and will be the first modern

international-standard beach resort hotel in the area. It should

prove to be an excellent addition to the hotel interests of the

Company. Construction has continued throughout the year, although

at a reduced pace, and the original contractor was replaced in the

first half of 2021 following repeated defaults in performance.

Completion of the construction process is expected to take place

during 2022, with a soft opening scheduled for the first quarter of

2023 and the official launch of the hotel during Cuba's

international Tourism Fair in May 2023.

DIVIDS

The Covid pandemic has clearly had a very negative impact on the

revenues generated by the Company's hotel interests and it was

decided, following its onset, that it was vital that CEIBA should

maintain sufficient cash to meet all of its existing and future

undertakings. Accordingly, the dividend policy was suspended in

2020 and no dividend has been paid since then. The Board would very

much like to reinstate the payment of dividends but, in view of

there still being considerable uncertainty as to how long it will

take to see a return of normal tourism numbers and with the added

uncertainty of the impact of the monetary reforms on the dividends

payable by Monte Barreto, it has been decided to maintain the

present position for another year. Accordingly, it is not intended

that any dividend be paid to shareholders in 2022. This stance will

be kept under constant review and it remains the Board's intention

to reinstate the dividend as soon as appropriate.

BOARD

I am grateful to the Board for their commitment and input during

another challenging year. It is the Board's policy to undertake a

regular review of its own performance to ensure that it has the

appropriate mix of relevant experience and skills to ensure the

effective overall operation of the Company. In this latter regard,

I am delighted to welcome Jemma Freeman to the board. She was

appointed in October 2021 and is the Executive Chairman of Hunters

& Frankau Limited, the exclusive distributor for Habanos S.A.'s

cigar portfolio in the United Kingdom. The Freeman family have been

involved with cigars since the 1800's and with Cuba since the

1920's when they owned cigar factories in Havana. She brings a

wealth of experience, skills and diversity to the Board, in

addition to her deep knowledge and understanding of the Cuban

business environment, complementing those of our existing

directors.

THE INVESTMENT MANAGER

Aberdeen Standard Fund Managers Limited, a wholly owned

subsidiary of abrdn plc, has acted as manager of the Group's

portfolio of assets throughout the year. There has been no change

in the underlying key operational management of the Company and

this team continues to be headed by Sebastiaan Berger, who is

exclusively focused on the Company's assets and business and has

acted in this role for some 20 years. The Board reviewed the work

of the Investment Manager during the year and concluded that it was

very satisfied with the performance of the Investment Manager and

that it was in the best interests of shareholders that ASFML remain

as manager of the portfolio.

The Board extends its sincere thanks to the Investment Manager

and to the entire management team based in Cuba for their

commitment and efforts on behalf of the Company in these very

difficult times.

John Herring

Chairman

28 April 2022

STRATEGIC REPORT

INVESTMENT OBJECTIVE

The investment objective of the Company is to provide a regular

level of income and substantial capital growth.

INVESTMENT POLICY

The Company is a country fund with a primary focus on Cuban real

estate assets. The Company seeks to deliver the investment

objective primarily through investment in, and management of, a

portfolio of Cuban real estate assets, with a focus on the tourism

and commercial property sectors. Cuban real estate assets may also

include infrastructure, industrial, retail, logistics, residential

and mixed-use assets (including development projects).

The Company may also invest in any type of financial instrument

or credit facility secured by Cuba-related cash flows.

In addition, subject to the investment restrictions set out

below, the Company may invest in other Cuba-related businesses,

where such are considered by the Investment Manager to be

complementary to the Company's core portfolio ("Other Cuban

Assets"). Other Cuban Assets may include, but are not limited to,

Cuba-related businesses in the construction or construction supply,

logistics, energy, technology and light or heavy industrial

sectors.

Investments may be made through equity investments, debt

instruments or a combination of both.

The Company will invest either directly or through holdings in

special purpose vehicles ("SPVs"), joint venture vehicles,

partnerships, trusts or other structures. The Cuban Foreign

Investment Act (Law 118 / 2014) guarantees that the holders of

interests in Cuban joint venture companies may transfer their

interests, subject always to agreement between the parties and the

approval of the Cuban government.

INVESTMENT RESTRICTIONS

The following investment limits and restrictions apply to the

Company and its business which, where appropriate, will be measured

at the time of investment:

-- the Company will not knowingly or intentionally use or

benefit from confiscated property to which a claim is held by a

person subject to U.S. jurisdiction;

-- the Company may invest in Cuban and non-Cuban companies,

joint ventures and other entities that earn all or a substantial

part of their revenues from activities outside Cuba, although such

investments will, in aggregate, be limited to less than 10% of the

Gross Asset Value;

-- save for Monte Barreto (see the Investment Manager's Review

for more information on this asset), the Company's maximum exposure

to any one asset will not exceed 30 per cent. of the Gross Asset

Value;

-- no more than 20 per cent. of the Gross Asset Value will be

invested in Other Cuban Assets; and

-- no more than 20 per cent. of the Gross Asset Value will be

exposed to "greenfield" real estate development projects, being

new-build construction projects carried out on undeveloped

land.

The restrictions above apply at the time of investment and the

Company will not be required to dispose of any asset or to

re-balance the portfolio as a result of a change in the respective

valuations of its assets. The investment limits detailed above will

apply to the Group as a whole on a look-through basis, i.e. where

assets are held through subsidiaries, SPVs, or equivalent holding

vehicles, the Company will look through the holding vehicle to the

underlying assets when applying the investment limits.

KEY PERFORMANCE INDICATORS ("KPIs")

The KPIs by which the Company measures its economic performance

include:

-- Total income

-- Net income

-- Total net assets

-- Net asset value per share (NAV)*

-- Net asset value total return*

-- Market capitalisation

-- Premium / Discount to NAV *

-- Dividend per share

-- Gain / Loss per share

* These are considered Alternative Performance Measures.

In addition to the above measures, the Board also regularly

monitors the following KPIs of the joint venture companies in which

the Company is invested and their underlying real estate assets,

all of which are Alternative Performance Measures.

In the case of commercial properties, other KPIs include:

-- Occupancy levels

-- Average monthly rate per square meter (AMR)

-- Earnings before interest, tax, depreciation and amortisation (EBITDA)

-- Net income after tax

In the case of hotel properties, other KPIs include:

-- Occupancy levels

-- Average Daily Rate per room (ADR)

-- Revenue per available room (RevPAR)

-- EBITDA

-- Net income after tax

The Board also monitors the financial performance of the Cuban

joint venture companies that own the commercial and hotel

properties using these KPIs. The Board and the Investment Manager

seek to influence the management decisions of the Cuban joint

venture companies through representation on their corporate bodies

with the objective of generating reliable and growing cash flow for

the Cuban joint venture companies, which in turn will be reflected

in reliable and growing dividend streams in favour of the

Company.

PRINCIPAL RISKS

PRINCIPAL RISKS

Introduction

The Company is exposed to a variety of risks and uncertainties.

The Board, through the Audit Committee, is responsible for the

management of risk and has put in place a regular and robust

process to identify, assess and monitor the principal risks and

uncertainties facing the business. A core element of this process

is the Company's risk register which identifies the risks facing

the Company and identifies how these may impact on operations,

performance and solvency and what mitigating actions, if any, can

be taken. There are a number of risks which, if they occurred,

could have a material adverse effect on the Company and its

financial condition, performance and prospects. As part of its risk

process, the Board also seeks to identify emerging risks to ensure

that they are effectively managed as they develop. In the event

that an emerging risk has gained significant weight or importance,

that risk is categorised and added to the Company's risk register

and is monitored accordingly.

Principal Risks

The Company invests in Cuba, a frontier or pre-emerging market,

which may increase the risk as compared to investing in similar

assets in other jurisdictions.

In addition to general country-risk, the most significant risks

faced by the Company during the financial year appear in the table

below, together with a description of the possible impact thereof,

mitigating actions taken by the Company and an assessment of how

such risks are trending at the present time.

The Board relies upon its external service providers to ensure

the Company's compliance with applicable regulations and, from time

to time, employs external advisers to advise on specific concerns.

The operation of key controls in the Investment Manager's and other

third party service providers risk management processes and how

these apply to the Company's business are reviewed regularly by the

Audit Committee along with internal control reports from these

entities.

Type of Risk Description and Possible Mitigating Action Trend

Impact

Emerging Risks relating to the Cuban Financial System

Cuban Financial During the second half The Investment Manager á

Reforms - Financial of 2020 and continuing has closely followed all

Autonomy Rules throughout 2021, in the developments relating to

midst of the economic the adoption and implementation

disruption caused by the of these new measures,

Covid-19 pandemic and and has communicated its

strengthened sanctions views and interacted regularly

maintained in place by at all appropriate levels

the U.S. government, the in order to extend their

Cuban government adopted application to the operations

new financial reforms of the joint venture companies

aimed at creating a new in which the Company has

objective system for the a participation.

allocation of limited Although the interpretation

liquidity reserves within of the new financial autonomy

the economy and intending rules, as well as the practical

to provide "real financial ability of the Cuban financial

autonomy" to Cuban entities, system to successfully

including foreign investment implement them in the short

vehicles such as the joint term, remain subject to

venture companies in which significant uncertainty,

the Company invests. These the Investment Manager

reforms set fixed levels believes that the new financial

of "liquidity" for various autonomy rules will in

types of income and largely most cases create an objective

remove the requirement (non-discretionary) and

to obtain centralised largely decentralised mechanism

foreign exchange approvals for the allocation of liquid

for international payments resources, thereby significantly

(such as the distribution increasing the financial

of dividends to foreign autonomy of joint venture

shareholders) sourced companies and representing

from the "liquid" financial a real reduction in liquidity

resources over which the risk.

entities have autonomous/decentralised Where insufficient liquidity

control. This new "liquidity" may be generated from operations,

generated automatically then the relevant joint

in the course of operations venture companies will

is in addition to the remain subject, as before,

regular centralised/government to the more general system

allocations of liquidity, of centralised allocation

which must still be provided of liquidity, with the

(as was the case prior inherent risks that this

to adoption of the reforms) implies.

in the event that the

financial autonomy rules

do not generate sufficient

liquid resources from

operations to cover international

obligations. However,

these measures are being

implemented gradually

and do not at present

apply to all economic

sectors or to all joint

venture companies. In

particular, the new rules

are not presently being

applied to joint venture

companies in the commercial

real estate sector (such

as Inmobiliaria Monte

Barreto S.A. in which

the Company has a 49%

interest) with the result

that these companies remain

fully dependent on centrally

assigned liquidity for

their international payments.

The new measures may take

time to show the intended

effect or may not have

the stated positive impact

on the liquidity position

of the country, or their

application may not be

fully extended to all

of the joint venture companies

in which the Company has

a participation, which

may have a negative effect

of the affairs of the

Company.

---------------------------------------- ------------------------------------- -------

Currency Reform As part of the 2020-2021 The currency devaluation á

Risk economic reform package risk associated with the

adopted by the Cuban government imposition of the CUP as

in order to continue modernising sole currency for operations

the Cuban economy, new is new and significant.

currency reforms aimed The cash and currency positions

at harmonising exchange of each of the joint venture

rates and eliminating companies in which the

Cuba's dual currency system Company has a participation

required all foreign investment are continuously monitored

vehicles to convert and for the purpose of reducing

denominate their assets currency risk to the greatest

and legal obligations, extent possible. There

and to carry out all transactions, are presently no hedging

in Cuban Pesos (" CUP mechanisms available to

" previously denominated mitigate this new risk.

and carried out in US$).

The Cuban Peso has a fixed

(non-market) exchange

rate of US$1.00 : CUP24,

which may be subject to

further devaluation at

the discretion of the

Cuban Central Bank.

---------------------------------------- ------------------------------------- -------

General Liquidity The continued high levels The Investment Manager á

of the Cuban Financial of tension between the actively monitors and manages

System and Repatriation United States and Cuba the liquidity position

Risk and the maintenance by of the Company, its subsidiaries

the Biden administration and the joint ventures,

of harsh U.S. sanctions in which it invests to

imposed during the Trump the greatest extent possible

administration, which so that cashflows of the

have resulted in steep Company are transferred

reductions in U.S. family to bank accounts outside

remittances and travellers Cuba. The Investment Manager

to Cuba, as well as the has no control or influence

global fall in international over the execution or timing

tourism and other economic of payments to be transferred

shocks associated with by Cuban banks to the Company's

the Covid-19 pandemic, international bank accounts.

together with numerous

transitional difficulties

associated with the implementation

of the currency reform

measures described above,

have had strong negative

impacts on the fragile

economic and liquidity

positions in Cuba. In

the final months of 2021

and through the first

quarter of 2022, there

was a marked deterioration

in the timing of international

transfers from Cuba. The

duration of these negative

effects is unknown, and

they may in turn have

a continuing negative

impact on the ability

of the joint venture companies

in which the Company has

an interest to make distributions

abroad, which in turn

may have a negative impact

on the ability of the

Company to carry out its

investment programme.

---------------------------------------- ------------------------------------- -------

Risks relating Cuba maintains strong Although the conflict resulted á

to the War in historical, political in an abrupt halt of the

Ukraine and economic ties to Russia tourists travelling from

and to Ukraine. The Russian-Ukrainian Russia and Ukraine to Cuba,

conflict that erupted the operator of the Company's

in February 2022 resulted tourism assets has refocused

in an abrupt halt in Russia its marketing efforts to

and Ukraine tourism to attract tourists from its

the island. Since the historical principal tourist

reopening of the tourism supplier (Canada) and other

sector in November 2021, countries.

Cuba welcomed a significant

number of Russian and

Ukranian tourists to the

island. Further aspects

of the Russia-Cuba relationship

may eventually be affected

by the conflict, including

Russian investments in

Cuba, banking relationships

and other areas.

---------------------------------------- ------------------------------------- -------

Public Health Risk

Global Pandemic Although Cuba and many The Board discusses current â

Risk other parts of the world issues with the Investment

appear to have now passed Manager to limit the impact

the worst stage of the of the pandemic on the

Covid-19 pandemic and business of the Company.

to have reached, or be The Board recognises that

on the point of reaching, tourism is particularly

a stage of declining numbers affected by the various

of new cases, hospitalisations travel restrictions that

and deaths, the continued have been imposed and considers

effects of the public that this is a risk that

health risks associated is likely to continue to

with the Covid-19 pandemic, impact upon the operating

including the arrival environment of the Company

of new variants, may have in the short term .

a lasting and as yet unquantifiable The Board's actions are

negative impact on the targeted at (i) protecting

global tourism industry, the welfare of the various

the economy of Cuba, and teams involved in the affairs

the operations and performance of the Company, (ii) ensuring

of the assets of the Company. operations are maintained

The pandemic may directly to the extent possible

or indirectly affect all and to protect and support

other risk categories the assets of the Company

mentioned in this matrix. for the duration of the

present crisis, and (iii)

to mitigate insofar as

possible the longer-term

negative impact of economic

and operational disruption

caused by this and future

pandemics.

---------------------------------------- ------------------------------------- -------

Risks Relating to the Company and its Investment Strategy

Investment Strategy The setting of an unattractive The Company's investment ->

and Objective strategic proposition strategy and objective

to the market and the is subject to regular review

failure to adapt to changes to ensure that it remains

in investor demand may attractive to investors.

lead to the Company becoming The Board considers strategy

unattractive to investors, regularly and receives

a decreased demand for strategic updates from

shares and a widening the Investment Manager,

discount. investor relations reports

and updates on the market

from the Company's Broker.

At each Board meeting,

the Board reviews the shareholder

register and any significant

movements. The Board considers

shareholder sentiment towards

the Company with the Investment

Manager and Broker, and

the level of discount at

which the Company's shares

trade.

---------------------------------------- ------------------------------------- -------

Investment Restrictions Investing outside of the The Board sets, and monitors, ->

investment restrictions its investment restrictions

and guidelines set by and guidelines, and receives

the Board could result regular reports which include

in poor performance and performance reporting on

inability to meet the the implementation of the

Company's objectives, investment policy, the

as well as a discount. investment process and

application of the guidelines.

The Investment Manager

attends all Board meetings.

The Board monitors the

share price relative to

the NAV.

---------------------------------------- ------------------------------------- -------

Portfolio and Operational Risks

Joint Venture The investments of the Prior to entering into ->

Risk Group in Cuban real estate any agreement to acquire

assets are made through an investment, the Investment

Cuban joint venture companies Manager will perform or

in which Cuban government procure the performance

entities hold an equity of due diligence on the

interest, giving rise proposed acquisition target.

to risks relating to the The Group tries to structure

liquidity of investments, its equity investments

government approval, corporate in Cuban joint venture

governance and deadlock. companies so as to include

a viable exit strategy.

The Investment Manager,

or the members of the on-the-ground

team, regularly attend

the Board meetings of the

joint venture companies

through which Group interests

are held, and actively

manage relations with the

management teams of each

joint venture company,

the relevant Cuban shareholders

and relevant third parties

to ensure that Group interests

are enhanced.

---------------------------------------- ------------------------------------- -------

Real Estate Risk As an indirect investor The Investment Manager á

in real estate assets, regularly monitors the

the Company is subject level of real estate risk

to risks relating to property in the Cuban market and

investments, including reports to the Board at

access to capital and each meeting regarding

finance, global capital recent developments. The

and financial market conditions, Investment Manager works

acquisition and development closely with the on-the-ground

risk, competition, tenant team, the external hotel

risk, environmental risk managers and the joint

and others, and the materialisation venture managers to identify,

of these risks could have monitor and actively manage

a negative effect on specific local real estate risk.

properties, development In the case of Monte Barreto,

projects or the Group tenant risk has been augmented

generally. by the new financial autonomy

rules, which result amongst

others in certain categories

of tenants paying their

rents with varying degrees

of liquidity. The Investment

Manager, together with

the management team of

Monte Barreto, now assesses

the impact of the new financial

autonomy rules in all new

leasing decisions.

---------------------------------------- ------------------------------------- -------

Construction Risk As a developer and investor The Investment Manager á

in new construction as regularly monitors all

well as refurbishment construction and refurbishment

projects, the Company activities carried out

is subject to risks relating within Group companies

to the planning, execution and works closely with

and cost of construction the on-the-ground management

works, including the availability team and the joint venture

and transportation of managers to identify, monitor

materials and the cost and actively manage all

thereof, inclement weather, construction risks. The

contractor risk, execution Investment Manager reports

risk and the risk of delay. to the Board at each meeting

The materialisation of regarding recent developments

these risks could have in this respect. In the

a negative effect on the construction context, the

implementation of development availability and transportation

projects of the Group. of construction materials

have been significantly

affected by the Covid-19

pandemic worldwide, thereby

increasing construction

costs.

---------------------------------------- ------------------------------------- -------

Tourism Risk As an indirect investor The Investment Manager â

in hotel assets, the Company regularly monitors the

is subject to numerous local and regional tourism

risks relating to the markets and meets regularly

tourism sector, both in with the external hotel

outbound and inbound markets, management to identify,

including the cost and monitor and manage global

availability of air travel, and local tourism risk

the imposition of travel and to develop appropriate

restrictions by overseas strategies for dealing

governments, seasonal with changing conditions.

variations in cash flow, The Company aims to maintain

demand variations, changes a diversified portfolio

in or significant disruptions of tourism assets spanning

to travel patterns, risk various hotel categories

related to the manager (city hotel / beach resort,

of the hotel properties, business / leisure travel,

and the materialisation luxury / family) in numerous

of these risks could have locations across the island.

a negative impact on specific As the world reemerges

properties or the Company from the Covid-19 pandemic

generally. the Investment Manager

is working closely with

the external hotel management

to optimise the resumption

of full scale operations

at the hotels in which

the Company has an interest.

---------------------------------------- ------------------------------------- -------

Valuation Risk Asset valuations may fluctuate As part of the valuation á

materially between periods process, the Investment

due to changes in market Manager engages an independent

conditions. The combined third party valuer to provide

effects of higher levels an independent valuation

of risk associated with report on each of the indirectly

financial and monetary owned real estate assets

reforms, the continuation of the Group. The valuations

under the Biden administration are also subject to review

of an aggressive U.S. by the Investment Manager's

sanction regime and the Alternatives Pricing Committee.

slower than expected recovery

of the worldwide tourism

market in the face of

the pandemic have resulted

in increased discount

rates and lower income

projections, leading to

a rise in the volatility

of valuations.

---------------------------------------- ------------------------------------- -------

Dependence on The Company is dependent The Board receives reports ->

Third Party Service on the Investment Manager from its service providers

Providers and other third parties on internal controls and

for the provision of all risk management at each

systems and services relating Board meeting. It receives

to its operations and assurance from all its

investments, and any inadequacies significant service providers

in design or execution as well as back-to-back

thereof, control failures assurances where activities

or other gaps in these are themselves sub-delegated

systems and services could to other third party providers

result in a loss or damage with which the Company

to the Company. In addition, has no direct contractual

the continued high level relationship. In the course

of aggression of U.S. of its activities, the

sanctions may limit the Management Engagement Committee

pool of service providers of the Board reviews the

willing or able to work engagements of all third

with the Company. party service providers

on an annual basis. Further

details of the internal

controls which are in place

are set out in the Directors'

Report.

---------------------------------------- ------------------------------------- -------

Loss of Key Fund The loss of key managers Under the Management Agreement, ->

Personnel contracted by the Investment the Investment Manager

Manager to manage the has the obligation to provide

portfolio of investments at all times personnel

of the Group could impact with adequate knowledge,

performance of the Company. experience and contacts

in the Cuban market. In

order to mitigate key manager

risk. The Investment Manager

makes every effort to spread

knowledge and experience

of the Cuban market within

the organisation so as

to reduce reliance on a

small team of individuals.

---------------------------------------- ------------------------------------- -------

Risks Relating to Investment in Cuba and the U.S. Embargo

General Economic, The Group's underlying The Company benefits from

Political, Legal investments are situated the services of its highly

and Financial and operate within a unique experienced on-the-ground

Environment within economic and legal market, management team consisting

Cuba with a comparatively high of eight members. With

level of uncertainty, a well-balanced mix of

and a sensitive political Cuban and foreign professionals

environment. who all have long-standing

expertise in the country,

the team is one of the

most practised investment

groups focused exclusively

on investment in the Cuban

market, which constantly

monitors the economic,

political and financial

environment within Cuba.

The subsidiaries of the

Company have been structured

to benefit from existing

investment protection and

tax treaties to which Cuba

is a party.

---------------------------------------- ------------------------------------- -------

U.S. government Tensions remain high between The Investment Manager ->

restrictions relating the governments of the closely follows developments

to Cuba United States and Cuba relating to the relationship

and the U.S. government between the United States

maintains numerous legal and Cuba and monitors all

restrictions aimed at new restrictions adopted

Cuba, including the inclusion by the United States to

of Cuba on the U.S. list measure their possible

of state sponsors of terrorism. impact on the assets of

Contrary to pre-election the Group. The Group has

campaign statements and adapted its investment

widely held initial expectations, model to the existing sanctions,

the Biden administration but the risk remains of

has not taken any steps further sanctions being

to soften or suspend any adopted in the future.

restrictions against Cuba,

although it is possible

that it might do so in

the future. The rise of

further tensions with

the United States or the

adoption by the U.S. government

of further restrictions

against Cuba could negatively

impact the operations

of the Company and its

access to third-party

service providers, the

value of its investments,

the liquidity or tradability

of its shares, or its

access to international

capital and financial

markets.

---------------------------------------- ------------------------------------- -------

Helms-Burton Risk On 2 May 2019, Title III At the time of acquiring ->

of the Helms-Burton Act each of its interests in

was brought fully into Cuban joint venture companies,

force by the Trump administration the Company carried out

following 23 years of extensive due diligence

successive uninterrupted investigations in order

suspensions. Numerous to ensure that no claims

legal claims were subsequently existed under applicable

launched before U.S. courts U.S. legislation, and in

against U.S. and foreign particular that there were

investors in Cuba, which no claims certified by

has had and could have the U.S. Foreign Claims

a further negative impact Settlement Commission under

on the foreign investment its Cuba claims program

climate in Cuba and may with respect to any of

hinder the ability of the properties in which

the Company to access the Company acquired an

international capital interest. However, given

and financial markets the broad definitions and

in the future. In light terms of the Helms-Burton

of the political nature Act and its purpose of

of the Helms-Burton Act, creating legal uncertainty

and the fact that under on the part of investors

Title III of the Act, in Cuba, as well as the

Cuban persons who were absence of any register

not U.S. Persons at the of uncertified claims or

time their property was case law, there is no certain

expropriated but subsequently way for the Company to

became U.S. Persons have verify beyond doubt whether

the right to make claims, or not a Helms-Burton action

there is also a risk that under Title III could be

legal claims might be brought in respect to a

initiated against the particular property, or

Company or its subsidiaries whether the Company may

before U.S. courts. The be deemed to indirectly

Biden administration has profit or benefit from

not taken any steps to certain activities carried

suspend or repeal Title out by other parties. The

III of the Helms-Burton Company does not have any

Act, although it is possible property or assets in the

that it might do so in United States that could

the future . be subject to seizure.

---------------------------------------- ------------------------------------- -------

Transfer Risk Numerous U.S. legal restrictions The Investment Manager ->

- U.S. Sanctions contained in the Cuban is conscious of and closely

Assets Control Regulations follows developments concerning

and other legal provisions the U.S. legal restrictions

target financial transactions, that target financial transactions

instruments, and other and assets. The Company

assets in which there does not carry out any

is a Cuban connection. international transfers

As a result U.S. and international in U.S. Dollars or through

banks, clearing houses, U.S. banks or intermediaries.

brokers and other financial The Investment Manager

intermediaries may refuse manages the banking relationships

to deal with the Company of the Company and generally

or may freeze, block, acts at all times so as

refuse to honor, reverse to minimise the impact

or otherwise impede legitimate of these legal provisions

transactions or assets on the legitimate transactions

of the Company, even where and assets of the Company.

no U.S. link is established.

---------------------------------------- ------------------------------------- -------

Currency Risk As a result of U.S. sanctions The Company does not hedge á

prohibiting the use of its foreign currency risks.

the U.S. dollar, the Group

deals in numerous currencies

and fluctuations in exchange

rates can have a negative

impact on the performance

of the Group, as well

as the expression of the

Company's NAV in Sterling

and/or USD.

The risk relating to monetary

reforms recently adopted

by the Cuban government

imposing the use of the

CUP are described elsewhere

in this table.

---------------------------------------- ------------------------------------- -------

Risks relating to Regulatory and Tax framework

Tax Risk Changes in the Group's The Investment Manager

tax status or tax treatment regularly reviews the tax

in any of the jurisdictions rules that may affect the

where it has a presence operations or investments

may adversely affect the of the Company and seeks

Company or its shareholders. to structure the activities

of the Company in the most

tax efficient manner possible.

However, the Company holds

investment structures in

numerous jurisdictions

arising from past acquisitions,

and the general direction

of change in many jurisdictions

is not favourable.

---------------------------------------- ------------------------------------- -------

The financial risks associated with the Company include market

risk, liquidity risk and credit risk, all of which are described in

greater detail in note 19 to the Consolidated Financial

Statements.

The Board will continue to assess these risks on an ongoing

basis and is confident that the procedures that the Company has put

in place are sufficient to ensure that the necessary monitoring of

risks and controls has been carried out throughout the reporting

period.

INVESTMENT MANAGER'S REVIEW

2021 PERFORMANCE

The performance of CEIBA Investments Limited ("CEIBA" or the "

Company ") is largely dependent on the fair values of the

properties in which it has an interest as calculated using

discounted cash flow models by the independent RICS valuer

Arlington Consulting - Consultadoria Imobiliaria Limitada, trading

under the name Abacus ("Abacus"). As at 31 December 2021, the fair

values of all of the assets in which CEIBA Investments has an

interest decreased, mainly as a result of (i) a fall in projected

income levels as a result of the continued effects of the Covid-19

pandemic and its negative impact on the Cuban tourism sector and

the Cuban economy, (ii) the continuation under the Biden

administration of President Trump's intensified Cuba embargo

policies, and (iii) increased discount rates as a result of higher

levels of perceived risk in the present circumstances, in

particular as regards the liquidity issues faced by the

country.

As at 31 December 2021, the Net Asset Value of the Company was

US$160,322,589 (31 December 2020: US$194,425,614) and the NAV total

return for the year was -17.5 % (2020: -6.0 %). The loss on the

change in the fair value of the equity investments during the year

was US$13,843,717 (2020: loss US$41,914,276). The total dividend

income from the Cuban joint venture companies during 2021 was

US$3,050,124 (2020: US$13,258,912). The net loss of the Company for

2021 attributable to the shareholders was US$28,811,901 (2020:

US$19,808,620).

INTRODUCTION

If there are two things that I have in my DNA, they are

positivism and looking at a brighter future instead of looking

back.

After another difficult year, during which the country faced

extremely challenging conditions, by November 2021 Cuba had

demonstrated to the world that its home-grown Abdala and Soberana 2

vaccines were indeed effective in the fight against Covid-19 and

that its country-wide vaccination program had been diligently

implemented and resulted in rapidly falling numbers of new cases

and fatalities, and once again these qualities took the upper hand

and I thought that the Cuban economy had hit bottom and would begin

rising to a brighter future.

But at the start of Cuba's high tourism season, just as Cuba was

reopening its international borders and welcoming international

travellers back to the island, the Omicron variant of the Covid-19

virus emerged in South Africa and rapidly spread throughout the

world, causing a new wave of restrictive travel measures aimed at

slowing the swift pace of infections produced by the new variant.

These measures resulted in many travel cancellations from Canada

(historically Cuba's most important source of tourists during the

very important period from December to April each year). Despite

this obvious setback, tourist numbers began to improve, with Russia

joining Canada as one of the principal source markets. All of our

hotels re-opened, occupancy levels and profitability started to

increase, and I hoped that Cuba's precarious liquidity position

would soon start to show signs of improvement!

However, once again positive momentum was short-lived.

When on 24 February 2022 Russia invaded Ukraine, all Russian

(and Ukrainian) travel came to an abrupt halt and Cuba once again

found itself facing the prospect of a difficult high season.

The general lack of liquidity within Cuba's economy during 2021,

the continuation under the Biden administration of the strengthened

Trump sanctions against Cuba and the present uncertainty regarding

the timing of a tourism recovery have all taken their toll and have

forced CEIBA to make downward adjustments to our asset

valuations.

This has triggered that the 2021 year-end result of the Company

is a net loss attributable to the shareholders of US$28,811,901.

The outlook for 2022 will largely depend on how long the

Russia-Ukraine conflict will last, how it will impact world

politics and Cuba's important relationships, and its effect on

international travel patterns and the recovery of Cuba's tourism

industry. To a lesser extent, the coming year could also be further

affected by the rise of any new variant of the Covid-19 virus.

In addition, starting in the final months of 2021 and continuing

through to today, the Cuban banking system has experienced

significant delays in the execution of payments instructed, even

where such payments are made with the required "liquidity" in

accordance with the new financial autonomy rules. This shows that

the Cuban liquidity position is precarious, and this may make it

more challenging to continue implementing its program of monetary

reforms.

Monetary Reforms

Cuba's recent monetary reforms, announced in 2020 and

implemented in 2021, eliminated Cuba's double currency and were

undoubtedly planned on the basis of a projected improvement in the

country's precarious liquidity position that was expected to result

from a growing (not shrinking) economy. It introduced a fixed

official exchange rate of 24 Cuban Pesos to 1 United States Dollar

and was aimed primarily at improving financial discipline,

transparency and accountability within Cuba's state-owned

enterprises.

However, the events described above and the continuation of U.S.

sanctions under the Biden administration (particularly those

affecting family remittances and U.S. travel) that were widely

expected to be relaxed, jointly had a negative impact on the

liquidity position of the country and complicated the

implementation of the reforms, provoking numerous distortions in

both the private and foreign investment sectors.

In addition, the scarcity of hard currency income to pay for

imported products, resulting in shortages of basic products for

sale in local currency (CUP) shops, triggered significant inflation

and a fall in the informal exchange rate so that by the end of 2021

the street rate of exchange had reached CUP75 to USD1, falling

further to CUP 110 to USD 1 by 15 April 2022. By contrast, joint

ventures, international airlines and all state-owned businesses

were obliged to use the official rate of CUP24 to USD1, in turn

provoking undesired monetary arbitrage.

The government has not signalled any future devaluation of the

CUP and instead has argued that it hopes to close the discrepancy

between the official and informal rates through increased national

production and an improved supply of basic products in the CUP

retail outlets.

By the end of 2021, the lack of liquidity in the economy also

began to be noticeable in delays in the execution of international

payments made under the financial autonomy rules, which in turn

puts significant pressure on one of the principal objectives of the

monetary reforms for foreign trade and investment, which is to

guarantee financial autonomy and the repatriation of profits.

The Colony

In March 2022 I visited Finca El Rosillo, a small privately

owned farm next to the main highway to Pinar del Rio Province where

the owners produce a delicious honey made by bees that do not

sting. The bees create their colonies in rotten tree trunks and

protect them by sealing them off and leaving only a single entry

and exit that is constantly guarded to protect the colony from its

biggest enemy: hornets (that do sting). This seems to be a good

metaphor for the short-term strategy of Cuba: seal all points of

entry, grow the internal economy and avoid getting stung by

hornets.

US Cuban Embargo - 60 Years Old

On 3 February 2022 the Cuban economy had endured 60 years under

the U.S. embargo, it having been first adopted by President Kennedy

in 1962 as Proclamation 3447 entitled Embargo on All Trade with

Cuba, and having the main purposes of stopping the spread of

communism and causing "hunger, desperation and overthrow of

government." During the subsequent six decades, the legal measures

creating the embargo have ebbed and flowed, gaining or losing

strength in accordance with the prevailing political winds in

Florida, but the negative impact on the island has been

constant.

In its present form, subsequent to the adoption of the

Helms-Burton Act of 1996, the U.S. embargo against Cuba is

enshrined in law and can only be overturned by Congress, which

would be no small feat in today's politically divided reality in

the United States. The embargo prohibits trade between U.S. persons

and Cuba, but its insidious negative effects also extend

extra-territorially to a large number of valid and legitimate

transactions between Cuba and its international partners, whether

they be other sovereign governments or, most importantly for the

Company, foreign investors who invest or trade on the island.

Following a significant relaxation of the embargo rules during

the Obama administration, the Trump administration resumed a much

harder line and returned the United States to a policy of strong

aggression towards its smaller neighbour. So far, the Biden

administration has not relaxed any of the harsher sanctions of the

Trump era, notwithstanding his stated intent to do so expressed

during the presidential campaign in 2020.

In early March 2022, it was announced that the U.S. Embassy in

Havana would be re-staffed and would resume a certain number of

direct consular services in Havana. The expectation remains that

some easing of the present sanctions will be forthcoming, most

likely in the areas of family remittances and the facilitation of

travel between the U.S. and Cuba.

Conflict in Ukraine

In February 2022, Russia invaded Ukraine. Both countries are

traditional allies of Cuba and both were important sources of

tourists for the island during parts of the pandemic and especially

from the full reopening of the Cuban tourism sector in November

2021 until the outbreak of the war. In January and February 2022,

Russian travellers were amongst the largest groups of tourists to

the island, roughly equal to Canada, which usually is the leading

source of travellers. The war has resulted in the cancellation of

most direct flights between Russia and Cuba, representing a further

blow to the Cuban tourism industry, already hard hit by two years

of pandemic-related hotel closures and travel restrictions. It

remains unclear at present whether Russian tourism to the island

will rebound or whether other markets will be able to make up the

shortfall. The war in Ukraine is also expected to have other

indirect impacts on the Cuba economy in areas such as the price of

oil, shipping costs and the availability of ships to Cuba

(especially from Europe). Russian investments on the island may be

affected, as well as banking relationships.

PORTFOLIO ACTIVITY

The Miramar Trade Centre / Monte Barreto

The largest real estate holding of the Company is its 49%

interest in Inmobiliaria Monte Barreto S.A. ("Monte Barreto"), the

Cuban joint venture company that owns and operates the Miramar

Trade Centre, a six-building mixed-use commercial real estate

complex comprising approximately 56,000 square metres

(approximately 600,000 square feet) of net rentable area that

constitutes the core of the new Miramar business district in

Havana.

Occupancy rates remained largely stable throughout the year,

declining a modest 1.6% from 98.2% at the beginning of the year to

96.6% at year-end. The property suffered a small number of

departures relating to the pandemic, and the market has tightened

somewhat. Revenues declined by 3.6% compared to the prior year as a

result of the lower occupancy rate and modest rent incentives

granted. However, Monte Barreto registered net income of US$15.6

million during the year (2020: US$14.4 million), representing an

8.5% increase over the prior year and a new record for annual

profit. The increase was primarily the result of savings resulting

from the monetary reforms implemented during the year, including

reduced operational expense (mainly salary and electricity

costs).

Demand for international-standard office accommodation in Havana

remains strong, predominantly from multi-national companies, NGOs

and foreign diplomatic missions. Monte Barreto remains the market

leader. As a consequence, the operational outlook for Monte Barreto

in 2022 remains positive, as we expect occupancy levels to remain

in the high nineties throughout the coming year. However, in light

of the present market conditions, which remain uncertain -

particularly as regards liquidity - the joint venture is applying

its general strategy of rental increases as leases are renewed on a

case by case basis.

In accordance with the new provisions of Resolution 115 dealing

with financial autonomy and the allocation of hard currency

resources, commercial real estate activities have been excluded

from some of the general rules relating to "liquid" payments (the

ability to transfer funds abroad on an autonomous basis, without

foreign exchange controls), and consequently the local payments of

many tenants of the joint venture are presently not received with

liquidity and conversely most local payments to be made by the

joint venture are similarly not made with liquidity. As a result,

the joint venture is presently operating under a mixed regime

having reduced liquidity requirements, in which certain liquid

resources of the joint venture are generated internally through

operations, and certain resources are allocated centrally.

Given the present limited financial autonomy of Monte Barreto,

in combination with the current economic situation and liquidity

difficulties faced by the country, Monte Barreto did not have

sufficient liquid resources (whether generated internally or

allocated centrally) to pay significant dividends payable to the

Company during the past year. Management is currently discussing

potential solutions for the liquidity issues of Monte Barreto with

the relevant Cuban authorities and pending agreement and

implementation of such a solution accumulated profits remain in the

joint venture company. In addition to the above, hard currency

transfers made by Cuban banks are presently experiencing delays.

Dividend income recorded by the Company from Monte Barreto during

the year was US$2.6 million, compared to US$6.9 million in 2020.

Due to the uncertainty on the timing of payment of the dividends

owed to the Company by Monte Barreto, the Company has made a

provision in its financial statements in the amount of

US$12,281,408 representing the outstanding dividends receivable

from Monte Barreto.

The valuation of Monte Barreto has been adjusted downward at 31

December 2021 by US$13.7 million to US$67.7 million, representing a

16.9% decline as compared with the December 2020 valuation. This

was driven mainly by an increase in the discount rate to 12.8%

(2020: 9.8%) applied in the discounted cash flow model of Monte

Barreto in order to take into account the disruption to the Cuban

economy caused by the Covid-19 pandemic, continued U.S. aggressive

measures and the increased liquidity, transfer and currency risks

faced by Monte Barreto and its shareholders.

We expect these headwinds to remain present throughout 2022 and,

as a result, we believe that only part of the presently outstanding

dividends will be paid during the current year. Nevertheless, we

believe that the pace of distribution of dividends will pick up

once again when the country re-emerges from the present

difficulties, which is not likely to occur until 2023.

The Hotels of Miramar

Through its indirect ownership of a 32.5% interest in Miramar,

the Group has interests in the following hotels:

- the Meliã Habana Hotel, a 397-room international-category

5-star business hotel located on prime ocean-front property in

Havana (directly opposite the Miramar Trade Center);

- the Meliã Las Americas Hotel, a 340-room

international-category 5-star beach resort hotel located in

Varadero;

- the Meliã Varadero Hotel, a 490-room international-category

5-star beach resort hotel located in Varadero; and

- the Sol Palmeras Hotel, a 607-room international-category

4-star beach resort hotel located in Varadero.

The Hotels are operated by Meliã Hotels International S.A.

("Meliã Hotels International"), which also has a 17.5% equity

interest in Miramar (and a 10% equity interest in TosCuba).

Performance of the Hotels

As a result of the Covid-19 pandemic and the resulting collapse

of the worldwide travel industry, the Hotels once again faced an

extremely challenging business environment in 2021. While the Sol

Palmeras and the Meliã Habana hotels were able to maintain services

throughout the year, occupancy and room rates were reduced. The

Meliã Las Americas and Meliã Varadero hotels resumed operations

towards the end of the year (in November and December 2021,

respectively) following the formal reopening of the Cuban tourism

industry in November 2021.

With two of its hotels closed throughout most of the year and

the other two operating at very low levels, together with the

one-time foreign exchange expense of US$5.4 million relating to the

conversion of monetary assets under the monetary reforms, the net

loss after tax of Miramar was US$9.6 million (2020: net loss of

US$3.5 million). This also resulted in lower dividend income earned

by the Company from Miramar during the year of US$500 thousand,

compared to US$6.3 million in the prior year.

All four of the Hotels of Miramar are presently operating under

volatile and unpredictable market conditions. We believe that the

Hotels are presently in a very strong competitive position within

the Cuban market, given that two of the four operated throughout

the year and consequently Miramar has a stronger working capital

position and other operational advantages over competitors.

However, since the formal re-opening of the Cuban tourism sector in

November 2021 (following the success of the Cuban vaccination and

other public health efforts to control the pandemic), the

subsequent arrival of the Omicron variant in December 2021, closely

followed by the Russian invasion of Ukraine, have once again

affected the most important outbound tourism markets for Cuba:

Canada, Western Europe and Russia. The outlook for 2022 remains

uncertain and will depend on numerous factors external to Cuba,

including in particular the recovery of international travel

patterns and the availability of airlift.

Once hotel operations return to normal as the world emerges from

the Covid-19 pandemic and international travel and tourism markets

recover from the disruption suffered over the last two years, we

expect the liquid resources directly generated by the operations of

Miramar under the new liquidity rules to be more than sufficient to

allow Miramar to distribute dividends.

The valuation of Miramar has been adjusted downwards at 31

December 2021 to US$94.5 million (2020: US$103.2 million),

representing a 9.2% decline. This was driven mainly by an increase

in the discount rates applied in the discounted cash flow models of

the Hotels in order to take into account the disruption to the

Cuban tourism industry caused by the Covid-19 pandemic and the

uncertain timing of recovery, continued U.S. aggressive measures,

as well as a slightly more conservative approach to the recovery of

occupancy rates as the world emerges from the pandemic.

The TosCuba Project

The Company has an 80% interest in Mosaico Hoteles S.A.

("Mosaico Hoteles"), representing a 40% indirect interest in

TosCuba, the Cuban joint venture company that is constructing the

401 room Meliã Trinidad Península Hotel.

As at 31 December 2021, all structural works (including windows

and roofing) had been substantially completed and electric,

plumbing and air-conditioning works had started. The building

process has been progressing slowly since the beginning of the

Covid-19 pandemic in March 2020 but is now expected to be completed

within the next twelve months.

During the first months of 2021 the joint venture, under the

leadership of Mosaico Hoteles, undertook a full review and

reorganisation of the hotel construction process, which resulted in

the termination of the turnkey construction contract with the

Cuban-Italian construction partnership (with effect from 30 June

2021) and the renegotiation and increase of existing finance

arrangements. TosCuba has now taken full control over the site as

well as all stored materials and equipment, and will now complete

the construction of the hotel on its own, with technical assistance

on pricing, tender procedures and product selection from

International Hospitality Projects S.L., a Spanish construction

adviser in the hotel sector. Under the new structure, significant

progress was made in the second half of 2021 in the tendering and

execution of major supply arrangements, and the pace of

construction is now ramping up once again to pre-pandemic levels.

It is now estimated that construction of the hotel will be

completed by the first quarter of 2023.

In April 2018, the Company arranged and executed a US$45 million

construction finance facility to be disbursed under two tranches of

US$22.5 million each. The terms of the facility were amended in

August 2021 to take into account the new construction process and

other circumstances. At 31 December 2021, the Company's full

participation in the first tranche (Tranche A) in the amount of

US$18 million (2020: US$16.1 million) was fully disbursed, and the

amount of US$709 thousand was disbursed under the second tranche

(Tranche B), the maximum principal amount of which was increased to

US$29 million under the August 2021 amendment to the facility. The

increased principal of Tranche B includes an amount of US$4 million

that may be used for the purchase of equipment needed by the

relevant Cuban utility companies to ensure the provision of the

required water and electrical services to the hotel.

Repayment of the amended facility is secured by the future

income of the hotel, and repayment of Tranche B has also been

guaranteed by Cubanacán (the Cuban shareholder in the joint venture

company) and is further secured by Cubanacán's dividend

entitlements in Miramar.

The total cost of the project - including incorporation of the

joint venture company, acquisition of surface rights, construction

of the hotel, financing for the acquisition of equipment necessary

to guarantee the proper functioning of public utilities and

start-up costs - is presently estimated at US$78.8 million. Of this

amount, US$16 million represents the share capital invested in

TosCuba by the shareholders, of which the Company contributed

US$6.4 million (40%), more than US$11.2 million represents grants

received under the Spanish Cuban Debt Conversion Programme, and

US$4 million represents finance to be granted to third parties

(which will be repaid). The remaining funds necessary to complete

the project will be disbursed under the construction finance

facility.

GBM Interinvest Technologies Mariel S.L.

In December 2020, the Company formalised its participation in a

new multi-phase industrial park real estate project to be developed

in the Special Development Zone of Mariel, Cuba by acquiring a 50%

interest in GBM Interinvest Technologies Mariel S.L., the Spanish

company that is developing the project.

Groundworks on the 11.3-hectare site for the construction of the

first four warehouses of the project began in the first quarter of

2021 and were completed in June 2021. Discussions with potential

tenants are currently being pursued with a view to coordinating the

start of construction works with the existence of real demand.

The Company paid an initial amount of US$303,175 for its 50%

interest entered into a Convertible Loan Agreement in the principal

amount of EUR500,000 (US$566,316) during the course of 2021. The

full investment of the Company in this project is expected to be

approximately US$1.5 million.

FINTUR Facility

Since 2002, the Company has arranged and participated in

numerous secured finance facilities extended to Casa Financiera

FINTUR S.A. ("FINTUR"), the Cuban government financial institution

for the tourism sector. Under the most recent FINTUR Facility,

originally executed in 2016 in the principal amount of EUR24

million and subsequently amended in 2019 through the addition of a

second tranche in the principal amount of EUR12 million, the

Company initially held a EUR4 million participation under Tranche A

and a EUR2 million participation under Tranche B.

This facility generates an 8.00% interest rate and operated

successfully without delay or default until the closure of all

Cuban hotels in March 2020 as a result of the Covid-19 pandemic. At