TIDMCEL

RNS Number : 7248G

Caparo Energy Ltd

17 May 2011

NOT FOR RELEASE, PUBLICATION OR DISTRIBUTION, DIRECTLY OR

INDIRECTLY, IN OR INTO THE UNITED STATES, AUSTRALIA, CANADA OR

JAPAN

Press Release 17 May 2011

Caparo Energy Limited

("Caparo Energy" or the "Company")

Progress with Suzlon: Delivery of Initial Projects Ahead of

Schedule

2,000 MW Gamesa Agreement

Secured Land for up to 3,000 MW

Update on Mezzanine Funding

The board of directors of Caparo Energy (the "Board") is pleased

to announce a number of developments in connection with the

Company's operations.

Suzlon

In connection with the Company's agreement with Suzlon Energy

Limited ("Suzlon"), the Board is pleased to report that first

deliveries, meaning commissioned and connected to the grid, of the

initial 100.8 MW of projects, as announced on 28 January 2011, are

now anticipated to commence by the end of June 2011, several months

ahead of the previously announced schedule of Q4 2011. The company

has also recently drawn down a tranche of senior debt from its

lenders for these projects.

In addition, the Company is currently in the process of

finalising the sites for the remaining 400 MW of projects, which

are due to be commissioned and connected to the grid by March 2012,

and anticipates placing purchase orders for these between July and

September 2011. On this basis, the Board believes that the Company

is on track to meet the roll-out schedule announced in January

2011, which would result in a cumulative 500 MW of capacity being

commissioned by March 2012 and a further 500 MW to be commissioned

progressively by March 2013.

Gamesa

The Company also announces that it has entered into, through its

wholly owned subsidiary Caparo Energy (India) Ltd, an agreement

with Gamesa Wind Turbines Pvt Ltd ("Gamesa"), a global leader in

wind turbine manufacturing, for the supply, erection, commissioning

and operation/maintenance of a further cumulative 2,000 MW of

turbine capacity for wind power projects to be set up in India (the

"Gamesa Agreement"). The Gamesa Agreement provides for the turbine

capacity to be delivered progressively from 2012 up until the end

of 2016.

The Board believes that the Gamesa Agreement is priced

attractively, relative to current market prices for each of the

models of turbines to be supplied, and is subject to certain

adjustments, for deliveries after the first 450 MW, based on an

agreed formula to reflect changes in applicable international

indices. In return for the delivery of up to 2,000 MW of capacity,

Gamesa will receive certain commitment advances over a period of

three years..

Under the Gamesa Agreement, Caparo Energy will be responsible,

inter alia, for site assessments and the procurement of the land

required for installation of the wind farms.

Land

The Company has secured land that it believes will be suitable

for the installation of 3,000 MW of wind power generation farms in

sites across various wind-rich states. These include leases and

direct allotments, licences and sanctions from the respective state

authorities and the initial permissions for the installation and

connection of power generation farms.

Preliminary wind assessment studies undertaken by the Company

through an internationally recognised firm in this field indicate

that these sites will represent attractive wind resources once

developed. The Company has commenced the installation of wind masts

on these sites, in order to collect more detailed wind data, and

anticipates that the first wind power projects for these locations

will be commissioned from Q4 2012.

The securing of independent access to land and turbines is part

of the Company's long-term strategy for value creation, as

previously disclosed in its AIM Admission Document.

Funding

As previously announced on 28 January 2011, in order to limit

the Company's reliance on its internal cash flow in the short and

medium term and to ensure that the Company is able to acquire

generating capacity in accordance with the delivery timeframes set

out in both the Suzlon and Gamesa agreements, the Company announces

that it is in advanced discussions with a number of parties in

connection with the provision of additional mezzanine financing and

that several non-binding term sheets have been agreed. This

financing, which is anticipated to fund in excess of 600 MW of

projects to be delivered under both the Suzlon and the Gamesa

agreements, is expected to be finalised in various tranches by the

end of Q3 2011. A further update on the outcome of these financing

initiatives will be provided in due course.

Ravi Kailas, Caparo Energy's Chief Executive Officer, said:

"We have been working closely with Suzlon and are pleased with

the advancement of the delivery schedule of the initial projects

and the progress on placing our next purchase orders with them.

"The long term agreement with Gamesa represents the kick-off of

our second phase of building wind farm capacity. This has been

achieved sooner than we expected. The Indian wind energy market has

been very active and we view the terms of this new agreement as

favourable to us. Through our strong relationships with market

leaders Suzlon and Gamesa, the Company should, be able to secure

its supply of wind power capacity in a rising market at

preferential pricing.

"Successfully securing access to land required to meet this

supply will create significant long-term value for the Company and

its stake holders."

Further information on the Company can be found at

www.caparoenergy.com.

- Ends -

For further information please contact:

Caparo Energy Limited

Ravi Kailas, Chief Executive Officer +91 40 4396 0000

Strand Hanson Limited

Angela Peace / Paul Cocker / James Harris +44 (0) 20 7409 3494

Mirabaud Securities LLP

Peter Krens / Rory Scott +44 (0) 20 7878 3360

Pelham Bell Pottinger

Charles Vivian / Philippe Polman +44 (0) 20 7861 3232

This information is provided by RNS

The company news service from the London Stock Exchange

END

DRLGGUMGAUPGURM

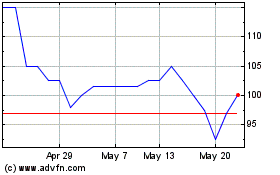

Celadon Pharmaceuticals (LSE:CEL)

Historical Stock Chart

From Jun 2024 to Jul 2024

Celadon Pharmaceuticals (LSE:CEL)

Historical Stock Chart

From Jul 2023 to Jul 2024