TIDMCNR

RNS Number : 3811U

Condor Gold PLC

28 March 2023

Condor Gold Plc

7/8 Innovation Place

Douglas Drive

Godalming

Surrey GU7 1JX

Telephone +44 020 74932784

THIS ANNOUNCEMENT CONTAINS INSIDE INFORMATION FOR THE PURPOSES

OF REGULATION (EU) 596/2014 AS IT FORMS PART OF DOMESTIC LAW IN THE

UNITED KINGDOM BY VIRTUE OF THE EU (WITHDRAWAL) ACT 2018

("MAR").

28 March 2023

Condor Gold Plc

("Condor Gold","Condor" or the "Company")

Condor Gold Announces Its Audited Results For The Year Ended 31

December 2022 and Annual General Meeting of Shareholders

Condor Gold (AIM: CNR; TSX: COG) is pleased to announce its

audited results for the year ended 31 December 2022 and provides

notification that the Annual General Meeting of shareholders of the

Company will be held at 3:00 p.m. on 11 May 2023 at 7/8 Innovation

Place, Godalming, Surrey, GU7 1JX, United Kingdom.

The Company has published the formal notice of meeting (the

"Notice") on its website (www.condorgold.com) together with the

related voting proxy form for use by shareholders. A copy of the

Notice, together with the proxy voting form, the Annual Report for

the year ended 31 December 2022 will be posted to all shareholders

who have elected to receive them in hard copy.

HIGHLIGHTS FOR THE YEARED 31 DECEMBER 2022

-- In Q1 2022 the Company released good drill results for Mestiza open pit:

o 6.3 m true width at 6.84 g/t gold from 31.45 m (drill hole

LIDC568), approximately 50 m below surface outcrop (which occurs on

a rise).

o 4.1 m true width at 15.23 g/t gold from 47.80 m (drill hole

LIDC514) approximately 40 m below surface.

o 3.6 m true width at 29.1 g/t gold from 105.70 m (drill hole

LIDC471) approximately 85 m below surface.

-- In La India open pit new drill results included: 34.1 m true

width at 2.56 g/t gold and 28.7 m true width at 2.62 g/t gold.

-- Updated Mineral Resource Estimate at La India Project of

9,672 kt at 3.5g/t gold for 1,088,000 oz gold in the indicated

mineral resource category and 8,642 kt at 4.3 g/t gold for

1,190,000 oz gold in the inferred mineral resource category.

-- The La India Project's total open pit Mineral Resource

Estimate is 8,693 kt at 3.2 g/t gold for 893,000 oz gold in the

indicated mineral resource category and 3,026 kt at 3.0 g/t gold

for 291,000 oz gold in the inferred mineral resource category. The

Project's total underground Mineral Resource Estimate is 979 kt at

6.2 g/t gold for 194,000 oz gold in the indicated mineral resource

category and 5,615 kt at 5.0 g/t gold for 898,000 oz gold in the

inferred mineral resource category.

-- The Cacao Mineral Resource has increased 69% to 1,164 kt at

2.5g/t gold for 101,000 oz gold in the inferred mineral resource

category. The deposit remains 'open' along strike and at depth.

-- Feasibility Study confirmatory metallurgical test work

demonstrated that gold recovery is independent of grade and a fixed

gold recovery of 91% assuming a 75 micron grind size has been used

in the project economics. At a finer grind size of 53 microns an

average gold extraction of 94.7% was achieved, indicating a

potential upside gold recovery of about 93%.

-- In October 2022, a Feasibility Study demonstrated a robust

and economically viable base case for the La India open pit

only:

o Probable Mineral Reserve of 7.3Mt at 2.56g/t gold for 602,000

oz gold

o Production averages 81,545 oz gold per annum for the first 6

years of an 8.4 year mine life

o An Internal Rate of Return ("IRR") of 23% and a post tax, post

upfront capital cost NPV of US$86.9 million using a discount rate

of 5% and price of US$1,600 oz gold (Mineral Reserve Case).

o An IRR of 43% and a post tax, post upfront capital cost NPV of

US$205.2 million using a discount rate of 5% and price of US$2,000

oz gold.

o Low initial capital requirement of US$105.5 million (including

contingency and EPCM contract)

o Low average Life of Mine All-in Sustaining cash costs US$1,039

per oz gold

-- Land acquisition continued at the La India open pit and

associated mine site infrastructure. To date, 99.6% of the core

areas have been purchased.

-- Site clearance of 14 hectares has been completed for the

processing plant location, including areas for offices, warehouses,

a stockpile, and a buffer zone.

-- On 12 October 2022, Jim Mellon assumed the Chairmanship of Condor Gold

-- GBP6,650,000 of gross proceeds raised by way of private

placements, the issue of convertible loan notes, and an open offer

during 2022.

POST PERIOD HIGHLIGHTS

-- On 13 March 2023 - the sales process is now entering the end

of its first phase with various parties having conducted site

visits and others ongoing. Three formal expressions of interest

including 2 non-binding offers (subject to further due diligence)

have been received by the Company and further offers are expected

as 9 companies are under a Non-Disclosure Agreement (NDA).

Cautionary Statement: Investors should note that, whilst the

Board is encouraged by the process to date, there can be no

guarantee that the Company will complete the sale of its

assets.

CONDOR GOLD PLC

CHAIRMAN'S STATEMENT and CEO's REPORT FOR THE YEARED 31 DECEMBER

2022

Chairman's introductory comments

Dear Shareholder,

Condor is at an important point in its history. It is very close

to mining, with substantial proven reserves, and a carefully costed

mining plan. It is now the time for a larger company to take on the

reins of our key assets and our CEO, Mark Child, has been working

hard to find the right partner. The gold price is rising and the

omens for further rises are good. The Company enjoys strong

shareholder support and I am confident that our outcomes are

positive.

Jim Mellon

Chairman

CEO'S Report

Dear Shareholder,

I am pleased to present Condor Gold Plc's ("Condor", the

"Company" or the "Group", www.condorgold.com or, if you are viewing

from Canada, ca.condorgold.com) annual report for the 12-month

financial year to 31 December 2022. The fully permitted La India

Open Pit and associated mine site infrastructure has been

materially de-risked. with the completion of all technical studies

required for a Feasibility Study Technical Report ("2022 FS")

utilising the new SAG Mill package acquired by Condor in March

2021. Details of the 2022 FS were announced on 12 September 2022

and filed on SEDAR (https://www.sedar.com) and made available on

the Company's websites under "Technical Reports" on 26 October

2022. During the year Condor produced a much more robust Mineral

Resource Estimate for the La India Project, details of which are

included in the 2022 FS.

The Company's strategy has been to develop the fully permitted

La India Project in two stages using the new SAG Mill that has

already been purchased. The delivery of a Feasibility Study on La

India open pit with an average of 81,524 oz gold per annum for the

initial six years for a relatively low total upfront capital cost

of US$106 million is a landmark and further de-risks the Project.

At US$1,600 oz gold, the La India open pit Mineral Reserve produces

total revenues of US$888 million, the total operating costs of

mining, process and G&A are US$480 million, leading to an

operating profit of US$408 million or a 46% operating margin. After

government and other royalties, but before sustaining capital, the

operating profit is US$355 million, which in Condor's opinion is

ample to repay any project debt on the relatively low upfront

capex. At US$2,000 oz gold after paying royalties, but before

sustaining capital the operating profit is US$563 million. In

reality, two permitted high grade feeder pits will be added during

the early years of production thus increasing production ounces of

gold. Early production is targeted at 100,000 oz gold p.a.

The plan would be to materially expand production with a stage

two expansion by converting existing Mineral Resources into Mineral

Reserves and an associated integrated mine plan. On 25 October

2021, the Company announced the results of a Preliminary Economic

Assessment and filed on SEDAR a technical report entitled "Condor

Gold Technical Report on the La Indian Gold Project, Nicaragua,

2021" detailing average annual production of 150,000 oz of gold

over the initial nine years of production from open pit and

underground Mineral Resources and provides an indication of a

production target. Outside the main La India open pit Mineral

Reserve, there are additional open pit Mineral Resources on four

deposits (America, Mestiza, Central Breccia and Cacao) which

represent an aggregate 206 Kt at 9.9 g/t gold for 66,000 oz in the

indicated Mineral Resource category and 2.1Mt at 3.3 g/t gold for

223,000 oz gold in the inferred Mineral Resource category. In

addition, there is an aggregate underground Mineral Resource (La

India, America, Mestiza, Central Breccia San Lucas,

Cristalito-Tatescame, and Cacao) of 979Kt a 6.2 g/t for 194,000 oz

gold in the indicated Mineral Resource category and 5.6Mt at 5.0

g/t gold for 898,000 oz gold in the inferred Mineral Resource

category.

The Company informed the Ministry of the Environment and Natural

Resources ("MARENA") that it had commenced construction (consisting

of site clearance of 14ha, importing the SAG Mill and completing

the FS studies) and fulfilled the initial conditions of an

Environmental Permit (the "EP") granted for the development,

construction, and operation of an open pit mine, a 2,800 tpd or 1.0

Mt per annum CIP processing plant and associated infrastructure at

the La India Project, Nicaragua.

During 2022, Condor produced a much more robust and conversative

Mineral Resource Estimate ("MRE") of the entire La India Project,

which comprises six separate deposits all of which have potential

to be expanded. The focus has been on strengthening the confidence

of the geological model for the 2022 FS on La India Open Pit. The

update on La India Open Pit includes assay results from infill

drilling, a new lithological, structural and weathering model, a

new depletion model for historic and artisanal mining and an

increase in the cut-off grade to 0.65 g/t gold from 0.50 g/t gold.

The updated Mineral Resource includes the latest operating costs

and bulk density measurements. I am pleased the drilling on the

Cacao deposit increased the MRE in the inferred mineral resource

category by 69% to 101,000 oz gold at 2.5 g/t gold, the

interpretation is that drilling has clipped the top of a fully

preserved epithermal vein system with a strike length of at least

1km with the potential to host over 1 million oz gold.

The MRE update was prepared by SRK Consulting (UK) Limited

("SRK") and uses the terminology, definitions and guidelines given

in the Canadian Institute of Mining, Metallurgy and Petroleum

("CIM") Standards on Mineral Resources and Mineral Reserves (May

2014).

The updated Mineral Resource Estimate is 9,672 kt at 3.5g/t gold

for 1,088,000 oz gold in the indicated mineral resource category

and 8,642 kt at 4.3g/t gold for 1,190,000 oz gold in the inferred

mineral resource category. The 2022 FS was conducted on La India

Open Pit which has a Mineral Resource Estimate of 8,487 kt at

3.0g/t gold in for 827,000 oz gold in the indicated mineral

resource category and 893 Kt at 2.4 g/t gold for 69,000 oz gold in

the inferred mineral resource category. The La India Open Pit

Mineral resource is inclusive of a Probable Mineral Reserve of

7.3Mt at 2.56g/t gold for 602,000 oz gold.

Outside the main La India open pit Mineral Reserve (the subject

of the 2022 FS), there is a historical estimate, outlined in the

2021 Preliminary Economic Assessment, of additional open pit

Mineral Resources on four deposits (America, Mestiza, Central

breccia and Cacao) which represent an aggregate 206 Kt at 9.9 g/t

gold for 66,000 oz in the indicated Mineral Resource category and

2.1Mt at 3.3 g/t gold for 223,000 oz gold in the inferred Mineral

Resource category. In addition, there is an aggregate underground

Mineral Resource (La India, America, Mestiza, Central Breccia San

Lucas, Cristalito-Tatescame, and Cacao) of 979Kt at 6.2 g/t for

194,000 oz gold in the indicated mineral resource category and

5.6Mt at 5.0 g/t gold for 898,000 oz gold in the inferred mineral

resource category.

In March 2022, the Company announced drill results from infill

drilling on Mestiza open pit of 6.3 m true width at 6.84 g/t gold

from 31.45 m and 3.6 m true width at 29.1 g/t gold are both

reassuring of the high-grade nature of the deposit and continuity

of grade. The wide zones of mineralisation within the La India open

pit, near surface of 34.1 m true width at 2.56 g/t gold amalgamated

from 2.80 m drill depth are confirmatory in nature.

During 2022, the Company has been focused on de-risking La India

Project by completing several technical and engineering studies for

the 2022 FS, some of which are a condition of the EP. In addition

to a much more robust and conservative MRE for the entire La India

Project, the following key technical studies were completed:

-- The Tailings Storage Facility ("TSF") and two water retention

ponds have been fully designed and engineered with drawings one

step short of "issued for construction", which is beyond an FS

level detail of design. Tierra Group Inc, of Denver, Colorado

completed site visits and the engineering studies. The study

included 23 geotechnical drill holes and 55 geotechnical test pits

have been completed.

-- The engineering of stormwater attenuation structure at La

Simona has been completed and designed to FS level.

-- Completion of the site wide water balance ("SWWB"), including

the design of a surface water management plan by SRK. SRK's work

includes the area of the permitted La India, America and Mestiza

open pits. The ultimate objective of the exercise is to produce

engineering plans for the installation of the physical components

of a management system, including the piping, pumping and

structural requirements that will satisfy Nicaraguan authorities

and at the same time meet the design standards for a feasibility

study. The SWWB will include consideration of the pit dewatering

contributions (i.e. subsurface hydrology). SRK's remit includes an

emphasis on training and capacity building for the local Condor

team to ensure full ownership and facilitate implementation and

sustainability of the SWWB.

-- Hydrogeology / pit water management - Condor successfully

intercepted the deepest level of the 1950s-era underground mine

workings, providing confidence that the said workings are suitable

to tap into, in order to draw down ground water levels and support

depressurization of the pit slopes. A test borehole close to the

historical mineshaft was drilled in November 2021 and additional

boreholes were drilled to the south and are locations for the

long-term pumping station.

-- The processing plant designs to FS level have been completed

by Hanlon Engineering (owned by GR Engineering Services in

Australia) using the new SAG Mill packaged purchased by Condor in

February 2021. The processing plant designed has been laid out with

the ability to double capacity from 2,800tpd.

-- Site preparation and clearance of 14 hectares around the

location of the processing plant has been completed.

-- Pit Geotechnical - approximately 2,800 m of geotechnical

drilling was completed by December 2021. Pit angles to FS level

have been completed. This involved oriented core drilling, followed

by televiewer logging.

-- Mine and waste dump schedules for a number of mining

scenarios have been completed to a level that can be submitted to

MARENA. The FS level mine and waste dump schedules have been

completed.

-- The power studies completed to FS level. Several meetings

have been held with the Ministry of Energy and Mines. National grid

electricity pylons are located 700 meters from the processing

plant, and the Government is building a new electricity sub-station

12km from the processing plant. Designs for supplying grid power

via the new sub-station are underway.

-- The compensation plan under the local law is to replace every

tree removed with 10 new trees. Condor has a tree nursery which

currently has approximately 8,000 trees.

Highlights: Feasibility Study La India Open Pit only

The 2022 FS demonstrates a robust and economically viable base

case for the La India open pit:

-- Probable Mineral Reserve of 7.3Mt at 2.56g/t gold for 602,000 oz gold

-- Production averages 81,545 oz gold per annum for the first six years of an 8.4 year mine life

-- An Internal Rate of Return ("IRR") of 23% and a post tax,

post upfront capital cost NPV of US$86.9 million using a discount

rate of 5% and price of US$1,600 oz gold (Mineral Reserve

Case).

-- An Internal Rate of Return ("IRR") of 43% and a post tax,

post upfront capital cost NPV of US$205.2 million using a discount

rate of 5% and price of US$2,000 oz gold.

-- Low initial capital requirement of US$105.5 million (including contingency and EPCM contract)

Low average Life of Mine All-in Sustaining cash costs US$1,039

per oz gold

The Company's strategy of a two-stage approach to production is

supported by technical study released in October 2021, Condor Gold

announced the key findings of a technical report on the La India

Gold Project prepared by SRK. This technical report (the "Technical

Report") presented the results of a strategic mining study to

Preliminary Economic Assessment ("PEA") standards. The strategic

study covers two scenarios: Scenario A, in which the mining is

undertaken from four open pits, termed La India, America, Mestiza

and Central Breccia Zone ("CBZ"), which targets a plant feed rate

of 1.225 million tonnes per annum ("Mtpa"); and Scenario B, where

the mining is extended to include three underground operations at

La India, America and Mestiza, in which the processing rate is

increased to 1.4 Mtpa. The 2021 Technical Report was issued in

October 2021 and filed on SEDAR and the Company's websites for

public disclosure to NI 43-101 standards.

Highlights 1.225 Mtpa PEA La India Open Pit + Feeder Pits :

-- IRR of 58% and a post-tax Net Present Value ("NPV") of US$302

million, at a discount rate of 5% and gold price of

US$1,700/oz.

-- Average annual production of 120,000 oz of gold over the initial 6 years of production.

-- 862,000 oz of gold produced over 9-year Life of Mine.

-- Initial capital requirement of US$153 million (including contingency).

-- Payback period 12 months.

-- All-in Sustaining Costs ("AISC") of US$813 per oz gold.

-- Robust Base Case presents an IRR of 48% and a post-tax NPV of

US$236 million at a discount rate of 5% and gold price of

US$1,550/oz.

Highlights: 1.4Mtpa PEA Open Pit + Underground Operations

-- IRR of 54% and a post-tax NPV of US$418 million, after

deducting upfront capex, at a discount rate of 5% and gold price of

US$1,700/oz.

-- Average annual production of 150,000 oz of gold over the initial 9 years of production.

-- 1,469,000 oz of gold produced over 12-year Life Of Mine.

-- Initial capital requirement of US$160 million (including

contingency), where the underground development is funded through

cash flow.

-- Payback period 12 months.

-- All-in Sustaining Costs of US$958 per oz gold over Life Of Mine.

The Company remains convinced that the La India Project is a

major gold district with the potential for significant future

discoveries. Condor's geologists have identified two major

north-northwest-striking mineralised basement feeder zones

traversing the Project, the "La India Corridor", which hosts 90% of

Condor's gold mineral resource and the "Andrea Los Limones

Corridor". Numerous geophysics, soil geochemistry and surface rock

chips indicate the possibility for further mineralisation along

strike. The updated MRE 2022 for the Cacao deposit increased the

MRE in the inferred mineral resource category by 69% to 101,000 oz

gold at 2.5 g/t gold, the interpretation is that drilling has

clipped the top of a fully preserved epithermal vein system with a

strike length of at least 1km with the potential to host over 1

million oz gold.

The Company continues to enhance its social engagement and

activities in the community, thereby maintaining its social licence

to operate. Condor has strengthened its community team and

stepped-up social activities and engagement programmes. The main

local focus is the drinking water programme, implemented in April

2017. A total of 740 families are currently benefiting from the

program and currently receive five-gallon water dispensers each

week. In May 2021, the Company installed a water purification plant

at a cost of approximately US$200,000 to double the amount of

drinking water provided to the local communities.

In January 2018 Condor initiated 'Involvement Programmes', which

now extend to six groups in the local village to benefit

communities which may be affected by the mine. Taking the Elderly

Group as an example, a committee of six people has been formed. The

Company allocates monthly support to the Elderly Group, which

decides how this money is spent to benefit the elderly in the

Community. Projects include a garden for medicinal herbs which are

made into products which are used by group members and sold to

others in the community.

Condor continues to have very constructive meetings with key

Ministries that granted the EP for the La India, La Mestiza and

America open pits. The Company has been operating in Nicaragua

since 2006 and, as a responsible gold exploration and development

company, continues to add value to the local communities and

environment by generating sustainable socio-economic and

environmental benefits. The new mine would potentially create

approximately 1,000 jobs during the construction period, with

priority to be given to suitable skilled members of the local

community. The upfront capital cost of approximately US$105 million

as detailed in the 2022 FS will have a significant positive impact

on the economy. The Government and local communities will benefit

significantly from future royalties and taxes.

In June 2022 the Company announced it had raised GBP3.25 million

by way of a private placement of new ordinary shares. (See RNS for

details). On 21 December 2022 the Company announced a fundraise of

GBP3.3M. See RNS for details).

Turning to the financial results for the year 2022, the Group's

loss for the year was GBP2,537,459 (2021: GBP2,330,003). The

Company raised a total of GBP5,574,674 million after expenses

during the financial period (2021: GBP11,459,817). The net cash

balance of the Group at 31 December 2022 was GBP2,444,093 (2021:

GBP2,072,046).

On 22 November 2022, the Company announced a strategy update and

informed the market that it had appointed an advisor to sell its

assets.The Board reviewed the Company's options, including going

through a financing and construction phase as a single asset,

single jurisdiction company with no existing gold production, and

concluded that it is in the best interests of the Company and all

stakeholders to sell the assets of the Company to a gold producer

with mine building expertise, thus ensuring a new mine at La India,

a significant investment in the local area, and a regeneration of

the local communities.

The focus for 2023 is to execute on a successful sale of the

assets while maintaining a social license to operate at the fully

permitted La India Project.

M L Child

CEO

Date: 27 March 2023

CONDOR GOLD PLC

CONSOLIDATED STATEMENT OF COMPREHENSIVE INCOME

FOR THE YEARED 31 DECEMBER 2022

Notes Year Ended Year Ended

31.12.22 31.12.21

GBP GBP

Administrative expenses (2,537,459) (2,330,003)

Operating loss 5 (2,537,459) (2,330,003)

Finance income 4 4,899 -

Loss before income tax (2,532,560) (2,330,003)

Income tax expense 6 - -

Loss for the year (2,532,560) (2,330,003)

============ ============

Other comprehensive income:

Other comprehensive income to be reclassified to profit or loss in

subsequent periods:

Currency translation differences 3,232,610 (119,937)

------------ ------------

Other comprehensive (loss) / income for the year 3,232,610 (119,937)

============ ============

Total comprehensive loss for the year 700,050 (2,449,940)

============ ============

Loss attributable to:

Non-controlling interest - -

Owners of the parent (2,532,560) (2,330,003)

------------ ------------

(2,532,560) (2,330,003)

============ ============

Total comprehensive loss attributable to:

Non-controlling interest - -

Owners of the parent 700,050 (2,449,940)

------------ ------------

700,050 (2,449,940)

============ ============

Earnings per share expressed in pence per share:

Basic and diluted (in pence) 8 (1.60) (1.70)

============ ============

CONDOR GOLD PLC

CONSOLIDATED STATEMENT OF FINANCIAL POSITION

AS AT 31 DECEMBER 2022

Notes 31.12.22 31.12.21

GBP GBP

ASSETS:

NON-CURRENT ASSETS

Property, plant and equipment 9 - 7,473,433

Intangible assets 10 - 28,100,980

- 35,574,413

------------- -------------

CURRENT ASSETS

Assets classified as held for sale 11 42,937,116 -

Trade and other receivables 13 916,963 775,693

Cash and cash equivalents 2,444,093 2,072,046

46,298,172 2,847,739

------------- -------------

TOTAL ASSETS 46,298,172 38,422,152

============= =============

LIABILITIES:

CURRENT LIABILITIES

Trade and other payables 15 406,207 248,176

------------- -------------

TOTAL LIABILITIES 406,207 248,176

============= =============

NET CURRENT ASSETS 45,891,965 2,599,563

------------- -------------

NET ASSETS 45,891,965 38,173,976

============= =============

SHAREHOLDERS' EQUITY ATTRIBUTABLE

TO OWNERS OF THE PARENT

Called up share capital 16 31,747,809 29,326,143

Share premium 46,681,635 42,528,627

Exchange difference reserve 750,572 (2,482,038)

Retained earnings (33,288,051) (31,198,756)

45,891,965 38,173,976

============= =============

Non-controlling interest - -

TOTAL EQUITY 45,891,965 38,173,976

============= =============

The financial statements were approved and authorised for issue

by the Board of directors on 27 March 2023 and were signed on its

behalf by:

M L Child - Chief Executive Officer

Company No: 05587987

CONDOR GOLD PLC

CONSOLIDATED STATEMENT OF FINANCIAL POSITION

AS AT 31 DECEMBER 2022

Share Share Exchange Retained Total Non-Controlling Total

Capital premium difference earnings Interest Equity

reserve

GBP GBP GBP GBP GBP GBP GBP

At 1 January

2021 23,732,526 37,175,626 (2,362,101) (29,381,952) 29,164,099 - 29,164,099

------------ ---------- ----------- ------------ ----------- --------------- -----------

Comprehensive

income:

Loss for the

year - - - (2,330,003) (2,330,003) - (2,330,003)

Other

comprehensive

income:

Currency

translation

differences - - (119,937) - (119,937) - (119,937)

Total

comprehensive

income - - (119,937) (2,330,003) (2,449,940) - (2,449,940)

------------ ---------- ----------- ------------ ----------- --------------- -----------

New shares

issued 5,593,617 5,366,126 - - 10,959,743 - 10,959,743

Issue costs - (13,125) - - (13,125) - (13,125)

Share based

payment - - - 513,199 513,199 - 513,199

Total

transactions

with owners,

recognised

directly in

equity 5,593,617 5,353,001 - 513,199 11,459,817 - 11,459,817

------------ ---------- ----------- ------------ ----------- --------------- -----------

At 31 December

2021 29,326,143 42,528,627 (2,482,038) (31,198,756) 38,173,976 - 38,178,976

------------ ---------- ----------- ------------ ----------- --------------- -----------

Comprehensive

income:

Loss for the

year - - - (2,532,560) (2,532,560) - (2,532,560)

Other

comprehensive

income:

Currency

translation

differences - - 3,232,610 - 3,232,610 - 3,232,610

Total

comprehensive

income - - 3,232,610 (2,532,560) 700,050 - 700,050

------------ ---------- ----------- ------------ ----------- --------------- -----------

New shares

issued 2,421,666 4,168,008 - - 6,589,674 - 6,589,674

Issue costs - (15,000) - - (15,000) - (15,000)

Share based

payment - - - 443,265 443,265 - 443,265

Total

transactions

with owners,

recognised

directly in

equity 2,421,666 4,153,008 - 443,265 7,017,939 - 7,017,939

------------ ---------- ----------- ------------ ----------- --------------- -----------

At 31 December

2022 31,747,809 46,681,635 750,572 (33,288,051) 45,891,965 - 45,891,965

------------ ---------- ----------- ------------ ----------- --------------- -----------

Share premium reserve represents the amounts subscribed for

share capital in excess of the nominal value of the shares issued,

net of cost of issue.

The exchange difference reserve is a separate component of

Shareholders' equity in which the exchange differences, arising

from translation of the results and financial positions of foreign

operations that are included in the Group's Consolidated Financial

Statements, are reported.

Retained earnings represent the cumulative net gains and losses

recognised in the consolidated income statement.

CONDOR GOLD PLC

CONSOLIDATED STATEMENT OF FINANCIAL POSITION

AS AT 31 DECEMBER 2022

Notes 31.12.22 31.12.21

GBP GBP

ASSETS:

NON-CURRENT ASSETS

Property, plant and equipment 9 - 4,309,955

Investments 11 751,977 751,977

Other receivables 13 43,500,630 39,511,480

-------------- --------------

44,252,607 44,573,412

-------------- --------------

CURRENT ASSETS

Assets classified as held for

sale 11 4,474,402 -

Trade and other receivables 13 333,101 33,329

Cash and cash equivalents 2,407,187 1,956,467

-------------- --------------

7,214,690 1,989,796

-------------- --------------

TOTAL ASSETS 51,467,297 46,563,208

============== ==============

LIABILITIES:

CURRENT LIABILITIES

Trade and other payables 15 249,357 169,456

-------------- --------------

TOTAL LIABILITIES 249,357 169,456

-------------- --------------

NET CURRENT ASSETS 6,965,333 1,820,340

-------------- --------------

NET ASSETS 51,217,940 46,393,752

============== ==============

SHAREHOLDERS' EQUITY

Called up share capital 16 31,747,809 29,326,143

Share premium 46,681,635 42,528,627

Retained earnings (27,211,504) (25,461,018)

TOTAL EQUITY 51,217,940 46,393,752

============== ==============

The loss for the financial year dealt with in the financial

statement of the parent company was GBP2,193,751 (2021:

GBP1,970,977).

The financial statements were approved and authorised for issue

by the Board of directors on 27 March 2023 and were signed on its

behalf by:

M L Child - Chief Executive Officer

Company No: 05587987

CONDOR GOLD PLC

COMPANY STATEMENT OF CHANGES IN EQUITY

AS AT 31 DECEMBER 2022

Share Share premium Retained Total

capital earnings

GBP GBP GBP GBP

At 1 January 2021 23,732,526 37,175,626 (24,003,240) 36,904,912

----------- -------------- ------------- ------------

Comprehensive income:

Loss for the period - - (1,970,977) (1,970,977)

Total comprehensive

income - - (1,970,977) (1,970,977)

----------- -------------- ------------- ------------

New shares issued 5,593,617 5,366,126 - 10,959,743

Issue costs - (13,125) - (13,125)

Share based payment - - 513,199 513,199

Total transactions with

owners recognised directly

in equity 5,593,617 5,353,001 513,199 11,459,817

----------- -------------- ------------- ------------

At 31 December 2021 29,326,143 42,528,627 (25,461,018) 46,393,752

----------- -------------- ------------- ------------

Comprehensive income:

Loss for the period - - (2,193,751) (2,193,751)

Total comprehensive

income - - (2,193,751) (2,193,751)

----------- -------------- ------------- ------------

New shares issued 2,421,666 4,168,008 - 6,589,674

Issue costs - (15,000) - (15,000)

Share based payment - - 443,265 443,265

Total transactions with

owners recognised directly

in equity 2,421,666 4,153,008 443,265 7,017,939

----------- -------------- ------------- ------------

At 31 December 2022 31,747,809 46,681,635 (27,211,504) 51,217,940

----------- -------------- ------------- ------------

Share premium reserve represents the amounts subscribed for

share capital in excess of the nominal value of the shares issued,

net of cost of issue.

Retained earnings represent the cumulative net gains and losses

recognised in the Company's income statement.

CONDOR GOLD PLC

COMPANY STATEMENT OF CHANGES IN EQUITY

AS AT 31 DECEMBER 2022

Year Ended Year-Ended

31.12.22 31.12.21

GBP GBP

Cash flows from operating activities

Loss before tax (2.532,560) (2,330,003)

Share based payment 443,265 513,199

Depreciation 68,315 88,264

Exchange differences 3,187 78,873

Finance income (4,899) -

(2,022,692) (1,649,667)

(Increase) / Decrease in trade

and other receivables (141,270) (661,284)

Increase / (Decrease) in trade

and other payables 158,031 (18,236)

Net cash used in operating activities (2,005,931) (2,329,187)

------------ ------------

Cash flows from investing activities

Purchase of tangible fixed assets (446,853) (2,370,879)

Purchase of intangible fixed

assets (3,754,742) (6,188,725)

Interest received 4,899 -

Net cash used in investing activities (4,196,696) (8,559,604)

------------ ------------

Cash flows from financing activities

Net proceeds from share issue 6,574,674 8,801,446

Net cash from financing activities 6,574,674 8,801,446

------------ ------------

Increase / (Decrease) in cash

and cash equivalents 372,047 (2,087,345)

------------ ------------

Cash and cash equivalents at

beginning of year 2,072,046 4,159,391

Cash and cash equivalents at

end of year 2,444,093 2,072,046

============ ============

CONDOR GOLD PLC

COMPANY STATEMENT OF CHANGES IN EQUITY

AS AT 31 DECEMBER 2022

Year Ended Year Ended

31.12.22 31.12.21

GBP GBP

Cash flows from operating activities

Loss before tax (2,193,751) (1,970,977)

Share based payment 443,265 513,199

Finance income (4,899) -

(1,755,385) (1,457,778)

(Increase) / Decrease in trade

and other receivables (299,772) (2,673)

Increase / (Decrease) in trade

and other payables 79,901 (14,330)

Net cash used in operating activities (1,975,256) (1,474,781)

------------ ------------

Cash flows from investing activities

Purchase of tangible fixed assets (164,447) (2,164,783)

Interest received 4,899 -

Loans to subsidiaries (3,989,150) (7,250,989)

Net cash used in investing activities (4,148,698) (9,415,772)

------------ ------------

Cash flows from financing activities

Proceeds from share issue 6,574,674 8,801,446

Net cash from financing activities 6,574,674 8,801,446

------------ ------------

Increase / (Decrease) in cash

and cash equivalents 450,720 (2,089,107)

------------ ------------

Cash and cash equivalents at

beginning of year 1,956,467 4,045,574

Cash and cash equivalents at

end of year 2,407,187 1,956,467

============ ============

Basis of preparation

The financial statements have been prepared in accordance with

UK-adopted International Financial Reporting Standards (IFRS and

IFRIC interpretations) ("IFRS") in force at the reporting date, and

their interpretations issued by the International Accounting

Standards Board ("IASB"), and with IFRS and their interpretations

issued by the IASB. The parent company financial statements have

also been prepared in accordance with those parts of the Companies

Act 2006 applicable to companies reporting under IFRS. The

financial statements have been prepared under the historical cost

convention except for the revaluation of certain financial

instruments that are measured at fair value.

The financial information set out in this announcement does not

constitute the Group's statutory financial statements for the year

ended 31 December 2022 or 2021, but is derived from these financial

statements. The financial statements for the year ended 31 December

2021 have been delivered to the Registrar of Companies. The

financial statements for the year ended 31 December 2022 will be

forwarded to the Registrar of Companies following the Company's

Annual General Meeting. The Auditors have reported on these

financial statements; their reports were unqualified and did not

contain statements under Section 498(2) or (3) of the Companies Act

2006.

Going concern

The Group reviews its going concern status, via comparisons to

budgets, cash flow forecasts, and access to further financing. At

the balance sheet date the Group had GBP2,444,093 of cash. In

common with many exploration companies, the Company raises finance

for its exploration and appraisal activities in discrete tranches

to finance its activities for limited periods only. The Directors

have identified that further funding will be required during 2022

for working capital purposes and to construct the processing

facility at La India Project. The Directors are confident that the

Company will be able to raise these funds however there is no

binding agreement in place to date. In addition, the timing and

quantum of any asset sale is currently uncertain. These conditions

may cast doubt on the Group and Company's ability to continue as a

going concern. It is not the Company's intention to cease trading

after the potential sale of the Nicaraguan assets.

The Directors have prepared a cash flow forecast which assumes

that the Group and Company is not able to raise additional funds

within the going concern period and if that was the case, the

forecasts demonstrate that austerity measures can be implemented to

reduce the Group and Company's cash outflows to the minimal

contracted and committed expenditure while also maintaining the

Group's licences and permits. These forecasts assume that Directors

and Key management personnel salaries are deferred and/or reduced

as part of the austerity measures - notwithstanding the above,

further funding would nonetheless be required in order to continue

into operational existence for at least 12 months from the date of

approval of this report. Based on their assessment of the financial

position, the Directors however have a reasonable expectation that

the Group and Company will be able to continue in operational

existence for the next twelve months and continue to adopt the

going concern basis of accounting in preparing these financial

statements.

- Ends -

For further information please visit www.condorgold.com or

contact:

Condor Gold plc Mark Child, CEO

+44 (0) 20 7493 2784

Beaumont Cornish Limited Roland Cornish and James Biddle

+44 (0) 20 7628 3396

SP Angel Corporate Finance Ewan Leggat

LLP +44 (0) 20 3470 0470

About Condor Gold plc:

Condor Gold plc was admitted to AIM in May 2006 and dual listed

on the TSX in January 2018. The Company is a gold exploration and

development company with a focus on Nicaragua.

On 25 October 2021 Condor announced the filing of a Preliminary

Economic Assessment Technical Report ("PEA") for its La India

Project, Nicaragua on SEDAR https://www.sedar.com. The highlight of

the technical study is a post-tax, post upfront capital expenditure

NPV of US$418 million, with an IRR of 54% and 12 month pay-back

period, assuming a US$1,700 per oz gold price, with average annual

production of 150,000 oz gold per annum for the initial 9 years of

gold production. The open pit mine schedules have been optimised

from designed pits, bringing higher grade gold forward resulting in

average annual production of 157,000 oz gold in the first 2 years

from open pit material and underground mining funded out of

cashflow.

In August 2018, the Company announced that the Ministry of the

Environment in Nicaragua had granted the Environmental Permit

("EP") for the development, construction and operation of a

processing plant with capacity to process up to 2,800 tonnes per

day at its wholly-owned La India gold Project ("La India Project").

The EP is considered the master permit for mining operations in

Nicaragua. Condor has purchased a new SAG Mill, which has mainly

arrived in Nicaragua. Site clearance and preparation is at an

advanced stage.

Environmental Permits were granted in April and May 2020 for the

Mestiza and America open pits respectively, both located close to

La India. The Mestiza open pit hosts 92 Kt at a grade of 12.1 g/t

gold (36,000 oz contained gold) in the Indicated Mineral Resource

category and 341 Kt at a grade of 7.7 g/t gold (85,000 oz contained

gold) in the Inferred Mineral Resource category. The America open

pit hosts 114 Kt at a grade of 8.1 g/t gold (30,000 oz) in the

Indicated Mineral Resource category and 677 Kt at a grade of 3.1

g/t gold (67,000 oz) in the Inferred Mineral Resource category.

Following the permitting of the Mestiza and America open pits,

together with the La India Open Pit Condor has 1.12 M oz gold open

pit Mineral Resources permitted for extraction.

Disclaimer

Neither the contents of the Company's website nor the contents

of any website accessible from hyperlinks on the Company's website

(or any other website) is incorporated into, or forms part of, this

announcement.

Qualified Persons

The technical and scientific information in this press release

has been reviewed, verified and approved by Andrew Cheatle, P.Geo.,

who is a "qualified person" as defined by NI 43-101 and Gerald D.

Crawford, P.E., who is a "qualified person" as defined by NI 43-101

and is the Chief Technical Officer of Condor Gold plc.

Technical Information

Certain disclosure contained in this document relating to the La

India Project of a scientific or technical nature has been

summarized or extracted from the technical report entitled "Condor

Gold Technical Report on the La India Gold Project, Nicaragua",

dated October 2022 (the "Technical Report"), prepared in accordance

with NI 43-101. The Technical Report was prepared by or under the

supervision of Tim Lucks, Principal Consultant (Geology &

Project Management), Fernando Rodrigues, Principal Consultant

(Mining), Eric Olin, Principal Consultant (Metallurgy) Benjamin

Parsons, Principal Consultant (Resource Geology), each of SRK

Consulting (UK) Limited, each of whom is an independent Qualified

Person as such term is defined in NI 43-101.

Forward Looking Statements

All statements in this press release, other than statements of

historical fact, are 'forward-looking information' with respect to

the Company within the meaning of applicable securities laws,

including statements with respect to: Developmment Plans for the La

India Project, Mineral Reserves and Resources at La India Project.

Forward-looking information is often, but not always, identified by

the use of words such as: "seek", "anticipate", "plan", "continue",

"strategies", "estimate", "expect", "project", "predict",

"potential", "targeting", "intends", "believe", "potential",

"could", "might", "will" and similar expressions. Forward-looking

information is not a guarantee of future performance and is based

upon a number of estimates and assumptions of management at the

date the statements are made including, among others, assumptions

regarding: future commodity prices and royalty regimes;

availability of skilled labour; timing and amount of capital

expenditures; future currency exchange and interest rates; the

impact of increasing competition; general conditions in economic

and financial markets; availability of drilling and related

equipment; effects of regulation by governmental agencies; the

receipt of required permits; royalty rates; future tax rates;

future operating costs; availability of future sources of funding;

ability to obtain financing and assumptions underlying estimates

related to adjusted funds from operations. Many assumptions are

based on factors and events that are not within the control of the

Company and there is no assurance they will prove to be

correct.

Such forward-looking information involves known and unknown

risks, which may cause the actual results to be materially

different from any future results expressed or implied by such

forwardlooking information, including, risks related to: mineral

exploration, development and operating risks; estimation of

mineralisation, resources and reserves; environmental, health and

safety regulations of the resource industry; competitive

conditions; operational risks; liquidity and financing risks;

funding risk; exploration costs; uninsurable risks; conflicts of

interest; risks of operating in Nicaragua; government policy

changes; ownership risks; permitting and licencing risks; artisanal

miners and community relations; difficulty in enforcement of

judgments; market conditions; stress in the global economy; current

global financial condition; exchange rate and currency risks;

commodity prices; reliance on key personnel; dilution risk; payment

of dividends; as well as those factors discussed under the heading

"Risk Factors" in the Company's annual information form for CONDOR

GOLD PLC. Registered in England and Wales No 5587987 Registered

Office: 7/8 Innovation Place, Douglas Drive, Godalming, Surrey, GU7

1JX the fiscal year ended December 31, 2020 dated March 31, 2021,

available under the Company's SEDAR profile at www.sedar.com.

Although the Company has attempted to identify important factors

that could cause actual actions, events or results to differ

materially from those described in forward-looking information,

there may be other factors that cause actions, events or results

not to be as anticipated, estimated or intended. There can be no

assurance that such information will prove to be accurate as actual

results and future events could differ materially from those

anticipated in such statements. The Company disclaims any intention

or obligation to update or revise any forward-looking information,

whether as a result of new information, future events or otherwise

unless required by law.

This information is provided by RNS, the news service of the

London Stock Exchange. RNS is approved by the Financial Conduct

Authority to act as a Primary Information Provider in the United

Kingdom. Terms and conditions relating to the use and distribution

of this information may apply. For further information, please

contact rns@lseg.com or visit www.rns.com.

RNS may use your IP address to confirm compliance with the terms

and conditions, to analyse how you engage with the information

contained in this communication, and to share such analysis on an

anonymised basis with others as part of our commercial services.

For further information about how RNS and the London Stock Exchange

use the personal data you provide us, please see our Privacy

Policy.

END

FR EAPDXASFDEFA

(END) Dow Jones Newswires

March 28, 2023 02:00 ET (06:00 GMT)

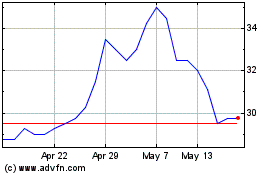

Condor Gold (LSE:CNR)

Historical Stock Chart

From Nov 2024 to Dec 2024

Condor Gold (LSE:CNR)

Historical Stock Chart

From Dec 2023 to Dec 2024