1st Quarter Results

23 April 2010 - 1:58AM

UK Regulatory

TIDMCOD

RNS Number : 6568K

Compagnie de Saint-Gobain

22 April 2010

April 22, 2010

FIRST-QUARTER 2010 SALES:

down 0.5% (down 2.4% like-for-like)

Saint-Gobain's consolidated sales for first-quarter 2010 came in at EUR8,737

million, versus EUR8,782 million in the first quarter of 2009, representing a

decline of 0.5% on an actual structure basis and of 2.0% at constant exchange

rates*.

Exchange rates accounted for a 1.5% rise in sales, powered chiefly by sharp

gains in Scandinavian currencies and most emerging country currencies

(particularly the Brazilian real) against the euro, offsetting the slide in the

US dollar. Changes in Group structure also had a slightly positive impact,

driving sales up 0.4%.

Like-for-like (comparable Group structure and exchange rates), consolidated

sales were down 2.4%. Volumesslipped 1.7%, while sales prices edged down 0.7%

compared to the strong 2.3% rise in first-quarter 2009.

This slight drop in like-for-like consolidated sales conceals starkly

contrasting performances across business sectors and geographical areas, in line

with the economic scenario presented by the Group at the end of February.

Trading was very upbeat in the following Group businesses and areas:

- activities linked to industrial output (representing the bulk of sales for

the Innovative Materials Sector), which saw double-digit organic growth over the

quarter;

- all Group businesses in Asia and Latin America, which confirmed their

return to growth, delivering a 22% rise in sales over the three months to March

31.

Businesses related to household consumption (Packaging Sector) continued to hold

up very well, reporting like-for-like sales almost identical to the previous

year.

* Based on average exchange rates for first-quarter 2009.

The Group's other businesses exposed to construction markets in Europe and North

America continued to face tough conditions, amplified by a very cold winter in

the first two months of the year.

For the Group's businesses in general, March - which benefited from a return to

"normal" weather conditions in the Northern hemisphere and an extra working day

compared with 2009 - saw a sharp improvement in trading compared to the first

two months of the year.

Sales trends by business sector and major geographic area are as follows:

+------------------------+-----------+-----------+-----------+------------+---------------+

| | | | | | |

| | Q1 | Q1 | % | % | % change |

| | 2009 | 2010 | change | change |like-for-like |

| | (EUR | (EUR | on an | on a | |

| |millions) |millions) | actual | comparable | |

| | | |structure | structure | |

| | | | basis | basis | |

| | | | (en %) | (en %) | |

| | | | | | |

| | | | | | |

+------------------------+-----------+-----------+-----------+------------+---------------+

| BY BUSINESS SECTOR | | | | | |

| | | | | | |

| Innovative Materials | 1,863 | 2,106 | +13.0% | +12.9% | +10.4% |

| (1) | 1,050 | 1,193 | +13.6% | +14.1% | +9.6% |

| Flat Glass | 818 | 921 | +12.6% | +11.8% | +11.9% |

| High-Performance | | | | | |

| Materials | 2,456 | 2,413 | -1.8% | -2.3% | -3.3% |

| | 1,280 | 1,191 | -6.9% | -6.5% | -8.1% |

| Construction Products | 1,184 | 1,229 | +3.8% | +2.4% | +1.9% |

| (1) | | | | | |

| Interior Solutions | 3,911 | 3,663 | -6.3% | -6.8% | -8.8% |

| Exterior Solutions | | | | | |

| | 800 | 787 | -1.6% | -1.7% | -0.4% |

| Building Distribution | | | | | |

| | (248) | (232) | ------ | ------- | ------- |

| Packaging | | | | | |

| | 8,782 | 8,737 | -0.5% | -0.9% | -2.4% |

| Internal sales and | | | | | |

| other | | | | | |

| | | | | | |

| GROUP | | | | | |

| | | | | | |

| | 2,822 | 2,678 | -5.1% | -5.1% | -5.1% |

| | 3,756 | 3,622 | -3.6% | -3.6% | -5.6% |

| BY GEOGRAPHIC AREA | 1,228 | 1,249 | +1.7% | +0.9% | +6.1% |

| | 1,339 | 1,609 | +20.2% | +17.9% | +8.3% |

| France | | | | | |

| Other Western European | (363) | (421) | ----- | ----- | ----- |

| countries | | | | | |

| North America | 8,782 | 8,737 | -0.5% | -0.9% | -2.4% |

| Emerging countries and | | | | | |

| Asia/Pacific | | | | | |

| | | | | | |

| Internal sales | | | | | |

| | | | | | |

| GROUP | | | | | |

+------------------------+-----------+-----------+-----------+------------+---------------+

(1) Including inter-division eliminations.

Performance of Group business sectors (like-for-like basis)

Innovative Materials reported double-digit organic growth of 10.4% over the

quarter, buoyed by the rebound in markets linked to industrial output in North

America and to a lesser extent in Western Europe, as well as the sharp rise in

sales in emerging countries and Asia (which represent 35% of the Sector's

sales).

· Flat Glass reported 9.6% organic growth. The strong rally in the global

automotive market and robust momentum in Asia and emerging countries (which

account for over 39% of the Sector's sales) more than offset sluggish

construction markets across Western Europe. Despite the slight rise in prices

for commodity products (float glass) in Europe compared with first-quarter 2009,

sales prices across the Sector were still down, mainly due to the time-lag in

passing float glass price increases onto processed products.

· High-Performance Materials (HPM) posted an 11.9% increase in sales, fueled

chiefly by the sharp rally in industrial output in Asia and North and South

America, and the more modest industrial output gains in Europe. This more than

offset the slowdown (in terms of volumes and prices) in businesses linked to

capital expenditure.

Construction Products (CP) salesfell 3.3%, reflecting the impact of very poor

weather conditions in the Northern hemisphere over the first two months of the

year.

· Interior Solutions sales for the first quarter were dampened by slack

construction markets across Europe and the US, which vigorous demand in Asia and

Latin America failed to offset. In this context, sales prices were slightly down

on average compared to the same year-ago period, particularly in the US, despite

an upward trend at the end of the quarter.

· Exterior Solutions salesclimbed 1.9% on the back of vigorous growth in

Asia (particularly for Pipe) and Latin America, as well as brisk trading in US

Exterior Products, bolstered by the rebuilding of inventory levels by

distributors. Sales prices remained upbeat, reflecting the rising trend in

commodity and energy costs.

Building Distribution was hard hit by persistently tough conditions on European

construction markets and by extremely harsh winter weather in the first two

months of the year, driving an 8.8% drop in sales. Sales fell in most countries

where the Sector operates, although the decline was smaller in the UK, thanks to

a more favorable basis for comparison. Sales prices held up well.

Trading remained brisk for thePackaging business, in line with first-quarter

2009 (down 0.4%). Robust sales prices helped offset the slight drop in volumes

in Europe.

Analysis by geographic area (like-for-like basis)

Sales trends for the quarter varied widely from one region to the next. Latin

America and Asia confirmed the recovery begun in fourth-quarter 2009. Countries

in the Northern hemisphere benefited from the upturn in industrial output, but

continued to face challenging market conditions in construction, intensified by

very bad weather conditions over the first two months of the year. Trading in

March - which gained from an extra working day compared to 2009 - was up

significantly compared to January and February in both Europe and North America.

- Sales in France and other Western European countries were down 5.1% and

5.6%, respectively, for the quarter, on the back of the ongoing contraction in

sales to the construction industry. In contrast, markets linked to industrial

output saw a timid recovery, allowing the Innovative Materials business to post

robust growth gains throughout the region.

- North America reported 6.1% organic growth, buoyed by the strong rebound in

industrial output combined with robust sales for Packaging and Exterior

Products.

- Like-for-like sales advanced 8.3% in Asia and emerging countries, thanks to

vigorous momentum in Latin America and Asia, with overall organic growth of 22%

for the quarter. Trading in Eastern European countries remained very sluggish,

although there was a relative improvement in March compared to the previous two

months, spurred by more favorable weather conditions.

Update on asbestos claims in the United States

Some 1,000 claims were filed against CertainTeed in first-quarter 2010, in line

with the number of claims filed in the three months to March 31, 2009. Taking

into account some 1,000 claims settled during this period (unchanged from

first-quarter 2009), the number of claims outstanding at March 31, 2010 was

virtually the same as at December 31, 2009.

Outlook

After persistently tough conditions in the three months to March 31, the Group

is expecting for the next few quarters:

- consolidation of the relative improvement in residential construction observed

in March inNorth America and Western Europe, although trading should continue to

vary widely from one country to the next (upturn in the UK and US, further

decline in Southern Europe). Industrial markets should continue to trend upwards

in the short term, while household consumption should remain upbeat.

- further growth gains throughout 2010 in Asia and emerging countries

particularly in Asia and Latin America. In Eastern Europe, however, trading is

expected to remain difficult over the next few months, although somewhat better

than in the first three months of the year.

During this first quarter,the Group resolutely pursued its action plan

priorities amid an economic climate that remained fragile. As announced in

February, further cost cutting measures were launched, targeting EUR200 million in

additional cost savings for full-year 2010, while the Group's first-quarter

operating income also received a boost from the cost savings already unlocked in

the second half of 2009.

The Group therefore confirms its targets for full-year 2010:

- strong growth in operating income at constant exchange rates (2009 exchange

rates);

- free cash flow of above EUR1 billion;

- a persistently robust financial structure.

Forthcoming results announcements:

Results for first-half 2010: July 29, 2010, after close of trading on the Paris

Bourse.

+-------------------------------------+-------------------------------+

| C Analyst & Investor relations | Press relations |

+-------------------------------------+-------------------------------+

| | |

| F Florence TRIOU-TEIXEIRA +33 1 | S Sophie CHEVALLON +33 1 47 |

| 47 62 45 19 | 62 30 48 |

| E Etienne HUMBERT | |

| +33 1 47 62 30 49 | |

| V Vivien DARDEL | |

| +33 1 47 62 44 29 | |

| | |

+-------------------------------------+-------------------------------+

This information is provided by RNS

The company news service from the London Stock Exchange

END

QRFPGUCACUPUGAP

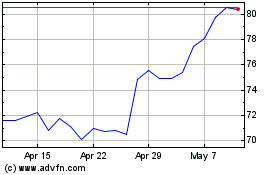

Compagnie De Saint-gobain (LSE:COD)

Historical Stock Chart

From Oct 2024 to Nov 2024

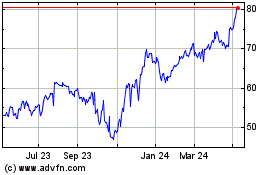

Compagnie De Saint-gobain (LSE:COD)

Historical Stock Chart

From Nov 2023 to Nov 2024