Final Results

11 July 2001 - 8:17PM

UK Regulatory

RNS Number:7237G

Comprop Limited

11 July 2001

ComProp Limited ("the Company" or "ComProp")

Preliminary announcement of audited results for year ended 31 March 2001

Chairman's Statement

Result

The profit before taxation for the year was #14,061,000 (2000 : #1,193,000).

This major advance can be attributed to the profit on the sale of Channel

Television along with the freehold properties Television Centre and Television

House offset partially by the losses on the sale of Bourne Group, the write

off of goodwill and business restructuring costs incurred on the

discontinuation of retail and servicing.

Change

This was a year of continuous change. Starting with the negotiation of the

sale of Bourne Group and then Channel Television.

Dividend

In October 2000 the Company paid an interim capital dividend of 125p per share

amounting to #17,167,000. Your board has therefore decided not to recommend

the payment of a final dividend. At last year's annual general meeting I

stated that I did not see the company paying dividends for the foreseeable

future and I can presently see no reason to vary that statement.

Directors

John Henwood, chief executive since 1987, having started his career as a

trainee in 1962, retired from executive duties in December 2000. I am glad to

tell you that John has willingly remained on the board as a non-executive

director, but I would like to thank John publicly again for all his unstinting

efforts over the years.

Michael Lucas, managing director of Channel Television, retired from this

company's board at the time of the sale of Channel Television. Michael. He

joined our board in 1990 as Director of Television. Throughout his time on the

board he has made a valuable contribution, not only to the broadcasting

business but also across the group, for which I would like to thank him on

behalf of shareholders and colleagues alike.

Rosie Matthew who has worked for the Company first as company secretary and

more recently as personal assistant to John Henwood, decided to retire at the

same time as him. Rosie has worked closely with the board in an organisational

capacity. I would like to personally thank Rosie for her help during the time

I have been chairman.

Post Balance Sheet Events

The Board has also today announced our proposed acquisition of a portfolio of

properties. Your board believes that this deal puts the Company well on course

to becoming a significant Channel Island property company.

And Finally

As I have already mentioned this has been a year of significant change. There

has been a parting of the ways with some staff and new opportunities for

others. I would like to thank our staff who served during the year for their

loyalty and efforts on behalf of the group.

Tom Scott

Chairman

11th July 2001

Consolidated profit and loss account for the year ended 31 March 2001

2001 2000

#'000 #'000

Turnover

Continuing operations 2,079 2,032

Discontinued operations 2,015 10,011

Total turnover 4,094 12,043

Cost of sales (846) (2,963)

Gross profit 3,248 9,080

Net operating expenses (4,037) (7,942)

Operating (loss)/profit

Continuing operations (243) (193)

Discontinued operations (546) 1,331

Total operating (loss)/profit (789) 1,138

Exceptional items

Gain on sale of subsidiaries 13,134

Gain on sale of properties 3,730

Cost of business restructuring (2,612)

14,252 -

Profit on ordinary activities before interest 13,463 1,138

Net interest receivable 598 55

Profit on ordinary activities before taxation 14,061 1,193

Tax on profit on ordinary activities (58) (271)

Profit on ordinary activities after taxation 14,003 922

Dividends (17,167) (176)

Retained (loss)/profit for the financial year (3,164) 746

Earnings per share - basic & diluted 102.6p 6.8p

Consolidated Balance sheets at 31 March 2001

Group Group

2001 2000

#'000 #'000

Fixed assets

Tangible fixed assets 1,485 8,742

Investment in group undertakings - -

1,485 8,742

Current assets

Stocks 34 677

Debtors 450 1,666

Cash at bank and in hand 9,541 721

10,025 3,064

Creditors

Amounts falling due within one year (1,463) (1,879)

Net current assets/(liabilities) 8,562 1,185

Total assets less current liabilities 10,047 9,927

Creditors

Amounts falling due after more than one year (3) (244)

Net assets 10,044 9,683

Capital and reserves

Share capital 687 676

Reserves 9,357 9,007

Equity shareholders' funds 10,044 9,683

The accounts were approved by the Board on 11 July 2001 and signed on its

behalf by:

T.H. Scott

C.R. Day

Consolidated cash flow statement for the year ended 31 March 2001

2001 2000

#'000 #'000

Net cash inflow from operating activities 1,208 1,889

Returns on investments and servicing of finance

Interest received 527 55

Taxation

Jersey and Guernsey income tax paid (350) (81)

UK Corporation tax paid - (82)

(350) (163)

Capital expenditure and financial investment

Purchase of tangible fixed assets (844) (881)

Sale of tangible fixed assets 10,554 80

Net cash outflow from capital expenditure & financial investment 9,710 (801)

Acquisitions and disposals

Sale of subsidiary undertakings net of selling expenses and cash 15,708 -

balances

Purchase of subsidiary undertakings - net of cash acquired (1,150) -

14,558 -

Equity dividend paid

Dividends paid (17,167) (446)

Financing

Loan notes issued 110 -

Loans repaid (10) -

Issue of ordinary shares 234 25

Minority interest investment - 227

Net cash inflow from financing 334 252

Increase in cash in the period 8,820 786

Statement of total recognised gains and losses

The group has no recognised gains or losses other than those stated in the

profit and loss account, therefore no statement of total recognised gains and

losses is presented.

Notes

1. Dividends

2001 2000 2001 2000

Pence Pence #'000 #'000

Interim dividend - 1.3 - 176

Capital dividend paid 13 October 2000 125.0 - 17,167 -

Proposed final dividend - - - -

125.0 1.3 17,167 176

The dividends expressed in pence per share are stated after deduction of

Jersey income tax. The total amounts of the dividends are shown net of Jersey

income tax. The Capital dividend was paid gross without deduction of income

tax at source. The taxation authorities in both Jersey and Guernsey advised

the Company that this distribution would not be subject to taxation in their

respective jurisdictions.

2. Earnings per share

The calculation of earnings per share is based on the profit of #14,003,000

(2000: #922,000) and on the weighted average of 13,647,039 (2000: 13,512,663)

ordinary shares in issue during the year. The share options had no dilutive

potential in the current or preceding year and as a result the fully diluted

earnings per share is the same as the basic earnings per share.

3. Exceptional items

(a) Gain on sale of subsidiaries

In May 2000, Bourne Group Limited was sold to its management for #50,000

giving rise to a net loss of #1,252,000, including goodwill previously written

off to reserves.

In June 2000, Channel Television Limited and its subsidiary, Creative Channel

Limited, were sold to a management buy-in team for #16,310,000.

Proceeds Goodwill Fees & Carrying (Loss) /

write-off expenses value gain

(all

cash) #'000 #'000 #'000 #'000

#'000

Bourne Group Limited 50 (1,214) (32) (56) (1,252)

Channel Television 16,310 - (603) (1,321) 14,386

Limited

16,360 (1,214) (635) (1,377) 13,134

Fees on the sale of Channel Television Limited include #320,000 paid to CI

Investments Limited a company owned by T Scott (Chairman).

The Company has given certain warranties in respect of the sale of Channel

Television. Claims under the warranties must be notified by 13 December 2001.

The maximum claimable is #5 million and only the excess over #250,000 in

aggregate may be claimed.

(b) Gain on sale of properties

The freehold properties Television Centre, Jersey and Television House,

Guernsey were sold in September 2000 for #10,500,000. The gain represents the

difference between the sale proceeds and the carrying value of the land and

buildings net of selling expenses.

(c) Cost of business restructuring

Cash spend Asset Total

#'000 write-off #'000

#'000

Head office - 26 26

Channel Rentals 125 384 509

Rediffusion Channel Islands - 2,077 2,077

125 2,487 2,612

Head office was restructured as a result of the sale of Channel Television.

Channel Rentals withdrew from retailing and third party servicing in the

summer of 2000, resulting in the need to restructure the business.

The activities of Rediffusion Channel Islands were transferred to Channel

Rentals several years ago. The restructuring of the business leads to the need

to write-off goodwill which was previously written off to reserves.

4. Post Balance Sheet Events

The Company has entered into negotiations to buy development/investment

properties in the Channel Islands for circa #50 million. The consideration is

to be settled by the issue of about #18 million in shares of the Company and

the balance in cash.

The Company will be entering into long term borrowing arrangements of

approximately #30 million. The transaction will require the company to relist

on AIM.

5. Financial information

The financial information set out in this document does not constitute the

Company's statutory financial statements for the years ended 31 March 2001 and

2000. The auditors have given an unqualified audit report on the accounts for

the year ended 31 March 2001.

6. Annual General Meeting

The Annual General Meeting will be held on 8 August 2001 at 11.30 am at The

Atlantic Hotel, St Brelade, Jersey.

7. Annual Report

The Annual Report will be sent to shareholders in due course. Once issued,

further copies can be obtained from the Company's registered office at

Television Centre, La Pouquelaye, St Helier, Jersey JE2 3TP.

Contacts:

Tom Scott / Charles Day ComProp Limited 01534 83 55 00

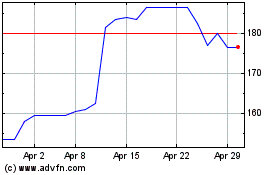

Cppgroup (LSE:CPP)

Historical Stock Chart

From Jun 2024 to Jul 2024

Cppgroup (LSE:CPP)

Historical Stock Chart

From Jul 2023 to Jul 2024