TIDMCSSG

RNS Number : 8125S

Croma Security Solutions Group PLC

14 March 2023

Croma Security Solutions Group Plc

("CSSG", "Croma", "the "Company" or the "Group")

Interim Results

Expanding Security Centre Network Showing Returns

Croma Security Solutions Group plc (AIM:CSSG) is pleased to a

nnounce its unaudited interim results for the six months to 31

December 2022 (the "Period")

Financial highlights from continuing operations:

-- Revenues grew by 25% to GBP3.77 million (H1 2021: GBP3.01 million)

-- EBITDA of GBP0.46 million (H1 2021: GBP0.39 million), represented an increase of 18%

-- Revenues from existing security centres grew 35% on a like for like basis to GBP1.32 million

-- Revenues from our strategic partnership with iLOQ were encouraging at over GBP0.38 million

-- Ungeared with cash balances of GBP0.61 million (31 December 2021: GBP0.65 million)

-- As with recent previous years, the Group is not paying an interim dividend

Operational highlights from continuing operations:

-- The Group acquired Southern Stronghold Limited and Safecell

Security Group Limited (with three security centres between them)

for net cash of GBP1.27 million

-- A further GBP0.085 million was invested in improvements to

the existing portfolio of security centres

-- Identified acquisition opportunities supporting the further

expansion of the security centre network

Assets held for sale:

-- As announced on 6 December 2022, the Board is considering the

proposed divestment of Vigilant Security (Scotland) Limited ("Croma

Vigilant") and expects this process to be resolved by the end of

the financial year

-- Croma Vigilant generated revenues up 7% during the Period to

GBP15.9 million (H1 2021: GBP14.86 million)

-- Profit before tax was GBP0.13 million (H1 2021: GBP0.35

million), held back by a mix of factors including some

non-recurring exceptional costs, general wage inflation which is

beginning to be passed on in adjusted contract rates and upfront

investment in people ahead of a new substantial contract win

commencing in January 2023.

Outlook:

-- Second half trading in our core businesses has started well

-- Croma Vigilant has begun the second half positively with the

substantial new contract commencing as planned

Nick Hewson, Non-Executive Chairman of CSSG, said : "We are

pleased that our decision to invest heavily in our security systems

and locks businesses is beginning to show strong returns. As set

out in December, we will look to deploy the proceeds of the sale of

the manned guarding business as and when it is sold into further

geographic expansion of our network of security centres".

For further information visit www.cssgroupplc.com or

contact:

Croma Security Solutions Group Plc Tel: +44 (0)7834 482 400

Roberto Fiorentino, CEO

Teo Andreeva, CFO designate

WH Ireland Limited Tel: +44 (0)207 220 1666

(Nominated Adviser and Broker)

Mike Coe

Sarah Mather

Novella Tel: +44 (0)203 151 7008

Tim Robertson

Claire de Groot

Safia Colebrook

This announcement contains inside information for the purposes

of Article 7 of the UK version of Regulation (EU) No 596/2014 which

is part of UK law by virtue of the European Union (Withdrawal) Act

2018, as amended ("MAR"). Upon the publication of this announcement

via a Regulatory Information Service, this inside information is

now considered to be in the public domain

Chairman's Statement

Introduction

I am pleased to report the Group's unaudited interim results for

the six months to 31 December 2022 ("H1" or the "Period").

The Group currently comprises two distinct businesses, Croma

Vigilant and Croma Systems and Locks. In December 2022, the Board

announced its intention to divest Croma Vigilant, its manned

guarding business and concentrate on its systems and locks

businesses. The intention to divest means that the trading

performance of Croma Vigilant is reported separately in the

consolidated statement of comprehensive income ("SOCI") and its

assets and liabilities are grouped and shown separately in the

consolidated statement of financial position. The results for the

continuing businesses of systems and locks ("the Continuing Group")

and comparative numbers have been restated in the SOCI.

The Continuing Group generated revenues from continuing

operations of GBP3.77 million (H1 2021: GBP3.01 million) and EBITDA

of GBP0.46 million (H1 2021: GBP0.39 million).

The Continuing Group provides a range of innovative security

technology services including CCTV, intruder alarms, FastVein

(Biometrics) and high security locks. It operates through 14

security centres, the majority operating under the Croma brand and

each security centre markets and sells the entire range of the

Continuing Group's services. Eventually, all of our security

centres will be operating under our Croma brand, providing a

comprehensive security services solution in each location.

Revenues from security centres grew 63% to GBP1.61 million (H1

2021: GBP0.99 million) and like for like growth (excluding the

three new centres that came on stream during the Period) was up 35%

to GBP1.32 million. Footfall in those same centres grew 7% like for

like, and by 30% when taking into account the new centres

acquired.

To complement and improve its range of services, the Continuing

Group also engages in strategic partnerships with various providers

of innovative security solutions, and I am pleased to report that

our strategic partnership with our Scandinavian partner iLOQ

continues to develop positively. 'iLOQ' is a new battery free door

lock which can be opened by smartphone. The lock is powered by the

mobile phone itself, an important feature clearly differentiating

it from competing products. The potential applications for the

mobile iLOQ are significant across multiple industries, given its

advantages not only in security, but also in data collection,

identity, access and control applications. Under the partnership,

Croma sells, installs and maintains iLOQ equipment in the UK. This

strategic collaboration contributed over GBP0.38 million to our

revenues for the Period and we confidently expect this revenue

stream to grow.

Financial review - Continuing Group

Revenue from continuing businesses increased by 25% for the

Period to GBP3.77m (H1 2021: GBP3.05m). Cash balances (excluding

cash in the subsidiary to be sold) at 31 December 2022 were GBP0.61

million (31 December 2021: GBP0.65 million). The Continuing Group

spent GBP1.29 million during the Period investing in new security

centres, including three freehold premises, and a further GBP0.085

million improving our existing network of centres. Earnings per

share from continuing businesses increased over 30% to 1.40p per

share (H1 2021: 1.07p). As with recent previous years, the Group is

not paying an interim dividend.

Other than lease and short-term trading liabilities, the

Continuing Group is debt free.

Acquisitions

During the Period, the Continuing Group completed two

acquisitions for the Croma Systems and Locks division, being

Southern Stronghold Limited and Safecell Security Group

Limited.

Southern Stronghold Limited ("Stronghold") was acquired in July

2022 for a total consideration of GBP0.96 million. Stronghold is a

long-standing locksmith business that operates from two freehold

premises, one in Coventry and a second near Southampton in Totton.

Coventry is the larger of the operations and is a main Assa/Abloy

service centre and provides a large number of Master Key systems to

local businesses. Stronghold also has an on-line business

"Stronghold Direct".

Safecell Security Group Limited was acquired in December 2022

for a total consideration estimated to be GBP0.75 million, part of

which is deferred and dependant on the working capital of the

business at the completion date. Safecell is a well-known and

long-standing security business based in Manchester, providing a

comprehensive range of services with a particular focus on

electronic and physical security together with fire systems, to

retail and commercial customers across the North of England.

Safecell's locksmith business operates from premises in Bury (North

Manchester).

The acquisitions have increased the number of the Continuing

Group's security centres which now number 14, and have

significantly enhanced the geographic reach of the Continuing Group

and its ability to service nationwide security clients.

I am pleased to report that both acquisitions have performed

well since acquisition and their integration is proceeding

smoothly.

Asset held for sale

As announced on 6 December 2022, the Board is considering the

proposed divestment of Croma Vigilant. Discussions in relation to

the proposed divestment remain ongoing, and although there can be

no certainty that the Group will complete the disposal, the Board

hopes to resolve a sale by the end of the current financial year.

If the proposed divestment of Croma Vigilant were to proceed, it

would be classified as a fundamental disposal under the AIM rules

and, as a result, would be subject to shareholders' approval.

Revenues from Croma Vigilant were up 7% for the Period to

GBP15.92 million (H1 2021: GBP14.86 million). However, profit

before tax was GBP0.13 million (H1 2021: GBP0.36 million) held back

by a number of factors including non-recurring exceptional costs,

up-front investment in staff costs ahead of the start of a

substantial contract that commenced successfully, as planned, in

January 2023, as well as general wage inflation which has impacted

staff retention and the ability to recruit. The increased wage

costs are beginning to be passed on in adjusted contract rates and

will be reflected in all new contracts.

Board changes

During the Period, the former executive directors of the Group,

Sebastian Morley and Paul Williamson, stepped down from the Board

in order to pursue the purchase of Croma Vigilant, following which

I was appointed Non-Executive Chairman. In addition, post Period

end, Richard Juett, CFO gave notice of his intention to resign with

effect from 31 March 2023. We thank them for their service. Teo

Andreeva, currently the Group's financial controller, will become

CFO from 1 April 2023 and we welcome her to the Board.

Outlook

The sale process for Croma Vigilant continues and the Board

hopes it will be resolved by the end of the financial year. The

Continuing Group is trading well and has the potential for further

growth. We will continue to seek out opportunities to further

expand our national chain of security centres.

A N Hewson

Non-executive Chairman

14 March 2023

CROMA SECURITY SOLUTIONS GROUP PLC

CONSOLIDATED STATEMENT OF COMPREHENSIVE INCOME

FOR 6 MONTHSED 31 DECEMBER 2022

6 months 6 months Year

ended ended ended

31-Dec-22 31-Dec-21 30-Jun-22

unaudited unaudited audited

as restated as restated

Notes GBP000s GBP000s GBP000s

Revenue 3,770 3,005 5,831

Cost of sales (2,072) (1,790) (3,273)

------------

Gross profit 1,698 1,215 2,558

Administrative expenses (1,431) (1,055) (2,902)

Other operating income - 42 55

---------- ------------

Operating profit/(loss) 267 202 (289)

Analysed as:

Earnings before interest, tax, depreciation,

impairment, and amortisation of intangible

assets 455 394 738

Impairment - - (627)

Amortisation (30) (45) (82)

Depreciation (158) (147) (318)

Operating profit/(loss) 267 202 (289)

Finance costs (13) (13) (31)

Profit before tax 254 189 (320)

Tax (45) (30) (89)

Profit/(loss) for the period from continuing

operations 209 159 (409)

Profit for the period from discontinued

operations 6 101 284 472

Profit and total comprehensive income

for the period attributable to owners

of the parent 310 443 63

Earnings per share 3

Basic and diluted earnings/(loss)

per share (pence) from continuing

operations 1.40 1.07 (2.74)

Basic and diluted earnings per share

(pence) from discontinued operations 0.68 1.91 3.17

CROMA SECURITY SOLUTIONS GROUP PLC

CONSOLIDATED STATEMENT OF FINANCIAL POSITION

AT 31 DECEMBER 2022

31-Dec-22 31-Dec-21 30-Jun-22

unaudited unaudited audited

GBP000s GBP000s GBP000s

Assets

Non-current assets

Goodwill 4,851 6,464 5,827

Other intangible assets 177 246 207

Property, plant and equipment 1,953 1,433 1,477

Right-of-use assets 706 894 1,120

7,687 9,037 8,631

Current assets

Inventories 1,232 800 1,076

Trade and other receivables 1,298 6,047 6,778

Cash and cash equivalents 613 3,509 2,556

Assets classified as held for sale 8,922 - -

12,065 10,356 10,410

Total assets 19,752 19,393 19,041

Liabilities

Non-current liabilities

Deferred tax (104) (88) (117)

Lease liabilities (601) (586) (796)

(705) (674) (913)

Current liabilities

Trade and other payables (2,098) (5,844) (5,609)

Borrowings and lease liabilities (140) (352) (376)

Liabilities directly associated with (4,668) - -

assets classified as held for sale

(6,906) (6,196) (5,985)

Total liabilities (7,611) (6,870) (6,898)

Net assets 12,140 12,523 12,143

========== ========== ==========

Issued capital and reserves attributable

to owners of the parent

Share capital 794 794 794

Treasury shares (399) (399) (399)

Share premium 6,133 6,133 6,133

Merger reserve 2,139 2,139 2,139

Capital redemption reserve 51 51 51

Retained earnings 3,422 3,805 3,425

Total equity 12,140 12,523 12,143

========== ========== ==========

CROMA SECURITY SOLUTIONS GROUP PLC

CONSOLIDATED STATEMENT OF CASHFLOWS

FOR 6 MONTHSED 31 DECEMBER 2022

6 months 6 months Year

ended ended ended

31-Dec-22 31-Dec-21 30-Jun-22

unaudited unaudited audited

as restated as restated

Notes GBP000s GBP000s GBP000s

Cash generated from/(used in) operating

activities 5 755 (282) (860)

Cash flows from investing activities

Purchase of subsidiaries net of

cash acquired (1,287) (137) (94)

Purchase of property, plant and

equipment (160) (1,093) (1,216)

Proceeds on disposal of property, plant

and equipment - 18 31

Net cash used in investing activities (1,447) (1,212) (1,279)

Cash flows from financing activities

Payments to reduce lease liabilities (196) (123) (445)

Increase/(reduction) in borrowings 6 (1) 5

Dividends paid (313) (298) (298)

Interest paid (6) (8) -

Net cash used in financing activities (509) (430) (738)

Net decrease in cash and cash equivalents (1,201) (1,924) (2,877)

Cash and cash equivalents at beginning

of period 2,556 5,433 5,433

Cash and cash equivalents at end

of the period 1,355 3,509 2,556

Total cash and cash equivalents at the end of

the period can be analysed as:

Included as part of continuing

operations 613 3,509 2,556

Included as part of assets held

for sale 742 - -

1,355 3,509 2,556

CROMA SECURITY SOLUTIONS GROUP PLC

CONSOLIDATED STATEMENT OF CHANGES IN EQUITY

Capital

Share Treasury Share Merger Redemption Retained Total

Capital Shares Premium Reserve Reserve Earnings Equity

GBP000s GBP000s GBP000s GBP000s GBP000s GBP000s GBP000s

Balance at 1 July 2022 794 (399) 6,133 2,139 51 3,425 12,143

Profit for the period - - - - - 310 310

Dividends paid - - - - - (313) (313)

At 31 December 2022 794 (399) 6,133 2,139 51 3,422 12,140

========= ========= ========= ========= ============ ========== ========

Balance at 1 July 2021 794 (399) 6,133 2,139 51 3,660 12,378

Profit for the period - - - - - 443 443

Dividends paid - - - - - (298) (298)

Balance at 31 December

2021 794 (399) 6,133 2,139 51 3,805 12,523

========= ========= ========= ========= ============ ========== ========

Balance at 1 July 2021 794 (399) 6,133 2,139 51 3,660 12,378

Profit for the year - - - - - 63 63

Dividends paid - - - - - (298) (298)

Balance at 30 June

2022 794 (399) 6,133 2,139 51 3,425 12,143

========= ========= ========= ========= ============ ========== ========

NOTES TO THE INTERIM FINANCIAL STATEMENTS FOR 6 MONTHS TO 31

DECEMBER 2022

1. Basis of preparation

The interim financial information in this report has been

prepared using accounting policies consistent with UK-adopted

international accounting standards ("IFRS"). IFRS is subject to

amendment and interpretation by the International Accounting

Standards Board (IASB) and the IFRS Interpretations Committee and

there is an ongoing process of review and endorsement by the UK

Endorsement Board. The financial information has been prepared on

the basis of IFRS that the Directors expect to be adopted by the UK

and applicable as at 30 June 2023. The Group has chosen not to

adopt IAS 34 "Interim Financial Statements" in preparing the

interim financial information.

Statutory accounts

Financial information contained in this document does not

constitute statutory accounts within the meaning of section 434 of

the Companies Act 2006 ("the Act"). The statutory accounts for the

year ended 30 June 2022 have been filed with the Registrar of

Companies. The report of the auditors on those statutory accounts

was unqualified, did not draw attention to any matters by way of

emphasis and did not contain a statement under section 498(2) or

(3) of the Act.

The financial information for the six months ended 31 December

2022 and 31 December 2021 is unaudited.

2. Accounting policies

The accounting policies applied by the Group in this interim

report are the same as those applied by the Group in the

consolidated financial statements for the year ended 30 June 2022,

however IFRS 5 "Non-current Assets Held for Sale and Discontinued

Operations" has been applied following the Boards' decision in

December 22 to divest itself of the operations of Croma Vigilant.

Specifically the assets and liabilities of Croma Vigilant are

classified as "held for sale" and shown separately in the statement

of financial position from continuing operations. In the statement

of comprehensive income the results of Croma Vigilant is presented

separately from continuing operations as a single line "profit for

the period from discontinued operations" with all comparatives

restated accordingly.

A number of other new and amended standards and interpretations

are effective from 1 January 2023 but they do not have a material

effect on the Group's financial statements.

3. Earnings per share

Earnings per share is based upon the profit for the period and

the weighted average number of shares in issue and ranking for

dividend. The following reflects the profit and share data used in

the basic and diluted EPS computations:

6 months 6 months Year

ended ended ended

As restated As restated

31-Dec-22 31-Dec-21 30-Jun-22

Earnings

Earnings/(loss) for the purposes of

basic and diluted earnings per share

being net profit attributable to equity

shareholders

- continuing operations 209 159 (409)

- discontinued operations 101 284 472

Number of shares (thousands)

Weighted average number of shares

used in basic and diluted EPS 14,902 14,902 14,902

The calculation of diluted earnings per share assumes conversion of all

potentially dilutive ordinary shares, all of which arise from share options.

A calculation is performed to determine the number of share options that

are potentially dilutive based on the number of shares that could have

been acquired at fair value, considering the monetary value of the subscription

rights attached to the outstanding share options.

4. Acquisition of subsidiaries

As part of the continuing strategy to expand the network of

security centres, on 6 July 2022 the company purchased a business

comprising 100% of the share capital of Southern Stronghold

Limited, a business trading out of Locksmiths branches in Coventry

and Totton for GBP965,000 in cash.

The estimated fair value of net assets acquired is set out

below:

Book Fair value Fair

Value Adjustments Value

GBP000s GBP000s GBP000s

Freehold property 131 289 420

Plant and equipment 2 48 50

Inventories 338 (88) 250

Trade receivables 95 95

Cash and cash equivalents 116 116

Trade and other payables (46) (46)

Goodwill 80 80

Purchase consideration 636 329 965

======== ============= ========

On 20 December 2022 the company purchased Safecell Security

Group Limited for an estimated consideration of GBP750,000 to be

satisfied in cash. The Acquisition extends the geographic reach of

the Group and through its Bury site provides a base from which the

company can better service, support and expand existing

relationships with clients that have operations in the area. The

Bury systems business will operate alongside the successful

acquisition last year of Safeguard (N/W) Ltd in Warrington.

The estimated fair value and book value of net assets acquired

is set out below:

Book

& Fair

Value

GBP000s

Plant and equipment 67

Inventories 63

Trade receivables 95

Cash and cash equivalents 312

Trade and other payables (120)

Goodwill 334

Estimated Purchase consideration 750

========

5. Cash generated from/(used in) operating activities:

6 months 6 months Year

ended ended ended

31-Dec-22 31-Dec-21 30-Jun-22

unaudited unaudited audited

As restated As restated

GBP000s GBP000s GBP000s

Operating profit/(loss) 267 202 (289)

Depreciation and amortisation 188 192 1,006

Decrease/(Increase) in inventories 157 17 (258)

(Increase)/decrease in trade and

other receivables (265) 2,410 37

Increase in trade and other payables 390 78 78

Cash generated from continuing operations 737 2,899 574

Cash generated/ (used in) assets

held for sale 95 (3,050) (1,096)

Tax paid (77) (131) (338)

755 (282) (860)

========== ============ ============

6. Discontinued operations

As announced in December 2022 the board has decided to divest

itself of its manned guarding division, Croma Vigilant and

accordingly the results of this division are set out separately as

follows:

6 months 6 months Year

ended ended ended

31-Dec-22 31-Dec-21 30-Jun-22

unaudited unaudited audited

GBP000s GBP000s GBP000s

Revenue 15,925 14,864 29,334

Cost of sales (13,908) (12,640) (25,496)

Gross profit 2,017 2,224 3,838

Operating profit 139 363 534

Finance costs (12) (11) (14)

Profit before tax 127 352 520

Tax (26) (68) (48)

Profit after tax 101 284 472

================ ================ ================

The results of the discontinued activities of the group for the year ended

30 June 2022 and the six months ended 31 December 2021 have been re-presented,

as required by IFRS 5, so that the disclosures relate to all operations

that have been discontinued by 31 December 22 for all periods presented.

6. Financial information

The Board of Directors approved this interim report on 14 March

2023.

A copy of this report can be obtained by writing to the Finance

Director at our registered office; Unit 7 & 8, Fulcrum 4,

Solent Way, Whiteley, Hampshire PO15 7FT or from our website at

www.cssgroupplc.com

This information is provided by RNS, the news service of the

London Stock Exchange. RNS is approved by the Financial Conduct

Authority to act as a Primary Information Provider in the United

Kingdom. Terms and conditions relating to the use and distribution

of this information may apply. For further information, please

contact rns@lseg.com or visit www.rns.com.

RNS may use your IP address to confirm compliance with the terms

and conditions, to analyse how you engage with the information

contained in this communication, and to share such analysis on an

anonymised basis with others as part of our commercial services.

For further information about how RNS and the London Stock Exchange

use the personal data you provide us, please see our Privacy

Policy.

END

IR VXLFFXXLBBBZ

(END) Dow Jones Newswires

March 14, 2023 03:00 ET (07:00 GMT)

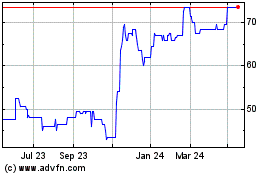

Croma Security Solutions (LSE:CSSG)

Historical Stock Chart

From Dec 2024 to Jan 2025

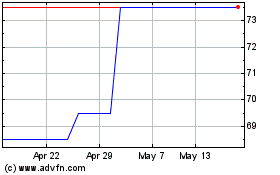

Croma Security Solutions (LSE:CSSG)

Historical Stock Chart

From Jan 2024 to Jan 2025