TIDMCTEC

RNS Number : 3051T

ConvaTec Group PLC

14 November 2023

14 November 2023

Convatec Group Plc

Trading update for the ten months ended 31 October 2023

Strong sales growth continued with margin expansion on track

Convatec, a global medical products and technologies company,

announces its trading update for the ten months ended 31 October

2023. Revenue increased by 6.7% on an organic basis(1) . On a

reported basis revenue rose by 2.5%, impacted by the strategic exit

of the hospital care activities and related industrial sales in

2022. On a constant currency basis revenue increased by 2.6%.

In Advanced Wound Care ('AWC'), organic growth was high-single

digit, consistent with the performance in the first half of the

year, with a strong performance in Global Emerging Markets, good

growth in Europe and North America enhanced by the contribution of

InnovaMatrix(2) , our next-generation placental extracellular

matrix product.

In Ostomy Care ('OC') organic growth was mid-single digit. Sales

growth from Convatec's Ostomy products performed in line with the

first half, with strong growth in Global Emerging Markets, good

growth in North America and key European markets. As expected, the

negative impact of Flexi-Seal(3) moderated to a mid-single digit

decline for the year to date, as the tough COVID comparatives

normalised and as the business became sole supplier to the

HealthTrust Performance Group, a major GPO, in the US.

In Continence Care ('CC'), organic growth was mid to high-single

digit with continued strong performance on customer satisfaction,

retention and pricing in the US. The lower rate of growth than the

first half was phasing, as expected, and in line with our guidance

of mid to high-single digit growth for the year.

In Infusion Care ('IC'), organic growth was high-single digit,

building on the first half performance. Underlying demand for

Convatec's infusion sets remained strong with the market responding

positively to recent new insulin pump launches, and as the business

continued to expand outside of diabetes. We note the recent

extensive coverage regarding GLP1s and confirm that we do not

expect any material impact on our business. GLP1s(4) are deemed

effective for patients who retain the ability to produce insulin,

whereas our products serve patients on insulin-intensive therapy

who no longer produce sufficient insulin endogenously.

Strategic progress over the last four months

-- In AWC, our new product portfolio continued launching

successfully and drove our organic growth as expected.

-- In OC, the development of our new one-piece convex pouching

system, Esteem Body(TM) , is on track to start launching in early

2024 in the US and Europe.

-- In CC, in France we began the launch of our new compact

catheter, GentleCath Air(TM) for Women with FeelClean(TM)

Technology. This technology is designed for urethral protection and

to reduce the risk of UTIs.

-- In IC, we continued to diversify, supporting several new

launches. BetaBionics' iLet pump and Medtronic's 780G pump are

progressing well, while Tandem's Mobi pump began rolling out in the

US in Q3. AbbVie's Parkinson's disease therapy launched in Japan

and regulatory approvals for other key global markets are in

process.

-- In quality and operations, our plant network optimisation is

progressing well, with the migration from the EuroTec facility, in

the Netherlands, to Slovakia and a restructuring of activities in

Switzerland.

-- Two acquisitions were completed in the period, for a combined

consideration of $28 million, to further strengthen our Home

Services Group in the US.

-- To accelerate our simplification and productivity agenda, in

our Global Business Services, we opened a new facility in Kuala

Lumpur to provide 24-7 support to the group, started the migration

of HR services and created a new IT Centre of Excellence.

On track to deliver guidance

We now expect organic revenue growth for 2023 to be between

6.75% and 7.5% (previously 6.0%-7.5%). Adjusted operating profit

margin is expected to expand to at least 20.5%, on a constant

currency basis.

Karim Bitar, the Chief Executive Officer, commented:

"We are pleased with the execution of our FISBE strategy this

year. Convatec has pivoted to a higher level of organic sales

growth over recent years. We are on track to deliver a mid-20s

adjusted operating margin in 2026 or 2027, and double-digit

compound growth in EPS and free cash flow, from 2024 onwards."

***

Notes

Technical guidance

- Based on FX rates to date and spot for the remainder of the

year, the foreign exchange impact on 2023 revenue growth is

currently not material but there is a headwind to 2023 adjusted

operating margin of 60bps.

- Guidance on interest expense, tax rate and debt leverage is unchanged:

o Interest expense towards the top of the $70-80m range.

o Adjusted book tax rate at c.24%.

o Net debt/adjusted EBITDA leverage at year end to be

approximately 2.3x.

Conference Call details

A conference call to discuss the trading update will be held for

analysts and investors at 8:30am GMT. Details are included

below:

-- UK Wide: +44 (0) 33 0551 0200

-- USA Local: +1 786 697 3501

-- Password: Quote " Convatec - Trading Update" when prompted by the operator

Footnotes

Organic growth is calculated by applying the applicable prior

period average exchange rates to the Group's actual performance in

the respective period and excluding acquired and

disposed/discontinued businesses

2 Triad Life Sciences, now known as Advanced Tissue Technologies

(ATT), included in organic growth from 1 April 2023

3 Faecal management system, which was moved to Ostomy Care at

the start of this year

(4) At the moment Glucagon-like Peptide-1 receptor agonists

(GLP1s) are not FDA or EMA approved for patients with type 1

diabetes. The ADA (American Diabetes Association) does not advocate

their use in type 1 diabetes.

Contacts

Kate Postans, Vice President,

Analysts & Investor Relations & Corporate

Investors Communications +44 (0) 7826 447807

Sheebani Chothani, Investor +44 (0) 7805 011046

Relations & Corporate Communications ir@convatec.com

Manager

Buchanan: Charles Ryland / Chris

Media Lane +44 (0)207 466 5000

About Convatec

Pioneering trusted medical solutions to improve the lives we

touch: Convatec is a global medical products and technologies

company, focused on solutions for the management of chronic

conditions, with leading positions in advanced wound care, ostomy

care, continence care, and infusion care. With around 10,000

colleagues, we provide our products and services in almost 100

countries, united by a promise to be forever caring. Our solutions

provide a range of benefits, from infection prevention and

protection of at-risk skin, to improved patient outcomes and

reduced care costs. Group revenues in 2022 were over $2 billion.

The company is a constituent of the FTSE 100 Index (LSE:CTEC). To

learn more about Convatec, please visit

http://www.convatecgroup.com

Forward Looking Statements

This document includes certain forward-looking statements with

respect to the operations, performance and financial condition of

the Group. Forward-looking statements are generally identified by

the use of terms such as "believes", "estimates", "aims",

"anticipates", "expects", "intends", "plans", "predicts", "may",

"will", "could", "targets", continues", or their negatives or other

similar expressions. These forward-looking statements include all

matters that are not historical facts.

Forward-looking statements are necessarily based upon a number

of estimates and assumptions that, while considered reasonable by

the Company, are inherently subject to significant business,

economic and competitive uncertainties and contingencies that are

difficult to predict and many of which are outside the Group's

control. As such, no assurance can be given that such future

results, including guidance provided by the Group, will be

achieved. Forward-looking statements are not guarantees of future

performance and such uncertainties and contingencies, including the

factors set out in the "Principal Risks" section of the Strategic

Report in our Annual Report and Accounts, could cause the actual

results of operations, financial condition and liquidity, and the

development of the industry in which the Group operates, to differ

materially from the position expressed or implied in the

forward-looking statements set out in this document. Past

performance of the Group cannot be relied on as a guide to future

performance.

Forward-looking statements are based only on knowledge and

information available to the Group at the date of preparation of

this document and speak only as at the date of this document. The

Group and its directors, officers, employees, agents, affiliates

and advisers expressly disclaim any obligations to update any

forward-looking statements (except to the extent required by

applicable law or regulation).

This information is provided by RNS, the news service of the

London Stock Exchange. RNS is approved by the Financial Conduct

Authority to act as a Primary Information Provider in the United

Kingdom. Terms and conditions relating to the use and distribution

of this information may apply. For further information, please

contact rns@lseg.com or visit www.rns.com.

RNS may use your IP address to confirm compliance with the terms

and conditions, to analyse how you engage with the information

contained in this communication, and to share such analysis on an

anonymised basis with others as part of our commercial services.

For further information about how RNS and the London Stock Exchange

use the personal data you provide us, please see our Privacy

Policy.

END

MSCDBBDBUBBDGXX

(END) Dow Jones Newswires

November 14, 2023 02:00 ET (07:00 GMT)

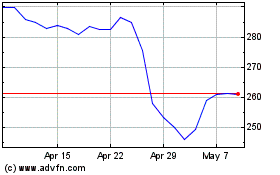

Convatec (LSE:CTEC)

Historical Stock Chart

From Nov 2024 to Dec 2024

Convatec (LSE:CTEC)

Historical Stock Chart

From Dec 2023 to Dec 2024