TIDMEAAS

RNS Number : 3878U

eEnergy Group PLC

28 March 2023

28 March 2023

eEnergy Group plc

("eEnergy" or "the Group")

Results for the six months ended 31 December 2022

eEnergy Group plc (AIM: EAAS), the net zero energy services

provider, is pleased to announce its interim results for the six

months ended 31 December 2022.

Financial Highlights

-- Revenue up 58% to GBP15.1 million (HY21: GBP9.6 million)

* Energy Management revenues of GBP6.6 million (HY21:

GBP4.8 million)

* Energy Services revenues of GBP8.5 million (HY21:

GBP4.8 million)

-- Adjusted EBITDA (1) up 87% to GBP1.5 million (HY21: GBP0.8

million)

-- Profit before tax of GBP0.4 million (HY21: loss of GBP1.0

million)

-- Profit before tax and exceptional items of GBP0.7 million

(HY21: GBP0.2 million)

-- Contracted future revenues increased 45% to GBP26.4 million

at 31 December 2022 (31 December 2021 GBP18.3 million)

-- Cash GBP1.1 million (FY22: GBP1.4 million) excluding GBP0.4

million of restricted cash balances (FY22: GBP0.2 million)

reflecting scheduled payments of trade creditors and legacy

balance sheet items following drawdown of the new subordinated

debt facility

-- As at 24 March 2023, the Group's cash balance was GBP1.1

million (excluding restricted cash balances of GBP0.5 million).

This included a payment of GBP0.5 million received in advance

which may, in certain circumstances, be returnable in May

2023

Operational Highlights

-- Key contract renewals and wins comprising healthcare and

education trusts as well as two significant framework agreements

-- Launch of eSolar in September 2022 with 12.3 MW under HOT's

as at 31 December 2022

-- Cross selling proposition continues to improve, with 35%

of Energy Service's TCV signed in H1 FY22 coming from existing

customers

Post Period End

-- Q3 TCV Values:

* Energy Management GBP3.2 million

* Energy Services GBP4.4 million

-- Experiencing strong appetite and trading in eSolar

-- Stabilised working capital with Net Debt broadly flat during

Q3, post period end

-- Appointment of John Foley as Non-Exec Chairman, with David

Nicholl moving to Non-Executive Director

Full Year Outlook

eEnergy continues to grow its pipeline of new business

opportunities, both with existing and new customers. As at 31

December 2022, the Company had contracted forward revenues

("Forward Order Book"), of GBP26.4 million over four years (up 45%

on HY21). Of the Forward Order Book, GBP8.8 million is expected to

be recognised as revenue in H2 FY23 and GBP6.8 million recognised

in FY24.

The working capital position has been stabilised during Q3 as a

result of management actions and the Board are expecting healthy

conversion of earnings to operating cashflow for H2 as a whole. As

at 24 March 2023, the Group's cash balance was GBP1.1 million

(excluding restricted cash balances of GBP0.5 million). This

included a GBP0.5 million payment received in advance which may, in

certain circumstances, be returnable in May 2023.

The first months of H2 trading have been strong as we win new

clients and cross selling opportunities within our existing client

base continues to bear fruit. Contract wins during Q3 give

improving visibility on the remaining three month outlook for FY23,

and the Board remains optimistic to deliver full year trading

expectations. As previously stated, interest expense for the year

will reflect the drawdown of the subordinated debt facility.

Harvey Sinclair, CEO of eEnergy, commented : "eEnergy continues

to make progress towards making net zero possible and profitable.

Following a transformational year in 2022 bringing our offering

under one unified brand, the first half of the year has seen us

grow the business across both Energy Management and Energy

Services. Our financial year is traditionally second half weighted

and based on the new business pipeline and a contracted forward

order book of GBP26.4 million, with GBP8.8 million to be recognised

in H2, we remain optimistic to deliver full year trading

expectations."

Investor & Analyst presentation

Management will provide a live presentation relating to the

interim results via the Investor Meet Company platform on 28 March

2023 at 11:15am GMT. The presentation is open to all existing and

potential shareholders. Questions can be submitted at any time

during the live presentation. Investors can sign up to Investor

Meet Company for free and add to meet eEnergy Group plc via:

https://www.investormeetcompany.com/eenergy-group-plc/register-investor

An online analyst briefing will be held at 10:00am GMT. Analysts

wishing to attend should contact eenergy@tavistock.co.uk to

register.

Note: (1) Adjusted EBITDA excluding Exceptional Items.

Exceptional Items are those items which, in the opinion of the

Directors, should be excluded in order to provide a consistent and

comparable view of the underlying performance of the Group's

ongoing business, including the costs incurred in delivering the

'Buy & Build' strategy associated with acquisitions and

strategic investments, costs of restructuring and transforming

acquired businesses and share-based payments.

Contacts:

eEnergy Group plc Tel: +44 20 7078 9564

Harvey Sinclair, Chief Executive info@eenergyplc.com ;

Officer www.eenergyplc.com

Crispin Goldsmith, Chief Financial

Officer

Singer Capital Markets (Nominated Tel: +44 20 7496 3000

Adviser and Joint Broker)

Justin McKeegan, Asha Chotai, James

Maxwell (Corporate Finance)

Tom Salvesen (Corporate Broking)

Canaccord Genuity Limited (Joint Tel: +44 20 7523 8000

Broker)

Max Hartley, Tom Diehl (Corporate

Broking)

Tavistock Tel: +44 207 920 3150

Jos Simson, Heather Armstrong, Katie eEnergy@tavistock.co.uk

Hopkins

About eEnergy Group plc

eEnergy (AIM: EAAS) is a net zero energy services provider,

empowering organisations to achieve net zero by tackling energy

waste and transitioning to clean energy, without the need for

upfront investment. It is making net zero possible and profitable

for all organisations in four ways:

-- Transition to the lowest cost clean energy through the

Group's digital procurement platform and energy management

services.

-- Tackle energy waste with granular data and insight on energy

use and dynamic energy management.

-- Reduce energy use with the right energy efficiency solutions without upfront cost.

-- Reach net zero with onsite renewable generation and electric vehicle (EV) charging.

eEnergy is a Top 5 B2B energy company and has been awarded The

Green Economy Mark by London Stock Exchange.

CEO Statement

H1 FY23 has continued to build on what was a transformational

FY22 for eEnergy when further investment was made in the business

and the Company's business divisions unified under a single eEnergy

brand. The board believes that the business is at an inflection

point which has been escalated at a quicker rate due to the long

term increase in energy prices, the increase in appetite for net

zero solutions in conjunction with the need for improved energy

security. This is evidenced by an increase in our sales both from

new customers and improving our cross selling rates to existing

clients following the establishment of a more integrated

proposition last year.

Energy Market

According to the International Energy Agency, the increase in

wholesale electricity prices in 2022 was most prominent in Europe,

where on average, prices were more than twice as high as in 2021.

The mild winter so far in 2022/23 has helped ease wholesale

electricity prices, aided by sustained liquefied natural gas

inflows and sufficient gas storage inventories. However, this

status of the global gas balance is delicate and there are a number

of uncertainties in the short term for the rest of 2023.

These now established tailwinds continue to provide eEnergy with

significant opportunities to continue its growth trajectory as

organisations globally mitigate energy costs and accelerate a move

to, not just Net Zero, but to improve their security by

establishing energy independence away from the grid.

Results

Revenue increased by 58% to GBP15.1 million, up from GBP9.6

million in the prior year, with Energy Management and Energy

Services contributing GBP6.5 million and GBP8.5 million

respectively. Adjusted EBITDA was up 87% to GBP1.5 million in

comparison to GBP0.8 million in HY21.

Both Energy Services and Energy Management have seen significant

contract and framework wins during the period. We continue to win

significant opportunities with education trusts to support their

net zero strategies with contracts for lighting services, on-site

generation services with eSolar and management through My

ZeERO.

In addition we are increasing our presence in new segments with

a particular focus on healthcare.

Following the successful launch of eCharge in March and later

eSolar in September 2022, eEnergy has seen increasing levels of

appetite from its customers for on-site generation services through

its capital free Electrical Vehicle ("EV") charging and solar

energy offerings. In addition, eCharge has secured a contract, to

install 70 chargers across 35 locations across the UK with a new

customer.

In November 2022, eEnergy announced that it had raised GBP2.5

million through the issue of a new sub-ordinated debt facility from

exiting shareholder, Hawk Investment Holdings, and a new strategic

investor, FFIH, and all Directors of the company, used to fund

additional Energy Services working capital as a result of

lengthened cash collection cycles as well as funding the next phase

of MY ZeERO stock-build, other balance sheet liabilities and

general working capital. This allowed eEnergy to tackle a tightened

liquidity position and to support further growth of the business

and continued investment in the Company's market leading

platform.

Strategy

eEnergy's new clear and integrated product and service offering

remains key to delivering on our core strategy of making net zero

possible and profitable businesses and organisations, without the

need for capital investment. The Company's integrated end-to-end

solution driven platform, which include market leading digital

products, underpinned by its Energy-as-a-Service model, make it

easier than ever before for an organisation to transition to Net

Zero.

While new customer acquisition remains central to the Company's

growth strategy, in the last 12 months we have established an

integrated cross selling platform, promoting additional products

and services to eEnergy's existing 2,000 strong customer base. This

allows for increased re-occurring revenues streams at an improved

margin, giving greater long term revenue visibility and

predictability.

The Board welcomes John Foley as new Non-Executive Chair to

eEnergy. John is a barrister and chartered accountant who has

served on a number of public and private company boards. He was CEO

of MacLellan Group plc, a UK facilities management provider, for 12

years. He was co founder of Premier Technical Services Group Ltd

("PTSG") a specialist provider of facilities services, and was its

Chairman from inception in 2007 until early November 2022 (he

remains a Non-Executive Director. He is also currently Chairman of

SEC Newgate Spa, the parent company of a global strategic

communications and advisory group and is also Chairman of Servoca

Plc, a provider of staffing solutions and outsourced services.

David Nicholl will continue to make positive contributions to

the Board and Group strategy in moving to the role of Non-Executive

Director.

Outlook

The energy crisis, exacerbated by the war in Ukraine has put a

spot light on the UK's energy security, consumption and management.

It has never been more critical for organisations to ensure their

ability to mitigate risk, especially during the cost of living

crisis. These market conditions have driven the awareness of the

benefits of energy management both from a cost and environmental

perspective and eEnergy's proposition helps organisations to

navigate these complicated issues.

The Group maintains its cautious optimism while international

macroeconomics continue to be unpredictable. The new business

pipeline and forward order book remain robust and supported by the

H2 weighting and, as at 24 March 2023, there is visibility over 93%

of the Full Year revenue expectation. As such, the board remains

optimistic to deliver full year trading expectations. As previously

stated, interest expense for the year will reflect the drawdown of

the subordinated debt facility.

Harvey Sinclair

Chief Executive

28 March 2023

CFO Statement

Group key performance indicators

Period Year Period Year

to 31 December to to 31 December to

2022 30 June 2021 30 June

2022 2021

GBP'000 GBP'000 GBP'000 GBP'000

Revenue 15,124 22,096 9,592 13,596

Ad j. EBITDA 1,508 3,021 807 830

Ad j. EBITDA% 10.0% 13.7% 8.4% 6.1%

Cash & cash equivalents (exc.

restricted balances) 1,050 1,380 2,430 3,332

Net Cash / (Debt) (excl.

Of IFRS16) (6,567) (3,642) (516) 1,486

Summary performance

H1 FY23 was another period of significant growth for the Group.

Revenue of GBP15.1 million was up 58% from H1 FY22, driving an 87%

increase in Adjusted EBITDA to GBP1.5 million and delivering Profit

Before Tax of GBP0.4 million (H1 FY22: GBP(1.0) million Loss Before

Tax).

In November, the Group announced an additional GBP2.5 million in

debt funding into the business through a new subordinated bond in

order to give the business the working capital headroom to fund

additional Energy Services working capital as a result of

lengthened cash collection cycles as well as funding the next phase

of MY ZeERO stock-build, other balance sheet liabilities and

general working capital .

Net debt increased by GBP2.7 million in the period, reflecting a

GBP3.9 million increase in working capital. This was largely driven

by repayment of legacy (non-trade) liabilities and increased

accrued revenue balances, reflecting the scale of organic growth

and a transition to lengthened cash collection cycles across both

Energy Services and Energy Management.

A number of initiatives were instigated to mitigate this

increased working capital requirement going forward, as a result of

which net debt has stabilised during Q3 with a further GBP0.8m of

legacy liabilities also settled.

The increase in Net Working Capital also reflected progress in

strengthening the Balance Sheet. During the period GBP0.9 million

of legacy liabilities were settled and contingent consideration of

GBP0.4 million in relation to the acquisition of Utility Team was

satisfied, primarily for shares rather than cash, with the balance

of GBP0.5 million written back to the Balance Sheet.

As at 24 March 2023, the Group's cash balance was GBP1.1 million

(excluding restricted cash balances of GBP0.5 million). This

included a payment of GBP0.5 million received in advance which may,

in certain circumstances, be returnable in May 2023.

Divisional Performance

Energy Services

The strong momentum in new contract wins built during H2 FY22

converted into accelerated revenue growth in H1 FY23, delivering

revenues of GBP8.5 million, an impressive 79% up on the same period

last year.

Strong execution and focus on cost management delivered a 60bps

improvement in Gross Margins to 38.4%, despite inflationary

pressures across the economy. We segment Energy Services into three

verticals - Measure (primarily MY ZeERO), Reduce (primarily

lighting) and Connect (eSolar and eCharge). Budgeted Gross Margins

vary from 50% in Measure, 34% in Reduce to 30% in Connect.

GBP10.6 million of new contract signings were delivered during

the period, taking the total to GBP20.4 million for the calendar

year 2022, double that for calendar year 2021. This accelerating

momentum has continued into Q3.

The Group has built a strong pipeline of Solar opportunities

over the last 12 months and had12.3 MW under Heads of Terms as at

31 December 2022. Lead times on Solar projects are long given the

number of stakeholders involved and consents required. After a long

development cycle these projects are now poised to accelerate

growth during Q4 FY23 and into FY24.

Energy Management

The Energy Management business has continued to perform well

despite a challenging market backdrop of unprecedently high

volatility in energy prices and a period where the primary focus

has been on integration rather than growth.

Underlying organic revenue growth of 8% was boosted by

annualisation of the Utility Team acquisition (completed September

2021) to record overall 37% growth year-on-year to GBP6.6 million

for the half-year, with EBITDA up 19% to GBP1.7 million.

The Board believes that the quality of earnings in this business

unit are strong, with 95% of revenue from commissions paid by

energy suppliers linked to long-term customer supply contracts at a

77% budgeted Gross Margin.

A key part of the integration has been a focus on service

delivery. The Group has invested in both the team and delivery

platform to ensure a best-in-class customer experience through the

life of the relationship which will maintain and enhance retention

rates as well as giving a differentiated proposition for new

business acquisition. This investment has led to a temporary

reduction in the EBITDA margin to 25.9% in the period (from 29.8%

for H1 FY22) which is expected to normalise in H2.

Cash Flow and Working Capital

Net cash outflow from operating activities for the period was

GBP2.0 million (H1 FY22 net cash outflow of GBP3.2 million).

There were two key drivers of this operating cash outflow.

First, the repayment of GBP0.9 million of legacy (non-trade)

liabilities which is planned to conclude during H2. Second, the

scale of organic growth led to an increase of GBP2.5 million in

trade working capital, mainly due to an increase in accrued revenue

of GBP3.3 million.

Accrued revenue is recognised where revenue generating activity

within a given period is rewarded by cashflow in future periods.

Accrued revenue therefore represents contracted future cash

receipts.

As discussed in the FY22 Annual Report, the increase has been

caused both by organic growth and through a transition,

now-completed, to new payment cycles in both Energy Management

(GBP2.5 million impact) and Energy Services (GBP0.7 million

impact). This was accentuated by seasonal delays to receipts over

the Christmas period.

There was also a largely non-cash reduction of GBP0.9 million in

contingent consideration, relating to the acquisition of Utility

Team.

Cash flow in the period also reflected GBP0.5 million investment

in developing the Group's proprietary technology platforms,

including a new self-service client portal in Energy Management and

MY ZeERO's cloud analytics.

Initiatives implemented by management during H1, outlined below,

have stabilised working capital during Q3 FY23 and, together with

the completion of legacy liability repayments during Q4, are

expected to deliver strong cash generation for H2 as a whole.

A focus on improving payment terms from energy suppliers has

resulted in 27% of January and February TCV signed in Energy

Management now being invoiced on signing, up from 2% average for H1

FY23.

Off-balance sheet funding has been secured for the first batch

of MY ZeERO eMeters, giving rise to an expected GBP0.2m cash

benefit during H2 FY23.

In Energy Services, there has been increased demand for Capex

(customer-pays) projects which give a significantly improved cash

collection profile to the Group compared to the zero-capital

upfront product. Capex products have accounted for 45% of Q3 FY23

cash receipts to-date in Energy Services, up from 30% in H1

FY23.

The Group is working with a number of funding partners with the

aim of improving cash collection cycles on funded projects.

Diversification of supply chains across the business, aimed at

reducing concentration risk and mitigating inflationary pressures,

have also had a secondary benefit of delivering additional working

capital capacity.

Borrowings and Funding

The increase in Net Working Capital during H1 was financed

through the issue of GBP2.5 million of subordinated bonds in

November 2022.

Post period end, improved operating cash flow has contributed to

a stabilised net debt position during Q3 FY23. Between 1 January

and 24 March 2023 there was a modest increase of GBP0.1 million of

net debt (to GBP6.7 million, including unrestricted cash of GBP1.1

million), after a further GBP0.8 million reduction in legacy

liabilities. This compares to a GBP2.9 million increase in H1 FY23,

GBP3.3 million increase in H2 FY22 and GBP1.8 million in H1 FY22.

The Board believes this marks substantial progress.

The pricing and structure of the subordinated bonds reflect the

fact that they are intended to be short-term in nature, with the

Board expecting the Group to deliver a healthy conversion of

operating profit to operating cashflow going forward.

Under the guidance of the new Chairman, the Board is addressing

the structure of the Group's capital base and borrowing

facilities.

H2 FY23 Outlook

Momentum across both parts of the business means that, going

into Q4, the Group is well positioned to meet the Board's

expectations for the full-year out-turn. As at 24 March there is

good visibility on 93% of the Full Year revenue expectation.

Energy Services continue to benefit from accelerating momentum

and are strengthening their presence in attractive new market

segments.

Continued investment in capabilities and infrastructure is

delivering an enhanced customer proposition and user experience,

supporting retention and new business wins.

Revenue growth during H2 FY23 is expected to be supported by

positive revenue impact from eCharge and eSolar, launched during

2022, which leverage the existing Group cost base.

A substantial improvement in operating margins is expected from

H1 FY23 to H2 FY23 as a result of operating efficiencies delivered

during H1 FY23 and the benefits of operational gearing.

Crispin Goldsmith

Chief Financial Officer

28 March 2023

CONSOLIDATED STATEMENT OF COMPREHENSIVE INCOME

For the six month period ended 31 December 2022

Period Period

to to Year to

31 December 31 December 30 June

2022 2021 2022

Note GBP'000 GBP'000 GBP'000

----- -------------- -------------- ----------

Continuing operations

Revenue from contracts with customers 15,124 9,592 22,096

Cost of sales (6,781) (4,067) (9,131)

------------------------------------------- ----- -------------- -------------- ----------

Gross profit 8,343 5,525 12,965

Operating expenses (7,085) (5,911) (12,233)

------------------------------------------- ----- -------------- -------------- ----------

Included within operating expenses

are:

* Other exceptional items 4 250 1,193 2,289

Adjusted operating expenses (6,835) (4,718) (9,944)

-------------- --------------

Adjusted earnings before interest,

taxation, depreciation and amortisation 3 1,508 807 3,021

------------------------------------------- ----- -------------- -------------- ----------

Earnings before interest, taxation,

depreciation and amortisation 1,258 (386) 732

Depreciation and amortisation (684) (401) (2,636)

Finance costs (143) (227) (323)

Profit / (Loss) before taxation 431 (1,014) (2,227)

Income tax Credit 150 - 736

------------------------------------------- ----- -------------- -------------- ----------

Profit / (Loss) for the year

from continuing operations attributable

to the owners of the company 581 (1,014) (1,491)

=========================================== ===== ============== ============== ==========

Attributable to:

Owners of the company 3 617 (932) (1,431)

Non-controlling interest (36) (82) (60)

------------------------------------------- ----- -------------- -------------- ----------

581 (1,014) (1,491)

------------------------------------------- ----- -------------- -------------- ----------

Other comprehensive income -

items that may be reclassified

subsequently to profit and loss

Translation of foreign operations (105) 107 (125)

------------------------------------------- ----- -------------- -------------- ----------

Total other comprehensive (loss)

/ profit (105) 107 (125)

------------------------------------------- ----- -------------- -------------- ----------

Total comprehensive profit /

(loss) for the year 476 (907) (1,616)

=========================================== ===== ============== ============== ==========

Total comprehensive profit /

(loss) attributable to:

Owners of the company 512 (825) (1,556)

Non-controlling interest (36) (82) (60)

------------------------------------------- ----- -------------- -------------- ----------

476 (907) (1,616)

------------------------------------------- ----- -------------- -------------- ----------

Basic and diluted earnings (loss)

per share from continuing operations

attributable to owners of the

company 5 0.15p (0.31)p (0.44)p

------------------------------------------- ----- -------------- -------------- ----------

CONSOLIDATED STATEMENT OF FINANCIAL POSITION

As at 31 December 2022

As at As at

31 December 30 June

2022 2022

Note GBP'000 GBP'000

----- -------------

NON-CURRENT ASSETS

Property, plant and equipment 417 458

Intangible assets 6 28,666 28,733

Right of use assets 642 777

Deferred Tax Asset 1,071 1,071

Total non-current assets 30,796 31,039

------------------------------------------ ----- ------------- ---------

Inventories 745 809

Trade and other receivables 19,946 16,022

Financial assets at fair value through

profit or loss 21 21

Cash and cash equivalents 8 1,453 1,802

------------------------------------------ ----- ------------- ---------

Total current assets 22,165 18,654

------------------------------------------ ----- ------------- ---------

TOTAL ASSETS 52,961 49,693

------------------------------------------ ----- ------------- ---------

NON-CURRENT LIABILITIES

Lease liability 206 399

Borrowings 7 7,356 5,011

Other non-current liabilities 2,431 2,252

Deferred Tax Liability 1,169 1,318

Provisions 786 860

Total non-current liabilities 11,948 9,840

CURRENT LIABILITIES

Trade and other payables 16,607 16,802

Lease liability 492 492

Borrowings 7 261 11

Total current liabilities 17,360 17,305

------------------------------------------ ----- ------------- ---------

TOTAL LIABILITIES 29,308 27,145

------------------------------------------ ----- ------------- ---------

NET ASSETS 23,653 22,548

========================================== ===== ============= =========

Equity attributable to owners of

the parent

Issued share capital 16,386 16,373

Share premium 47,667 47,360

Other reserves 570 261

Reverse acquisition reserve (35,246) (35,246)

Foreign currency translation reserve (243) (138)

Accumulated losses (5,368) (5,985)

------------------------------------------ ----- ------------- ---------

Total equity attributable to owners

of the parent 23,766 22,625

------------------------------------------ ----- ------------- ---------

Non-controlling interest (113) (77)

------------------------------------------ ----- ------------- ---------

Total equity 23,653 22,548

========================================== ===== ============= =========

CONSOLIDATED STATEMENTS OF CASHFLOWS

For the six month period ended 31 December 2022

Period Period Year to

to 31 December to 31 December 30 June

2022 2021 2022

GBP'000 GBP'000 GBP'000

---------------- ---------------- ---------

Cash flow from operating activities

Operating profit / (loss) - continuing

operations 581 (1,014) (1,491)

Adjustments for:

Depreciation and amortisation 684 401 2,636

Finance cost (net) 143 158 264

Taxation (150) - -

Share based payment 309 170 520

Share of loss in associate - 30 -

Foreign exchange movement - 12 -

Gain on derecognition of contingent

consideration (448) - (1,032)

-------------------------------------------- ---------------- ---------------- ---------

Operating cashflow before working

capital movements 1,119 (243) 897

(Increase) / decrease in trade and

other receivables (3,906) 65 (9,857)

(Decrease) / increase in trade and

other payables 664 (2,612) 165

Decrease / (increase) in inventories 68 (42) (95)

Decrease / (increase) in deferred

income 53 (414) 2,650

Net cash (outflow) /

inflow from operating activities (2,002) (3,246) (6,240)

-------------------------------------------- ---------------- ---------------- ---------

Cash flow from investing activities

Cash acquired on acquisition of

business - 2,800 4,007

Cash paid to acquire subsidiaries - (10,582) (11,081)

Expenditure on intangible assets (535) (457) (401)

Purchase of property, plant and

equipment (93) (117) (294)

-------------------------------------------- ---------------- ---------------- ---------

Net cash (outflow) from investing

activities (628) (8,356) (7,769)

-------------------------------------------- ---------------- ---------------- ---------

Cash flows from financing activities

Interest (paid) received (130) (97) (188)

Repayment of lease liabilities (39) (109) (347)

Net proceeds from the issue of shares - 11,382 11,382

Net proceeds from loans and borrowings 2,445 - 4,891

Repayment of borrowings - (333) (3,287)

-------------------------------------------- ---------------- ---------------- ---------

Net cash inflow from financing activities 2,276 10,843 12,451

-------------------------------------------- ---------------- ---------------- ---------

Net decrease in cash and cash equivalents (354) (759) (1,558)

Effect of exchange rates on cash 5 15 28

Cash and cash equivalents at the

start of the period 1,802 3,332 3,332

Cash and cash equivalents at the

end of the period 1,453 2,588 1,802

============================================ ================ ================ =========

CONSOLIDATED STATEMENT OF CHANGES IN EQUITY

For the six month period ended 31 December 2022

Reverse Foreign Non

Share Share Acqn. Other Currency Accum. Control Total

Capital Premium Reserve Reserves Reserve Losses Interest Equity

GBP'000 GBP'000 GBP'000 GBP'000 GBP'000 GBP'000 GBP'000 GBP'000

At 1 July

2022 16,373 47,360 (35,246) 261 (138) (5,985) (77) 22,548

Translation

of foreign

operations - - - - (105) - - (105)

Profit for

the period - - - - - 617 (36) 581

---------------------- --------- --------- --------- ---------- ---------- -------- ---------- --------

Total comprehensive

loss for the

period - - - - (105) 617 (36) 476

----------

Issue of shares

during the

period 13 307 - - - - - 320

Share based

payments - - - 309 - - - 309

Total transactions

with owners 13 307 - 309 - - - 629

---------------------- --------- --------- --------- ---------- ---------- -------- ---------- --------

Balance at

31 December

2022 16,386 47,667 (35,246) 570 (243) (5,368) (113) 23,653

====================== ========= ========= ========= ========== ========== ======== ========== ========

CONSOLIDATED STATEMENT OF CHANGES IN EQUITY

For the six month period ended 31 December 2021

Reverse Foreign Non

Share Share Acqn. Other Currency Accum. Control Total

Capital Premium Reserve Reserves Reserve Losses Interest Equity

GBP'000 GBP'000 GBP'000 GBP'000 GBP'000 GBP'000 GBP'000 GBP'000

At 1 July

2021 16,071 33,014 (35,246) 601 (13) (4,554) - 9,873

Translation

of foreign

operations - - - - 107 - - 107

Loss for the ( 932

period - - - - - ) (82) (1,014)

---------------------- --------- --------- --------- ---------- ---------- -------- ---------- --------

Total comprehensive

loss for the ( 932

period - - - - 107 ) (82) (907)

----------

Shares issued

during the

period 296 14,771 - - - - - 15,067

Cost of share

issue - (618) - - - - - (618)

Share based

payments - - - 170 - - 170

Acquisition

of new entity - - - - - - (241) (241)

---------------------- --------- --------- --------- ---------- ---------- -------- ---------- --------

Total transactions

with owners 296 14,153 - 170 - - (241) 14,378

---------------------- --------- --------- --------- ---------- ---------- -------- ---------- --------

Balance at

31 December

2021 16,367 47,167 (35,246) 771 94 (5,486) (323) 23,344

====================== ========= ========= ========= ========== ========== ======== ========== ========

SELECTED NOTES TO THE FINANCIAL INFORMATION

For the six month period ended 31 December 2022

1 Basis of preparation

The condensed consolidated interim financial statements of

eEnergy Group plc (the "Group") for the six month period ended 31

December 2022 have been prepared in accordance with Accounting

Standard IAS 34 Interim Financial Reporting.

The interim report does not include all the notes of the type

normally included in an annual financial report. Accordingly, this

report is to be read in conjunction with the annual report for the

year ended 30 June 2022, which was prepared under UK adopted

international accounting standards (IFRS), and any public

announcements made by eEnergy Group plc during the interim

reporting period and since.

These condensed consolidated interim financial statements do not

constitute statutory accounts as defined in Section 434 of the

Companies Act 2006. The Group's statutory financial statements for

the year ended 30 June 2022 prepared under IFRS have been filed

with the Registrar of Companies. The auditor's report on those

financial statements was unqualified and did not contain a

statement under Section 498(2) of the Companies Act 2006. These

condensed consolidated interim financial statements have not been

audited.

Basis of preparation - going concern

The interim financial statements have been prepared under the

going concern basis.

At 31 December 2022 the Group had unrestricted cash reserves of

GBP1.1m (30 June 2022: GBP1.4m; 31 December 2021: GBP2.4m).

The Directors have a reasonable expectation that the company and

Group have sufficient resources to continue to operate for the

foreseeable future. The Group has shown significant improvement in

revenue and operating profitability. To help facilitate the growth

of the company, and finance working capital, the company raised

GBP2.5m of additional funding in November 2022.

In assessing whether the going concern assumption is

appropriate, the Directors have taken into account all relevant

information about the current and future position of the Group and

Company, including the current level of resources and the ability

to trade within the terms and covenants of its loan facility.

Taking these matters into consideration, the Directors consider

that the continued adoption of the going concern basis is

appropriate. The interim financial statements do not reflect any

adjustments that would be required if they were to be prepared

other than on a going concern basis.

Accounting policies

The accounting policies adopted are consistent with those of the

previous financial year and corresponding interim reporting

period.

3. SEGMENT REPORTING

The following information is given about the Group's reportable

segments:

The Chief Operating Decision Maker is the Board of Directors.

The Board reviews the Group's internal reporting in order to assess

performance of the Group. Management has determined the operating

segments based on the reports reviewed by the Board.

The Board considers that during the six month period ended 31

December 2022 and 31 December 2021, the Group operated in two

business segments, the Energy Management segment and the Energy

Services segment, which largely comprised of LED lighting

solutions.

Energy Energy

Mgmt Services Central Group

------------------------------------ -------- ---------- -------- ---------

2022 GBP'000 GBP'000 GBP'000 GBP'000

------------------------------------ -------- ---------- -------- ---------

Revenue - Total 6,604 8,520 - 15,124

Cost of sales (1,532) (5,249) - (6,781)

-------- ---------- -------- ---------

Gross Profit 5,072 3,271 - 8,343

Operating expenses (3,359) (2,291) - (5,650)

-------- ---------- -------- ---------

Operating EBITDA 1,713 980 - 2,693

Central management costs - - (1,185) (1,185)

Adjusted EBITDA 1,713 980 (1,185) 1,508

Depreciation and amortisation (401) (70) (213) (684)

Finance and similar charges (4) (52) (87) (143)

-------- ---------- -------- ---------

Profit / (loss) before exceptional

items 1,308 858 (1,485) 681

Exceptional items (134) (129) 13 (250)

-------- ---------- -------- ---------

Profit / (loss) before tax 1,174 729 (1,472) 431

-------- ---------- -------- ---------

Taxation credit - - 150 150

-------- ---------- -------- ---------

Profit / (loss) after tax 1,174 729 (1,322) 581

======== ========== ======== =========

Non-controlling interest (36) - - (36)

Profit / (loss) attributable

to owners of the Company 1,210 729 (1,322) 617

======== ========== ======== =========

Net Assets

Non current assets 26,530 3,862 404 30,796

Current assets 7,644 12,079 2,442 22,165

-------- ---------- -------- ---------

Assets - Total 34,174 15,941 2,846 52,961

Liabilities (9,849) (10,435) (9,024) (29,308)

--------

Net assets 24,325 5,506 (6,178) 23,653

======== ========== ======== =========

Energy Energy

Mgmt Services Central Group

------------------------------------ -------- ---------- -------- ---------

2021 GBP'000 GBP'000 GBP'000 GBP'000

------------------------------------ -------- ---------- -------- ---------

Revenue 4,832 4,760 - 9,592

Cost of sales (1,107) (2,960) - (4,067)

-------- ---------- -------- ---------

Gross Profit 3,725 1,800 - 5,525

Operating expenses (2,298) (1,524) - (3,822)

-------- ---------- -------- ---------

Operating EBITDA 1,427 276 - 1,703

Central management costs - - (896) (896)

Adjusted EBITDA 1,427 276 (896) 807

Depreciation and amortisation (344) (56) (1) (401)

Finance and similar charges (24) (184) (19) (227)

-------- ---------- -------- ---------

Profit / (loss) before exceptional

items 1,059 36 (916) 179

Exceptional items (139) (63) (991) (1,193)

-------- ---------- -------- ---------

Profit / (loss) before tax 920 (27) (1,907) (1,014)

-------- ---------- -------- ---------

Taxation charge - - - -

-------- ---------- -------- ---------

Profit / (loss) after tax 920 (27) (1,907) (1,014)

======== ========== ======== =========

Non-controlling interest (82) - - (82)

Profit / (loss) attributable

to owners of the Company 1,002 (27) (1,907) (932)

======== ========== ======== =========

Net Assets

Non current assets 23,269 3,932 4,385 31,586

Current assets 6,878 4,161 524 11,563

-------- ---------- -------- ---------

Assets - Total 30,147 8,093 4,909 43,149

Liabilities (8,891) (6,167) (4,747) (19,805)

--------

Net assets 21,256 1,926 162 23,344

======== ========== ======== =========

4. EXCEPTIONAL ITEMS

Operating expenses include items that the Directors consider to

be exceptional by their nature. These items are:

Period Period

to to Year to

31 December 31 December 30 June

2022 2021 2022

GBP'000 GBP'000 GBP'000

--------------------------------- ------------- ------------- ---------

Acquisition related expenses - 820 1,273

Changes to initial recognition

of contingent consideration (448) - (1,032)

Incremental restructuring and

integration costs 389 198 1,181

Share based payment expense 309 175 520

Other strategic investments - - 347

Total exceptional expenses 250 1,193 2,289

------------- ------------- ---------

Acquisition expenses are the costs incurred in completing the

"Buy and Build" strategy associated with acquisitions and strategic

investments.

The share based payment charge reflects the non cash cost of the

Management Incentive Plan awards made on 7 July 2020 and the award

of options made to the senior management team on 7 December 2021

which are being amortised over their three year vesting period.

5. EARNINGS PER SHARE

The calculation of the basic and diluted earnings per share is

calculated by dividing the profit or loss for the year by the

weighted average number of ordinary shares in issue during the

year.

Period to Period to Year to 30

31 Dec 2022 31 Dec 2021 June 2022

------------------------------------- ------------- ------------- ------------

Profit / (loss) profit for

the year from continuing

operations attributable to

owners of the Company - GBP 617,000 (932,000) (1,431,000)

Weighted number of ordinary

shares in issue 350,036,790 304,325,269 323,783,394

Number of shares for diluted

earnings per share 417,158,305 - -

------------------------------------- ------------- ------------- ------------

Basic earnings per share

from continuing operations

- pence 0.18p (0.31)p (0.44)p

Diluted Basic earnings per

share from continuing operations

- pence 0.15p (0.31)p (0.44)p

-------------------------------------- ------------- ------------- ------------

The comparative periods do not include a diluted earnings per

share calculation, or number of shares for the diluted earnings per

share calculation, since the business was loss-making in those

periods.

6. INTANGIBLE ASSETS

Customer Trade

Goodwill Software relation-ships names Total

GBP'000 GBP'000 GBP'000 GBP'000 GBP'000

------------------------- --------- --------- ---------------- --------- ---------

Cost

At 1 July 2022 23,816 1,258 4,311 1,594 30,979

Adjustment to goodwill

on acquisition (315) - - - (315)

Additions in the

period - 653 - - 653

At 31 December

2022 23,501 1,911 4,311 1,594 31,317

========= ========= ================ ========= =========

Amortisation

At 1 July 2022 - (219) (433) (1,594) (2,246)

Amortisation in

the period - (164) (241) - (405)

At 31 December

2022 - (383) (674) (1,594) (2,651)

--------- --------- ---------------- --------- ---------

Net book value

at

30 June 2022 23,816 1,039 3,878 - 28,733

--------- --------- ---------------- --------- ---------

Net book value

at

31 December 2022 23,501 931 3,637 - 28,666

========= ========= ================ ========= =========

7. BORROWINGS

31 December 31 December 30 June

2022 2021 2022

GBP'000 GBP'000 GBP'000

------------- ------------ ------------ ---------

Current

Borrowings 261 579 11

261 579 11

------------- ------------ ------------ ---------

Non-current

Borrowings 7,356 2,367 5,011

7,356 2,367 5,011

------------- ------------ ------------ ---------

In February 2022 the Group refinanced substantially all of its

existing bank indebtedness and consolidated its borrowings into a

single GBP5,000,000, four year, revolving credit facility provided

to eEnergy Holdings Limited, an intermediate holding company in the

Group. The new facility is secured by way of debentures granted to

the lender by all of the Group's trading subsidiaries. The facility

includes covenants relating to debt service cover and gearing and

is repayable on or before 12 February 2024.

During the current period the Group secured a further

GBP2,525,000 in subordinated debt which has been structured secured

discounted capital bonds. The bonds are being issued at a 21.29%

discount to their face value (equivalent to a discount rate of

1.25% per month plus a 2% repayment fee) and are due to be redeemed

by the Company (through the payment of in aggregate GBP3,207,754)

on or before 24 May 2024 (in respect of GBP2,000,000) and on or

before 21 June 2024 (in respect of GBP525,000).

Maturity of the borrowings as of 31 December 2022 are as

follows:

GBP'000

----------------------- --------

Current 261

Due between 1-2 years 7,356

Due between 2-5 years -

Due beyond 5 years -

----------------------- --------

7,617

----------------------- --------

8. CASH & CASH EQUIVALENTS

Period to Period to Year to 30

31 Dec 2022 31 Dec 2021 June 2022

--------------------- ------------- ------------- -----------

Unrestricted Cash 1,050 2,430 1,380

Restricted Cash 403 158 422

---------------------- ------------- ------------- -----------

1,453 2,588 1,802

--------------------- ------------- ------------- -----------

Restricted cash relates to financing arrangements and customer

collections.

9. RELATED PARTY TRANSACTIONS

Key management personnel are considered to the Board of

Directors. The amount payable to the Board of Directors for the six

months ended 31 December 2022 was GBP400,509 (31 December 2021:

GBP563,000).

10. EVENTS AFTER THE BALANCE SHEET DATE

Nothing to disclose.

This information is provided by RNS, the news service of the

London Stock Exchange. RNS is approved by the Financial Conduct

Authority to act as a Primary Information Provider in the United

Kingdom. Terms and conditions relating to the use and distribution

of this information may apply. For further information, please

contact rns@lseg.com or visit www.rns.com.

RNS may use your IP address to confirm compliance with the terms

and conditions, to analyse how you engage with the information

contained in this communication, and to share such analysis on an

anonymised basis with others as part of our commercial services.

For further information about how RNS and the London Stock Exchange

use the personal data you provide us, please see our Privacy

Policy.

END

IR DDGDXXXDDGXR

(END) Dow Jones Newswires

March 28, 2023 02:00 ET (06:00 GMT)

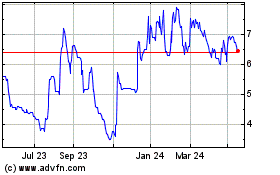

Eenergy (LSE:EAAS)

Historical Stock Chart

From Dec 2024 to Jan 2025

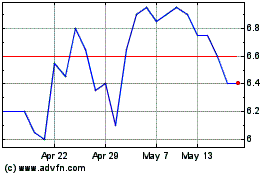

Eenergy (LSE:EAAS)

Historical Stock Chart

From Jan 2024 to Jan 2025