TIDMEML

RNS Number : 6149M

Emmerson PLC

30 April 2018

Emmerson PLC

Report and Financial Statements

Emmerson PLC announces its results for the nine month period

ended 31 December 2017.

For further information please contact:

FIM Capital Limited

Graham Smith Tel: +44 (0)1624 681250

-------------------- --------------------------

Directors' report

The Directors submit their report with the audited financial

statements for the nine month period ended 31 December 2017.

Business of the Company

The Company was incorporated in the Isle of Man under the Laws

with registered number 013301V on 1 March 2016. All of the

Company's Ordinary Shares were admitted to the London Stock

Exchange's Main Market and commenced trading on 15 February

2017.

Emmerson PLC ("the Company") objective was to acquire an

exploration or production company or business in the natural

resources sector with either all or a substantial portion of its

operations in South East Asia, Africa, and the Middle East. On 16

October 2017, the Company entered into a binding Memorandum of

Understanding with the board and principal shareholders of Moroccan

Salts Limited ("MSL") regarding a proposed acquisition of 100% of

the share capital of MSL by way of a reverse takeover (the

"Acquisition").

The Company has changed its accounting year-end to 31 December,

to be consistent with that of MSL. Consequently, these financial

statements cover a nine month period only.

Results for the period and distributions

The total comprehensive loss attributable to the equity holders

of the Company for the period was GBP207,490 (31 March 2017:

GBP199,789).

The Company paid no distribution during the period.

Business performance for the period

During the financial period the Company made a loss per share of

0.43 pence (13 months to 31 March 2017: a loss per share of 1.31

pence per share).

The Acquisition of MSL

MSL is a British Virgin Islands registered company focussed on

developing the Khemisset potash project located near Rabat in

northern Morocco (the "Project"). MSL has a substantial ground

position in, and extensive technical information on the Khemisset

potash basin, and has recently conducted confirmatory drilling on

the project area. Both the recent and historic drilling results

inform the view of MSL, shared by the Company, that the Project

could emerge as a top tier global potash mine with potential to

return substantial gains for new and existing shareholders.

The Board of Directors (the Board") of the Company have agreed,

subject to General Meeting approval, to acquire the entire share

capital of MSL for total consideration of GBP10,000,000, to be

satisfied in full by the issue of 333,333,333 new shares of the

Company each at an implied price of GBP0.03 per share. In addition,

if the Acquisition completes the Company will take on certain

liabilities of MSL and concurrent with the acquisition raise

working capital for the enlarged group to take the Project forward.

A budget and work programme for the Project has now been agreed,

the quantum of the fundraise at the date of this announcement is

GBP6,000,000 through the issue of a further 200,000,000 new shares

of the company each at GBP0.03 per share.

The Directors believe that the Acquisition would be in the best

interests of all shareholders.

Financial risk management

The Company's principal financial instruments comprise cash

balances and accounts payable arising in the normal course of its

operations.

The Company's objectives when managing capital are to safeguard

the Company's ability to continue as a going concern in order to

provide returns for shareholders and benefits for other

stakeholders and to maintain an optimal capital structure to reduce

the cost of capital.

As at 31 December 2017 there is no significant exposure to

liquidity, price or cash flow risk the only credit risk applicable

is over the cash balance which is held with a reputable bank.

Subsequent events

Details of significant events that have occurred since 31

December 2017 are provide in note 9 to these financial

statements.

Future Developments

The Company was incorporated to acquire a natural resources deal

which the board believes will deliver significant return to

investors. Shareholders will be given a chance to vote on the

Moroccan Salts Limited acquisition and additional fundraise Friday

the 29(th) May at the Companies General Meeting.

Principal risks and uncertainties

The Directors consider that the following are the principal risk

factors that could materially and adversely affect the Company's

future operating results or financial position:

-- Deterioration in Moroccan economic conditions or in the

potash market in particular. There is a risk that changes in the

relevant law and legislation could have an adverse effect on the

Company's future performance, expected return and or feasibility of

the project.

-- General economic risk - the Company is exposed to general

economic risk, including changes in the economic outlook in its

principal markets and government changes in industrial, fiscal,

monetary or regulatory policies.

-- Performance risk - the Company is exposed to the risk that

the performance of the project. The Company limits this risk by

having regular updates with key stakeholders to monitor and react

to any significant developments.

The Directors are confident that they have put in place a strong

management team capable of dealing with the above issues as they

arise.

Directors

The Directors who held office during the period and to the date

of this report, together with details of their interest in the

shares of the Company at 31 December 2017 and the date of this

report were:

Number of ordinary

shares

Appointed 1 March

Cameron Pearce (Chairman) 2016 6,000,001

Appointed 1 March

Sam Quinn 2016 3,000,001

Ed McDermott Appointed 21 June -

2016

Details of the Directors' fees are given in note 5 to the

accounts.

Substantial shareholders

No single person directly or indirectly, individually or

collectively, exercises control over the Company. The Directors are

aware of the following persons, who had an interest in 3% or more

of the issued ordinary share capital of the Company as at 31

December 2017:

Shareholder % of issued share capital of the Company

Jim Nominees Limited 31.98%

Cameron Pearce 12.45%

Thomas Grant and Company Nominees Limited 8.99%

Pershing Nominees Limited 8.99%

Sam Quinn 6.23%

Winterflood Securities Limited 4.72%

Nomura Custody Nominees Limited 3.11%

Director

30 April 2018

Corporate Governance Statement

As a company with a Standard Listing, the Company is not

required to comply with the provisions of the Corporate Governance

Code. Although, the Company does not comply with the UK Corporate

Governance Code, the Company intends to adopt corporate governance

procedures, their Model Code, as are appropriate for the size and

nature of the Company and the size and composition of the Board.

The company has not chosen a apply a particular corporate

governance code, as the directors consider that the most widely

recognised codes are not appropriate for companies with limited

board resources. These corporate governance procedures have been

selected with due regard to for the provisions of the Corporate

Governance Code insofar as is appropriate. A description of these

procedures is set out below:

-- No Director will be required to submit for re-election until

the first annual general meeting of the Company following the

Acquisition.

-- Until the Acquisition is completed, the Company will not have

nomination, remuneration, audit or risk committees. The Board as a

whole will instead review its size, structure and composition, the

scale and structure of the Directors' fees (taking into account the

interests of Shareholders and the performance of the Company), take

responsibility for the appointment of auditors and payment of their

audit fee, monitor and review the integrity of the Company's

financial statements and take responsibility for any formal

announcements on the Company's financial performance. Following the

Acquisition, the Board intends to put in place nomination,

remuneration, audit and risk committees.

-- The Board has a share dealing code that complies with the

requirements of the Market Abuse Regulations. All persons

discharging management responsibilities comply with the share

dealing code from the date of Admission.

-- Following the Acquisition and subject to eligibility, the

Directors may, in future, seek to transfer the Company from a

Standard Listing to either a Premium Listing or other appropriate

listing venue, based on the track record of the company or business

it acquires, subject to fulfilling the relevant eligibility

criteria at the time. However, in addition to or in lieu of a

Premium Listing, the Company may determine to seek a listing on

another stock exchange. Following such a Premium Listing, the

Company would comply with the continuing obligations contained

within the Listing Rules and the Disclosure and Transparency Rules

in the same manner as any other company with a Premium Listing.

The Directors are responsible for internal control in the

Company and for reviewing its effectiveness. Due to the size of the

Company, all key decisions are made by the Board in full. The

Directors have reviewed the effectiveness of the Company's systems

during the period under review and consider that there have been no

material losses, contingencies or uncertainties due to the weakness

in the controls. The Board will be responsible for taking all

proper and reasonable steps to ensure compliance with the Model

Code by the Directors.

Reappointment of auditor

The auditors, Crowe Clark Whitehill LLP, have indicated their

willingness to continue in office and a resolution seeking to

reappoint them will be proposed at the Annual General Meeting.

On behalf of the Board

Cameron Pearce

Director

30 April 2018

Statement of Directors' responsibilities in respect of the

Directors report and the financial statements

The Directors are responsible for preparing the Directors'

Report and the financial statements in accordance with applicable

law and regulations. In addition, the Directors have elected to

prepare the financial statements in accordance with International

Financial Reporting Standards ("IFRSs"), as adopted by the European

Union ("EU").

The financial statements are required to give a true and fair

view of the state of affairs of the Company and of the profit or

loss of the Company for that period.

In preparing these financial statements, the Directors are

required to:

-- select suitable accounting policies and then apply them consistently;

-- make judgements and accounting estimates that are reasonable and prudent;

-- state whether applicable accounting standards have been

followed, subject to any material departures disclosed and

explained in the financial statements ; and

-- prepare the financial statements on the going concern basis

unless it is inappropriate to presume that the Company will

continue in business.

The Directors are responsible for keeping proper accounting records that are sufficient to

show and explain the Company's transactions and disclose with reasonable accuracy at any time

its financial position. They have general responsibility for taking such steps as are reasonably

open to them to safeguard the assets of the Company and to prevent and detect fraud and other

irregularities.

The Directors are responsible for the maintenance and integrity

of the corporate and financial information included on the

Company's website; the work carried out by the auditors does not

involve the consideration of these matters and, accordingly, the

auditors accept no responsibility for any changes that may have

occurred in the accounts since they were initially presented on the

website. Legislation governing the preparation and dissemination of

financial statements may differ from one jurisdiction to

another.

We confirm that to the best of our knowledge:

* the financial statements, prepared in accordance with

International Financial Reporting Standards as

adopted by the EU, give a true and fair view of the

assets, liabilities, financial position and profit or

loss of the company;

-- the director's report includes a fair review of the

development and performance of the business and the position of the

company, together with a description of the principal risks and

uncertainties that they face.

By Order of the Board

Cameron Pearce

Director

30 April 2018

Report of the Independent Auditors

Opinion

We have audited the financial statements of Emmerson plc for the

period ended 31 December 2017, which comprise:

-- The statement of comprehensive income for the period ended 31 December 2017

-- the statement of financial position as at 31 December 2017 ;

-- the statement of cash flows for the period then ended;

-- the statement of changes in equity for the period then ended; and

-- the notes to the financial statements, including a summary of

significant accounting policies.

The financial reporting framework that has been applied in the

preparation of the financial statements is applicable law and

International Financial Reporting Standards (IFRSs) as adopted by

the European Union.

In our opinion:

-- the financial statements give a true and fair view of the

state of the Company's affairs as at 31 December 2017 and of the

loss for the period then ended;

-- the financial statements have been properly prepared in

accordance with IFRSs as adopted by the European Union;

Basis for opinion

We conducted our audit in accordance with International

Standards on Auditing (UK) (ISAs (UK)) and applicable law. Our

responsibilities under those standards are further described in the

Auditor's responsibilities for the audit of the financial

statements section of our report. We are independent of the Company

in accordance with the ethical requirements that are relevant to

our audit of the financial statements in the UK, including the

FRC's Ethical Standard, and we have fulfilled our other ethical

responsibilities in accordance with these requirements. We believe

that the audit evidence we have obtained is sufficient and

appropriate to provide a basis for our opinion.

Conclusions relating to going concern

We have nothing to report in respect of the following matters in

relation to which ISAs (UK) require us to report to you when:

-- The directors' use of the going concern basis of accounting

in the preparation of the financial statements is not appropriate;

or

-- The directors have not disclosed in the financial statements

any identified material uncertainties that may cast significant

doubt about the Group's or the parent company's ability to continue

to adopt the going concern basis of accounting for a period of at

least twelve months from the date when the financial statements are

authorised for issue.

Overview of our audit approach

Materiality

In planning and performing our audit we applied the concept of

materiality. An item is considered material if it could reasonably

be expected to change the economic decisions of a user of the

financial statements. We used the concept of materiality to both

focus our testing and to evaluate the impact of misstatements

identified.

Based on our professional judgement, we determined overall

materiality for the financial statements as a whole to be

GBP17,000, based on a percentage (3%) of net assets.

We use a different level of materiality ('performance

materiality') to determine the extent of our testing for the audit

of the financial statements. Performance materiality is set based

on the audit materiality as adjusted for the judgements made as to

the entity risk and our evaluation of the specific risk of each

audit area having regard to the internal control environment.

Where considered appropriate performance materiality may be

reduced to a lower level, such as, for related party transactions

and directors' remuneration.

We agreed with the Board to report to it all identified errors

in excess of GBP850. Errors below that threshold would also be

reported to it if, in our opinion as auditor, disclosure was

required on qualitative grounds.

Overview of the scope of our audit

As part of designing our audit, we determined materiality and

assessed the risks of material misstatement in the financial

statements. In particular, we focussed on where the directors made

subjective judgements. However as the trading activity of the

company was minimal in the period under review we did not identify

any significant subjective judgements.

Key Audit Matters

Key audit matters are those matters that, in our professional

judgement, were of most significance in our audit of the financial

statements of the current period and include the most significant

assessed risks of material misstatement (whether or not due to

fraud) that we identified. These matters included those which had

the greatest effect on: the overall audit strategy, the allocation

of resources in the audit; and directing the efforts of the

engagement team. These matters were addressed in the context of our

audit of the financial statements as a whole, and in forming our

opinion thereon, and we do not provide a separate opinion on these

matters.

Given the nature of the company and the lack of significant

estimates and judgements we did not consider there to be any key

audit matters.

Other information

The directors are responsible for the other information. The

other information comprises the information included in the annual

report, other than the financial statements and our auditor's

report thereon. Our opinion on the financial statements does not

cover the other information and, except to the extent otherwise

explicitly stated in our report, we do not express any form of

assurance conclusion thereon.

In connection with our audit of the financial statements, our

responsibility is to read the other information and, in doing so,

consider whether the other information is materially inconsistent

with the financial statements or our knowledge obtained in the

audit or otherwise appears to be materially misstated. If we

identify such material inconsistencies or apparent material

misstatements, we are required to determine whether there is a

material misstatement in the financial statements or a material

misstatement of the other information. If, based on the work we

have performed, we conclude that there is a material misstatement

of this other information, we are required to report that fact.

We have nothing to report in this regard.

Responsibilities of the directors for the financial

statements

As explained more fully in the directors' responsibilities

statement 7, the directors are responsible for the preparation of

the financial statements and for being satisfied that they give a

true and fair view, and for such internal control as the directors

determine is necessary to enable the preparation of financial

statements that are free from material misstatement, whether due to

fraud or error.

In preparing the financial statements, the directors are

responsible for assessing the company's ability to continue as a

going concern, disclosing, as applicable, matters related to going

concern and using the going concern basis of accounting unless the

directors either intend to liquidate the company or to cease

operations, or have no realistic alternative but to do so.

Auditor's responsibilities for the audit of the financial

statements

Our objectives are to obtain reasonable assurance about whether

the financial statements as a whole are free from material

misstatement, whether due to fraud or error, and to issue an

auditor's report that includes our opinion. Reasonable assurance is

a high level of assurance, but is not a guarantee that an audit

conducted in accordance with ISAs (UK) will always detect a

material misstatement when it exists. Misstatements can arise from

fraud or error and are considered material if, individually or in

the aggregate, they could reasonably be expected to influence the

economic decisions of users taken on the basis of these financial

statements.

A further description of our responsibilities for the audit of

the financial statements is located on the Financial Reporting

Council's website at: www.frc.org.uk/auditorsresponsibilities. This

description forms part of our auditor's report.

Use of our report

This report is made solely to the company's members, as a body.

Our audit work has been undertaken so that we might state to the

company's members those matters we are required to state to them in

an auditor's report and for no other purpose. To the fullest extent

permitted by law, we do not accept or assume responsibility to

anyone other than the company and the company's members as a body,

for our audit work, for this report, or for the opinions we have

formed.

Matthew Stallabrass (Senior Statutory Auditor)

for and on behalf of

Crowe Clark Whitehill LLP

Statutory Auditor

London

30 April 2018

Statement of Comprehensive Income

for the nine month period ended 31 December 2017

9 months to 31 Dec 2017 13 months to 31 Mar 2017

Notes GBP GBP

Administrative fees and other expenses 5 (207,490) (199,801)

------------------------ -------------------------

Operating loss (207,490) (199,801)

Finance revenue - 12

Loss before tax (207,490) (199,789)

Income tax - -

Loss for the period and total comprehensive loss for

the period (207,490) (199,789)

------------------------ -------------------------

Basic and diluted loss per share (pence) 6 (0.43) (1.21)

There was no other comprehensive income for the period ended 31

December 2017.

The accompanying notes form an integral part of the financial

statements.

Statement of Financial Position as at 31 December 2017

Notes As at 31 Dec 2017 As at 31 Mar 2017

GBP GBP

Current assets

Cash and cash equivalents 564,788 796,961

Prepayments 10,045 7,053

------------------ ------------------

Total current assets 574,833 804,014

Current liabilities

Trade and other payables 15,240 36,931

------------------ ------------------

Total current liabilities 15,240 36,931

Net assets 559,593 767,083

------------------ ------------------

Equity

Stated capital 7 966,872 966,872

Retained earnings (407,279) (199,789)

------------------ ------------------

Total equity 559,593 767,083

------------------ ------------------

The accompanying notes form an integral part of the financial

statements.

The financial statements were approved and authorised for issue

by the Board of Directors on 30 April 2018 and were signed on its

behalf by:

Cameron Pearce Sam Quinn

Director Director

Statement of Changes in Equity

for the nine month period ended 31 December 2017

Stated capital Retained earnings Total equity

GBP GBP GBP

Balance as at 1 March 2016 on incorporation 2 - 2

Total comprehensive loss during the thirteen months to 31 March

2017

Loss for the period - (199,789) (199,789)

--------------- ------------------ -------------

Total comprehensive loss - (199,789) (199,787)

Contributions from equity holders

Ordinary shares issued 1,132,997 - 1,132,997

Ordinary share issue costs (166,127) - (166,127)

--------------- ------------------ -------------

Total contributions from equity holders 966,870 - 966,870

Balance as at 31 March 2017 966,872 (199,789) 767,083

--------------- ------------------ -------------

Total comprehensive loss during the nine months to 31 December

2017

Loss for the period - (207,490) (207,490)

--------------- ------------------ -------------

Total comprehensive loss - (207,490) (207,490)

Contributions from equity holders

New shares issued - - -

Share issue costs - - -

--------------- ------------------ -------------

Total contributions from equity holders - - -

Balance as at 31 December 2017 966,872 (407,279) 559,593

--------------- ------------------ -------------

The accompanying notes form an integral part of the financial

statements.

Statement of Cash Flows

for the thirteen month period ended 31 December 2017

Notes 9 months to 31 Dec 2017 13 months to 31 Mar 2017

GBP GBP

Operating activities

Loss after tax (207,490) (199,789)

Changes in working capital

Increase in trade and other receivables (2,992) (7,053)

(Decrease)/increase in trade and other payables (21,691) 36,931

------------------------ -------------------------

Net cash flows from operating activities (232,173) (169,911)

Financing activities

Ordinary shares issued (net of issue costs) 7 - 966,872

------------------------ -------------------------

Net cash flows from financing activities - 966,872

(Decrease)/Increase in cash and cash equivalents (232,173) 796,961

Cash and cash equivalents at the beginning of the

period 796,961 -

Cash and cash equivalents at 31 December 2017 564,788 796,961

------------------------ -------------------------

The accompanying notes form an integral part of the financial

statements.

1. General information

Emmerson plc (the "Company") is a company incorporated and

domiciled in the Isle of Man.

The principal activities of the Company are described in

Directors' report. The Company had no employees during the period

other that Directors.

The comparatives in the financial statements is for the thirteen

month period from incorporation to the year end of 31 March

2017.

During the year, the company changed its year end to 31 December

2017 to align it with the accounting period of the target company.

Therefore, the period to 31 December 2017 is for nine months

only.

2. Basis of preparation

2.1 Statement of compliance

These financial statements have been prepared in accordance with

and comply with International Financial Reporting Standards

("IFRS") as adopted by the European Union, International Financial

Reporting Interpretations Committee ("IFRIC") interpretations and

the Isle of Man Companies Act 2006.

2.2 Basis of preparation

The financial statements have been prepared on a historical cost

basis.

2.3 Going concern

The Company's business activities, together with the factors

likely to affect its future development, performance and positions

are set out in the Chairman's Statement.

The Company is an investment company, and currently has no

income stream until a suitable acquisition is identified. It is

therefore dependent on its cash reserves to fund ongoing costs.

The Directors have reviewed the Company's ongoing activities

including its future intentions in respect of acquisitions and

having regard to the Company's existing working capital position

and its ability to potentially raise finance, if required, the

Directors are of the opinion that the Group has adequate resources

to enable it to continue in existence for a period of at least 12

months from the date of these financial statements.

2.4 Use of estimates and judgments

The preparation of financial statements in accordance with the

standards and interpretations noted in section 2.1 above requires

management to make judgments, estimates and assumptions that affect

the application of accounting policies and the reported amounts of

assets, liabilities, income and expenses. Actual results may differ

from these estimates.

Estimates and underlying assumptions are reviewed on an ongoing

basis. Revisions to accounting estimates are recognised in the

period in which the estimate is revised and in any future periods

affected. The areas involving a higher degree of judgment or

complexity, or areas where assumptions and estimates are

significant to the financial statements are disclosed in note

4.

2.5 Future changes in accounting policies

At the date of authorisation of this financial information, the

directors have reviewed the Standards in issue by the International

Accounting Standards Board ("IASB") and IFRIC, which are effective

for annual accounting periods ending on or after the stated

effective date. In their view, none of these standards would have a

material impact on the financial reporting of the Company.

The directors do not expect that the adoption of these standards

will have a material impact on the financial statements of the

company. IFRS 9 may impact the measurement of financial instruments

in the future.

3. Significant accounting policies

The principal accounting policies applied in the preparation of

these financial statements are set out below:

3.1 Foreign currency

Transactions in foreign currencies are translated to the

functional currency at the exchange rates ruling at the dates of

the transactions. Monetary assets and liabilities denominated in

foreign currencies at the reporting date are retranslated to the

functional currency at the exchange rate at that date. Exchange

differences arising on translation are recognised in profit or

loss.

3.2 Earnings per share

The Company presents basic and diluted earnings per share

("EPS") data for its ordinary shares. Basic EPS is calculated by

dividing the profit or loss attributable to ordinary shareholders

of the Company by the weighted average number of ordinary shares

outstanding during the period. Diluted EPS is calculated by

adjusting the earnings and number of shares for the effects of

dilutive potential ordinary shares.

3.3 Income tax

Income tax expense comprises current tax and deferred tax.

Current income tax

Current tax is recognised in profit or loss, being resident in

the Isle of Man, a 0% rate of corporate income tax applies to the

Company.

Deferred income tax

Deferred income tax is recognised on temporary differences

arising between the tax bases of assets and liabilities and their

carrying amounts in the financial statements. Deferred income tax

assets and liabilities are measured on an undiscounted basis at the

tax rates that are expected to apply to the period when the related

asset is realised or the liability is settled, based on tax rates

(and tax laws) that have been enacted or substantively enacted at

the date of the Statement of Financial Position.

3.4 Financial instruments

Financial assets and financial liabilities are recognised when

the Company becomes a party to the contractual provisions of a

financial instrument. Financial assets and financial liabilities

are offset if there is a legally enforceable right to set off the

recognised amounts and interests and it is intended to settle on a

net basis.

3.5 Cash and cash equivalents

Cash and cash equivalents in the statement of financial position

comprise cash at bank balances only. For the purpose of the

statement of cash flows, cash and cash equivalents consist of bank

balances only.

4. Significant accounting judgements, estimates and assumptions

Key sources of estimation uncertainty

The preparation of financial statements in conformity with IFRS

requires management to make estimates and assumptions that affect

the reported amounts of income, expenditure, assets and

liabilities. Estimates and judgements are continually evaluated,

including expectations of future events to ensure these estimates

to be reasonable.

At present the Company is looking to acquire an exploration or

production company or business in the natural resources sector. As

the Company currently has no trading or investing activities, nor

does it hold any significant assets other than cash balances, there

are no accounting matters which are subject to estimate or

judgement.

5. Administrative fee and other expenses

9 months to 13 months

31 Dec 2017 to

31 Mar 2017

GBP GBP

Directors' remuneration 70,000 50,000

Professional fees 60,473 77,646

Listing fees 20,833 31,755

Audit fees 10,800 14,400

Administration fees 13,500 11,250

Broker fees 17,038 2,964

Miscellaneous fees 14,846 11,786

Total 207,490 199,801

------------- -------------

The company did not employ any staff during the period other

than Directors. The Directors are the only members of Key

Management and their remuneration related solely to short term

employee benefits.

6. Loss per share

The calculation of the basic and diluted loss per share is based

on the following data:

9 months to 13 months to

31 Dec 2017 31 Mar 2017

---------------------------------------------------------------------------------------- ------------- -------------

Earnings

Loss from continuing operations for the period attributable to the equity holders of

the Company

(GBP) (207,490) (199,789)

Number of shares

Weighted average number of ordinary shares for the purpose of basic and diluted

earnings per

share 48,183,344 16,505,162

---------------------------------------------------------------------------------------- ------------- -------------

Basic and diluted loss per share (pence) (0.43) (1.21)

---------------------------------------------------------------------------------------- ------------- -------------

There are no potentially dilutive shares in issue.

7. Stated capital

Number of Ordinary Stated capital Total share

shares issued capital

and fully paid

GBP GBP

At 1 March 2016

on incorporation 2 2 2

Issue of shares 48,183,342 966,870 966,870

At 31 March 2017 48,183,344 966,872 966,872

------------------- ------------------- --------------- ------------

Issue of shares - - -

At 31 December

2017 48,183,344 966,872 966,872

------------------- ------------------- --------------- ------------

The Ordinary Shares issued by the Company have a no par value

and each Ordinary Share carries one vote on a poll vote.

On incorporation on 1 March 2016, the Company issued 2 Ordinary

Shares of no par value to the Founders at par for cash

consideration of GBPnil.

On 6 April 2016, the Company issued 9,000,000 Ordinary Shares of

no par value to the Founders at 0.5p each for cash consideration of

GBP45,000.

During the period from 19 April 2016 to 15 August 2016, the

Company issued 8,750,100 Ordinary Shares of no par value to certain

unrelated investors at 2p each for cash consideration of

GBP175,000.

On 15 February 2017, on admission to the standard list of the

London Stock Exchange, the company issued 30,433,242 of no par

value at 3p each for cash consideration of GBP912,997.

In the prior year, the issue of shares is stated net of share

issue costs. The allocation of joint costs between the issuing of

equity and acquiring the exchange listing as part of the admission

process is a matter of judgement. The Directors had regard to the

number of shares issued on listing as a proportion of the total

shares in issue after the listing and following this exercise

GBP109,000 was recognised in the statement of comprehensive income

and GBP166,000 directly in equity.

8. Financial instruments

8.1 Categories of financial instruments

As at As at 31

31 Dec 2017 Mar 2017

GBP GBP

Financial assets

Cash and cash equivalents 564,788 796,961

Financial liabilities

Trade and other payables at cost 15,240 36,931

Financial liabilities held at cost are made up of trade and

other payables of GBP4,440 (31 Mar 2017:GBP6,351) and accruals of

GBP10,800 (31 Mar 2017:GBP28,400).

8.2 Financial risk management objectives and policies

The Company's cash balances are held with a major UK clearing

bank.

As all monetary assets and liabilities and all transactions of

Company are denominated in its functional currency, the director

considers the Company is not exposed to significant foreign

currency risk.

The Company will implement appropriate foreign currency risk

management procedures upon completion of the Acquisition.

9. Events after the reporting date

No such events have been noted.

This information is provided by RNS

The company news service from the London Stock Exchange

END

MSCSDSFLSFASEFL

(END) Dow Jones Newswires

April 30, 2018 10:28 ET (14:28 GMT)

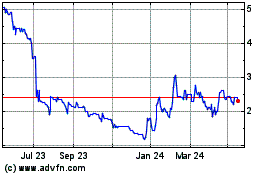

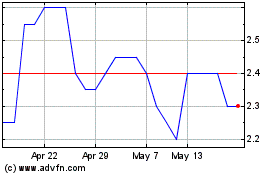

Emmerson (LSE:EML)

Historical Stock Chart

From Jun 2024 to Jul 2024

Emmerson (LSE:EML)

Historical Stock Chart

From Jul 2023 to Jul 2024