Emmerson PLC Change of Nominated Advisor and Joint Broker

01 July 2024 - 4:00PM

RNS Regulatory News

RNS Number : 4437U

Emmerson PLC

01 July 2024

Emmerson PLC / Ticker: EML /

Index: AIM / Sector: Mining

1 July 2024

Emmerson PLC ("Emmerson" or

the "Company")

Change of Nominated Advisor

and Joint Broker

Emmerson PLC ("Emmerson" or the "Company"), the Moroccan focused potash

development company, is pleased to announce that,

following the completion of the all-share merger

between Liberum Capital Limited and Panmure Gordon Group Limited,

the Company has changed its Nominated Adviser and Joint Broker to

Panmure Liberum Limited with immediate effect.

**ENDS**

For further information, please

visit www.emmersonplc.com,

follow us on Twitter (@emmerson_plc), or contact:

|

Emmerson PLC

Graham Clarke / Jim Wynn / Charles

Vaughan

|

+44 (0)

207 138 3204

|

|

Panmure Liberum Limited (Nominated Advisor and Joint

Broker)

Scott Mathieson / Matthew

Hogg

|

+44 (0)20

3100 2000

|

|

Shard Capital LLP (Joint Broker)

Damon Heath / Isabella

Pierre

|

+44 (0)20

7186 9927

|

|

BlytheRay (Financial PR and IR)

Tim Blythe / Megan Ray / Said

Izagaren

|

+44 (0)

207 138 3204

|

Notes to Editors

Emmerson is focused on advancing the

Khemisset project ("Khemisset" or the "Project") in Morocco into a

low cost, high margin supplier of potash, and the first primary

producer on the African continent. With an initial 19-year life of

mine, the development of Khemisset is expected to deliver long-term

investment and financial contributions to Morocco including the

creation of permanent employment, taxation, and a plethora of

ancillary benefits. As a UK-Moroccan partnership, the Company is

committed to bringing in significant international investment over

the life of the mine.

Morocco is widely recognised as one

of the leading phosphate producers globally, ranking third in the

world in terms of tonnes produced annually, and the development of

this mine is set to consolidate its position as the most important

fertiliser producer in Africa. The Project has a large JORC

Resource Estimate (2012) of 537Mt @ 9.24% K2O, with significant

exploration potential, and is perfectly located to support the

expected growth of African fertiliser consumption whilst also being

located on the doorstep of European markets. The need to feed the

world's rapidly increasing population is driving demand for potash

and Khemisset is well placed to benefit from the opportunities this

presents. The Feasibility Study released in June 2020 indicated the

Project has the potential to be among the lowest capital cost

development stage potash projects in the world and also, as a

result of its location, one of the highest margin projects. Updated

financial estimates published in February 2024 indicated a net

present value of US$2.2 billion, with an internal rate of return of

approximately 40%.

This information is provided by RNS, the news service of the

London Stock Exchange. RNS is approved by the Financial Conduct

Authority to act as a Primary Information Provider in the United

Kingdom. Terms and conditions relating to the use and distribution

of this information may apply. For further information, please

contact

rns@lseg.com or visit

www.rns.com.

RNS may use your IP address to confirm compliance with the terms

and conditions, to analyse how you engage with the information

contained in this communication, and to share such analysis on an

anonymised basis with others as part of our commercial services.

For further information about how RNS and the London Stock Exchange

use the personal data you provide us, please see our

Privacy

Policy.

END

APPBUGDLCUDDGSI

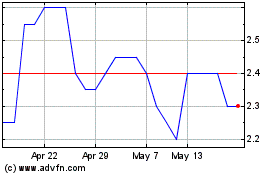

Emmerson (LSE:EML)

Historical Stock Chart

From Oct 2024 to Nov 2024

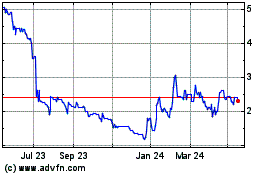

Emmerson (LSE:EML)

Historical Stock Chart

From Nov 2023 to Nov 2024