Acquisition

18 December 2007 - 6:01PM

UK Regulatory

RNS Number:1206K

Gemfields Resources PLC

18 December 2007

18 December 2007

Gemfields Resources plc

("Gemfields")

Acquisition of Kagem

Gemfields Resources plc (AIM: GEM), the AIM-listed Zambian gemstone mining and

exploration company, is pleased to announce that it has conditionally agreed to

acquire from Rox Limited ("Rox", a Pallinghurst Resources portfolio company) a

75% interest in the Kagem emerald mine in Zambia.

Rox has also granted to Gemfields an option to acquire a portfolio of in excess

of 25 licences and licence applications for gemstone exploration in Madagascar

held through its subsidiary Oriental Mining.

In addition, Faberge Limited, another Pallinghurst Resources portfolio company

has agreed to grant Gemfields an option to acquire a worldwide and exclusive 15

year licence to use the Faberge brand name in respect of gemstones (excluding

diamonds).

Under the proposed transaction, Gemfields is to acquire Greentop International

Inc. (a BVI company) and Krinera Group SA (a Panamanian company), the holding

companies through which Rox's interest in the Kagem mine is held (via

intermediate holding companies). In consideration for the acquisition of

Greentop and Krinera and the options referred to above, Gemfields will issue to

Rox 137,910,340 new ordinary shares in Gemfields (constituting 55% of Gemfields'

issued share capital after implementation of the transaction on a fully diluted

basis).

As the proposed transaction is classified as a reverse takeover under the AIM

Rules, the transaction is conditional, amongst other things, on Gemfields

obtaining the approval of its shareholders. Gemfields' shares have been

suspended from trading pending the preparation and publication of a re-admission

document and notice of extraordinary general meeting ("EGM") setting out the

details of the proposed transaction and seeking shareholder approval. A

competent persons report is being prepared and will form part of the

re-admission document. It is expected that the re-admission document and notice

of EGM will be sent to shareholders as soon as they are available, which is

currently intended to be in the first quarter of 2008.

Graham Mascall, Chairman of Gemfields said:

"This transaction adds significant value-adding building blocks to Gemfields'

vision of becoming a leading supplier of both rough and polished coloured

gemstones. Since its IPO in November 2005, Gemfields has assembled a world class

operational team with extensive experience in all aspects of the gemstone

business. Significant operational synergies will be generated from the

combination of these two sets of assets.

Gemfields will now be the dominant company on Zambia's Fwaya-Fwaya emerald belt,

and this bodes well for further consolidation of the belt. Gemfields' current

position in the emerald industry will form the basis for targeting significant

interests in other coloured gemstones."

Mr Brian Gilbertson, Chairman of Pallinghurst Resources said:

"We have long held the view that the coloured gemstone industry is unusually

fragmented and undercapitalised. Given the increasing popularity of coloured

gemstones, and the resulting price increases in recent years, Pallinghurst

Resources believes that a significant opportunity exists in pursuing

consolidation and vertical integration of the coloured gemstone industry.

The vision of supplying a range of ethically sourced coloured gemstones with

guaranteed provenance, and with the premium stones bearing the Faberge brand

name, creates an attractive value proposition. The combination of the assets of

Gemfields and Rox establishes a solid framework for the development of an

integrated company involved in the exploration, mining, processing, marketing

and sales of coloured gemstones on an international scale. "

Kagem

Kagem is the largest emerald mine in Zambia and is one of the most attractive

operating emerald assets in Africa. Notably, Kagem has a long and demonstrated

history of producing high quality emeralds. During the last three years, Kagem

has produced an average of 6.5 million carats of emeralds annually. Gemfields

believes that these production levels can be significantly improved.

Kagem presently has in excess of 350 employees and has two processing plants.

The Kagem assets include a cutting works in nearby Kitwe where lower grade

emeralds will be cut and polished.

While Kagem's licence area is extensive and includes five emerald bearing belts,

production to date has focussed on a single pit known as "FF-F10" which lies on

the Fwaya-Fwaya belt.

Under the terms of the proposed transaction, Gemfields would acquire Rox's 75%

indirect interest in Kagem. The Government of the Republic of Zambia owns the

remaining 25%.

Faberge

Under the terms of the proposed transaction, Gemfields will acquire an option to

be granted a 15 year worldwide and exclusive licence to use the Faberge name in

branding, marketing and selling coloured gemstones (excluding diamonds). The

name carries exceptional branding potential and would, in terms of the proposed

transaction, become Gemfields' flagship brand. The option will be exercisable by

Gemfields in the three months following completion of the transaction, however,

if it has not done so, Faberge Limited can require it to.

Madagascar

Madagascar is presently one of the most prospective mineral provinces in the

world for coloured gemstones. Gemfields would, in terms of the proposed

transaction, be granted an option to acquire Oriental Mining which holds a

portfolio in excess of 25 licences and licence applications in Madagascar

covering rubies, sapphires and emeralds, as well as garnets and tourmalines. The

option is exercisable by Gemfields at any time in the three months following

completion of the proposed transaction, however, if it has not done so, Rox may

require it to.

Enquiries:

Gemfields

Richard James, CFO richard.james@gemfields.co.uk

+44 (0)20 7016 9416

Conduit PR

Leesa Peters/Ed Portman +44 (0)20 7429 6600

+44 (0)781 215 9885

Canaccord Adams Limited

Robin Birchall +44 (0)20 7050 6500

About Gemfields Resources plc

Gemfields is an AIM-quoted gemstone exploration, mining and processing company.

Gemfields existing assets include:

* The wholly owned Mbuva-Chibolele emerald mine on the Fwaya-Fwaya belt,

where trial mining commenced in July 2006. A 10,050 carat emerald was

recovered from Mbuva-Chibolele in August 2007;

* The wholly owned Kamakanga emerald mine on the western limb of the

Fwaya-Fwaya belt in Zambia, which was acquired in December 2005;

* The 50% (an agreement to increase to 76% is expected to be signed

shortly) owned Kariba amethyst mine where production is being ramped up, and

a large-scale amethyst prospecting licence in the surrounding area;

* An option (valid until 31 March 2008) to acquire the Jagoda pink

tourmaline mine for USD 1.95 million. Geological mapping is presently

underway on this property;

* Substantial prospecting licences in the Ndola Rural Emerald Restricted

Area.

About Rox Limited

Rox Limited is incorporated in the Cayman Islands and is a portfolio company of

Pallinghurst Resources (see www.pallinghurst.com for more information). Rox was

established by Pallinghurst Resources as a special purpose vehicle for the

pursuit of consolidation and vertical integration of the coloured gemstone

sector.

About Faberge Limited

Faberge Limited, another portfolio company of Pallinghurst Resources, acquired

the worldwide rights to the Faberge brand name from Unilever in January 2007.

First established in 1842 in Russia (but originally of French descent), Faberge

is one of the most revered luxury names in history. Faberge's catalogues of

luxury items and objets d'art are intimately associated with the use of colour

and of coloured gemstones. A Faberge egg belonging to the Rothschild Family was

sold at auction in November 2007 by Christies for a record breaking GBP 8.9

million.

In a reversal of the Faberge family's loss of the rights to the Faberge name in

a legal settlement in 1951, the historic re-unification of the Faberge brand

with the direct descendents of Peter Carl Faberge was announced in October 2007.

Mark Dunhill, the former president of Alfred Dunhill Ltd, was appointed as CEO

of the unified Faberge in November 2007 (see www.faberge.com for more

information).

End.

This information is provided by RNS

The company news service from the London Stock Exchange

END

ACQTRBRTMMIBBLR

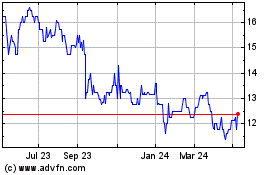

Gemfields (LSE:GEM)

Historical Stock Chart

From Jan 2025 to Feb 2025

Gemfields (LSE:GEM)

Historical Stock Chart

From Feb 2024 to Feb 2025