Gemfields PLC Market Update - Quarter to 30 June 2012

22 August 2012 - 4:00PM

UK Regulatory

TIDMGEM

Gemfields plc

("Gemfields" or the "Company")

Market Update - Quarter to 30 June 2012

22 August 2012

Gemfields plc (AIM: GEM) presents an operational update for the three month

period and year ending 30 June 2012. All figures are approximate, unaudited

and, unless otherwise stated, the phrase "carats" includes both emerald and

beryl.

Highlights

Production summary for the Kagem emerald mine:

The final quarter of the year saw strong production growth to 7.3 million

carats (versus 4.9 million carats in the prior quarter);

Grade for the quarter was 181 carats per tonne (versus 236 carats per tonne in

the prior quarter), with unit production costs of USD 0.57 per carat (versus

USD 0.85 per carat in the prior quarter)

Cash rock handling unit cost were USD 3.5 per tonne (versus USD 3.7 per tonne

in the prior quarter)

Unit ore production costs reduced by 48% from USD 200 per tonne in the prior

quarter to USD 104 per tonne

Kagem's large-scale on-going waste movement programme is progressing well to

open up new areas for future ore production

Revenue of USD 9.0 million from successful Jaipur auction of 3.47 million

carats in June 2012

At 30 June 2012, Gemfields had USD 36.7 million in cash and debt outstanding of

USD 2.9 million

The Montepuez ruby mine in Mozambique is on track to commence bulk sampling in

the coming quarter

Demand for ethical emeralds continues to remain firm across all major markets

with Gemfields' next higher quality rough emerald auction scheduled to take

place in Singapore between the 29 October and 3 November 2012

Ian Harebottle, CEO of Gemfields, commented:

"On the back of solid demand for Gemfields' products, pleasing stock levels and

healthy cash balances, our decision to focus primarily on mine development and

waste mining during the past year is, I believe, well justified. Despite some

early minor delays and slightly lower than anticipated full year production

volumes, the past few quarters have continued to deliver improving production

volumes, a trend that is likely to continue in the near term. This, together

with the progress that has been achieve at our Mozambican ruby mine, provides

management with the confidence that the coming year will continue to underpin

Gemfields' ambitious growth plans."

A graphical production update is available at www.gemfields.co.uk.

Production Update

The 75%-owned Kagem emerald mine is presently Gemfields' only operating emerald

mine and is the single largest emerald mine in the world. The key production

parameters by quarter are summarised below:

Production Performance

Quarterly Summary Units Sep-10 Dec-10 Mar-11 Jun-11 Sep-11 Dec-11 Mar-12 Jun-12 TOTAL

Gemstone Production million 12.8 5.9 3.5 10.8 4.9 3.9 4.9 7.3 54.1

(Emerald+Beryl) carats

Ore Production 'k tonnes 19.5 16.0 12.0 21.7 24.0 17.5 20.8 40.7 172.1

(Reaction Zone)

Grade (Emerald+Beryl/ carats / 658 369 290 500 205 222 236 181 314

Reaction Zone) tonne

Waste Mined million 0.9 0.8 0.8 1.4 2.2 2.2 1.6 2.8 12.7

(including TMS) tonnes

Stripping Ratio 48 48 66 67 92 125 78 68 74

Cash Operating Cost USD 3.5 3.6 3.6 3.5 7.2 7.0 6.0 9.8 44.2

million

Cash Rock Handling USD / 3.6 4.6 4.4 2.4 3.3 3.2 3.7 3.5 3.5

Unit Cost tonne

Financial Performance*

Quarterly Summary Units Sep-10 Dec-10 Mar-11 Jun-11 Sep-11 Dec-11 Mar-12 Jun-12 TOTAL

Total Operating cost USD 3.5 3.6 3.6 3.5 3.9 3.4 4.2 4.2 29.7

million

Unit Production cost USD 0.27 0.62 1.03 0.32 0.79 0.87 0.85 0.57 0.55

per carat /carats

Unit Production cost USD 178 227 298 160 162 193 200 104 173

per tonne of ore /tonne

*Note: With effect from July 2011, Gemfields adopted a new accounting policy

whereby all waste moving costs are capitalised and are then subsequently

amortised when the ore corresponding to that waste is mined. As of 30 June

2012, approximately USD 14.5 million of waste moving costs have been

capitalised and will be amortised later when the associated ore is mined.

The quarter to 30 June 2012 produced 7.3 million carats at a grade of 181

carats per tonne of ore and a unit production cost of USD 0.57 per carat

(excluding capitalised waste moving costs).

The previously announced large-scale waste movement programme to open up new

areas for future ore production continues. This programme has gained pace with

over 8.7 million tonnes of rock having been moved in the past four quarters.

Whilst the stripping ratio has come down over the last two quarters, management

anticipates that this will increase in the near term as larger areas of

overburden are mined in order to further increase the levels of ore available

for future mining and as the push-back project is accelerated. Management

expects an overall increase in operating efficiencies and performance as the

stripping ratio stabilises in the medium term and as Kagem is able to mine both

waste and ore more efficiently.

Approximately 1.9 million tonnes of waste were moved by the contractor during

the quarter (compared to 0.7 million tonnes in the previous quarter), with cash

rock handling unit costs decreasing to USD 3.5 per tonne in the current quarter

(compared to USD 3.7 in the prior quarter).

Kagem's key annual production parameters are summarised below:

Kagem Annual UNITS YEAR YEAR YEAR YEAR YEAR YEAR YEAR

Production to 30 to 30 to 30 to 30 to 30 to 30 to 30

Summary Jun Jun Jun Jun Jun Jun Jun

2006 2007 2008 2009 2010 2011 2012

Gemstone million

Production carats 10.2 9.4 9.9 28 17.4 33.0 21.1

(Emerald+Beryl)

Ore Production '000 22 29 42 80 61 69 103

(Reaction Zone) tonnes

Grade carats/

(Emerald+Beryl/ tonne 462 325 233 349 286 478 205

Reaction Zone)

Waste Mined million 1.8 2.8 5.1 4.0 2.5 3.9 8.7

(incl. TMS) tonnes

Waste+TMS: stripping 83 96 120 50 42 57 85

Reaction Zone ratio

Total Rock million 1.8 2.8 5.1 4.1 2.6 3.9 8.8

Handling tonnes

As a direct result of the short term focus on waste mining and the previously

reported delays, the year ending 30 June 2012 saw annual production of 21.1

million carats, a 36% decrease in the record breaking 33.0 million carats

produced in the prior year. The grade for the year to 30 June 2012 ended at 205

carats per tonne, versus 478 in the prior year. While the achieved grade

remains somewhat below historic levels, such fluctuations are common within

gemstone mining, generally averaging out over time. The past three quarters

have delivered constantly improving production volumes, a trend that is likely

to continue in the near term. Unit production costs increased 73% from USD

0.43 to USD 0.74 per carat and unit rock handling costs fell 50% from USD 3.53

to USD 1.78 per tonne (note the asterisk under the "Financial Performance"

table above).

Gemfields' trial underground mining project achieved 92 metres of horizontal

advance during the quarter ending 30 June 2012 from 88 blasts (versus 73.9

metres in the quarter ending March 2012). The total linear development to date

is 470.9 metres (versus 378.9 meters at 31 March 2012). A total of 1,560

tonnes of ore was produced during the quarter (versus 1,040 tonnes in the prior

quarter) with 40 tonnes of waste removal. Production mining has been the focus

following the successful completion of the second escape route. Approximately

147,805 carats were produced by the underground operation in the quarter ending

30 June 2012, versus 141,315 carats in the prior quarter.

Despite the slightly reduced demand experienced for some of the lower quality

goods placed on offer during the Company's previous auction held in Jaipur in

June 2012, demand for ethical emeralds continues to remain firm across all

major markets. Gemfields next higher quality rough emerald auction is scheduled

to take place in Singapore between 29 October and 3 November 2012.

Illegal mining activity within the boundaries of the Kagem mining licence is

not yet fully resolved and Gemfields continues to work with key ministries to

alleviate this challenge.

Start-up operations at Montepuez Ruby Mining Lda, (Gemfields' 75% owned ruby

project in Mozambique) are progressing to schedule, with a core team and

equipment operational and on site. Various targets have been identified and

bulk sampling is set to commence in earnest during the coming quarter.

Cash Balances

At 30 June 2012, Gemfields had USD 36.7 million in cash (and debt outstanding

of USD 2.9 million).

Enquiries:

Gemfields

dev.shetty@gemfields.co.uk

Dev Shetty,

CFO +44 (0)20 7518 3402

Canaccord Genuity Limited

Nominated Adviser and Joint Broker to Gemfields

Tarica Mpinga/Andrew Chubb

+44 (0)20 7523 8000

Neil Passmore

+44 (0)20 7155 8630

JP Morgan Cazenove

Jos Simson/Emily Fenton

+44 (0)20 7920 3150

Tavistock Communications

Notes to Editors:

Gemfields plc is a leading gemstone miner listed on the AIM market of the

London Stock Exchange (ticker: `GEM'). The Company's principal asset is the 75%

owned Kagem emerald mine in Zambia, the world's single largest emerald mine. In

addition to the Kagem emerald mine, Gemfields has a 50% interest in the Kariba

amethyst mine in Zambia.

The Company also owns controlling stakes in a highly prospective ruby deposit

in Mozambique and licences in Madagascar including ruby, emerald and sapphires

deposits.

In July 2009 Gemfields commenced a formal auction programme for its Zambian

emeralds. To date, the Company has held 10 auctions which have generated

revenues totalling USD 133.7 million.

END

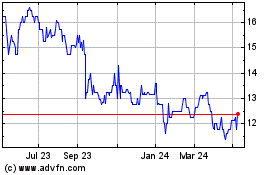

Gemfields (LSE:GEM)

Historical Stock Chart

From Dec 2024 to Jan 2025

Gemfields (LSE:GEM)

Historical Stock Chart

From Jan 2024 to Jan 2025