Gemfields PLC Auction Update (2159I)

01 July 2013 - 4:00PM

UK Regulatory

TIDMGEM

RNS Number : 2159I

Gemfields PLC

01 July 2013

Gemfields plc

("Gemfields" or the "Company")

Auction Update

1 July 2013

On 10 June 2013, Gemfields plc (AIM: GEM) advised that the

auction of higher grade rough emeralds originally scheduled to take

place in Singapore from 10-14 June 2013 had been put on hold

pending further discussions with the Zambian Ministry of Mines,

Energy and Water Development (the "Ministry").

Gemfields today advises that, at the written request of the

Ministry, this auction will now take place in Lusaka, Zambia. The

scheduled dates are 15-19 July 2013. The auction will comprise the

rough emeralds that were to be auctioned in Singapore, all of which

were mined by Kagem Mining Limited ("Kagem") at the Kagem emerald

mine in Zambia (which is 75% owned by Gemfields, with the remaining

25% owned by the Government of the Republic of Zambia.

As a result of the delay in holding the auction, Gemfields will

have completed only two auctions in the financial year ending 30

June 2013, generating aggregate auction revenues for the year of

USD 42.0 million. In the prior financial year (to 30 June 2012),

four auctions were held, generating aggregate auction revenues of

USD 77.9 million. Gemfields' revenues generated by auctions will

therefore decline 46% year on year as the next auction will take

place in the new financial year commencing 1 July 2013.

Both Gemfields and Kagem continue to actively correspond with

the Ministry and hope that solutions supporting the optimisation of

Kagem's revenues and the continued growth of the wider Zambian

emerald sector will be reached as soon as possible.

Background (and Changes at the Ministry and to the board of

Kagem)

At a press conference in Lusaka on Friday 5 April 2013, Yamfwa

Mukanga, the then Minister of Mines, Energy and Water Development

addressed members of the media and distributed a press statement

seemingly restraining the Kagem emerald mine (and other producers)

from auctioning emeralds outside of Zambia. Kagem is the only

Zambian emerald producer that has sold via overseas auctions in

recent years. The proceeds of those auctions have been repatriated

to Kagem in Zambia.

Christopher Yaluma was appointed as the Minister of Mines,

Energy and Water Development in late May 2013 (a position he had

previously served in until June 2012). Subsequently, on 18 June

2013, the Ministry (which appoints one director to the board of

Kagem) replaced their incumbent Kagem director with Dr Sixtus

Mulenga, a veteran mining-geologist who also serves as a

non-executive director on the boards of Mopani Copper Mines plc and

AEL Zambia plc. Dr Mulenga also played an instrumental role in

Zambia becoming an EITI-compliant country.

Ian Harebottle, CEO of Gemfields, commented:

"While we have received repeated assurances that there is no ban

on overseas auctions, we have been asked by the Ministry of Mines

to host an auction of higher grade emeralds within Zambia as part

of a consultative process. Although there is presently no law in

Zambia that prohibits the export of emeralds for auction purposes,

we naturally wish to ensure that we work collaboratively with the

Government of the Republic of Zambia, who are our

fellow-shareholders in the world-class Kagem emerald mine. It

remains our hope that a framework solution which allows Kagem to

maximise its revenues will soon be found."

Enquiries:

Gemfields mark.summers@gemfields.co.uk

Mark Summers, CFO +44 (0)20 7518 3283

Canaccord Genuity Limited +44 (0)20 7523 8000

Nominated Adviser and Joint Broker to Gemfields

Tarica Mpinga/Andrew Chubb

JP Morgan Cazenove +44 (0)20 7134 4726

Jamie Riddell

Tavistock Communications +44 (0)20 7920 3150

Jos Simson/Emily Fenton/Jessica Fontaine

Notes to Editors:

Gemfields plc is a leading gemstone miner listed on the AIM

market of the London Stock Exchange (ticker: `GEM'). The Company's

principal asset is the 75% owned Kagem emerald mine in Zambia, the

world's single largest emerald mine. In addition to the Kagem

emerald mine, Gemfields has a 50% interest in the Kariba amethyst

mine in Zambia.

The Company also owns controlling stakes in a highly prospective

ruby deposit in Mozambique and licences in Madagascar including

ruby, emerald and sapphires deposits.

In July 2009 Gemfields commenced a formal auction programme for

its Zambian emeralds. To date, the Company has held twelve auctions

which have generated revenues totalling USD 175.8 million.

Gemfields recently acquired the Fabergé brand with a view to

creating a globally recognised coloured gemstone champion. Fabergé

provides Gemfields with direct control over a high-end luxury goods

platform and a global brand with exceptional heritage.

This information is provided by RNS

The company news service from the London Stock Exchange

END

MSCMMGFVGGRGFZZ

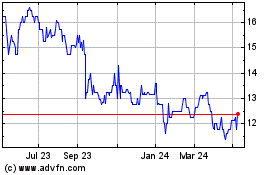

Gemfields (LSE:GEM)

Historical Stock Chart

From Dec 2024 to Jan 2025

Gemfields (LSE:GEM)

Historical Stock Chart

From Jan 2024 to Jan 2025