TIDMGHE

RNS Number : 2784X

Gresham House PLC

19 December 2023

NOT FOR RELEASE, PUBLICATION OR DISTRIBUTION, IN WHOLE OR IN

PART, DIRECTLY OR INDIRECTLY, IN, INTO OR FROM ANY JURISDICTION

WHERE TO DO SO WOULD CONSTITUTE A VIOLATION OF THE RELEVANT LAWS OR

REGULATIONS OF SUCH JURISDICTION

19 December 2023

Recommended Final Cash Offer for Gresham House plc ("Gresham

House")

by

Seed Bidco Limited ("Bidco")

Scheme of Arrangement Becomes Effective

On 17 July 2023, the boards of directors of Gresham House and

Bidco, a newly incorporated entity formed by funds advised by

Searchlight Capital Partners, L.P. and its affiliates

("Searchlight") for the purposes of making an offer for Gresham

House, made an announcement pursuant to Rule 2.7 of the Takeover

Code (the "Rule 2.7 Announcement") that they had reached agreement

on the terms and conditions of a recommended final cash offer for

the entire issued and to be issued ordinary share capital of

Gresham House by Bidco (the "Acquisition"), to be implemented by

means of a scheme of arrangement under Part 26 of the Companies Act

2006 (the "Scheme").

On 30 August 2023, the Scheme was approved by the Scheme

Shareholders at the Court Meeting and General Meeting. On 13

December 2023, the High Court made an order sanctioning the

Scheme.

Gresham House and Bidco are pleased to announce that the Scheme

Court Order has been delivered to the Registrar of Companies and

accordingly, the Scheme has now become Effective in accordance with

its terms and, pursuant to the Scheme, the entire issued and to be

issued share capital of Gresham House is now owned by Bidco.

Gresham House Shareholders who were on the register of members

of Gresham House at the Scheme Record Time, being 6.00 p.m. on 18

December 2023, will receive 1,105 pence in cash for each Scheme

Share. The latest date for the dispatch of cheques to Gresham House

Shareholders (who hold their Gresham House Shares in certificated

form) and settlement through CREST (for those Gresham House

Shareholders who hold their Gresham House Shares via CREST) for

cash consideration payable under the Scheme is 2 January 2024.

As a result of the Scheme having become effective, share

certificates in respect of Gresham House Shares have ceased to be

valid documents of title and entitlements to Gresham House Shares

held in uncertificated form in CREST have been cancelled.

As the Scheme has now become Effective, Gresham House duly

announces that, as of today's date Anthony Townsend, Rachel

Beagles, Sarah Ing, Gareth Davis and Simon Stilwell have each

tendered their resignations and have stepped down from the Gresham

House board of directors with immediate effect.

Applications have been made for the suspension of: (i) trading

in Gresham House Shares on AIM, and (ii) the listing of Gresham

House Shares on AIM. Trading in Gresham House Shares on AIM is

expected to be suspended with effect from 7.30 a.m. today and the

cancellation of admission to trading of Gresham House Shares on AIM

is expected to take place at 7.00 a.m. on, 20 December 2023.

Capitalised terms used in this announcement, unless otherwise

defined, have the same meaning as set out in the Scheme

Document.

All references to times are to times in London, unless otherwise

stated.

Enquiries:

Gresham House

Anthony Dalwood, Chief Executive Officer +44 (0)20 3837

Kevin Acton, Chief Financial Officer 6270

Evercore (Joint Lead Financial Adviser and

Rule 3 Adviser to Gresham House)

Ed Banks

Tariq Ennaji +44 (0)20 7653

Jamie Prescott 6000

Blackdown Partners (Joint Lead Financial Adviser

to Gresham House)

Peter Tracey +44 (0)20 3807

Tom Fyson 8484

Canaccord (Nominated Adviser and Joint Broker

to Gresham House)

Bobbie Hilliam +44 (0)20 7523

Harry Pardoe 8000

Jefferies (Financial Adviser and Joint Broker

to Gresham House)

Paul Nicholls

James Umbers

Samie Zare +44 (0)20 7029

Jordan Cameron 8000

Houston (PR Adviser to Gresham House)

Kay Larsen

Alex Clelland +44 (0)20 4529

Kelsey Traynor 0549

Searchlight

James Redmayne

Giles Marshall +44 (0)20 7290

Jonathan Laloum 7910

Dean Street Advisers (Financial Adviser to

Searchlight and Bidco)

Mervyn Metcalf +44 (0)20 3818

Graeme Atkinson 8520

Rothschild & Co (Financial Adviser to Searchlight

and Bidco)

Ravi Gupta

Christopher Kaladeen

Peter Brierley +44 (0)20 7280

David Morrison 5000

Prosek Partners (PR Adviser to Searchlight

and Bidco) +44 (0)20 3890

Evangeline Barata 9193

Important notices

Evercore Partners International LLP ("Evercore"), which is

authorised and regulated by the Financial Conduct Authority in the

United Kingdom, is acting exclusively as financial adviser to

Gresham House and no one else in connection with the matters

described in this announcement and will not be responsible to

anyone other than Gresham House for providing the protections

afforded to clients of Evercore nor for providing advice in

connection with the matters referred to herein. Neither Evercore

nor any of its subsidiaries, branches or affiliates owes or accepts

any duty, liability or responsibility whatsoever (whether direct or

indirect, whether in contract, in tort, under statute or otherwise)

to any person who is not a client of Evercore in connection with

this announcement, any statement contained herein, any offer or

otherwise. Apart from the responsibilities and liabilities, if any,

which may be imposed on Evercore by the Financial Services and

Markets Act 2000 and successor legislation, or the regulatory

regime established thereunder, or under the regulatory regime of

any jurisdiction where exclusion of liability under the relevant

regulatory regime would be illegal, void or unenforceable, neither

Evercore nor any of its affiliates accepts any responsibility or

liability whatsoever for the contents of this announcement, and no

representation, express or implied, is made by it, or purported to

be made on its behalf, in relation to the contents of this

announcement, including its accuracy, completeness or verification

of any other statement made or purported to be made by it, or on

its behalf, in connection with Gresham House or the matters

described in this announcement. To the fullest extent permitted by

applicable law, Evercore and its affiliates accordingly disclaim

all and any responsibility or liability whether arising in tort,

contract or otherwise (save as referred to above) which they might

otherwise have in respect of this announcement or any statement

contained herein.

Blackdown Partners Limited ("Blackdown Partners"), which is

authorised and regulated by the Financial Conduct Authority, is

acting exclusively as financial adviser to Gresham House and no one

else in connection with the matters described in this announcement

and will not be responsible to anyone other than Gresham House for

providing the protections afforded to clients of Blackdown Partners

nor for providing advice in connection with the matters referred to

herein. Neither Blackdown Partners nor any of its subsidiaries,

branches or affiliates owes or accepts any duty, liability or

responsibility whatsoever (whether direct or indirect, whether in

contract, in tort, under statute or otherwise) to any person who is

not a client of Blackdown Partners in connection with this

announcement, any statement contained herein, any offer or

otherwise. Apart from the responsibilities and liabilities, if any,

which may be imposed on Blackdown Partners by the Financial

Services and Markets Act 2000, or the regulatory regime established

thereunder, or under the regulatory regime of any jurisdiction

where exclusion of liability under the relevant regulatory regime

would be illegal, void or unenforceable, neither Blackdown Partners

nor any of its affiliates accepts any responsibility or liability

whatsoever for the contents of this announcement, and no

representation, express or implied, is made by it, or purported to

be made on its behalf, in relation to the contents of this

announcement, including its accuracy, completeness or verification

of any other statement made or purported to be made by it, or on

its behalf, in connection with Gresham House or the matters

described in this announcement. To the fullest extent permitted by

applicable law, Blackdown Partners and its affiliates accordingly

disclaim all and any responsibility or liability whether arising in

tort, contract or otherwise (save as referred to above) which they

might otherwise have in respect of this announcement or any

statement contained herein.

Canaccord Genuity Limited ("Canaccord"), which is authorised and

regulated in the United Kingdom by the Financial Conduct Authority,

is acting exclusively for Gresham House as nominated adviser and

joint broker in connection with the matters set out in this

announcement and for no one else and will not be responsible to

anyone other than Gresham House for providing the protections

afforded to its clients nor for providing advice in relation to the

matters set out in this announcement. Neither Canaccord nor any of

its subsidiaries, branches or affiliates and their respective

directors, officers, employees or agents owes or accepts any duty,

liability or responsibility whatsoever (whether direct or indirect,

whether in contract, in tort, under statute or otherwise) to any

person who is not a client of Canaccord in connection with this

announcement, any statement contained herein or otherwise.

Jefferies International Limited ("Jefferies"), which is

authorised and regulated in the United Kingdom by the Financial

Conduct Authority, is acting exclusively for Gresham House as joint

broker in connection with the matters set out in this announcement

and for no one else and will not be responsible to anyone other

than Gresham House for providing the protections afforded to its

clients nor for providing advice in relation to the matters set out

in this announcement. Neither Jefferies nor any of its

subsidiaries, branches or affiliates and their respective

directors, officers, employees or agents owes or accepts any duty,

liability or responsibility whatsoever (whether direct or indirect,

whether in contract, in tort, under statute or otherwise) to any

person who is not a client of Jefferies in connection with this

announcement, any statement contained herein or otherwise.

Dean Street Advisers Limited ("Dean Street Advisers"), which is

authorised and regulated in the United Kingdom by the Financial

Conduct Authority, is acting exclusively for Searchlight and Bidco

in connection with the matters set out in this announcement and for

no one else and will not be responsible to anyone other than

Searchlight and Bidco for providing the protections afforded to its

clients nor for providing advice in relation to the matters set out

in this announcement. Neither Dean Street Advisers nor any of its

subsidiaries, branches or affiliates and their respective

directors, officers, employees or agents owes or accepts any duty,

liability or responsibility whatsoever (whether direct or indirect,

whether in contract, in tort, under statute or otherwise) to any

person who is not a client of Dean Street Advisers in connection

with this announcement, any statement contained herein or

otherwise.

N.M. Rothschild & Sons Limited ("Rothschild & Co"),

which is authorised and regulated in the United Kingdom by the

Financial Conduct Authority, is acting exclusively for Searchlight

and Bidco in connection with the matters set out in this

announcement and for no one else and will not be responsible to

anyone other than Searchlight and Bidco for providing the

protections afforded to its clients nor for providing advice in

relation to the matters set out in this announcement. Neither

Rothschild & Co nor any of its subsidiaries, branches or

affiliates and their respective directors, officers, employees or

agents owes or accepts any duty, liability or responsibility

whatsoever (whether direct or indirect, whether in contract, in

tort, under statute or otherwise) to any person who is not a client

of Rothschild & Co in connection with this announcement, any

statement contained herein or otherwise.

Further information

This announcement is for information purposes only and is not

intended to, and does not constitute, or form part of any offer,

invitation, inducement or the solicitation of an offer to purchase,

otherwise acquire, subscribe for, sell or otherwise dispose of or

exercise rights in respect of any securities or the solicitation of

any vote or approval in any jurisdiction pursuant to the

Acquisition or otherwise, nor shall there be any sale, issuance or

transfer of securities of Gresham House in any jurisdiction in

contravention of applicable law. The Acquisition will be made and

implemented solely through the Scheme Document and the accompanying

Forms of Proxy (or, in the event that the Acquisition is to be

implemented by way of a Takeover Offer, the Offer Document and

Forms of Acceptance), which will together contain the full terms

and conditions of the Acquisition, including details of how to

vote, or procure the vote, in respect of the Acquisition. Any vote

or decision in respect of, or other response to, the Acquisition

should be made only on the basis of the information contained in

the Scheme Document (or, in the event that the Acquisition is to be

implemented by way of a Takeover Offer, the Offer Document).

Gresham House encourages Gresham House Shareholders to read the

Scheme Document carefully as it contains important information

relating to the Acquisition and the Scheme.

This announcement does not constitute a prospectus, prospectus

equivalent document or an exempted document.

The statements contained in this announcement are made as at the

date of this announcement, unless some other time is specified in

relation to them, and publication of this announcement shall not

give rise to any implication that there has been no change in the

facts set out in this announcement since such date.

Overseas Shareholders

The release, publication or distribution of this announcement in

certain jurisdictions may be restricted by law. Persons who are not

resident in the United Kingdom or who are subject to the laws of

other jurisdictions should inform themselves of, and observe, any

applicable requirements. Further details in relation to Overseas

Shareholders are contained in the Scheme Document. Any failure to

comply with the applicable restrictions may constitute a violation

of the securities laws of any such jurisdiction. To the fullest

extent permitted by applicable law, the companies and persons

involved in the Acquisition disclaim any responsibility or

liability for the violation of such restrictions by any person.

The Acquisition relates to shares of an English company and is

proposed to be effected by means of a scheme of arrangement under

the laws of England and Wales. Neither the US proxy solicitation

rules nor the tender offer rules under the US Exchange Act apply to

the Acquisition. Accordingly, the Acquisition is subject to the

disclosure requirements, rules and practices applicable in the

United Kingdom to schemes of arrangement, which differ from the

requirements of US proxy solicitation or tender offer rules.

However, if Bidco were to elect to implement the Acquisition by

means of a Takeover Offer, such Takeover Offer would be made in

compliance with all applicable laws and regulations, including

Section 14(e) of the US Exchange Act and Regulation 14E thereunder.

Such a Takeover Offer would be made in the United States by Bidco

and no one else. In addition to any such Takeover Offer, Bidco,

certain affiliated companies and the nominees or brokers (acting as

agents) of Bidco may make certain purchases of, or arrangements to

purchase, shares in Gresham House outside such Takeover Offer

during the period in which such Takeover Offer would remain open

for acceptance. If such purchases or arrangements to purchase were

to be made, they would be made outside the United States and would

comply with applicable law, including the US Exchange Act.

None of the securities referred to in this announcement have

been approved or disapproved by the US Securities and Exchange

Commission, any state securities commission in the United States or

any other US regulatory authority, nor have such authorities passed

upon or determined the adequacy or accuracy of the information

contained in this announcement. Any representation to the contrary

is a criminal offence in the United States.

Gresham House's financial statements, and all financial

information that is included in this announcement, or that is

included in the Scheme Document, have been prepared in accordance

with accounting standards applicable in the United Kingdom and may

not be comparable to financial statements of companies in the

United States or other companies whose financial statements are

prepared in accordance with generally accepted accounting

principles in the United States.

Unless otherwise determined by Bidco or required by the Code and

permitted by applicable law and regulation, the Acquisition will

not be made available, directly or indirectly, in, into or from a

Restricted Jurisdiction where to do so would violate the laws in

that jurisdiction and no person may vote, or procure the vote, in

favour of the Scheme and the Acquisition by any such use, means,

instrumentality or from within a Restricted Jurisdiction or any

other jurisdiction if to do so would constitute a violation of the

laws of that jurisdiction. Accordingly, copies of this announcement

and all documents relating to the Acquisition are not being, and

must not be, directly or indirectly, mailed or otherwise forwarded,

distributed or sent in, into or from a Restricted Jurisdiction

where to do so would violate the laws in that jurisdiction, and

persons receiving this announcement and all documents relating to

the Acquisition (including custodians, nominees and trustees) must

observe these restrictions and must not mail or otherwise

distribute or send them in, into or from such jurisdictions where

to do so would violate the laws in that jurisdiction.

The availability of the Acquisition to Gresham House

Shareholders who are not resident in the United Kingdom may be

affected by the laws of the relevant jurisdictions in which they

are resident. Persons who are not resident in the United Kingdom

should inform themselves of, and observe, any applicable

requirements.

The Acquisition will be subject to the applicable requirements

of the Code, the Panel, the London Stock Exchange, the FCA and the

AIM Rules.

Dealing Disclosure Requirements of the Code

Under Rule 8.3(b) of the Code, any person who is, or becomes,

interested in 1 per cent. or more of any class of relevant

securities of the offeree company or of any securities exchange

offeror must make a Dealing Disclosure if the person deals in any

relevant securities of the offeree company or of any securities

exchange offeror. A Dealing Disclosure must contain details of the

dealing concerned and of the person's interests and short positions

in, and rights to subscribe for, any relevant securities of each of

(i) the offeree company and (ii) any securities exchange offerors,

save to the extent that these details have previously been

disclosed under Rule 8. A Dealing Disclosure by a person to whom

Rule 8.3(b) applies must be made by no later than 3.30 p.m. (London

time) on the Business Day following the date of the relevant

dealing.

If two or more persons act together pursuant to an agreement or

understanding, whether formal or informal, to acquire or control an

interest in relevant securities of an offeree company or a

securities exchange offeror, they will be deemed to be a single

person for the purpose of Rule 8.3 of the Code.

Dealing Disclosures must also be made by the offeree company, by

any offeror and by any persons acting in concert with any of them

(see Rules 8.1, 8.2 and 8.4 of the Code).

Details of the offeree and offeror companies in respect of whose

relevant securities Dealing Disclosures must be made can be found

in the Disclosure Table on the Panel's website at

www.thetakeoverpanel.org.uk, including details of the number of

relevant securities in issue, when the Offer Period commenced and

when any offeror was first identified. You should contact the

Panel's Market Surveillance Unit on +44 (0)20 7638 0129 if you are

in any doubt as to whether you are required to make a Dealing

Disclosure.

In accordance with the Code, normal United Kingdom market

practice and Rule 14e-5(b) of the US Exchange Act, Rothschild &

Co, Dean Street Advisers, Evercore, Blackdown Partners, Canaccord

and Jefferies and their respective affiliates may continue to act

as exempt principal traders in Gresham House securities on AIM.

These purchases and activities by exempt principal traders which

are required to be made public in the United Kingdom pursuant to

the Code will be reported to a Regulatory Information Service and

will be available on the London Stock Exchange website at

www.londonstockexchange.com. This information will also be publicly

disclosed in the United States to the extent that such information

is made public in the United Kingdom.

Publication on website and hard copies

This announcement will be available free of charge, subject to

certain restrictions relating to persons resident in Restricted

Jurisdictions, on Gresham House's website at

www.greshamhouse.com/ghe-plc-offer and on Bidco's website at

www.seed-offer.com by no later than 12.00 p.m. on the 20 December

2023.

Neither the content of any website referred to in this

announcement nor the content of any website accessible from

hyperlinks is incorporated into, or forms part of, this

announcement.

This information is provided by RNS, the news service of the

London Stock Exchange. RNS is approved by the Financial Conduct

Authority to act as a Primary Information Provider in the United

Kingdom. Terms and conditions relating to the use and distribution

of this information may apply. For further information, please

contact rns@lseg.com or visit www.rns.com.

RNS may use your IP address to confirm compliance with the terms

and conditions, to analyse how you engage with the information

contained in this communication, and to share such analysis on an

anonymised basis with others as part of our commercial services.

For further information about how RNS and the London Stock Exchange

use the personal data you provide us, please see our Privacy

Policy.

END

SOAGRBDDDBBDGXC

(END) Dow Jones Newswires

December 19, 2023 02:15 ET (07:15 GMT)

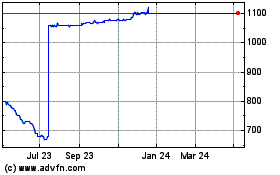

Gresham House (LSE:GHE)

Historical Stock Chart

From Dec 2024 to Dec 2024

Gresham House (LSE:GHE)

Historical Stock Chart

From Dec 2023 to Dec 2024