TIDMGKP

RNS Number : 1140Z

Gulf Keystone Petroleum Ltd.

12 March 2012

Not for release, publication or distribution in or into the

United States or jurisdictions other than the United Kingdom and

Bermuda where to do so would constitute a contravention of the

relevant laws of such jurisdiction.

12 March 2012

Gulf Keystone Petroleum Ltd. (AIM: GKP)

("Gulf Keystone" or "the Company")

Kurdistan Operational Update

Gulf Keystone today provides an update on its ongoing

exploration and appraisal programme in the Kurdistan Region of

Iraq, which includes the Shaikan block, a major discovery with

independently audited gross oil-in-place volumes of between 8

billion barrels to 13.4 billion barrels calculated on the P90 to

P10 basis, with a mean value of 10.5 billion barrels.

Shaikan-4 Appraisal Well

The well testing programme for the Shaikan-4 appraisal well,

drilled 6 km to the west of the Shaikan-1 discovery well, remains

ongoing, with six out of seven planned tests completed to date.

Portions of major intervals, such as the Kurre Chine, Butmah, Mus,

Alan and Sargelu formations will continue to be tested and so far

aggregate flow rates in excess of 14,000 barrels of oil equivalent

per day ("boepd") have been achieved. Portions of the well that

appear to be high quality oil reservoir on the electric logs, and

where proven commercial flow rates were achieved by testing

previous wells, will not be tested.

The first five tests have been conducted in the northern

"footwall" - on the lower side of the inclined fault bounding the

Shaikan structure. This is the first occurrence of flow from the

footwall and proves an extension of the Triassic and Jurassic

reservoirs outside the central part of the structure. The latest

test (Test 6) is being conducted in the "hanging wall" (the upper

side of the inclined fault) from a new reservoir in the uppermost

Sargelu formation which had not been previously flow tested. The

test is ongoing and rates in excess of 4,000 boepd have been

recorded.

Shaikan-5 Appraisal Well

After drilling the Shaikan-5 appraisal well, 6 km to the

north-east of the Shaikan-2 appraisal well, to the depth of 1,876

metres in the Jurassic, it became necessary to drill a sidetrack

due to a portion of the drill string becoming stuck in the hole.

The sidetrack operations were successfully performed at the depth

of 1,370 metres, after which the Shaikan-5 drilling operations have

resumed below 1,730 metres, to continue drilling to the estimated

total depth ("TD") of 3,500 metres, subject to technical

conditions.

Shaikan-6 Appraisal Well

The Shaikan-6 appraisal well, 9 km to the east of the Shaikan-2

appraisal well, is currently drilling a 12.25" hole at the depth of

2,058 metres in the Jurassic. The well will drill to the estimated

TD of 3,800 metres subject to technical conditions.

Shaikan-7 Exploration Well

The tendering process has commenced for a rig to drill the

Shaikan-7 exploration well, which will target the lower Triassic

and the Permian, the deepest prospective undrilled horizons of the

Shaikan structure.

Shaikan Extended Well Test

As part of the ongoing Extended Well Test ("EWT") on the Shaikan

block, the output from the Shaikan-1 & 3 EWT facility reached

137,060 gross barrels of oil between 1 January and 6 March 2012.

Due to unprecedented cold weather and poor visibility, combined

with work required to connect an additional 20,000 barrel storage

tank, the average test production between 1 January and 25 February

was 2,077 gross barrels of oil per day ("bopd"). Since 25 February

test production has averaged 5,641 gross bopd.

Shaikan Field Export Pipeline Project

On 6 March 2012, Gulf Keystone initiated a tendering process for

the export pipeline site construction and installation for the

Shaikan field export pipeline project.

As part of the ongoing tendering process for the materials

procurement for the Shaikan field export pipeline project, which

was announced on 12 January 2012, bids are currently being received

with the technical and commercial evaluation to follow.

Gulf Keystone is the Operator of the Shaikan block with a

working interest of 75 per cent and is partnered with Kalegran Ltd.

(a 100 per cent subsidiary of MOL Hungarian Oil and Gas Plc.) and

Texas Keystone Inc., which have working interests of 20 per cent

and 5 per cent respectively.

Akri-Bijeel Block: Aqra/ Bekhme Anticline Resources

Following the completion of the Bekhme-1 exploration well

testing programme in December 2011, after the well reached TD at

5,000 metres in the Triassic, Gulf Keystone has received results of

an independent evaluation of estimated petroleum resources for the

Aqra/Bekhme anticline on the Akri-Bijeel block by Dynamic Global

Advisors (DGA), independent Houston-based exploration

consultants.

The DGA report, based on the Bekhme-1 wireline logging data and

2D seismic data, while recognizing the fact that no hydrocarbons

had been produced to surface, has indicated a significant range of

between 2.5 billion barrels and 5.4 billion barrels of gross

oil-in-place volumes calculated on the P90 to P10 basis, with the

mean resource estimate for the reservoirs in the Aqra/ Bekhme

anticline of 3.9 billion barrels. While this range of resource

estimate is significant, a considerable portion of the oil resource

is likely to comprise heavy oil. Further evaluation would be

required as to whether the oil is commercially recoverable.

DGA's previous assessments of assets on behalf of Gulf Keystone

included independent evaluation of the Shaikan discovery, including

two major upgrades of the gross oil-in-place volumes announced in

April and November 2011, as well as a preliminary evaluation of the

Sheikh Adi resources (1 billion barrels to 3 billion barrels

calculated on the P90 to P10 basis) announced in August 2011.

Akri-Bijeel Block: Aqra-1 Appraisal Well

The first appraisal well to assess the Bijell discovery on the

Akri-Bijeel block, is being drilled 8 km to the north-west of the

Bijell--1 discovery well and 26 km to the west-northwest of the

Bekhme-1 exploration well. After reaching the depth of 989 metres,

the Aqra-1 drilling operations have been temporarily halted in

order to repair the rig following a lightning strike. Once the

drilling operations have resumed, Aqra-1 will drill to an estimated

TD of over 4,700 metres in the Triassic subject to technical

conditions.

Gulf Keystone has a 20 per cent working interest in the

Akri-Bijeel block, operated by Kalegran Ltd., a 100 per cent

subsidiary of MOL Hungarian Oil and Gas Plc., which holds 80 per

cent working interest in the block. The Operator's P50 resource

estimate for the Bijell discovery is 2.4 billion barrels of

oil-in-place, while the ongoing 2012/13 exploration and appraisal

programme is targeting existing and identified hydrocarbon

prospects in the Akri-Bijeel block.

Ber Bahr-1 Exploration Well

After the setting of 7" casing at the depth of 3,343 metres in

the Triassic, the first exploration well on the Ber Bahr block is

drilling at the depth of 3,347 metres.

Gulf Keystone has a 40 per cent working interest in the Ber Bahr

block, operated by Genel Energy, which holds a 40 per cent working

interest in the block. The Kurdistan Regional Government has a 20

per cent carried interest in the Ber Bahr Production Sharing

Contract. The Operator's resource estimate for the Ber Bahr block

is 1.5 billion barrels of oil equivalent-initially-in-place.

John Gerstenlauer, Gulf Keystone's Chief Operating Officer

commented:

"We believe that these new results of the ongoing Shaikan-4 well

testing programme are excellent, confirming our early understanding

that this well may prove to be our best one to date in the

Kurdistan Region of Iraq. We anticipate that future test production

from Shaikan-4 will significantly increase our existing production

level, which reached 6,970 gross barrels of oil per day on 4 March

2012. In parallel to the continuing increase in the test production

of the Shaikan crude, our work on the Shaikan export pipeline

project is progressing. In addition to a number of important

operational developments on the Shaikan block, we are pleased to

report on the progress in the Ber Bahr-1 exploration well drilling

activities and to present results of an independent report by

Dynamic Global Advisors on estimated resources for the Aqra/ Bekhme

anticline on the Akri-Bijeel block. The substantial remaining

potential of the Akri-Bijeel block is currently being targeted by

the Operator's 2012/13 wide-ranging exploration, appraisal and

early development programme."

Enquiries:

Gulf Keystone Petroleum: +44 (0) 20 7514 1400

Todd Kozel, Executive Chairman

and

Chief Executive Officer

Ewen Ainsworth, Finance Director

Strand Hanson Limited +44 (0)20 7409 3494

Simon Raggett / Rory Murphy /

James Harris

Mirabaud Securities LLP +44 (0)20 7878 3362

Peter Krens

Pelham Bell Pottinger +44 (0) 20 7861 3232

Mark Antelme

or visit: www.gulfkeystone.com

John Gerstenlauer, the Company's Chief Operating Officer, who

has 33 years of relevant experience within the sector and meets the

criteria of a qualified person under the AIM note for mining, oil

and gas companies, has reviewed and approved the technical

information contained in this announcement. Mr. Gerstenlauer is a

member of the Society of Petroleum Engineers.

Notes to Editors:

-- Gulf Keystone Petroleum Ltd. (AIM: GKP) is an independent oil

and gas exploration and production company focused on exploration

in the Kurdistan Region of Iraq.

-- Gulf Keystone Petroleum International (GKPI) holds Production

Sharing Contracts for fourexploration blocks in Kurdistan,

including the Shaikan block.

-- Shaikan is a major discovery with independently audited gross

oil-in-place volumes of between 8 billion barrels to 13.4 billion

barrels.

-- The Company's shares have traded on the AIM market of the

London Stock Exchange since listing on 8(th) September 2004.

-- Gulf Keystone Petroleum Limited is registered in Hamilton,

Bermuda with further offices in Erbil, Kurdistan (Iraq), Algiers,

Algeria and London, UK.

-- Gross oil-in-place (or petroleum-initially-in-place) is that

quantity of petroleum that is estimated, as of a given date, to be

contained in known accumulations prior to production. The range of

uncertainty of the oil-in-place (petroleum-initially-in-place)

volumes is represented by a probability distribution with a low,

mid and high provided: P90 represents at least a 90% probability

(high) that the quantities determined to be in place will equal or

exceed the low estimate; P50 represents at least a 50% probability

(mid) that the quantities determined to be in place will equal or

exceed the mid estimate; and P10 represents at least a 10%

probability (low) that the quantities determined to be in place

will equal or exceed the high estimate.

Not for release, publication or distribution, directly or

indirectly, in or into the United States or jurisdictions other

than the United Kingdom and Bermuda where to do so would constitute

a contravention of the relevant laws of such jurisdiction. This

document (and the information contained herein) does not contain or

constitute an offer of securities for sale, or solicitation of an

offer to purchase securities, in the United States or jurisdictions

other than the United Kingdom and Bermuda where to do so would

constitute a contravention of the relevant laws of such

jurisdiction. The securities referred to herein have not been and

will not be registered under the US Securities Act of 1933, as

amended (the "Securities Act"), and may not be offered or sold in

the United States unless the securities are registered under the

Securities Act, or an exemption from the registration requirements

of the Securities Act is available. No public offering of the

securities will be made in the United States.

This information is provided by RNS

The company news service from the London Stock Exchange

END

MSCGGUPWWUPPPWG

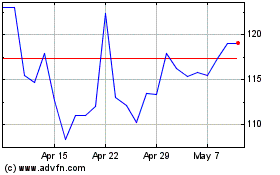

Gulf Keystone Petroleum (LSE:GKP)

Historical Stock Chart

From Jan 2025 to Feb 2025

Gulf Keystone Petroleum (LSE:GKP)

Historical Stock Chart

From Feb 2024 to Feb 2025