Hunting PLC (LSE:HTG), the global engineering group, issues the

following Trading Update for Q1 2024, ahead of its Annual General

Meeting that will take place today at 10:30a.m. BST in London.

Highlights

- Positive start to the year, with EBITDA of c.$28.9 million

during Q1 2024 (Q1 2023 – c.$22.4 million), marginally ahead of

management’s expectations.

- Sales order book remains healthy at c.$544.0 million (Q1 2023 –

c.$492.9 million), with tender pipeline for new OCTG orders

remaining buoyant.

- OCTG and Subsea product groups reporting a good first quarter,

ahead of management’s expectations, as offshore and international

activity continues to be strong.

- Advanced Manufacturing business also reporting a positive

quarter, with a good mix of energy and non-oil and gas sales.

- Perforating Systems has reported a slower first quarter, as US

onshore markets remain soft; however, the outlook for H2 remains

more positive as international activity is projected to drive new

drilling.

- Total cash and bank / (borrowings) of c.$(33.6) million at

quarter-end reflecting new orders, which are driving higher

inventory and receivables.

- Full-year guidance remains unchanged with both EBITDA of

c.$125-135 million and EBITDA margin of 12-13% targeted. EBITDA to

Free Cash Flow conversion of 50% still anticipated for the full

year, driven by increased EBITDA and robust working capital

management.

Commenting on Q1 2024 trading and the market outlook, Hunting’s

Chief Executive, Jim Johnson said:

“The year has started positively for the Group, with Q1 2024

results marginally ahead of management’s expectations, and well

ahead of the Q1 2023 result, which demonstrates the continued

growth momentum of the Group. Our OCTG, Subsea and Advanced

Manufacturing product groups are continuing to see strong momentum

as offshore and international activity remains robust. While

Perforating Systems has had a slow start to the year, H2 2024 is

likely to see stronger activity as increased LNG exports in the US

drive natural gas demand.

“It is particularly pleasing to see our Q1 2024 EBITDA result

surpassing the Q4 2023 result, given the strong result delivered in

the prior quarter, with Subsea being our standout performer this

quarter.

“2024 is likely to be a further year of growth for the industry

driven by geopolitical and macro-economic factors. Therefore,

management remains confident of delivering its current EBITDA

guidance, given the broad-based strength of the global oil and gas

sector.”

Trading Statement

$ million

Q1 2024

Q4 2023

Q1 2023

Sales order book

544.0

565.2

492.9

Revenue

244.9

228.1

211.5

EBITDA

28.9

28.2

22.4

EBITDA margin

12

%

12

%

11

%

Working Capital

469.6

415.9

456.5

Total cash and bank / (borrowings)

(33.6

)

(0.8

)

(59.8

)

EBITDA in Q1 2024 was c.$28.9 million, which compares to c.$22.4

million in Q1 2023 and $28.2 million in Q4 2023. EBITDA margin

remains in line with management’s expectations with full-year

guidance remaining between 12-13%, as product mix, some higher

product pricing and stronger facility utilisation continue to

improve performance.

Driven by the current sales order book, coupled with some

forward purchasing of raw materials associated with imminent

projects, working capital has increased in the quarter. Management

remains confident of delivering a reduction in inventory throughout

the balance of the year, which will release cash and, coupled with

the improved EBITDA, remains focused on delivering an EBITDA to

Free Cash Flow conversion of c.50%. The final dividend recommended

for 2023 of 5.0 cents per share is due for payment on 10 May 2024,

following shareholder approval on 17 April 2024, which will absorb

c.$7.9 million.

The Group’s OCTG product lines have commenced the year strongly,

with activity in North and South America and Asia Pacific supported

by buoyant levels of offshore and international projects. Tender

activity across the Middle East has remained very positive in the

period, which supports the projected revenue growth in this product

line in the short to medium term. OCTG accessories manufacturing

has continued to deliver good results supported by strong activity

in South America, specifically in Guyana and Brazil.

Results for the Group’s Subsea product lines have been strong

during Q1 2024, as orders for titanium and steel stress joints,

hydraulic valves and couplings and flow access modules have

increased, given the strong offshore drilling environment.

The Group’s Advanced Manufacturing product lines continue to

report good growth as energy-related and non-oil and gas sales

momentum continue to increase.

Hunting’s Perforating Systems product lines continue to target

increasing international sales as market activity in South America

and the Middle East continue to improve. The onshore US market has

been less resilient in the period due, in part, to the lower

activity and soft pricing for natural gas. However, activity levels

are projected to improve in the second half of the year as new LNG

capacity comes on stream in the US, which will support higher

exports.

In summary, the majority of the Group’s product lines have

reported a positive start to the year, leading to management

retaining its full-year EBITDA guidance of $125-135 million.

Directorate Change

As previously announced, Jay Glick, Company Chair, will be

retiring as a Director at the conclusion of the AGM with Stuart

Brightman succeeding Mr Glick as Hunting PLC’s Company Chair.

The Board thanks Jay for his services to the Company since 2015,

chairing the Company from 2017 and overseeing the Group through the

COVID-19 pandemic and subsequent recovery. Jay has overseen the

rollout of the Hunting 2030 Strategy which was launched at the

Company’s Capital Markets Day in 2023 and which continues to be

executed by management.

Date of H1 2024 Trading Statement

Hunting PLC’s next Trading Statement will be announced on Monday

8 July 2024.

Notes to Editors:

About Hunting PLC

Hunting is a global engineering group that provides

precision-engineered equipment and premium services, which add

value for our customers. Established in 1874, it is a premium

listed public company traded on the London Stock Exchange. The

Company maintains a corporate office in Houston and is

headquartered in London. As well as the United Kingdom, the Company

has operations in China, Indonesia, Mexico, Netherlands, Norway,

Saudi Arabia, Singapore, United Arab Emirates and the United States

of America.

The Group reports in US dollars across five operating segments:

Hunting Titan; North America; Subsea Technologies; Europe, Middle

East and Africa (“EMEA”) and Asia Pacific.

Hunting PLC’s Legal Entity Identifier is

2138008S5FL78ITZRN66.

View source

version on businesswire.com: https://www.businesswire.com/news/home/20240416045568/en/

Hunting PLC Jim Johnson, Chief Executive Bruce Ferguson,

Finance Director Tel: +44 (0) 20 7321 0123

Buchanan Ben Romney Barry Archer Tel: +44 (0) 20 7466

5000

or

lon.IR@hunting-intl.com

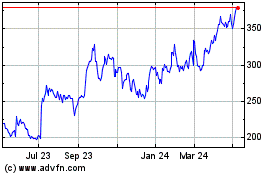

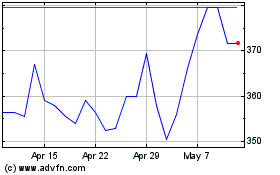

Hunting (LSE:HTG)

Historical Stock Chart

From Jan 2025 to Feb 2025

Hunting (LSE:HTG)

Historical Stock Chart

From Feb 2024 to Feb 2025