ICG Enterprise Trust Plc: Unaudited Interim Results for the six

months ended 31 July 2024

ICG Enterprise Trust plc

Unaudited Interim Results for the six months ended 31 July 2024

8 October 2024

| |

|

|

| |

|

|

| |

|

|

| |

|

|

| |

Highlights

- NAV per Share of

1,946p at 31 July 2024, NAV per Share Total Return* of 2.8% in the

period (5 year annualised: 12.5%)

- Portfolio Return*

on a Local Currency Basis of 3.8% (Sterling return 2.6%) for the

six months in the period

- Portfolio companies

reporting ~14% LTM earnings growth1

- Third consecutive

six-month period of higher new investment levels

- Nine Full Exits in the period

generating proceeds of £48.7m and representing a weighted-average

Uplift to Carrying Value of 25.8%

- Q2 dividend of 8.5p

per share, taking total dividends for H1 FY25 to 17p (H1 FY24:

16p). The Board's intention remains to pay total dividends of at

least 35p per share for FY25, an increase of 6% on FY24

- Buybacks continue

to be executed: £21m returned in H1 FY25 at a weighted-average

discount to NAV of 37.8% across both long-term (£11m) and

opportunistic (£10m) programmes, in aggregate increasing NAV per

share by 19p (~1%)

- The Board welcomes the recent

announcement by the FCA regarding costs and the Manager is

reviewing ICG Enterprise Trust's disclosures as a result

1 Based on Enlarged Perimeter covering 63% of the Portfolio. See

page 9.

*This is an Alternative Performance Measure. Please refer to the

Glossary for the definition.

|

|

| |

Oliver Gardey |

|

|

| |

Head of Private

Equity Fund Investments, ICG |

|

|

| |

|

For the six months to

31 July 2024 our Portfolio Return on a Local Currency Basis was

3.8% and we report a NAV per Share of 1,946p at period end.

During the period we invested £104m into new transactions. These

included supporting Datasite, Visma and Audiotonix – highlighting

our ability to invest in companies that benefit from long-term

structural growth trends in areas such as digital transformation

and tech-enabled business services.

We are experiencing an increased level of transaction activity.

This is the third six-month period of sequentially higher new

investments. And as our portfolio companies are realised we are

generating meaningful value: we had nine Full Exits in the period

that were realised at a weighted-average uplift to carrying value

of 25.8%.

Over the last five years – a period that encompasses COVID-19,

inflation, interest rate hikes and geopolitical uncertainty – our

Portfolio has delivered attractive growth; our NAV per Share Total

Return has been 80%; and we have enhanced our shareholder

distribution policy.

I am confident in the transatlantic Portfolio we have constructed.

I believe our strategy to invest in profitable, cash generative

middle market companies positions us well to deliver attractive

returns for our shareholders.

|

|

PERFORMANCE OVERVIEW

| |

|

|

|

Annualised |

|

Performance to 31 July 2024 |

3 months |

6 months |

1 year |

3 years |

5 years |

10 years |

|

Portfolio Return on a Local Currency Basis |

3.2% |

3.8% |

5.9% |

11.5% |

15.9% |

13.6% |

| NAV per Share Total

Return |

1.6% |

2.8% |

4.0% |

10.3% |

12.5% |

13.2% |

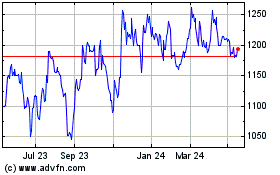

| Share Price Total Return |

11.4% |

10.3% |

17.3% |

10.1% |

11.7% |

11.5% |

| FTSE All-Share Index Total

Return |

4.3% |

11.8% |

13.5% |

8.3% |

5.8% |

6.3% |

|

Half-year ended: |

Jul 2020 |

Jul 2021 |

Jul 2022 |

Jul 2023 |

Jul 2024 |

Fund performance

|

Portfolio return (local currency) |

(3.6)% |

14.9% |

7.4% |

4.6% |

3.8% |

|

Portfolio return (sterling) |

0.1% |

12.8% |

12.4% |

1.6% |

2.6% |

|

NAV |

£775m |

£1,044m |

£1,269m |

£1,290m |

£1,274m |

|

NAV per Share Total Return (%) |

(1.0)% |

11.1% |

10.9% |

0.8% |

2.8% |

|

|

|

|

|

|

|

|

Investment activity

|

New

Investments |

£52m |

£133m |

£144m |

£64m |

£104m |

| As %

opening Portfolio |

6% |

14% |

12% |

5% |

8% |

| Total

Proceeds |

£94m |

£185m |

£107m |

£94m |

£86m |

| As %

opening Portfolio |

12% |

19% |

9% |

7% |

6% |

|

|

|

|

|

|

|

|

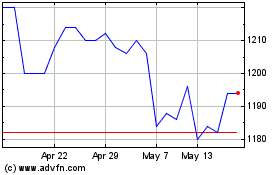

Shareholder experience

|

Closing

share price |

790p |

1,084p |

1,166p |

1,174p |

1,340p |

| Total

dividends per share for HY |

10p |

12p |

14p |

16p |

17p |

| Share

Price Total Return |

(16.9)% |

13.7% |

(1.6)% |

2.9% |

10.3% |

| Total

shareholder distributions |

£10m |

£12m |

£15m |

£17m |

£33m |

| - o/w

distributions dividends (%) |

92% |

78% |

100% |

63% |

34% |

| - o/w

distributions buybacks (%) |

8% |

22% |

—% |

37% |

66% |

| Total

shareholder distributions as % |

|

|

|

|

|

| - Total Proceeds |

10% |

7% |

14% |

18% |

38% |

| - Opening NAV |

1.2% |

1.3% |

1.3% |

1.3% |

2.5% |

| Portfolio activity

overview for H1 FY25 |

Primary |

Direct |

Secondary |

Total |

ICG-managed |

| Local Currency return |

3.6% |

5.0% |

2.5% |

3.8% |

2.1% |

| Sterling return |

2.4% |

3.7% |

1.4% |

2.6% |

1.0% |

| New Investments |

£58m |

£44m |

£3m |

£104m |

£17m |

| Total Proceeds |

£51m |

£9m |

£26m |

£86m |

£50m |

|

New Fund Commitments |

£52m |

- |

£20m |

£72m |

£20m |

|

Closing Portfolio value |

£739m |

£444m |

£219m |

£1,402m |

£410m |

|

% Total Portfolio |

52.7% |

31.7% |

15.6% |

100.0% |

29.2% |

COMPANY TIMETABLE

A presentation for investors and analysts will be held at 10:00 GMT

today. A link for the presentation can be found on the Results

& Reports page of the Company website. A recording of the

presentation will be made available on the Company website after

the event.

| |

FY25 Second Interim Dividend |

| Ex-dividend date |

14 November 2024 |

| Record date |

15 November 2024 |

| Dividend payment date |

29 November 2024 |

ENQUIRIES

Institutional investors and analysts:

Martin Li,

Shareholder Relations

+44 (0) 20 3545 1816

Nathan Brown, Deutsche Numis

+44 (0) 20 7260 1426

David Harris, Cadarn

Capital +44

(0) 20 7019 9042

Media: Cat

Armstrong, Corporate

Communications +44

(0) 20 3545 1850

ABOUT ICG ENTERPRISE TRUST

ICG Enterprise Trust is a leading listed private

equity investor focused on creating long-term growth by delivering

consistently strong returns through selectively investing in

profitable, cash-generative private companies, primarily in Europe

and the US, while offering the added benefit to shareholders of

daily liquidity.

We invest in companies directly as well as

through funds managed by Intermediate Capital Group ('ICG') and

other leading private equity managers who focus on creating

long-term value and building sustainable growth through active

management and strategic change.

NOTES

Included in this document are Alternative

Performance Measures (“APMs”). APMs have been used if considered by

the Board and the Manager to be the most relevant basis for

shareholders in assessing the overall performance of the Company,

and for comparing the performance of the Company to its peers and

its previously reported results. The Glossary includes further

details of APMs and reconciliations to International Financial

Reporting Standards (“IFRS”) measures, where appropriate.

In the Manager’s Review and Supplementary

Information, all performance figures are stated on a Total Return

basis (i.e. including the effect of re-invested dividends). ICG

Alternative Investment Limited, a regulated subsidiary of

Intermediate Capital Group plc, acts as the Manager of the

Company.

DISCLAIMER

The information contained herein and on the

pages that follow does not constitute an offer to sell, or the

solicitation of an offer to acquire or subscribe for, any

securities in any jurisdiction where such an offer or solicitation

is unlawful or would impose any unfulfilled registration,

qualification, publication or approval requirements on ICG

Enterprise Trust PLC (the "Company") or its affiliates or agents.

Equity securities in the Company have not been and will not be

registered under the applicable securities laws of the United

States, Australia, Canada, Japan or South Africa (each an “Excluded

Jurisdiction”). The equity securities in the Company referred to

herein and on the pages that follow may not be offered or sold

within an Excluded Jurisdiction, or to any U.S. person ("U.S.

Person") as defined in Regulation S under the U.S. Securities Act

of 1933, as amended (the "U.S. Securities Act"), or to any

national, resident or citizen of an Excluded Jurisdiction.

The information on the pages that follow may

contain forward looking statements. Any statement other than a

statement of historical fact is a forward looking statement. Actual

results may differ materially from those expressed or implied by

any forward looking statement. The Company does not undertake any

obligation to update or revise any forward looking statements. You

should not place undue reliance on any forward looking statement,

which speaks only as of the date of its issuance.

CHAIR’S FOREWORD

ICG Enterprise Trust has delivered a 2.8% NAV

per Share Total Return and 10.3% Share Price Total Return in the

first half of the year. This solid NAV per Share growth and

sustained returns for our shareholders, in a half-year with

continued economic and political headwinds, is supported by robust

underlying earnings growth (LTM EBITDA growth1: 14%), an

active capital allocation policy and prudent balance sheet

management.

Over the five years to 31 July 2024, the

investment strategy has generated an annualised NAV per Share Total

Return of 12.5% and Share Price Total Return of 11.7%. The

volatility of our share price has reduced over this time period and

liquidity has increased. I believe these factors enable ICG

Enterprise Trust to have an increasingly meaningful role in an

investor’s long-term portfolio.

Capital allocation remains a priority for the

Board and in this period we returned £33m (2.5% of opening NAV) to

shareholders through:

- Dividends: we

remain committed to a progressive dividend policy, announcing today

a Q2 dividend of 8.5p per share and reaffirming the Board’s

intention to pay total dividends of at least 35p per share for

FY25;

- Long-term share

buyback programme: returned £11m across 46 separate trading days at

a weighted-average discount to NAV of 38.3%; and

- FY25

opportunistic share buyback programme: returned £10m across four

separate trading days at a weighted-average discount to NAV of

37.2%.

The combined buyback programmes in aggregate

increased NAV per Share by 19p (~1%) during the period.

We are pleased to see a continued increase in

shareholder engagement, and the evolution in recent quarters of our

sales and marketing programme is yielding benefits. I enjoyed

meeting a number of shareholders at our Shareholder Seminar in

June, and look forward to more engagement before year-end.

The Board welcomes the new FCA announcement on

reporting of costs, and as a result the Manager is reviewing ICG

Enterprise Trust's disclosures.

As we look to the second half of the financial

year and beyond, geopolitical headwinds persist. However, the Board

maintains its positive outlook that private equity remains a strong

engine of growth to outperform public markets.

Jane Tufnell

Chair

7 October 2024

MANAGER’S REVIEW

Alternative Performance Measures

The Board and the Manager monitor the financial performance of the

Company on the basis of Alternative Performance Measures (APM),

which are non-IFRS measures. The APM predominantly form the basis

of the financial measures discussed in this review, which the Board

believes assists shareholders in assessing their investment and the

delivery of the investment strategy.

The Company holds certain investments in

subsidiary entities. The substantive difference between APM and

IFRS is the treatment of the assets and liabilities of these

subsidiaries. The APM basis “looks through” these subsidiaries to

the underlying assets and liabilities they hold, and it reports the

investments as the Portfolio APM. Under IFRS, the Company and its

subsidiaries are reported separately. The assets and liabilities of

the subsidiaries are presented on the face of the IFRS balance

sheet as a single carrying value. The same is true for the IFRS and

APM basis of the Cash flow statement.

The following table sets out IFRS metrics and

the APM equivalents:

|

IFRS (£m) |

31 July 2024 |

31 July 2023 |

APM (£m) |

31 July 2024 |

31 July 2023 |

|

Investments |

1,362.0 |

1,342.7 |

Portfolio |

1,401.8 |

1,398.8 |

|

NAV |

1,273.5 |

1,290.3 |

|

|

|

|

Cash flows from the sale of portfolio investments |

9.3 |

15.7 |

Total Proceeds |

86.4 |

94.1 |

|

Cash flows related to the purchase of portfolio investments |

23.3 |

15.5 |

Total New Investment |

104.4 |

64.1 |

|

|

|

|

|

|

|

The Glossary includes definitions for all APM

and, where appropriate, a reconciliation between APM and IFRS.

Our investment strategy

We focus on investing in buyouts of profitable, cash-generative

businesses in developed markets that exhibit defensive growth

characteristics which we believe support strong and resilient

returns across economic cycles.

We take an active approach to portfolio

construction, with a flexible mandate that enables us to deploy

capital in Primary, Secondary and Direct investments.

Geographically we focus on the developed markets of North America

and Europe which have deep and mature private equity markets

supported by a robust corporate governance ecosystem.

|

|

Medium-term target |

Five-year average |

31 July 2024 |

|

1. Target Portfolio composition

1 |

|

|

|

| Investment category |

|

|

|

| Primary |

~50% |

59% |

52% |

| Direct |

~25% |

28% |

32% |

| Secondary |

~25% |

13% |

16% |

| Geography2 |

|

|

|

| North America |

~50% |

42% |

44% |

| Europe (inc. UK) |

~50% |

51% |

49% |

| Other |

— |

7% |

7% |

| |

|

|

|

| 2. Balance

sheet |

|

|

|

| Net cash/(Net

debt)3 |

~0% |

—% |

(6)% |

1 As percentage of Portfolio; 2 As percentage of Portfolio; 3 Net

cash/(net debt) as a percentage of NAV

Note: five year average is the linear average of FY exposures for

FY21 - FY24 and H1 FY25 |

ICG Enterprise Trust benefits from access to

ICG-managed funds and Direct investments, which represented 29.2%

of the Portfolio value at period end and generated a 2.1% return on

a local currency basis.

Performance overview

At 31 July 2024, our Portfolio was valued at

£1,402m, and the Portfolio Return on a Local Currency Basis for the

first half of the financial year was 3.8% (H1 FY24: 4.6%).

Due to the geographic diversification of our

Portfolio, the reported value is impacted by changes in foreign

exchange rates. During the period, FX movements affected the

Portfolio negatively by £(16.1)m, driven by Sterling appreciation

versus both the Euro and US Dollar. In Sterling terms, Portfolio

growth during the period was 2.6%.

The net result for shareholders was that ICG

Enterprise Trust generated a NAV per Share Total Return of 2.8%

during H1 FY25, ending the period with a NAV per Share of

1,946p.

Movement in the Portfolio

£m |

Six months to

31 July 2024 |

Six months to

31 July 2023 |

|

Opening

Portfolio1 |

1,349 |

1,406 |

|

Total New Investments |

104 |

64 |

|

Total Proceeds |

(86) |

(94) |

| Portfolio net cashflow |

18 |

(30) |

| Valuation

movement2 |

51 |

65 |

|

Currency movement |

(16) |

(43) |

|

Closing Portfolio |

1,402 |

1,399 |

1 Refer to the Glossary

2 90.3% of the Portfolio is valued using 30 June 2024 (or later)

valuations (2023: 92.4%) |

|

NAV per Share Total Return |

Six months to

31 July 2024 |

Six months to

31 July 2023 |

|

% Portfolio growth (local currency) |

3.8% |

4.6% |

| % currency movement |

(1.2)% |

(3.0%) |

| % Portfolio growth

(Sterling) |

2.6% |

1.6% |

| Impact of (net cash)/net

debt |

0.1% |

0.1% |

| Management fee and other

expenses |

(0.9)% |

(1.0)% |

| Co-investment Incentive Scheme

Accrual |

(0.1)% |

(0.2)% |

| Impact

of share buybacks and dividend reinvestment |

1.0% |

0.3% |

|

NAV per Share Total Return |

2.8% |

0.8% |

For Q2 the Portfolio Return on a Local Currency

Basis was 3.2% and the NAV per Share Total Return was 1.6%.

Executing our investment strategy

Commitments

in the period |

Total New Investments

in the period |

Growth

in the period |

Total Proceeds

in the period |

|

Making commitments to funds, which expect to be drawn over 3 to

5 years |

Cash deployments into portfolio companies, either through funds

or directly |

Driving growth and value creation of our portfolio

companies |

Cash realisations of investments in Portfolio companies, plus

Fund Disposals |

£72m

(H1 FY24: £110m) |

£104m

(H1 FY24: £64m) |

£51m

(H1 FY24: £65m) |

£86m

(H1 FY24: £94m) |

Commitments

Our evergreen structure and flexible investment mandate enables us

to commit through the cycle, maintaining vintage diversification

for our Portfolio and sowing the seeds for future growth.

During the period we made five new fund

Commitments totalling £72.0m, including £19.8m to funds managed by

ICG plc, as detailed below:

|

Fund |

Manager |

Commitment during the period |

|

|

|

Local currency |

£m |

| ICG Strategic Equity V |

ICG |

$25.0m |

£19.8m |

| Investindustrial VIII |

Investindustrial |

€15.0m |

£12.9m |

| Leeds VIII |

Leeds Equity |

$20.0m |

£15.7m |

| Oak Hill VI |

Oak Hill |

$15.0m |

£11.9m |

| Thoma Bravo XVI |

Thoma Bravo |

$15.0m |

£11.7m |

At 31 July 2024, ICG Enterprise Trust had

outstanding Undrawn Commitments of £575m:

|

Movement in outstanding Commitments |

Six months to 31 July 2024 (£m) |

|

Undrawn Commitments as at 1 February 2024 |

552 |

| New Fund Commitments |

72 |

| New Commitments relating to

Co-investments |

54 |

| Drawdowns |

(104) |

|

Currency and other movements, including repayment of commitments

which can be reinvested |

2 |

|

Undrawn commitments as at 31 July 2024 |

575 |

Total Undrawn Commitments at 31 July 2024

represented £452m of Undrawn Commitments to funds within their

Investment Periods, with £123m to funds outside their Investment

Periods.

|

|

31 July 2024

£m |

31 July 2023

£m |

|

Undrawn Commitments – funds in Investment Period |

452 |

429 |

| Undrawn

Commitments – funds outside Investment Period |

123 |

119 |

|

Total Undrawn Commitments |

575 |

549 |

| Total

available liquidity (including facility) |

(126) |

(159) |

|

Overcommitment net of total available

liquidity |

449 |

390 |

|

Overcommitment % of net asset value |

35.3% |

30.2% |

Commitments are made in the funds' underlying

currencies. The currency split of the undrawn commitments at 31

July 2024 was as follows:

| |

31 July 2024 |

31 July 2023 |

| Undrawn

Commitments |

£m |

% |

£m |

% |

| US Dollar |

325 |

56.6% |

272 |

49.4% |

| Euro |

221 |

38.4% |

261 |

47.6% |

|

Sterling |

29 |

5.0% |

16 |

3.0% |

|

Total |

575 |

100.0% |

549 |

100.0% |

Investments

Total new investments of £104m during the period, of which 16%

(£17.0m) were alongside ICG. New investment by category detailed in

the table below:

|

Investment Category |

Cost (£m) |

% of New Investments |

|

Primary |

£57.8m |

55.4% |

|

Direct |

£43.8m |

42.0% |

|

Secondary |

£2.7m |

2.6% |

|

Total |

£104.4m |

100.0% |

The five largest underlying new investments in

the period were as follows:

|

Investment |

Description |

Manager |

Country |

Cost £m1 |

|

Datasite |

Provider of SaaS software focused on virtual data rooms |

ICG |

United States |

24.6 |

| Visma |

Provider of business

management software and outsourcing services |

HgCapital |

Norway |

14.9 |

| Audiotonix |

Manufacturer of audio mixing

consoles |

PAI Partners |

United Kingdom |

12.8 |

| Eque2 |

Developer of enterprise

resource planning software intended for construction and

contracting industries |

Bowmark |

United Kingdom |

3.4 |

|

Multiversity |

Provider of online higher education |

CVC |

Italy |

2.9 |

|

Total of top 5 largest underlying new

investments |

58.6 |

1 Represents ICG Enterprise Trust's indirect

investment (share of fund cost) plus any direct investments in the

period.

Growth

The portfolio grew by £51 million (+3.8%) on a Local Currency Basis

in the six months to 31 July 2024.

Growth across the Portfolio was split as follows:

- By investment type: growth was

spread across Primary (3.6%), Secondary (2.5%) and Direct

(5.0%)

- By geography: North America and

Europe experienced similar growth

The growth in the Portfolio is underpinned by

the performance of our Portfolio companies, which delivered robust

financial performance during the period:

|

|

Top 30 |

Enlarged Perimeter |

|

Portfolio coverage |

40% |

63% |

|

Last Twelve Months ('LTM') revenue growth |

6.8% |

9.4% |

|

LTM EBITDA growth |

10.4% |

13.9% |

|

Net Debt / EBITDA |

4.3x |

4.4x |

|

Enterprise Value / EBITDA |

15.3x |

14.9x |

|

Note: values are weighted averages for the respective portfolio

segment; see Glossary for definition and calculation

methodology |

Quoted company exposure

We do not actively invest in publicly quoted

companies but gain listed investment exposure when IPOs are used as

a route to exit an investment. In these cases, exit timing

typically lies with the manager with whom we have invested.

At 31 July 2024, ICG Enterprise Trust’s exposure

to quoted companies was valued at £60m, equivalent to 4.3% of the

Portfolio value (31 January 2024: 4.8%). Across the Portfolio,

quoted positions resulted in a £4m increase in Portfolio NAV during

the period. The share price of our largest listed exposure, Chewy,

increased by 36% in local currency (USD) during the period. This

positively impacted the Portfolio Return on a Local Currency Basis

by approximately 0.5%.

At 31 July 2024 Chewy was the only quoted

investment that individually accounted for 0.5% or more of the

Portfolio value:

|

Company |

Ticker |

31 July 2024

% of Portfolio value |

|

Chewy |

CHWY-US |

1.6% |

|

Other companies |

|

2.7% |

|

Total |

|

4.3% |

Realisations

During the first half of FY25, the ICG Enterprise Trust Portfolio

generated Total Realisation Proceeds of £86m.

Realisation activity during the period included

nine Full Exits generating proceeds of £48.7m. These were completed

at a weighted average Uplift to Carrying Value of 25.8% and

represent a weighted average Multiple to Cost of 3.1x for those

investments.

The five largest underlying realisations in the period were as

follows:

|

Realisation |

Description |

Manager |

Country |

Proceeds £m |

|

Vettafi |

Provider of financial indices and data |

ICG |

United States |

10.3 |

| Visma |

Provider of business

management software |

ICG |

Norway |

8.2 |

| Datasite |

Provider of SaaS software focused

on virtual data rooms |

ICG |

United States |

7.8 |

| Compass Community |

Provider of children's fostering

services |

Graphite |

United Kingdom |

7.4 |

| Iris |

Provider of software for the

accountancy and payroll sectors |

ICG |

United Kingdom |

7.0 |

|

Total of 5 largest underlying realisations |

|

40.7 |

Balance sheet and liquidity

Net assets at 31 July 2024 were £1,274m, equal

to 1,946p per share.

At 31 July 2024, the drawn debt was £93.3m (31

January 2024: £20.0m), resulting in a net debt position of £76.4m

(31 January 2024: £8.8m). At 31 July 2024, the Portfolio

represented 110.1% of net assets (31 January 2024: 105.1%).

|

|

£m |

% of net assets |

|

Portfolio |

1,402 |

110.1% |

| Cash |

17 |

1.3% |

| Drawn debt |

(93) |

(7.3%) |

| Co-investment Incentive Scheme

Accrual |

(47) |

(3.7%) |

| Other

net current liabilities |

(5) |

(0.4%) |

|

Net assets |

1,274 |

100.0% |

Our objective is to be fully invested through

the cycle, while ensuring that we have sufficient financial

resources to be able to take advantage of attractive investment

opportunities as they arise.

At 31 July 2024, ICG Enterprise Trust had a cash

balance of £16.9m (31 January 2024: £11.2m) and total available

liquidity of £125.7m (31 January 2024: £195.9m).

|

|

£m |

|

Cash at 31 January 2024 |

11 |

|

Total Proceeds |

86 |

|

New investments |

(104) |

|

Debt drawn down |

74 |

| Shareholder returns |

(33) |

| Management fees |

(8) |

| FX and

other expenses |

(10) |

|

Cash at 31 July 2024 |

17 |

|

Available undrawn debt facilities |

109 |

|

Total available liquidity |

126 |

Dividend and share buyback

ICG Enterprise Trust has a progressive dividend policy alongside

two share buyback programmes to return capital to shareholders.

Progressive dividend policy (since

2017)

The Board has declared a dividend of 8.5p per share in respect of

the second quarter, taking total dividends for the period to 17p

(H1 FY24: 16p). It remains the Board's intention to declare total

dividends of at least 35p per share for the financial year,

implying an increase of 6% on the previous financial year (FY24:

33p).

Long-term share buyback programme (since

2022)

The following purchases have been made under the Company's

long-term share buyback programme:

|

Buyback activity summary |

H1 FY25 |

Since 19 October

20221 |

|

Number of shares purchased |

920,000 |

2,432,188 |

|

Aggregate consideration |

£11.0m |

£28.5m |

|

Weighted average discount to last reported NAV |

38.3% |

38.7% |

1 Being

the date the long-term share buyback programme was announced, up to

and including 1 October 2024

Note: aggregate consideration excludes commission, PTM and

SDRT |

The Board believes the buyback programme

demonstrates the Manager’s discipline around capital allocation;

underlines the Board’s confidence in the long-term prospects of the

Company, its cashflows and NAV; will enhance the NAV per share;

and, over time, may positively influence the volatility of the

Company’s discount and its trading liquidity.

Opportunistic share buyback programme (since

May 2024)

During the period, the Board announced an opportunistic share

buyback programme for FY25 of up to £25m. This will enable us to

take advantage of current trading levels, when the ability to

purchase shares in meaningful size at a significant discount

presents itself. The following purchases have been made under this

programme:

|

Buyback activity summary |

H1 FY25 |

Since 8 May 20241 |

|

Number of shares purchased |

835,000 |

993,000 |

|

Aggregate consideration |

£10.0m |

£11.9m |

|

Weighted average discount to last reported NAV |

37.2% |

37.2% |

1 Being

the date the opportunistic share buyback programme was announced,

up to and including 1 October 2024

Note: aggregate consideration excludes commission, PTM and

SDRT |

Foreign exchange rates

The details of relevant FX rates applied in this report are

provided in the table below:

| |

Average rate 6 months to |

Period end rate |

|

|

31 July 2024 |

31 July 2023 |

31 July 2024 |

31 July 2023 |

|

GBP:EUR |

1.1738 |

1.1465 |

1.1875 |

1.1671 |

| GBP:USD |

1.2678 |

1.2445 |

1.2856 |

1.2836 |

| EUR:USD |

1.0801 |

1.0854 |

1.0826 |

1.0997 |

Activity since the period end

Notable activity between 1 August 2024 and 31 August 2024

included:

- No new fund commitments

- New investments of £3.5m

- Realisation Proceeds of £9.2m

ICG Private Equity Fund Investments Team

7 October 2024

SUPPLEMENTARY INFORMATION

This section presents supplementary information

regarding the Portfolio (see Manager’s Review and the Glossary for

further details and definitions).

Portfolio composition

|

Portfolio by calendar year of investment |

% of value of underlying investments

31 July 2024 |

% of value of underlying investments

31 July 2023 |

| 2024 |

6.7% |

—% |

| 2023 |

7.4% |

2.3% |

| 2022 |

17.7% |

17.0% |

| 2021 |

26.2% |

27.4% |

| 2020 |

9.5% |

10.7% |

| 2019 |

11.6% |

12.7% |

| 2018 |

8.0% |

10.7% |

| 2017 |

2.6% |

6.2% |

| 2016 |

2.9% |

4.0% |

| 2015

and older |

7.4% |

9.0% |

|

Total |

100.0% |

100.0% |

|

Portfolio by sector |

% of value of underlying investments

31 July 2024 |

% of value of underlying investments

31 July 2023 |

|

TMT |

28.7% |

24.1% |

| Consumer goods and

services |

18.3% |

20.9% |

| Healthcare |

10.7% |

13.2% |

| Business services |

12.9% |

12.9% |

| Industrials |

8.2% |

8.1% |

| Education |

5.3% |

5.4% |

| Financials |

7.6% |

6.0% |

| Leisure |

4.4% |

4.8% |

|

Other |

3.9% |

4.6% |

|

Total |

100.0% |

100.0% |

|

Portfolio by fund currency1 |

31 July 2024

£m |

31 July 2024

% |

31 July 2023

£m |

31 July 2023

% |

| US Dollar |

701.0 |

50.0% |

671.3 |

48.0% |

| Euro |

566.2 |

40.4% |

612.0 |

43.8% |

| Sterling |

134.6 |

9.6% |

115.2 |

8.2% |

|

Other |

0.0 |

—% |

0.3 |

—% |

|

Total |

1,401.8 |

100.0% |

1,398.8 |

100.0% |

| 1 Currency

exposure by reference to the reporting currency of each fund . |

Portfolio Dashboard

The tables below provide disclosure on the

composition and dispersion of financial and operational performance

for the Top 30 and the Enlarged Perimeter. At 31 July 2024, the Top

30 Companies represented 40% of the Portfolio by value and the

Enlarged Perimeter represented 63% of total Portfolio value. This

information is prepared on a value-weighted basis, based on

contribution to Portfolio value at 31 July 2024.

| |

% of value at 31 July 2024 |

|

Sector exposure |

Top 30 |

Enlarged Perimeter |

|

TMT |

33.0% |

28.6% |

| Industrials |

16.0% |

9.0% |

| Consumer goods and

services |

15.7% |

18.1% |

| Business services |

10.8% |

14.8% |

| Healthcare |

8.2% |

10.3% |

| Leisure |

6.9% |

5.4% |

| Education |

6.0% |

6.4% |

| Financials |

3.4% |

4.1% |

|

Other |

— % |

3.3% |

|

Total |

100.0% |

100.0% |

| |

% of value at 31 July 2024 |

|

Geographic exposure1 |

Top 30 |

Enlarged Perimeter |

|

North America |

40.3% |

43.5% |

| Europe |

53.6% |

52.1% |

|

Other |

6.1% |

4.4% |

|

Total |

100.0% |

100.0% |

|

1 Geographic exposure is calculated by reference to the location of

the headquarters of the underlying Portfolio companies |

| |

|

% of value at 31 July 2024 |

|

LTM revenue growth |

Top 30 |

Enlarged Perimeter |

| <0% |

20.2% |

21.0% |

| 0-10% |

48.6% |

38.9% |

| 10-20% |

25.9% |

24.5% |

| 20-30% |

5.3% |

8.8% |

| >30% |

—% |

4.1% |

|

n.a. |

—% |

2.6% |

|

Weighted average |

6.8% |

9.4% |

|

Note: for consistency, any excluded investments are excluded for

all dispersion analysis. |

| |

|

% of value at 31 July 2024 |

|

LTM EBITDA growth |

Top 30 |

Enlarged Perimeter |

| <0% |

21.4% |

22.7% |

| 0-10% |

23.2% |

20.1% |

| 10-20% |

31.4% |

26.2% |

| 20-30% |

11.1% |

11.1% |

| >30% |

13.0% |

17.0% |

|

n.a |

—% |

2.9% |

|

Weighted average |

10.4% |

13.9% |

Note: for consistency, any excluded investments are excluded for

all dispersion analysis.

|

| |

|

% of value at 31 July 2024 |

|

EV/EBITDA multiple |

Top 30 |

Enlarged Perimeter |

| 0-10x |

8.3% |

10.3% |

| 10-12x |

25.9% |

21.6% |

| 12-13x |

2.5% |

4.5% |

| 13-15x |

22.5% |

21.2% |

| 15-17x |

18.9% |

18.0% |

| 17-20x |

5.4% |

7.8% |

| >20x |

16.5% |

13.3% |

|

n.a. |

—% |

3.4% |

|

Weighted average |

15.3x |

14.9x |

Note: for consistency, any excluded investments are excluded for

all dispersion analysis.

|

| |

|

% of value at 31 July 2024 |

|

Net Debt / EBITDA |

Top 30 |

Enlarged Perimeter |

| <2x |

23.6% |

18.5% |

| 2-4x |

20.0% |

21.0% |

| 4-5x |

8.1% |

12.5% |

| 5-6x |

13.8% |

14.9% |

| 6-7x |

18.5% |

15.2% |

| >7x |

16.1% |

14.1% |

|

n.a. |

—% |

3.8% |

|

Weighted average |

4.3x |

4.4x |

|

Note: for consistency, any excluded investments are excluded for

all dispersion analysis. |

Top 30 companies

The table below presents the 30 companies in which ICG

Enterprise Trust had the largest investments by value at 31 July

2024. The valuations are gross of underlying managers fees and

carried interest.

| |

Company |

Manager |

Year of investment |

Country |

Value as a % of Portfolio |

| 1 |

Minimax |

|

|

|

|

| |

Supplier of fire protection

systems and services |

ICG |

2018 |

Germany |

3.4% |

| 2 |

Froneri |

|

|

|

|

| |

Manufacturer and distributor of

ice cream products |

PAI Partners |

2013 / 2019 |

United Kingdom |

2.5% |

| 3 |

Datasite Global

Corporation |

|

|

|

|

| |

Provider of SaaS software focused

on virtual data rooms |

ICG |

2024 |

United States |

2.1% |

| 4 |

Leaf Home

Solutions |

|

|

|

|

| |

Provider of home maintenance

services |

Gridiron |

2016 |

United States |

1.7% |

| 5 |

Visma |

|

|

|

|

| |

Provider of business management

software and outsourcing services |

Hg/

ICG |

2024 |

Norway |

1.7% |

| 6 |

Chewy |

|

|

|

|

| |

Retailer of pet products and

services |

BC Partners |

2014 / 2015 |

United States |

1.6% |

| 7 |

European Camping

Group |

|

|

|

|

| |

Operator of premium campsites and

holiday parks |

PAI Partners |

2021 / 2023 |

France |

1.6% |

| 8 |

Newton |

|

|

|

|

| |

Provider of management consulting

services |

ICG |

2021 / 2022 |

United Kingdom |

1.5% |

| 9 |

Precisely |

|

|

|

|

| |

Provider of enterprise

software |

Clearlake/

ICG |

2021 / 2022 |

United States |

1.4% |

| 10 |

Curium

Pharma |

|

|

|

|

| |

Supplier of nuclear medicine

diagnostic pharmaceuticals |

ICG |

2020 |

United Kingdom |

1.4% |

| 11 |

Davies

Group |

|

|

|

|

| |

Provider of speciality business

process outsourcing services |

BC Partners |

2021 |

United Kingdom |

1.4% |

| 12 |

IRI 2 |

|

|

|

|

| |

Provider of mission-critical data

and predictive analytics to consumer goods manufacturers |

New Mountain |

2022 |

United States |

1.3% |

| 13 |

PSB Academy |

|

|

|

|

| |

Provider of private tertiary

education |

ICG |

2018 |

Singapore |

1.2% |

| 14 |

Ambassador Theatre

Group |

|

|

|

|

| |

Operator of theatres and

ticketing platforms |

ICG |

2021 |

United Kingdom |

1.2% |

| 15 |

Yudo |

|

|

|

|

| |

Designer and manufacturer of hot

runner systems |

ICG |

2017 / 2018 |

South Korea |

1.2% |

| 16 |

Domus |

|

|

|

|

| |

Operator of retirement homes |

ICG |

2017 / 2021 |

France |

1.2% |

| 17 |

David Lloyd

Leisure |

|

|

|

|

| |

Operator of premium health

clubs |

TDR |

2013 / 2020 |

United Kingdom |

1.2% |

| 18 |

Crucial

Learning |

|

|

|

|

| |

Provider of corporate training

courses focused on communication skills and leadership

development |

Leeds Equity |

2019 |

United States |

1.2% |

| 19 |

ECA Group |

|

|

|

|

| |

Provider of autonomous systems

for the aerospace and maritime sectors |

ICG |

2022 |

France |

1.1% |

| 20 |

Planet

Payment |

|

|

|

|

| |

Provider of integrated payments

services focused on hospitality and luxury retail |

Advent/

Eurazeo/

ICG |

2021 |

Ireland |

1.0% |

| 21 |

Ivanti |

|

|

|

|

| |

Provider of IT management

solutions |

Charlesbank/

ICG |

2021 |

United States |

1.0% |

| 22 |

Class

Valuation |

|

|

|

|

| |

Provider of residential mortgage

appraisal management services |

Gridiron |

2021 |

United States |

1.0% |

| 23 |

Vistage |

|

|

|

|

| |

Provider of CEO leadership and

coaching for small and mid-size businesses in the US |

Gridiron/

ICG |

2022 |

United States |

0.9% |

| 24 |

Audiotonix |

|

|

|

|

| |

Manufacturer of audio mixing

consoles |

PAI Partners |

2024 |

United Kingdom |

0.9% |

| 25 |

KronosNet |

|

|

|

|

| |

Provider of tech-enabled customer

engagement and business solutions |

ICG |

2022 |

Spain |

0.9% |

| 26 |

Brooks

Automation |

|

|

|

|

| |

Provider of semiconductor

manufacturing solutions |

THL |

2021 / 2022 |

United States |

0.9% |

| 27 |

DigiCert |

|

|

|

|

| |

Provider of enterprise security

solutions |

ICG |

2021 |

United States |

0.9% |

| 28 |

AML

RightSource |

|

|

|

|

| |

Provider of compliance and

regulatory services and solutions |

Gridiron |

2020 |

United States |

0.8% |

| 29 |

Archer

Technologies |

|

|

|

|

| |

Operator of private

hospitals |

Cinven |

2023 |

United States |

0.8% |

| 30 |

AMEOS Group |

|

|

|

|

| |

Operator of private hospitals |

ICG |

2021 |

Switzerland |

0.7% |

| |

Total of the 30 largest underlying

investments |

|

|

|

39.7% |

The 30 largest fund investments by value

The table below presents the 30 largest fund

investments by value at 31 July 2024. The valuations are net of

underlying managers’ fees and carried interest.

| |

Fund |

Year of commitment |

Value £m |

Outstanding commitment £m |

| 1 |

PAI Strategic Partnerships ** |

|

|

|

| |

Mid-market and large buyouts |

2019 |

32.2 |

0.2 |

| 2 |

ICG Strategic Equities

Fund III |

|

|

|

| |

GP-led secondary

transactions |

2018 |

31.1 |

10.8 |

| 3 |

CVC European Equity

Partners VII |

|

|

|

| |

Large buyouts |

2017 |

29.4 |

1.1 |

| 4 |

ICG Strategic Equities

Fund IV |

|

|

|

| |

GP-led secondary

transactions |

2021 |

27.6 |

9.9 |

| 5 |

Gridiron Capital Fund

III |

|

|

|

| |

Mid-market buyouts |

2016 |

26.4 |

4.0 |

| 6 |

ICG Europe

VII |

|

|

|

| |

Mezzanine and equity in

mid-market buyouts |

2018 |

29.3 |

5.0 |

| 7 |

ICG Ludgate Hill (Feeder

B) SCSp |

|

|

|

| |

Secondary portfolio |

2021 |

24.8 |

13.7 |

| 8 |

PAI Europe

VII |

|

|

|

| |

Mid-market and large buyouts |

2017 |

24.4 |

2.6 |

| 9 |

Gridiron Capital Fund

IV |

|

|

|

| |

Mid-market buyouts |

2019 |

24.0 |

0.6 |

| 10 |

Resolute IV |

|

|

|

| |

Mid-market buyouts |

2018 |

23.3 |

1.0 |

| 11 |

ICG Augusta Partners

Co-Investor ** |

|

|

|

| |

Secondary fund

restructurings |

2018 |

21.9 |

17.1 |

| 12 |

Seventh

Cinven |

|

|

|

| |

Large buyouts |

2019 |

20.2 |

0.7 |

| 13 |

ICG Ludgate Hill

III |

|

|

|

| |

Secondary portfolio |

2022 |

20.0 |

5.5 |

| 14 |

ICG Europe

VIII |

|

|

|

| |

Mezzanine and equity in

mid-market buy-outs |

2021 |

19.3 |

16.9 |

| 15 |

Oak Hill V |

|

|

|

| |

Mid-market buyouts |

2019 |

18.2 |

0.9 |

| 16 |

Advent Global Private

Equity IX |

|

|

|

| |

Large buyouts |

2019 |

17.0 |

0.8 |

| 17 |

Graphite Capital Partners

IX |

|

|

|

| |

Mid-market buyouts |

2018 |

17.0 |

3.0 |

| 18 |

Graphite Capital Partners

VIII * |

|

|

|

| |

Mid-market buyouts |

2013 |

20.9 |

1.8 |

| 19 |

Resolute V |

|

|

|

| |

Mid-market buy-outs |

2021 |

16.1 |

1.3 |

| 20 |

AEA VII |

|

|

|

| |

Mid-market buyouts |

2019 |

16.1 |

0.5 |

| 21 |

Sixth Cinven

Fund |

|

|

|

| |

Large buyouts |

2016 |

15.3 |

2.9 |

| 22 |

ICG Ludgate Hill (Feeder)

II Boston SCSp |

|

|

|

| |

Secondary portfolio |

2022 |

14.9 |

5.2 |

| |

|

|

|

|

| 23 |

Permira VII |

|

|

|

| |

Large buyouts |

2019 |

14.0 |

1.3 |

| 24 |

Investindustrial

VII |

|

|

|

| |

Mid-market buyouts |

2019 |

13.8 |

4.3 |

| 25 |

BC European Capital

X |

|

|

|

| |

Large buyouts |

2016 |

13.3 |

1.4 |

| 26 |

ICG LP Secondaries Fund I

LP |

|

|

|

| |

LP-led secondary

transactions |

2022 |

13.0 |

38.2 |

| 27 |

New Mountain Partners

VI |

|

|

|

| |

Mid-market buy-outs |

2020 |

12.4 |

1.2 |

| 28 |

Bowmark Capital Partners

VI |

|

|

|

| |

Mid-market buyouts |

2018 |

12.3 |

3.4 |

| 29 |

New Mountain Partners

V |

|

|

|

| |

Mid-market buyouts |

2017 |

11.4 |

1.1 |

| 30 |

CVC Capital Partners

VIII |

|

|

|

| |

Large buyouts |

2020 |

11.4 |

2.2 |

| |

Total of the largest 30 fund investments |

|

591.1 |

158.6 |

| |

Percentage of total investment Portfolio |

|

42.0% |

- |

* Includes the associated top up funds

** All or part of interest acquired through a

secondary purchase

PRINCIPAL RISKS AND UNCERTAINTIES

The principal risks and uncertainties facing the Company are

substantially the same as those disclosed in the Strategic Report

and in the notes to the Financial Statements in the Company’s

latest Annual Report for the year ended 31 January 2024 which was

approved by the Board on 7 May 2024.

The Company considers its principal risks (as well as several

underlying risks comprising each principal risk) in four

categories:

Investment risks: the risk to performance

resulting from ineffective or inappropriate investment selection,

execution or monitoring.

External risks: the risk of failing to deliver

the Company’s investment objective and strategic goals due to

external factors beyond the Company’s control.

Operational risks: the risk of loss resulting

from inadequate or failed internal processes, people or systems and

external event, including regulatory risk.

Financial risks: the risks of adverse impact on

the Company due to having insufficient resources to meet its

obligations or counterparty failure and the impact any material

movement in foreign exchange rates may have on underlying

valuations.

A comprehensive risk assessment process is undertaken regularly

to re-evaluate the impact and probability of each risk

materialising and the strategic, financial and operational impact

of the risk. Where the residual risk is determined to be outside of

appetite, appropriate action is taken.

In addition to these, emerging risks are regularly considered to

assess any potential impact on the Company and to

determine whether any actions are required. The Board also

regularly considers the evolution of requirements and standards

relating to ESG and responsible investing.

Related Party Transactions

There have been no material changes in the

related party transactions described in the 31 January 2024 Annual

Report.

Directors’ Responsibility

Statement

The Directors are responsible for preparing the Interim Report,

in accordance with applicable laws and regulations. The Directors

confirm that, to the best of their knowledge:

- The condensed interim financial

statements have been prepared in accordance with UK-adopted IAS 34

Interim condensed financial statements and gives a true and fair

view of the assets, liabilities, financial position and profit or

loss of the Company;

- The Chair’s Statement and

Manager’s Review includes a fair review of the information required

by DTR 4.2.7R of the Disclosure Guidance and Transparency Rules,

being an indication of important events that have occurred during

the first six months of the financial year and their impact on the

condensed interim financial statements, and a description of the

principal risks and uncertainties for the remaining six months of

the year; and

- The interim financial statements

include a fair review of the information required by DTR 4.28R of

the Disclosure Guidance and Transparency Rules, being related party

transactions that have taken place in the first six months of the

financial year and that have materially affected the financial

position or performance of the Company during that period, and any

changes in the related party transactions described in the last

Annual Report that could do so.

The Interim Report was approved by the Board and the above

Directors’ Responsibility Statement was signed on its behalf by the

Chair.

Jane Tufnell

Chair

7 October 2024

Unaudited Interim Financial Statements for the period

ended 31 July 2024

INTERIM CONDENSED FINANCIAL STATEMENTS

Income statement

Half year to 31 July 2024

(Unaudited) |

Half year to 31 July 2023

(Unaudited) |

| |

|

|

|

|

|

|

|

|

|

Notes

|

Revenue

return

£’000

|

Capital return

£’000

|

Total

£’000

|

Revenue

return

£’000

|

Capital return

£’000

|

Total

£’000

|

|

Investment returns |

|

|

|

|

|

|

|

| Income, gains and losses on

investments |

|

254 |

34,697 |

34,951 |

481 |

19,267 |

19,748 |

| Deposit interest |

|

29 |

- |

29 |

324 |

- |

324 |

| Other income |

|

5 |

- |

5 |

78 |

- |

78 |

| Foreign

exchange gains and losses |

|

- |

741 |

741 |

- |

38 |

38 |

|

|

|

288 |

35,438 |

35,726 |

883 |

19,305 |

20,188 |

| Expenses |

|

|

|

|

|

|

|

| Investment management

charges |

|

(797) |

(7,172) |

(7,969) |

(802) |

(7,219) |

(8,021) |

| Other

expenses including finance costs |

|

(1,283) |

(3,481) |

(4,764) |

(1,320) |

(3,899) |

(5,219) |

|

|

|

(2,080) |

(10,653) |

(12,733) |

(2,122) |

(11,118) |

(13,240) |

| |

|

|

|

|

|

|

|

| Profit/(loss) before

tax |

|

(1,792) |

24,785 |

22,993 |

(1,239) |

8,187 |

6,948 |

|

Taxation |

|

- |

- |

- |

1,837 |

(1,837) |

- |

|

Profit/(loss) for the period |

|

(1,792) |

24,785 |

22,993 |

598 |

6,350 |

6,948 |

|

Attributable to: |

|

|

|

|

|

|

|

|

Equity shareholders |

|

(1,792) |

24,785 |

22,993 |

598 |

6,350 |

6,948 |

|

Basic and diluted earnings per share |

|

|

|

34.67p |

|

|

10.21p |

The columns headed ‘Total’ represent the income statement for

the relevant financial years and the columns headed ‘Revenue

return’ and ‘Capital return’ are supplementary information in line

with guidance published by the AIC. There is no Other Comprehensive

Income.

All profits are from continuing operations.

The notes on pages 25 to 27 form an integral

part of the interim financial statements.

Balance sheet

|

|

Notes |

31 July

2024

(unaudited)

£’000 |

31 January

2024

(audited)

£’000 |

|

Non-current assets |

|

|

|

|

Investments held at fair value |

7 |

1,362,012 |

1,296,382 |

|

Current assets |

|

|

|

| Cash and cash equivalents |

|

9,789 |

9,722 |

|

Prepayments and receivables |

|

1,920 |

2,258 |

|

|

|

11,709 |

11,980 |

|

Current liabilities |

|

|

|

| Borrowings |

|

(93,305) |

(20,000) |

|

Payables |

|

(6,894) |

(5,139) |

|

|

|

(100,199) |

(25,139) |

|

Net current assets/(liabilities) |

|

(88,490) |

(13,159) |

|

Total assets less current liabilities |

|

1,273,522 |

1,283,223 |

|

Capital and reserves |

|

|

|

| Share capital |

|

7,292 |

7,292 |

| Capital redemption

reserve |

|

2,112 |

2,112 |

| Share premium |

|

12,936 |

12,936 |

| Capital reserve |

|

1,255,707 |

1,263,616 |

| Revenue

Loss |

|

(4,525) |

(2,733) |

|

Total equity |

|

1,273,522 |

1,283,223 |

|

Net asset value per share (basic and diluted) |

6 |

1,946.4p |

1,909.4 |

The notes on pages 25 to 27 form an integral

part of the interim financial statements.

The financial statements on pages 21 to 27 were

approved by the Board of Directors on 7 October 2024 and signed on

its behalf by:

Jane

Tufnell Alastair

Bruce

Director Director

Cash flow statement

|

|

Half year to

31 July 2024

(unaudited)

£’000 |

Half year to

31 July 2023

(unaudited)

(restated)

£’000 |

|

Operating activities |

|

|

| Sale of portfolio

investments |

9,287 |

15,737 |

| Purchase of portfolio

investments |

(23,295) |

(13,705) |

| Cash flow to subsidiaries'

investments |

(89,643) |

(52,921) |

| Cash flow from subsidiaries'

investments |

72,870 |

77,331 |

| Interest income received from

portfolio investments |

200 |

294 |

| Dividend income received from

portfolio investments |

52 |

296 |

| Other income received |

34 |

401 |

| Investment management charges

paid |

(8,006) |

(7,488) |

| Other

expenses paid |

(1,007) |

(2,892) |

|

Net cash (outflow)/ inflow from operating

activities |

(39,508) |

17,053 |

|

Financing activities |

|

|

| Bank facility fee paid |

(1,362) |

(1,628) |

| Interest paid |

(414) |

(2,903) |

| Credit Facility utilised |

92,378 |

90,087 |

| Credit Facility repaid |

(18,412) |

(82,476) |

| Purchase of shares into

treasury |

(21,456) |

(6,477) |

| Equity

dividends paid |

(11,238) |

(10,886) |

|

Net cash inflow/ (outflow) from financing

activities |

39,496 |

(14,282) |

|

Net (decrease)/ increase in cash and cash

equivalents |

(12) |

2,771 |

|

Cash and cash equivalents at beginning of

year |

9,722 |

20,694 |

| Net (decrease)/ increase in

cash and cash equivalents |

(12) |

2,771 |

| Effect

of changes in foreign exchange rates |

79 |

39 |

|

Cash and cash equivalents at end of period |

9,789 |

23,504 |

The notes on pages 25 to 27 form an integral part of the interim

financial statements.

Statement of changes in equity

|

|

Share capital

£’000 |

Capital redemption

reserve

£’000 |

Share premium

£’000 |

Capital reserve

£’000 |

Revenue

reserve

£’000 |

Total

shareholders’

equity

£’000 |

Half year

to 31 July 2024

(Unaudited) |

| Opening balance at 1 February

2024 |

7,292 |

2,112 |

12,936 |

1,263,616 |

(2,733) |

1,283,223 |

| Profit for the period and

total comprehensive income |

— |

— |

— |

24,785 |

(1,792) |

22,993 |

| Dividends paid or

approved |

— |

— |

— |

(11,238) |

— |

(11,238) |

|

Purchase of shares into treasury |

— |

— |

— |

(21,456) |

— |

(21,456) |

|

Closing balance at 31 July 2024 |

7,292 |

2,112 |

12,936 |

1,255,707 |

(4,525) |

1,273,522 |

|

|

|

|

|

|

|

|

| |

|

|

|

|

|

|

|

|

Share capital

£’000 |

Capital redemption

reserve

£’000 |

Share premium

£’000 |

Capital reserve

£’000 |

Revenue

reserve

£’000 |

Total

shareholders’

equity

£’000 |

Half year

to 31 July 2023

(Unaudited) |

| Opening balance at 1 February

2023 |

7,292 |

2,112 |

12,936 |

1,279,751 |

(1,473) |

1,300,618 |

| Profit for the period and

total comprehensive income |

— |

— |

— |

6,350 |

597 |

6,948 |

| Dividends paid or

approved |

— |

— |

— |

(10,886) |

— |

(10,886) |

|

Purchase of shares into treasury |

— |

— |

— |

(6,420) |

— |

(6,420) |

|

Closing balance at 31 July 2023 |

7,292 |

2,112 |

12,936 |

1,268,795 |

(875) |

1,290,260 |

The notes on pages 25 to 27 form an integral part of the

financial statements.

NOTES TO THE FINANCIAL STATEMENTS

For the period ended 31 July 2024

1 GENERAL INFORMATION

These interim condensed financial statements

relate to ICG Enterprise Trust Plc (‘the Company’). ICG Enterprise

Trust Plc is registered in England and Wales and is incorporated in

the United Kingdom. The Company is domiciled in the United Kingdom

and its registered office is Procession House, 55 Ludgate Hill,

London EC4M 7JW. The Company’s objective is to provide long-term

growth by investing in private companies managed by leading private

equity managers.

2 FINANCIAL INFORMATION

The interim condensed financial statements are

unaudited and do not comprise statutory accounts within the meaning

of section 434 of the Companies Act 2006. Within the notes to the

interim condensed financial statements, all current and comparative

data covering the period to (or as at) 31 July 2024 is unaudited.

Data given in respect of the year to 31 January 2024

is audited. The statutory accounts for the year to 31 January 2024

have been reported on by Ernst & Young LLP and delivered to the

Registrar of Companies. The report of the auditors was (i)

unqualified, (ii) did not contain an emphasis of matter paragraph,

and (iii) did not contain any statements under section 498(2) or

(3) of the Companies Act 2006.

3 BASIS OF PREPARATION

The interim financial statements have been

prepared in accordance with UK-adopted IAS 34 Interim financial

Reporting (IAS 34) and on the basis of the accounting policies and

methods of computation set out in the financial statements of the

Company for the year to 31 January 2024.

The financial information for the year ended 31

January 2024 was prepared in accordance with UK-adopted

International Accounting Standards (‘UK-IAS’) and the Statement of

Recommended Practice ('SORP') for investment trusts issued by the

Association of Investment Companies in July 2022.

The Company comprises one operating segment which is also a

reporting segment.

Going concern

These financial statements have been prepared on

a going concern basis. In making their going concern assessment,

the Directors have considered the potential impact of principal

risks on the Company’s business activities; the Company’s net cash

position; the availability of the Company’s credit facility and

compliance with its covenants; and the Company’s cash flow

projections, in particular those arising from committed but undrawn

commitments.

The Directors have concluded based on the above

assessment that the preparation of the interim condensed financial

statements on a going concern basis, to 31 October 2025, a period

of more than 12 months from the signing of the interim condensed

financial statements, continues to be appropriate.

4 DIVIDENDS

|

|

Half year to

31 July

2024

£’000 |

Half year to

31 July

2023

£’000 |

|

Third Quarterly dividend in respect of year ended 31 January 2024

of 8.0p per share (2023: 7.0p) |

5,345 |

4,781 |

| Final dividend in respect of

year ended 31 January 2024 of 9.0p per share (2023: 9.0p) |

5,894 |

6,105 |

|

Total |

11,239 |

10,886 |

The Board has approved an interim dividend for

the quarter to 30 April 2024 of 8.5p per share (totalling £5.56m)

which has been paid on 30 August to shareholders on the register on

16 August 2024. The Board has proposed a second interim dividend of

8.5p per share in respect of the year ended 31 January 2025 which

will be paid on 29 November 2024 to shareholders on the register at

the close of business on 15 November 2024.

5 EARNINGS PER SHARE

|

Earnings per share |

Half year to 31 July 2024 |

Half year to 31 July 2023 |

|

Revenue return per ordinary share |

(2.70)p |

0.88p |

| Capital return per ordinary

share |

37.38p |

9.33p |

| Earnings per ordinary share

(basic and diluted) |

34.67p |

10.21p |

|

Weighted average number of shares |

66,310,774 |

68,040,279 |

Revenue return per ordinary share is calculated

by dividing the revenue return attributable to equity shareholders

of £-1.8m (2023: £0.6m) by the weighted average number of ordinary

shares outstanding during the year.

Capital return per ordinary share is calculated

by dividing the capital return attributable to equity shareholders

of £24.8m (2023: £6.4m) by the weighted average number of ordinary

shares outstanding during the year.

Basic and diluted earnings per ordinary share

are calculated by dividing the earnings attributable to equity

shareholders of £23.0m (2023: £6.9m) by the weighted average number

of ordinary shares outstanding during the year..

The weighted average number of ordinary shares

outstanding (excluding those held in treasury) during the year was

66,310,774 (2023: 68,040,279). There were no potentially dilutive

shares, such as options or warrants, in either year.

6 NET ASSET VALUE PER SHARE

The net asset value per share is calculated on

equity attributable to equity holders of £1,273.5m (31 January

2024: £1,300.6m) and on 65,429,867 (31 January 2024: 67,204,867)

ordinary shares in issue at the period end. There were no

potentially dilutive shares, such as options or warrants, at either

year end. Calculated on both the basic and diluted basis the net

asset value per share was 1,946.4p (31 January 2024: 1,909.4p).

7 FAIR VALUE ESTIMATION

IFRS 13 requires disclosure of fair value

measurements of financial instruments categorised according to the

following fair value measurement hierarchy:

- Quoted prices (unadjusted) in

active markets for identical assets or liabilities (level 1).

- Inputs other than quoted prices

included within level 1 that are observable for the asset or

liability, either directly (that is, as prices) or indirectly (that

is, derived from prices) (level 2).

- Inputs for the asset or liability

that are not based on observable market data (that is, unobservable

inputs) (level 3).

The valuation techniques applied to level 3

assets are described in note 1(c) of the annual financial

statements. No investments were categorised as level 1 or level

2.

The Company’s policy is to recognise transfers

into and transfers out of fair value hierarchy levels at the end of

the reporting year when they are deemed to occur.

The following table presents the assets that are

measured at fair value at 31 July 2024 and 31 January 2024:

| |

Level 1 |

|

Level 2 |

|

Level 3 |

|

Total |

|

31 July 2024 |

£’000 |

|

£’000 |

|

£’000 |

|

£’000 |

|

Investments held at fair value |

|

|

|

|

|

|

|

| Unquoted investments |

- |

|

- |

|

281,766 |

|

281,766 |

| Quoted investments |

- |

|

- |

|

- |

|

- |

|

Subsidiary undertakings |

- |

|

- |

|

1,080,246 |

|

1,080,246 |

|

Total investments held at fair value |

- |

|

- |

|

1,362,012 |

|

1,362,012 |

| |

Level 1 |

|

Level 2 |

|

Level 3 |

|

Total |

|

31 January 2024 |

£’000 |

|

£’000 |

|

£’000 |

|

£’000 |

|

Investments held at fair value |

|

|

|

|

|

|

|

| Unquoted investments |

- |

|

- |

|

260,296 |

|

260,296 |

| Quoted investments |

- |

|

- |

|

- |

|

- |

|

Subsidiary undertakings |

- |

|

- |

|

1,036,086 |

|

1,036,086 |

|

Total investments held at fair value |

- |

|

- |

|

1,296,382 |

|

1,296,382 |

All unquoted and quoted investments are valued

at fair value in accordance with IFRS 13. The Company has no quoted

investments as at 31 July 2024; quoted investments held by

subsidiary undertakings are reported within Level 3.

Investments in level 3 securities are in respect

of private equity fund investments and co-investments. These are

held at fair value and are calculated using valuations provided by

the underlying manager of the investment, with adjustments made to

the statements to take account of cash flow events occurring after

the date of the manager’s valuation, such as realisations or

liquidity adjustments.

The following tables present the changes in

level 3 instruments for the period ended 31 July 2024 and 31 July

2023.

|

|

Half year to

31 July 2024

£’000 |

Half year to

31 July 2023

£’000 |

|

Opening balances |

1,296,382 |

1,349,075 |

| Additions |

104,356 |

64,055 |

| Disposals |

(82,158) |

(86,090) |

|

Gains and losses recognised in profit or loss |

43,432 |

15,617 |

|

Closing balances |

1,362,012 |

1,342,657 |

GLOSSARY

| Term |

Short form |

Definition |

Alternative Performance Measures

|

APMs |

Alternative Performance Measures are a term defined by the European

Securities and Markets Authority as “financial measures of

historical or future performance, financial position, or cash

flows, other than a financial measure defined or specified in the

applicable financial reporting framework”.

APMs are used in this report if considered by the Board and the

Manager to be the most relevant basis for shareholders in assessing

the overall performance of the Company and for comparing the

performance of the Company to its peers, taking into account

industry practice.

Definitions and reconciliations to IFRS measures are provided in

the main body of the report or in this Glossary, where

appropriate.

|

|

Carried Interest |

|

Carried interest is equivalent to a performance fee. This

represents a share of the profits that will accrue to the

underlying private equity managers, after achievement of an agreed

Preferred Return. |

|

Cash drag |

|

Cash drag is the negative impact on performance arising as a result

of the allocation of a portion of the entity’s assets to cash. |

|

Co-investment |

|

Co-investment is a Direct Investments in a company alongside a

private equity fund. |

|

Co-investment Incentive Scheme Accrual |

|

Co-investment Incentive Scheme Accrual represents the estimated

value of interests in the Co-investment Incentive Scheme operated

by the subsidiary partnerships of the Company. |

|

Commitment |

|

Commitment represents the amount of capital that each investor

agrees to contribute to a fund or a specific investment. |

|

Compound Annual Growth Rate |

CAGR |

The rate of return that would be required for an investment to grow

from its beginning balance to its ending balance, assuming the

profits were reinvested at the end of each period of the

investment's life span. |

|

Deployment |

|

Please see ‘Total new investment’. |

|

Direct Investments |

|

An investment in a portfolio company held directly, not through a

private equity fund. Direct Investments are typically

co-investments with a private equity fund. |

|

Discount |

|

Discount arises when the Company’s shares trade at a price below

the Company’s NAV per Share. In this circumstance, the price that