India Capital Growth Fund Limited Net Asset Value

06 February 2025 - 10:30PM

RNS Regulatory News

RNS Number : 2108W

India Capital Growth Fund Limited

06 February 2025

06 February 2025

India Capital Growth Fund Limited (the "Company" or

"ICGF")

Net

Asset Value statement at 31 January 2025

The Company announces its Net Asset

Value ("NAV") per ordinary share as at 31 January 2025 was 193.49

pence.

In January, the NAV was down 7.43%

in Sterling terms, whilst the BSE MidCap TR Index was down 7.32%,

delivering an underperformance against the notional benchmark of

0.11%. In local currency terms, the NAV was down 7.30%.

The Company also announces its Net

Asset Value per ordinary share before Indian CGT (deferred tax

provision) as at 31 January 2025 was 204.21 pence.

|

Portfolio analysis by sector as at 31

January

2025

|

|

|

|

|

|

Sector

|

No.

of Companies

|

%

of Portfolio

|

|

Financial Banks

|

5

|

16.4%

|

|

Industrials

|

6

|

13.1%

|

|

Consumer Discretionary

|

5

|

11.3%

|

|

Auto & Auto Ancillary

|

4

|

9.7%

|

|

Consumer Staples

|

4

|

9.5%

|

|

Healthcare

|

2

|

7.3%

|

|

Digital

|

2

|

5.5%

|

|

Chemicals

|

2

|

4.9%

|

|

IT Services

|

2

|

4.7%

|

|

Textiles

|

2

|

4.6%

|

|

Cement

|

2

|

4.4%

|

|

Financial Services

|

1

|

3.9%

|

|

Financial NBFC

|

1

|

1.2%

|

|

Energy

|

0

|

0.0%

|

|

Metals

|

0

|

0.0%

|

|

Utilities

|

0

|

0.0%

|

|

Real Estate

|

0

|

0.0%

|

|

Total Equity Investment

|

38

|

96.6%

|

|

Cash & cash

equivalents

|

|

3.4%

|

|

Total Portfolio

|

38

|

100.0%

|

|

Top

20 holdings as at 31 January

2025

|

|

|

|

|

|

Holding

|

Sector

|

%

of Portfolio

|

|

Federal Bank

|

Financial Banks

|

5.6%

|

|

Neuland Laboratories

|

Healthcare

|

5.3%

|

|

Skipper

|

Industrials

|

4.8%

|

|

Dixon Technologies

|

Consumer Discretionary

|

4.7%

|

|

Persistent Systems

|

IT Services

|

4.0%

|

|

Multi Commodity Exchange

|

Financial Services

|

3.9%

|

|

Emami

|

Consumer Staples

|

3.7%

|

|

Ramkrishna Forgings

|

Auto & Auto Ancillary

|

3.7%

|

|

Affle India

|

Digital

|

3.1%

|

|

IDFC Bank

|

Financial Banks

|

3.1%

|

|

PI Industries

|

Chemicals

|

3.1%

|

|

RBL Bank

|

Financial Banks

|

2.9%

|

|

JK Lakshmi Cement

|

Cement

|

2.7%

|

|

City Union Bank

|

Financial Banks

|

2.6%

|

|

Sona BLW Precision

Forgings

|

Auto & Auto Ancillary

|

2.6%

|

|

CCL Products India

|

Consumer Staples

|

2.4%

|

|

PSP Projects

|

Industrials

|

2.4%

|

|

Cartrade Technologies

|

Digital

|

2.4%

|

|

Gokaldas Exports

|

Textiles

|

2.3%

|

|

Balkrishna Industries

|

Auto & Auto Ancillary

|

2.3%

|

|

Portfolio analysis by market capitalisation size as at

31 January 2025

|

|

*Market capitalisation

size

|

No. of Companies

|

% of Portfolio

|

|

Small Cap (M/cap <

US$4bn)

|

28

|

68.0%

|

|

Mid Cap (US$4bn < M/cap <

US$12bn)

|

9

|

27.4%

|

|

Large Cap (M/cap >

US$12bn)

|

1

|

1.2%

|

|

Total Equity Investment

|

38

|

96.6%

|

|

Net Cash

|

|

3.4%

|

|

Total Portfolio

|

38

|

100.0%

|

*At six monthly intervals the

investment team will review the portfolio and the market

capitalisation to best reflect its positioning in the Mid and Small

cap segment of the market. In its review exercise carried out in

January 2025, the market cap definitions of Large, Mid and Small

cap companies have been updated. The definitions are based on the

classification adopted by the Association of Mutual Funds in India

(AMFI), which is mandated by the Securities & Exchange Board of

India (SEBI) to define Large, Mid and Small cap companies. AMFI

utilises the following methodology to define market capitalisation

(six months average market cap across all exchanges is

considered):

·

The top 100 largest companies by market cap are

classified as Large cap

·

The next 150 companies by market cap are defined

as Mid cap

·

All other companies are defined as Small

cap

As a result, ICGF has adopted the

following market cap classifications from 1 January

2025:

·

Small cap: Market cap < USD 4

billion

·

Mid cap: USD 4 billion < Market cap < USD 12

billion

·

Large cap: Market cap > USD 12

billion

This information is provided by RNS, the news service of the

London Stock Exchange. RNS is approved by the Financial Conduct

Authority to act as a Primary Information Provider in the United

Kingdom. Terms and conditions relating to the use and distribution

of this information may apply. For further information, please

contact

rns@lseg.com or visit

www.rns.com.

RNS may use your IP address to confirm compliance with the terms

and conditions, to analyse how you engage with the information

contained in this communication, and to share such analysis on an

anonymised basis with others as part of our commercial services.

For further information about how RNS and the London Stock Exchange

use the personal data you provide us, please see our

Privacy

Policy.

END

NAVFQLFBELLLBBV

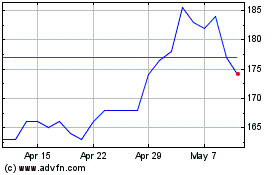

India Capital Growth (LSE:IGC)

Historical Stock Chart

From Jan 2025 to Feb 2025

India Capital Growth (LSE:IGC)

Historical Stock Chart

From Feb 2024 to Feb 2025