Katoro Gold PLC Statement re broker (5513G)

02 March 2018 - 10:58PM

UK Regulatory

TIDMKAT

RNS Number : 5513G

Katoro Gold PLC

02 March 2018

Katoro Gold plc (Incorporated in England and Wales)

(Registration Number: 9306219)

Share code on AIM: KAT

ISIN: GB00BSNBL022

("Katoro" or "the Company")

Dated: 2 March 2018

Katoro Gold Plc ('Katoro' or the 'Company')

Statement re broker

Katoro Gold Plc (AIM:KAT), the Tanzania focused gold exploration

and development company, notes the announcement made today by the

Financial Conduct Authority ("FCA") regarding Beaufort Securities

Limited ("BSL"), the Company's broker, and Beaufort Asset Clearing

Services Limited ("BACSL") being placed into insolvency and that

the FCA has imposed requirements on BSL and BACSL to cease all

regulatory activity with immediate effect.

The Company is seeking to appoint a new broker as soon as

possible and a further announcement will be made when this

appointment is made.

**ENDS**

This announcement contains inside information as stipulated

under the Market Abuse Regulations (EU) no. 596/2014.

For further information please visit www.katorogold.com or

contact:

Louis Coetzee +27 (0) 83 Katoro Gold Executive Chairman

2606126 plc

Richard +44 (0) 20 Strand Hanson Nominated Adviser

Tulloch 7409 3494 Limited

Ritchie

Balmer

Frederick

Twist

Isabel de +44 (0) 207 St Brides Investor and

Salis 236 1177 Partners Ltd Media Relations

Priit Piip Adviser

Notes to editors:

In May 2017 Katoro was admitted to trading on AIM. Katoro owns

100% of the Imweru and Lubando Gold Projects in Tanzania, which

both have Mineral Resources established in accordance with the JORC

(2012) Code. The total Mineral Resources stated for Imweru consist

of 11.607 Mt at grade of 1.38 g/t for a Mineral Resource of 515,110

oz Au at a resource pay limit of 0.4 g/t for the open pittable

material and 1.3 g/t for the underground material, while the

Lubando Mineral Resources equate to 6.78 Mt at grade of 1.10 g/t

for 239,870 oz Au at a pay limit of 0.4 g/t to a depth of 200 m and

1.3 g/t below the 200 m depth cut-off. The respective projects also

include the earlier stage Sheba (within the Imweru Licence

Portfolio and Imweru Option Portfolio), Pamba and Busolwa (both

within the Lubando Licence Portfolio and Lubando Option Portfolio)

projects. The JORC Code compliant Competent Person's Report for

each of Imweru and Lubando are available on Katoro's website

www.katorogold.com.

The Company's primary focus is on advancing and developing

Imweru through a work programme which will include, inter alia, a

feasibility study and a drilling programme, with the aim, subject

to funding, to commence production with an initial target of 50,000

oz gold per annum within 18-24 months from admission to AIM.

Updates on the Katoro's activities will be announced as required

and posted on its website www.katorogold.com.

This information is provided by RNS

The company news service from the London Stock Exchange

END

MSCLLFELVRIFIIT

(END) Dow Jones Newswires

March 02, 2018 06:58 ET (11:58 GMT)

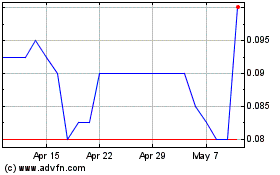

Katoro Gold (LSE:KAT)

Historical Stock Chart

From May 2024 to Jun 2024

Katoro Gold (LSE:KAT)

Historical Stock Chart

From Jun 2023 to Jun 2024