TIDMKCR

RNS Number : 5677G

KCR Residential REIT PLC

30 March 2022

30 March 2022

KCR Residential REIT plc

("KCR" or the "Company")

Interim Results

KCR Residential REIT plc, the residential REIT group, is pleased

to announce its unaudited consolidated interim results for the six

months to 31 December 2021.

Operational highlights

-- Revenue for the six months to 31 December 2022 increased by

27% to GBP604,583 (2020: GBP475,407) and gross profit improved by

26% to GBP585,702 (2020: GBP465,030)

-- Portfolio level occupancy - 100% of all available flats let,

and rental values achieved have marginally increased with capital

values holding firm.

-- Net total assets increased to GBP27.3m (2020: GBP24.2m)

following the partial exercise of the Torchlight option which

resulted in net asset value per share reducing to 33.03p (2020:

40.86p). The cash position as at 31 December 2021 was GBP2.8m

(2020: 0.4m)

-- Secured bank borrowings increased to GBP13.2 million (2020:

GBP12.6 million) following the completion of refinancing

transactions across the portfolio.

Contacts:

KCR Residential REIT plc info@kcrreit.com

+44 20 3793 5236

Russell Naylor, Executive Director

James Thornton, Non-Executive Chairman

Arden Partners plc +44 20 7614 5900

Richard Johnson

Louisa Waddell

Benjamin Onyeama-Christie

Notes to Editors:

KCR's objective is to build a substantial residential property

portfolio that generates secure income flow for shareholders. The

Directors intend that the group will acquire, develop and manage

residential property assets in a number of jurisdictions including

the UK.

A copy of the Interim Results will be available at

www.kcrreit.com .

CHAIRMAN'S STATEMENT

FOR THE SIX MONTHSED 31 DECEMBER 2021

KCR Residential REIT plc ("KCR" or the "Company") and its

subsidiaries (together the "Group") currently operate in the

private rented residential investment market in London and the

South East. The Company acquires whole blocks of studio, one- and

two-bed apartments that are rented to private tenants and also

operates and owns freeholds of a portfolio of retirement living

accommodation, and other properties sold on long leases.

During the period, as activity levels rose in London and the

South East and Covid risk within a vaccinated UK population

reduced, a general influx to the city and a return to the office

fuelled higher prices in general for property sales and increased

rental demand. Positively for KCR, rents improved as our

refurbished apartments let into this environment and occupancy on

properties available across the portfolio is currently 100% with

nominal rental arrears. However, the operating environment

continued to be challenging with further friction in the economy

following from supply chain disruption, and with cost pressures

rising for the Company and consumer alike.

KCR has taken a significant number of positive steps forward in

its operations during the period with further considerable progress

made towards achieving breakeven from the existing portfolio. Each

of the detailed operating activities is set out in the Director's

report below, but I should highlight here the letting up of the

eight available apartments of the ten at the refurbished Coleherne

Road property.

A capital position has been put in place to move forward with

the next stages of upgrading the existing portfolio, with some

potential support for future development. Equity capital of GBP2.7m

was received in November 2021 as a result of the partial exercise

of the Torchlight option approved by shareholders in 2019, while

refinancing of the final two existing properties on a fixed rate

basis, with extended terms at reduced rates, improved the debt

funding position.

Sadly, it is impossible not to mention war in Ukraine. Supply

shortfalls of oil and gas, and consumer dietary staples, have

delivered a sudden major shock to European and the UK economies.

This situation looks set to continue for a sustained period with

significant increases in the prices of these and other commodities.

As we come to terms with this change the full impact on the UK

economy is unclear. However, the risk of potential future

stagflation clearly rises as consumers battle with these added

costs and planned tax increases on top of already significantly

heightened inflation levels.

KCR will therefore likely be operating within a much more

volatile and potentially restrained economic environment going

forward, and while portfolio opportunities may arise for the

Company from this market dislocation, from an operating perspective

presently the environment is unlikely to be improved. KCR continues

to work within a specific segment of rented residential that is in

high demand, is confident that the UK residential rented property

market is fundamentally under-supplied, and therefore that it is

building a sustainable long term future for the Company.

DIRECTOR'S REPORT

FOR THE SIX MONTHSED 31 DECEMBER 2021

We are pleased to report on the progress of the Group in the

six-month period to 31 December 2021.

Property portfolio

KCR has continued to progress the implementation of its two

operating strategies. As outlined in the 2021 Annual Report, KCR is

in the process of creating two operating lines, clearly

identifiable by brand, property quality and letting strategy.

1. Cristal Apartments. Residential apartments, developed to a

high modern specification, furnished and let on a Walk-In-Walk-Out

(WIWO) basis (the intention is for utilities, internet, furniture,

council tax to be included in the rental payment) for a

frictionless and flexible letting experience. Rental contracts may

be from a week to multi-year.

2. Osprey Retirement Living. 4* retirement living property

rented on the same basis as above, with optionality on furniture.

Rental contracts to be assured shorthold tenancies (six months

plus).

1. Cristal Apartments (WIWO letting strategy)

The Coleherne Road property has been repositioned and now

delivers the higher quality style of apartments that the Cristal

brand represents. Planning works are underway to explore options

(including extensions) for the Ladbroke Grove properties to

reposition these properties and optimise the existing

footprint.

-- The property at Coleherne Road, Earls Court, London, which

comprises ten studio and one-bedroom flats, has undergone a

refurbishment to significantly improve the interior and exterior

quality of the property. Works to eight of the ten flats have been

completed in full with letting up commencing during the half year

and full occupancy (of the eight completed flats) being achieved

during the December quarter. Revenue from this property will

continue to drive enhanced gross revenue for the Group. Reduced

direct operating costs (particularly maintenance) will

substantially increase the contribution that the property makes to

net income. Legal action is continuing to obtain vacant possession

to enable completion of works to the last two flats.

-- The Southampton block of 27 residential units at Deanery

Court, Chapel Riverside is 100% occupied. A number of units are

rented to short-let operators. As KCR receives these units back

from the tenants, mostly within the next 12 months, it intends to

move to renting them on a WIWO basis which is expected to result in

an increased revenue from the property. Implementation of this

strategy is expected to commence during the June 2022 quarter.

-- The Ladbroke Grove portfolio of 16 units is 100% occupied.

Increased supply from short let flats in this catchment area had an

impact on void periods for this property. Some refurbishment works

have been completed to upgrade the standard of previously vacant

flats in order to secure tenants. As outlined above, planning work

is underway to explore options for more substantive upgrades /

extensions to this portfolio.

2. Osprey retirement living (4* retirement apartments)

-- The Osprey retirement living portfolio and other properties

consists of 159 flats and 13 houses let on long leases in six

locations, together with an estate consisting of 30 freehold

cottages in Marlborough where Osprey delivers estate management and

sales services.

-- The key asset in the portfolio representing 70% of the Osprey

portfolio value is the freehold block at Heathside, Golders Green,

where 28 of the 37 residential units are held on long leases. The

strategy continues to be to selectively acquire long-leasehold

units in the block, subject to pricing, refurbish the units to a

high level and let them in the open market subject to assured

shorthold tenancies. An additional lease surrender was completed

during the half year and this apartment is currently subject to

refurbishment works to lift the standard of the apartment. Works

are expected to be complete in the next few weeks with rental

income contribution commencing during the June 2022 quarter. This

strategy has been successful; 100% of the eight acquired units are

let, with those that have had refurbishment works completed

achieving materially higher rental levels than the un-refurbished

apartments. As outlined in the 2021 Annual Report, Osprey has also

successfully taken back management of the Heathside property with

handover from the existing manager due to occur early April 2022.

This will enable Osprey to have greater control over the

positioning of the building as a whole and also deliver increased

incremental management revenue to the Group. In advance of hand

over planning is well advanced for a works programme to upgrade /

enhance the common parts and exterior of the property.

The Company continues to investigate the potential to enhance

value through redevelopment and roof extensions at four of the

seven sites. Outline proposals and discussions with planning

authorities have been positively received. Legal, structural and

economic viability work continues at each project.

Rental and occupancy performance

KCR increased gross revenue by 27% for the six months to

GBP604,583 (2020: GBP475,407) and gross profit improved 26% to

GBP585,702 (2020: GBP465,030). Improvement in gross revenue was

predominantly driven by the letting up of Coleherne Road during the

half year and leasehold extension income.

Portfolio level occupancy is high (currently 100% of all

available flats are let), rental values achieved have marginally

increased and capital values hold firm.

Financial

Revenue and gross margins improved in the six months to 31

December 2021. Administration costs continued to be controlled with

the marginal increase compared to prior period a result of legal

costs associated with taking back management of the Heathside

property and planning costs as work progresses across the

portfolio.

-- Revenue increased to GBP604,583 (2020: GBP475,407) an increase of 27%

-- Gross profit improved by 26% to GBP585,702 (2020: GBP465,030)

-- Operating profit before separately disclosed items improved

to GBP136,280 (2020: GBP121,780 loss) primarily due to the

revaluation uplift following the acquisition of an additional

apartment at Heathside

-- Operating profit increased to GBP101,598 (2020: GBP620,745

loss) which included GBP34,682 (2020: GBP498,965) of property

refurbishment costs

-- Loss for the period was GBP254,265 (2020: GBP859,476) and

loss per share reduced to 0.77p (2020: 3.12p)

KCR's property portfolio value was slightly higher than the

comparative half year at GBP24.4 million (2020: GBP23.7 million)

reflecting the acquisition of an additional apartment at Heathside

and capitalised works relating to the refurbishment program

(partially offset by the completion of the sale of the Lomond Court

property). The Group's current assets increased to GBP2,875,087

(2020: GBP464,836) with improvement in current assets driven

predominantly by the proceeds received from partial exercise of the

Torchlight option. Trade and other payables increased to GBP368,629

(2020: GBP257,495). Current liabilities reduced significantly to

GBP368,629 (2020: GBP1,843,683) following the successful refinance

of one of KCR's debt facilities which was reflected as a current

liability in the prior period. Following the completion of

refinancing transactions across the portfolio, secured bank

borrowings increased to GBP13.2 million (2020: GBP12.6 million).

Refinancing activity reduced overall debt costs and provided a

small level of additional funding which is being used to support

Group activities.

Total assets increased to GBP27.3m (2020: GBP24.2m) following

the partial exercise of the Torchlight option which resulted in net

asset value per share reducing to 33.03p (2020: 40.86p).

KCR's near term focus remains on achieving a break-even overall

position by improving rental income from existing assets through a)

the WIWO letting strategy, and b) refurbishment to improve building

quality, and enhancing gross rental returns while optimising

property management to reduce costs. Active focus on managing

corporate overheads is ongoing.

Throughout the year, the company remained a REIT and has

endeavoured to comply with REIT rules throughout the period and

since the balance sheet date.

CONSOLIDATED STATEMENT OF COMPREHENSIVE INCOME

FOR THE SIX MONTHSED 31 DECEMBER 2021 (unaudited)

Six months Six months

ended 31 ended 31 Year ended

December December 30 June

2021 2020 2021 (audited)

Notes GBP GBP GBP

Revenue 2 604,583 475,407 1,036,011

Cost of sales (18,881) (10,377) (20,606)

----------- ----------- ----------------

Gross profit 585,702 465,030 1,015,405

Administrative expenses (599,322) (591,818) (1,102,869)

Other operating income 4,900 5,008 2,803

Fair value through profit and

loss - Revaluation of investment

properties 145,000 - 501,330

Operating profit/(loss) before

separately disclosed items 136,280 (121,780) 416,669

Costs of refurbishment of investment

properties 3 (34,682) (498,965) (844,200)

----------- ----------- ----------------

Operating profit/(loss) 101,598 (620,745) (427,531)

Finance costs (355,866) (239,392) (497,432)

Finance income 3 661 729

----------- ----------- ----------------

Loss before taxation (254,265) (859,476) (924,234)

Taxation - - -

----------- ----------- ----------------

Loss for the period/year (254,265) (859,476) (924,234)

----------- ----------- ----------------

Total comprehensive expense for the

period/year (254,265) (859,476) (924,234)

=========== =========== ================

Loss per share expressed in pence 4

per share

Basic (0.77) (3.12) (3.34)

Diluted (0.33) (1.11) (1.19)

=========== =========== ================

CONSOLIDATED STATEMENT OF FINANCIAL POSITION

AT 31 DECEMBER 2021 (unaudited)

31

31 December December 30 June 2021

2021 2020 (audited)

Notes GBP GBP GBP

Non-current assets

Property, plant and equipment 14,477 34,892 23,378

Investment properties 5 24,407,000 23,662,120 24,262,000

24,421,477 23,697,012 24,285,378

------------ ------------ -------------

Current assets

Trade and other receivables 67,805 63,623 53,375

Cash and cash equivalents 2,807,282 401,213 66,915

------------ ------------ -------------

2,875,087 464,836 120,290

------------ ------------ -------------

Total assets 27,296,564 24,161,848 24,405,668

============ ============ =============

Equity

Shareholders' equity

Share capital 6 4,166,963 2,756,963 2,816,963

Share premium 14,941,897 13,535,468 13,594,317

Capital redemption reserve 344,424 344,424 344,424

Retained earnings (5,690,132) (5,371,109) (5,435,867)

------------ ------------ -------------

Total equity 13,763,152 11,265,746 11,319,837

------------ ------------ -------------

Non-current liabilities

Interest bearing loans and

borrowings 13,164,783 11,052,419 11,052,419

------------ ------------ -------------

Current liabilities

Trade and other payables 368,629 257,495 447,224

Interest bearing loans and

borrowings - 1,586,188 1,586,188

368,629 1,843,683 2,033,412

------------ ------------ -------------

Total liabilities 13,533,412 12,896,102 13,085,831

------------ ------------ -------------

Total equity and liabilities 27,296,564 24,161,848 24,405,668

============ ============ =============

Net asset value per share

(pence) 33.03 40.86 40.18

============ ============ =============

CONSOLIDATED STATEMENT OF CHANGES IN EQUITY

FOR THE SIX MONTHSED 31 DECEMBER 2021 (unaudited)

Capital

redemption Retained

Share capital Share premium reserve earnings Other reserves Total equity

GBP GBP GBP GBP GBP GBP

Balance at

1 July 2020 2,756,963 13,535,468 344,424 (4,511,633) 14,930 12,140,152

Changes in

equity

Transactions

with owners:

Equity element

of loan finance - - - - (14,930) (14,930)

Total transactions

with owners: - - - - (14,930) (14,930)

-------------- -------------- ------------ ------------ --------------- -------------

Total comprehensive

expense - - - (859,476) - (859,476)

Balance at

31 December

2020 2,756,963 13,535,468 344,424 (5,371,109) - 11,265,746

-------------- -------------- ------------ ------------ --------------- -------------

Changes in

equity

Transactions

with owners:

Issue of share

capital 60,000 58,849 - - - 118,849

-------------- -------------- ------------ ------------ --------------- -------------

Total transactions

with owners: 60,000 58,849 - - - 118,849

-------------- -------------- ------------ ------------ --------------- -------------

Total comprehensive

expense - - - (64,758) - (64,758)

-------------- -------------- ------------ ------------ --------------- -------------

Balance at

30 June 2021 2,816,963 13,594,317 344,424 (5,435,867) - 11,319,837

-------------- -------------- ------------ ------------ --------------- -------------

Changes in

equity

Transactions

with owners:

Issue of share

capital 1,350,000 1,347,580 - - - 2,697,580

-------------- -------------- ------------ ------------ --------------- -------------

Total transactions

with owners: 1,350,000 1,347,580 - - - 2,697,580

-------------- -------------- ------------ ------------ --------------- -------------

Total comprehensive

expense - - - (254,265) - (254,265)

-------------- -------------- ------------ ------------ --------------- -------------

Balance at

31 December

2021 4,166,963 14,941,897 344,424 (5,690,132) - 13,763,152

============== ============== ============ ============ =============== =============

CONSOLIDATED STATEMENT OF CASH FLOWS

FOR THE SIX MONTHSED 31 DECEMBER 2021 (unaudited)

Six months Six months Year

ended ended ended

31 December 31 December 30 June

2021 2021

2020 (audited)

GBP GBP GBP

Cash flows from operating activities

Loss for the period/year from continuing

operations (254,265) (859,476) (924,234)

Adjustments for

Depreciation charges 8,900 11,518 23,032

Loss on disposal of investment 5,000 - -

property

Revaluation of investment properties (145,000) - (501,330)

Finance costs 355,866 239,392 497,432

Finance income (3) (661) (729)

(Increase)/decrease in trade and

other receivables (14,430) 266 10,514

(Decrease)/increase in trade and

other payables (78,595) (116,921) 72,808

Cash used in operations (122,527) (725,882) (822,507)

Interest paid (355,866) (239,392) (497,432)

Net cash used in operating activities (478,393) (965,274) (1,319,939)

------------- ------------- ------------

Cash flows from investing activities

Purchase of investment properties

(including capital expenditure

on current properties) (285,000) (70,120) (168,670)

Proceeds from sale of investment 280,000 - -

properties

Interest received 3 661 729

------------- ------------- ------------

Net cash from/(used in) investing

activities (4,997) (69,459) (167,941)

------------- ------------- ------------

Cash flows from financing activities

Loan repayments in period (3,443,777) (100,000) (100,000)

New loans in period 3,969,954 - -

Proceeds from share issue 2,697,580 - 118,849

------------- ------------- ------------

Net cash from financing activities 3,223,757 (100,000) 18,849

------------- ------------- ------------

Increase/(decrease) in cash and

cash equivalents 2,740,367 (1,134,733) (1,469,031)

------------- ------------- ------------

Cash and cash equivalents at beginning

of period 66,915 1,535,946 1,535,946

============= ============= ============

Cash and cash equivalents at end

of period 2,807,282 401,213 66,915

============= ============= ============

NOTES TO THE CONSOLIDATED FINANCIAL STATEMENTS

FOR THE SIX MONTHSED 31 DECEMBER 2021 (unaudited)

1. Basis of preparation

The Company is registered in England and Wales. The consolidated

interim financial statements for the six months ended 31 December

2021 comprise those of the Company and subsidiaries. The Group is

primarily involved in UK property ownership and letting.

Statement of compliance

This consolidated interim financial report has been prepared in

accordance with the measurement principles of International

Financial Reporting Standards as adopted within UK GAAP. AIM-listed

companies are not required to comply with IAS 34 Interim Financial

Reporting and the Group has taken advantage of this exemption.

Selected explanatory notes are included to explain events and

transactions that are significant to an understanding of the

changes in financial performance and position of the Group since

the last annual consolidated financial statements for the year

ended 30 June 2021. This consolidated interim financial report does

not include all the information required for full annual financial

statements prepared in accordance with International Financial

Reporting Standards. The financial statements are unaudited and do

not constitute statutory accounts as defined in section 434(3) of

the Companies Act 2006.

A copy of the audited annual report for the year ended 30 June

2021 has been delivered to the Registrar of Companies. The

auditor's report on these accounts was unqualified and did not

contain statements under s498(2) or s498(3) of the Companies Act

2006.

This consolidated interim financial report was approved by the

Board of Directors on 29 March 2022.

Significant accounting policies

The accounting policies applied by the Group in this

consolidated interim financial report are the same as those applied

by the Group in its consolidated financial statements for the year

ended 30 June 2021.

Basis of consolidation

The interim financial statements include the financial

statements of the Company and its subsidiary undertakings. The

subsidiaries included within the consolidated financial statements,

from their effective date of acquisition, are K&C (Newbury)

Limited, K&C (Coleherne) Limited, K&C (Osprey) Limited, KCR

(Kite) Limited and KCR (Southampton) Limited.

Going Concern

The Directors have adopted the going-concern basis in preparing

the interim financial statements.

The Directors have concluded that it remains appropriate to

prepare these interim financial statements on a going concern

basis.

2. Operating segments

The Group is involved in UK property ownership and letting and

is considered to operate in a single geographical and business

segment.

Revenue analysed by class of business:

Six months Six months

ended ended Year ended

31 December 31 December 30 June

2021 2020 2021 (audited)

GBP GBP GBP

Rental income 422,219 358,556 724,680

Management fees 42,194 43,013 81,768

Resale commission 56,075 50,500 114,913

Ground rents 10,595 10,635 13,535

Leasehold extension income 73,500 12,703 96,275

Other income - - 4,840

------------- ------------- ----------------

604,583 475,407 1,036,011

============= ============= ================

3. Operating loss

The loss before taxation is stated after charging:

Six months Six months

ended ended Year ended

31 December 31 December 30 June

2021 2020 2021 (audited)

GBP GBP GBP

Costs of refurbishment of investment

properties 34,682 498,965 844,200

Directors' remuneration 73,624 75,000 222,191

During the six months ended 31 December 2021, the Group incurred

costs of GBP34,682 relating to major refurbishment of properties at

Coleherne Road, London, Ladbroke Grove, London and Heathside,

London.

During the six months ended 31 December 2020, the Group incurred

costs of GBP498,965 relating to major refurbishment of properties

at Coleherne Road, London and Heathside, London. This increased to

GBP844,200 in the year ended 30 June 2021.

During the 6 month period, the Company paid Naylor Partners, a

business owned by Russell Naylor, fees of GBP24,000 (December 2020

- GBP24,000); and Artefact Partners, a business owned by Richard

Boon, fees of GBPnil (December 2020 - GBP18,900). The Company paid

DGS Capital Partners LLP, a business partly owned by Michael

Davies, fees of GBPnil (December 2020 - GBP10,800).

The directors are considered to be key management personnel.

4. Basic and diluted loss per share

Basic

The calculation of loss per share for the six months to 31

December 2021 is based on the loss for the period attributable to

ordinary shareholders of GBP254,265 divided by a weighted average

number of ordinary shares in issue.

The weighted average number of shares used for the six months

ended 31 December 2021 was 33,012,022 (June 2021 - 27,651,823)

(December 2020 - 27,569,631).

Diluted

The calculation of loss per share for the six months to 31

December 2021 is based on the loss for the period attributable to

ordinary shareholders of GBP254,265 divided by a weighted average

number of ordinary shares in issue, adjusted for dilutive share

options held by Torchlight.

The weighted average number of shares used for the six months

ended 31 December 2021 was 77,569,631 (June 2021 - 77,569,631)

(December 2020 - 77,569,631).

5. Investment properties

Six months Six months

ended 31 ended 31 Year ended

December December 30 June

2021 2020 2021 (audited)

GBP GBP GBP

At start of period 24,262,000 23,592,000 23,592,000

Additions 285,000 70,120 168,670

Disposals (285,000) - -

Revaluations 145,000 - 501,330

----------- ----------- ----------------

At end of period 24,407,000 23,662,120 24,262,000

=========== =========== ================

Investment properties were valued by professionally qualified

independent external valuers at the date of acquisition and were

recorded at the values that were attributed to the properties at

acquisition date. The investment properties were independently

valued at, or within three months of the financial year ended 30

June 2021. The Directors have further considered the values as at

31 December 2021 and concluded that they remain appropriate.

Fair value is based on current prices in an active market for

similar properties in the same location and condition. The current

price is the estimated amount for which a property could be

exchanged between a willing buyer and willing seller in an arm's

length transaction after proper marketing wherein the parties had

each acted knowledgeably, prudently and without compulsion.

Valuations are based on a market approach which provides an

indicative value by comparing the property with other similar

properties for which price information is available. Comparisons

have been adjusted to reflect differences in age, size, condition,

location and any other relevant factors.

The fair value for investment properties has been categorised as

a Level 3 inputs under IFRS 13.

The valuation technique used in measuring the fair value, as

well as the significant inputs and significant unobservable inputs

are summarised in the following table -

Fair Value Valuation Technique Significant Significant Unobservable

Hierarchy Inputs Used Inputs

Level Income capitalisation Adopted gross 3.00% - 5.76%

3 and or capital value yield

on a per square foot

basis

Adopted rate

per square foot GBP303 - GBP982

6. Share capital

31 December 31 30 June

2021 December 2021 (audited)

Allotted, issued and fully paid: 2020

Nominal

Number: Class: value: GBP GBP GBP

41,669,631 Ordinary GBP0.10 4,166,963 2,756,963 2,816,963

4,166,963 2,756,963 2,816,963

============ ========== ================

At 1 July 2021, the Company had 28,169,631 Ordinary shares of

GBP0.10 each in issue.

On 27 October 2021, Torchlight Fund LP exercised options to

acquire 13,500,000 ordinary shares of 10p each at a price of

19.982p per share. The proceeds of the exercise provided the group

with additional cash funding of GBP2.7 million.

The Ordinary shares carry no rights to fixed income.

7. Convertible Loan Notes

As at 1 July 2020, the Company had GBP100,000 convertible loan

notes in issue. In July 2020, the convertible loan notes were

repaid in full.

8. Related Party Transactions

Details of remuneration and fees paid to directors are disclosed

at note 3 of these interim financial statements.

This information is provided by RNS, the news service of the

London Stock Exchange. RNS is approved by the Financial Conduct

Authority to act as a Primary Information Provider in the United

Kingdom. Terms and conditions relating to the use and distribution

of this information may apply. For further information, please

contact rns@lseg.com or visit www.rns.com.

RNS may use your IP address to confirm compliance with the terms

and conditions, to analyse how you engage with the information

contained in this communication, and to share such analysis on an

anonymised basis with others as part of our commercial services.

For further information about how RNS and the London Stock Exchange

use the personal data you provide us, please see our Privacy

Policy.

END

IR DBLBXLXLXBBK

(END) Dow Jones Newswires

March 30, 2022 04:00 ET (08:00 GMT)

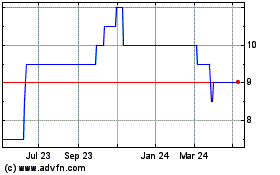

Kcr Residential Reit (LSE:KCR)

Historical Stock Chart

From Nov 2024 to Dec 2024

Kcr Residential Reit (LSE:KCR)

Historical Stock Chart

From Dec 2023 to Dec 2024