TIDMKEYS

RNS Number : 3739M

Keystone Law Group PLC

14 September 2023

14 September 2023

Keystone Law Group Plc

('Keystone', the 'Group' or the 'Company')

Interim results for the six month period ended 31 July 2023

- Strong client demand drives excellent operational and

financial performance with a 25.2% increase in adjusted PBT

- Ongoing business confidence supports interim ordinary dividend

of 5.8p and special dividend of 12.5p

- FY 2024 outlook comfortably ahead of current market expectations(1)

Keystone, the network and tech-enabled challenger law firm, is

pleased to announce its interim results for the six months ended 31

July 2023 ("H1 2024").

Financial Highlights:

-- Revenue growth of 14.9% to GBP42.3 million (H1 2023: GBP36.8 million)

-- Revenue per Principal up 12.2% to GBP104k (H1 2023: GBP92.8k)

-- PBT increased 29.3% to GBP5.3 million (H1 2023: GBP4.1 million)

-- Adjusted PBT increased 25.2% to GBP5.7 million (H1 2023: GBP4.5 million)

-- Adjusted basic EPS of 13.6p, up 22.5% (H1 2023: 11.1p)

-- Strong operating cash conversion at 113.3% with cash

generated from operations of GBP6.3 million (H1 2023: GBP4.9

million).

-- The Group remains debt-free with net cash of GBP11.3m (H1 2023: GBP7.5m)

-- Declared interim ordinary dividend of 5.8p (H1 2023: 5.2p) and special dividend of 12.5p

Operational Highlights:

-- Recruitment market conditions evolved positively

-- Keystone generated strong market and recruitment momentum during H1 2024:

o 144 qualified high-calibre new applicants (H1 2023: 122)

o 25 Principals joined, increasing the number of Principals to

415 (31 January 2023: 398)

o Total fee earners increased to 523 (31 January 2023: 507)

-- Ongoing investment in our people, culture and technology platform

Current Trading and Outlook:

-- Activity levels and client demand remain strong

-- Recruitment market conditions have moved in the Group's

favour, with the Keystone model continuing to attract high-calibre

talent, although economic uncertainty continues to weigh on

candidate flow

-- The Board is confident that the business will continue to

trade well for the rest of the year and that FY 2024 results will

be comfortably ahead of current market expectations(1) .

James Knight, Chief Executive Officer of Keystone,

commented:

"I have been delighted with the performance of the business

during the first half of this year. As anticipated, recruitment

market conditions have moved in our favour and Keystone's model

continues to prove highly attractive to the high-calibre lawyers we

pride ourselves on being able to attract and retain. I look forward

to the rest of the year, confident that Keystone's core business

fundamentals will continue to deliver strong results."

(1) Management understands current market expectations to be

revenue GBP78.9m and adjusted PBT GBP9.5m

Analyst Briefing

A meeting for analysts will be held virtually at 9.30am this

morning. Analysts wishing to attend this event can register via

email at keystonelaw@vigoconsulting.com.

For further information please contact:

Keystone Law Group plc

James Knight, Chief Executive Officer

Ashley Miller, Finance Director

www.keystonelaw.com

+44 (0) 20 3319 3700

Panmure Gordon (UK) Limited (Nominated Adviser and Joint

Broker)

Dominic Morley (Corporate Finance)

Rupert Dearden (Corporate Broking)

www.panmure.com

+44 (0) 20 7886 2500

Investec Bank plc (Joint Broker)

Carlton Nelson

James Rudd

www.investec.co.uk

+44 (0) 20 7597 5970

Vigo Consulting (Financial Public Relations)

Jeremy Garcia / Kate Kilgallen

keystonelaw@vigoconsulting.com

+44 (0)207 390 0233

The information contained within this announcement is deemed to

constitute inside information as stipulated under the Market Abuse

Regulation (EU) No. 596/2014 as it forms part of UK domestic law by

virtue of the European Union (Withdrawal) Act 2018 ("MAR").

Notes to editors

Keystone (AIM: KEYS), is an award-winning, UK Top 100, law firm,

providing conventional legal services in a GBP10bn addressable

market through its scalable and unique model, with three defining

characteristics:

-- Lawyers have freedom, flexibility and autonomy, and are paid up to 75% of what they bill.

-- Lawyers determine how, when and where they work, in contrast

to the conventional law firm model.

-- Lawyers are provided full infrastructure and support via its

central office team, bespoke user-friendly IT platform, and network

of colleagues and events.

Keystone is a full-service law firm, with 20 service areas and

more than 50 industry sectors delivered by over 400 high calibre

self-employed Principal lawyers who work from their own

offices.

In November 2020, Keystone was named Law Firm of the Year by The

Lawyer, the first time a 'new' law firm has won the award.

More information about Keystone can be found at

www.keystonelaw.co.uk .

Chief Executive's Statement

I am extremely pleased to report that Keystone Law has again

delivered a strong performance during the first half of this

financial year ("H1-2024" or the "period"), with revenue rising to

GBP42.3m (14.9% up on H1-2023: GBP36.8m), reported PBT of GBP5.3m

and adjusted PBT(1) of GBP5.7m (GBP4.1m and GBP4.5m respectively in

H1-2023) and cash generated from operations of GBP6.3m, an increase

of 27.8% (H1-2023: GBP4.9m).

In spite of the broader economic headwinds, client demand has

remained strong across all practice areas throughout the period and

this, together with rate rises implemented during last year, has

driven increased revenue per Principal of GBP104k, up 12.2% on

H1-2023.

During the period, we have seen conditions in the legal

recruitment market evolve positively for Keystone. The extremely

high level of demand for candidates, experienced during FY-2023,

has now slightly subsided and, although the uncertain economic

outlook continues to weigh on candidate movement, the results of

our recruitment activity in H1-2024 have been extremely

encouraging. The table below reflects these positive results:

Qualified Offers Offers

New Applicants Made Accepted

-------- --------------- ------ ---------

H1 2022 136 36 28

H1 2023 122 34 17

H1 2024 144 42 25

-------- --------------- ------ ---------

Twenty five Principals joined us during the Period (H1-2023: 22)

bringing the total number of Principals to 415 (31 January 2023:

398). These Principals, existing and new, have continued to recruit

Pod members to build their practices and leverage the value of

their clients. These Pod members satisfy either permanent resource

needs or shorter term project-based demand providing both

scalability and flexibility to our lawyers and, over time, have

become an increasingly important element of the Keystone model.

The central office team has continued to deliver exceptional

service to our lawyers. The ongoing investment in our IT platform

and infrastructure is very much part of "business as usual" for

Keystone. Our bespoke platform is the technological hub of the

business; built to support our model, it provides our lawyers with

first class, dynamic systems, which deliver a high-quality user

experience, whilst ensuring compliance and comprehensive IT

security. We have also continued to invest in the networking

programmes and social events, thereby providing extensive

opportunities for our lawyers to establish and build their personal

and professional networks within Keystone. These events are a core

element of the Group's cultural DNA, encouraging collaboration and

cross-referral of work thereby creating a fertile environment for

our lawyers to deliver high calibre, multi-lawyer and cross

disciplinary solutions to our clients.

I would, therefore, like to take this opportunity to thank

everyone at Keystone for their dedication and passion, which has

made these excellent results possible.

Dividend

I am pleased to announce that the Board has declared an interim

ordinary dividend of 5.8p per share as well as a special dividend

of 12.5p per share. These dividends will be payable on 13 October

2023 to shareholders on the register on 22 September 2023 and the

shares will go ex-dividend on 21 September 2023.

Summary and Outlook

In summary, I have been delighted with all aspects of the

Group's performance during H1-2024. Our lawyers have continued to

respond to demand across the legal sector driving strong revenue

growth, and this, together with the interest rate evolution and our

strong balance sheet, has contributed to the enhanced profits we

report today.

As expected, some of the heat has come out of the legal

recruitment market and this has been beneficial to our growth.

Although it is clear that the UK economy continues to face

significant headwinds, to date we have not been adversely affected

by these, and whilst there may be some impact on overall client

demand during the second half, we remain confident that Keystone

will continue to deliver strong results for the rest of this year,

which will be comfortably ahead of current market expectations(2)

.

James Knight

Chief Executive Officer

13 September 2023

(1) Adjusted PBT is calculated using profit before tax and

adding back amortisation and share-based payments for all

periods.

(2) Management understands current market expectations to be

revenue GBP78.9m and adjusted PBT GBP9.5m

CONSOLIDATED STATEMENT OF COMPREHENSIVE INCOME

For the period ended 31 July 2023

6 Months to 6 Months to

July 2023 July 2022

(Unaudited) (Unaudited)

Note GBP GBP

--------------------------------------- ---- ------------- ------------

Revenue 42,304,803 36,809,493

Cost of sales (31,212,674) (27,105,062)

--------------------------------------- ---- ------------- ------------

Gross profit 11,092,129 9,704,431

Depreciation and amortisation (448,914) (440,937)

Share-based payments 2 (250,073) (226,280)

Administrative expenses 2 (5,591,918) (4,881,419)

Other operating income 23,698 25,397

--------------------------------------- ---- ------------- ------------

Operating profit 4,824,922 4,181,192

Finance income 689,802 14,228

Finance costs (249,121) (48,649)

--------------------------------------- ---- ------------- ------------

Profit before tax 5,265,603 4,146,771

Corporation tax expense (1,430,321) (870,401)

--------------------------------------- ---- ------------- ------------

Profit and total comprehensive income

for the period attributable to equity

holders of the Parent 3,835,282 3,276,370

--------------------------------------- ---- ------------- ------------

Basic EPS (p) 1 12.2 10.5

Diluted EPS (p) 1 12.0 10.3

--------------------------------------- ---- ------------- ------------

The above results were derived from continuing operations.

CONSOLIDATED STATEMENT OF FINANCIAL POSITION

As at 31 July 2023

31 January

31 July 31 July

2023 2022 2023

(Unaudited) (Unaudited) (Audited)

Note GBP GBP GBP

---------------------------- ---- ------------- ------------ ----------

Assets

Non-current assets

Property, plant and

equipment

- Owned assets 168,197 194,936 187,677

- Right-of-use assets 308,146 719,006 513,577

---------------------------- ---- ------------- ------------ ----------

Total property, plant

and equipment 476,343 913,942 701,254

---------------------------- ---- ------------- ------------ ----------

Intangible assets 5,231,396 5,582,280 5,406,838

---------------------------- ---- ------------- ------------ ----------

Other assets 13,627 13,628 13,628

---------------------------- ---- ------------- ------------ ----------

5,721,366 6,509,850 6,121,720

---------------------------- ---- ------------- ------------ ----------

Current assets

Trade and other receivables 3 23,672,904 21,204,072 22,605,908

Cash and cash equivalents 11,347,917 7,457,485 9,151,875

---------------------------- ---- ------------- ------------ ----------

35,020,821 28,661,557 31,757,783

---------------------------- ---- ------------- ------------ ----------

Total assets 40,742,187 35,171,407 37,879,503

---------------------------- ---- ------------- ------------ ----------

Equity and liabilities

Equity

Share capital 62,797 62,548 62,732

Share premium 9,920,760 9,920,760 9,920,760

Share-based payments

reserve 1,077,714 976,238 1,028,247

Retained earnings 7,464,355 4,796,659 6,847,378

---------------------------- ---- ------------- ------------ ----------

Equity attributable

to equity holders

of the Parent 18,525,626 15,756,205 17,859,117

---------------------------- ---- ------------- ------------ ----------

Non-current liabilities

Lease liabilities - 340,607 109,484

Deferred tax liabilities 84,789 167,521 132,432

Provisions - 127,213 183,501

---------------------------- ---- ------------- ------------ ----------

84,789 635,341 425,417

---------------------------- ---- ------------- ------------ ----------

Current liabilities

Trade and other payables 20,125,906 17,402,869 18,347,358

Lease liabilities 416,905 538,544 538,544

Provisions 207,586 - -

Corporation tax liability 1,381,375 838,448 709,067

---------------------------- ---- ------------- ------------ ----------

22,131,772 18,779,861 19,594,969

---------------------------- ---- ------------- ------------ ----------

Total liabilities 22,216,561 19,415,202 20,020,386

---------------------------- ---- ------------- ------------ ----------

Total equity and

liabilities 40,742,187 35,171,407 37,879,503

---------------------------- ---- ------------- ------------ ----------

The interim statements were approved and authorised for issue by

the Board of Directors on 13 September 2023 and were signed on its

behalf by:

A Miller

Director

consolidated statement OF CHANGES IN EQUITY

For the period ended 31 July 2023

Attributable to equity holders of the Parent

-----------------------------

Share Share Share-based Retained

capital premium payment reserve earnings Total

GBP GBP GBP GBP GBP

----------------------------- -------- --------- ---------------- ----------- -----------

At 1 February 2022 (audited) 62,548 9,920,760 749,958 8,150,365 18,883,631

Profit for the period

and total comprehensive

income - - - 3,276,370 3,276,370

Transactions with owners

Share-based payment awards - - 226,280 - 226,280

Dividends paid - - - (6,630,076) (6,630,076)

----------------------------- -------- --------- ---------------- ----------- -----------

At 31 July 2022 (unaudited) 62,548 9,920,760 976,238 4,796,659 15,756,205

Profit for the period

and total comprehensive

income - - - 3,457,339 3,457,339

Transactions with owners

Share-based payments

vesting 184 - (224,419) 224,419 184

Share-based payments

awards - - 276,428 - 276,428

Dividends paid - - - (1,631,039) (1,631,039)

----------------------------- -------- --------- ---------------- ----------- -----------

At 31 January 2023 (audited) 62,732 9,920,760 1,028,247 6,847,378 17,859,117

----------------------------- -------- --------- ---------------- ----------- -----------

Profit for the period

and total comprehensive

income - - - 3,835,282 3,835,282

Transactions with owners

Share-based payments

vesting 65 - (200,605) 200,605 65

Share-based payments

awards - - 250,072 - 250,072

Dividends paid - - - (3,418,910) (3,418,910)

----------------------------- -------- --------- ---------------- ----------- -----------

At 31 July 2023 (unaudited) 62,797 9,920,760 1,077,714 7,464,355 18,525,626

----------------------------- -------- --------- ---------------- ----------- -----------

CONSOLIDA TED STATEMENT OF CASH FLOWS

For the period ended 31 July 2023

6 Months to 6 Months to Year ended

July 2023 (Unaudited) July 2022 (Unaudited) 31 January

Note GBP GBP 2023 (Audited)

-------------------------------------- ---- ---------------------- ---------------------- ---------------

Cash flows from operating activities

Profit before tax 5,265,603 4,146,771 8,384,677

Adjustments to cash flows from non-cash

items

Depreciation and amortisation 2 448,914 440,937 885,699

Share-based payments 250,073 226,280 502,708

Finance income (689,802) (14,228) (221,810)

Finance costs 249,121 48,649 147,089

-------------------------------------- ---- ---------------------- ---------------------- ---------------

5,523,909 4,848,409 9,698,363

Working capital adjustments

(Increase) in trade and other receivables (1,066,996) (1,230,258) (2,632,094)

Increase in trade and other payables 1,778,548 1,259,703 2,204,192

Increase in provisions 24,085 19,268 75,556

-------------------------------------- ---- ---------------------- ---------------------- ---------------

Cash generated from operations 6,259,546 4,897,122 9,346,017

Interest paid on client balances (201,475) (1,004) (70,791)

Interest portion of lease liability (47,646) (47,645) (76,298)

Corporation taxes paid (805,656) (1,019,244) (1,964,281)

-------------------------------------- ---- ---------------------- ---------------------- ---------------

Cash generated from operating activities 5,204,769 3,829,229 7,234,647

-------------------------------------------- ---------------------- ---------------------- ---------------

Cash flows from/(used in) investing

activities

Interest received 689,802 14,228 221,810

Purchases of property plant and equipment (48,561) (7,451) (64,080)

-------------------------------------------- ---------------------- ---------------------- ---------------

Net cash generated from/(used in)

investing activities 641,241 6,777 157,730

-------------------------------------------- ---------------------- ---------------------- ---------------

Cash flows from financing activities

Proceeds from issue of ordinary

shares 65 - 184

Lease repayments (231,123) (231,121) (462,247)

Dividends paid (3,418,910) (6,630,076) (8,261,115)

-------------------------------------- ---- ---------------------- ---------------------- ---------------

Net cash (used in) financing activities (3,649,968) (6,861,197) (8,723,178)

-------------------------------------------- ---------------------- ---------------------- ---------------

Net (decrease)/increase in cash

and cash equivalents 2,196,042 (3,025,191) (1,330,801)

Cash at 1 February 9,151,875 10,482,676 10,482,676

-------------------------------------- ---- ---------------------- ---------------------- ---------------

Cash at 31 July 11,347,917 7,457,485 9,151,875

-------------------------------------- ---- ---------------------- ---------------------- ---------------

NOTES TO THE interim report

1. General Information

The Company was incorporated as Keystone Law Group Limited on 13

May 2014 under the Companies Act 2006 (registration no. 09039092)

and subsequently used as the vehicle to acquire Keystone Law

Limited (the main trading company in the Group) and its

subsidiaries on 17 October 2014. The Company was re-registered as a

Public Limited Company on 10 November 2017. The Company was

incorporated and is domiciled in England and Wales. The principal

activity of the Group is the provision of legal services. The

address of its registered office is:

48 Chancery Lane

London

WC2A 1JF

The Interim Report is presented in Pounds Sterling, being the

functional currency of the companies within the Group.

Accounting Policies

Statement of Compliance

The Interim Report has been prepared in accordance with the

recognition and measurement principles of UK-adopted International

Accounting Standards.

Basis of Preparation

The Interim Report does not constitute statutory accounts as

defined in Section 434 of the Companies Act 2006. The Group's

statutory financial statements for the year ended 31 January 2023

have been filed with the Registrar of Companies. The auditor's

report on those financial statements was unqualified and did not

contain a statement under Section 498 (2) or (3) of the Companies

House 2006. The Interim Report information has been prepared in

accordance with the recognition and measurement principles of UK

adopted International Accounting Standards, and on the same basis,

and using the same accounting policies, as used in the financial

statements for the year ended 31 January 2023.

The Interim Report has not been audited or reviewed, in

accordance with the International Standard on Review Engagement

2410 (UK) issued by the Financial Reporting Council.

Going Concern

The Interim Report has been prepared on a going concern basis as

the Directors have reasonable expectation that the Group has

adequate resources to continue in operational existence for the

foreseeable future. The Group has no debt, is strongly cash

generative, and has a strong trading performance. The Group's

forecasts and projections show that the Group has sufficient

resources for both current and anticipated cash requirements.

ACCOUNTING DEVELOPMENTS

There have been no new standards or interpretations, relevant to

the Group's operations, applied in the Interim Report for the first

time.

ADJUSTED PBT

Adjusted PBT is utilised as a key performance indication for the

Group and is calculated as follows:

6 months 6 months

to July to July

2023 2022

(Unaudited) (Unaudited)

GBP'000 GBP'000

--------------------- ------------- ------------

Profit before tax 5,266 4,147

Amortisation 175 175

Share-based payments 250 226

--------------------- ------------- ------------

Adjusted PBT 5,691 4,548

--------------------- ------------- ------------

Earnings per Share

Basic earnings per share is calculated by dividing the profit

for the period by the weighted average number of ordinary shares

outstanding during the period. The weighted average number of

shares in the period was 31,373,312 (H1-2023: 31,273,941) and the

basic earnings per share was 12.2p (H1-2023: 10.5p). Diluted

earnings per share is calculated by dividing the same profit by the

weighted average number of ordinary shares, taking into account the

dilution effect from grants made under the Long Term Incentive Plan

(31,880,828 (H1-2023: 31,733,387)). Diluted earnings per share was

12.0p (H1-2023: 10.3p).

The adjusted earnings per share was 13.6p (H1-2023: 11.8p),

whilst the diluted adjusted earnings per share was 13.4p (H1-2023:

11.6p). Adjusted earnings are stated by making the same adjustments

to earnings as those made in calculating adjusted PBT.

2. Expenses by Nature

6 months 6 months

to July to July

2023 2022

(Unaudited) (Unaudited)

Expenses are comprised of: GBP GBP

----------------------------------- ------------- -------------

Depreciation - right-of-use assets 205,430 205,430

Depreciation - other 68,042 60,065

Amortisation 175,442 175,442

Staff costs 2,865,957 2,373,245

Share-based payments 250,073 226,280

Other administrative expenses 3,281,296 2,828,007

----------------------------------- ------------- -------------

6,846,240 5,868,469

----------------------------------- ------------- -------------

Included within staff costs above are the costs of employed fee

earners who are included within cost of sale (H1-2024: GBP555,335;

H1-2023: GBP319,842).

3. Trade and Other Receivables

31 July 31 July 31 January

2023 2022 2023

(Unaudited) (Unaudited) (Audited)

GBP GBP GBP

------------------------------ ------------- ------------ -----------

Trade receivables 14,721,714 13,909,185 13,285,914

Provision for impairment

of trade receivables (4,589,670) (4,716,481) (4,114,670)

------------------------------ ------------- ------------ -----------

Net trade receivables 10,132,045 9,192,704 9,171,244

Accrued income 10,706,147 9,322,320 10,030,078

Prepayments 1,733,806 1,278,865 2,271,739

Unbilled disbursements 945,286 1,235,809 970,078

Other receivables 155,621 174,374 162,769

------------------------------ ------------- ------------ -----------

Total current trade and

other receivables 23,672,904 21,204,072 22,605,908

------------------------------ ------------- ------------ -----------

Net trade receivables average

age (days) (unaudited) 32 32 36

------------------------------ ------------- ------------ -----------

4. DIVIDENDS

The Directors have declared an interim ordinary dividend of 5.8p

per share (H1-2023: 5.2p per share) as well as a special dividend

of 12.5p per share. The dividends will be paid on 13 October 2023

to shareholders on the register on 22 September 2023 with the

shares going ex-dividend on 21 September 2023. In accordance with

IAS10 "Events after the Balance Sheet Date", these dividends have

not been reflected in the Interim Report.

Keystone Law

48 Chancery Lane

London

WC2A 1JF

www.keystonelaw.co.uk

This information is provided by RNS, the news service of the

London Stock Exchange. RNS is approved by the Financial Conduct

Authority to act as a Primary Information Provider in the United

Kingdom. Terms and conditions relating to the use and distribution

of this information may apply. For further information, please

contact rns@lseg.com or visit www.rns.com.

RNS may use your IP address to confirm compliance with the terms

and conditions, to analyse how you engage with the information

contained in this communication, and to share such analysis on an

anonymised basis with others as part of our commercial services.

For further information about how RNS and the London Stock Exchange

use the personal data you provide us, please see our Privacy

Policy.

END

IR GPUCPBUPWGMW

(END) Dow Jones Newswires

September 14, 2023 02:00 ET (06:00 GMT)

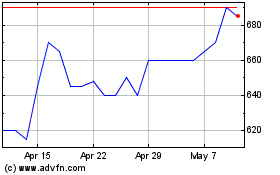

Keystone Law (LSE:KEYS)

Historical Stock Chart

From Dec 2024 to Jan 2025

Keystone Law (LSE:KEYS)

Historical Stock Chart

From Jan 2024 to Jan 2025