Publication of 2023 Annual Report

04 April 2024 - 5:00PM

UK Regulatory

Publication of 2023 Annual Report

Kenmare Resources plc

(“Kenmare” or “the Company” or “the Group”)

4 April 2024

Publication of 2023 Annual

Report

Kenmare Resources plc (LSE:KMR, ISE:KMR), one of

the leading global producers of titanium minerals and zircon, which

operates the Moma Titanium Minerals Mine (the "Mine" or "Moma") in

northern Mozambique, today announces the publication and filing of

its Annual Report for the year ended

31 December 2023.

The 2023 Annual Report (in ESEF-compliant and

PDF formats) is available for inspection on the Company's website

and can be downloaded here. It has also been submitted to Euronext

Dublin and the UK National Storage Mechanism and will shortly be

available for inspection at the following locations:

https://direct.euronext.com/#/oamfiling

and

https://data.fca.org.uk/#/nsm/nationalstoragemechanism

The 2023 Annual Report is available to view

directly by clicking on the link at the end of this

announcement.

Paper copies are expected to be posted on 11

April 2024 to shareholders who have requested to receive them.

2023 key highlights

Financial

- Recommended 2023 dividend of $50.0

million or USc56.04 per share, a 3% increase compared to 2022

(USc54.31), comprising an interim dividend of USc17.50 per share

(paid in October 2023) and a final dividend of USc38.54 per share

(payable in May 2024)

- Mineral product revenue of $437.1

million, a 12% decrease compared to 2022 ($498.3 million), driven

by a 10% lower average price received for Kenmare’s products, due

to weaker markets and a 3% reduction in shipments

- Total cash operating costs of

$228.1 million, up 4% on 2022 ($218.7 million), due to increased

heavy mobile equipment rental, higher fuel costs, and costs

associated with a severe lightning strike in Q1 2023

- Cash operating costs per tonne of

$209, a 15% increase compared to 2022 ($182 per tonne), due to

higher total cash operating costs and a 9% decrease in production

of finished products

- EBITDA of $220.3 million,

representing a strong EBITDA margin of 50% (2022: 60%), despite

weaker product pricing driving a 26% decrease on 2022 ($298.0

million)

- Profit after tax of $131.0 million,

down 36% on 2022 ($206.0 million)

- Diluted earnings per share of $1.37

per share, a 35% decrease on 2022 ($2.12 per share)

- Net cash of $20.7 million at

year-end 2023 (2022: $25.7 million), with cash and cash equivalents

of $71.0 million (2022: $108.3 million)

- Share buy-back of 5.9% of Kenmare’s

issued share capital for £23.6 million ($30.0 million) completed in

September 2023

- Post-period end, new debt

facilities agreed for a $200 million Revolving Credit Facility to

enhance financial flexibility and support Kenmare’s planned capital

programmes

Operational and corporate

- As announced on 15 March 2024,

Managing Director Michael Carvill will step down from his executive

role and Board position later this year – the Nomination Committee

has commenced a process to find his successor

- Strong safety performance achieved

in Q4 2023 has continued in Q1 2024, with the milestone of three

million hours without a Lost Time Injury passed in late

February

- Heavy Mineral Concentrate (“HMC”)

production of 1,448,300 tonnes in 2023, a 9% decrease compared to

2022 (1,586,200 tonnes), due to lower ore grades and mining rates

impacted by power interruptions and a severe lightning strike in Q1

2023

- Ilmenite production of 986,300

tonnes in 2023, a 9% decrease on 2022 (1,088,300 tonnes), broadly

in line with a 9% reduction in HMC processed

- Shipments of finished products of

1,045,200 tonnes in 2023, a 3% decrease on 2022 (1,075,600 tonnes),

due to weaker product markets and poor weather conditions in Q4

2023

- Ilmenite production guidance for

2024 is 950,000 to 1,050,000 tonnes

- Production in 2024 will be second

half weighted, with Q1 2024 production expected to be in line with

Q1 2023 – material uplift in production expected in Q2 2024

For further information, please contact:

Kenmare Resources plc

Jeremy Dibb / Katharine Sutton / Michael Starke

Investor Relations

ir@kenmareresources.com

Tel: +353 1 671 0411

Mob: +353 87 943 0367 / +353 87 663 0875

Murray (PR advisor)

Paul O’Kane

pokane@murraygroup.ie

Tel: +353 1 498 0300

Mob: +353 86 609 0221

About Kenmare Resources

Kenmare Resources plc is one of the world's

largest producers of mineral sands products. Listed on the London

Stock Exchange and the Euronext Dublin, Kenmare operates the Moma

Titanium Minerals Mine in Mozambique. Moma's production accounts

for approximately 7% of global titanium feedstocks and the Company

supplies to customers operating in more than 15 countries. Kenmare

produces raw materials that are ultimately consumed in everyday

quality-of life items such as paints, plastics, and ceramic

tiles.

All monetary amounts refer to United States

dollars unless otherwise indicated.

- 2024-04-04 Kenmare 2023 Annual Report

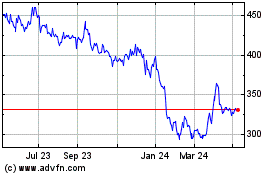

Kenmare Resources (LSE:KMR)

Historical Stock Chart

From Dec 2024 to Jan 2025

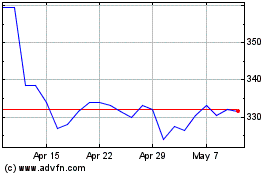

Kenmare Resources (LSE:KMR)

Historical Stock Chart

From Jan 2024 to Jan 2025