TIDMKWG

RNS Number : 9844S

Kingswood Holdings Limited

15 March 2023

15 March 2023

KINGSWOOD HOLDINGS LIMITED

("Kingswood" or the "Group")

Trading Update

Kingswood Holdings Limited (AIM: KWG), the international, fully

integrated wealth and investment management group, provides an

update on trading for the year ended 31 December 2022 ("FY2022")

and outlook for the year ended 31 December 2023 ("FY2023").

Trading update:

Kingswood continues to make exceptional progress against its

strategic objectives and its medium-term targets.

Subject to audit, the Group expects to report total revenue of

approximately GBP143.6m for FY2022, a decrease of GBP6.1m or 3.9%

year on year.

UK revenues increased to approximately GBP33.8m, a 54% increase

year on year, reflecting resilience to market headwinds and the

benefit of acquisitions in the current and prior periods.

The US business (in which KHL has a 50.1% interest and the US

financials are consolidated into Group reporting) expects to report

revenues of approximately GBP110m, a decrease of 14% year on year,

due to lower than expected capital markets activity affecting US

investment banking revenues and the timing of a large one-off, high

margin US transaction that was expected to be reported in 2022 and

that will now be recognised in 2023.

The Group expects FY2022 operating profit to be GBP8.5m, an

increase of GBP2.2m or 34% year on year, but below the Board's

expectations.

UK expects to report operating profit of GBP11.3m (a GBP5.2m or

84% increase year on year) and is in line with Board

expectations.

The US business expects to report operating profit of GBP2.8m (a

GBP2.4m or 46% decrease year on year) and below Board

expectations.

Further detail is set out below.

Strategic highlights:

-- Kingswood completed the acquisition of ten businesses in the

UK in 2022. Collectively, these businesses have added GBP1.7bn AuA,

28 advisers and GBP11.8m revenue to the Group in 2022 and will add

a further GBP6.0m incremental revenue in 2023.

-- In Q1 2023 two further acquisitions, Barry Fleming Partners

and Moloney Investments Ltd (MMPI), have completed, adding further

AuA of GBP0.7bn and revenue of GBP8.3m. The acquisition of MMPI is

a highly strategic investment, providing access to the attractive

Irish wealth management market and offering multiple new avenues

for growth.

-- UK AUM/A increased by GBP3.2bn to GBP8.1bn as at 31 December

2022, driven by inorganic growth and positive net flows of assets

under management and advice (AUM/A). AUM/A as at March 2023 is

GBP9.0bn following the acquisitions completed in the Q1 2023.

-- The acquisition of IBOSS has driven increased flows into

Kingswood investment solutions. Vertical Integration of AuA, where

an existing Wealth Planning client chooses a Kingswood Investment

product or service (MPS/PPS), increased to GBP650m by the end of

FY2022.

-- In the H2 2022, the UK business has continued to perform in

line with Board expectations, generating net positive inflows of

client AUM/A inflows and increasing revenue by more than 50% year

on year.

-- In October 2022, Kingswood announced that it had entered into

a debt facility with a leading global financial institution to

provide initial funding of GBP50m with the ability to increase the

commitment to GBP150m. This facility will further enable Kingswood

UK's strategic growth plans.

-- Technology has been successfully deployed in the business to

improve the client experience and productivity. Following the

launch of our market leading 'Kingswood Go' app in March 2022, over

3,300 clients have now been registered providing them with easier

access to their investment portfolio. Further investments in

technology will deliver an enhanced experience for the client

including digital fact finds and new propositions that will provide

both a face to face and a digitally delivered service.

-- Kingswood has launched a new AIM portfolio available for

clients, expanding the investment proposition.

-- Kingswood US has continued to grow its RIA/BD business

organically through the accelerated recruitment of registered

representatives, which supported an 19% increase in AUM/A to

$3.0bn. The US business continued to build its Investment Banking

operating segment, recruiting two new high quality IB groups in H1

2022 focused on mid-market equity capital markets.

Unaudited FY2022 financial highlights

-- The UK division has reported strong performance reflecting

rapid growth in the business. UK revenue will be approximately

GBP33.8m, a 54% year on year increase (2021: GBP21.9m). 87% of the

UK's revenue is recurring in nature, providing a strong,

annuity-style fee stream.

-- The UK division is expected to deliver operating profit of

approximately GBP11m, up 80% year-on-year (2021: GBP6.1m), which is

in line with Board expectations. Growth in operating profit, a

large part of which is driven by acquisitions, is underpinned by

careful cost management and realising synergy benefits from

business integrations to drive margin improvement. Central costs

are expected to be GBP5.6m, GBP0.7m higher year on year, reflecting

investment to support the growing business.

-- US division revenue will be approximately GBP110m, a

year-on-year reduction of 13.9% (2021: GBP127.8m) due to lower

transactional Investment Banking revenues resulting from a slowdown

in capital market activity, the timing of a large one-off

transaction and accordingly is below expectation. However, RIA/BD

revenues, which are recurring in nature and driven by AUM, have

grown 25% year over year on a like for like currency basis.

Operating profit is expected to be GBP2.8m (2021: GBP5.1m)

-- FY2022 Group revenue is therefore expected to be

approximately GBP143.6m, a 3.9% decrease on prior year (2021:

GBP149.7m).

-- FY2022 Group operating profit is expected to be approximately

GBP8.5m, 34% higher than 2021 but below the Board's expectations.

Year on year growth in operating profit was driven by acquisitions

and organic growth in the UK. It is lower than anticipated due to

the impact of lower US Investment Banking revenues and timing of a

large one-off revenue from a transaction in the US that had

expected to be reported in 2022 and will now be recognised in

2023.

-- As at December 2022, Group net assets are expected to be

GBP74.0m (2021: GBP76.9m) comprised of GBP(5.5)m net debt,

GBP(32.8)m deferred consideration and GBP112.3m of other net

assets. As at December 2022 the Group had drawn GBP25m of the debt

facility.

2023 Outlook

Our near-term target remains to build our AUM/A to in excess of

GBP10bn in UK&I and GBP12bn for the Group.

With the full year effect of the acquisitions made to date,

current Group FY2023 run rate operating profit is approximately

GBP14.7m. Through organic growth and further acquisitions through

2023 we are building a pipeline to deliver proforma operating

profit of GBP20m. Further upside should also be expected if markets

recover, but this is not assumed in our plans.

We continue to enjoy a strong and healthy pipeline of

acquisitions and have capacity with our debt facility to support

this. However, we are also considering sources of new capital to

ensure that we have a full range of options available to us. We

currently have four potential acquisitions in exclusivity and a

number of others in advanced negotiations.

In the US, we expect further progress in building out organic

growth in the RIA/BD business and look forward to an improvement in

capital market conditions.

David Lawrence, Kingswood Chief Executive Officer ,

commented:

"I am delighted that our business continues to make progress

across the Group with organic growth and positive net asset flows

complemented by ongoing acquisition activity. It is understandable

that capital markets activity softened in the US in 2022 as a

result of market conditions, with this division of our business

delivering lower operating profit contribution in the year.

However, the strategy and trajectory of the business continues as

planned. Our recent entry into the Irish market is a further

demonstration of Kingswood's progress and commitment to our future

growth. We expect to announce further acquisitions later in

2023."

S

For further details, please contact:

Kingswood Holdings Limited +44 (0)20 7293 0730

David Lawrence www.kingswood-group.com

finnCap Ltd (Nomad & Broker) +44 (0)20 7220 0500

imon Hicks / Abigail Kelly

GreenTarget (for Kingswood media) +44 (0)20 7324 5498

Jamie Brownlee / Ellie Basle Jamie.Brownlee@greentarget.co.uk

About Kingswood

Kingswood Holdings Limited (trading as Kingswood) is an

AIM-listed (AIM: KWG) international fully integrated wealth

management group with circa GBP9 billion of assets under advice and

management. It services circa 19k clients from a growing network of

offices across the UK with overseas offices in US , Ireland and

South Africa.

Kingswood offers a range of trusted investment solutions to its

clients, which range from private individuals to some of the UK's

largest universities and institutions, including investment advice

and management, personal and company pensions and wealth planning.

Kingswood is focused on building on its position as a leading

player in the wealth and investment management market through

targeted acquisitions, creating a global business through strategic

partnerships.

The information contained within this announcement is deemed to

constitute inside information as stipulated under the retained EU

law version of the Market Abuse Regulation (EU) No. 596/2014 (the

"UK MAR") which is part of UK law by virtue of the European Union

(Withdrawal) Act 2018. The information is disclosed in accordance

with the Company's obligations under Article 17 of the UK MAR. Upon

the publication of this announcement, this inside information is

now considered to be in the public domain.

This information is provided by RNS, the news service of the

London Stock Exchange. RNS is approved by the Financial Conduct

Authority to act as a Primary Information Provider in the United

Kingdom. Terms and conditions relating to the use and distribution

of this information may apply. For further information, please

contact rns@lseg.com or visit www.rns.com.

RNS may use your IP address to confirm compliance with the terms

and conditions, to analyse how you engage with the information

contained in this communication, and to share such analysis on an

anonymised basis with others as part of our commercial services.

For further information about how RNS and the London Stock Exchange

use the personal data you provide us, please see our Privacy

Policy.

END

TSTLZLLFXXLLBBK

(END) Dow Jones Newswires

March 15, 2023 03:00 ET (07:00 GMT)

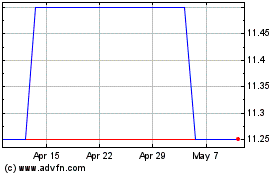

Kingswood (LSE:KWG)

Historical Stock Chart

From Dec 2024 to Jan 2025

Kingswood (LSE:KWG)

Historical Stock Chart

From Jan 2024 to Jan 2025