TIDMNXT

RNS Number : 3316Y

Next PLC

04 May 2023

Date: Embargoed until 07:00 hrs, Thursday 4 May 2023

Contacts: Amanda James, Group Finance Director Tel: 0333 777

(analyst calls) 8888

Alistair Mackinnon-Musson, Rowbell Tel: 020 7717

PR 5239

Photographs: https://www.nextplc.co.uk/media/image-gallery/campaign-images

First Quarter Trading Statement - 4 May 2023

HEADLINES

-- In the thirteen weeks to 29 April full price sales(1) were

down -0.7% versus last year, moderately ahead of our guidance

for this period, which was to be down -2%.

-- We are maintaining our sales and profit guidance for the full

year, with profit before tax forecast to be GBP795m and Earnings

Per Share (EPS) of 501.9p.

(1) Full price sales are VAT exclusive sales (including the full

value of commission based sales), less items sold in Sale events

and Clearance. They also exclude Joules sales and sales through

Total Platform. Full price sales are not statutory sales.

SALES PERFORMANCE

Full Price Sales Performance by Business Division

Full price sales performance by business division, versus last

year is set out below.

13 weeks to 29 April

Full price sales by division 2023/24 vs 2022/23

===================================== ====================

Online - 1.6%

Retail - 0.6%

====================

Total Product full price sales - 1.2%

Finance interest income +7.4%

====================

Total full price sales inc. interest

income - 0.7%

Total Trading Sales Including Markdown and Clearance Sales

Total Trading sales(2) , including markdown(3) and Clearance

sales(4) , were up +1.2% versus last year, this was driven by

higher Clearance sales. Last year we had very little Clearance

stock available, as a result of stock shortages in the run up to

Christmas 2021. This year, Clearance stock levels have returned to

normal and are commensurate with pre-COVID levels.

(2) Total Trading sales exclude sales through Total Platform and

Joules. Trading sales are not statutory sales.

(3) Markdown sales are those attributed to our main Sale events

(mid-season and end-of-season Sales).

(4) Clearance sales are those attributed to previous seasons'

stock, sold through our Online Clearance tab and Clearance Outlet

stores.

GUIDANCE FOR FULL PRICE SALES, PROFIT AND EARNINGS PER SHARE

Our guidance for full price sales and profit before tax remains

unchanged from that given in our Year End Results in March. For

clarity, our guidance is set out below.

Full Price Sales Guidance

Although our first quarter performance moderately exceeded our

sales guidance, we believe it is too early in the year to alter our

overall sales expectations for either the half or full year. To

maintain our first half forecast, we have moderated our sales

forecast for the second quarter, which is now planned to be -5%

down on last year (previous guidance was -4%). This adjustment

seems reasonable, as some of the first quarter's success,

particularly in holiday clothing sales leading up to Easter, might

have been pulled forward from the second quarter.

Shareholders might wonder why we are so cautious for sales in

Q2. As we explained in March, the second quarter last year

benefited from unusually warm weather and pent-up demand for events

such as weddings, proms etc.

The table below sets out our guidance compared to last year and

four years ago. As can be seen, the four year comparison looks

sensible, at +18.7% for both halves of the year.

Full price sales guidance for Versus Four year variance

2023/24 last year versus 2019/20(5)

============================== ========== ==================

First half (e) - 3.0% +18.7%

Second half (e) - 0.2% +18.7%

========== ==================

Full year guidance - 1.5% +18.7%

(5) Analysts' note: Over the last two years we compared sales

against the year commencing 2 February 2019 in order to account for

the 53-week year in 2020/21. When comparing this year, which

commenced 29 January 2023, against 2019/20 we are comparing against

the year commencing 27 January 2019, to account for the calendar

drift that has occurred over the last four years.

NEXT Profit and EPS Full Year Guidance

The table below sets out our unchanged guidance for the full

year.

Full year Versus

NEXT Profit and EPS guidance guidance last year

============================= ========= ==========

NEXT Profit before tax GBP795m - 8.7%

Pre-tax EPS 656.1p - 6.4%

Post-tax EPS 501.9p - 12.5%

========= ==========

CASH FLOW, SHAREHOLDER DISTRIBUTIONS AND INVESTMENTS

We are maintaining our guidance for GBP220m of surplus cash

generation (after interest, tax, capital expenditure and ordinary

dividends). It remains our intention that surplus cash will be (1)

returned to shareholders through share buybacks or (2) invested in

equity stakes in potential Total Platform clients. In the first

quarter we purchased GBP55m of shares at an average price of

GBP67.52 and spent GBP8.5m acquiring the brand name, domain names

and intellectual property of Cath Kidston.

SECOND QUARTER TRADING STATEMENT

Our next sales update will cover the first 26 weeks of the year

to 29 July 2023 and is scheduled for Thursday 3 August 2023.

Forward Looking Statements

Certain statements in this Trading Update are forward looking

statements. These statements may contain the words "anticipate",

"believe", "intend", "aim", "expects", "will", or words of similar

meaning. By their nature, forward looking statements involve risks,

uncertainties or assumptions that could cause actual results or

events to differ materially from those expressed or implied by

those statements. As such, undue reliance should not be placed on

forward looking statements. Except as required by applicable law or

regulation, NEXT plc disclaims any obligation or undertaking to

update these statements to reflect events occurring after the date

these statements were published.

This information is provided by RNS, the news service of the

London Stock Exchange. RNS is approved by the Financial Conduct

Authority to act as a Primary Information Provider in the United

Kingdom. Terms and conditions relating to the use and distribution

of this information may apply. For further information, please

contact rns@lseg.com or visit www.rns.com.

RNS may use your IP address to confirm compliance with the terms

and conditions, to analyse how you engage with the information

contained in this communication, and to share such analysis on an

anonymised basis with others as part of our commercial services.

For further information about how RNS and the London Stock Exchange

use the personal data you provide us, please see our Privacy

Policy.

END

TSTQXLFBXELXBBL

(END) Dow Jones Newswires

May 04, 2023 02:00 ET (06:00 GMT)

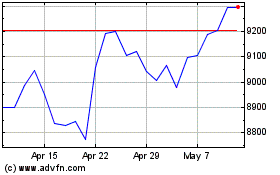

Next (LSE:NXT)

Historical Stock Chart

From Jun 2024 to Jul 2024

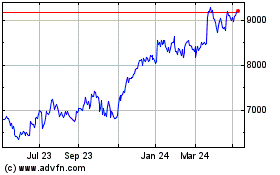

Next (LSE:NXT)

Historical Stock Chart

From Jul 2023 to Jul 2024